Crypto Market Recap: July 2025

The main driver was the approval of the first-ever crypto regulation in U.S. history. This legislation provides a foundation for broader adoption of digital assets and sets the stage for future growth, paving the way for institutional inflows into ETFs and fueling a broad market rally.

Crypto Regulation

The core of the U.S. policy shift lies in three major legislative acts:

Genius Act

The first comprehensive federal law on stablecoins in the U.S. It allows both banks and licensed financial institutions to issue stablecoins under a clear regulatory framework.

Issuer requirements include:

• Full 1:1 backing with assets such as U.S. dollars or Treasuries

• Ban on unbacked and algorithmic stablecoins

• Risk management and cybersecurity standards

• Transparent reporting practices

• Mandatory licensing and regular audits

Clarity Act

This bill aims to clearly distinguish between "securities" and "digital commodities", resolving long-standing confusion between the SEC and CFTC jurisdictions.

Key provisions:

• Clear definitions for digital commodities and securities

• Clear division of authority between regulators

• Legal recognition of decentralization (with a 4-year transition window)

• Legal framework for ICOs if decentralization is achieved

• International regulatory coordination

• Banks may custody crypto without including it in reserve requirements

• Custodian rules covering asset segregation, insurance, and oversight

Anti-CBDC Act

Prohibits the Federal Reserve from issuing a digital dollar (CBDC), citing concerns that a government-backed digital currency could enable excessive surveillance of citizens’ financial activity.

This bill is designed to protect transaction privacy and prevent expanded government control over personal finances.

How Did It Impact the Market

Together, these legislative initiatives mark a turning point in how the United States approaches crypto. For the first time, a comprehensive framework is beginning to take shape at the federal level, potentially accelerating both innovation and institutional adoption in the space.

-

BTC reached a new all-time high, up 8% for the month

-

ETH surged nearly 49%

-

Market participants expect a rate cut

-

Trump’s trade policy raises concerns

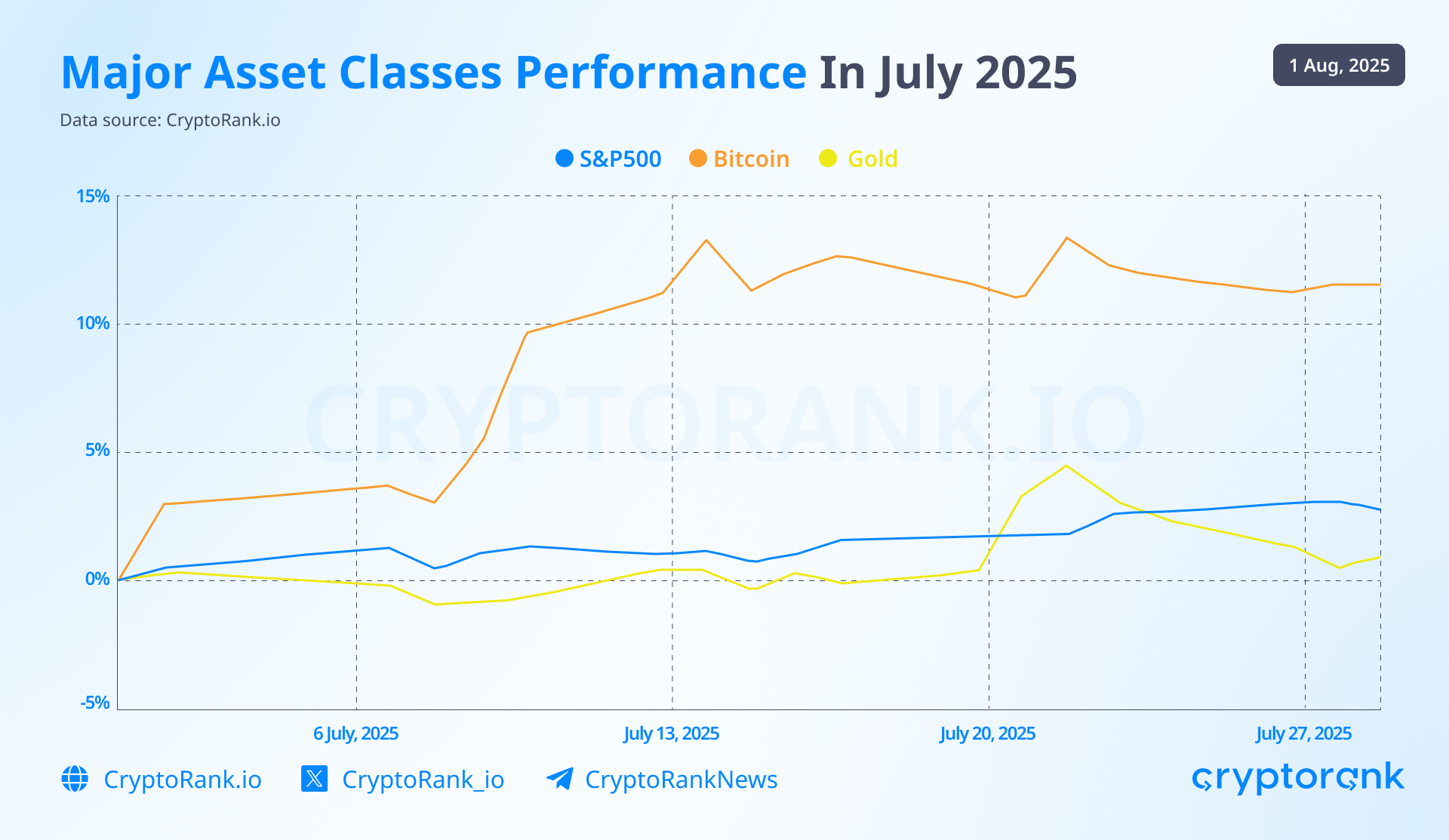

Bitcoin Outperforms S&P 500 and Gold

In July, supported by legislative developments, Bitcoin significantly outperformed both the S&P 500 and gold, delivering more than three times their returns over the month. The main driver behind Bitcoin’s performance was the introduction of crypto-friendly regulations in the United States.

The S&P 500 also posted a notable gain, reaching a new all-time high. However, concerns about the market being overheated began to intensify. This sentiment is reflected in several key indicators, including the ratio of U.S. government debt holders to equity holders, the Buffett Indicator, and the overall market capitalization-to-earnings ratio, among others.

The market still has potential drivers for further growth. One of them is a possible interest rate cut, which Donald Trump has been actively pushing for. However, the Federal Reserve continues to hold the rate at 4.5%, maintaining that inflation remains above its target.

On the flip side, risks remain. One notable example is Trump’s increasingly aggressive trade policy, which in early April triggered a sharp decline in both the S&P 500 and Bitcoin.

Gold, meanwhile, showed only a slight increase in July and mostly traded sideways. Despite the rally in risk assets, investors continue to perceive persistent risks and remain reluctant to abandon gold as a hedging instrument.

Data obtained by API

Bitcoin Reached New ATH, But Momentum May Fade

The reasons behind this rally were discussed earlier. Now, let’s take a look at what might lie ahead for Bitcoin in the next two months.

Historically, August and September have been weak months for both Bitcoin and the S&P 500. This is largely due to the summer holiday season in August and the end of the fiscal year for mutual funds in September, which often leads to tax-loss harvesting.

Another factor to consider is the typical “buy the rumor, sell the news” dynamic that frequently plays out in crypto markets. The key rumors and promises surrounding crypto regulation have now materialized into law, and there are no major legislative initiatives expected in the coming months. As a result, there is a lack of immediate catalysts for further upside.

Adding to the bearish outlook is the recent escalation of trade tensions under Donald Trump. On August 1st, Trump took the first step by announcing a new round of tariffs. The trade deal with China and several other countries remains in limbo, creating additional uncertainty for global markets.

On the other hand, the growing number of institutional Bitcoin buyers could be seen as a positive long-term factor. However, this trend is unlikely to have a significant impact on short-term price movements.

Taking all of this into account, bearish factors appear to outweigh bullish ones over the next two months.

Data source: CryptoRank API

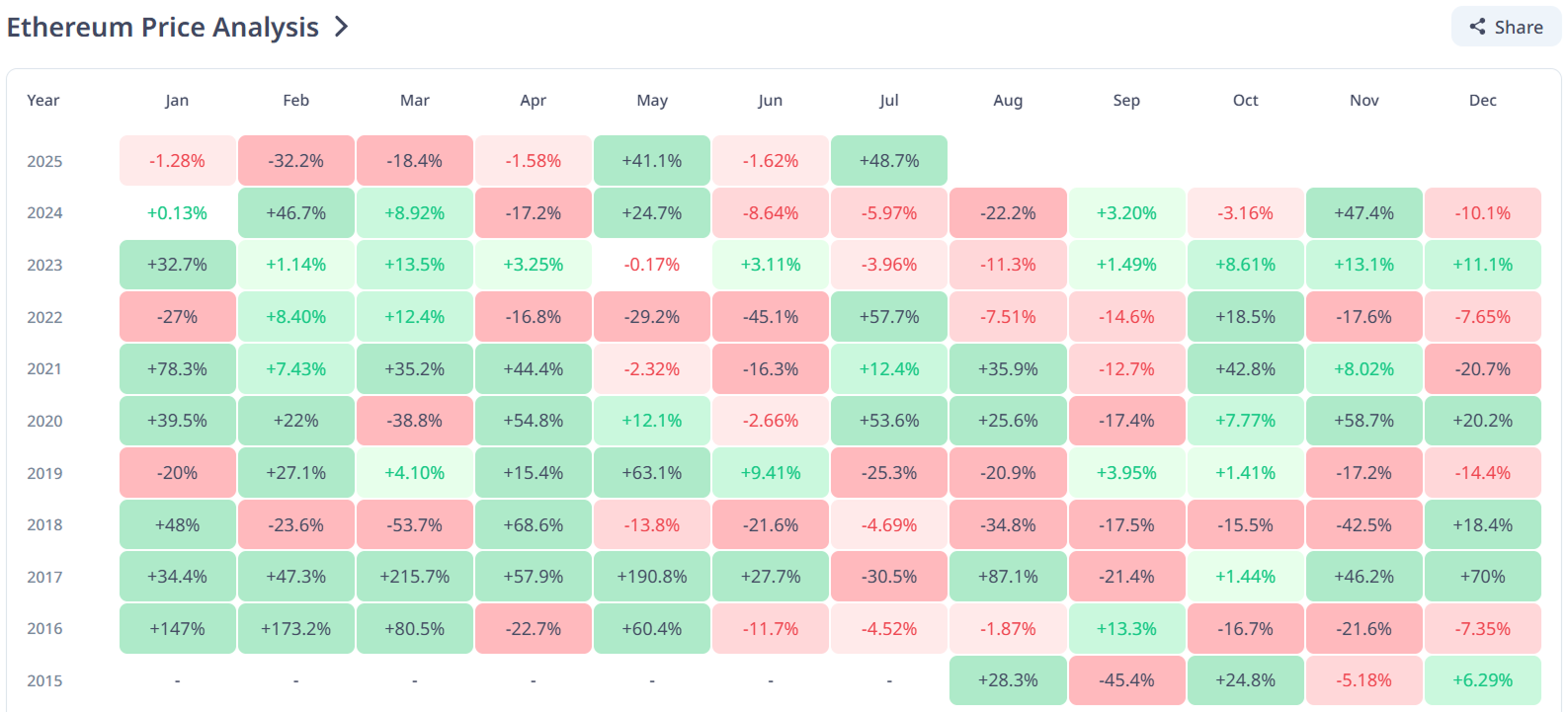

ETH Surges 49% on ETF Optimism and Regulatory Tailwinds

Ethereum, the core asset of the DeFi ecosystem, delivered an impressive 48.7% return in July. Interestingly, over the past two years, Ethereum has followed a clear pattern. It either experiences sharp monthly surges or undergoes a gradual decline stretched over several months.

Data obtained by API

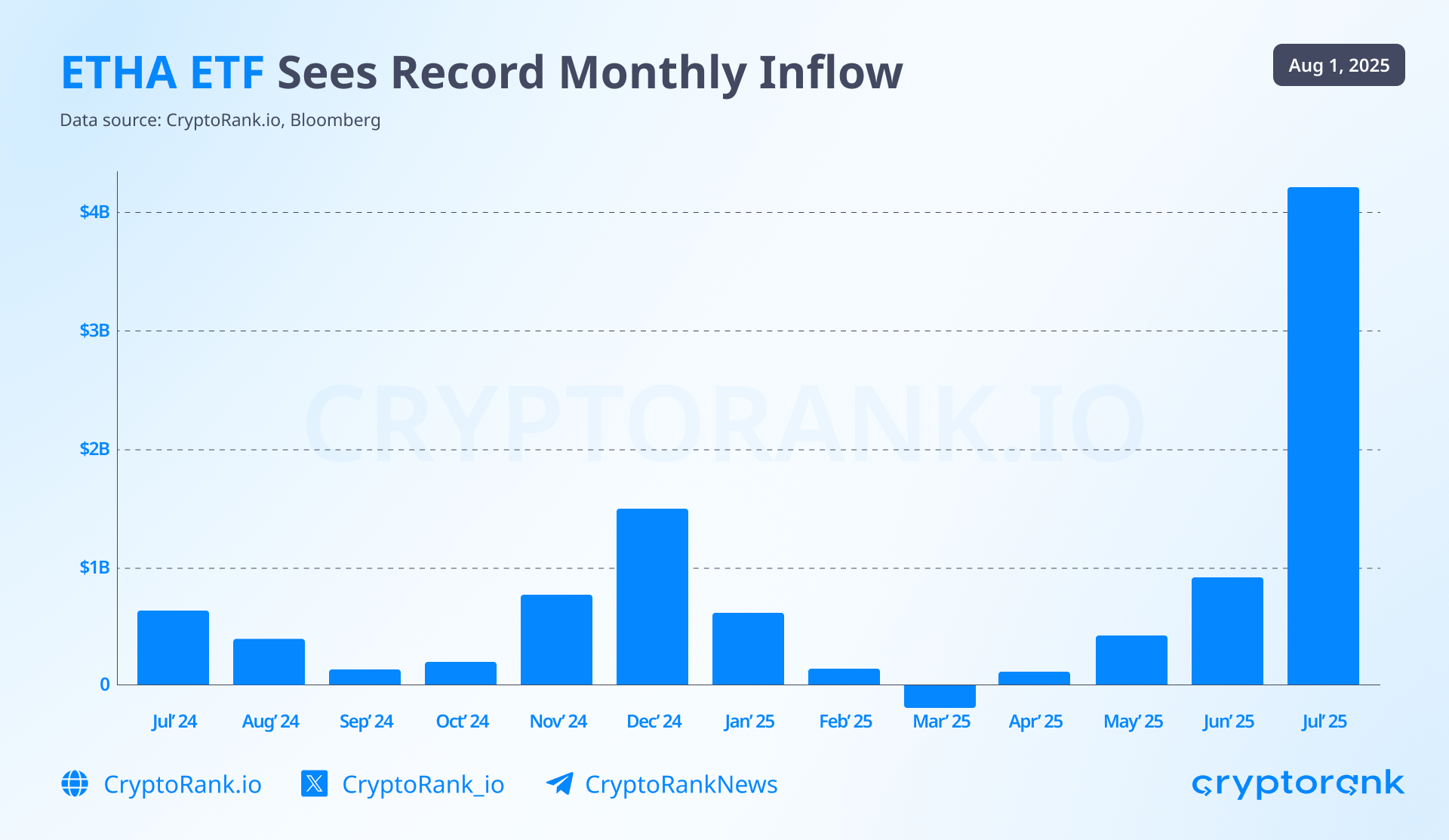

Currently, there are two main reasons behind Ethereum's recent growth: favorable crypto regulation and growing institutional interest in Ethereum.

The introduction of pro-crypto legislation has encouraged more institutional players to allocate capital to Ethereum, resulting in increased inflows into ETH ETFs. This has become one of the key drivers behind the price rally.

At the end of July, the SEC acknowledged BlackRock’s filing to enable staking for its spot Ethereum ETF. This move is expected to further boost the appeal of ETH ETFs among institutional investors.

Just like Bitcoin, August and September have historically been weak months for Ethereum. On the other hand, Ethereum stands to benefit even more from the new regulatory environment. As the leading chain for both DeFi and stablecoins, Ethereum is better positioned to capitalize on the pro-crypto legislation than Bitcoin.

Chains’ Performance

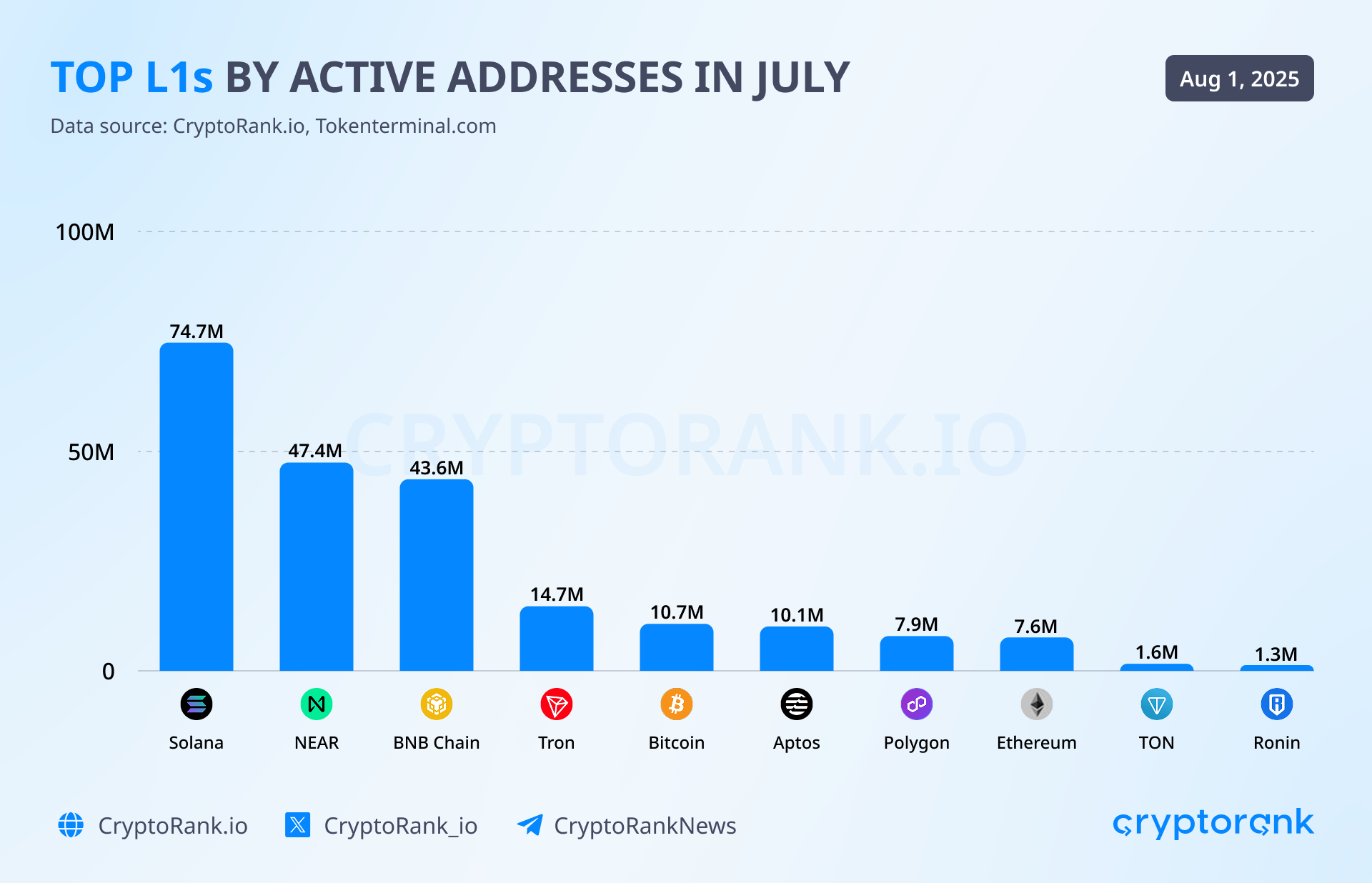

Solana Breaks Activity Records, Launches First ETF

In July, Solana implemented a major network upgrade, increasing its block capacity by 20% to 60 million compute units per block. It enabled higher throughput and expanded Solana’s scalability opportunities. The rise of the LetsBonk launchpad boosted the network’s activity metrics. July 2025 became the second-best month on record for Solana, with a total of 2.63 billion transactions. The network also maintained its leading position among L1s in terms of monthly active addresses, reaching 74.7 million.

The first U.S.-listed Solana ETF, the REX-Osprey SOL + Staking ETF, was officially launched on July 2. This fund provides direct exposure to SOL while also offering holders access to staking rewards. What’s more, XStocks launched tokenized versions of top U.S. shares like TSLAX, APPLX, NVDAX, METAX, and others. With this launch, these assets can now be traded on-chain on Solana or through CEXs.

BNB Tops DEX Volume, Speeds Up Blocks

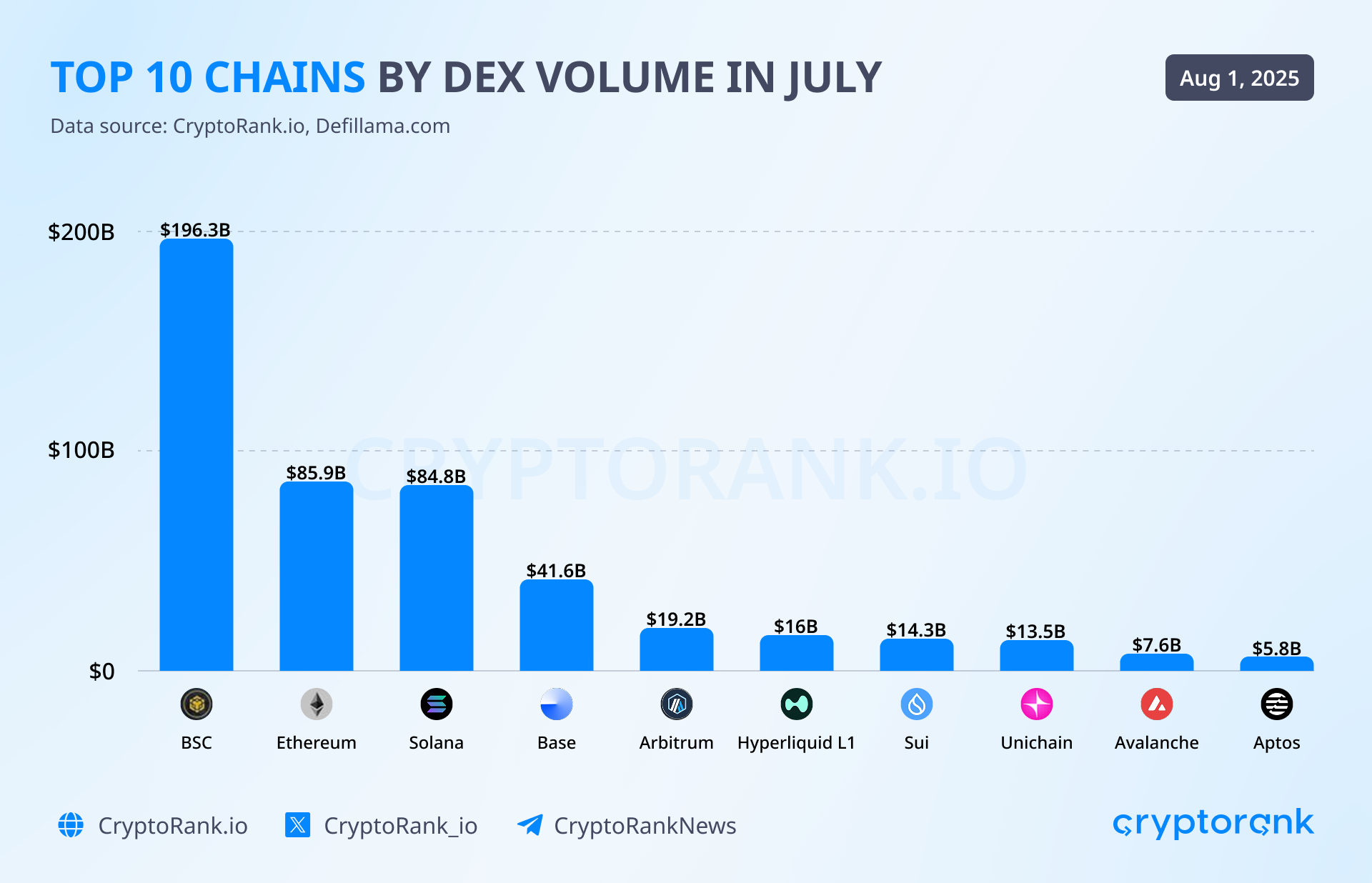

For the third consecutive month, BNB Chain has become the leader in DEX volume, outperforming Ethereum and Solana with $196B. BNB’s native DEX, PancakeSwap, is the main driver of the chain’s volume, becoming the #1 DEX across all chains with $188B in monthly volume ($178B on BNB Chain). Since the start of Q2, the network has more than doubled its monthly transactions (411M vs. 161M). In July, it also saw a new ATH in monthly active addresses, 71M.

The Maxwell upgrade on BNB Chain was implemented on June 30, 2025, and its impact became visible in July. Block production now averages 0.75 seconds per block (formerly 1.5 seconds), and transaction finality is down to about 1.875 seconds.

Base Hits TVL ATH, Becomes Fastest L2

Base set a new ATH in TVL, reaching $8.2B, the highest among Ethereum L2s. DEX volume also surged to $41.6 billion, showing a 47% month-over-month growth. The network saw 45M active addresses and 279M transactions in July. Major Base-native memecoins, like BRETT, TOSHI, and DEGEN, all grew 15-30%.

On July 17, the team showcased Base's roadmap, announcing new tools, partnerships, and technological advancements. Coinbase Wallet became the Base app, bringing together social, chat, payments, and trading all under one super app. On the same day, Base deployed its Flashblocks upgrade, cutting effective block times from roughly 2 seconds to just 200 milliseconds and making it the fastest Ethereum Layer 2 by far.

Tron Lists on Nasdaq, Boosts Stablecoin Lead

Tron maintained its lead in July as one of the top blockchains by fees earned, generating $57 billion and ranking as the #11 protocol in the entire crypto space. Its influence in the stablecoin sector continues to grow, with stablecoin supply rising to $82.5B on Tron, and monthly active addresses standing at 9.6M.

On July 24, 2025, Tron Inc. made its Nasdaq debut via a $100M reverse merger and commenced trading under the TRON ticker. The listing triggered a 36% surge in TRX trading volume to $1.83 billion within 24 hours.

To learn more about Tron, check out our Tron H1 2025 recap.

Hyperliquid Sets ATHs, Rolls Out HyperCore & HyperEVM

Hyperliquid’s TVL surged to a record $4.4 billion in July. Interestingly, liquidity is spread evenly across multiple core protocols like Kinetiq, HyperLend, Morpho, HL, Felix, HypurrFi, rather than concentrated in one spot. Open interest also reached a record $15.5 billion, while perp trading volume climbed to a new ATH of $323B.

Hyperliquid closed the month as the #7 crypto project by fees earned, getting $91M in revenue. A portion of this was used for a $4.9 million HYPE token buyback initiated by the team.

On the technical front, July marked the full rollout of HyperCore and HyperEVM, establishing Hyperliquid as a high-performance Layer 1 with EVM compatibility. These upgrades enabled real-time DeFi operations, cross-dApp liquidity, and seamless deployment of Ethereum smart contracts.

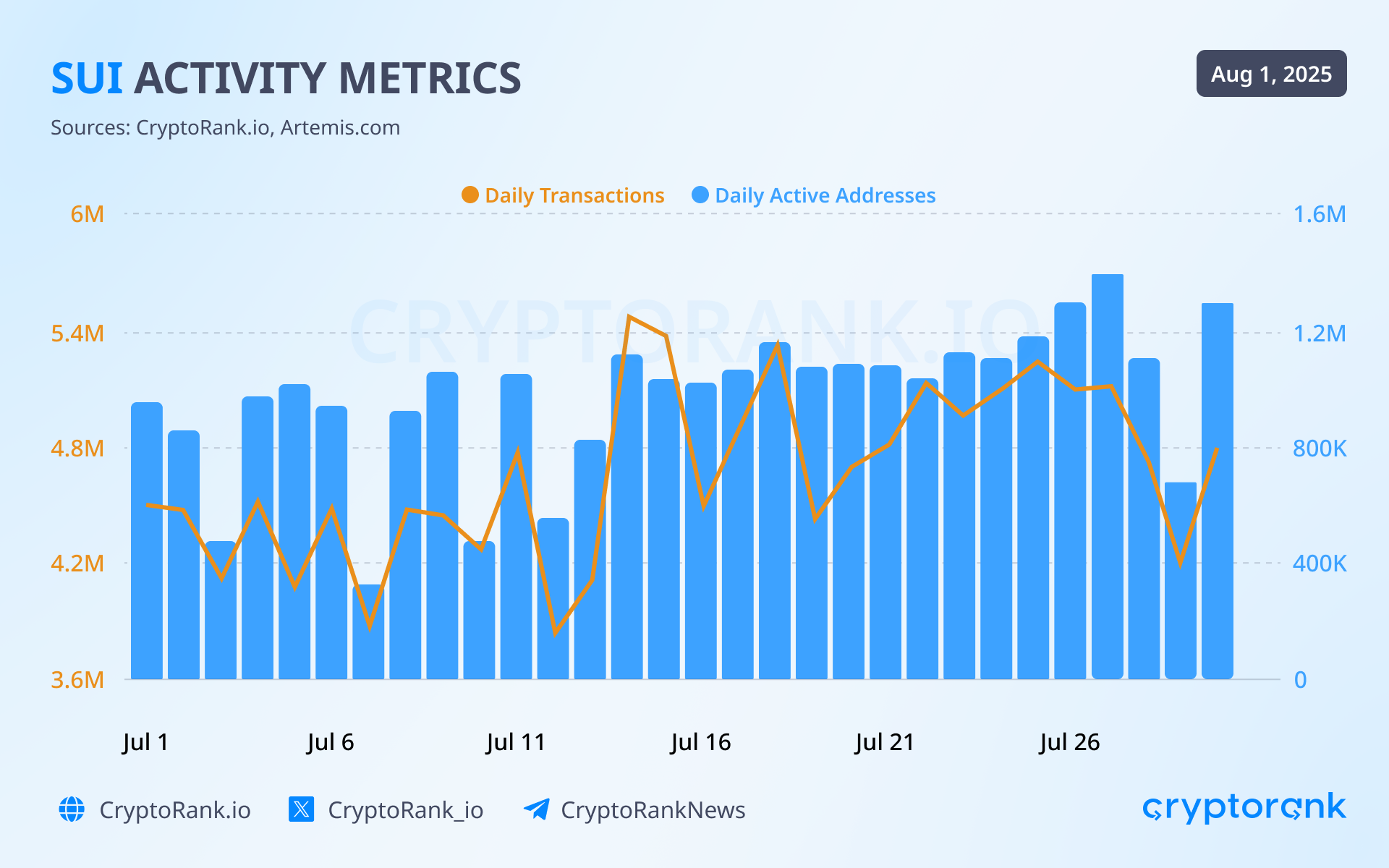

Sui Hits New Highs in Users and Volume

Sui hit multiple all-time highs in July, including 2.7 million daily active addresses and 10.5 million transactions on July 25 — the highest daily count since October 2024. The network also saw record weekly DEX volume of $4.3B.

On July 28, Mill City Ventures announced a $450 million private placement to back its Sui treasury strategy, as the fund aims to make SUI its primary digital asset reserve.

Sei Sets Multiple ATHs, Strengthens RWA Stance

In July, the network reached ATH in TVL ($1.41 billion), monthly DEX volume ($1.54 billion), and weekly active addresses (3.3M).

A major highlight was the integration of native USDC and Circle’s CCTP V2, which boosted transaction speed and reduced reliance on bridges. Also, Ondo Finance deployed USDY, tokenized US Treasury Bills, to Sei, strengthening its role as an important RWA hub.

Altcoin Growth: BNB, HYPE, ZORA

In July, altcoin season index, ASI, reached 60/100 for the first time in many months. Basically, this metric tracks the dominance of top 100 cryptocurrencies in comparison to Bitcoin. Its surge may signal the approaching altseason and provide insights on potential investment opportunities. In this month many altcoins made impressive runs. Below are some of the standout performers.

-

PENGU token surged over 130% month-to-month. The Pudgy NFT was the top collection by trading volume with 17.6K ETH, and its floor price surged over 60% to a peak of 16 ETH. Growth reasons include Pudgymania all over crypto Twitter, the SEC’s acknowledgment of Canary Capital’s application to launch a spot PENGU ETF, and PENGU’s addition to Hyperliquid.

-

BNB set a new ATH of $859. The token growth comes from an increased institutional demand and Binance’s 32nd quarterly burn, which removed 1.59M BNB (over $1B) from circulation. What’s more, Liminatus announced plans to invest up to $500M in BNB.

-

HYPE also set a new ATH, $49.8, reflecting rising demand for Hyperliquid’s on-chain perpetuals and a general ecosystem strengthening. Other drivers include a $4.9M buyback, strong partnerships (Raydium, Pear), Bybit listing, and more.

-

XRP saw 70% growth in July, climbing over $3.6, though it ended the month below $3. The surge factors are coming from regulatory clarity following Ripple’s SEC settlement, inclusion in Grayscale’s Digital Large Cap Fund, and the launch of ProShares XRP ETF.

-

ZORA made a parabolic 1200% run and, after a slight pullback, is trading at a $230M market cap. The rise is caused by integration with the Base App and a Binance Futures listing.

-

ENA rose over 100%, fueled by the launch of StablecoinX, a new publicly traded treasury company that raised $360 million to execute a large buyback and accumulation program for ENA.

DeFi is Thriving: Aave, Morpho, Maple

Aave has become the first protocol ever to reach $50B in TVL, standing at $59B, as of August 1. Ethereum is the dominating chain, accounting for 90% in Aave TVL. Notably, Base hit $1.29B TVL on Aave, becoming the fourth chain after Ethereum, Arbitrum, and Avalanche to reach the $1B milestone.

The upcoming launch of Aave v4 will strengthen its position as a leading DeFi protocol, by adding a variety of new features.

Morpho continued its growth and reached a $9B TVL, marking over 40% monthly gain. In July, the protocol has been growing its influence as a key liquidity hub on Ethereum, Hyperliqud, Unichain, and Katana. It has also become the second DEX on Ethereum by DEX volume, with $16B.

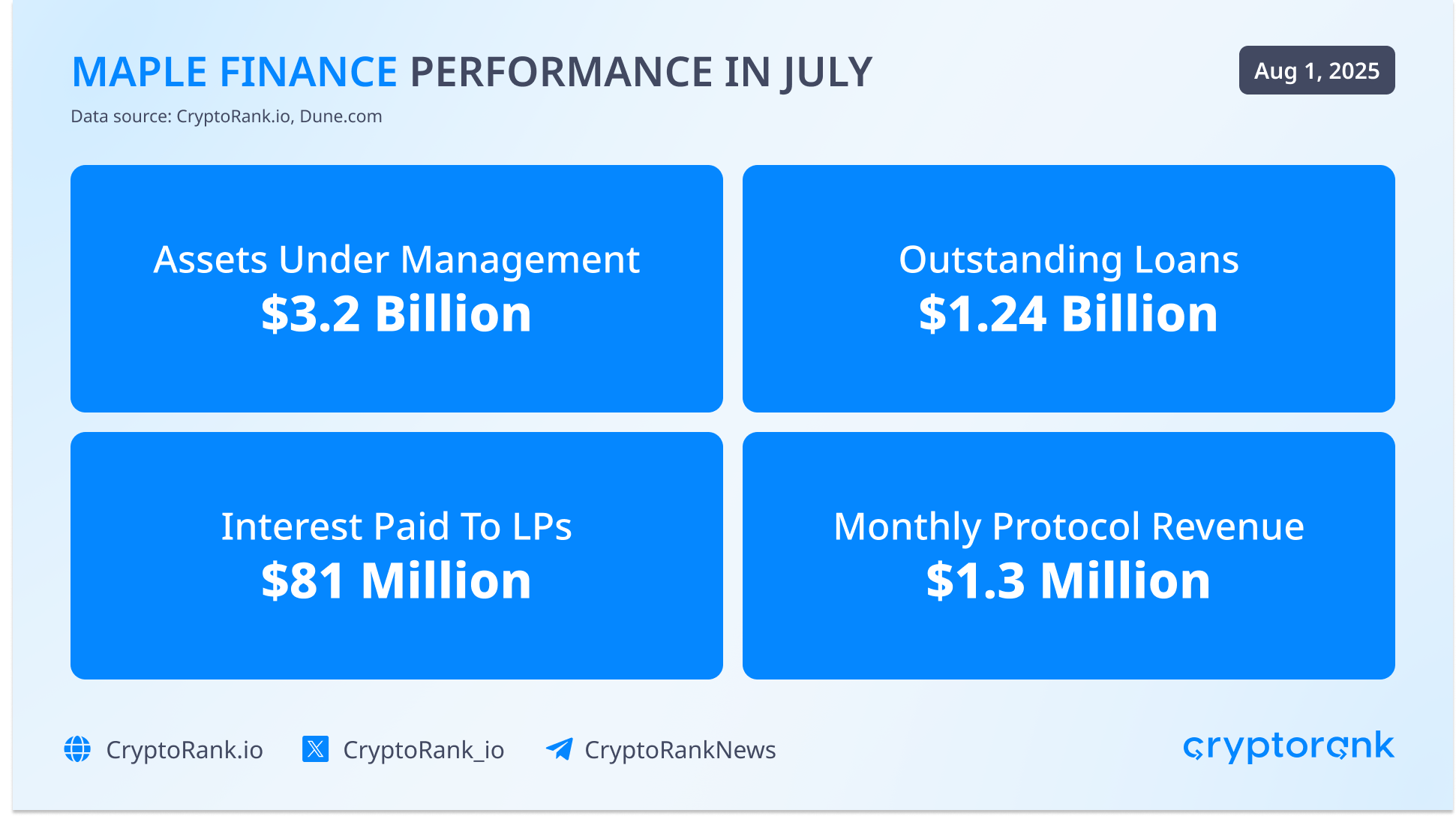

In July, Maple Finance became the largest on-chain asset manager, surpassing BlackRock’s BUIDL. Maple hit $3B in assets under management (AUM), showing over 300% growth in 3 months. Outstanding loans hit $1B, and syrupUSD has now $1.87B AUM.

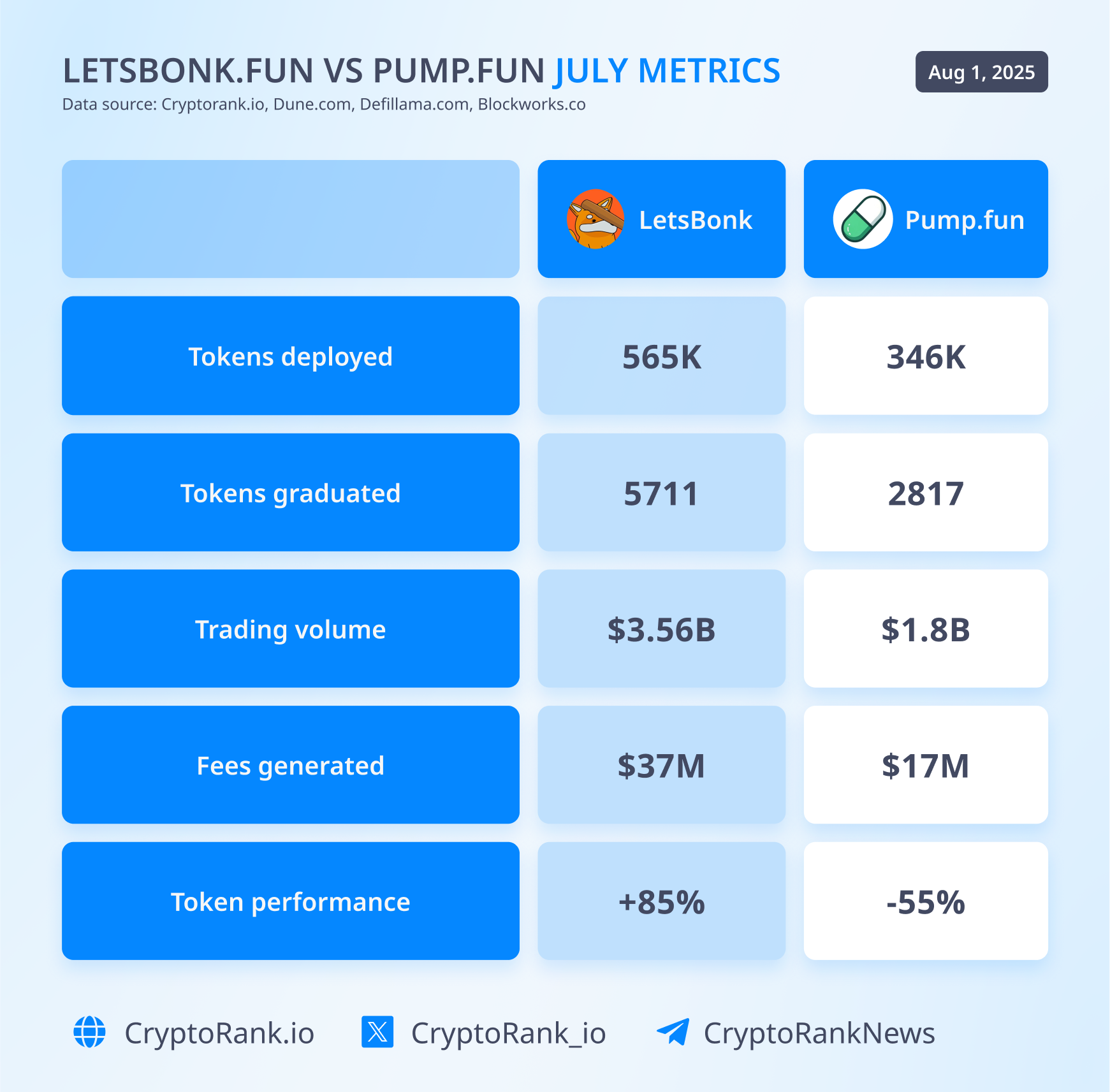

Pump.fun vs LetsBonk.fun

July became the first month when Pump.fun’s dominance among Solana launchpads was seriously challenged. All thanks to LetsBonk.fun, the new launchpad from the Bonk ecosystem. Starting July 6, LetsBonk began consistently outperforming Pump.fun in daily token launches, graduates, trading volume, and fees.

Interestingly, LetsBonk is built on the Raydium SDK. After losing a major revenue stream when Pump.fun launched its own DEX, PumpSwap, Raydium seems to have found a new source of income: its Launchlab brought in $46.9M in fees in July, an outstanding 1300% growth compared to June’s $3.25M.

Pump.fun Token Sale

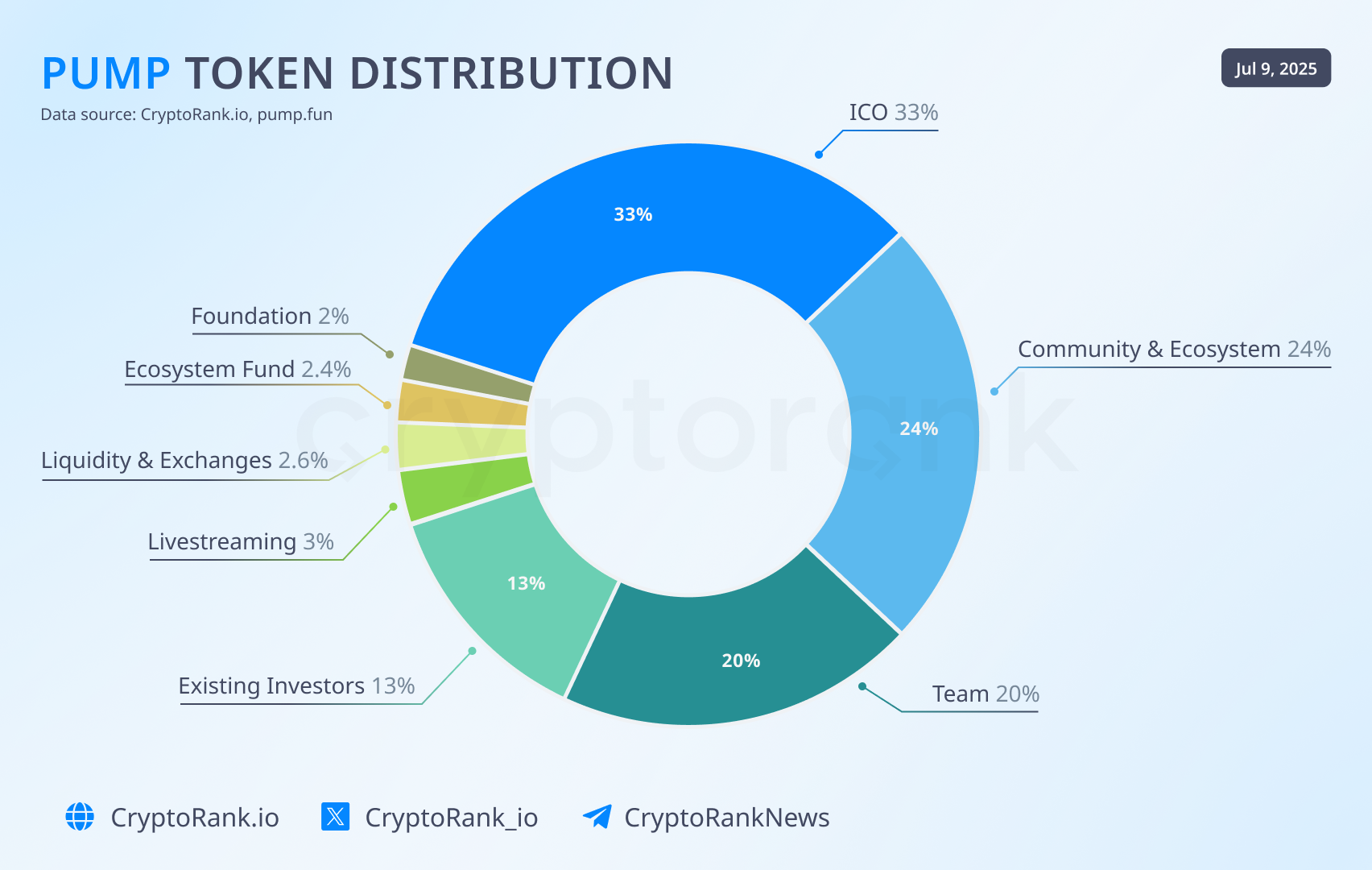

One of the most anticipated token launches, Pump.fun, finally happened in July. Here is the breakdown of PUMP tokenomics.

33% of PUMP’s supply was allocated for the token sale: 15% for the private round and 18% for the public round, with a total raise target of $1.32B. Both rounds offered tokens at the same $0.004 price, implying a $4B fully diluted valuation.

All the tokens were sold within 12 minutes after the sale started, despite public scepticism ahead of the event. Here are some key numbers about the PUMP sale.

The token was listed on CEXs on July 15 and traded at around $0.006 on day one. This price gave sale participants an instant ~50% profit, since 100% of tokens were unlocked at TGE.

The successful $1.32B raise made Pump.fun the third-largest token sale ever.

The Comeback of NFTs: CryptoPunks, Pudgy Penguins

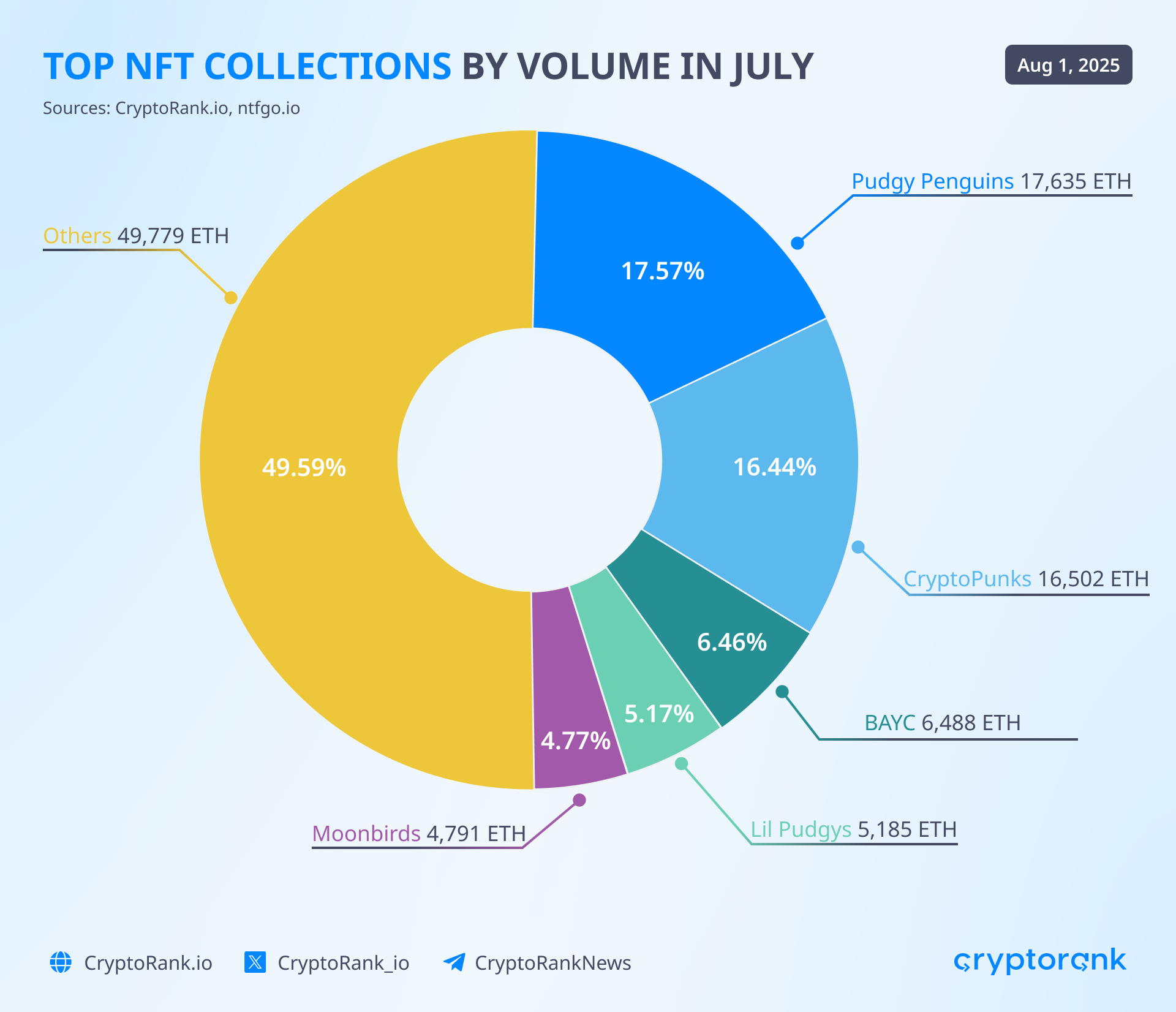

The NFT market showed strong performance in July, with the total market cap growing from $4.5B to $7.5B, the highest since January ‘25. Monthly trading volume surged to $321M, also marking the highest level since January.

The growth was led by blue-chip collections like CryptoPunks, which saw a $6 million sale and a 53% rise in floor price. Pudgy Penguins supported the rally, as the collection’s floor price jumped over 60%. Interestingly, Penguins were able to surpass Punks by trading volume in July: 17.6K ETH vs 16.4K ETH.

Ethereum remains dominant by trading volume, followed by Bitcoin, Polygon, BNB, and Solana.

The Bottom Line

July was an important month for the crypto industry. The U.S. passed clear rules for digital assets, giving the market more certainty and creating the basis for wider adoption. Bitcoin set ATH, and Ethereum finally broke out after months below $3,000, fueled by ETF inflows. Many DeFi protocols saw their TVL grow, and some major altcoins reached their highest prices in a while.

This new regulatory clarity, combined with growing participation, gives the crypto space a solid base for future growth. However, there are still risks from global politics, the economy, and seasonal trends that could affect the market in the coming months.