Crypto Fundraising Recap: January 2024

Key Takeaways:

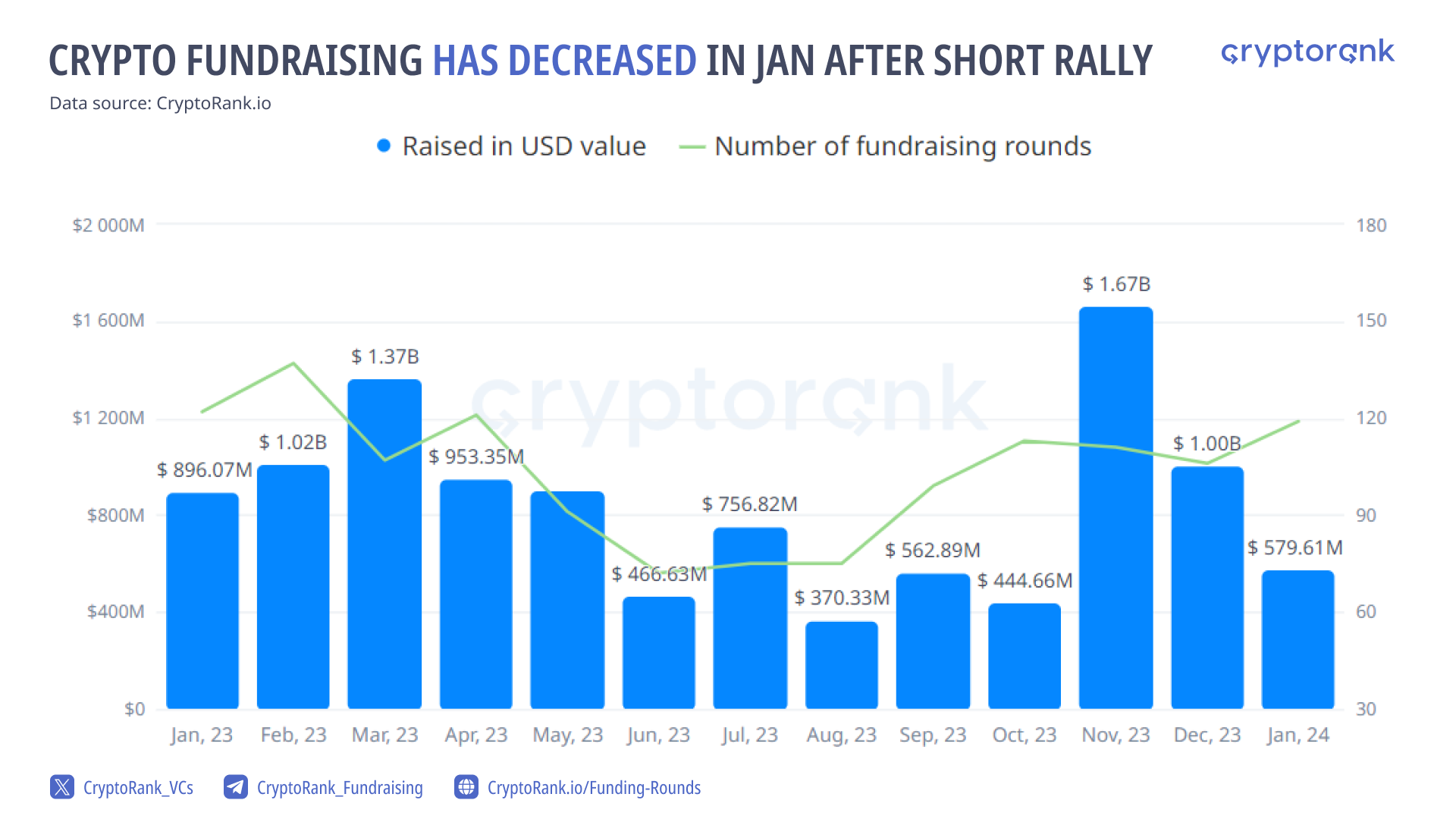

🔹 In January there were few huge rounds, therefore the amount of funds raised has decreased compared to December and November.

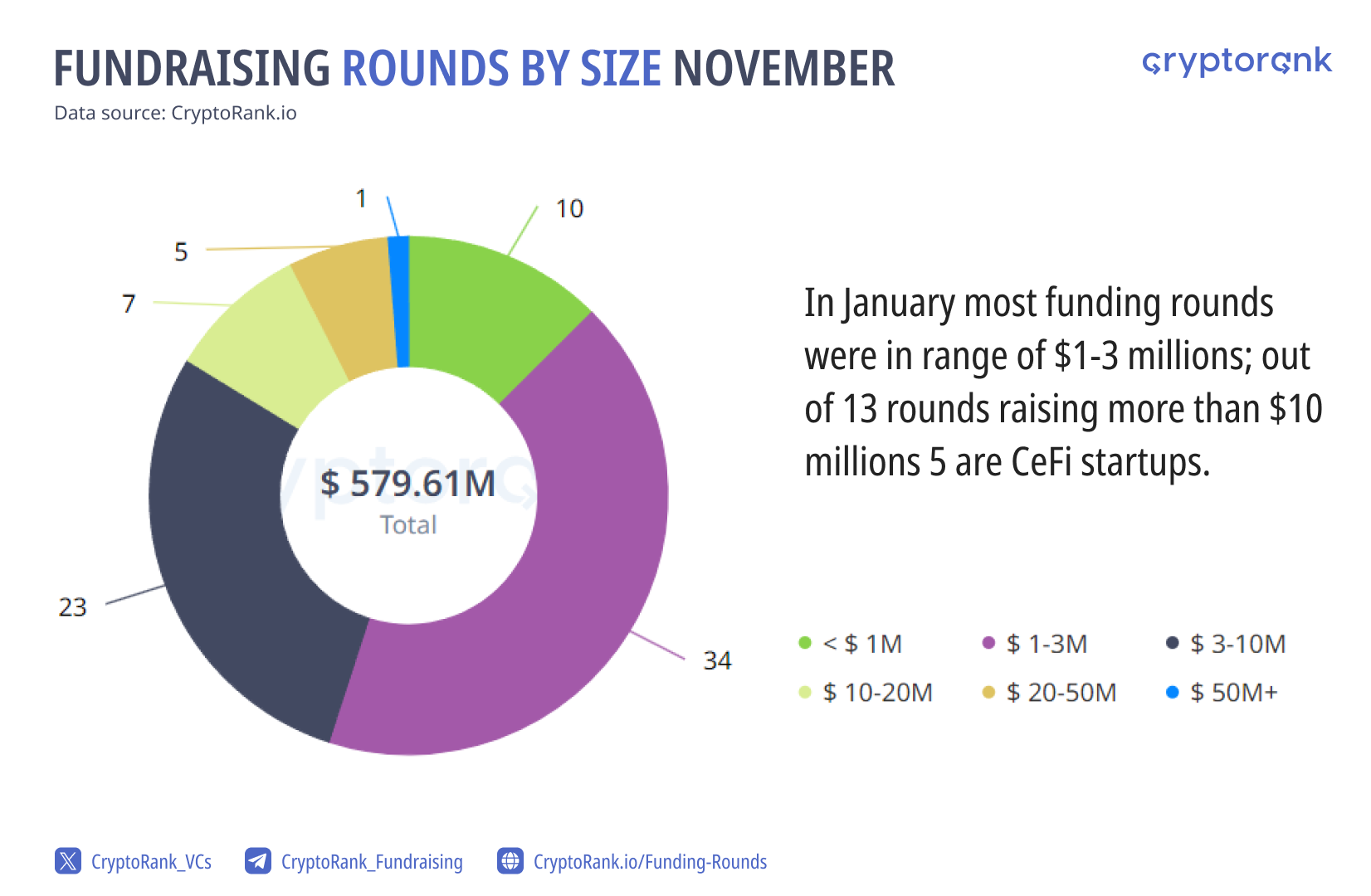

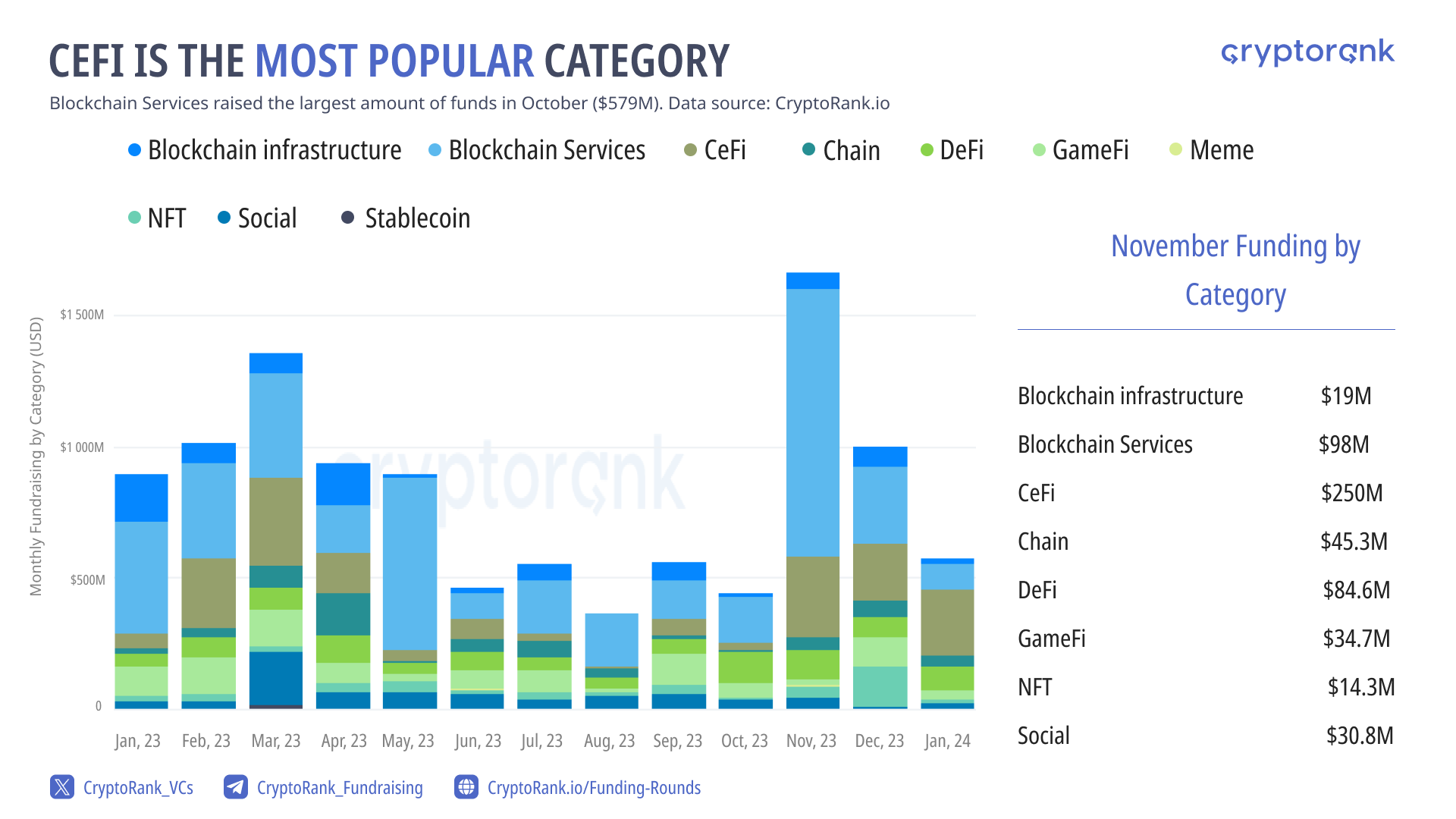

🔹 A total of 121 deals worth $579 million were closed, with the highest funding amounts going to CeFi ($250M) and Blockchain Service ($98M) startups.

🔹 The average size of a funding round is about $1-3 millions in January.

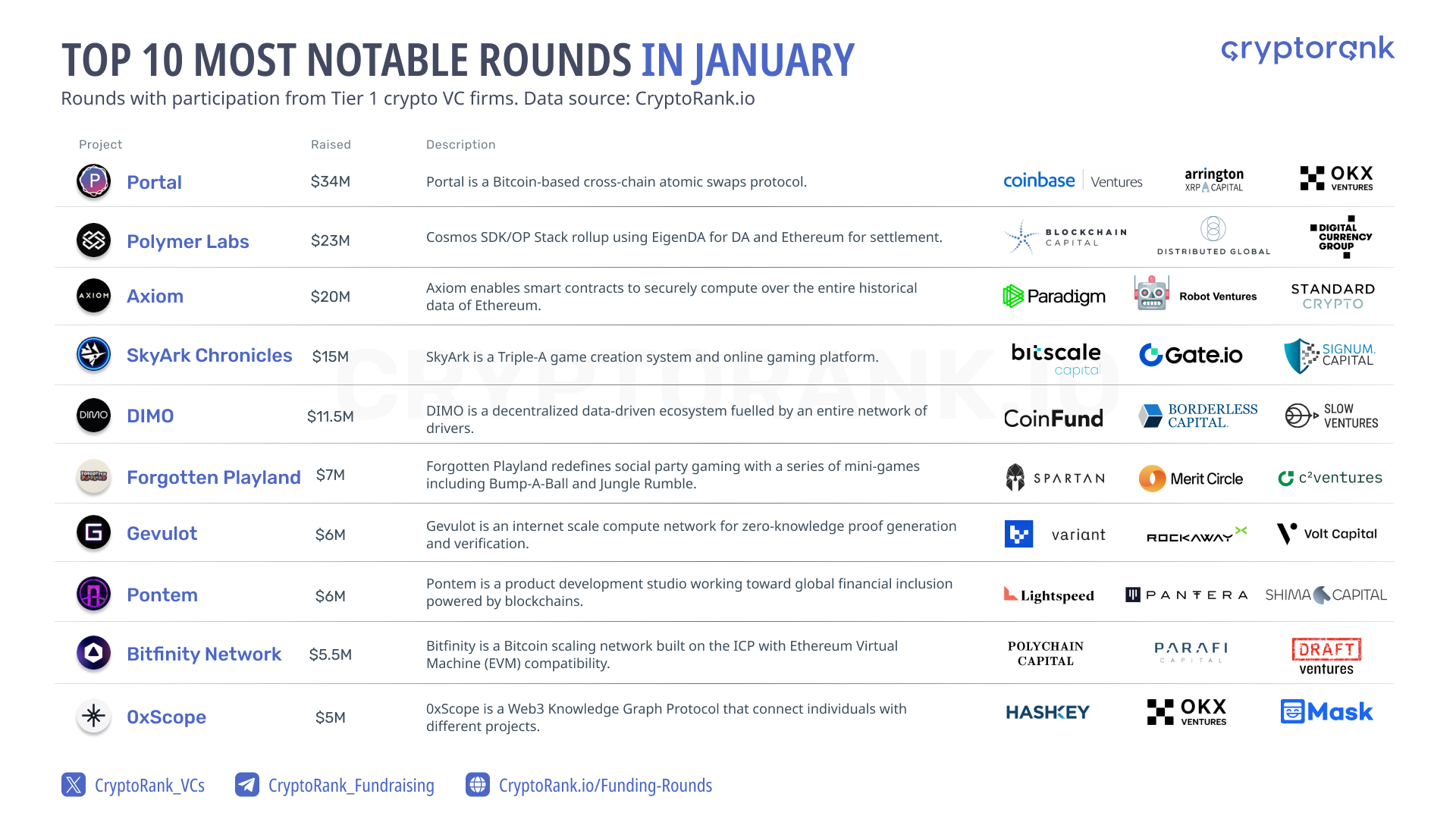

🔹 Bitcoin ecosystem and blockchain interoperability startups are in the focus of venture capital.

Fundraising Activity Keeps Upward Trend Despite Evident Decrease

The fundraising activity dramatically decreased in January compared to the two previous months in terms of the money raised amounts. However, the number of investment rounds increased slightly. It is worth mentioning that November and December saw several large-size funding rounds, exceeding $100 million in raises. Therefore, there is no reason to suggest that the recovery in crypto fundraising has stopped: January is often a less active month for VC funds and investors.

Bitcoin Ecosystem and Blockchains Interoperability are in the Focus

Observing the investment rounds month by month, one can see the preferences of venture funds, such that venture capital is currently flowing into interoperability protocols and projects based on Bitcoin. It is worth highlighting several projects among the notable rounds:

-

Portal, a Bitcoin-based cross-chain atomic swaps protocol, has raised $34 million from Coinbase Ventures, Arrington XRP Capital, OKX Ventures, and others. This indicates booming investments in the Bitcoin ecosystem, as described in our research.

-

Polymer Labs, which creates Cosmos SDK/OP Stack rollup using EigenDA for DA (data availability) and Ethereum for settlement, is also worth highlighting as one of the solutions aiming to solve the interoperability problem, which is in focus within the industry.

-

Axiom, a project that enables smart contracts to securely compute over the entire historical data of Ethereum, has also grabbed attention. It aims to efficiently extract and use data to create more complex solutions based on this data.

January saw fewer large-size rounds, but numerous remarkable deals were conducted in the previous two months. It's worth mentioning that in January, the HashKey Group announced a raise of $100 million. The newly raised capital will be used to solidify HashKey's Web3 ecosystem, accelerate product diversification of its licensed business in Hong Kong, and drive the Group's compliant and innovative development globally.

The Most Active VC

Venture firms have become more frequent investors in new startups since Bitcoin started to grow. OKX Ventures leads in the number of deals in January, which can indicate potential inflow of projects on OKX Jumpstart.

The Amount Raised in January Per Startup Decreased

As seen from the pie chart below, most funding rounds were in the range of $1-3 million, with just one round raising more than $50 million.

It's worth mentioning that CeFi startups tend to raise larger rounds. This can be attributed to more stable commission business models and the lack of bridges between traditional crypto finance, which brings more lucrative opportunities in terms of revenue to startups in that segment.

CeFi is the Dominant Category by Raised Amounts

For the first time in a long period, the Blockchain Services has not emerged as the leading category in terms of money raised, losing to CeFi, which startups raised $250 million in January. Despite the large amount of funding, CeFi is not a native crypto category, as it mostly includes startups on the edge of web2 finance and web3. It lacks decentralization and does not offer airdrops, making it akin to a Trojan horse in the crypto world.

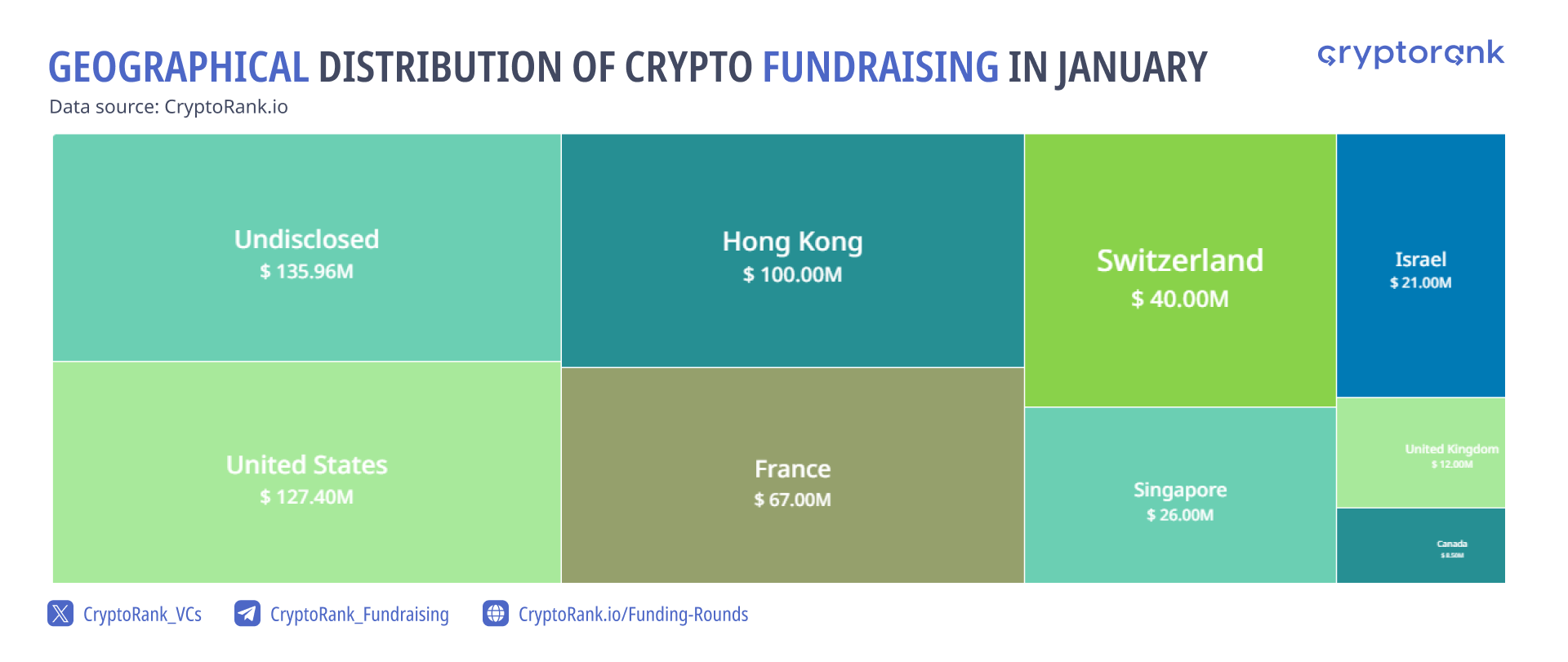

The United States Leads Crypto Fundraising in January

The United States continues to dominate the venture landscape, followed by Hong Kong, France, Switzerland, and Singapore. Both Hong Kong and Singapore are leaders in crypto fundraising in the Asian region. In Europe, the United Kingdom mostly dominates, although it did not raise a significant amount of funds this month, losing out to France and Switzerland.

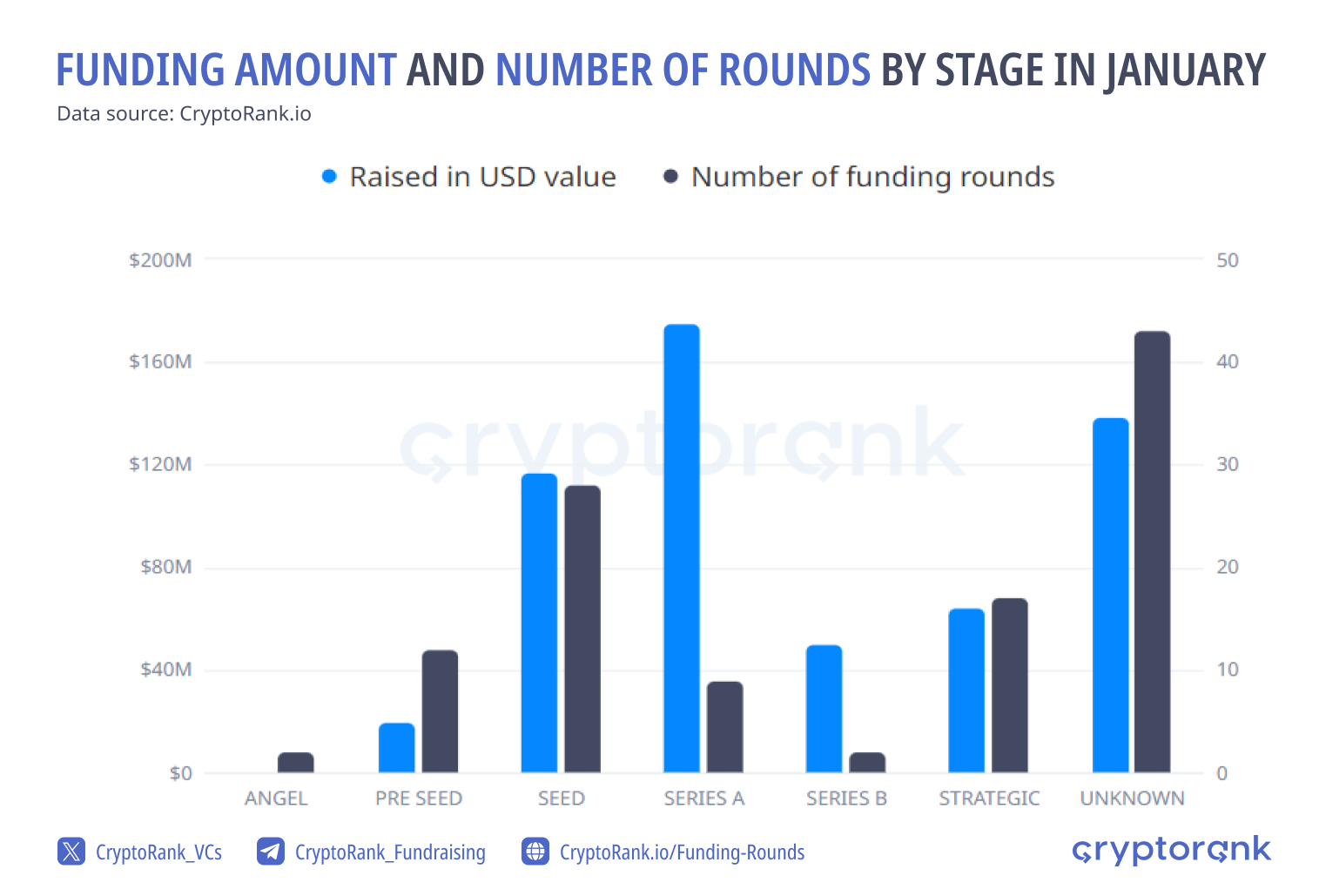

Seed and Pre-Seed Rounds Lead

In January, the dominant stages were seed and pre-seed, which indicates why, despite having the same number of funding rounds, there were lower amounts raised.

The Bottom Line

While January 2024 saw a decrease in the overall amount of funds raised compared to the preceding months, the upward trend in crypto fundraising remains intact. Despite fewer large rounds, the increased number of startups securing investments suggests continued confidence in the crypto market. Venture capital continues to flow into projects focusing on the Bitcoin ecosystem and blockchain interoperability, reflecting ongoing interest in foundational technologies. The coming year promises to be full of investment rounds and significant events for the crypto industry.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Hashed

Hashed HashKey Capital

HashKey Capital Polychain Capital

Polychain Capital Shima Capital

Shima Capital YZi Labs (Prev. Binance Labs)

YZi Labs (Prev. Binance Labs)