The Rise of DeFi and NFTs on the Bitcoin Blockchain

Decentralized Finance (DeFi) has caused a significant upheaval in the cryptocurrency realm. It has propelled Ethereum to the position of the second-largest blockchain by market capitalization and has given rise to numerous EVM-based and non-EVM blockchains.

A less widely recognized fact is that DeFi and NFT are also making strides in the realm of Bitcoin. They are demonstrating rapid growth in Total Value Locked (TVL) and NFT trading volume. This article examines the rise of DeFi and NFT activity on Bitcoin.

Bitcoins Becomes One of the Main Chains for NFT

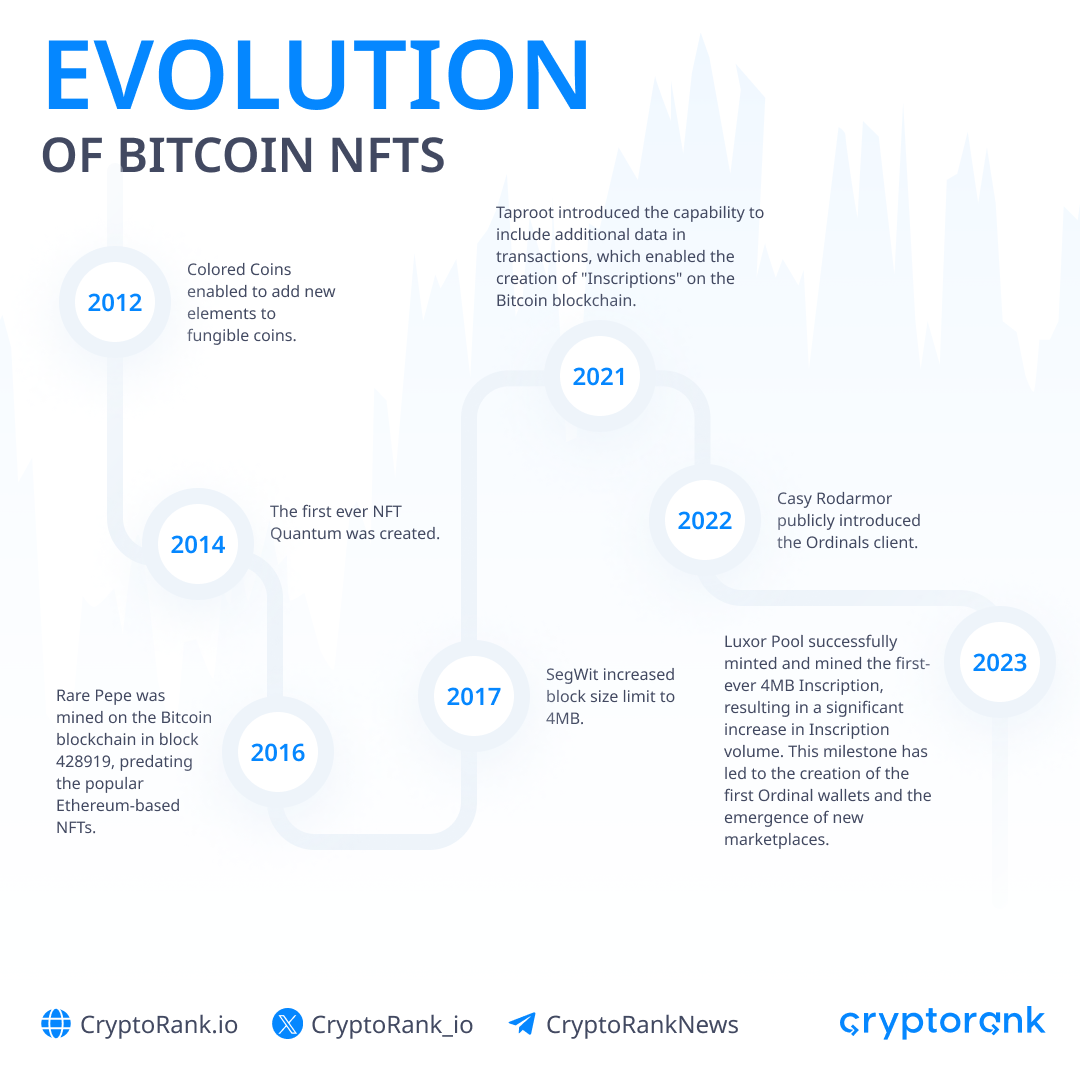

Bitcoin is quickly gaining dominance in the NFT market. NFTs on Bitcoin have been around for some time, but they only started gaining popularity this year, coinciding with the growth of Total Value Locked (TVL) and the introduction of Ordinals on the Bitcoin mainnet on January 20, 2023.

Although Ethereum has always been the leading blockchain for NFT trading, other blockchains like Solana, Polygon, and various NFT-specific blockchains like ImmutableX have attempted to create competition. However, it is surprising that the real competition is now coming from Bitcoin. In November, Bitcoin's share of NFT trading volume surpassed Ethereum's share, and this trend may continue in December.

Bitcoin Ordinals are the equivalent of non-fungible tokens (NFTs) on the Bitcoin blockchain, using satoshis as the smallest denomination. Each satoshi is assigned a serial number based on its mining order. The Ordinal protocol allows for the creation of NFTs on the main Bitcoin layer by attaching additional data, such as an image or text, to a satoshi.

NFTs were already possible on Bitcoin before the launch of the Ordinal protocol. However, Ordinal inscriptions are directly embedded into individual satoshis and stored in Bitcoin blocks. This means that Ordinals benefit from the security, immutability, and durability of Bitcoin itself.

The hype around Bitcoin NFTs grew rapidly after the launch of Ordinals. However, it quickly declined after a few months. The popularity then returned with the introduction of the BRC-20 token standard. November became the peak month for NFTs on Bitcoin, and December is expected to be even better.

Best Times for DeFi on Bitcoin Yet to Come

In addition to NFT trading volumes skyrocketing, Bitcoin TVL (Total Value Locked) has also reached an all-time high, surpassing $300 million and exceeding the previous ATH (All-Time High) of $221 million set in November 2021.

Bitcoin offers various solutions that enable decentralized finance (DeFi) on the Bitcoin network.

To foster the growth of the DeFi ecosystem on Bitcoin, it is essential for new projects to emerge and address the existing gaps. Currently, the Bitcoin ecosystem is lacking in convenient wallets, decentralized exchanges (DEXes), lending protocols, and other decentralized applications, which are integral to the blockchain ecosystem.

Some projects view this as an opportunity and try to enter this niche.

Bitcoin is being rediscovered by new projects and community members. This may be a historic moment for Bitcoin and an opportunity for a project to adopt the Bitcoin blockchain and leverage its potential benefits.

The Burden of Being an Industry Leader Makes Bitcoin More Conservative

Bitcoin's scripting language, deliberately designed to be simple and secure, stands in stark contrast to Ethereum's Turing-complete smart contract language. This scripting language limitation on Bitcoin constrains its ability to support the complex programmability required for many DeFi and NFT applications.

The conservative development approach inherent in the Bitcoin community further compounds the challenge. Prioritizing stability and security, the community demands broad consensus for major protocol changes. While this approach ensures a secure environment, it hinders the rapid implementation of new features, including those crucial for advanced DeFi applications.

Moreover, Bitcoin's philosophical focus on decentralization and resistance to change aligns with its primary goal – to serve as a decentralized and censorship-resistant digital gold. This focus on simplicity and robustness, however, comes at the cost of adaptability to the dynamic and experimental nature of the DeFi and NFT space.

Security concerns also play a significant role. The Bitcoin community, inherently risk-averse, is cautious about introducing complex financial instruments through smart contracts on its blockchain. The various vulnerabilities and exploits witnessed on other blockchains raise red flags, reinforcing the community's preference for security over experimental functionalities.

Why Users Choose DeFi and NFT on Bitcoin

There are compelling advantages to opting for Bitcoin as the platform for DeFi projects.

Battle tested

Bitcoin stands out as the world's most stable, secure, and decentralized blockchain. Since its inception in 2009, the network has consistently demonstrated its resilience, undergoing minimal modifications to its core protocol with almost no downtime. This exceptional track record positions Bitcoin as the ideal foundation for developers aiming to build the next generation of financial services and non-fungible tokens.

Industry leader

Bitcoin reigns supreme as the largest cryptocurrency in terms of market capitalization, mining infrastructure, and user base. The global shift towards BTC as the standard digital asset for both retail and institutional investors highlights the powerful network effects at play.

Wide holder base

As Bitcoin continues to rise in popularity, the demand for diversified use cases will inevitably increase. Currently, a significant percentage of circulating BTC is held in cold storage, calling for more productive utilization. Developing DeFi applications and NFTs on the Bitcoin blockchain promises to inject innovative and substantial utility into both the asset and the broader network. This evolution not only enhances the functionality of Bitcoin but also positions it as a versatile and dynamic force in the ever-expanding realm of decentralized finance.

Additionally, the hype surrounding the new Bitcoin price rally and the anticipation of approval for a Bitcoin ETF further strengthens the Bitcoin NFT and DeFi trend.

The Bottom Line

Bitcoin has shown significant growth in NFT trading volume and TVL. Over the past few years, new scaling solutions for Bitcoin have emerged, offering the benefits of DeFi and the reliability of the Bitcoin blockchain.

For Bitcoin to be compatible in the DeFi and NFT spheres, it needs to develop the entire ecosystem. There are new projects emerging with the goal of adopting the Bitcoin blockchain for broader use cases. However, this is not an easy task since the Bitcoin base code is not Turing complete, and Bitcoin was intentionally designed to resist centralized governance. As a result, changes to Bitcoin occur at a slow rate.

Undoubtedly, Bitcoin provides the most reliable and decentralized infrastructure for building a decentralized ecosystem. Bitcoin is now entering a phase of rediscovery, which can have a significant impact not only on its price and the ecosystem landscape but also on the entire financial system, as it has done in the past.