Crypto Market Recap: January 2024

Key Takeaways:

-

Spot Bitcoin ETFs were approved, but BTC closed the month in the red zone.

-

January was a good month for Token Sales, but we may see more big IDOs, IEOs and ICOs ahead.

-

CEXs showed an increase in trading volume while DEXs showed a decrease.

Market Performance

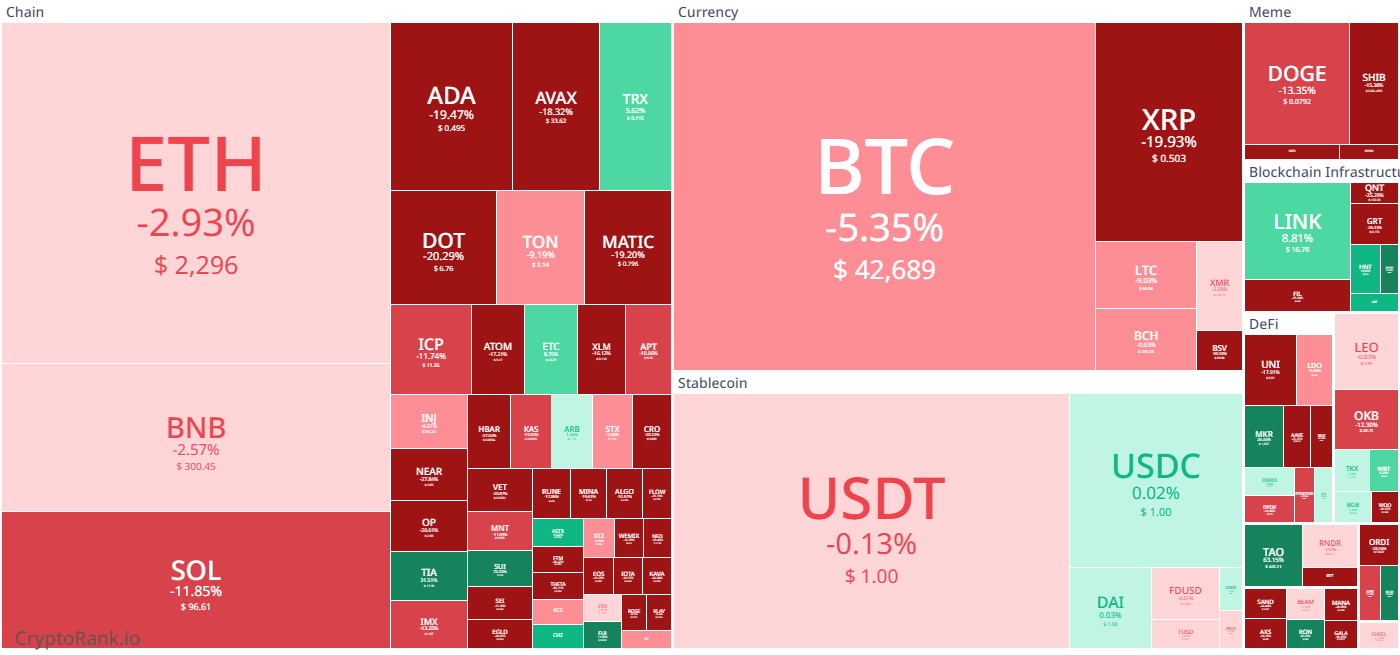

After a short bull market, January painted the crypto market landscape in red. Popular blockchain coins like ADA, AVAX, or MATIC (that fit in the current narrative) suffered the most. Solana, on the other hand, is confidently holding its popularity against the backdrop of Solana Airdrop Season. It turned out to be a difficult month for XRP amid continued uncertainty.

Sell The News Event For Bitcoin

The approval of spot Bitcoin ETFs was a "sell the news" event for BTC. Bitcoin showed rapid growth in the first 10 days of the year and hit an almost two-year high on the eve of the approval.

However, immediately after the approval, there was an outflow of money from BTC, amid which Bitcoin temporarily dipped below $40K. Since then, it has been trading sideways, ending the month flat.

Boring Month For Altcoins

As seen on the heatmap above, it was not very positive for the majority of altcoins. Nevertheless, a number of gainers have formed on the market. The best performing categories were DeFi, GameFi, and Blockchain Service. Among the key gainers there are two token sale launchpads, Solidus and DexCheck, which showed significant token price growth.

January Key Events

The month started on a positive note, but the optimism that existed in the market at the end of 2023 quickly evaporated, and changed to a few weeks of side trading.

Spot Bitcoin ETFs Approval

As most of the market expected, spot Bitcoin ETFs were approved on 10 January and the trading began on 11 January. It is too early to talk about success of these instruments, however, thay have some benefits to physical Bitcoin. Unlike cryptocurrencies, Google does not prohibit advertising Bitcoin ETFs, and this could be a very important tool to attract retail investors.

The next target is the approval of spot Ethereum ETFs, which is likely to happen in May this year. We are likely to see a similar pattern: rising ETH before the approval and a decline afterwards.

New Projects Enter Market

With the market rebounding, we've seen a lot of exciting projects launches each month. January also saw some big token launches, as well as significant airdrops. The market is open for new tokens and we will see more big projects coming to market soon.

The actual airdrop season is just beginning and the first quarter could be the biggest in terms of the airdrop value. Don't forget to keep an eye out for new projects, and our Fundraising Digest can help you with that.

Token Sales Interest Show Growth Trend

Despite the market ending the month in the red zone, token sale activity keeps growing. In January, almost $61M was raised across 128 token sales. This is a new high since March 2023, however, we are still far from the massive popularity of token sales.

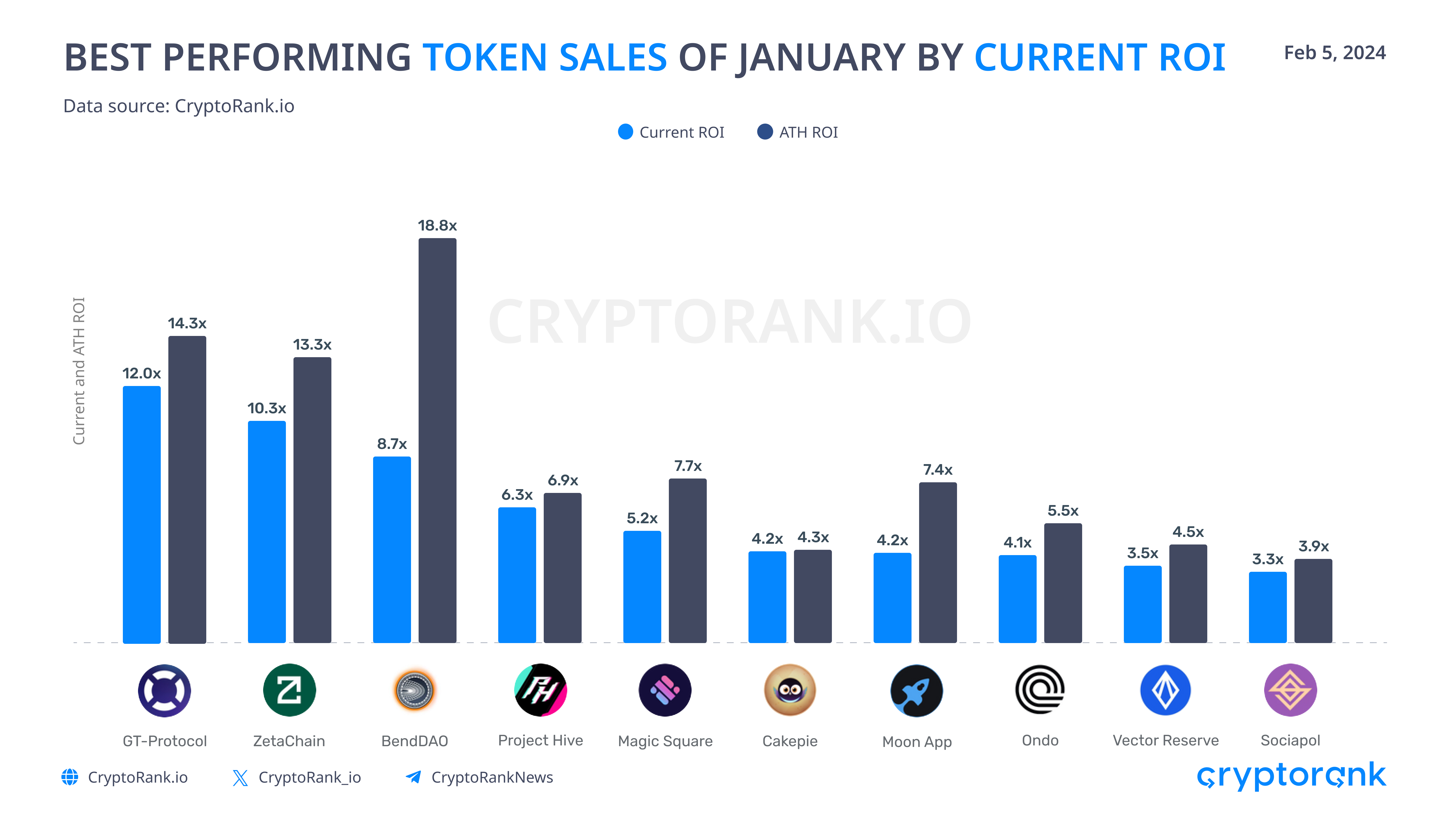

Among the most successful token sales of the month were GT Protocol, ZetaChain and the new token from BendDAO, BDIN. The long-awaited listing of Ondo also took place after the token sale on Coinlist.

ChainGPT Pad and DAO Maker stood out among the launchpads with the highest return on investment. All thanks to the launch of several very successful projects, including GT Protocol.

Most likely, we will see more interesting token sales ahead, but we should not expect a repeat of the 2021 token sales boom. Currently, airdrops have come to the forefront and they will remain the main method of token distribution in the near future.

Total Value Locked Raises

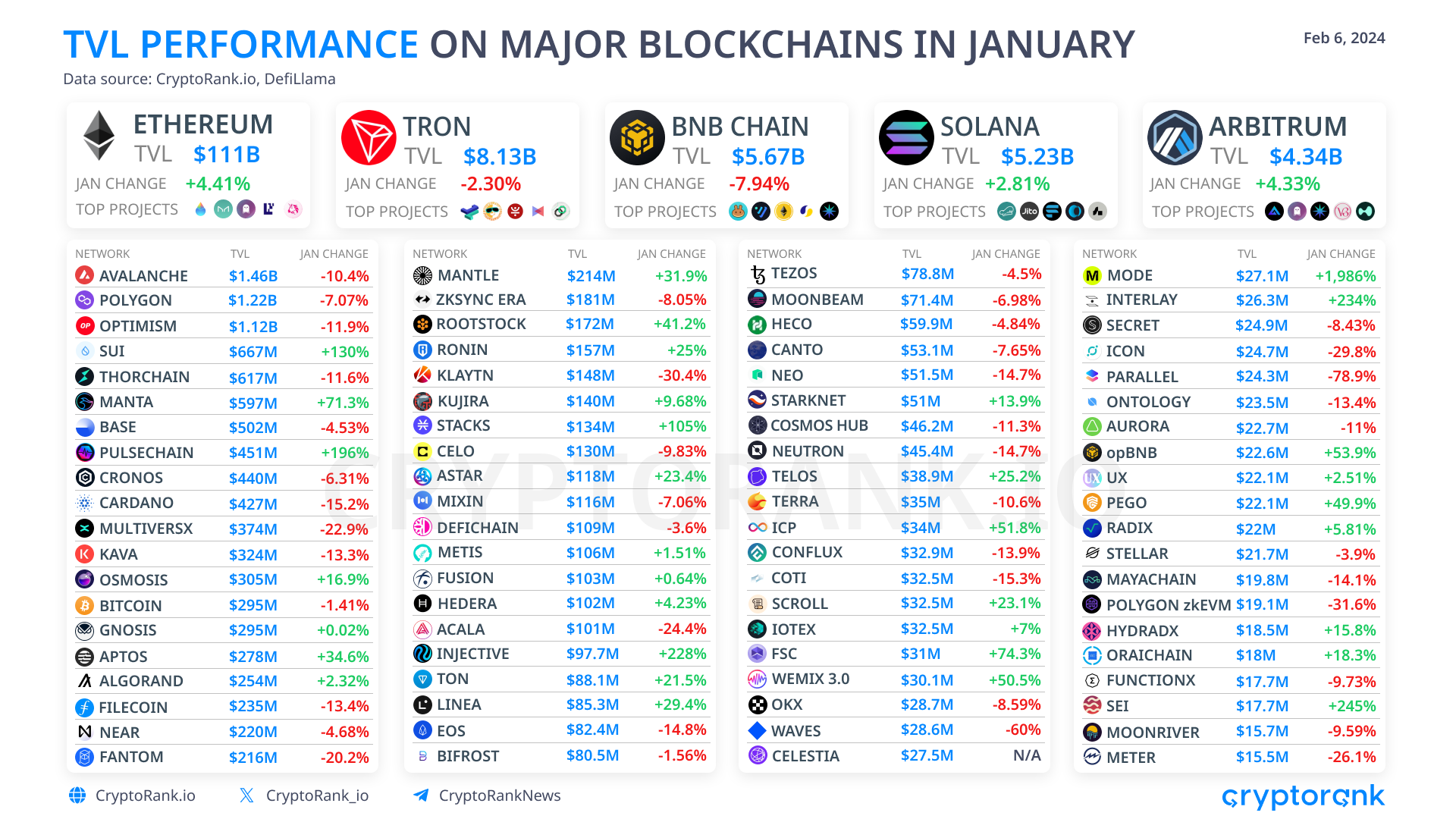

The growth of DeFi continues due to the growing interest in on-chain activity, drop hunting, and the constant emergence of new blockchains.

Ethereum remains the dominant force in DeFi, but we can highlight some changes this month. Sui now firmly holds the top 10 blockchains in terms of TVL, showing over 130% growth in January.

Among the projects, Ajna Protocol and IDEX were the leaders in TVL growth. Liquid Restaking Protocols: Renzo and ether.fi, which are still gaining popularity, can also be singled out. You can learn more about Liquid Restaking in our post.

CEXs Win, DEXs Don’t

Surprisingly, the trading volume growth figures for centralised and decentralised exchanges showed mixed movement.

Centralised exchanges reached a new high volume for the year in January, exceeding $800 billion. Binance remains the leader, followed by OKX and Coinbase.

The situation with decentralised exchanges is surprisingly different. The total trading volume showed a 14% decrease. The former exchanges on the three largest blockchains, Uniswap, PancakeSwap, and Orca, holding the leading positions.

Blockchain Utilization Grows

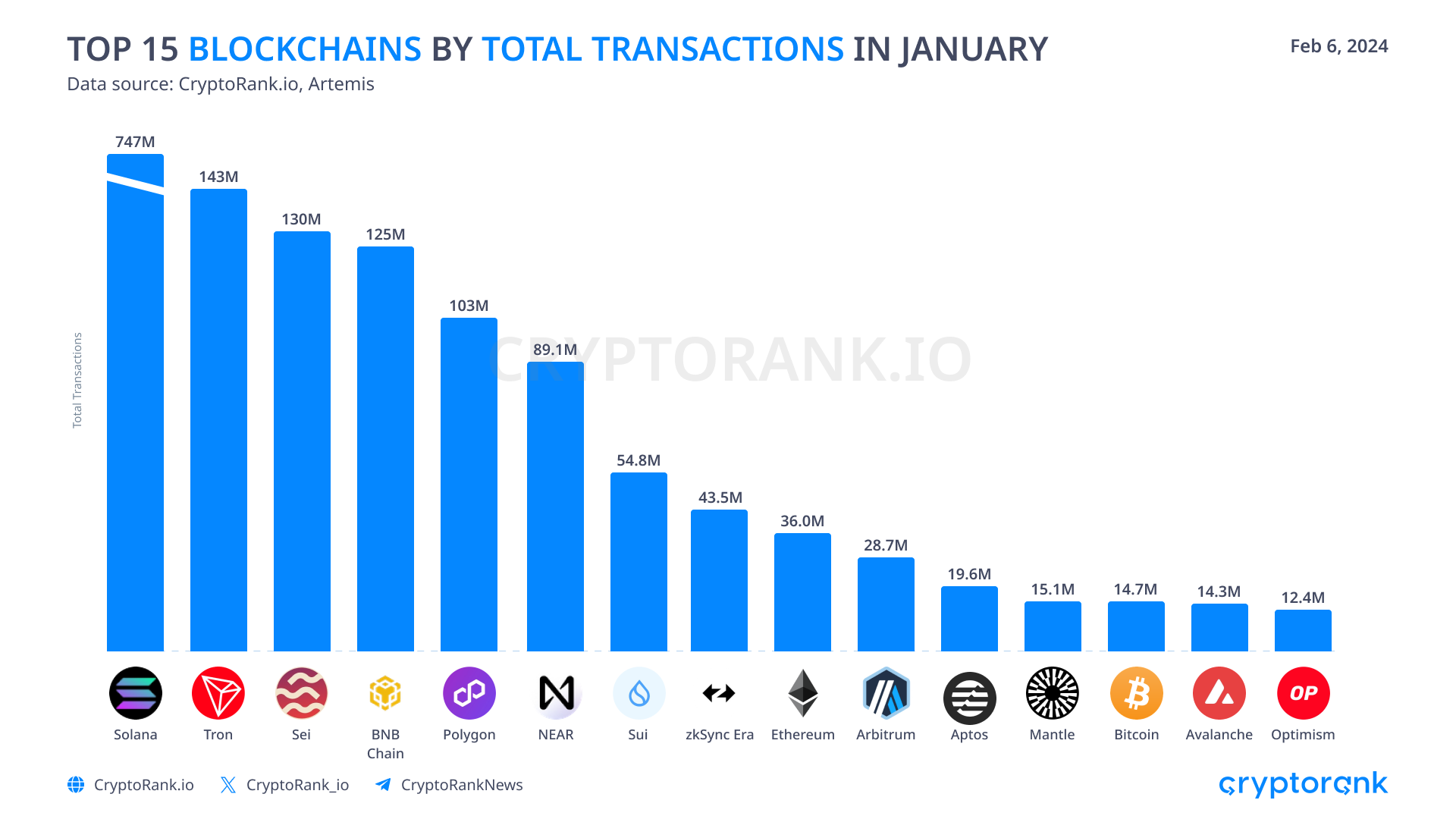

Solana remains the most popular blockchain by number of transactions, with a significantly increased number of total transactions over TRON and others compared to previous months. Sei also moved into the top 3, overtaking BNB.

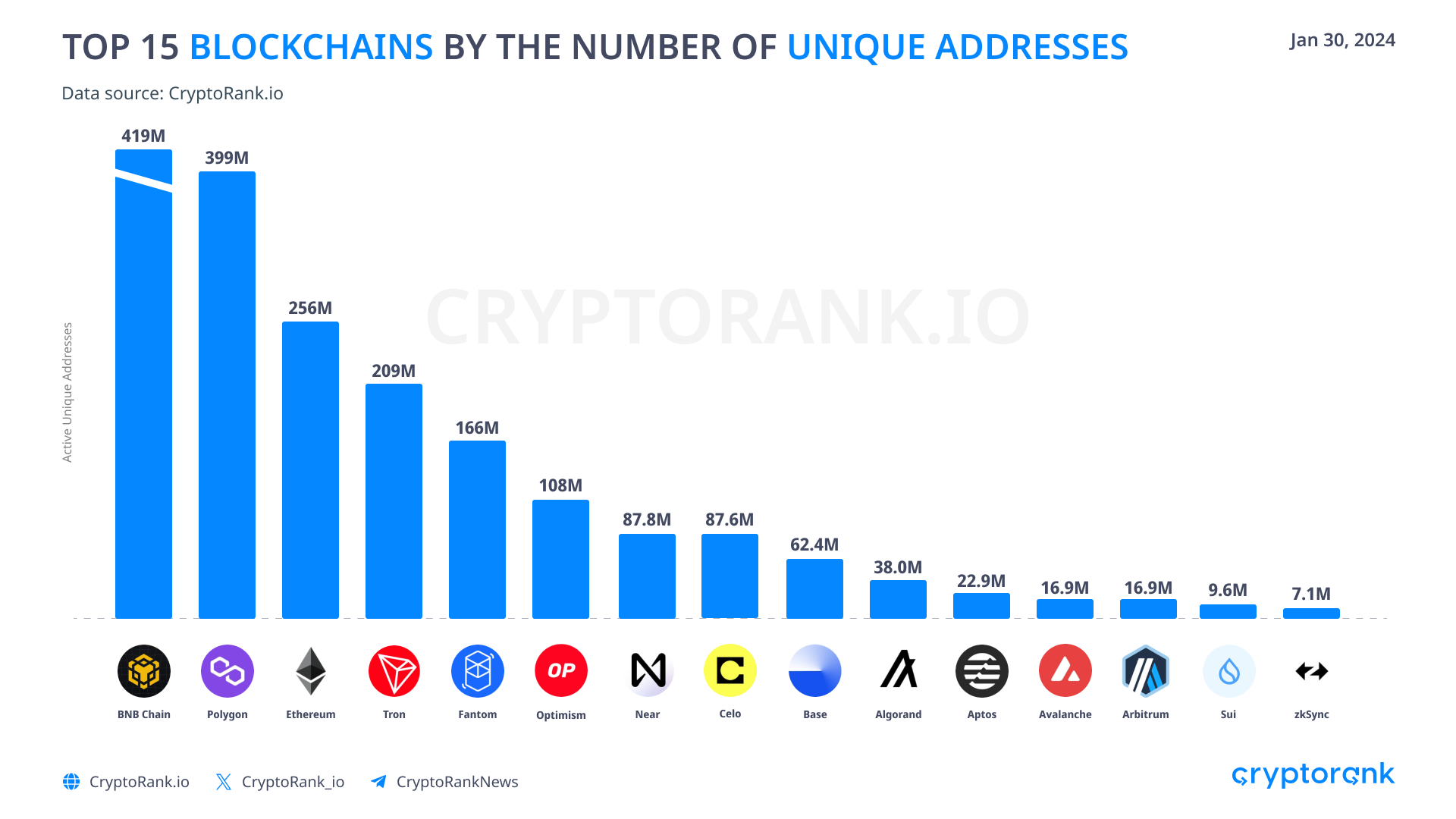

In terms of the number of blockchain addresses, Polygon takes the lead, quickly overtaking Ethereum and almost catching up with BNB Chain, with a difference of only 20 million addresses.

In general, the picture remains extremely positive for blockchain development, as we can see an influx of users in addition to a rise in the value of coins. Projects are taking advantage of this opportunity and launching their own blockchains, often Layer 2 or Cosmos solutions.

The Bottom Line

January was a very bright and productive start to 2024. The approval of spot bitcoin ETFs was an important step towards the introduction of cryptocurrencies into the global financial world. Despite the apparent lack of positivity in the market, the year has started well.

The airdrop season is just beginning and there are many new interesting projects on the horizon. Let's follow the development of the crypto market together with CryptoRank!

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

In This Insight

Coins

Read More