The Anticipated Approval of a Spot Bitcoin ETF: A Catalyst for Bull Run

What Is a Bitcoin ETF?

The Bitcoin Exchange-Traded Fund (ETF) is a fund that essentially tracks the price of Bitcoin. Shares of a spot Bitcoin ETF will be available on traditional stock exchanges, such as the New York Stock Exchange (NYSE), once the U.S. SEC grants approval to an ETF provider.

It is important to clarify that Bitcoin ETFs primarily fall into two categories: spot and futures ETFs. In the United States, the first Bitcoin futures ETF was approved by the SEC in October 2021. While spot Bitcoin ETFs have not been approved in the United States at this time, there is a lot of attention focused on this type of Bitcoin ETF.

What's The Difference Between Spot And Futures Bitcoin ETFs?

Spot Bitcoin ETFs:

- Description: These ETFs directly track the spot price of Bitcoin. They hold "physical" Bitcoin as their underlying asset.

- Performance: The value of a spot Bitcoin ETF is tied directly to the real-time market price of Bitcoin. Investors in these ETFs gain exposure to the actual cryptocurrency.

- Custody: Spot Bitcoin ETFs require secure and regulated custody solutions to hold the "physical" Bitcoin on behalf of investors.

Futures Bitcoin ETFs:

- Description: Futures Bitcoin ETFs do not hold physical Bitcoin. Instead, they track the performance of Bitcoin futures contracts.

- Performance: The value of a futures Bitcoin ETF is based on the anticipated future price of Bitcoin. Investors are exposed to the price movements of futures contracts rather than the spot price of Bitcoin.

- Custody: Since these ETFs deal with futures contracts, they might not require custody of physical Bitcoin. Instead, arrangements with futures clearing houses are needed.

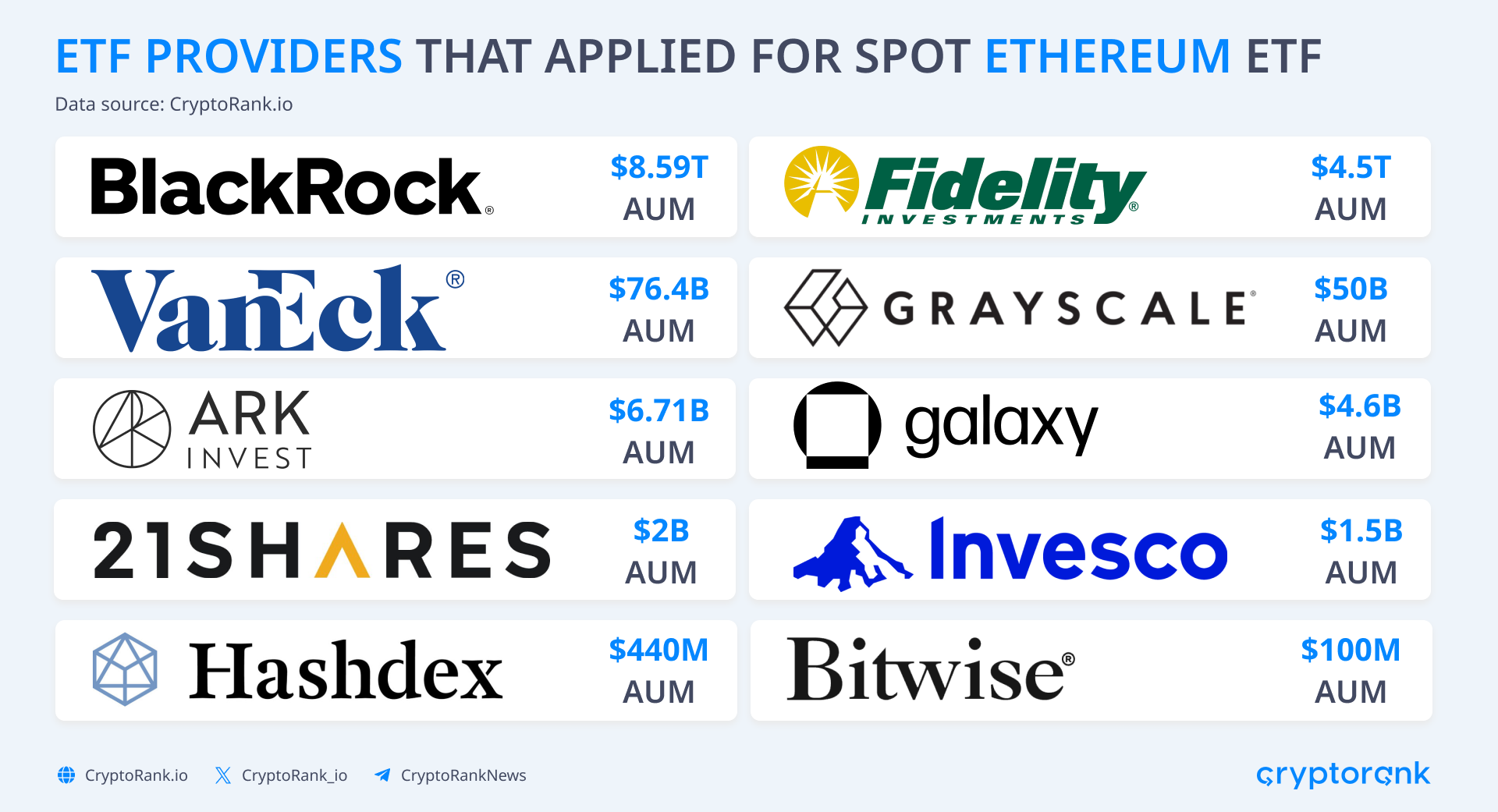

To the date, 14 major authorized participants (APs) have applied for a spot Bitcoin ETF. The total assets under management of these organizations exceed $14 trillion.

How Does Spot Bitcoin ETF Work?

A spot Bitcoin ETF tracks the real-time price of Bitcoin using physical Bitcoins as underlying assets. Authorized participants (APs), usually large financial institutions, play a vital role in the ETF's operation. They can create or redeem ETF shares in large blocks called creation units by delivering or receiving an equivalent value in Bitcoin.

This creation and redemption process helps keep the ETF's market price close to the spot price of Bitcoin. If the ETF trades at a premium, APs can create new shares and sell them at the higher market price, buying Bitcoin at the spot price to deliver to the ETF. Conversely, if the ETF trades at a discount, APs can redeem shares, receive Bitcoin from the ETF, and sell it at the higher market price.

Spot Bitcoin ETFs use regulated custody solutions to secure the underlying Bitcoin. These custodians hold the physical Bitcoin on behalf of the ETF and its investors. The ETF itself trades on traditional stock exchanges, providing access to a wide range of investors. Trading occurs at market prices, similar to traditional stocks.

The ETF's net asset value (NAV), calculated based on the value of the underlying Bitcoin holdings, is regularly disclosed. This transparency allows investors to assess the fund's value compared to its market price. Essentially, a spot Bitcoin ETF offers investors a way to gain exposure to actual cryptocurrency without direct ownership, using a mechanism to align the ETF's market price with the real-time spot price of Bitcoin.

What Does Approval of Spot Bitcoin ETF Mean For Crypto Industry?

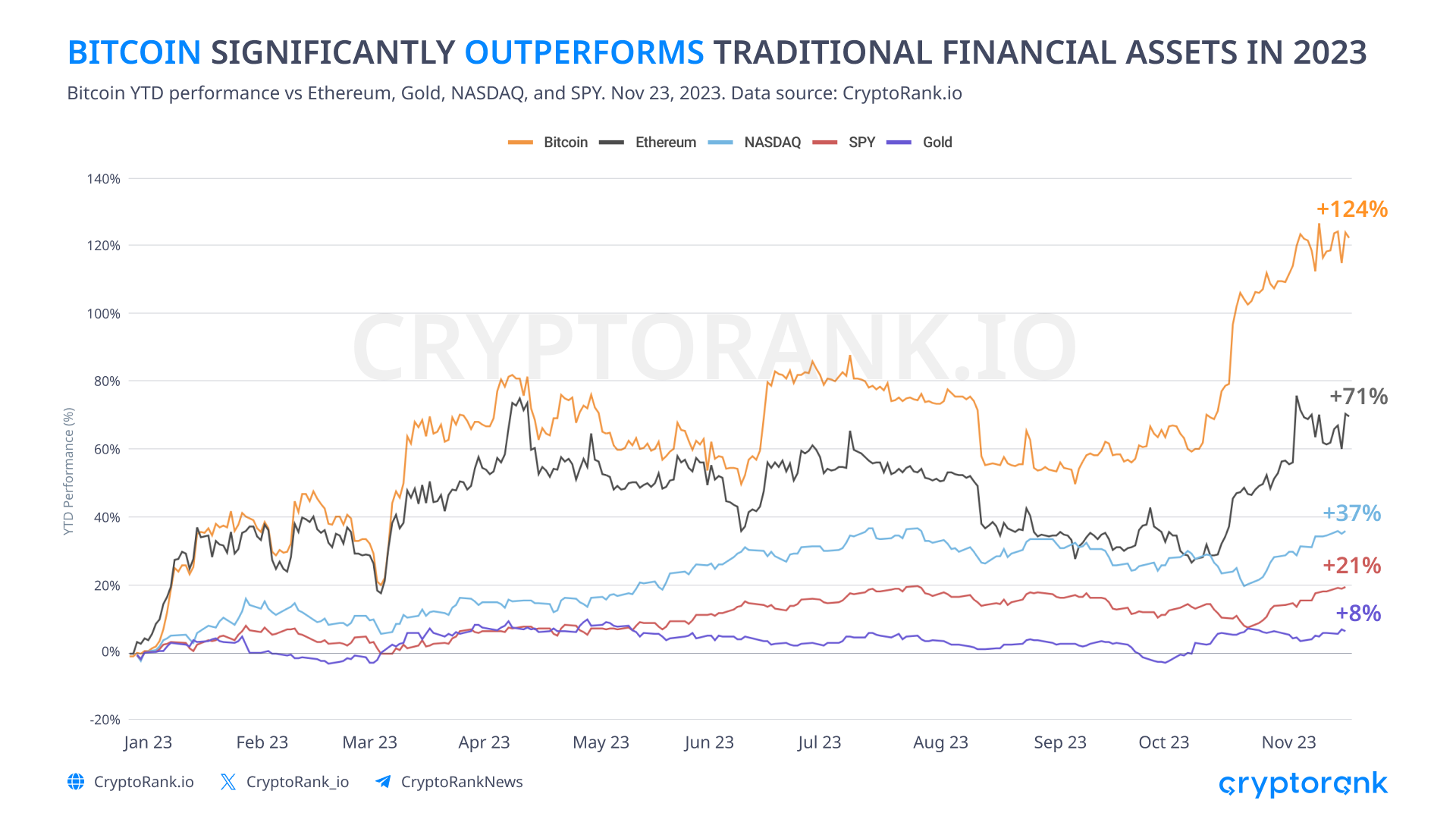

The approval of the first Bitcoin ETF is a highly anticipated event. The current bullish price of Bitcoin is heavily influenced by the high probability of ETF applications being approved. The interest of large institutions in purchasing BTC creates several factors that currently impact the crypto market.

Increased Demand And Price

The approval of a spot Bitcoin ETF could lead to increased demand for the cryptocurrency, and consequently, have an impact on its market price. In late October, when BlackRock's proposed ETF ticker was discovered on the Depository Trust & Clearing Corporation’s (DTCC) website, Bitcoin experienced a significant price surge of 30%, surpassing $30,000 for the first time since June 2022 and aiming for $40,000.

Tightening Of Regulation

Approval could trigger an increase in regulatory oversight, resulting in tighter regulations within the crypto industry. Authorities may aim to establish more rigorous frameworks to address potential concerns. As cryptocurrency becomes more regulated, it deviates from its path as an alternative for traditional finance.

Further Adoption of Crypto

The approval of a spot Bitcoin ETF could serve as a catalyst, promoting greater acceptance and use of cryptocurrencies in mainstream financial circles.

The adoption of cryptocurrency, particularly Bitcoin, can be categorized into three distinct waves: initial acceptance by the public, subsequent adoption by businesses, and more recently, recognition and acceptance by government entities.

These waves typically reach their peak during bull-run periods. Like the adoption of any technology, each wave involves innovators, early adopters, early majority, late majority, and laggards.

| Year | Public | Business | Government |

|---|---|---|---|

| 2012 | Innovators | Non | Non |

| 2016 | Early adopters | Innovators | Non |

| 2020 | Early majority | Early adopters | Innovators |

| 2024 | Late majority | Early majority | Early adopters |

Among the three categories of public, business, and government, the latter two, especially the government, stand out as the primary beneficiaries of adopting a spot Bitcoin ETF. These two categories are known for their preference for long-term investments, and there is a high anticipation of liquidity inflow from them.

If, as expected, the 2024 halving triggers a price rally, the crypto market should anticipate early adopters from the government and early majority of investors from businesses. A spot Bitcoin ETF is undoubtedly a useful tool for these types of investors.

Spot Ethereum ETF

Following the applications for a Bitcoin ETF, global hedge funds have now applied for an Ethereum ETF. Ethereum is the second-largest cryptocurrency in terms of market capitalization and trading volume, following Bitcoin.

It is unlikely that any currency other than Ethereum and Bitcoin will be chosen for the next spot ETF in the near future. However, if the adoption of spot BTC and ETH ETFs goes well in the coming years, we might see the emergence of ETFs on other currencies like Chainlink, Uniswap, Litecoin, Solana, etc.

Is the Crypto Winter Over?

While big players such as BlackRock, Ark, and Grayscale have applied for Bitcoin and Ethereum ETFs, there is no guarantee of their approval in the near future. The industry faces regulatory hurdles from global regulators like the SEC.

It is important to consider the bigger economic picture beyond cryptocurrencies. Worldwide markets are grappling with challenges such as higher interest rates and increased prices, which impact all types of investments, not just TradFi.

However, the end of 2023 appears more promising for the crypto industry compared to its beginning. The upcoming Bitcoin halving may coincide with the approval of a spot Bitcoin ETF, potentially leading to further growth and the start of the next bull run cycle for the crypto industry.

The Bottom Line

The upcoming approval of a spot Bitcoin ETF has significant implications for the crypto industry. It could lead to increased demand and higher market prices, but it may also result in stricter regulations. Despite existing obstacles and economic challenges, the industry expects positive changes by the end of 2023. The combination of the Bitcoin halving and the approval of a spot Bitcoin ETF has the potential to trigger a new bull run.

ARK Invest

ARK Invest BlackRock

BlackRock Fidelity

Fidelity Franklin Templeton Investments

Franklin Templeton Investments Galaxy

Galaxy