Table of Contents

- Intro

- Why Institutions Are Coming Into Crypto?

- GENIUS and CLARITY Acts Review

- GENIUS Act: Banking Standards for Stablecoins

- CLARITY Act: The Full Crypto Market Structure Framework

- What Is the Current Status of GENIUS and CLARITY Acts?

- When GENIUS and CLARITY Take Effect?

- Potential Impact on GENIUS and CLARITY on Crypto Market

- Which Institutions Will Launch Stablecoins After GENIUS Is Enacted?

- What Happens to Non-Payment Stablecoins after GENIUS?

- Which Crypto Assets Will Benefit the Most from GENIUS and CLARITY?

- End to Crypto Wild West

Table of Contents

- Intro

- Why Institutions Are Coming Into Crypto?

- GENIUS and CLARITY Acts Review

- GENIUS Act: Banking Standards for Stablecoins

- CLARITY Act: The Full Crypto Market Structure Framework

- What Is the Current Status of GENIUS and CLARITY Acts?

- When GENIUS and CLARITY Take Effect?

- Potential Impact on GENIUS and CLARITY on Crypto Market

- Which Institutions Will Launch Stablecoins After GENIUS Is Enacted?

- What Happens to Non-Payment Stablecoins after GENIUS?

- Which Crypto Assets Will Benefit the Most from GENIUS and CLARITY?

- End to Crypto Wild West

GENIUS and CLARITY Acts: U.S. Crypto Regulation & Adoption

Intro

Senators and House representatives declared 2025 the most important year for digital asset legislation, crypto institutional adoption, and making crypto in America great again. The two critical bills are driving this transformation: the GENIUS Act to regulate stablecoins and the CLARITY Act to establish a comprehensive crypto market structure framework. With their enactments around the corner, let's examine what these bills entail and their potential market impact.

Why Institutions Are Coming Into Crypto?

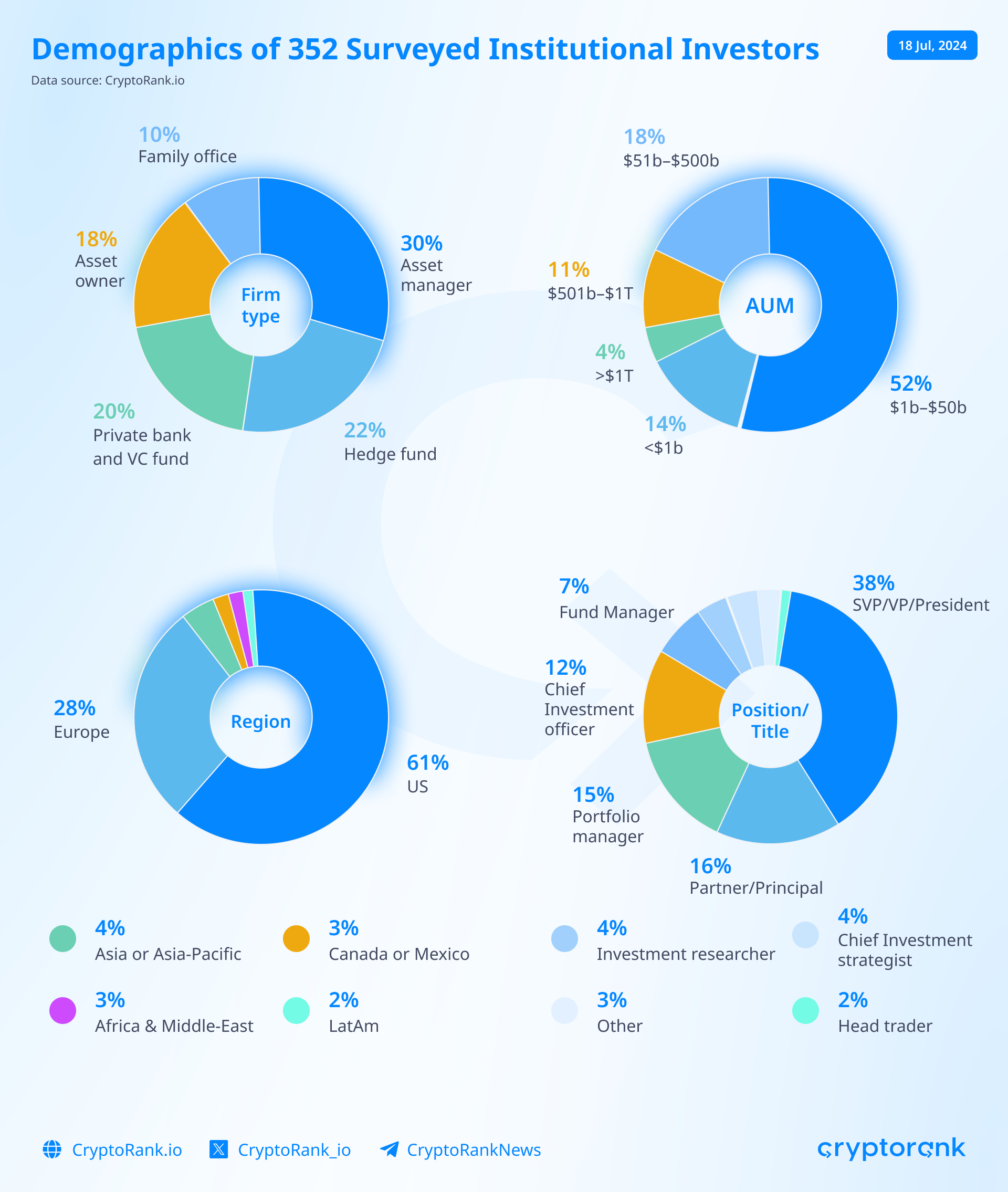

Recent data from an EY Parthenon 2025 survey of 352 institutional investors (61% US-based) reveals that 85% of them expanded their digital asset allocations in 2024, with 78% planning further increases in 2025. Here are the three primary incentives driving this crypto institutional adoption:

-

59% cite expectations of superior risk-return ratios compared to traditional assets

-

49% view it as investment in innovative technology

-

41% see crypto as an inflation hedge

Stablecoins and tokenized real-world assets are the most attractive sectors for institutional investors. Out of 352 global investors, 84% either use stablecoins or plan to do so. Meanwhile, 76% plan to invest in tokenized assets by 2026, targeting alternative funds (47%) and commodities (44%) first.

Finally, “greater regulatory clarity” was named the top catalyst for further institutional adoption by 57% of respondents, and “crypto custody rules” were identified as the most critical area needing clear guidance.

GENIUS and CLARITY Acts Review

The two most important crypto bills have taken shape in Congress with genuine prospects for enactment: the GENIUS Act and the CLARITY Act, which must advance together to establish the most comprehensive regulatory framework for crypto in the US.

GENIUS Act: Banking Standards for Stablecoins

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, first introduced in the Senate as S. 394 in February 2025, is a comprehensive stablecoin regulation bill that establishes federal oversight, reserve requirements, and licensing frameworks for payment stablecoins in the United States.

Issuers that acquire payment stablecoin status under GENIUS will be able to integrate directly into the US financial system, gaining legal authorization to be used in any business in the US and most of the globe.

Key Features of the GENIUS Act:

-

Definition of Payment Stablecoin. Section 2 defines payment stablecoins as digital assets intended for everyday transactions that can be redeemed at a 1:1 ratio any time. Non-fitting stablecoins are considered non-payment and outside regulation.

-

Payment Stablecoins Are Neither Securities Nor Commodities. Section 19 clarifies payment stablecoins won't be deemed securities or commodities under SEC/CFTC jurisdiction. Instead, they fall under banking-style supervision by the OCC, Fed, FDIC, and NCUA.

-

One-to-One Collateral Reserves Requirement. Section 4 requires full backing with U.S. currency, demand deposits, ≤93-day Treasuries, repos, or government money-market funds. This eliminates algorithmic stablecoins as payment methods.

-

Prohibition of Yields and Interest. Section 4 explicitly bans payment stablecoins from paying interest, dividends, rewards, or financial returns to holders. Yield-bearing stablecoins like stUSDT will never qualify as payment tokens.

-

Priority in Insolvency Protection. Section 11 grants payment stablecoin holders senior claims over reserve assets in insolvency proceedings. Even if an issuer's collateral freezes (like Circle in 2023), stablecoin holders get paid with priority, preserving the peg or enabling quick value recovery.

-

Mandated Cross-Chain Interoperability. Section 12 directs the Fed to prescribe open protocols for cross-chain payment stablecoin compatibility. Prevents corporate "walled gardens."

-

Hard Penalties for Unauthorized Issuance. Sections 3-4 impose $1 million daily fines and 5-year prison terms for unlicensed issuance. Regulators will review existing tokens that are being used for payments (USDC, USDT, etc.) and force them either to cease US issuance or to comply with GENIUS requirements.

CLARITY Act: The Full Crypto Market Structure Framework

The Digital Asset Market Clarity (CLARITY) Act of 2025, introduced in the House on May 29, is a crypto market structure bill that sets clear rules for custody, trading, token classification, and whether the asset is under SEC (security) or CFTC (commodity) jurisdiction.

Key Features of the CLARITY Act:

-

Commodity Definition. Section 301 defines a digital commodity as an asset "intrinsically linked to a blockchain system" whose value derives from blockchain use.

-

Security Definition. Section 302 defines a digital security as an investment of money in a common enterprise with an expectation of profits from the efforts of third parties.

-

Clear Jurisdictional Boundaries Between SEC and CFTC. Section 103 gives SEC authority over securities and CFTC over digital commodities. Crypto companies finally understand which agency governs which tokens.

-

Blockchains Can Legally Achieve "Decentralization." Section 204 recognizes blockchain networks as "mature" when no person or group controls them and introduces a 4-year timeline to achieve that status. Maturity of blockchain systems essentially means decentralization.

-

Initial Token Sales and Commodity Status Are Not Mutually Exclusive. Section 202 creates a conditional exemption for initial token sales from securities registration if issuers commit to decentralizing their networks. Allows performing compliant ICOs or IDOs.

-

International Regulatory Cooperation. Section 109 requires CFTC/SEC to coordinate with international regulators and information-sharing arrangements. Could lead to global crypto regulation standards.

-

Banks and Trusts Can Custody Native Crypto Assets. Section 310 allows banks and trust companies to hold digital commodity tokens without treating them as liabilities or holding capital reserves against them. Basically, it increases the usability of underlying blockchains.

-

Qualified Digital Asset Custodians Status. Section 405 establishes custodian criteria, including asset segregation, insurance, and internal controls. Mitigate risks that a user can face in collapses like FTX.

What Is the Current Status of GENIUS and CLARITY Acts?

As of July 2025, the GENIUS Act has successfully passed through the Senate with both committee and full chamber votes. What remains is a House committee review and floor vote before it heads to the President's desk. On the other hand, the CLARITY Act is only starting its legislative journey and is currently waiting for the House majority to vote.

|

Legislative Journey of the GENIUS and CLARITY Acts (July 2025) |

||

|

Legislative Step |

GENIUS Act (S. 394 and S.1582) |

CLARITY Act (H.R. 3633) |

|

Bill Introduction |

Introduced in Senate (Feb 2025 by Sen. Bill Hagerty) |

Introduced in House of Representatives (May 2025 by Rep. Hill) |

|

Committee Review and Vote |

✅ Approved by Senate Banking Committee (18–6 vote, March 2025) |

✅ Approved by House Financial Services (32–19) and Agriculture (47–6), June 10 |

|

Full Chamber Vote (House or Senate) |

✅ Passed Senate (June 17, 2025, with 68–30 vote) |

✅ Passed House (July 17, 2025, 294-134 vote) |

|

Send to the Other Chamber |

✅ Reviewed by the House Financial Services Committee review |

✅ Sent to Senate, referred to Banking Committee |

|

Repeat Committee + Full Vote in Other Chamber |

✅ Passed House (July 17, 2025, 308-122 vote) |

⏳ Senate committee vote (Banking) and Senate floor vote pending |

|

Final Passage in Both Chambers |

✅ Reconciled with Senate version |

⏳ Will require House and Senate to approve identical version post-Senate review |

|

Presidential Signature |

✅ Signed by Trump |

⏳ Pending, expected before September 30 |

When GENIUS and CLARITY Take Effect?

The GENIUS Act and its amendments take effect either 18 months after signing OR 120 days after Treasury and Federal Reserve finalize regulations implementing its substance, as stated in Section 20 of the GENIUS Act. Once the law takes effect, US stablecoin issuers must follow the GENIUS requirements – most importantly, they need regulatory approval before issuing payment stablecoins.

The CLARITY Act passed the House during "Crypto Week" and is now in the Senate. Senate Chairman Tim Scott urges the Senate to finish it by September 30 using the House version as a template, meaning the Senate won't write its own bill, and it should pass easily on a voice vote. The poll on Polymarket currently estimates the chances of CLARITY enactment in 2025 at over 80%. Most of the CLARITY Act becomes law 360 days after signing, except sections requiring agency rules, which start 60 days after those rules are published in the Federal Register (if that happens more than 360 days after signing).

Potential Impact on GENIUS and CLARITY on Crypto Market

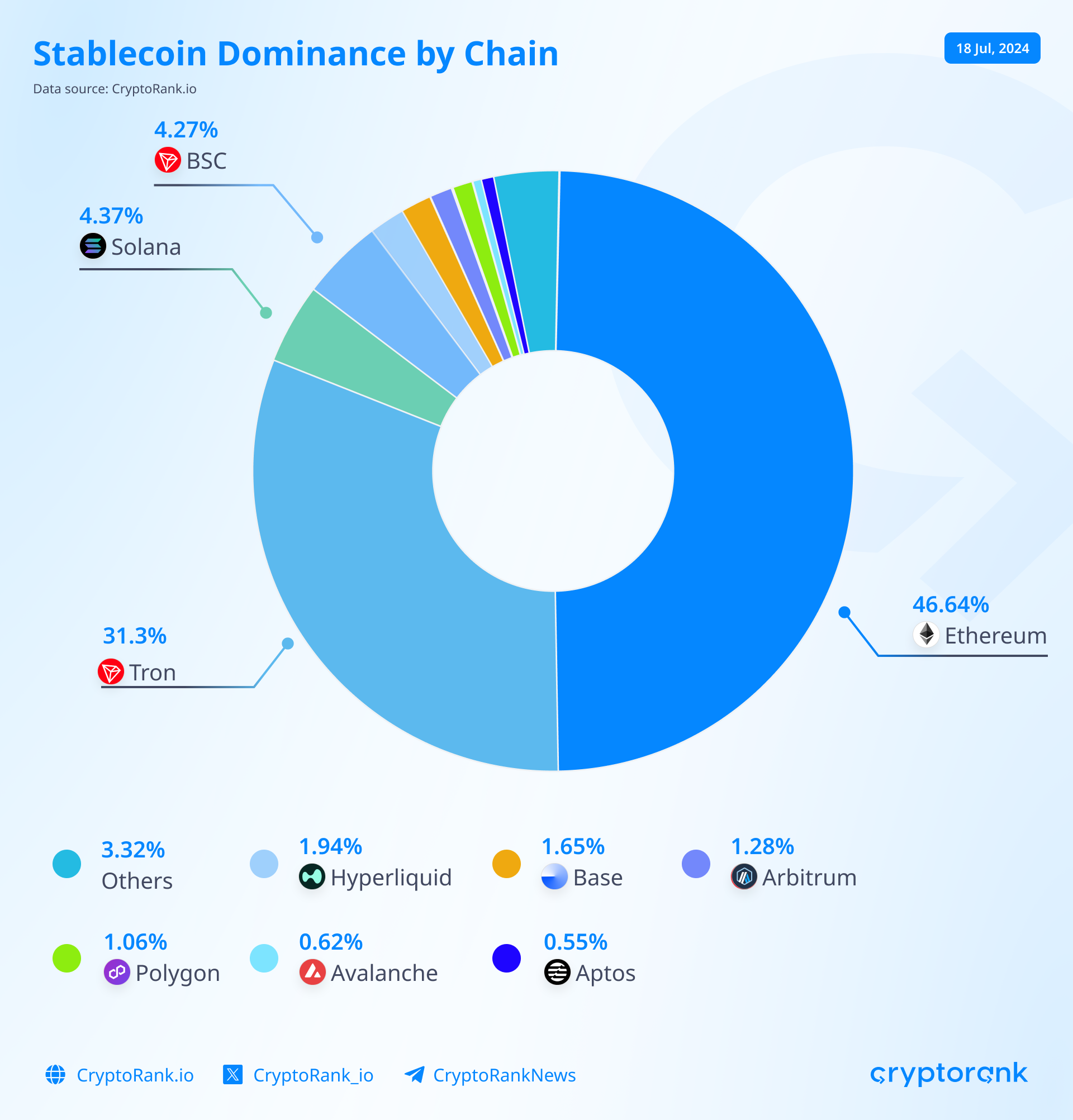

The GENIUS Act alone would boost stablecoin adoption and likely impact Ethereum as the dominant settlement layer for stablecoins. However, without the CLARITY Act, many crypto assets would remain trapped in regulatory limbo, and institutional investors might continue avoiding anything beyond BTC and ETH. The full bull case for late 2025–2026 requires both GENIUS and CLARITY to be enacted.

Which Institutions Will Launch Stablecoins After GENIUS Is Enacted?

The most significant development so far is Wyoming Stable Token (WYST), a U.S. dollar stablecoin authorized by Wyoming's Stable Token Act in 2023 and targeting mainnet launch on August 20, 2025. The Wyoming Stable Token Commission is still determining which of 11 blockchains will host the official launch: Ethereum, Solana, Aptos, Avalanche, Sei, Stellar, Sui, Arbitrum, Optimism, Base, or Polygon. Further, we can expect other crypto-friendly states, such as Arizona, Florida, and Texas, to follow with their state-backed stablecoins.

Eventually, we'll likely see all major banks like JPMorgan and Bank of America issuing their own stablecoins or collaborating on joint stablecoin projects. Meta will potentially revive its stablecoin project called Diem (formerly Libra), and Musk probably won't leave X (Twitter) without a similar product. Even large retailers such as Walmart and Amazon are reportedly considering launching their stablecoins. By issuing corporate stablecoins, institutions can eliminate the traditional 1.8% interchange fee and achieve enhanced programmability and control over their financial products.

What Happens to Non-Payment Stablecoins after GENIUS?

The GENIUS Act leaves out in uncertainty assets like DAI, USDe, and other crypto-collateralized or algorithmic stablecoins. Section 11 of the GENIUS Act mandates that Treasury complete a comprehensive study within 12 months examining the financial stability, consumer protection, and illicit finance risks posed by non-payment stablecoins.

During this interim period, regulators could potentially impose significant compliance costs and deter institutional partnerships for non-compliant stablecoins. The study could ultimately recommend folding certain non-payment stablecoins into the permitted charter system if they adopt stronger reserves and governance structures. Even Tether may remain in this gray area due to ongoing investigations by the US and EU authorities.

Which Crypto Assets Will Benefit the Most from GENIUS and CLARITY?

-

BTC. Bitcoin remains the primary beneficiary and value accrual asset from all positive trends in crypto, serving as the digital gold standard that institutions turn to first while entering the space.

-

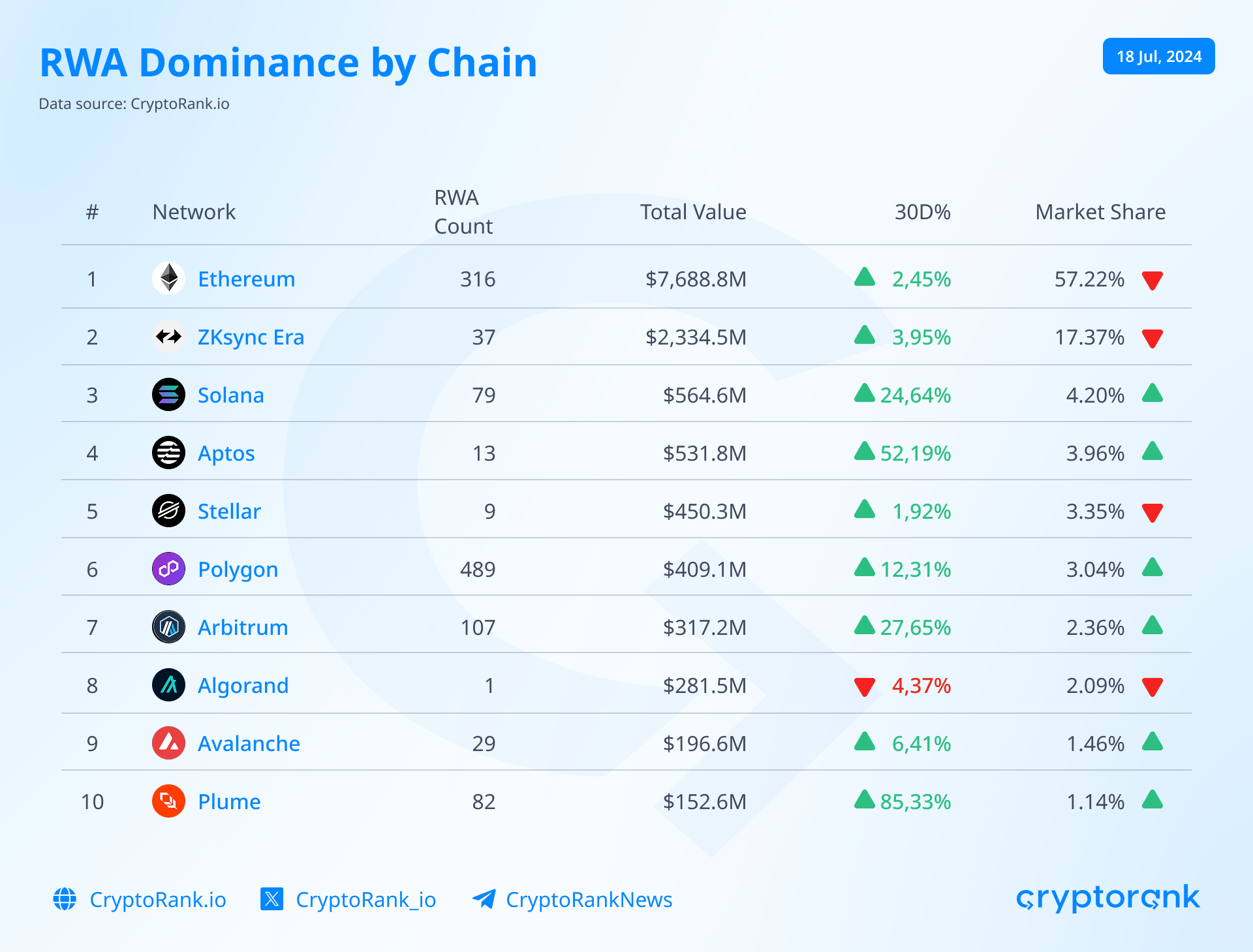

ETH. Ethereum stands to benefit most from both acts combined. The GENIUS Act favors ETH because Ethereum already holds ~50% of stablecoin dominance (excluding L2s), and it is likely to become a preferred platform for institutional stablecoins. Meanwhile, the CLARITY Act will boost RWA issuance, where Ethereum maintains 57%+ dominance. Additionally, Ethereum should easily achieve mature blockchain status under CLARITY's framework.

-

USDC and CRCLX. Circle's USDC is the most regulator-friendly stablecoin and will likely become the first explicitly regulated dollar stablecoin in the US, triggering broader business and fintech integration. CRCLX, the Circle’s tokenized stock issued by BackedFi, is probably the best and easiest stablecoin market play for post-GENIUS growth.

-

Other Chain Native Tokens. Native tokens of blockchains will become settlement layers for stablecoins, gain clear paths to maturity (decentralization) status, and serve as infrastructure for broader RWA tokenization. The blockchain tokens being considered by Wyoming's Stable Token Commission (SOL, APT, AVAX, SEI, XLM, SUI, ARB, OP, POL) deserve particular attention, as they received a form of institutional recognition.

End to Crypto Wild West

The GENIUS and CLARITY Acts represent the endgame for cryptocurrency as we know it, for better or for worse. These legislations will officially integrate crypto into traditional finance, permanently ending the Wild West era. This transition means the market inefficiencies and get-rich-quick opportunities that have characterized crypto will diminish with each passing day as institutional standards take hold.

As for benefits, institutional adoption will make crypto drastically safer for mainstream users and create vast new crypto-native products. In the end, we might get the final generational bull run, like what they were during crypto's former glory days.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Table of Contents

- Intro

- Why Institutions Are Coming Into Crypto?

- GENIUS and CLARITY Acts Review

- GENIUS Act: Banking Standards for Stablecoins

- CLARITY Act: The Full Crypto Market Structure Framework

- What Is the Current Status of GENIUS and CLARITY Acts?

- When GENIUS and CLARITY Take Effect?

- Potential Impact on GENIUS and CLARITY on Crypto Market

- Which Institutions Will Launch Stablecoins After GENIUS Is Enacted?

- What Happens to Non-Payment Stablecoins after GENIUS?

- Which Crypto Assets Will Benefit the Most from GENIUS and CLARITY?

- End to Crypto Wild West

Table of Contents

- Intro

- Why Institutions Are Coming Into Crypto?

- GENIUS and CLARITY Acts Review

- GENIUS Act: Banking Standards for Stablecoins

- CLARITY Act: The Full Crypto Market Structure Framework

- What Is the Current Status of GENIUS and CLARITY Acts?

- When GENIUS and CLARITY Take Effect?

- Potential Impact on GENIUS and CLARITY on Crypto Market

- Which Institutions Will Launch Stablecoins After GENIUS Is Enacted?

- What Happens to Non-Payment Stablecoins after GENIUS?

- Which Crypto Assets Will Benefit the Most from GENIUS and CLARITY?

- End to Crypto Wild West