Crypto Market Recap: Q1 2024

Key Takeaways:

-

Q1 2024 became a pivotal month for crypto, starting a true bull run.

-

Bitcoin was the relative best performer, largely due to the approval of spot Bitcoin ETFs and the upcoming halving.

-

Altseason can start anytime, but likely after Ethereum ETFs approval.

-

On-chain crypto activity continues to grow, with airdrop hunting being the strongest trend for bringing new users to web3.

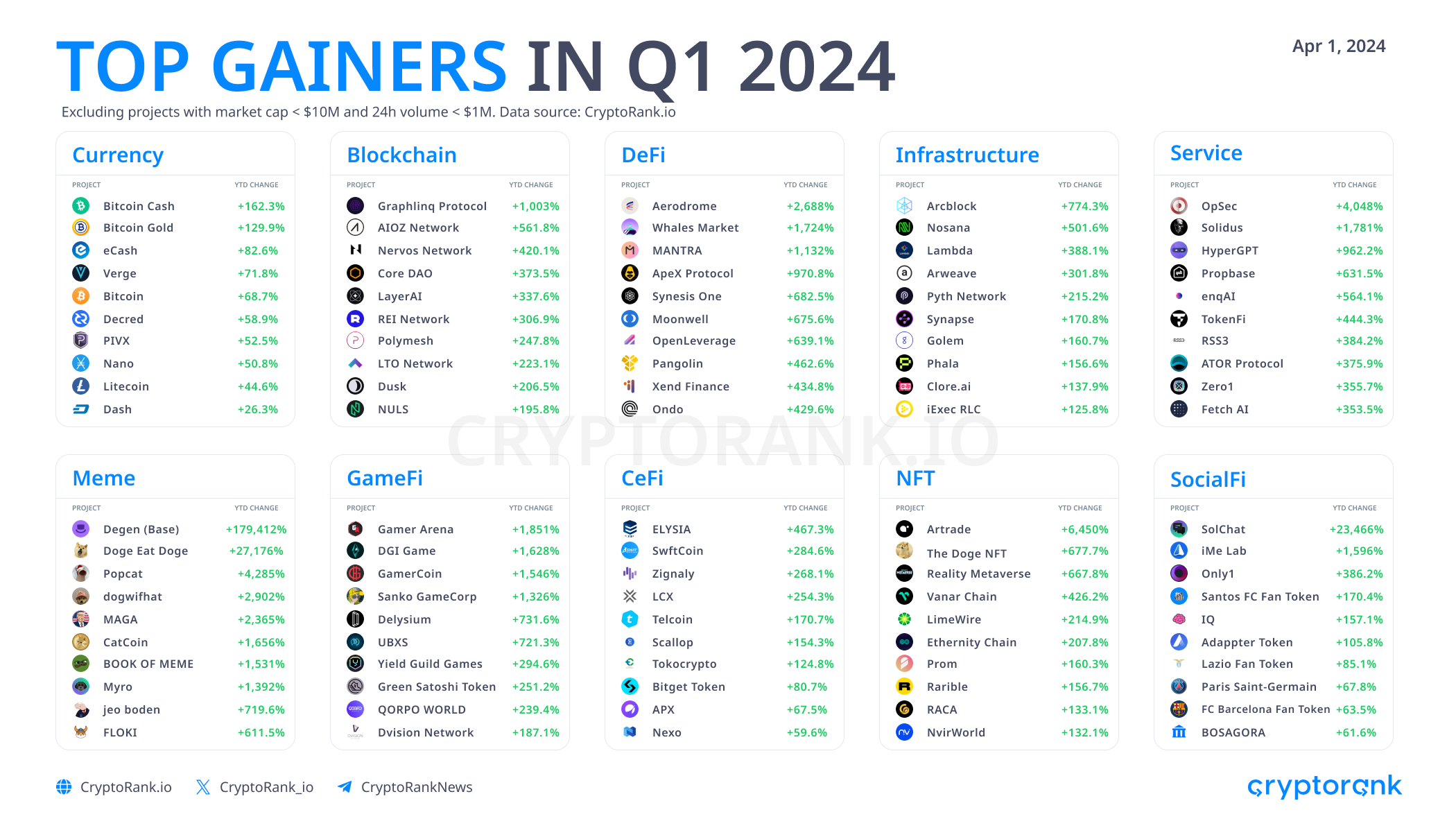

Market Performance

The onset of 2024 witnessed an exceptionally bullish surge in the crypto market, spurred by the confluence of three key factors: the approval of Bitcoin Exchange-Traded Funds (ETFs), the S&P 500 reaching unprecedented peaks, and the imminent Bitcoin halving. It is indisputable that we have now entered a bull market; the pressing query remains whether this momentum will usher in a vibrant altseason. Presently, the market adheres to its customary playbook, with Bitcoin assuming the role of a growth catalyst, either outpacing altcoins or delivering comparable results.

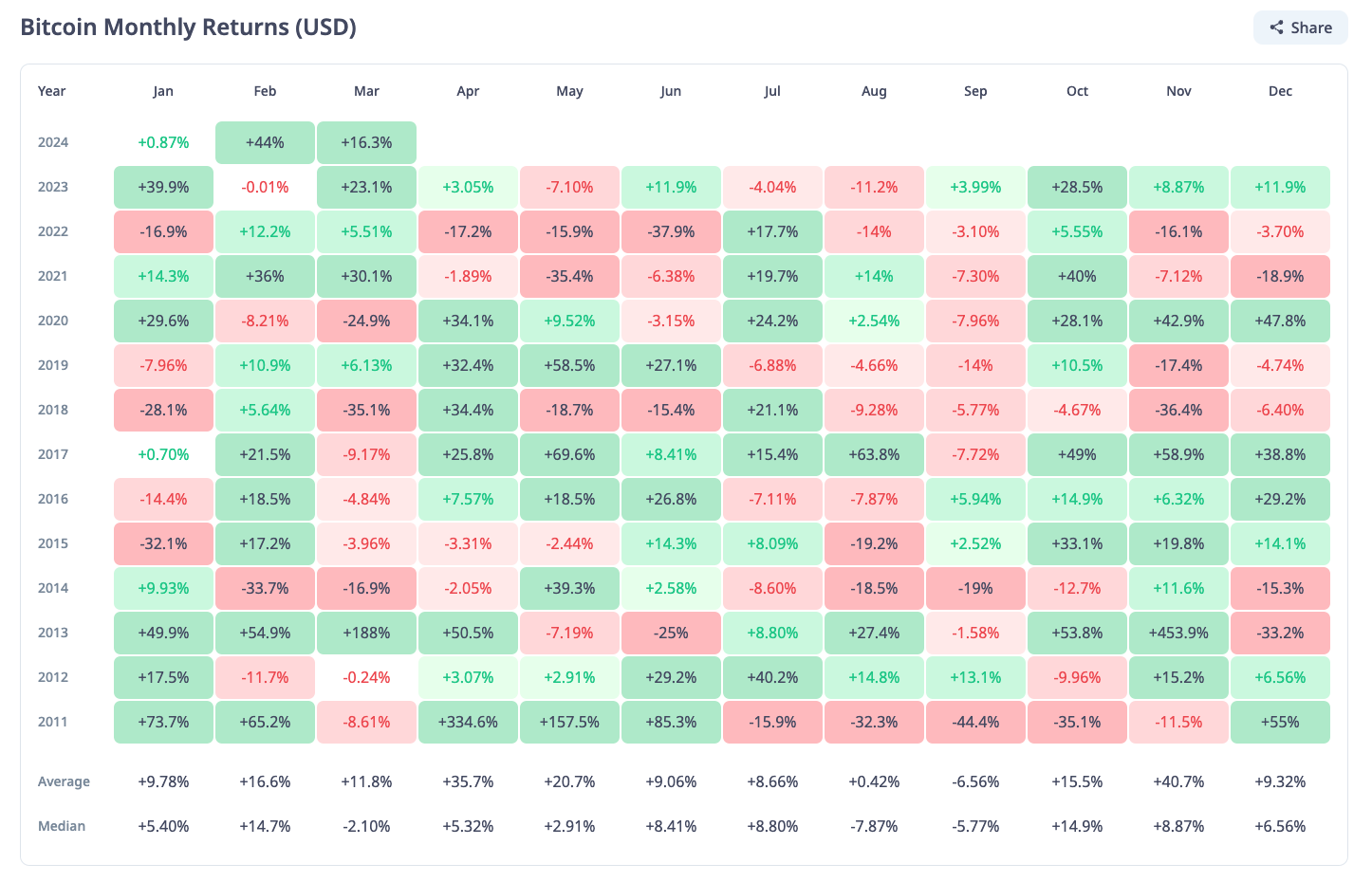

Bitcoin Performance

As mentioned above, Bitcoin gained nearly 70% in Q1. February became a pivoting month, as the main growth and purchases of spot Bitcoin ETFs happened then.

Altcoins Performance

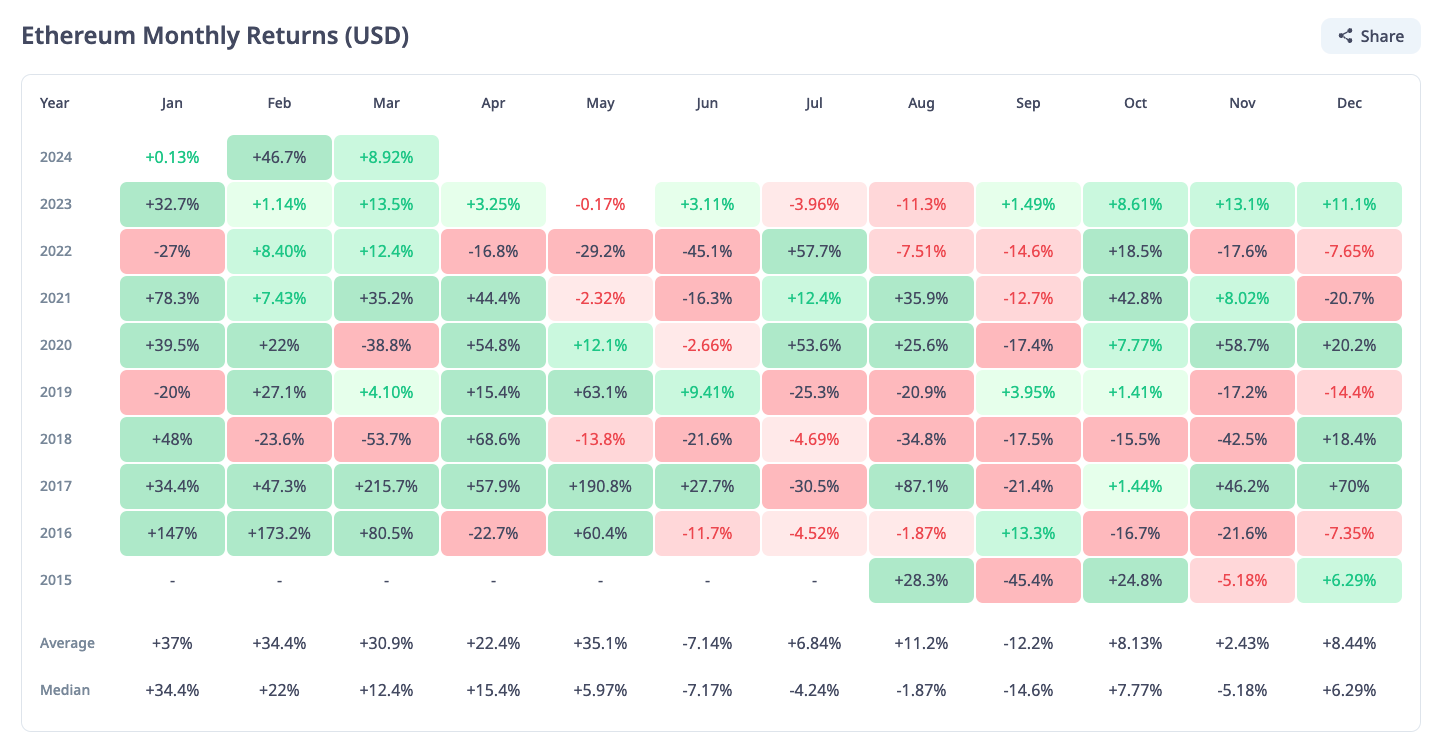

While Ethereum gained almost 60% in Q1, it is hard to call this performance successful. As an altcoin, it is necessary for ETH to outperform BTC. The second quarter of 2024 holds the potential to exert significant influence on Ethereum's price, particularly with developments surrounding the approval of an Ethereum ETF, which currently hangs in uncertainty.

The latter half of the top 10 cryptocurrencies typically experience considerable turbulence during a bull market, as new projects rapidly accumulate substantial market capitalization. Toncoin recently has entered into the top 10 cryptocurrencies, but its ability to maintain this position remains uncertain and will unfold over time. Cardano is experiencing a gradual decline in its position within the top 10, accompanied by XRP, which is demonstrating weakness compared to other coins. Both Cardano and XRP, along with some other blockchain platforms, were labeled as "useless blockchains" by Forbes, suggesting a lack of popularity among users and decentralized application (DApp) creators.

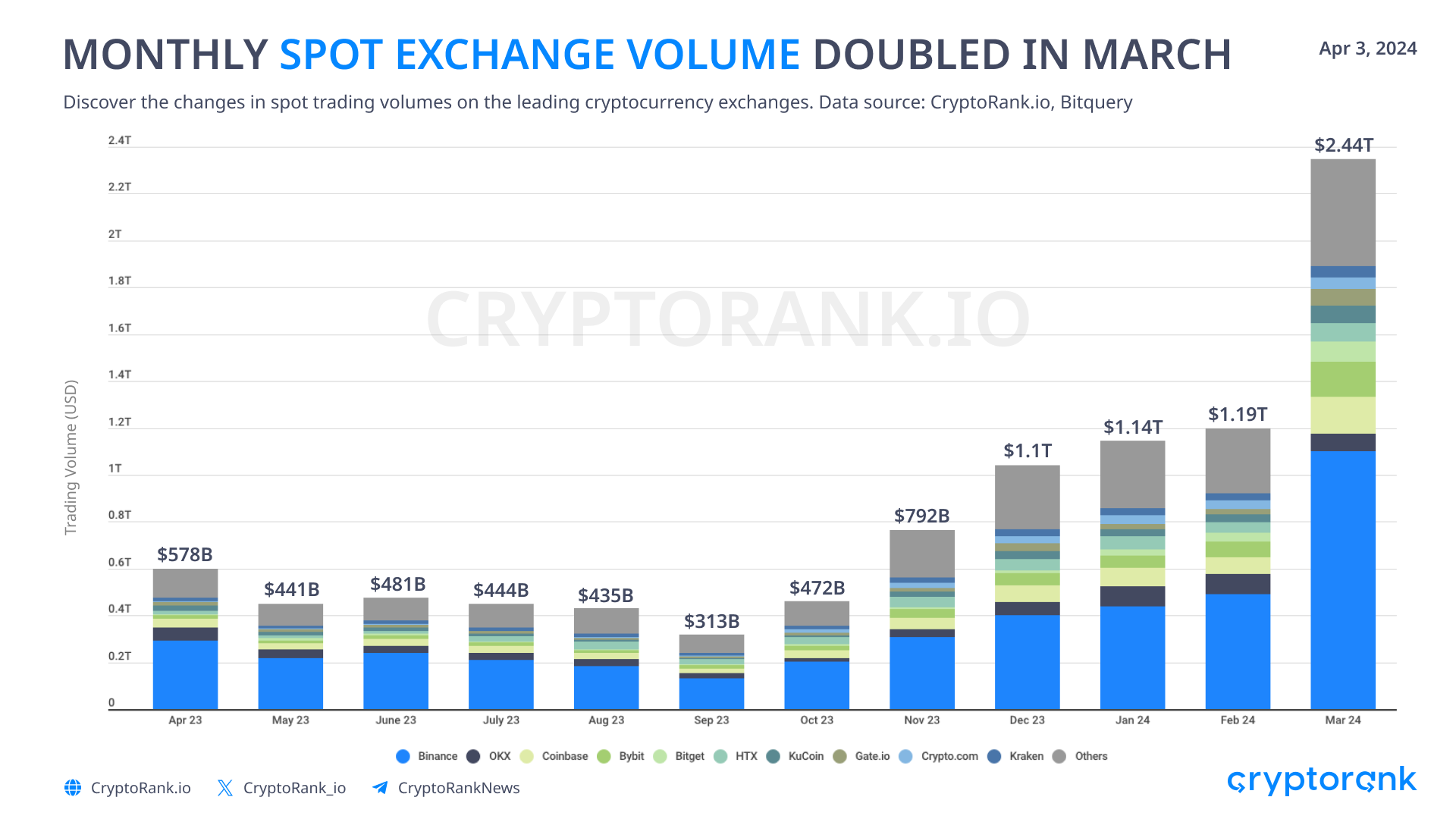

Trading Volume Shows Significant Increase

This quarter, we've witnessed a notable uptick in trading volumes across centralized exchanges, signaling an impending influx of investors and capital into the market.

Token Sales and Fundraising

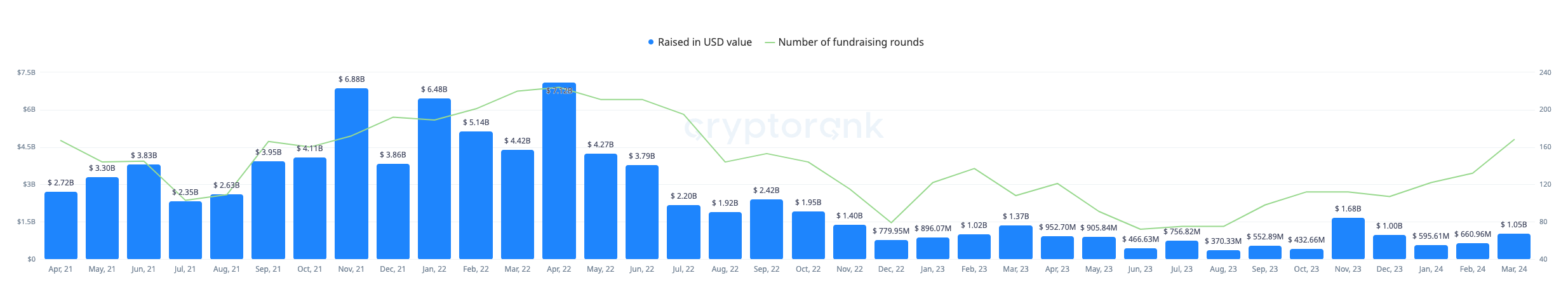

Along with the recovery of the crypto market, the interest of early-stage investors has increased significantly. First of all, it is worth mentioning the increase in the number of completed funding rounds this year. Despite the fact that this number is at the mid-2022 level, the amount of funding is still far from the previous bull run. Read more in our Fundraisng Recap.

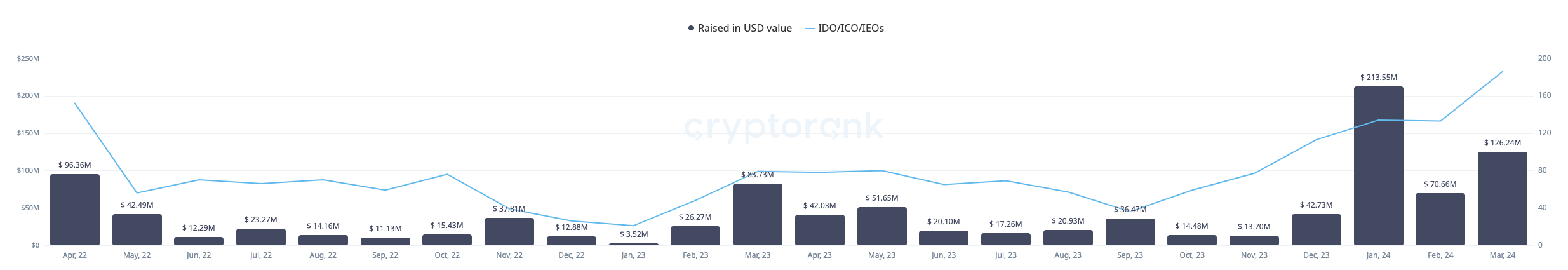

Speaking of public fundraising, which in crypto is represented by token sales, the situation here is much more interesting. While the token sale market is far from the ICO boom of 2017-2018, it is showing significant signs of recovery in 2024. The monthly number of token sales is at a 2-year high, while projects are managing to raise significant amounts of money.

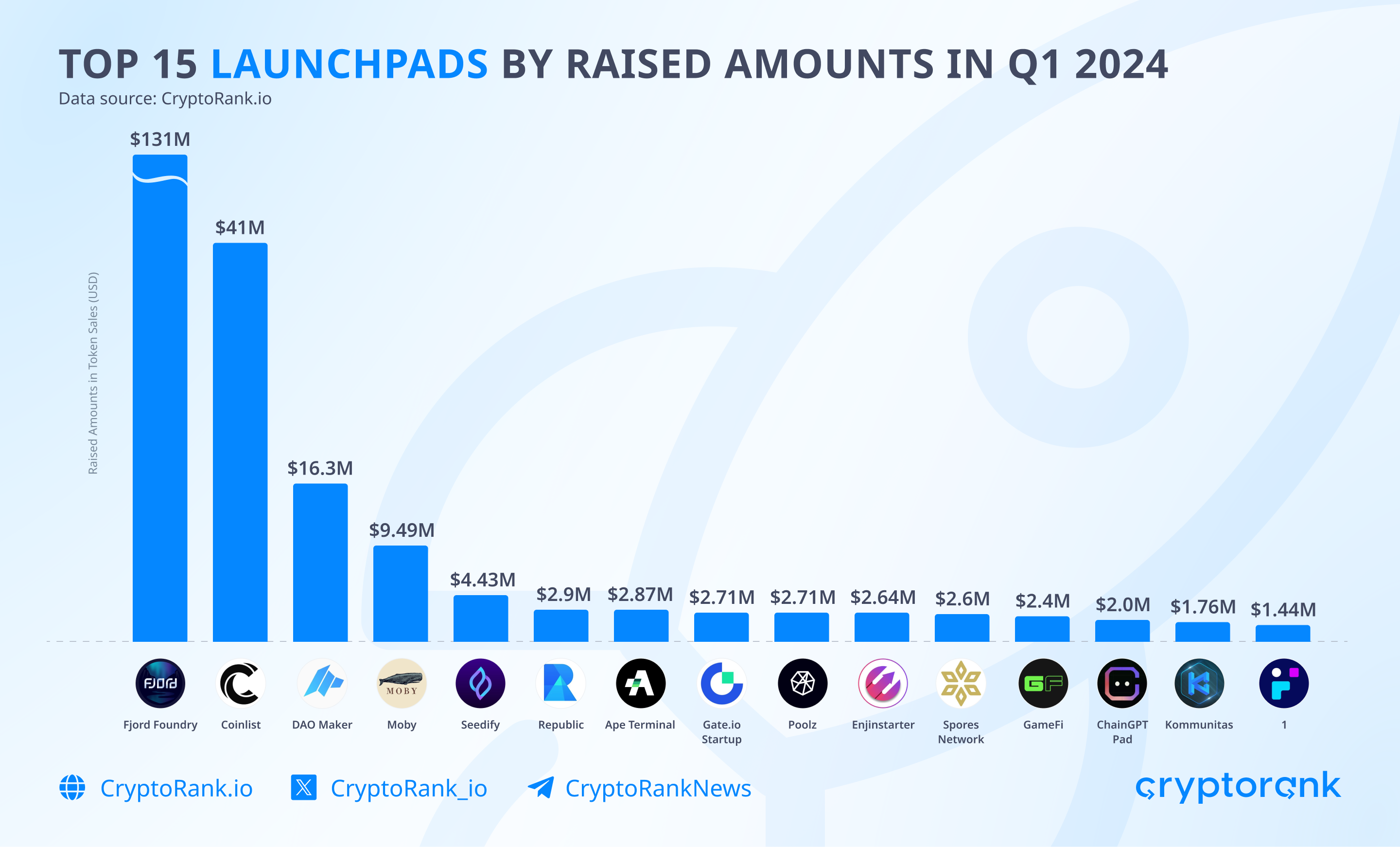

Fjord Foundry has emerged as a leader in Q1 2024, both in terms of the raised amount of funds and the number of Initial DEX Offerings (IDOs) conducted. Meanwhile, Coinlist has experienced a resurgence in popularity and has adjusted its participation mechanisms for token sales to prevent server overload and achieve fairer distribution of allocations. Other launchpad platforms have shown more modest outcomes in fundraising compared to Fjord and Coinlist.

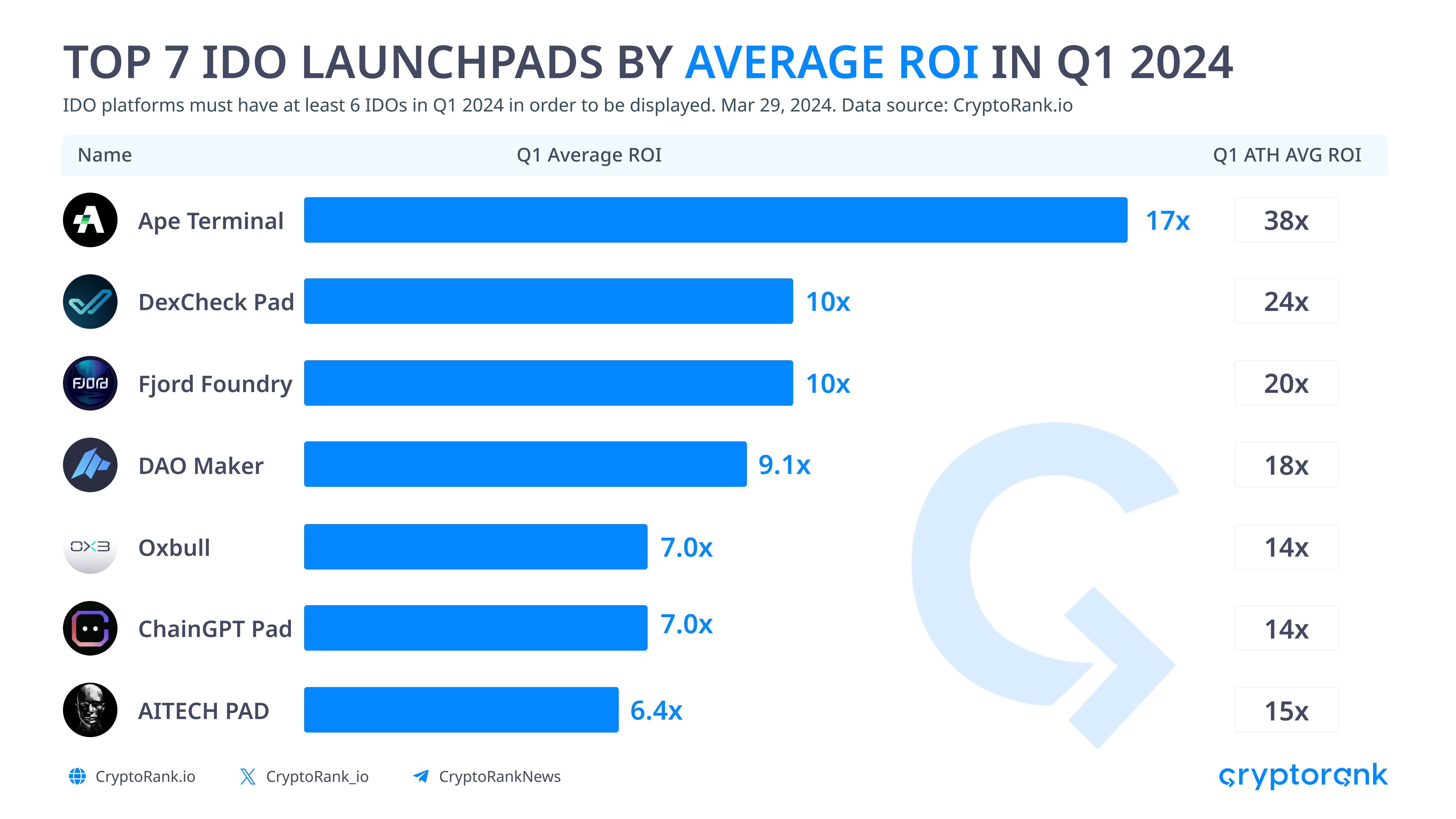

In terms of average ROI during the first quarter, Ape Terminal emerged as the frontrunner, closely followed by DexCheck Pad and Fjord Foundry. Remarkably, all of the top seven launchpads by average ROI significantly outperformed Bitcoin and the overall market growth, potentially sparking increased investor interest and heralding the onset of the IDO season in the market.

Regrettably for launchpads, Tier 1 projects typically steer clear of entering the market through IDOs. However, Tier 2 and Tier 3 projects have demonstrated significant performance this quarter. The critical disparity between Tier 1 and other tiers lies in the substantial gap between their All-Time High (ATH) price and current market price. Tier 1 projects typically maintain their token price for a longer duration, experiencing a more gradual decline or even growth. Conversely, most Tier 2 projects and below often see a decline in price over time. This tendency prompts many investors to sell tokens shortly after Token Generation Events (TGEs) and subsequent unlocks, leading to a shorter lifespan for projects and launchpads.

On-Chain Performance

While the crypto market is thriving in the current bull market, on-chain activity is also showing significant growth. The total value locked is growing both as a result of rising asset values and the growing interest of long-term investors to lock up their assets. Notably, TVL growth is fueling interest in airdrops, with many projects promising tokens to those who stake their assets. In particular, restaking protocols show good performance.

However, the on-chain activity is still quite far from the peaks of 2021-2022. There's still a lot of change in the landscape, mostly due to several upcoming blockchain launches.

Total Value Locked Raises, Still Far From ATH

As the bull run gains momentum, blockchain networks are engaged in fierce competition based on their Total Value Locked (TVL). Starknet, one of the most eagerly awaited projects this year, has emerged as the front-runner in TVL growth this quarter, closely followed by Sei. Notably, Ton, taking an unconventional path and currently maintaining minimal integration with other projects, has also seen significant growth in TVL.

With the onset of the bull market, Aptos has entered the fray among blockchains, securing the fourth position in terms of TVL growth this quarter. Additionally, Stacks, positioned as a Bitcoin Layer 2 chain, has garnered attention as part of the burgeoning Bitcoin DeFi trend.

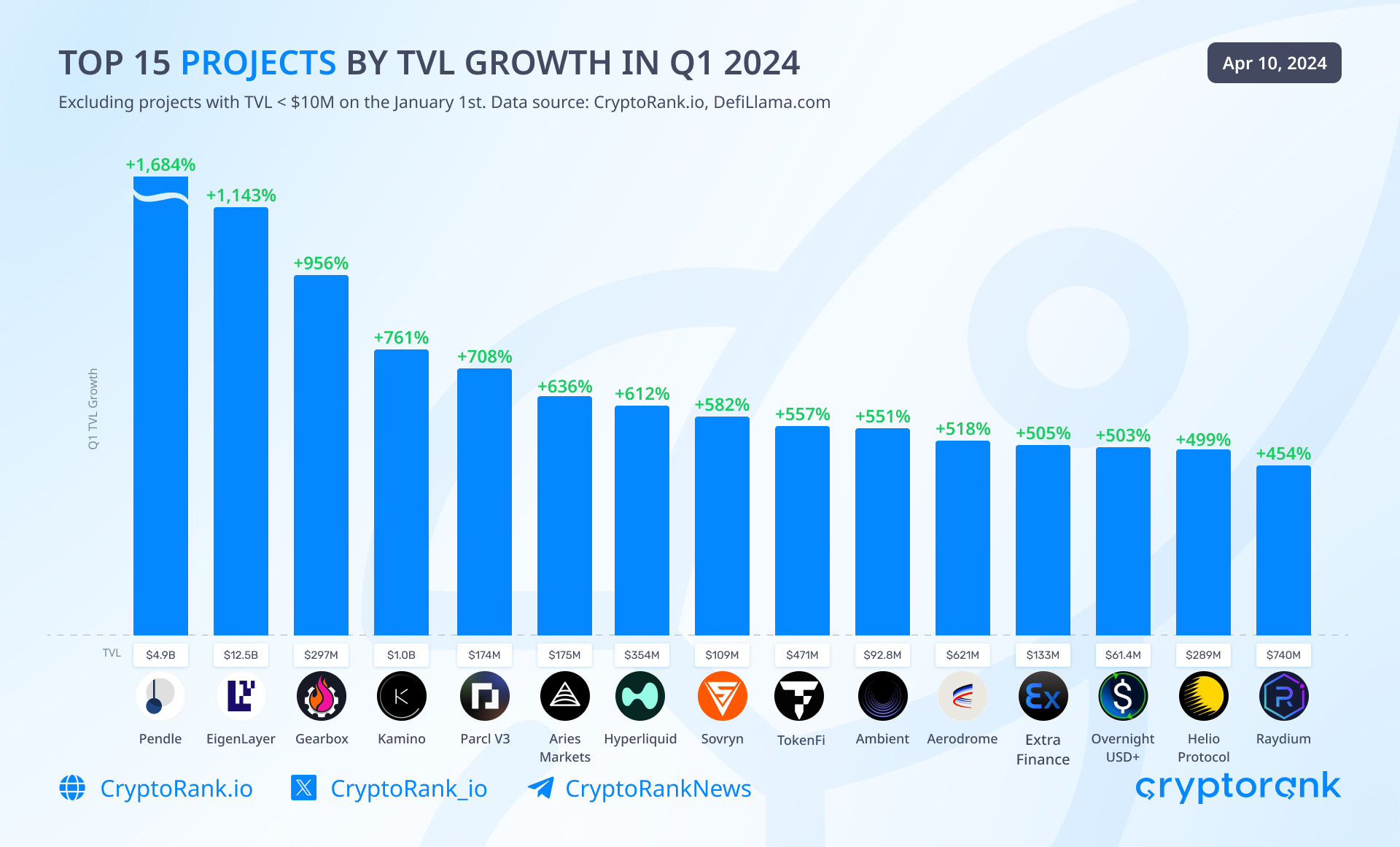

Among projects experiencing significant TVL growth, Pendle and EigenLayer have emerged as leaders, highlighting the considerable popularity of leverage and liquid restaking within the crypto community.

Furthermore, the presence of Kamino, Parcl, and Raydium—three projects built on the Solana blockchain—in the top 15 by TVL growth reflects the thriving nature of the Solana ecosystem, currently the largest non-Ethereum Virtual Machine (EVM) ecosystem.

Moreover, the performance of Aries Markets, built on Aptos, and Sovryn, built on Bitcoin, suggests that these non-EVM ecosystems should be recognized as deserving attention alongside both EVM-based and Solana ecosystems.

User Activity Continues Growing

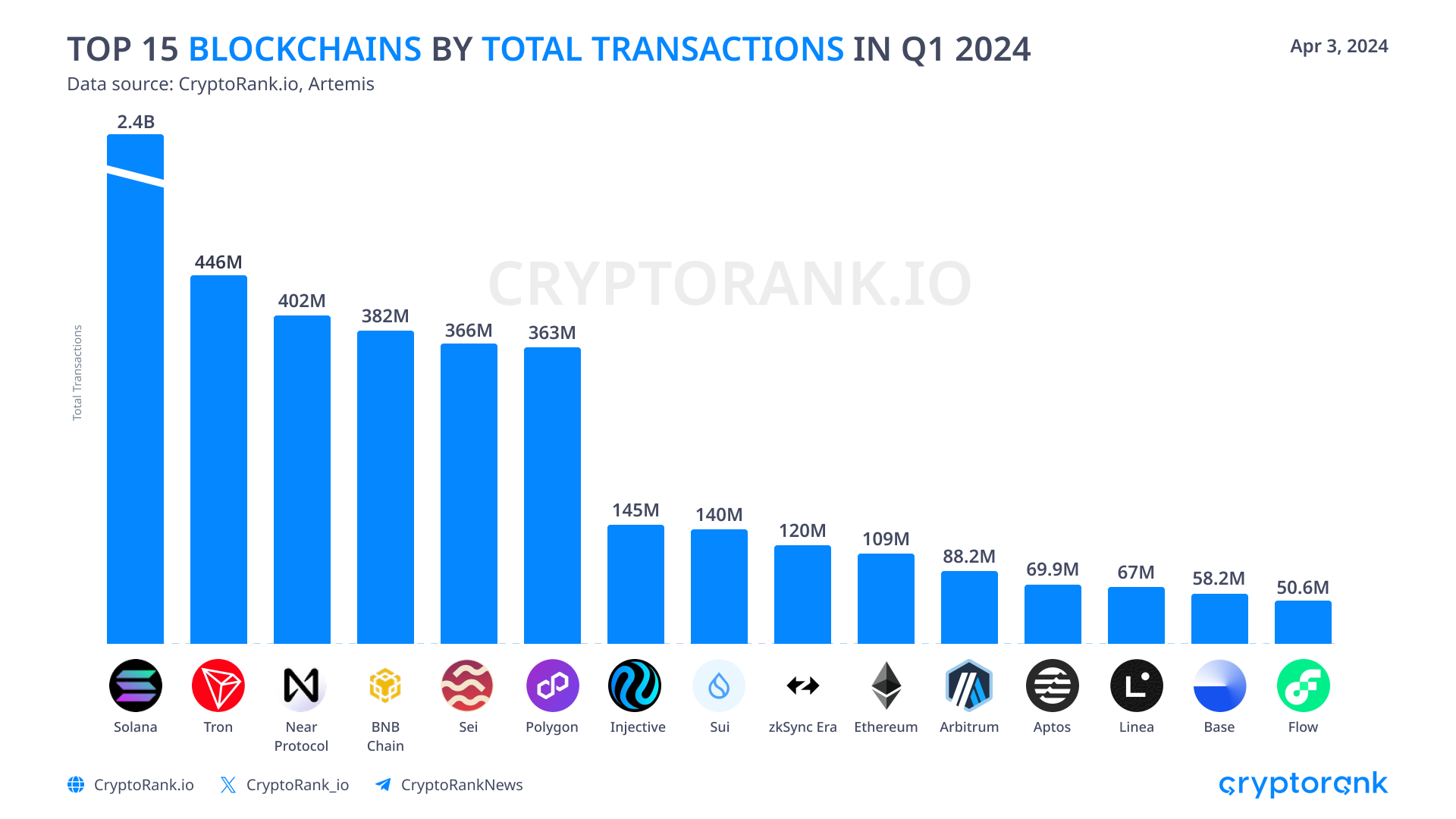

As expected, Solana maintains its undisputed leadership position by total transaction volume this quarter, owing to its efficient and cost-effective transaction capabilities. Tron continues to hold its second-place position among chains most frequently utilized for stablecoin transactions, while Near closely follows, endeavoring to explore new frontiers in the current bullish market climate.

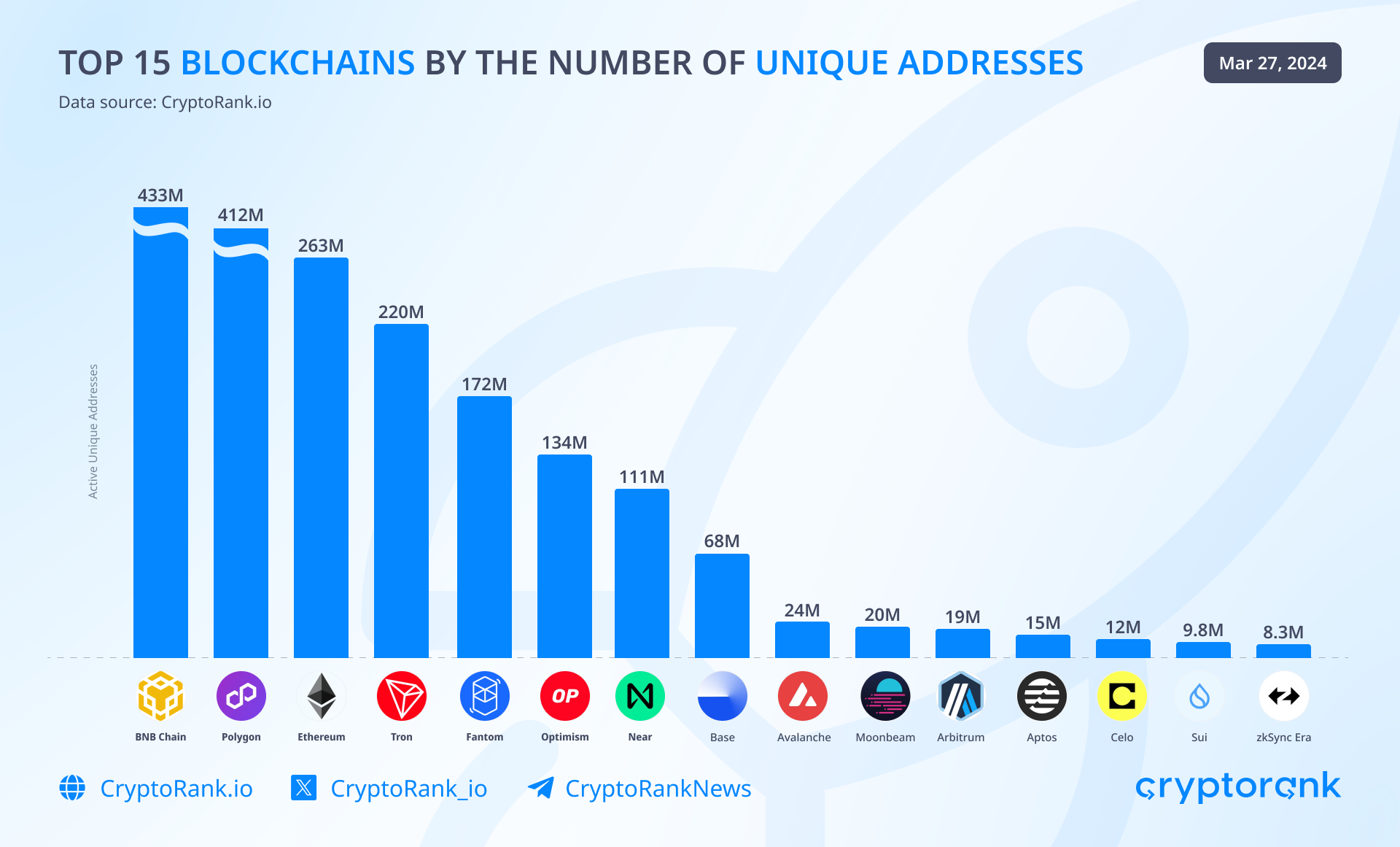

The leaderboard for unique addresses remains relatively stable on a monthly basis, with BNB Chain and Polygon maintaining their positions at the forefront.

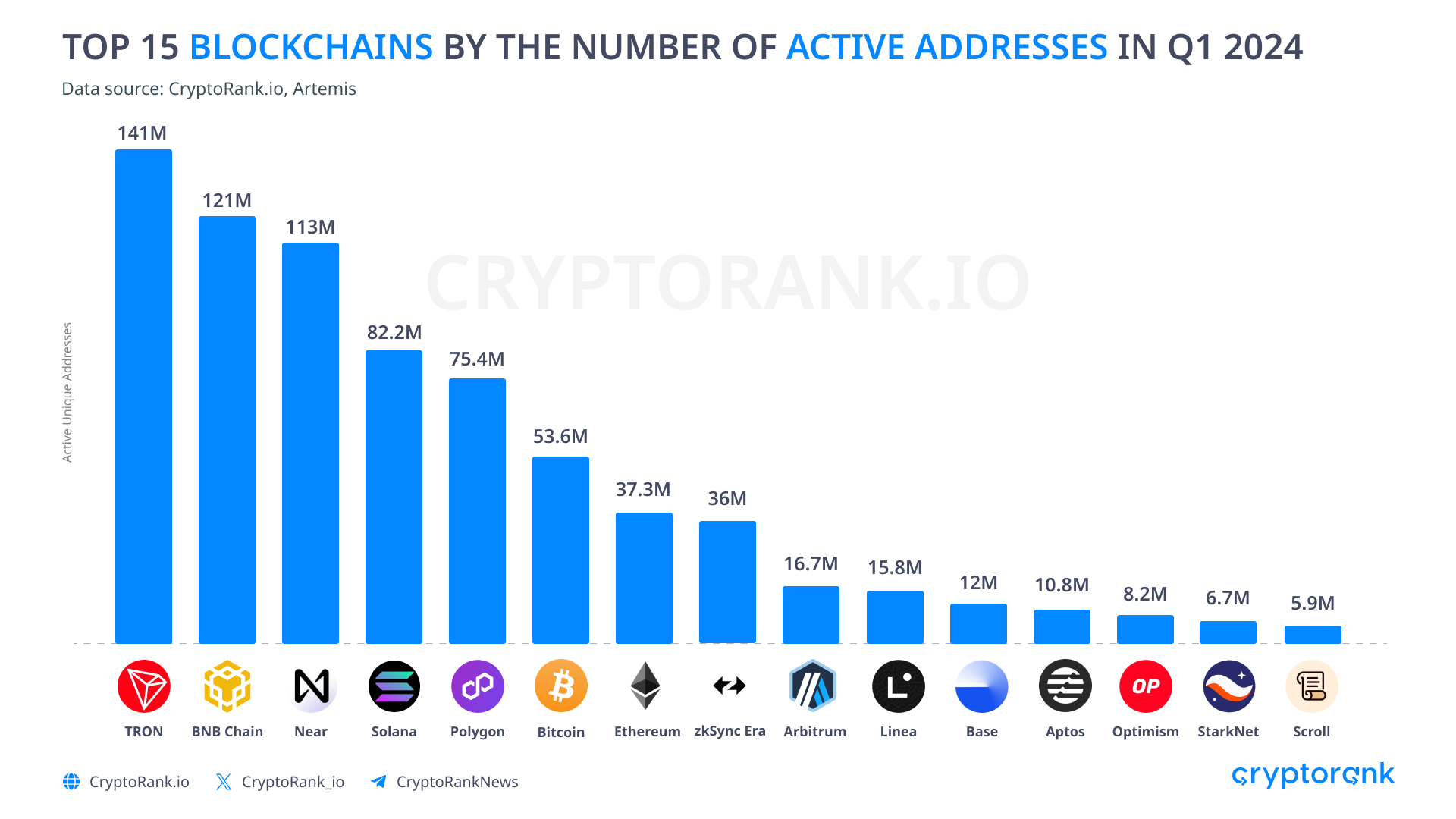

Tron emerges as the leading blockchain in terms of the number of active addresses, followed closely by BNB Chain and Near, presenting an intriguing landscape. Despite the potential incentives such as airdrops from ZkSync, Scroll, and other emerging blockchains, the active number of addresses on these platforms remains relatively limited compared to more established blockchains. This suggests that users may be drawn to older blockchains for reasons beyond financial motivation.

The Bottom Line

In the first quarter of 2024, we witnessed a lot of changes in the crypto market. While February was more of a boundless optimism, March brought some cooling in the sentiment of crypto market participants. However, the most interesting events are waiting for us in Q2 and Q3 of this year.

The second quarter will start with a very important event, the bitcoin halving. Almost a month later, we will see decisions on Ethereum ETF. Will it be approved or not, it will bring a lot of arguments to the table for altseason. Let's see what Q2 will bring us!

Read More