Crypto Fundraising Recap: Kеy Developments of 2023

Highlights

-

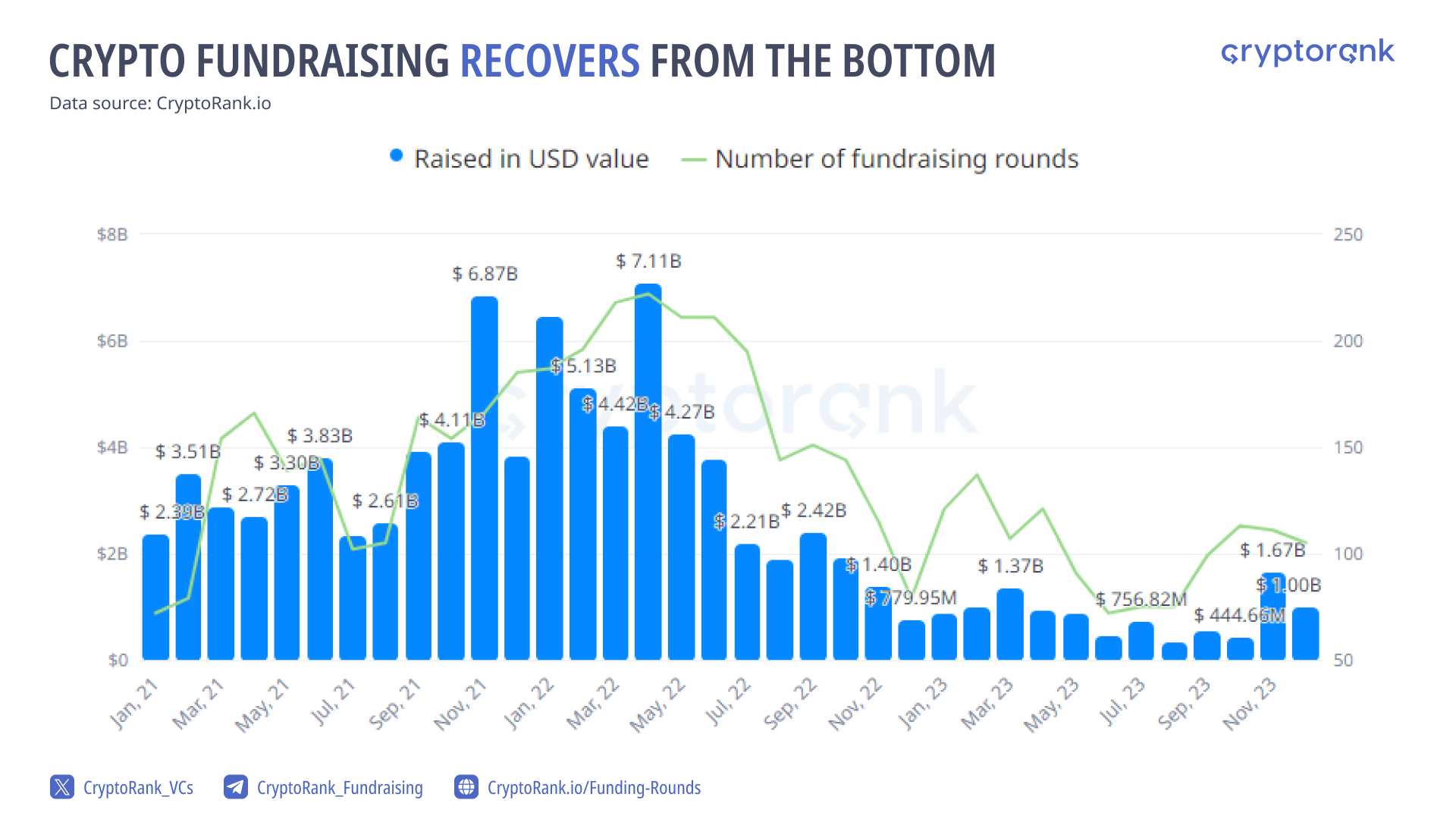

Despite the positive sentiment in the crypto market, crypto fundraising hit a three-year low this year, with a total of $9.7 billion raised in 1,189 funding rounds in 2023.

-

Increased competition among the projects has led to better quality startups appearing, which indicate the shift of the niche from blue to red ocean.

-

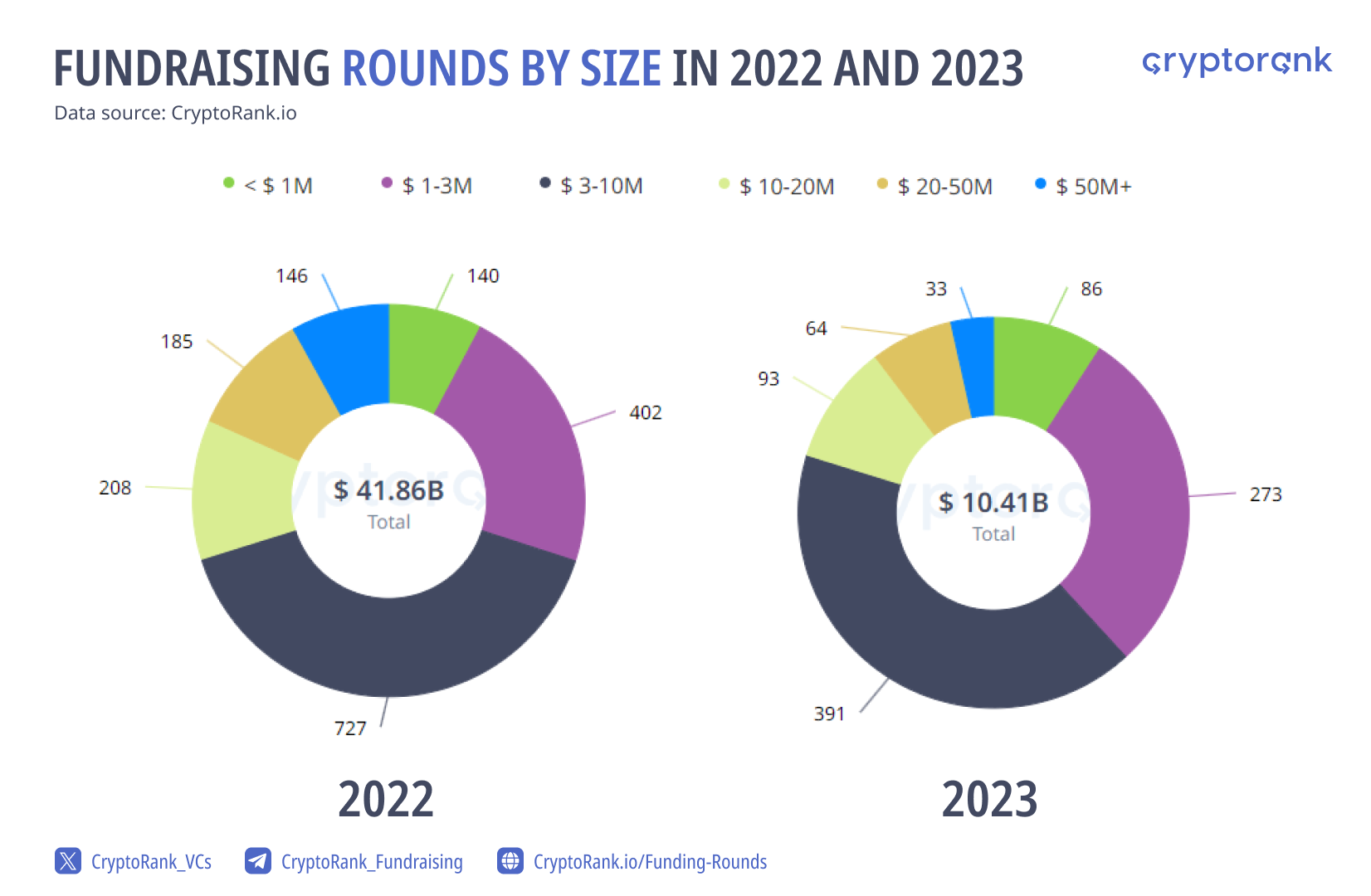

Venture Capital preference shifts toward early stage projects with decreasing investments in huge funding rounds.

-

BRC-20 fundraising has grown steadily by the end of 2023, indicating potentially one of the main trends of 2024.

Crypto Fundraising Remains Low due to a Lack of Innovations

While this year cannot be labeled as bearish for the crypto market, crypto fundraising activity in 2023 hit a three-year low. This downturn is attributed to the lag between price rallies and fundraising activity, as well as the lack of new business models in the crypto field.

Towards the end of the year, crypto fundraising showed signs of recovery, correlating with a price rally driven by anticipated ETF approval and the upcoming Bitcoin halving. The beginning of the year is expected to witness further growth in crypto fundraising activity following the ongoing price rally.

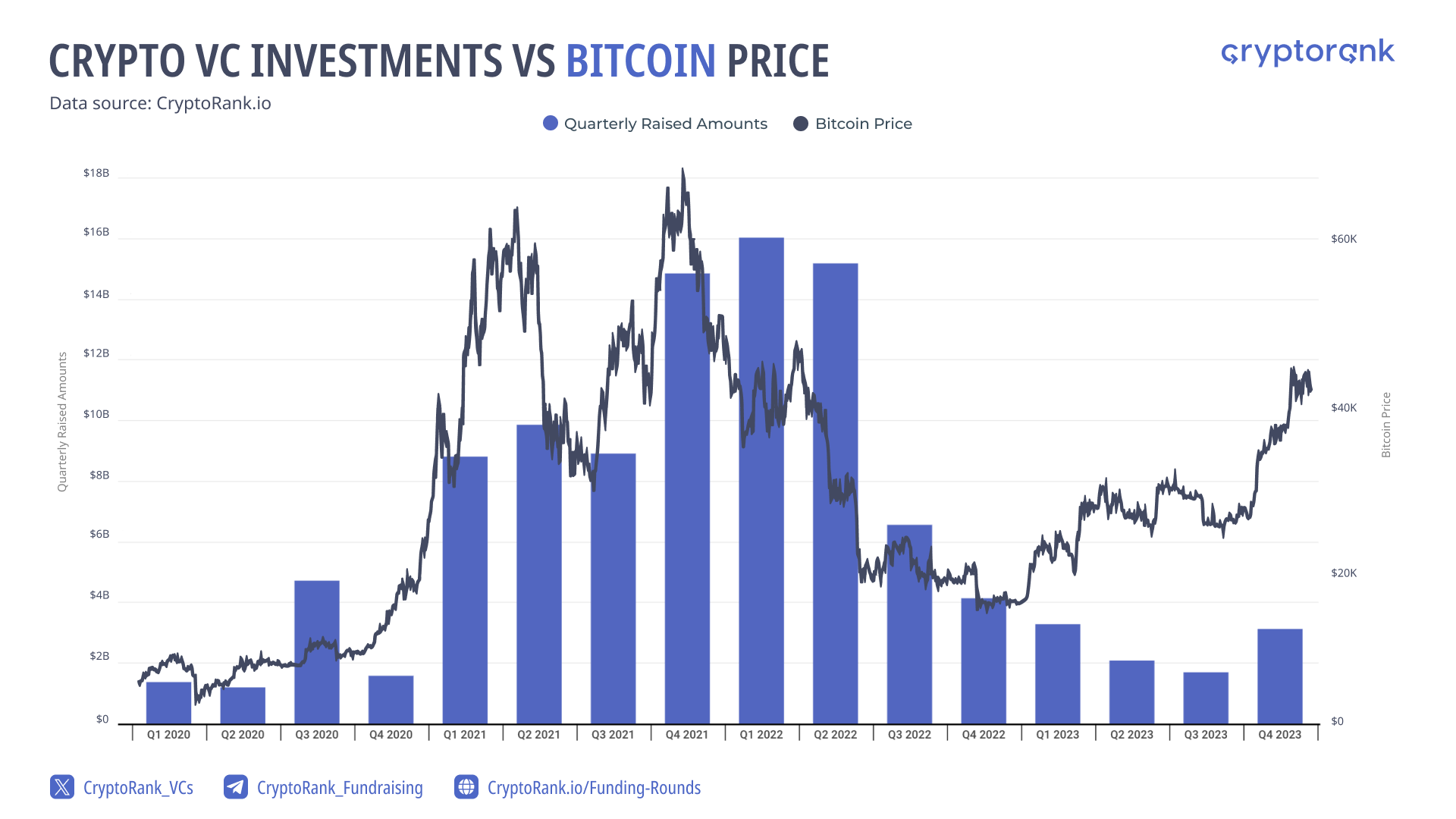

Comparing Bitcoin price with fundraising amounts, it is evident that fundraising activity remains low relative to the market cap. Venture funds have become more conservative in their crypto investments. The euphoria that once surrounded the crypto sector has waned, influenced by the emergence of a new global venture narrative in artificial intelligence and other segments.

Additionally, the current state of the market is characterized by a lack of paradigm-shifting projects, and new segments of Web3 are not emerging. This leads to a decline in overall crypto fundraising. The market has transitioned from the blue ocean stage, where new business models arose, to the red ocean stage, where numerous projects compete for a limited number of users.

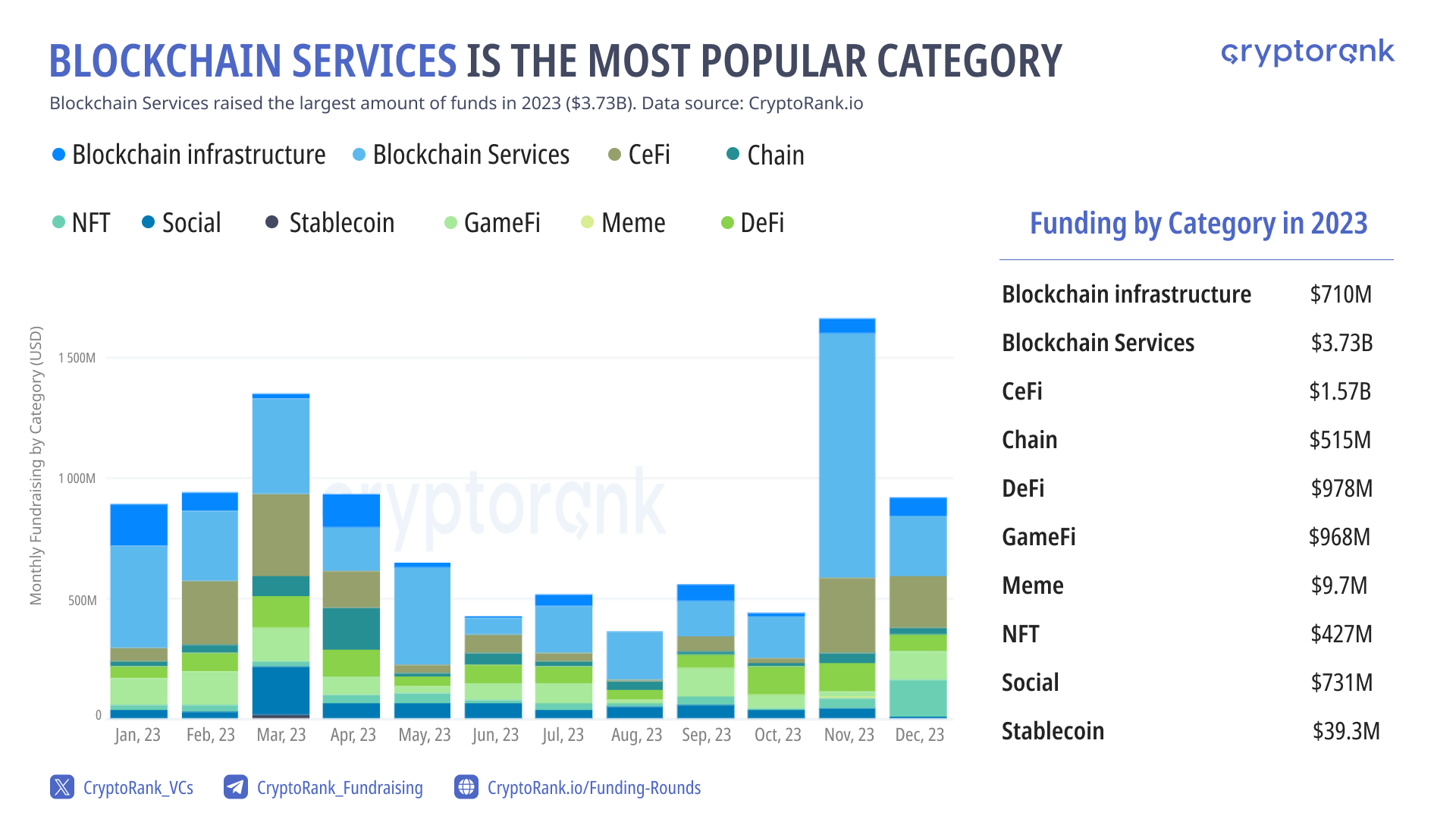

Blockchain Services Replace Ecosystem Blockchains as the Most Crucial Segment

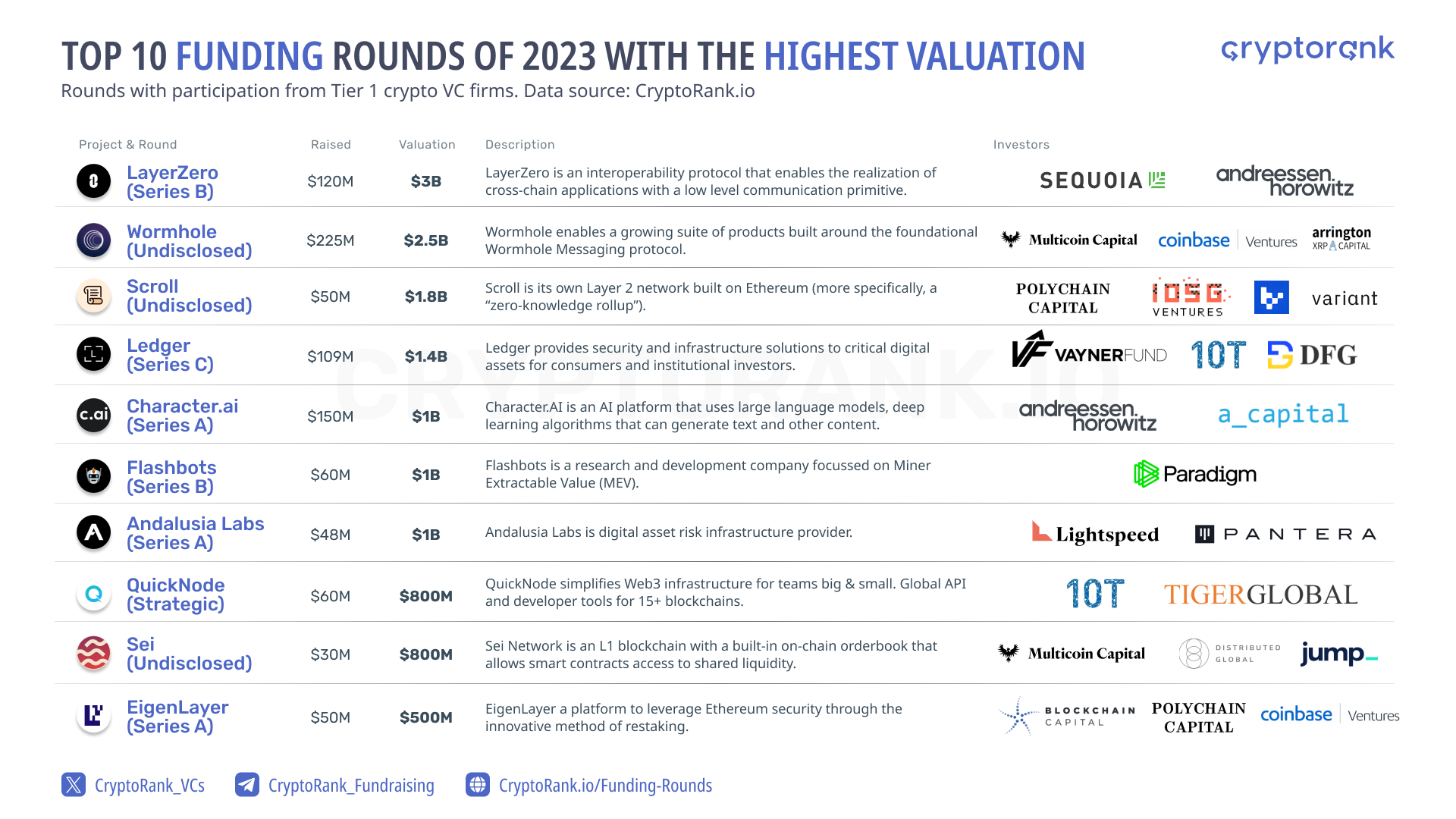

Among notable funding rounds is observed a shift from investments in Blockchains to investments in Blockchain Services. Interoperability is clearly in the focus, with Wormhole and LayerZero receiving $225M and $120M funding respectively. Among other noteworthy investments Character.ai is trying to combine AI and Blockchain technologies. Unchained Capital is one of the most remarkable rounds within bitcoin-native ecosystem.

Interoperability of Blockchains is in the Focus of Venture Capital

LayerZero and Wormhole stand out as the highest-valued crypto startups that secured funding this year, highlighting the issue of interoperability gaps among blockchains in the crypto market. Scroll and Sei are also worth mentioning as promising blockchain ecosystems, Scroll is a Layer 2 network built on Ethereum and Sei is a Cosmos based L1 blockchain with a focus on DeFi. Majority of blockchains try to stick to some larger ecosystem such as EVM compatible chains or Cosmos based blockchains, underlying again the importance of interoperability for growth.

Blockchain Services and DeFi Sectors are the Most Popular Among the Most Active VC

Among the most active investors, the top performers executed approximately 40 deals in 2023. Certain venture funds exhibit preferences for specific segments. For instance, Polygon Ventures, Animoca Brands, Shima Capital, and Andreessen Horowitz tend to focus on the GameFi segment, reflecting a larger proportion of their investment rounds in this area. While Balaji Srinivasan and Foresight Ventures look towards investments in the social segment.

Crypto Project Segments Tend to Maintain the Same Fundraising Proportions

Blockchain Services and DeFi dominate in the number of investment rounds during 2023, while in terms of money raised, Blockchain Services and CeFi lead the sectors for this year.

CeFi and DeFi are two segments that simultaneously compete and cooperate in terms of crypto adoption. CeFi tends to involve larger funding rounds than DeFi. In contrast, DeFi comprises numerous projects with similar business models and protocol logic across different blockchain networks. CeFi focuses on bridging traditional finance with the crypto world, facilitating a smoother transition between the two financial systems. Meanwhile, DeFi aims to introduce innovative solutions, often inspired by traditional finance, into the crypto space.

Overall, all segments of the crypto space tend to maintain a similar proportion of investments throughout the year.

Blockchain Services and CeFi Segments Get the Biggest Checks

Around 72% of funding rounds are between $1 million and $10 million, and only a limited number of projects, specifically 33, received funding exceeding $50 million. In comparison, 146 projects attracted $50+ million in 2022, which is approximately 5 times more. Early stages shrunk by about 2 times. This indicates that venture capital prefers small-cap early-stage over large-cap late-stage startups.

Blockchain services and CeFi are the most popular categories among funding rounds exceeding $50 million. This year, 12 blockchain services and 8 CeFi projects received more than $50 million in funding rounds. These two categories have the most solid business models, capable of generating significant amounts of cash flow sustainably. Therefore, projects in these categories dominate late-stage rounds.

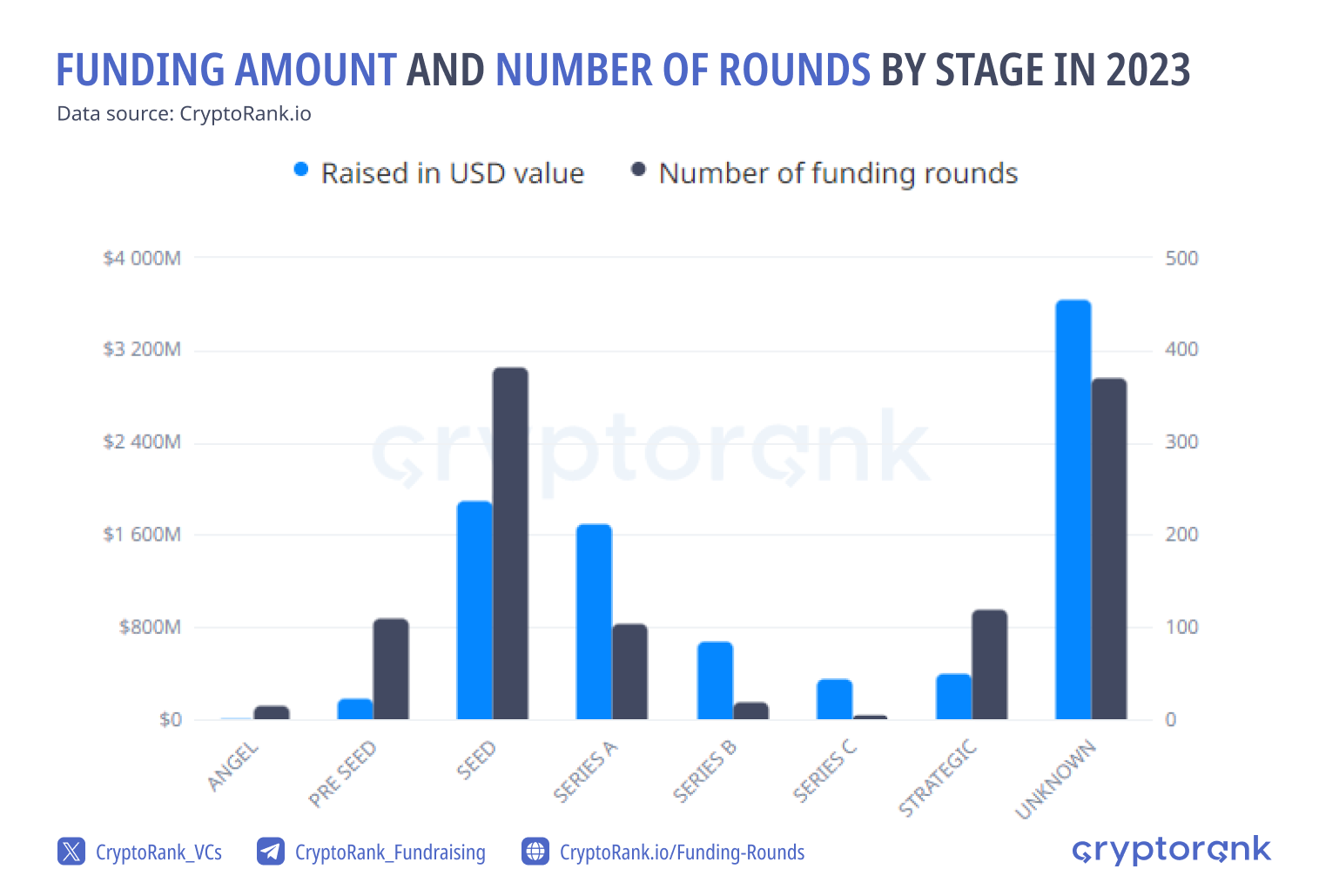

Venture Capital Prefers to Invest at the Seed Stage

The seed stage of investments is the most dominant in crypto fundraising, followed by strategic and pre-seed rounds. Additionally, a significant proportion of rounds remains uncategorized and is referred to as 'others. When comparing unknown rounds with other rounds, it can be concluded that unknown rounds mostly fall within the mid-range category between Seed and Series A rounds.

BRC-20 Trend Could Change the Industry Landscape

In the last months of 2023, projects focusing on BRC-20 getting started attracted investments alongside Bitcoin TVL and NFT volume growth, triggered by development in Bitcoin infrastructure. Bitcoin ecosystem growth can be the main event of the upcoming bull-run.

The design of the Bitcoin blockchain acts as a growth constraint for its ecosystem. However, the emergence of additional layers allows the resolution of some limiting factors, opening the door to a bitcoin-native ecosystem that can grow extremely rapidly, as seen with the surge in NFT volume on the Bitcoin chain.

Undoubtedly, the Bitcoin ecosystem has some advantages in terms of trust level, popularity, and decentralization, potentially making the bitcoin blockchain the most formidable rival for other blockchain ecosystems. You can find more information about the Bitcoin ecosystem here.

The United States Continues to be the Leading Jurisdiction

The United States is a leading financial jurisdiction, absorbing one-third of all crypto investments in 2023, followed by the United Kingdom and Germany. A substantial portion of the investment, equivalent to $2.59 billion, remains undisclosed.

Conclusion

The previous year saw a three-year low in terms of money raised by crypto startups, showing some recovery by the end of the year with the anticipation of BTC ETF approval and a price rally. Increased attention to crypto is expected to lead to a resurgence in investments in crypto projects in 2024.

On the one hand, the market lacks new emerging niches within the crypto space; on the other hand, current projects within existing niches have become more elaborate with defined niche leaders.

One of the potentially next big things is the development of a bitcoin-native ecosystem, which has the potential to significantly change the landscape of the entire industry, making it one of the largest ecosystems.

The year 2024 is expected to be impactful as it will determine whether the crypto market remains cyclical with halving, subsequent price rallies, and fundraising growth, or if it has entered a phase more dependent on overall economic events rather than inner industry factors.

For more insights, check out Analytics Dashboard on CryptoRank: https://cryptorank.io/funding-analytics

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

In This Insight

Coins

Funds

Read More

Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto) Coinbase Ventures

Coinbase Ventures Paradigm

Paradigm Polychain Capital

Polychain Capital YZi Labs (Prev. Binance Labs)

YZi Labs (Prev. Binance Labs)