Crypto Fundraising Recap Q1 2024

Key Takeaways:

-

In Q1 2024, a total of $2.3 billion was raised across 422 funding rounds;

-

Despite a positive upward trend in the amount of money raised, the current amount is still less than at the beginning of the previous bull run;

-

The average amount of money raised per round tends to decrease and equals around $5.4 million per round on average;

-

Restaking protocols, interoperability layers, and perpetual decentralized exchanges (DEX) are currently in the VC focus;

Crypto Fundraising Is On The Rise

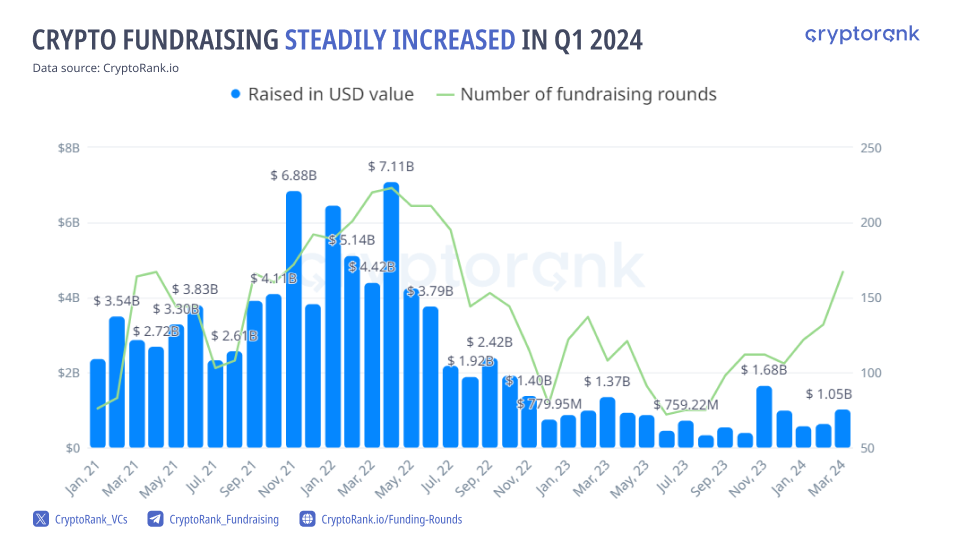

Crypto fundraising experienced a substantial surge throughout the first quarter of 2024, culminating in an impressive $1.03 billion raised in March alone. In total, an astounding $2.3 billion was secured in the first quarter. Concurrently, the number of funding rounds surged from 122 in January to 167 rounds in March. This trend appears notably bullish in the short term.

Venture Funds Have Become More Cautious

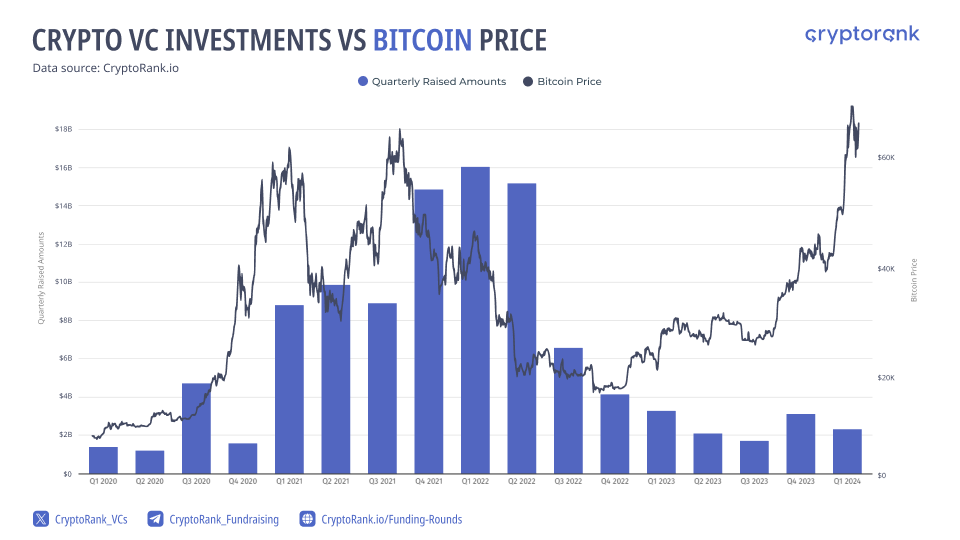

On a broader scale, the overall landscape presents a less optimistic outlook. Presently, there exists a significant disjunction between the price of Bitcoin and the volume of funds raised. Notably, while the disparity between the number of funding rounds and the Bitcoin price is less pronounced, it suggests a diminishing amount of capital raised per round. This phenomenon underscores a growing trend wherein venture funds are exercising greater caution and discernment in their crypto investments.

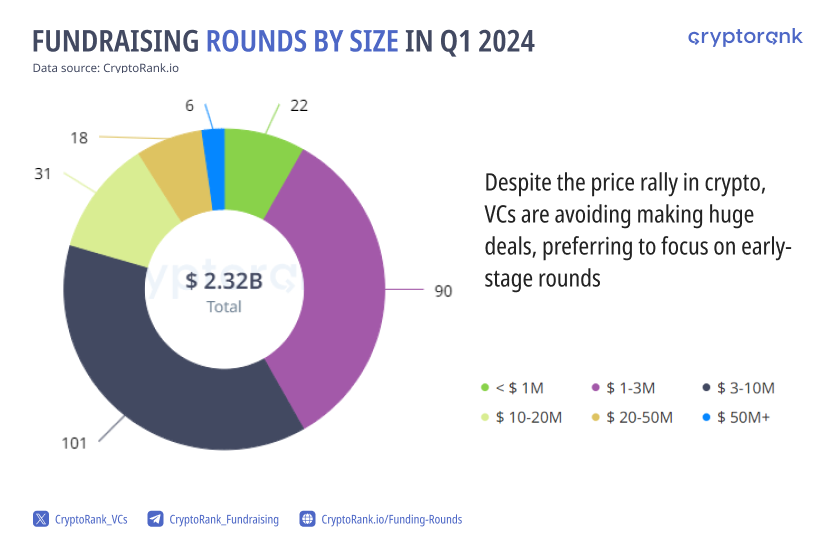

The accompanying chart corroborates that the majority of deals facilitated by venture firms fall within the range of $1-10 million dollars. Despite a notable rally in crypto prices, the number of investments exceeding $50 million this quarter remains modest, with only six such instances recorded. This figure pales in comparison to historical data spanning the last four years, signaling a subdued level of investment activity.

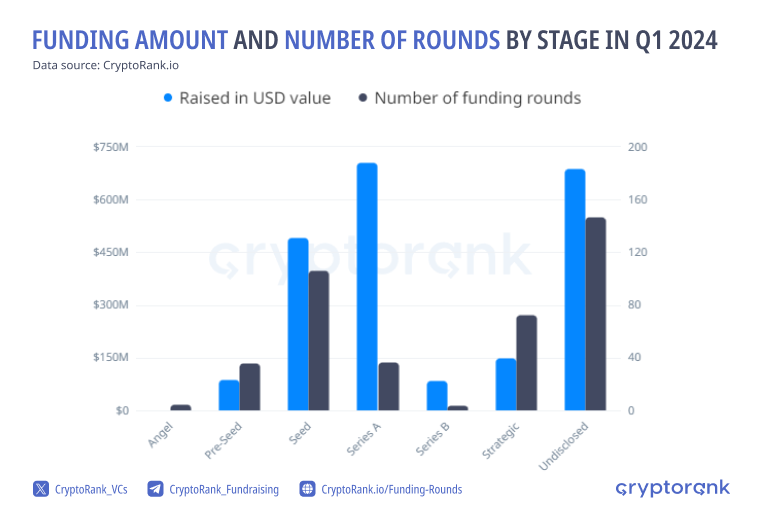

In terms of project stages, the Series A stage emerges as the most heavily financed, closely followed by the Seed stage. In contrast, both earlier and later stages receive considerably lesser amounts of funding.

Andreessen Horowitz Bets On EigenLayer

Venture capital attention is prominently directed towards restaking protocols, interoperability layers, and perpetual decentralized exchanges (DEX). EigenLayer, in particular, has garnered significant interest, securing an impressive $100 million investment exclusively from Andreessen Horowitz. This substantial backing has elevated expectations for the platform even further, underlining its potential to disrupt and innovate within the crypto landscape.

Another restaking protocol, Ether.Fi, shortly after raising $27 million in the first quarter, launched its token onto the market, achieving a fully diluted market cap (FDV) of $5 billion. This significant achievement sets a lofty FDV target for competing protocols, further emphasizing the growing competition and potential within the restaking protocol sector.

It's worth noting io.net, a decentralized network that serves as an aggregator of GPUs sourced from data centers, crypto miners, and decentralized storage providers. This innovative platform aims to provide cost-efficient GPU computing power tailored for AI/ML teams. Notably, io.net integrates the compelling narratives of blockchain technology and artificial intelligence, offering a synergistic solution that addresses the evolving needs of both sectors.

OKX Ventures Stands Out as The Most Active Investor in Q1 2024

Among venture funds, OKX Ventures emerged as a standout player in Q1 2024, having closed an impressive 31 deals. This heightened level of activity not only reflects OKX Ventures proactive investment strategy but also significantly contributes to the overall growth of the OKX business ecosystem. With its exchange serving as the flagship product, OKX has solidified its position as the second-largest exchange by market share, following closely behind Binance.

Animoca Brands, known for its active involvement in the investment scene, notably made 24 investments during the quarter, securing the second position in terms of the number of investments made. This underscores Animoca Brands' continued commitment to fostering innovation and growth within the crypto and blockchain sectors through strategic investment initiatives.

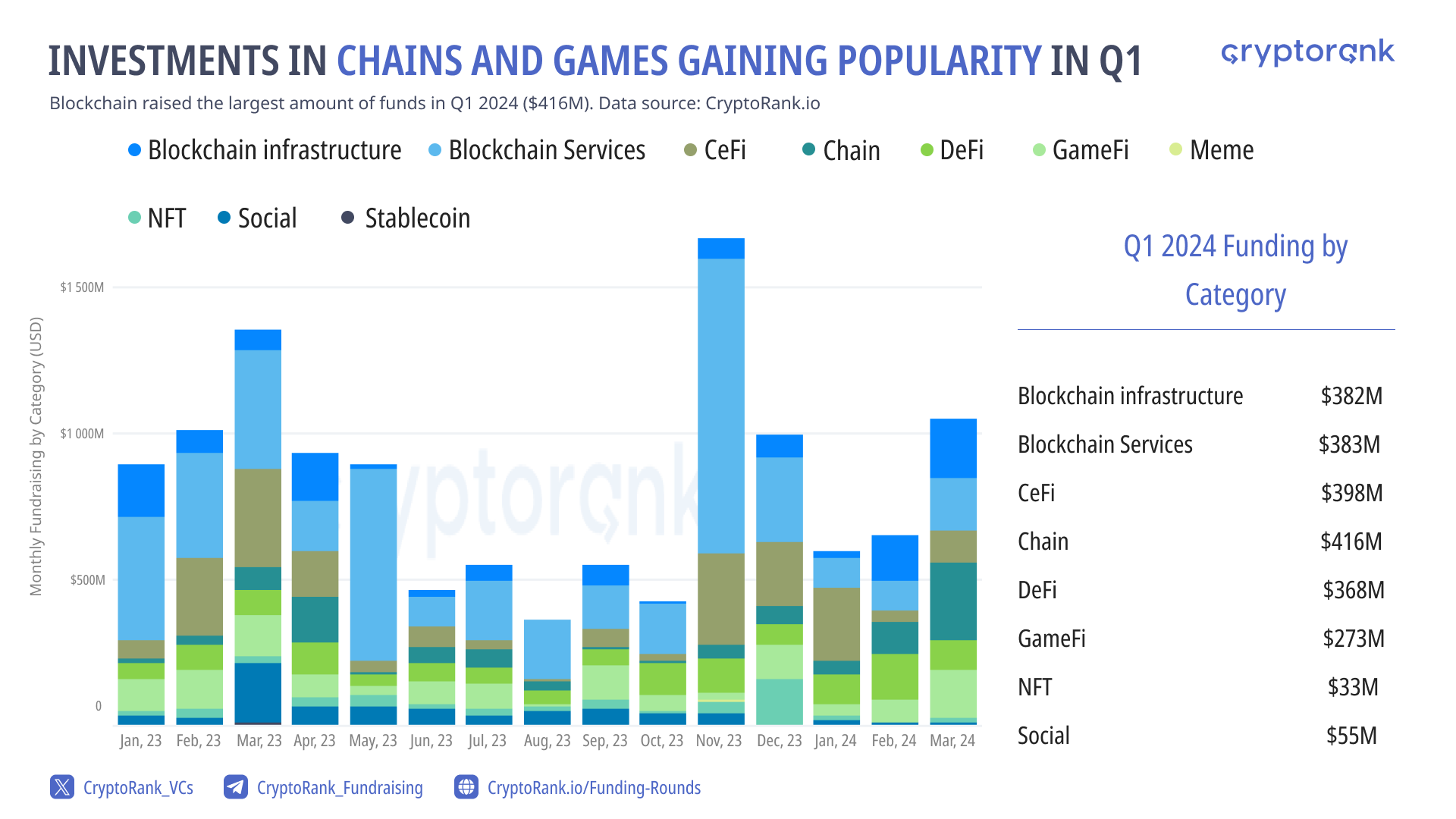

GameFi and Blockchain Sectors Are More Attractive On a Bull Market

The recent price rally has brought about a surge in the number of users in the Web-3 space. This uptick in user activity has, in turn, potentially fueled increased investment in the GameFi sector, which heavily relies on a growing user base—often seen during bullish market conditions. Additionally, as user participation and liquidity in the market continue to expand, we are witnessing the emergence of new blockchains.

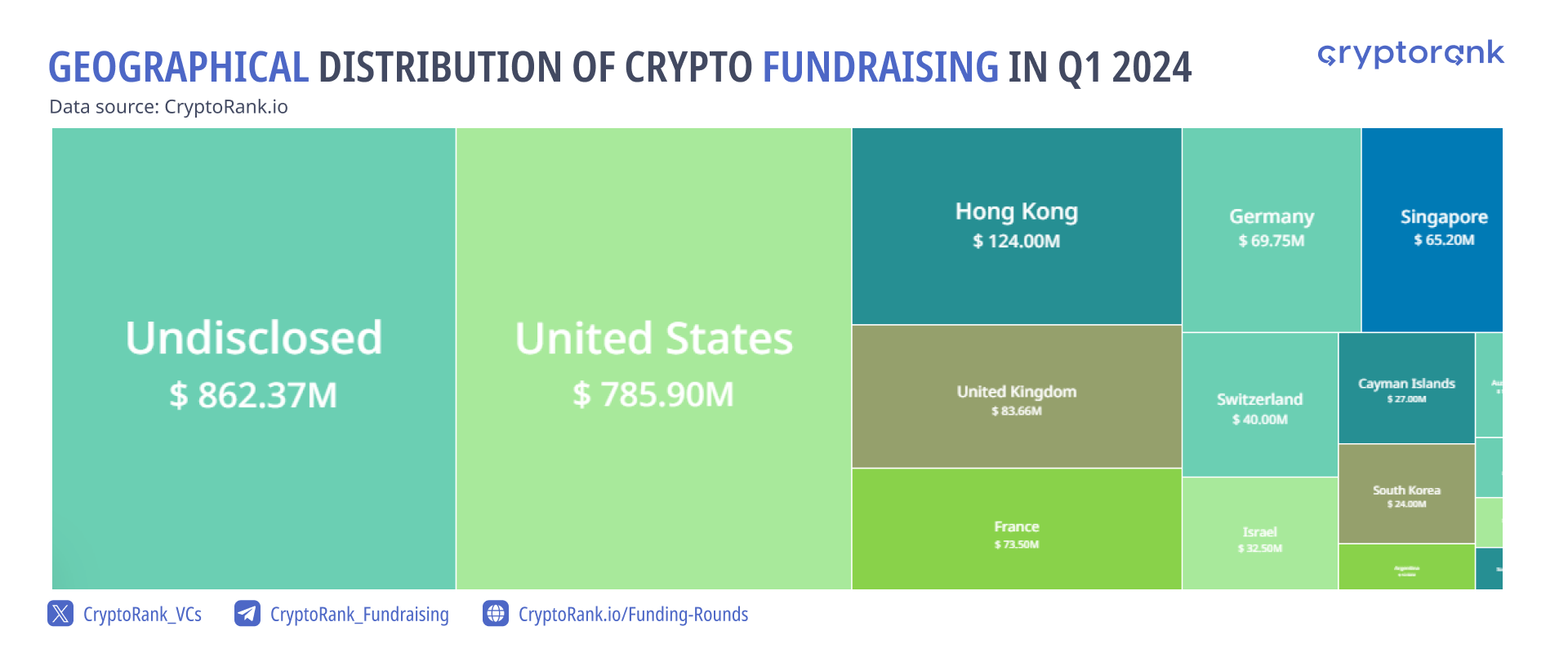

The United States Leads Crypto Fundraising, While Hong Kong Remains Asian Fundraising Hub

The United States maintains its position as the primary leader among jurisdictions for crypto fundraising. Hong Kong, renowned as the Asian crypto hub, follows behind, leveraging its strategic location and favorable regulatory environment. Meanwhile, the United Kingdom stands out in Europe due to its advanced financial infrastructure and robust jurisdictional framework especially for CeFi projects, making it an attractive destination for crypto-related ventures and investments.

The Bottom Line

The first quarter of the year commenced on a positive note for the crypto market, witnessing an uptick in the number of funds raised and deals closed. However, when viewed from a broader perspective, the total amount of funding has contracted, particularly in comparison to the preceding bull market. This discrepancy raises concerns regarding the potential duration and profitability of the current bull market, especially if fundraising amounts fail to register significant increases.

Projects like EigenLayer, Wormhole, and LayerZero could serve as catalysts, potentially encouraging venture funds to ramp up their investment amounts. Nonetheless, a sense of cautious optimism prevails among crypto investors, with the trajectory of further fundraising growth remaining uncertain. As such, the sustainability and robustness of the current market rally continue to be a subject of speculation and observation.

Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto) Animoca Brands

Animoca Brands OKX Ventures

OKX Ventures