Crypto Market Recap: Q2 2024

Key Takeaways:

-

The second quarter was marked by low volatility and insignificant price movements in the crypto market, even with the acceptance of a spot ETH ETF;

-

Meme coins have flourished during the current bull market, with GameFi and DeFi sectors also performing well;

-

Notcoin emerged as the biggest gainer among newly launched tokens, which gave rise to a segment of tap apps;

-

zkSync and Wormhole did not reach $1 billion in market cap, which can be linked to their frustrating airdrop campaign;

Second Quarter was Negative For Crypto Market With Few Exceptions

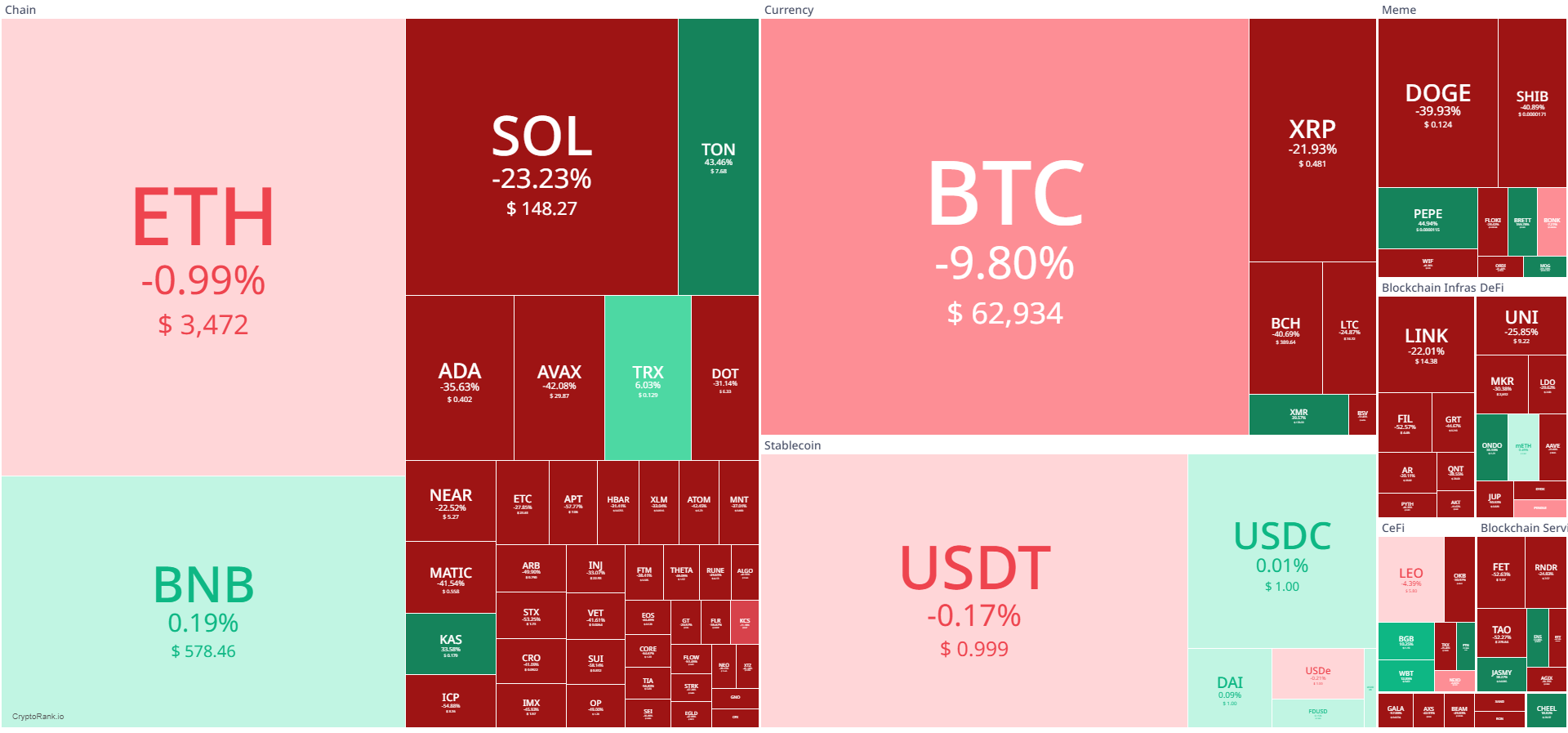

For most tokens, the second quarter was negative. However, a few, including BNB, TON, TRX, KAS, PEPE, XMR, and ONDO, managed to close the quarter with gains. Ethereum performed relatively well compared to other coins, losing only about 1%, while Bitcoin saw a decline of 9.8%.

The entire crypto market contracted by 12% in the second quarter, which appears to be a normal cooldown after two quarters of significant growth. The future direction of the crypto market remains uncertain. On one hand, we haven't seen a "true altseason," but on the other hand, Bitcoin and some altcoins managed to reach new all-time highs.

Meme Coins Flourish Amidst Current Bull Market Surge

The current bull market is especially favorable for meme coins, which have become the most flourishing category of tokens in terms of market growth. The other two pillars of the crypto market, GameFi and DeFi, also performed relatively well compared to other sectors. Additionally, the service sector showed solid performance.

IDO Performance Shows Moderate Results

The performance of IDOs in the second quarter was also quite pessimistic, with only three tokens trading at ten times their IDO price. A significant portion of tokens are trading below their IDO price.

Tier-one projects such as ZkSync and Wormhole are entering the market through direct listings on exchanges rather than IDOs.

Among newly launched tokens, Notcoin emerged as the biggest gainer, inspiring a boom in similar games that allow users to "mine" coins through taps. The derivative infrastructure protocol Ethena became the second-largest newly launched project by market cap. In contrast, the highly anticipated ZkSync and Wormhole secured only the third and fourth places by market cap among newly launched tokens.

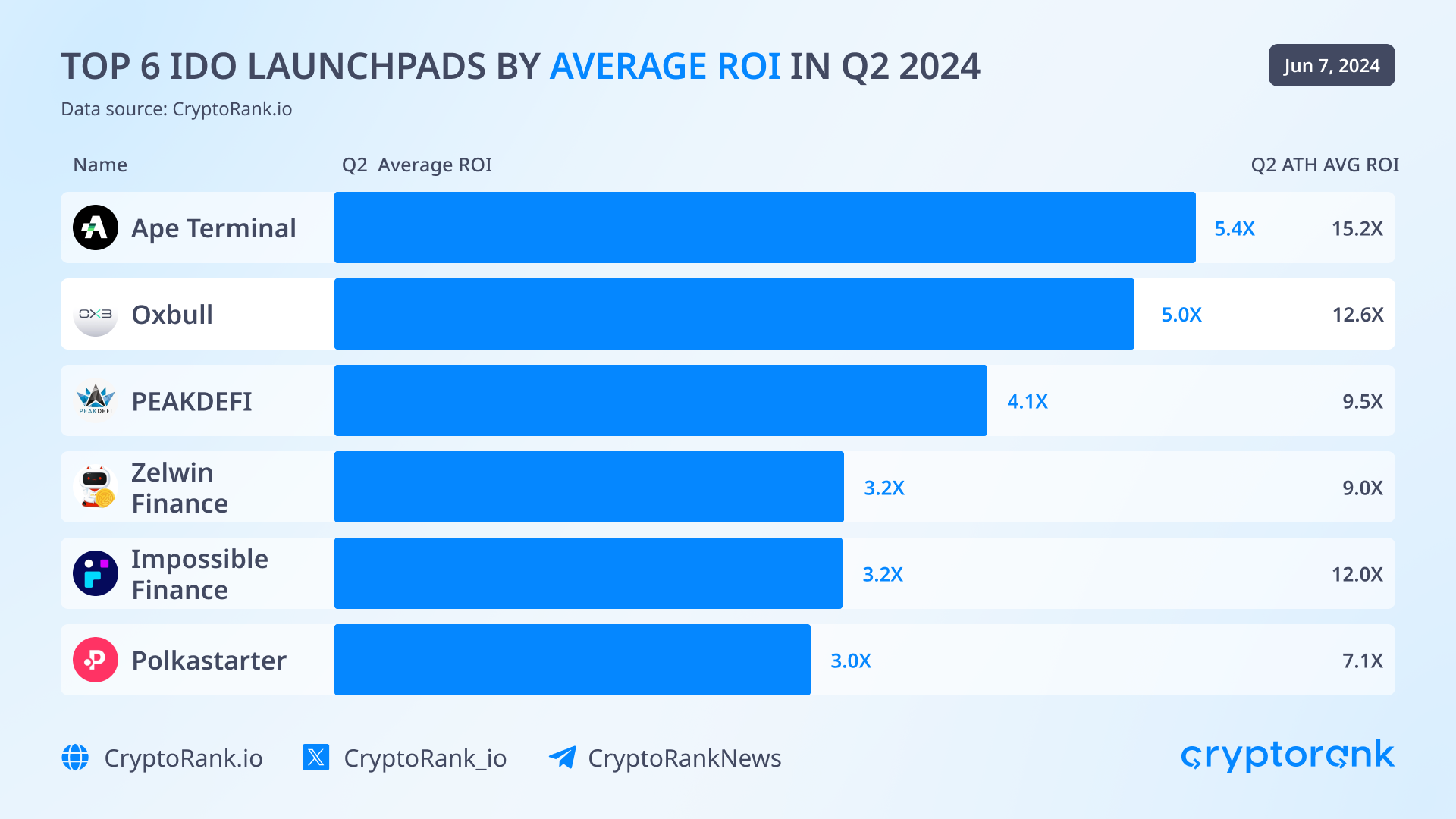

In terms of ROI for launchpads in the second quarter, Ape Terminal led the way, followed by Oxbull and PEAKDEFI.

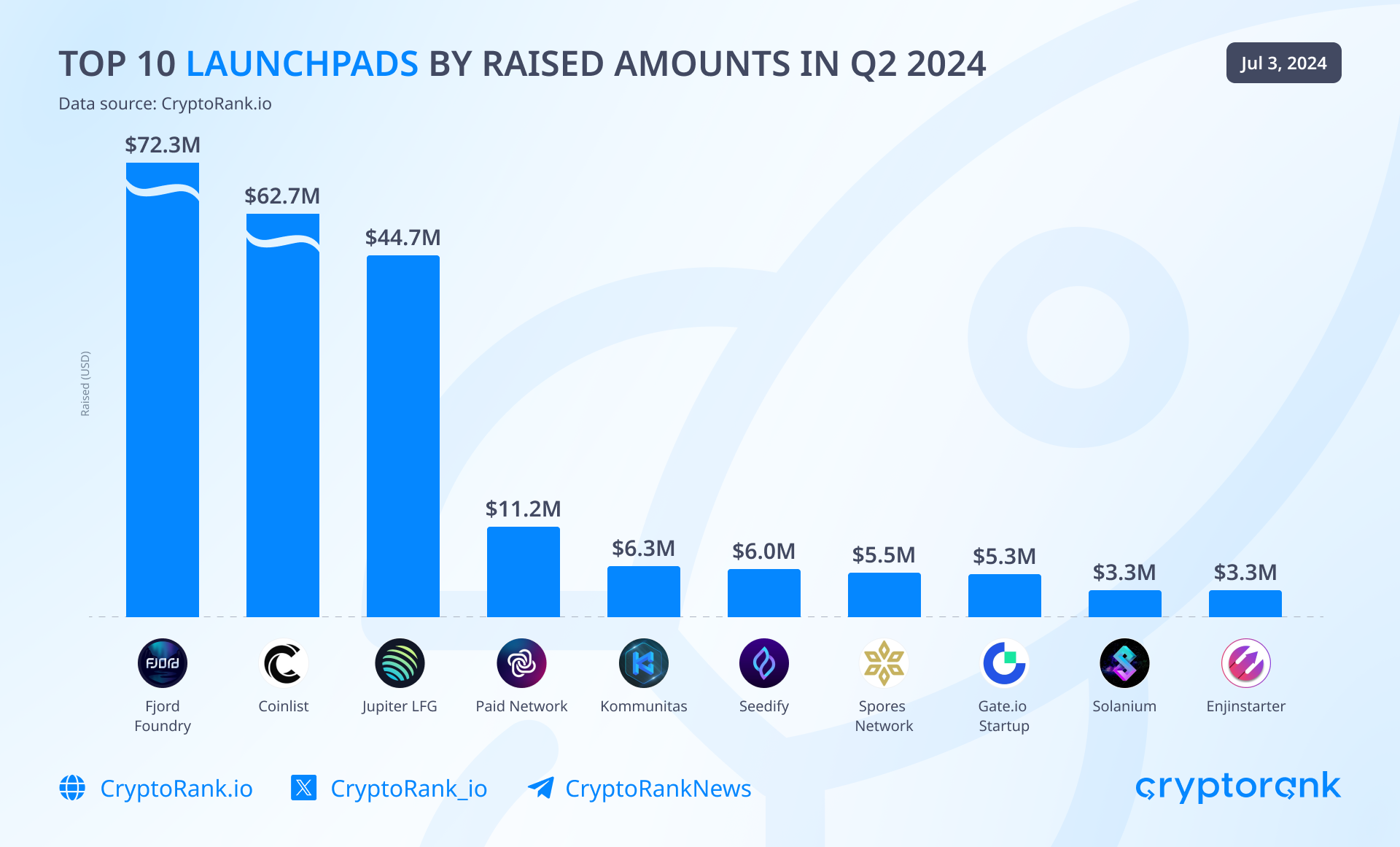

In terms of the amount raised, Fjord Foundry emerged as the leader, followed by Coinlist and Jupiter LFG.

Binance, Bitfinex, and Bitget Lead in Capital Inflow Gains

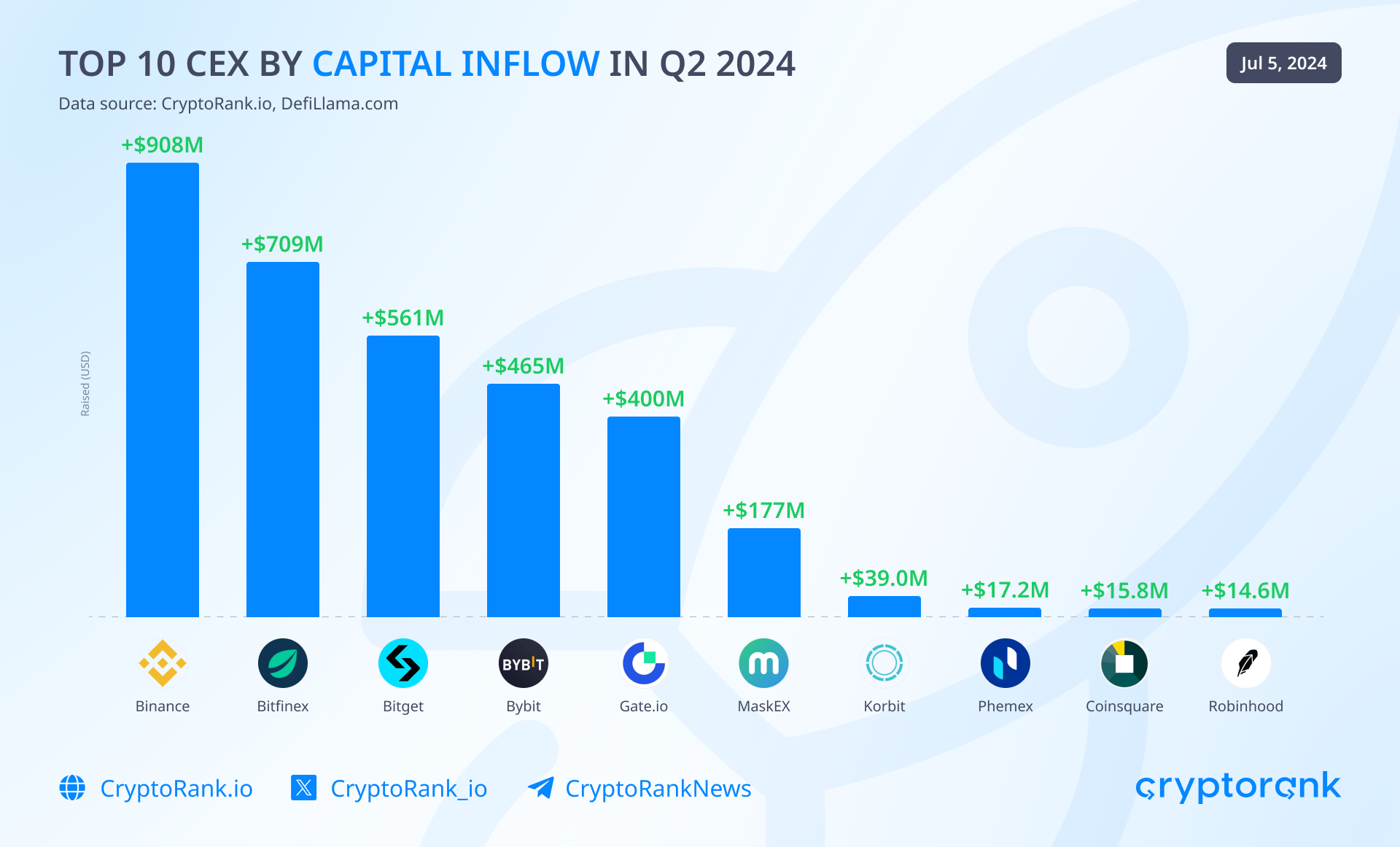

Despite the poor market performance, new capital inflow continues to grow through centralized exchanges. Binance led with an inflow of $908 million, followed by Bitfinex with $709 million and Bitget with $561 million.

Ton Ecosystem Thrives Amidst Overall Market Downturn

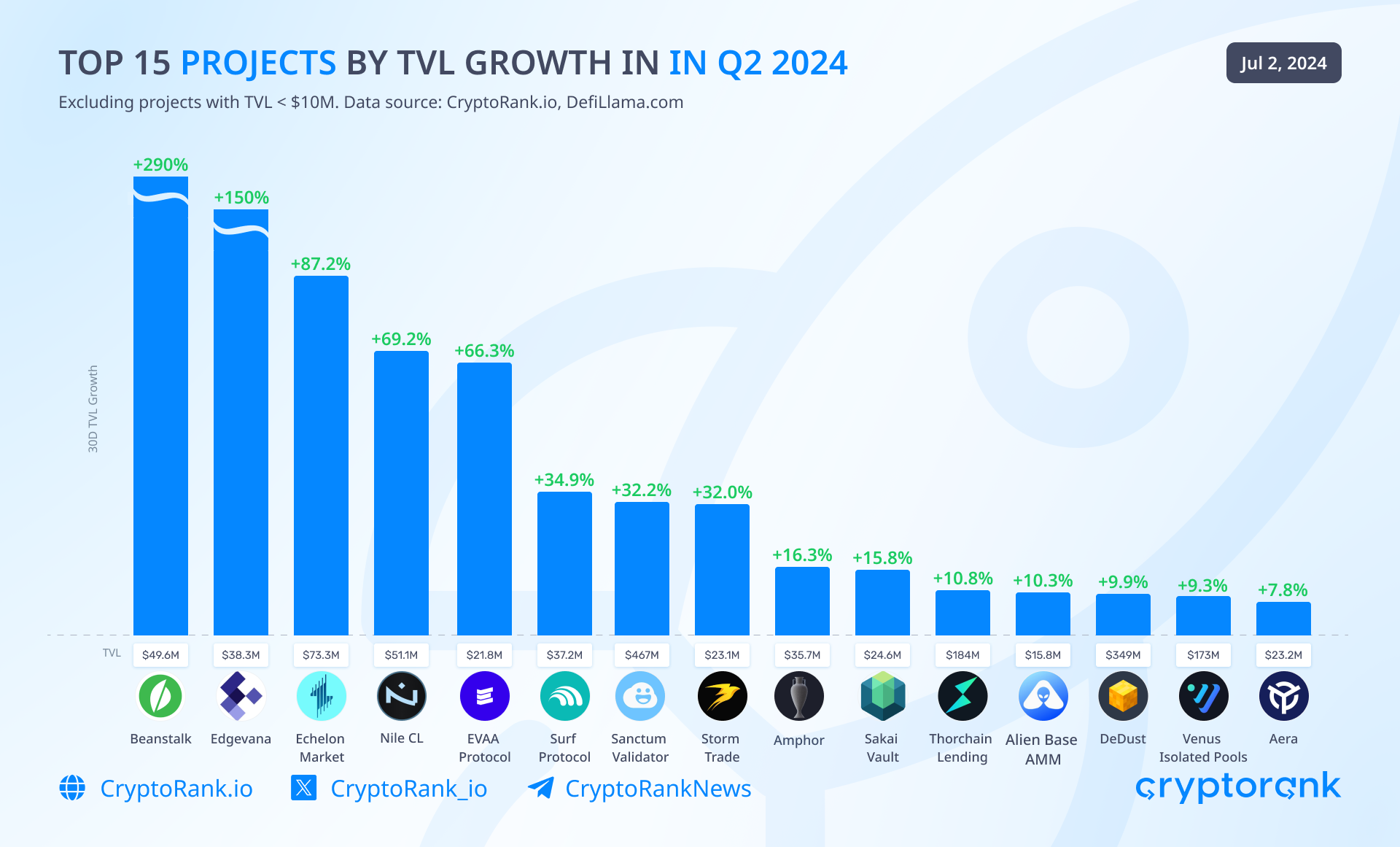

In the second quarter, most projects saw a decrease in their TVL (Total Value Locked). However, there were some gainers, with Beanstalk leading the way, followed by Edgevana and Echelon Market.

Notably, three projects from the Ton ecosystem—EVAA Protocol, Storm Trade, and DeDust—have entered the top 15 projects by TVL growth, indicating increasing exposure and success for the Ton ecosystem.

Airdrop Campaigns Attract Significant Capital into Ecosystems

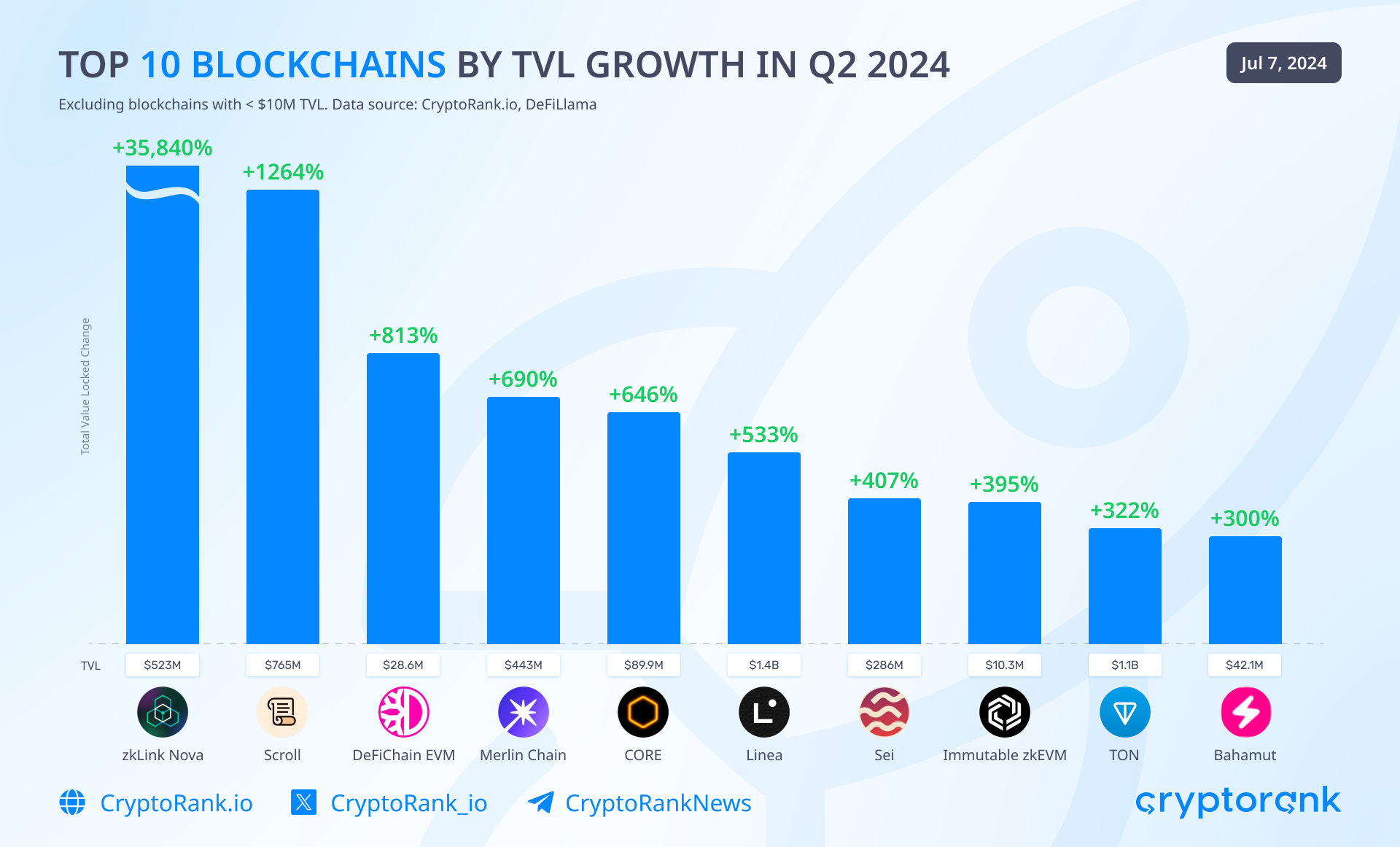

Among blockchains, zkLink Nova exhibited significant growth starting from a low base. Scroll achieved an impressive 1264% increase, driven by its airdrop campaign. Linea also demonstrated notable growth of 533%, spurred by the Linea Surge campaign. Ton surpassed $1 billion in TVL, growing by 322%, and becoming the third-largest non-EVM chain by TVL size, following Tron and Solana.

Solana, Tron, and Near Protocol Lead in On-Chain Activity

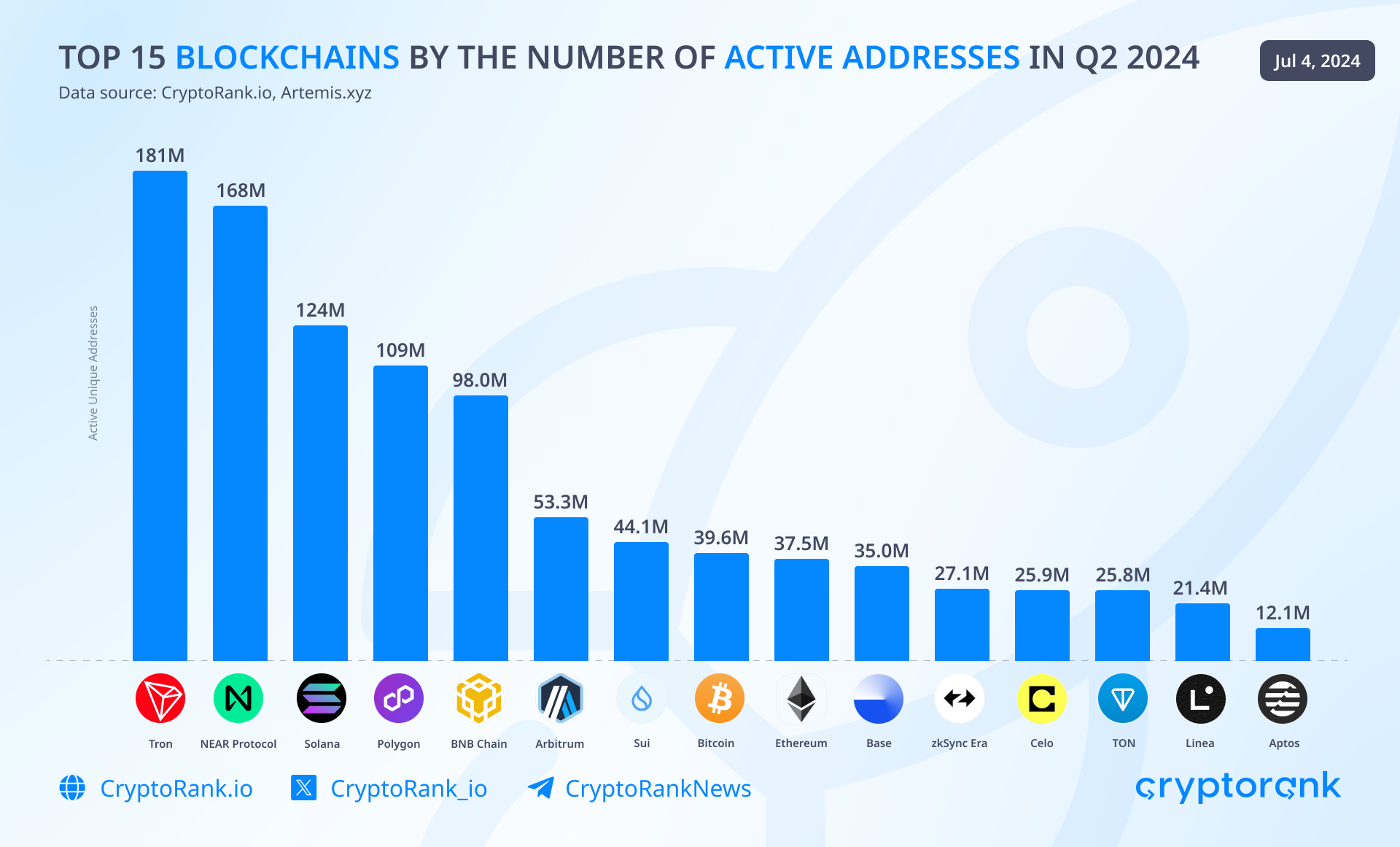

Among blockchains, Tron leads in the number of active addresses, followed by Near Protocol and Solana.

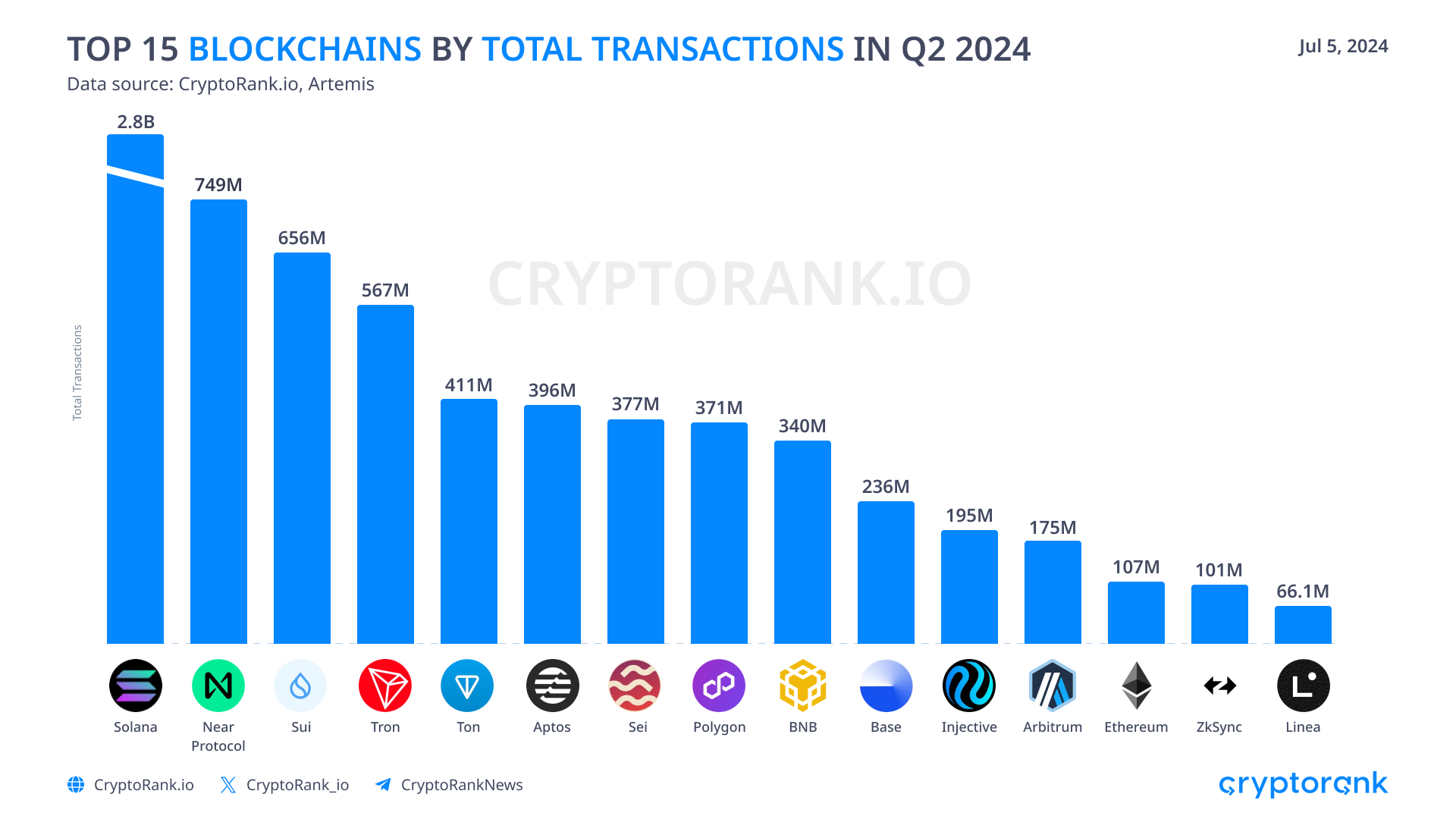

In terms of total transactions, Solana remains the top performer, followed by Near Protocol, Sui, Tron, and Ton. Sui and Ton experienced significant activity in Q2 2024, making it interesting to track their future performance.

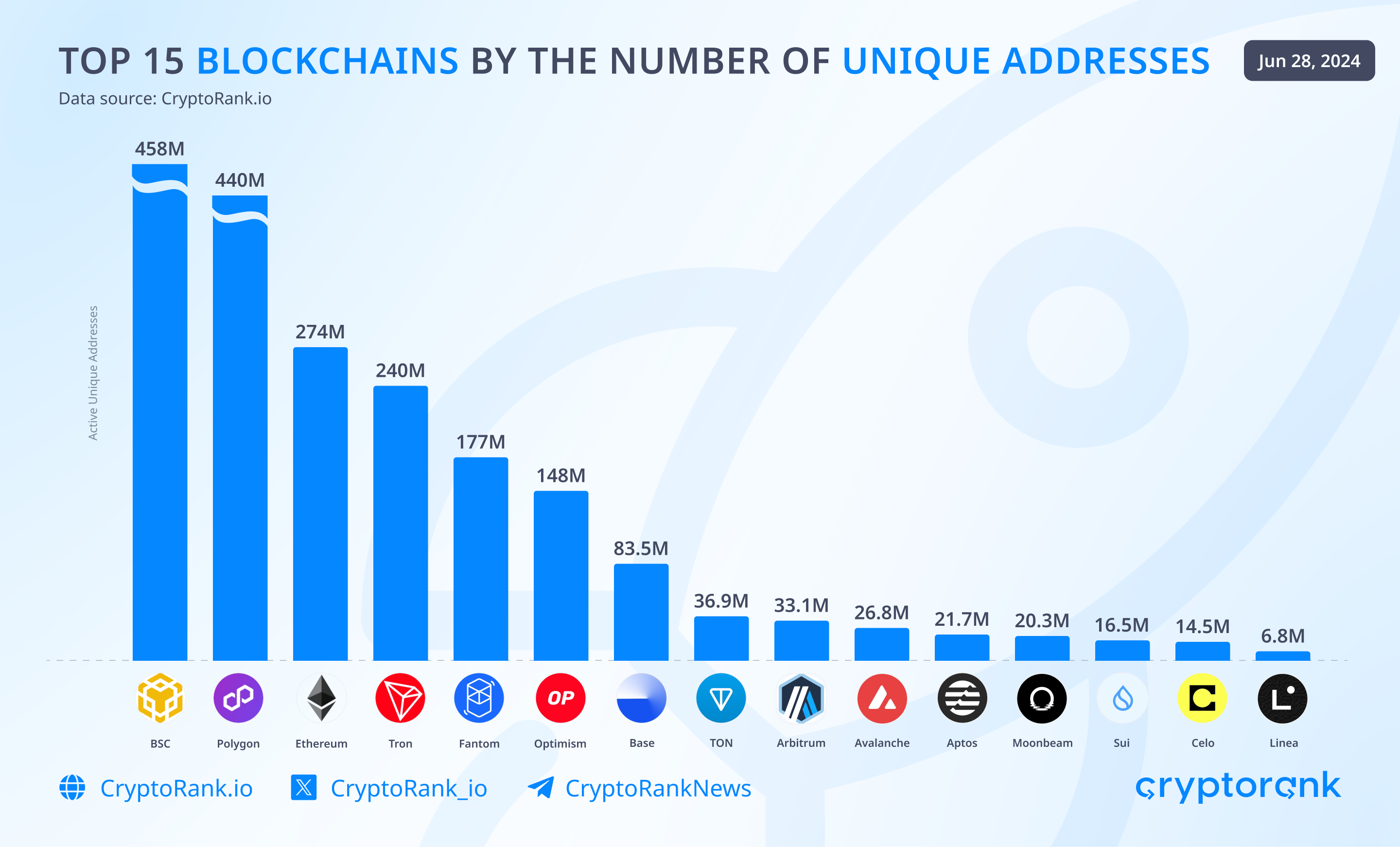

BSC, Polygon, and Ethereum Remain Undisputed Leaders by the Number of Unique Addresses

While BSC, Polygon, and Ethereum remain leaders in the number of unique addresses, other chains have shown impressive growth recently. Notably, Optimism and Base have made significant strides. However, the standout performer this quarter was Ton Blockchain, which experienced a remarkable 236% increase in unique addresses, growing from 11.3 million at the beginning of the quarter to over 36.9 million by its end.

The Bottom Line

The second quarter of 2024 was marked by low volatility and insignificant price movements in the crypto market, with meme coins thriving and sectors like GameFi and DeFi performing well. Despite an overall market contraction of 12%, a few tokens, including BNB and TON, managed to close the quarter with gains, highlighting a mixed performance amid general uncertainty.