Crypto Market Recap 2023: Market Analysis

Key Topics

-

The crypto market witnessed outstanding growth in 2023. Bitcoin and Solana are among the best performers with 155% and 918% growth respectively.

-

Trading volumes remain low, but showed significant growth in Q4.

-

Token sales market is recovering, but still too far from 2021 heights.

-

It was a good year for DeFi, with user interest shifting to new blockchains and narratives.

-

The NFT market is underperforming due to the lack of innovation.

In the previous part of our annual recap, we looked at the key narratives and news in 2023 that shaped the market. In part two, we'll take a look at the data, highlighting the year-over-year changes in key market indicators and individual coins. Enjoy reading!

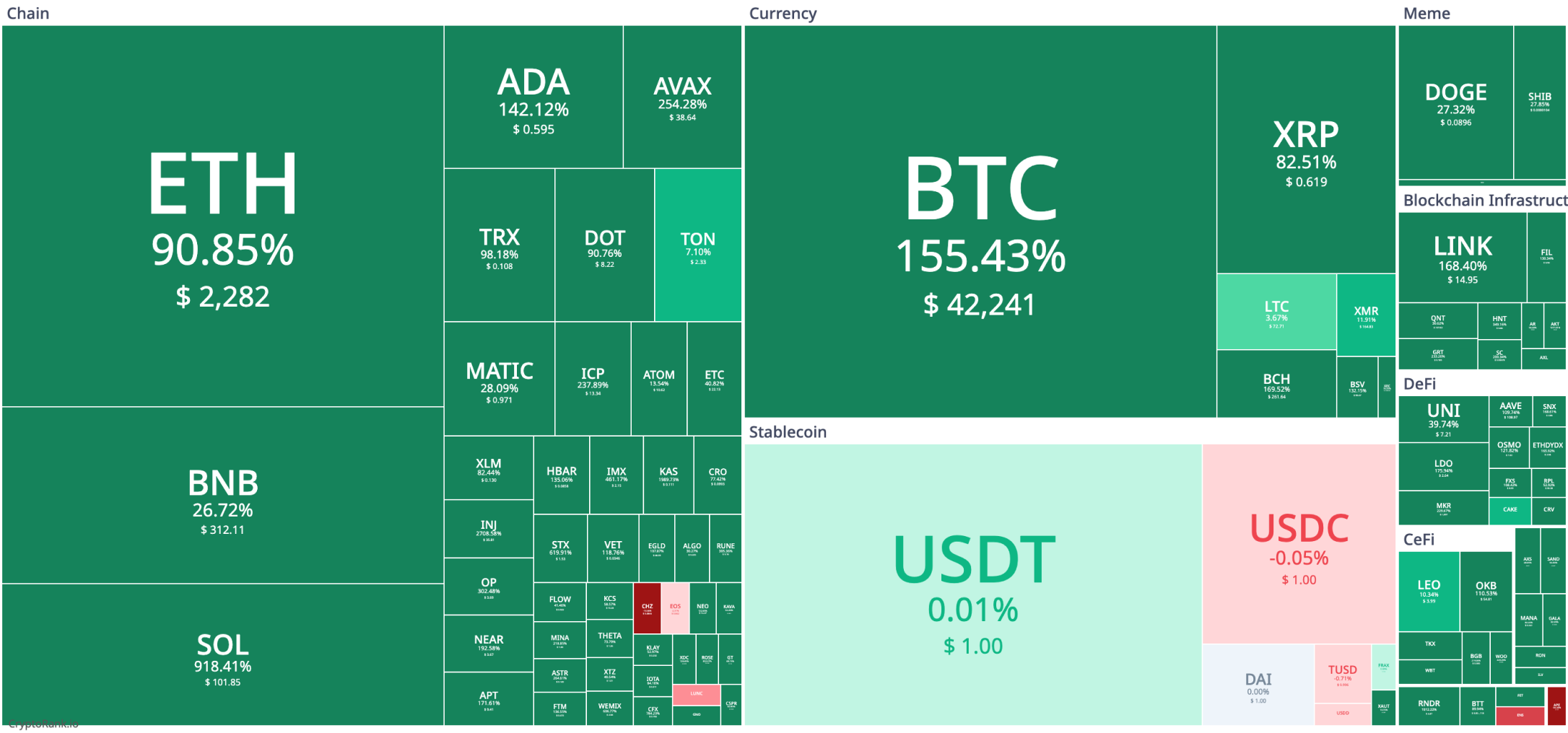

Market Performance

The year 2023 showed relatively smooth and significant price growth. According to data from CryptoRank.io, the aggregate market capitalisation of crypto grew by 105% from $840B on 1 January 2023 to $1.73T a year later on 1 January 2024. The price of Bitcoin also increased dramatically by 155%, while the price of Ethereum increased by 91%. Among the top 10 cryptos, Solana is the top gainer with a gain of 918%. Notably, the main price rally took place towards the end of the year, as news of the approval of a spot BTC ETF spread.

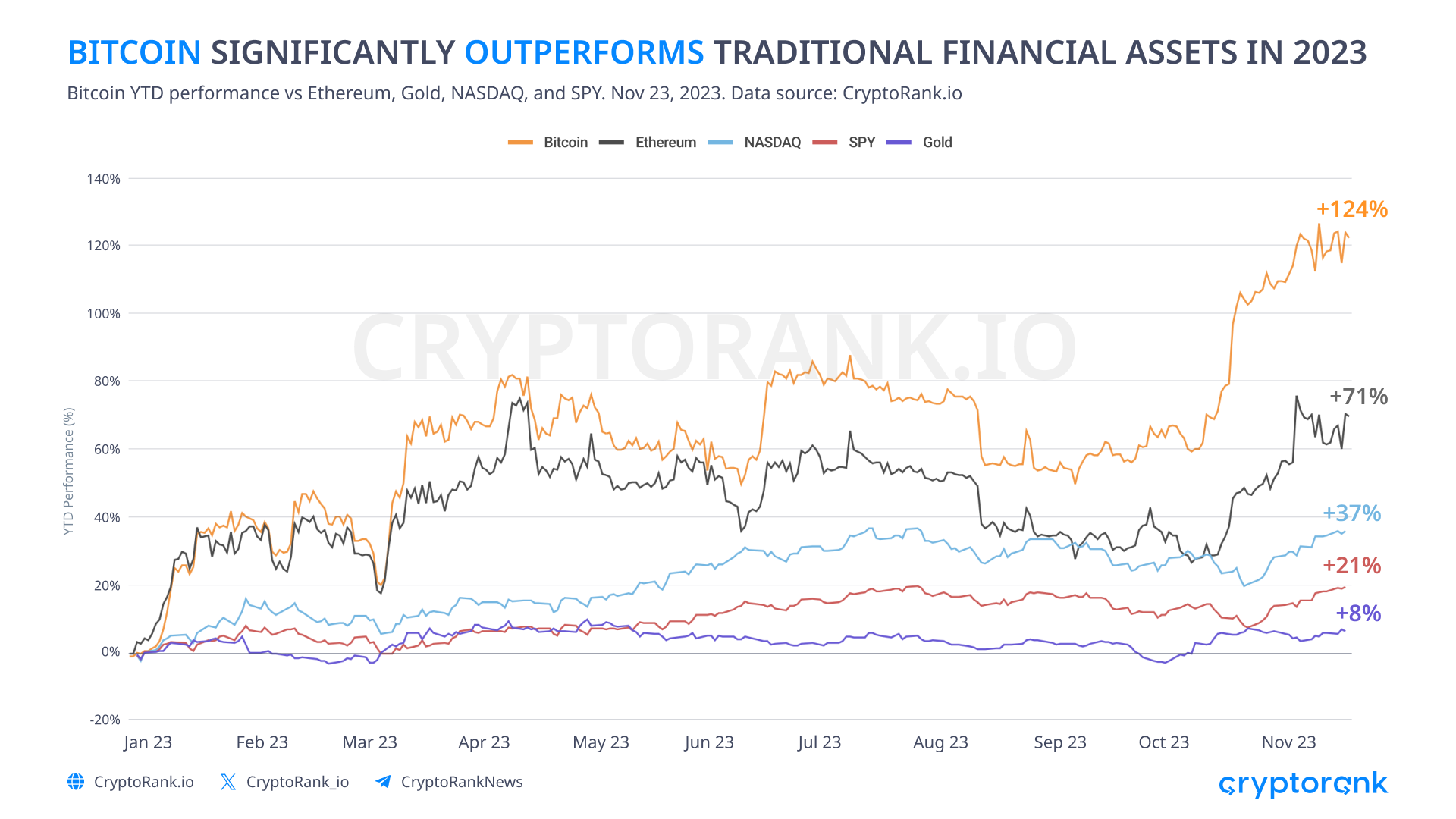

Bitcoin and Ethereum significantly outperformed traditional financial markets, outperforming the NASDAQ and S&P 500 indices. They experienced a decent recovery after a problematic 2022. Fears of a global recession are fading, making riskier assets more attractive to investors.

Changes in Top 10

Bitcoin and Ethereum have consistently been the leaders in terms of market capitalisation over the last 5 years. In 2022 and 2023, Ethereum narrowed the market cap gap with Bitcoin, reaching around 50% of Bitcoin's capitalisation, which even gave rise to the idea of a "Great Flip" between Bitcoin and Ethereum. However, by the beginning of 2024, Bitcoin had significantly widened the gap.

Before going any further, it is worth noting that the top 10 rankings in recent years have consisted almost entirely of blockchain ecosystem tokens and stablecoins. USDT remains the dominant stable, and has significantly increased its dominance among stables by early 2024. BNB, Solana, Avalanche, Polygon and Polkadot are relatively new Blockchain-ecosystems that continue to fight for dominance, changing their position in the top every year, among which BNB looks like a leader closely followed by Solana.

Bitcoin Performance Through 2023

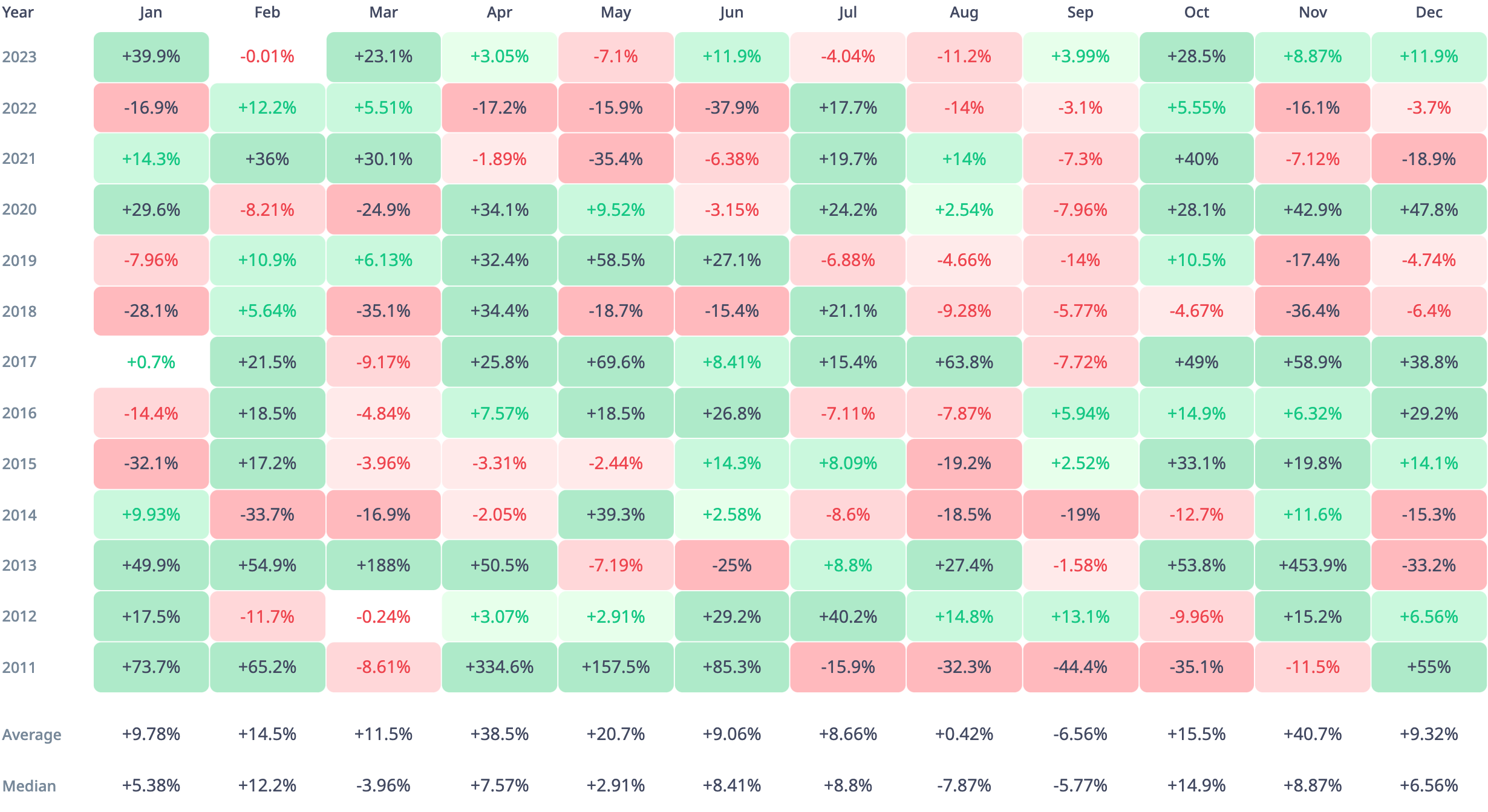

Bitcoin had a great year in 2023, but it wasn't the best year for it. January turned out to be the best month for bitcoin with a gain of almost 40%, while the real bull market began in the fourth quarter.

Bitcoin's rally has been driven by several factors: the expectation of spot ETF approval, the upcoming halving in April 2024 and the disappearance of recession fears. With the approval of the spot BTC ETF in January 2024, only two of the three factors remain to push the bitcoin price higher. However, with each half cycle, the bitcoin price grows more moderately. The strongest growth occurred in the first halving cycle in 2012, and since then the growth rate has been declining. Perhaps the next halving cycle will be the last that will somehow influence the bitcoin price.

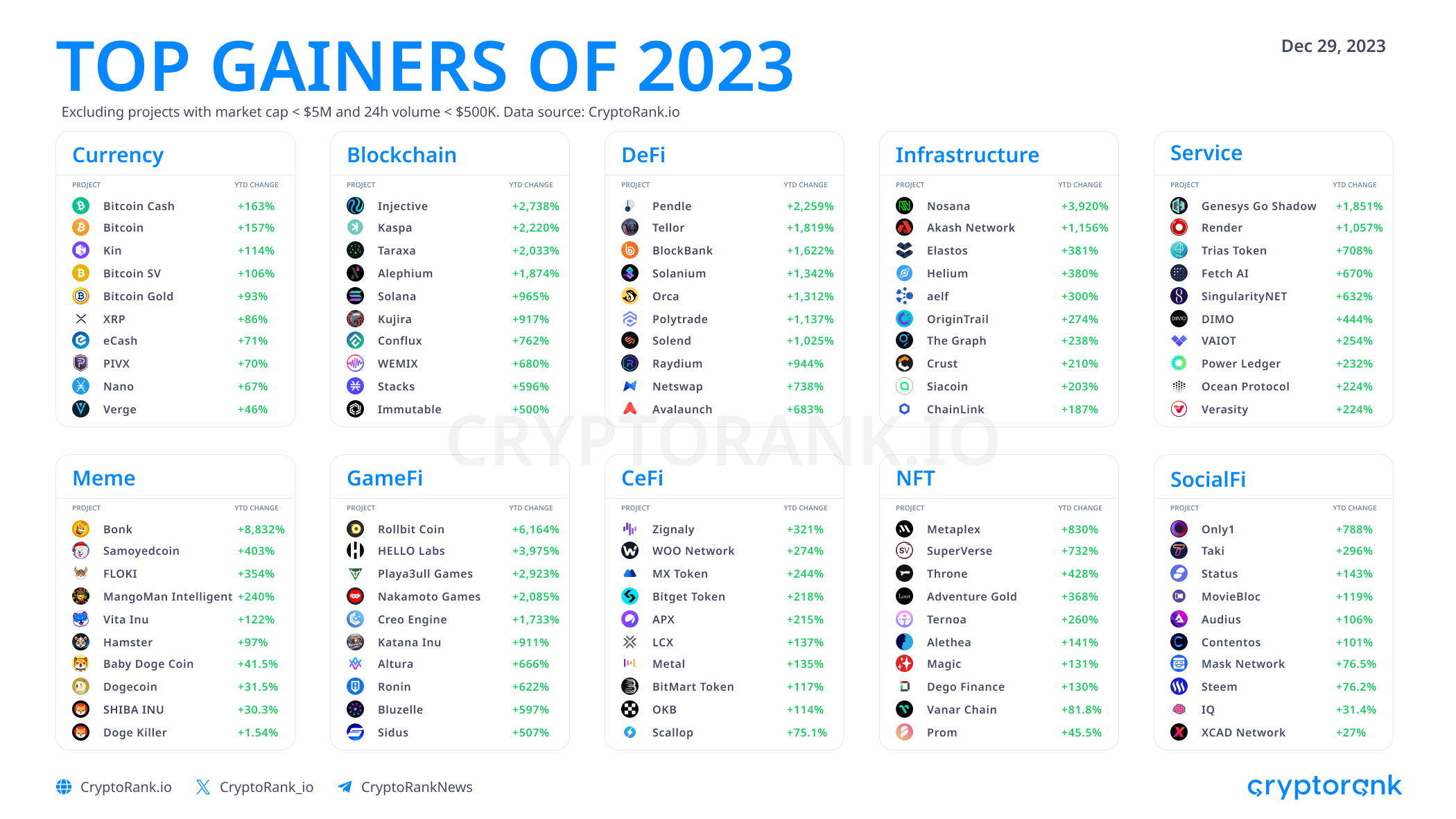

Altcoin Performance

It's also been a great year for altcoins, especially the ones that emerged in 2023. The infographic shows the coins that will exist on 1 January 2023. This year was good for narrative-backed cryptos, such as RWA, Liquid Staking Derivatives, and others. Separately, I would like to highlight blockchain coins, which have shown a very good performance this year.

Learn more about the top 2023 gainers in our X thread

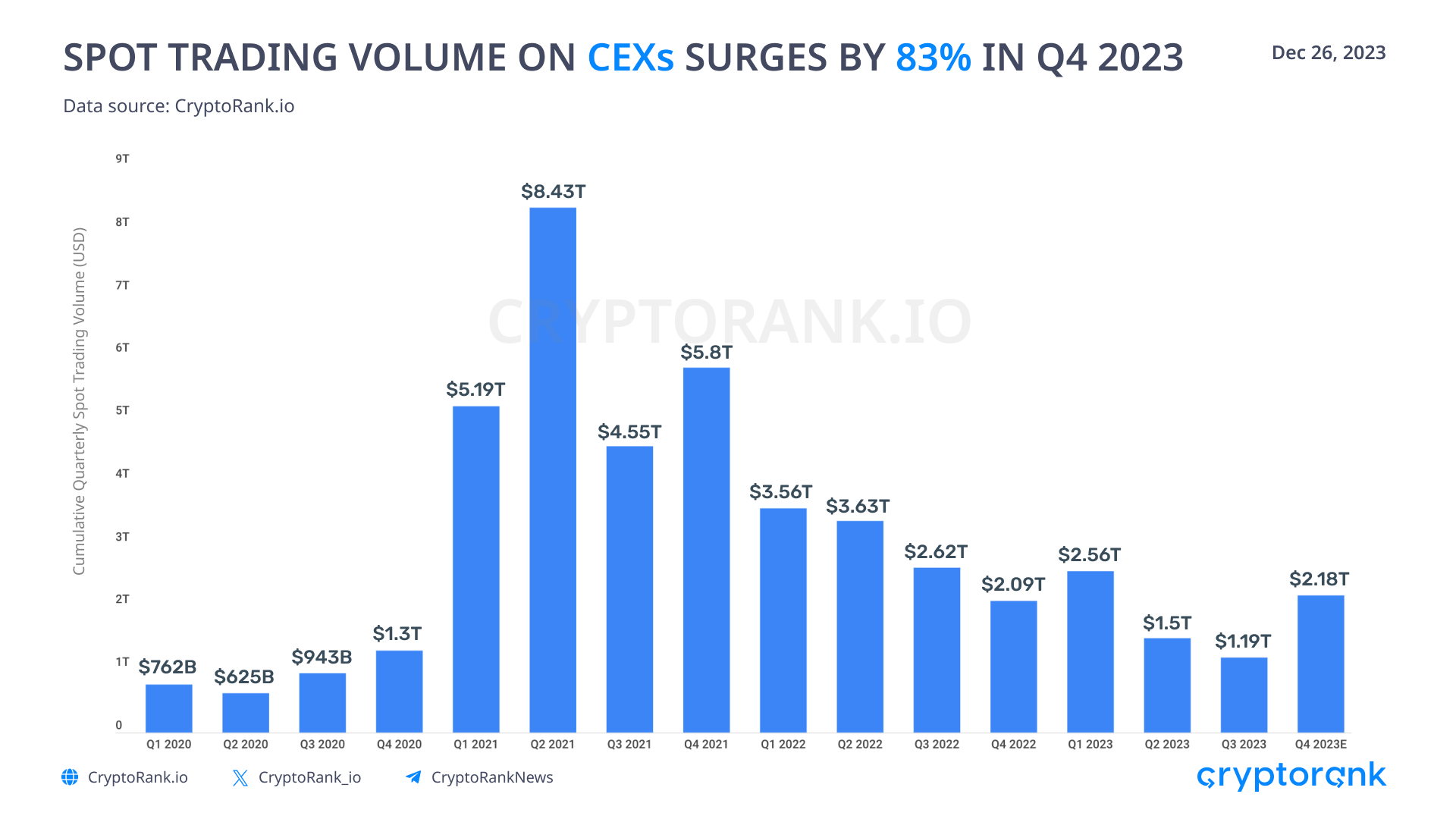

Exchange Trading Volumes Grows in Q4

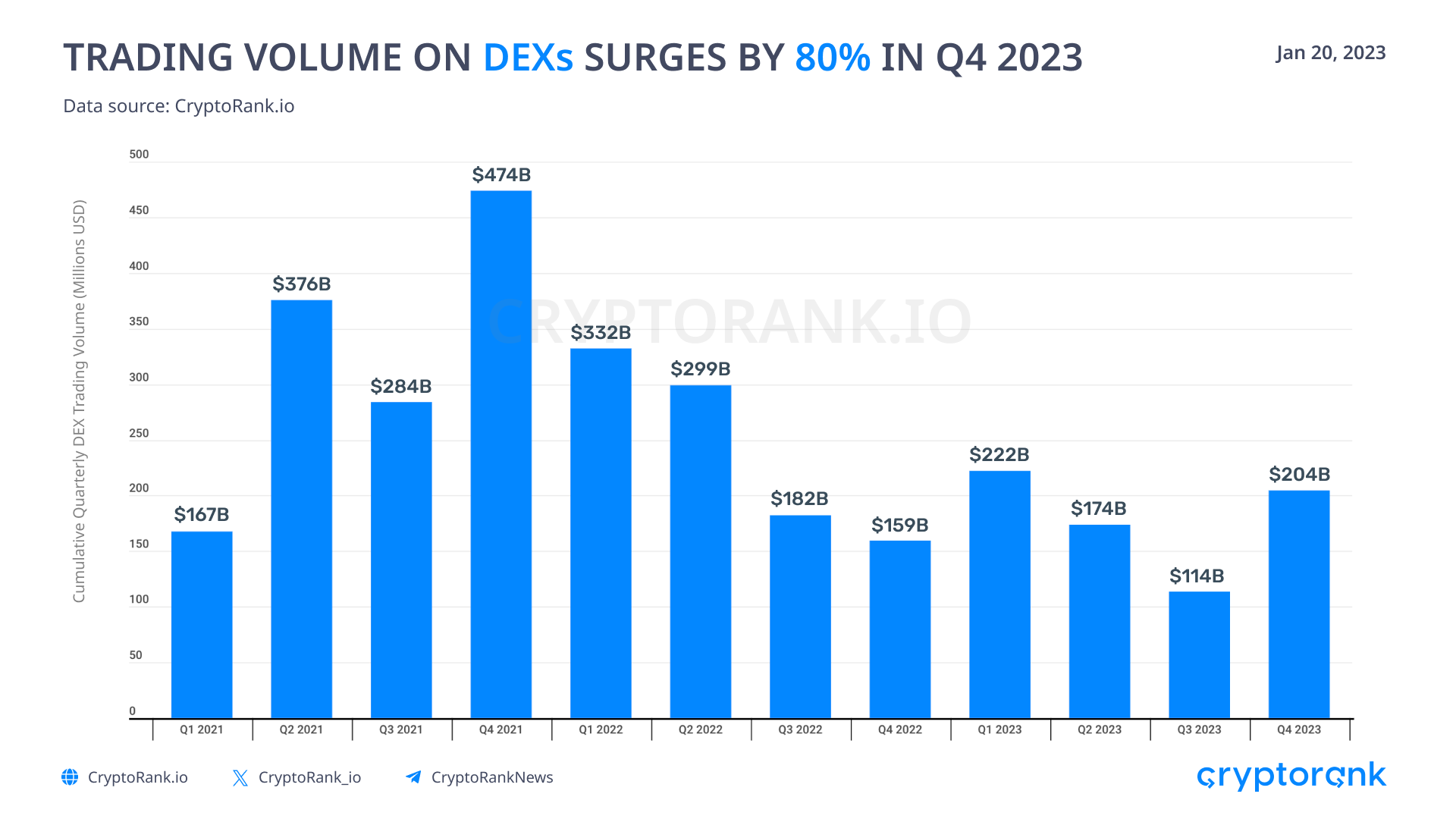

Despite the rise in cryptocurrency prices, trading volumes remain low, roughly at Q3-Q4 2022 levels. The first and fourth quarters showed a sharp increase in spot volumes, and these were the most bullish months. However, the second and third quarters also saw plenty of positivity and new coin launches, but spot volumes reached their lowest value since 2020.

The situation around the futures markets is somewhat different. Volumes are holding well above 2020 volumes. However, trading volumes are still 2 times below the peak in the second quarter of 2021.

The spot volume of trading on decentralised exchanges largely follows the trend of spot volume on centralised exchanges. As before, the share of DEX in the total crypto trading volume remains extremely low.

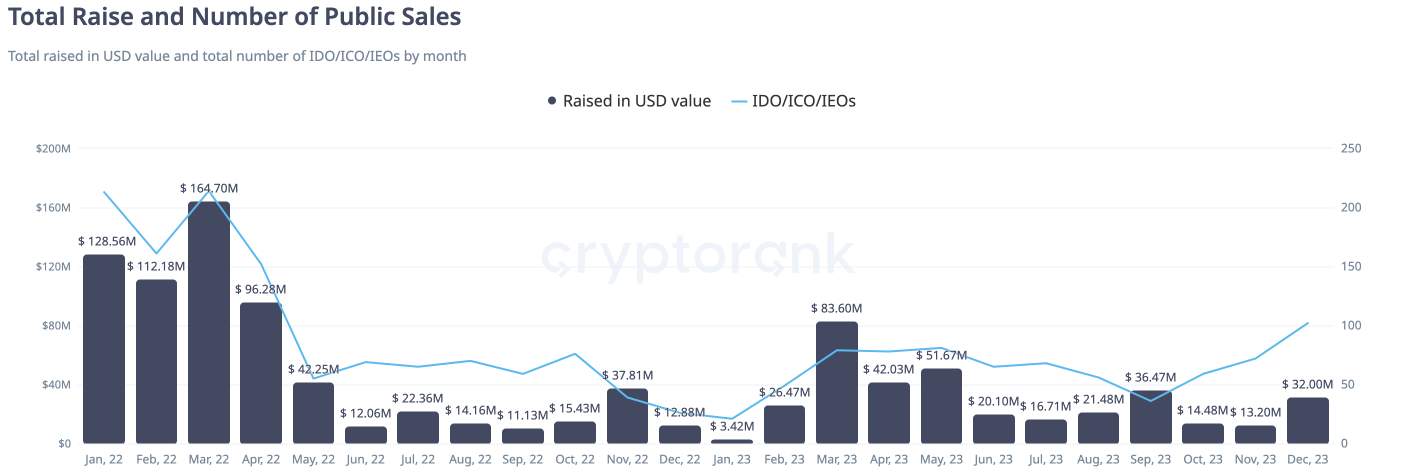

Token Sale Activity Show Signs of Recovery

Despite the growth of Token Sales in the fourth quarter, monthly raised amounts remain low. While the market is still in a long recovery, more high quality projects are needed to continue growth.

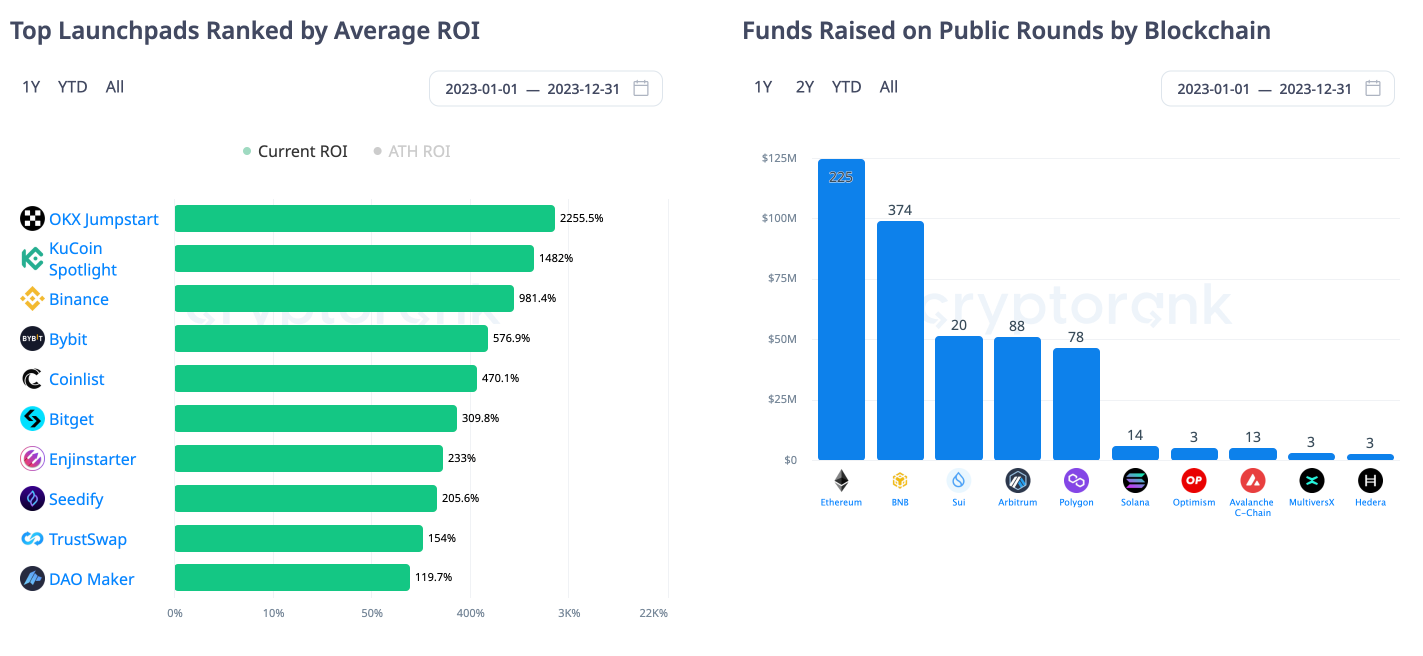

Centralised exchanges are clearly dominating the Token Sales market at the moment, showing very high returns for investors and the opportunity to get a large allocation. The leaders in terms of ROI were 3 IEO Launchpads: OKX Jumpstart, KuCoin Spotlight, and Binance.

Ethereum and BNB Chain remain the most popular blockchains among token sale projects. It is also worth noting Sui, which launched earlier this year and has already shown significant results.

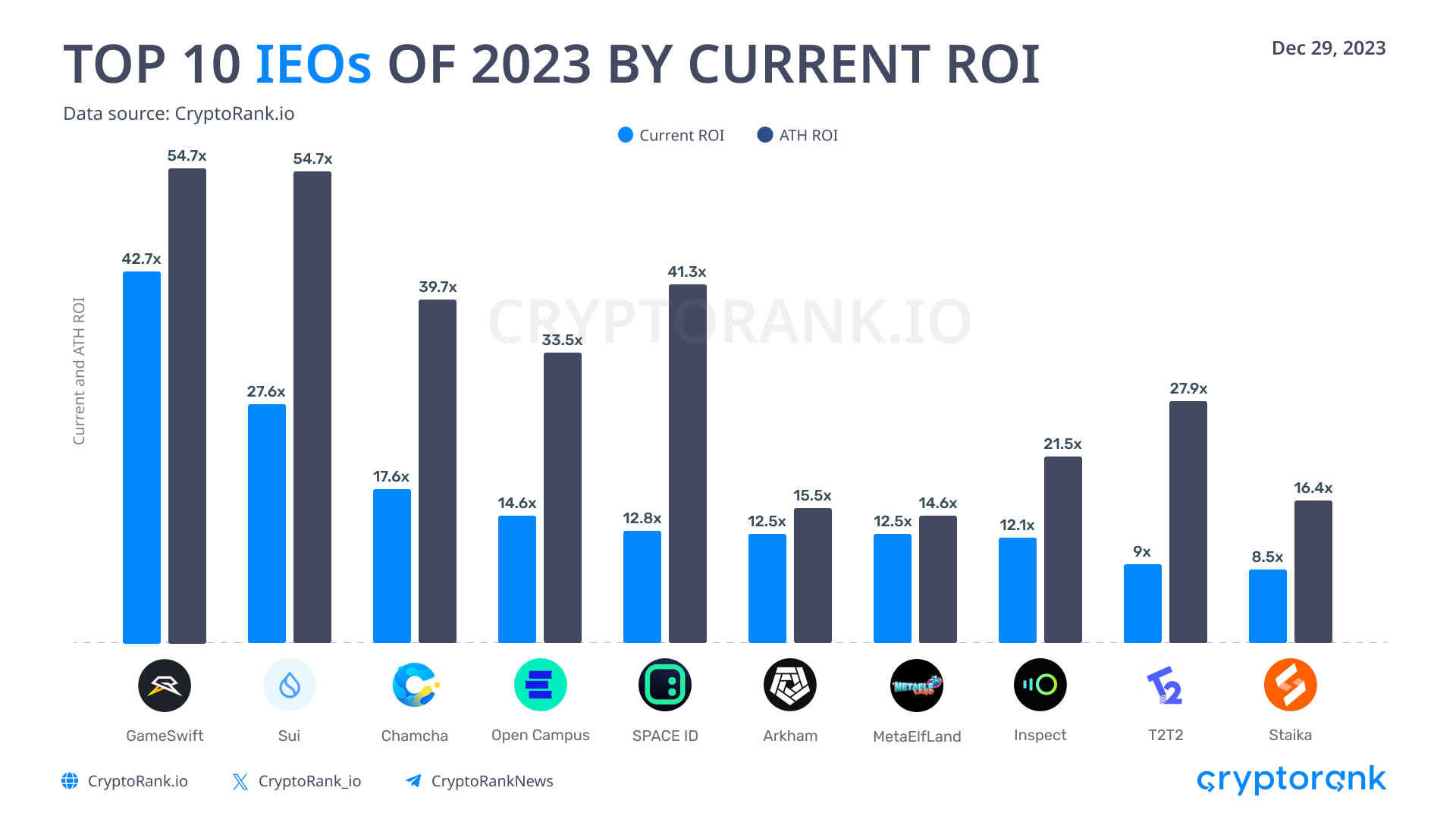

Speaking of IEO's success, one cannot help but highlight the top 10 most profitable projects, with GameSwift and SUI leading the way, as well as three token sales on Binance Launchpad: Open Campus, SPACE ID, and Arkham.

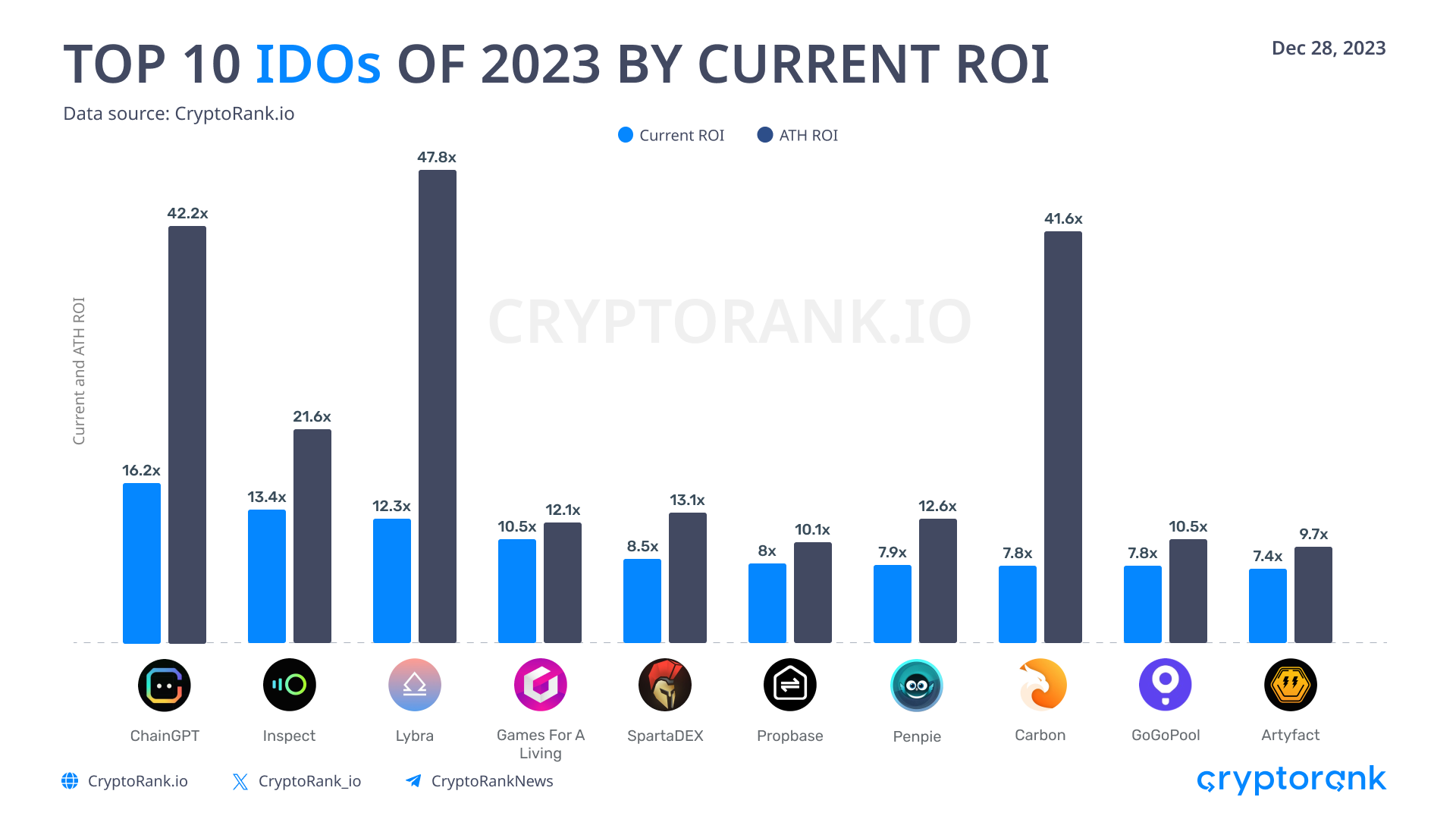

The most successful IDOs of 2023 were ChainGPT, Inspect, and Lybra. We can also highlight Carbon, one of the leaders in all-time high ROI. IDO launchpads show still lower average returns, largely due to a larger number of projects going to token sale. As a consequence, some of the projects show negative ROI and therefore spoil the launchpads statistics.

However, the situation around token seals remains ambiguous. Unfortunately, we will probably never see such heights as in 2021-2022 again. Nevertheless, private fundraising shows a slightly better picture. For more details, read our annual Crypto Fundraising Recap.

DeFi Total Value Locked Revives

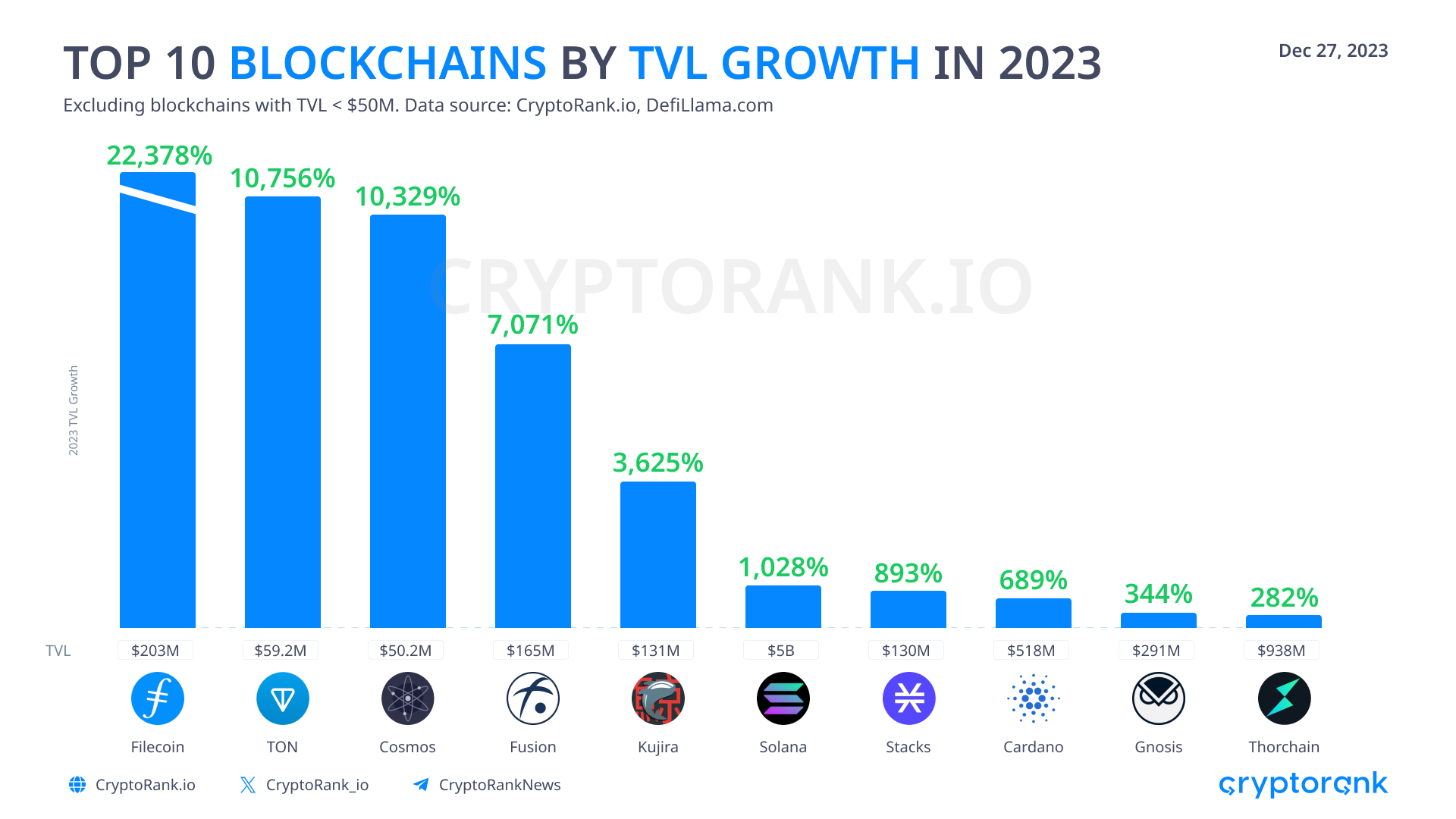

Many new blockchains have emerged this year, but the main growth in TVL came from existing blockchains that got a second wind this year. Filecoin, which launched the Filecoin Virtual Machine in early 2023, has seen TVL grow by more than 220 times. It is followed by TON, which gained popularity due to its deeper integration into the Telegram messenger. Other leaders in TVL growth include Cosmos, Solana, and Cardano, among the largest coins by market capitalisation.

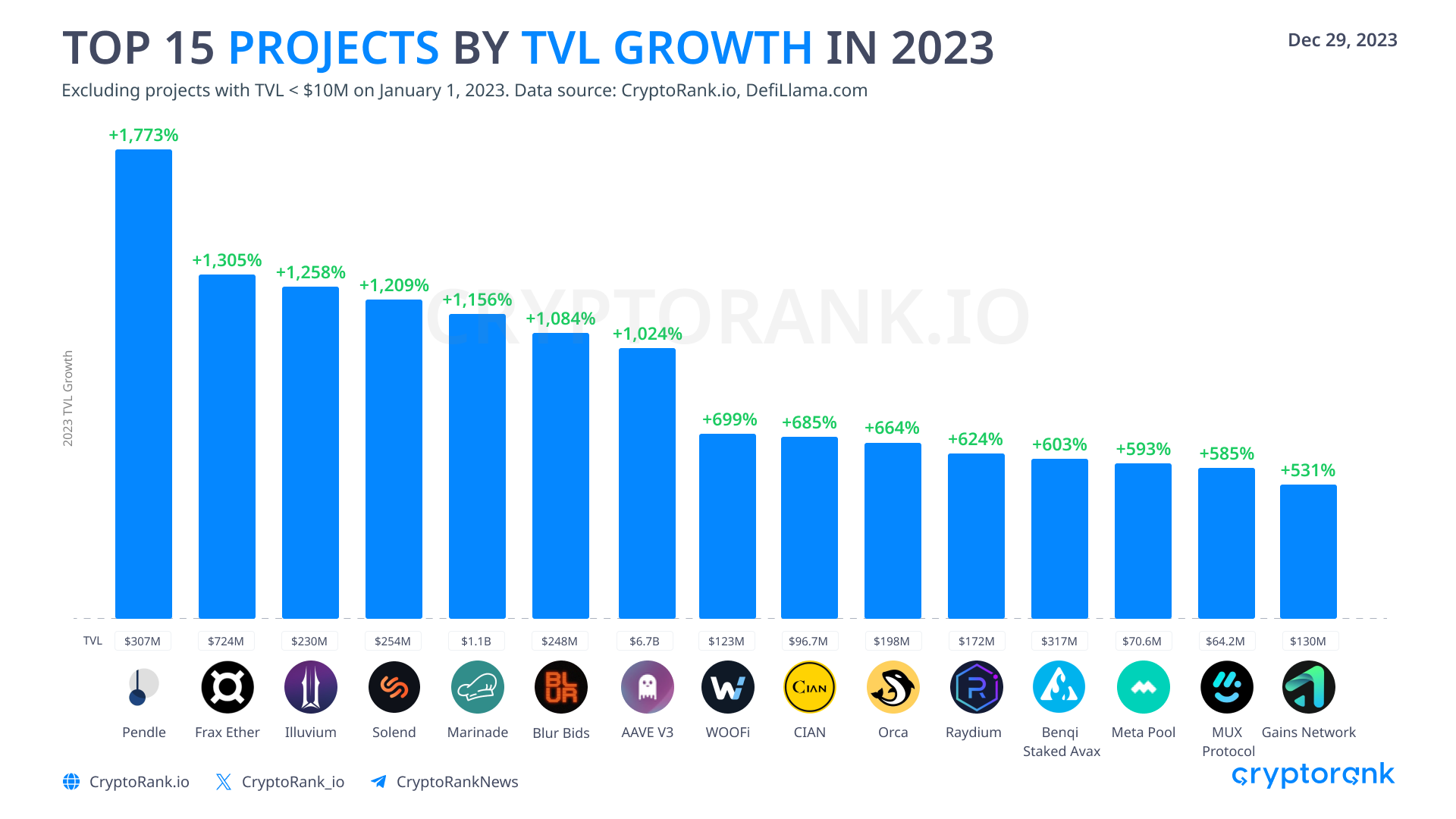

Speaking about the applications that showed the highest TVL growth, narrative-backed projects stand out here. Several Liquid Staking Protocols, such as Frax, Marinade, and Benqi, are among the growth leaders. Projects from the Solana ecosystem also stand out: Solend, Orca, Raydium.

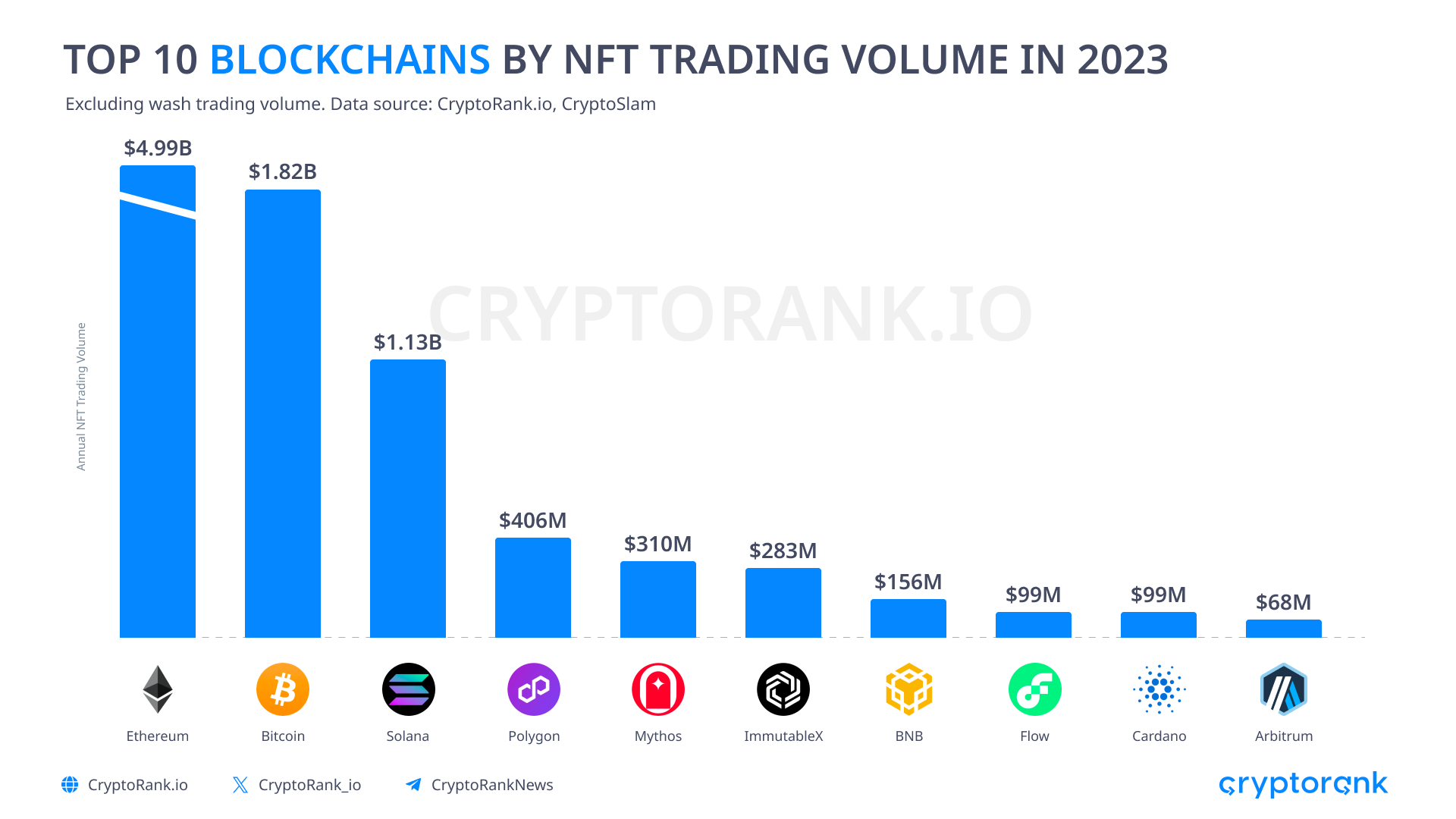

NFT Market Stagnates

The NFT market has lagged behind the cryptocurrency market and is still stagnating. Trading volumes on the key blockchain for NFT, Ethereum, are far from the volumes of 2021. The best month was February due to the Blur drop. And the bullrun we saw in Q4 made trading volume grow by only 2x. But the prices of most assets did not show a significant change, and the excitement on Ethereum comparable to 2021 has not been seen for a long time.

The major discovery in the world of NFTs in 2023 was Ordinals and other NFTs on the Bitcoin blockchain. Coming out of nowhere, it ranked second in trading volume for 2023. At the same time, it showed absolute dominance over Ethereum in the fourth quarter. We broke down the NFT situation on Bitcoin in more detail in the first part of the annual recap and a separate article.

Nevertheless, the NFT market is far from recovering. Its prospects are still unclear, largely due to a lack of innovation. Tokenized images are of little interest to users, as they are poorly aligned with current narratives. We will probably see a repeat of the 2021 NFT craze again in the future, but for now the market is on the side of class tokens.

The Bottom Line

The year 2023 has been a great year for the crypto market. New narratives were formed, a bull market was started and the first steps towards mass adoption of crypto were made. So far, 2024 is not as great a year for crypto as 2023 was, despite the long-awaited approval of spot Bitcoin ETFs. However, we expect the bull market to continue as new liquidity finally pours into the crypto space.

Read More

Crypto Fundraising Recap: Kеy Developments of 2023

Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto) Coinbase Ventures

Coinbase Ventures Paradigm

Paradigm Polychain Capital

Polychain Capital YZi Labs (Prev. Binance Labs)

YZi Labs (Prev. Binance Labs)