Zoomex vs the Giants: Can a Newcomer Compete on Liquidity Quality?

Key Highlights:

-

Zoomex demonstrates competitive liquidity depth across major assets, with over 62.7M USDT in BTC spot depth and 29.8M USDT in ETH, which puts it third and second respectively, among surveyed exchanges.

-

Futures market depth is strong in altcoins, including 3.4M USDT in XRP and 1.47M USDT in DOGE at ±0.1% depth, placing Zoomex ahead of HTX and close to MEXC.

-

Execution quality remains solid, with 0.03% slippage on a 1 BTC spot buy order and futures reaction time of 17 seconds, outperforming bigger names like Bitget and HTX.

Introduction and Methodology

As centralized crypto exchanges compete for market share, liquidity has emerged as a defining metric of trading quality. This report evaluates the liquidity of Zoomex’s markets, focusing on its performance relative to leading global competitors. Liquidity remains a critical factor for trading efficiency, user satisfaction, and institutional confidence in crypto markets. The goal is to determine whether Zoomex provides sufficient market depth and responsiveness to support both retail and professional trading activity. The analysis includes both spot and futures markets to present a balanced view of exchange quality.

The assessment relies on three core liquidity indicator, order book depth. For BTC pairs, the report also considers slippage and order book reaction time, simulated market orders. Liquidity depth is measured within ±2% of the mid-price for spot markets, and ±0.1% for futures markets. All comparisons use USDT-based trading pairs to ensure consistency. The snapshots were taken in July 2025.

Liquidity metrics are evaluated across five high-volume assets: BTC, ETH, SOL, XRP, and DOGE. These assets were selected due to their prominence in both retail and institutional portfolios and their consistent trading activity across platforms.

Zoomex is benchmarked against several major exchanges recognized for their deep markets and active user bases: Binance, Bybit, OKX, Bitget, HTX, and MEXC. These peers provide useful reference points to understand Zoomex’s position in the broader competitive landscape.

About Zoomex

Founded in 2021, Zoomex is a relatively new centralized exchange that has positioned itself as a trading-centric platform with a focus on execution speed, system stability, and low-cost access. While it does not yet rank among the highest-volume exchanges globally, Zoomex has carved out a niche by targeting active traders and users in emerging markets.

Zoomex supports both spot and derivatives markets, offering a wide range of trading pairs denominated in USDT. Its interface is clean and lightweight, optimized for fast navigation and order placement. One of its technical strengths is a responsive matching engine that aims to deliver low-latency execution, particularly on high-volatility assets.

What distinguishes Zoomex from more established competitors is its lean operational model and aggressive user acquisition strategy. The exchange offers competitive fee rebates, referral incentives, and frequent trading competitions to attract and retain users. Its focus on simplicity and trader-oriented features allows it to compete effectively within specific market segments.

Overall, Zoomex presents a focused alternative to larger platforms by emphasizing core trading functionality over broad feature sets or institutional integrations. Its trajectory will depend on whether it can scale its liquidity and maintain execution performance as its user base grows.

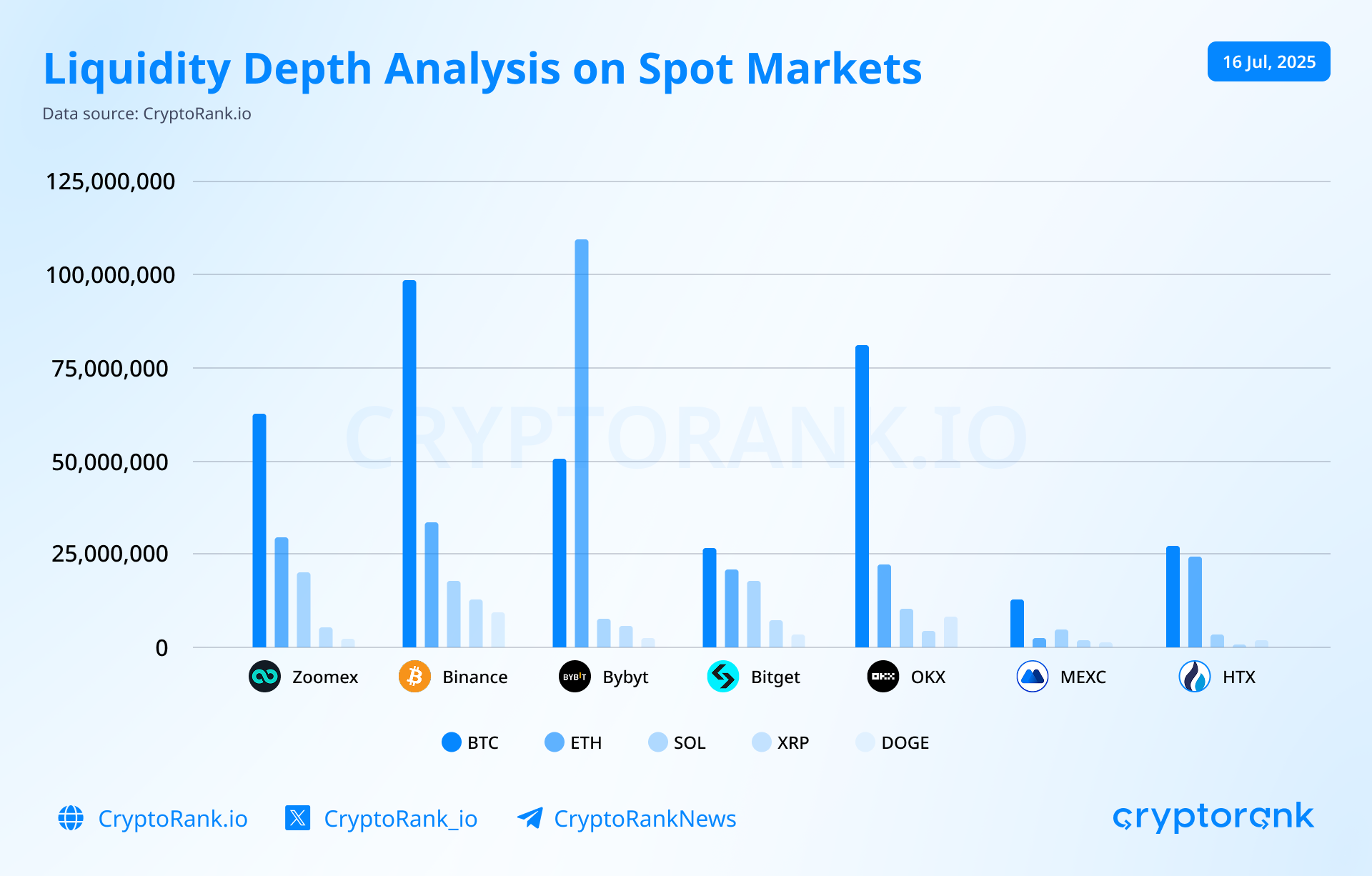

Analysis of Liquidity on Spot Markets

Based on the analysis, Zoomex shows competitive strength in BTC liquidity, outperforming several established players. With over 62.7 million USDT in visible depth across ±2% of the mid-price, Zoomex ranks third among the surveyed exchanges, behind only Binance and OKX. This level of liquidity suggests that the platform can accommodate large BTC trades with minimal price impact, placing it ahead of more mature exchanges like Bybit, Bitget, and HTX in this core market.

The exchange delivers standout performance in ETH trading pairs, surpassing major competitors. Zoomex records nearly 29.8 million USDT in ETH spot liquidity, second only to Bybit and Binance, and ahead of OKX, and Bitget. This is particularly notable given Zoomex’s younger market presence and signals strong trader engagement with ETH on the platform. For users focused on high-cap altcoins, Zoomex provides an execution environment comparable to the top-tier exchanges.

In SOL markets, Zoomex leads the field in spot liquidity. With over 20.5 million USDT in SOL order book depth, Zoomex edges out Binance and holds a clear lead over Bitget, Bybit, and OKX. This suggests that Zoomex has successfully attracted active trading in prominent altcoins, positioning itself as a platform with deeper-than-expected support for newer Layer 1 assets.

In XRP and DOGE markets, Zoomex holds a solid mid-tier position. XRP liquidity stands at 5.8 million USDT, ahead of HTX and MEXC but behind larger players such as Binance and Bitget. DOGE depth shows a similar pattern, with 2.78 million USDT available, which is sufficient for routine retail execution, though not yet at the scale required for high-frequency or institutional strategies.

Zoomex distinguishes itself by maintaining balanced liquidity across major markets. Unlike competitors that concentrate depth in one or two flagship pairs, Zoomex shows meaningful order book support across BTC, ETH, SOL, XRP, and DOGE. This even distribution enhances the platform’s usability for traders with diversified strategies and reflects a deliberate effort to scale liquidity beyond a single asset focus.

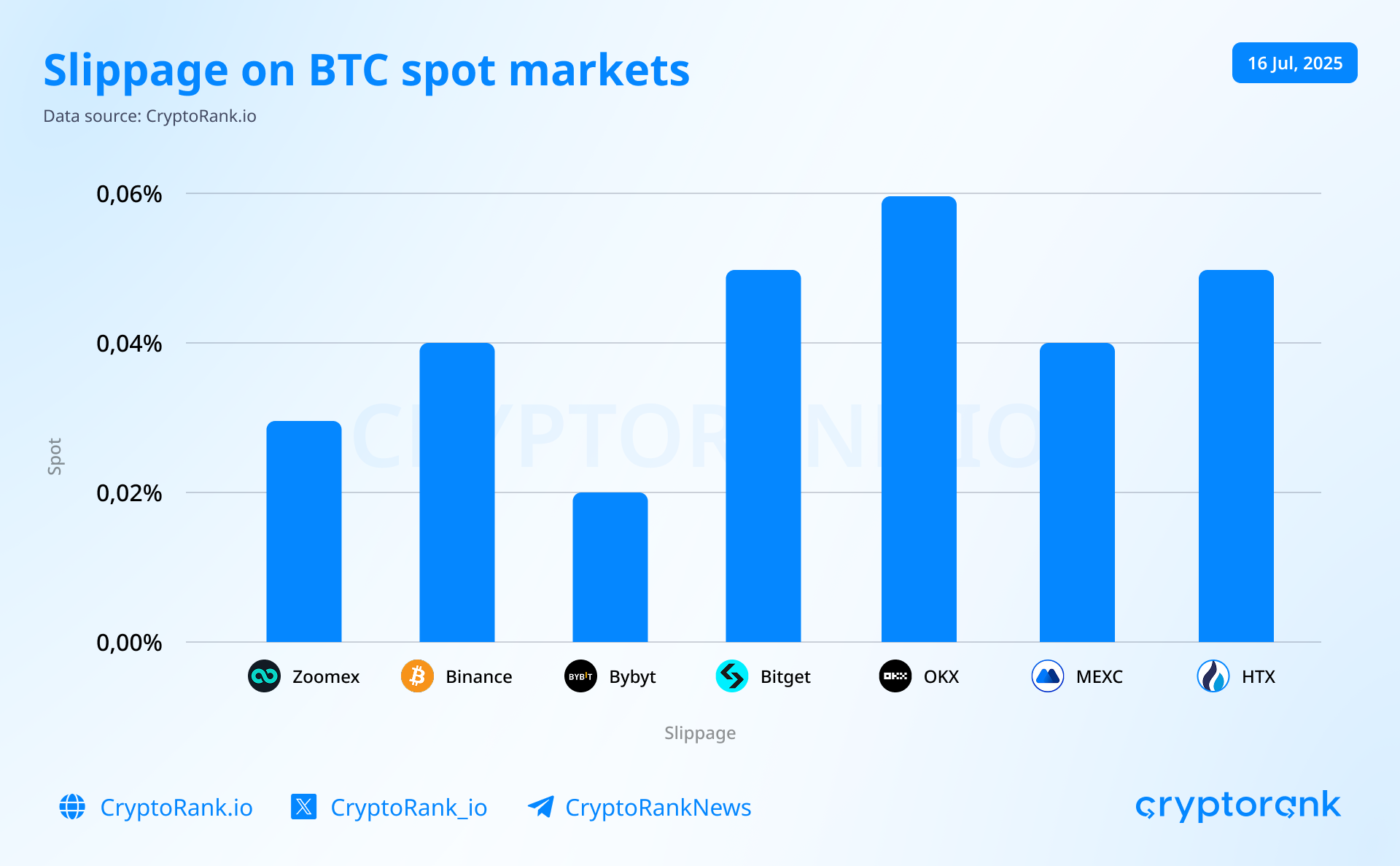

Slippage remains low across major exchanges for a 10 BTC market buy on the BTC/USDT spot pair, reflecting strong liquidity in this market. Zoomex records a slippage of 0.03%, slightly better than most competitors and just behind Bybit at 0.02%. Binance, MEXC, Bitget, and HTX fall in the 0.04% to 0.05% range, while OKX shows the highest at 0.06%. Though differences are small, Zoomex demonstrates efficient order handling and a well-supported top-of-book for large trades.

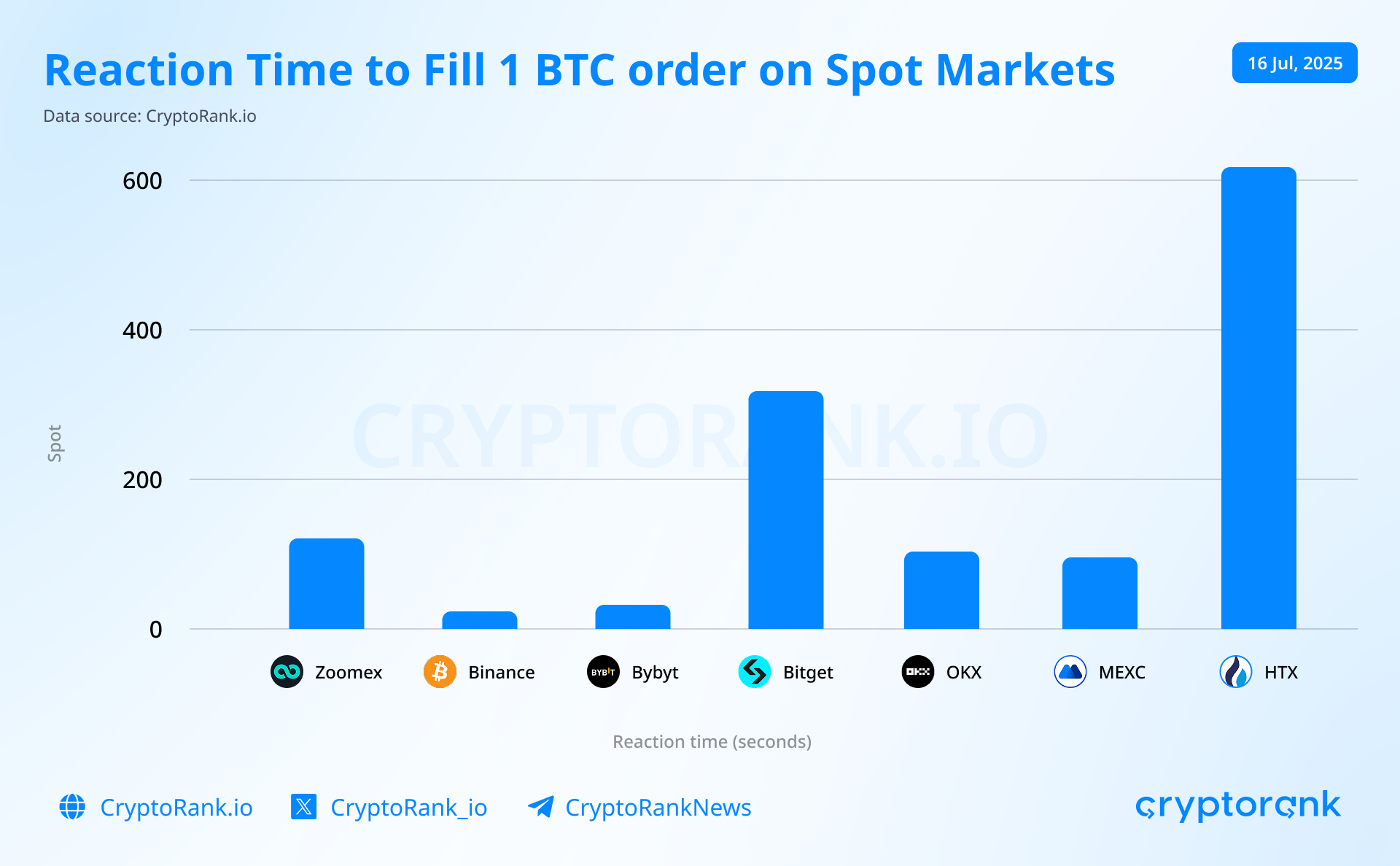

Zoomex records a spot execution time of 112 seconds to fill a simulated 1 BTC sell order, placing it in the middle tier of the group. Binance and Bybit lead significantly with reaction times of 20 and 26 seconds, respectively, reflecting their superior liquidity and trade matching efficiency. Zoomex performs faster than HTX and Bitget, which show notably slower response times at 571 and 294 seconds. While not yet matching the top-tier exchanges in speed, Zoomex demonstrates reasonably responsive order handling on its spot BTC market.

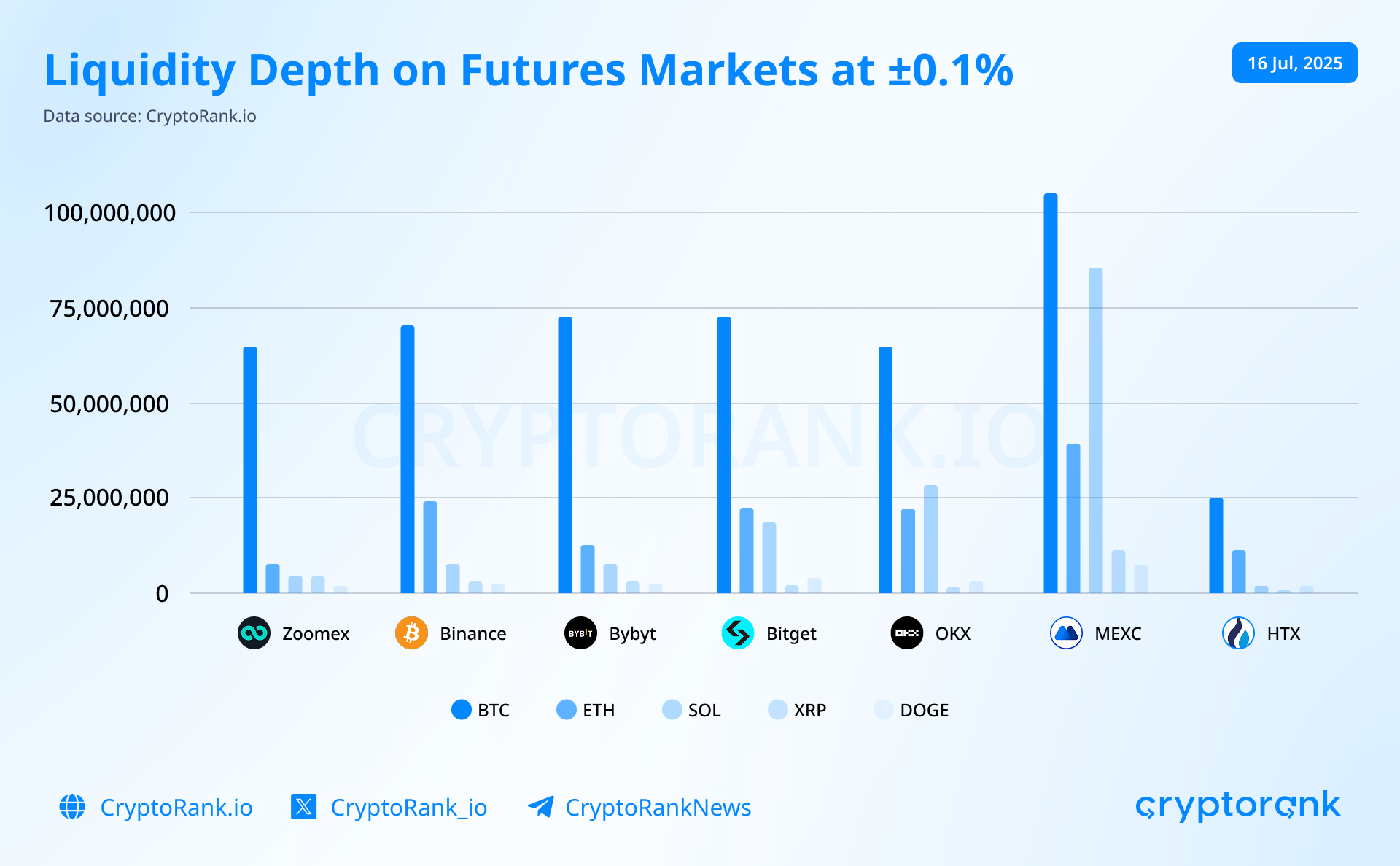

Analysis of Liquidity on Futures Markets

Zoomex demonstrates strong relative performance in BTC spot liquidity, holding over 62.7 million USDT within ±2 percent of the mid-price. This places it third overall among the analyzed exchanges, just behind Binance and OKX, and ahead of more established platforms like Bybit and Bitget. For a newer exchange, this depth signals that Zoomex can reliably support sizable BTC trades without significant slippage.

Its liquidity in ETH markets is equally notable. With nearly 29.8 million USDT in visible depth, Zoomex outpaces major names including Binance, OKX, and Bitget, and trails only Bybit. This suggests robust user activity and effective market-making in one of the most heavily traded assets. Among newer platforms, Zoomex stands out for the consistency of its support across high-volume trading pairs.

Zoomex’s SOL order book shows exceptional strength, leading all exchanges in this analysis with over 20.5 million USDT in depth. It surpasses Binance and holds a clear advantage over Bitget, Bybit, and OKX. MEXC, which often reports high liquidity figures, falls short here, reinforcing concerns about the quality or reliability of its reported depth.

In mid-cap markets like XRP and DOGE, Zoomex holds steady ground. With 5.8 million USDT in XRP and 2.78 million in DOGE, the exchange sits comfortably above MEXC and HTX, though still below the largest players. What distinguishes Zoomex is not dominance in any one market, but a consistent and well-balanced presence across all five assets. This broad coverage supports a more versatile trading experience and indicates a deliberate strategy to scale liquidity across the board, not just in flagship pairs.

Zoomex distinguishes itself by maintaining balanced liquidity across major markets. Unlike competitors that concentrate depth in one or two flagship pairs, Zoomex shows meaningful order book support across BTC, ETH, SOL, XRP, and DOGE. This even distribution enhances the platform’s usability for traders with diversified strategies and reflects a deliberate effort to scale liquidity beyond a single asset focus.

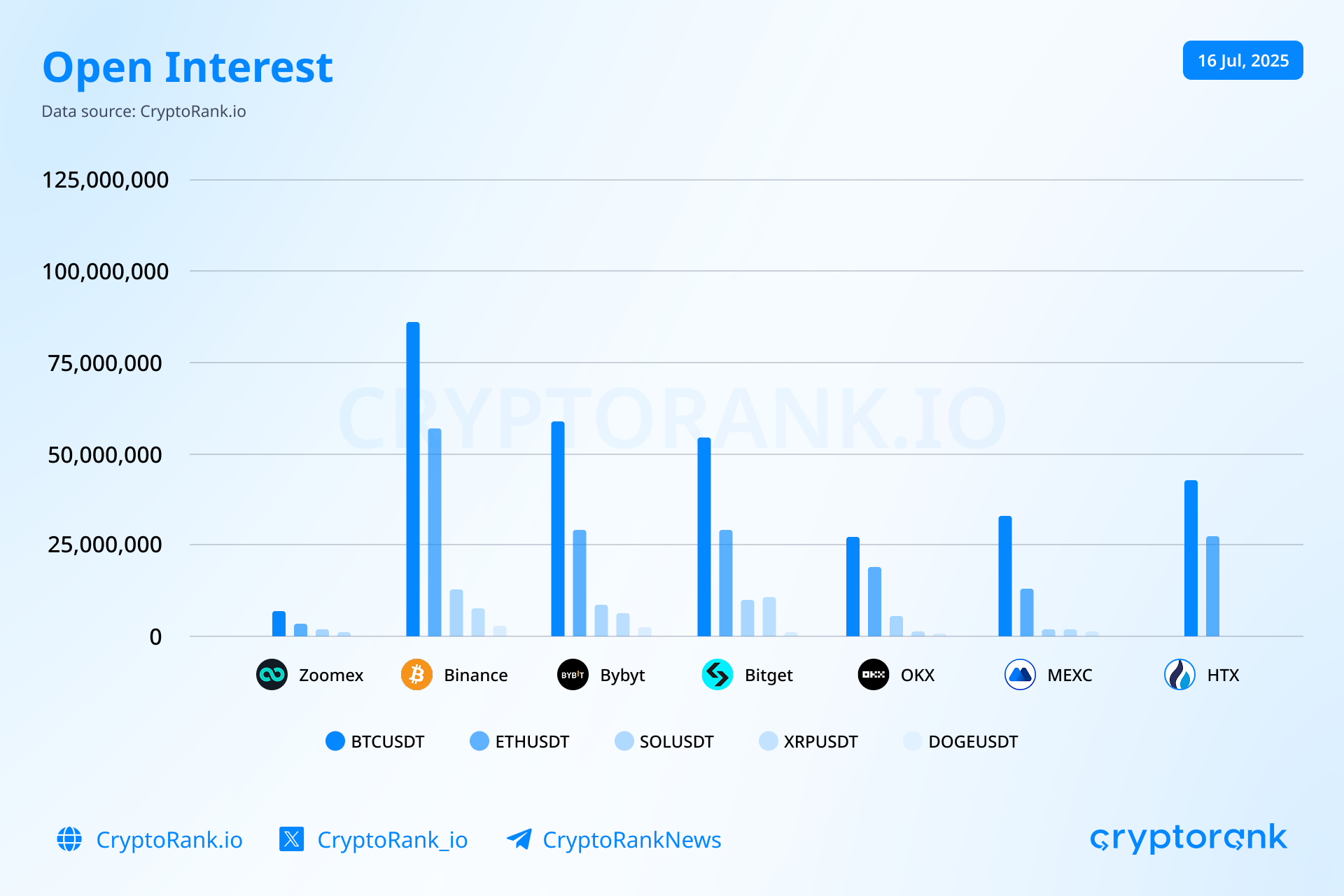

Open interest figures show that Zoomex lags well behind the top-tier exchanges in BTC and ETH derivatives markets. While Binance and Bybit post multi-billion-dollar open interest in BTC and ETH pairs, Zoomex records just 626 million USDT and 287 million USDT, respectively. This gap reflects its smaller institutional footprint and lighter trader positioning in core futures markets.

However, Zoomex performs more competitively on longer-tail assets. In SOL, XRP, and DOGE futures, it closely follows MEXC and even surpasses HTX by a wide margin. For example, Zoomex holds 90 million USDT in SOL open interest compared to just 14 million USDT on HTX, and leads in XRP and DOGE as well. These figures suggest that while Zoomex has yet to match the majors in flagship pairs, it is gaining traction in altcoin derivatives, possibly benefiting from retail-focused flows and targeted market-making strategies.

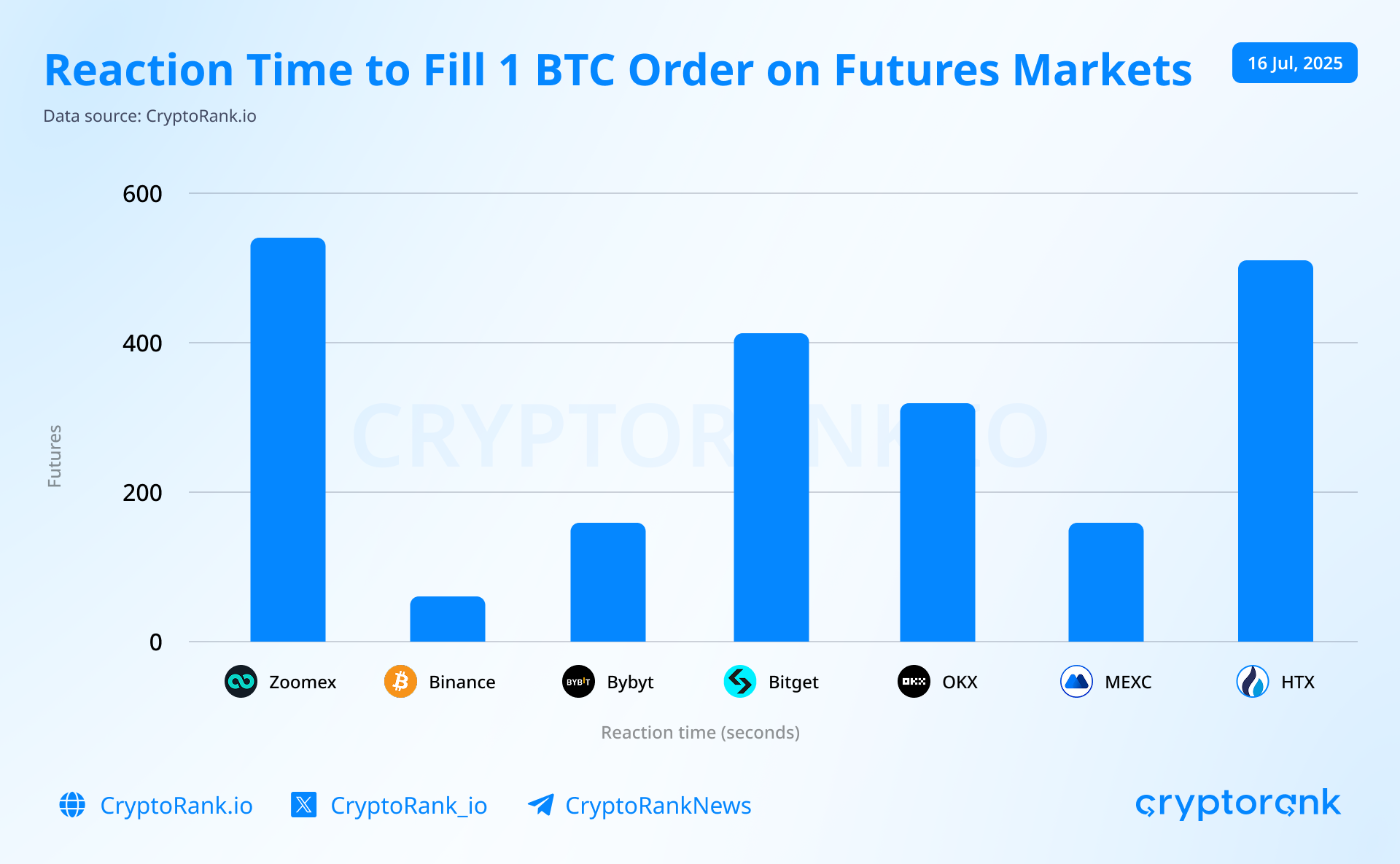

In the futures market, Zoomex delivers far more competitive results, filling the 1 BTC order in just 17 seconds. This places it close to OKX, HTX, and Bitget, which complete the same order within a 10 to 16-second range. While Binance and Bybit remain faster, executing in just 2 and 5 seconds, respectively, Zoomex’s futures engine demonstrates solid efficiency and keeps pace with several larger competitors under moderate trading load.

Key Findings from Analysis and Conclusion

Zoomex has positioned itself as a credible competitor in the centralized exchange space, offering liquidity depth that often rivals larger platforms. Its order books show strong coverage across major assets like BTC, ETH, and SOL, with particularly solid performance in altcoin futures markets such as XRP and DOGE. Execution metrics, such as low slippage and reasonable reaction times, further suggest that Zoomex provides a stable and efficient trading environment, even for larger orders.

However, the exchange still trails top-tier players in key areas. Open interest on BTC and ETH futures remains modest, pointing to a smaller institutional presence. Spot market execution is slower compared to leaders like Binance and Bybit. These gaps highlight the need for continued development in market depth and infrastructure. Still, Zoomex’s current performance indicates a solid foundation and real potential to close the gap with larger competitors over time.

Importantly, Zoomex’s strengths extend beyond its measurable liquidity performance. In just four years, it has attracted over 3 million registered users and developed a stable and versatile platform. Despite its shorter operational history, Zoomex’s infrastructure delivers the reliability, responsiveness, and feature set expected from more established platforms. Its systems handle market activity efficiently and provide users with a trading experience comparable to top-tier exchanges. This combination of rapid user growth and functional maturity reflects a strategic focus on long-term scalability.

As global crypto regulation evolves, exchanges with transparent operations and sound infrastructure will be best positioned to benefit. Zoomex’s consistent user engagement, broad asset support, and proven stability suggest it could play a growing role in the next phase of market development. Its early momentum is not yet fully reflected in institutional participation, but the underlying fundamentals point to substantial growth potential in a more mature and regulated environment.