Crypto Market Recap: February 2024

Key Takeaways:

-

February was the best month for Bitcoin since December 2020.

-

DeFi TVL showed strong growth, primarily driven by increases in Bitcoin, Ethereum, and Blast TVL.

-

Token sale market nears 1-year highs.

-

Bitcoin ETFs were the main growth driver last month.

-

Altseason is around the corner.

Market Performance

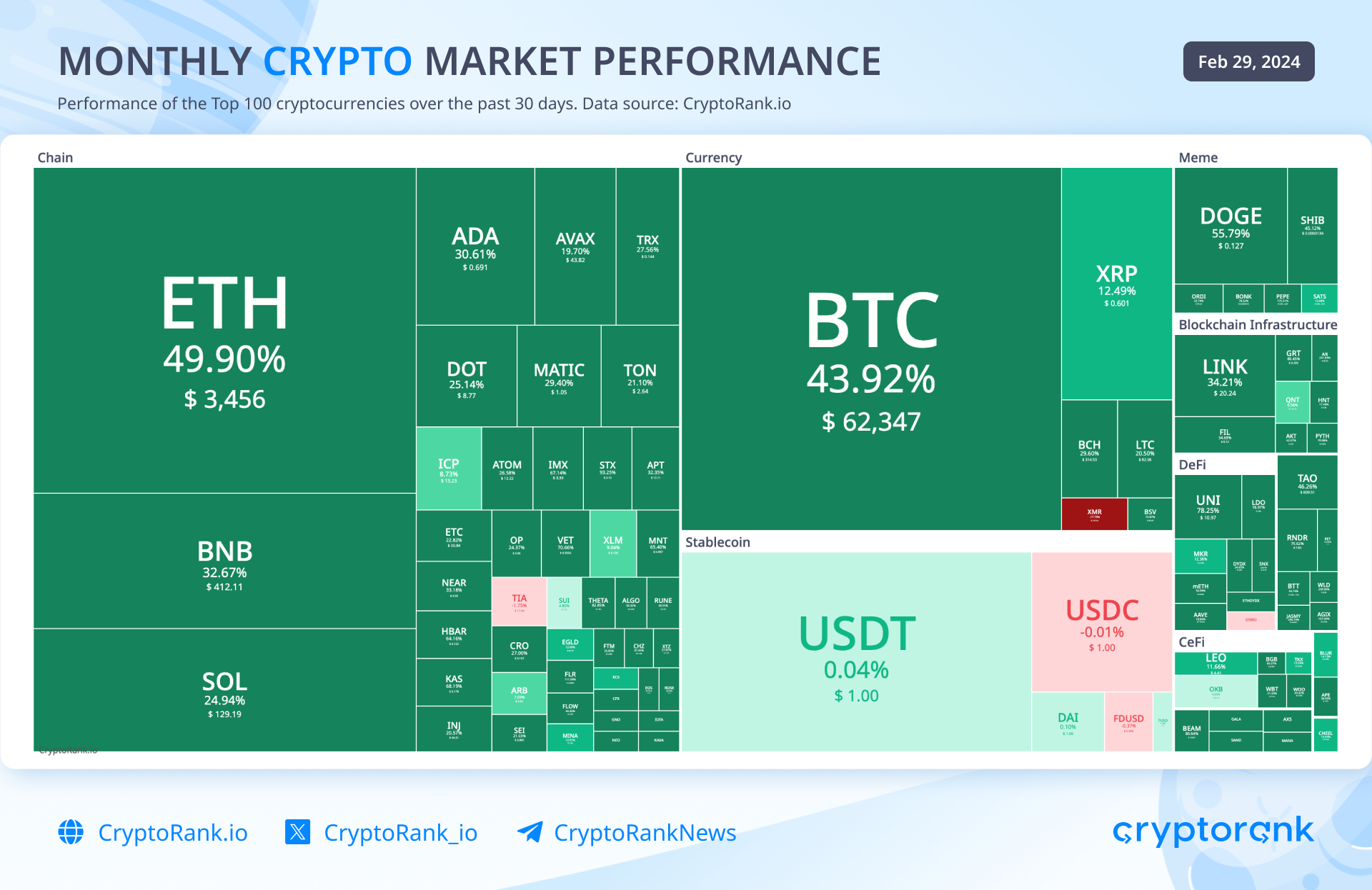

In February, the cryptocurrency market witnessed a meteoric rise fueled by several factors: the buoyant momentum of the overall market, the S&P 500 reaching unprecedented heights, the impending Bitcoin halving event, and the alleviation of selling pressure stemming from buyers of the Grayscale Bitcoin ETF, who had initially acquired the fund at a discount.

At the onset of the month, Bitcoin and Ethereum, two titans among the top 10 cryptocurrencies by market capitalization, exhibited remarkable surges. However, as the month drew to a close, Dogecoin emerged as the standout performer, experiencing significant growth and securing its position as the month's top gainer among the top 10 cryptocurrencies by market capitalization.

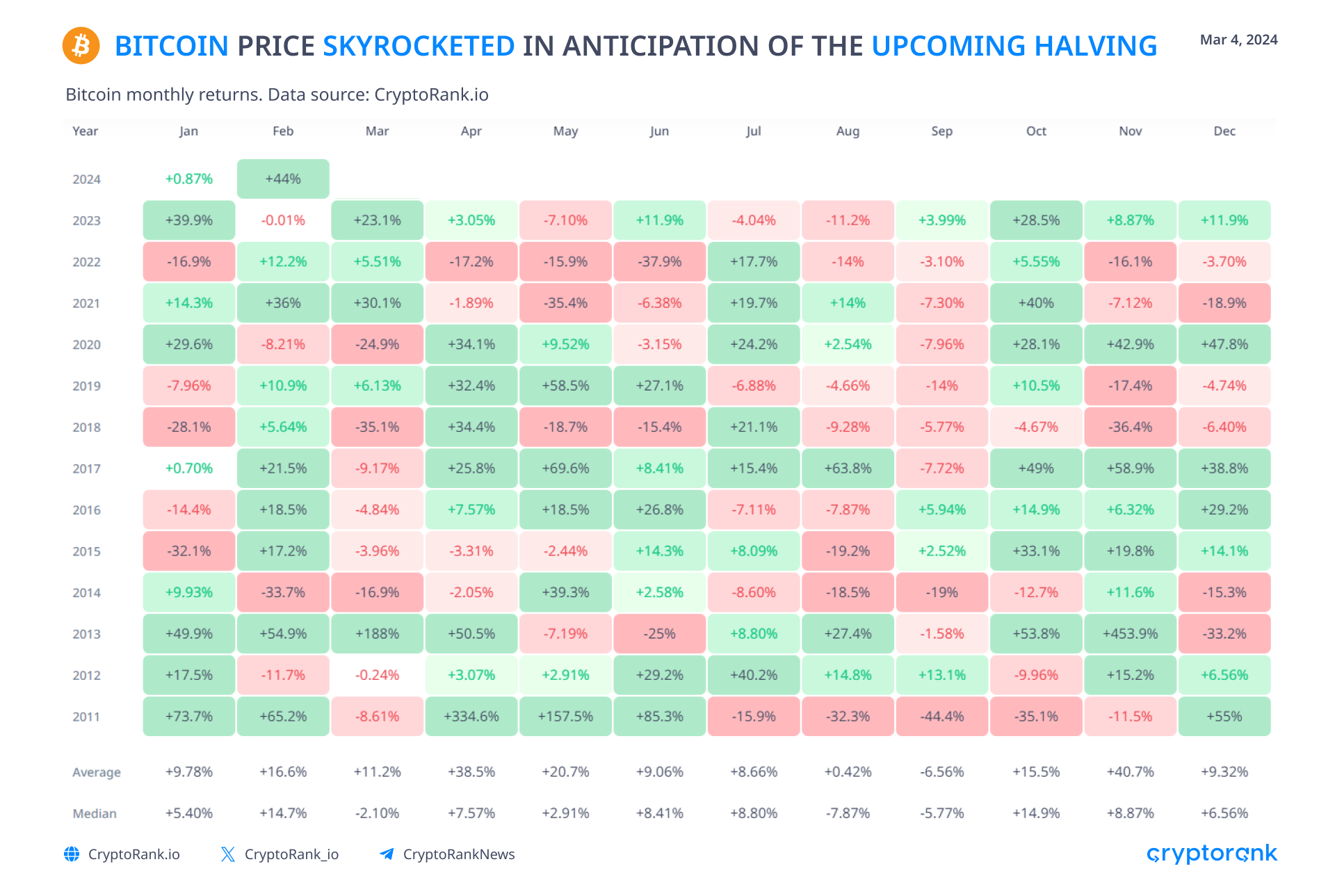

Best Performing Month for Bitcoin in Years

February marked a significant milestone for Bitcoin, representing its most impressive performance since December 2020. Presently, Bitcoin finds itself amidst a confluence of favorable conditions propelling its growth trajectory. These include the recent approval of ETFs and the subsequent influx of fresh capital into the market, the expansion of financial markets, the looming halving event, and the evolution of the Bitcoin DeFi ecosystem alongside the emergence of layer 2 solutions.

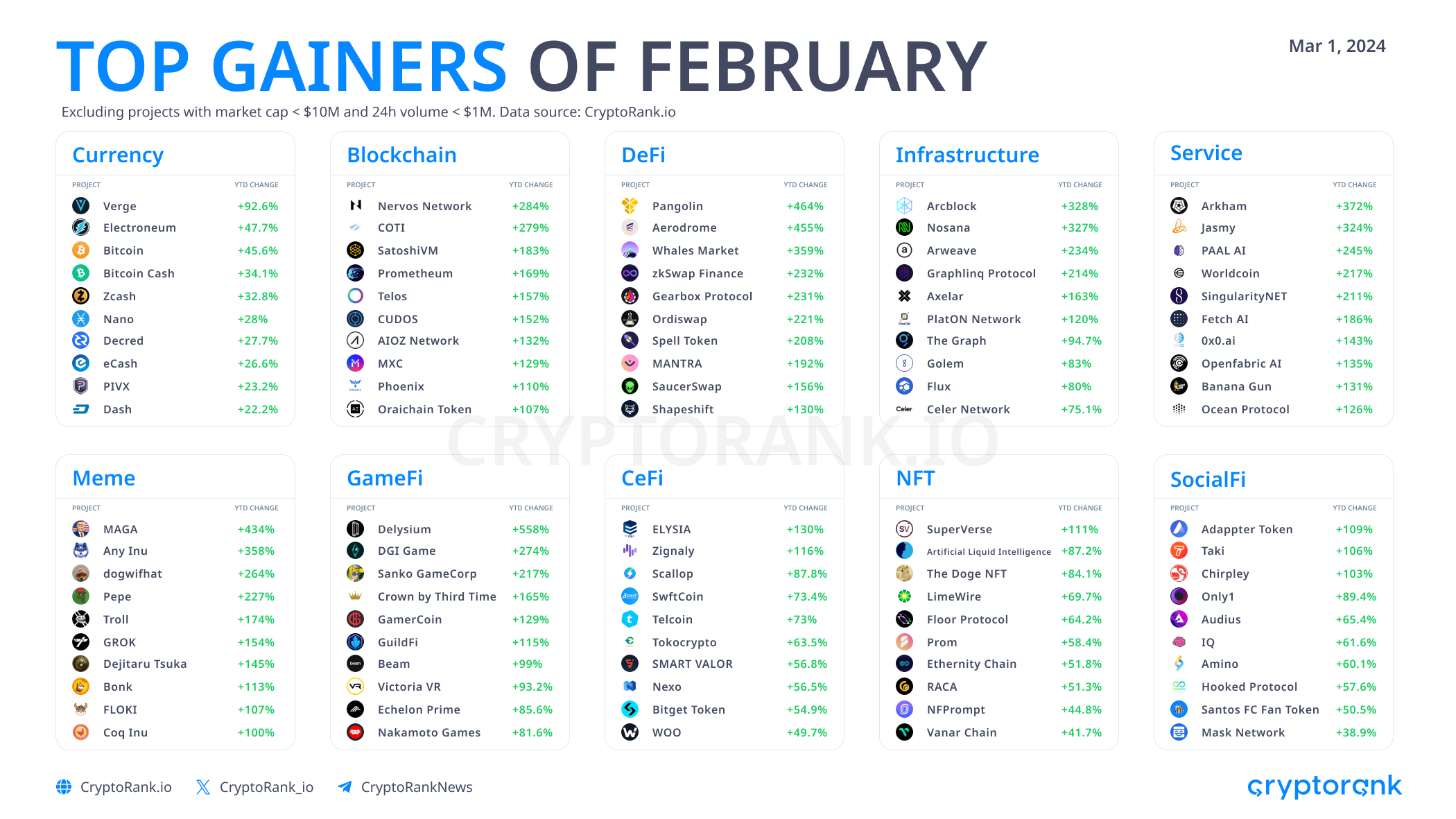

Altcoins Skyrocketed Following Bitcoin

In tandem with Bitcoin's surge, the month of February proved exceptionally prosperous for altcoins as well. DeFi, Services, and GameFi emerged as the leading categories experiencing substantial growth, owing to their active development and broad applicability for users compared to other sectors. Within this landscape, three standout performers — Delysium, Pangolin, and Aerodrom — secured positions among the top three gainers, showcasing the resilience and potential of projects within these burgeoning sectors.

The market's rise also marked a time of active memecoins trading. During February, we saw memecoins posting huge gains, and it is noteworthy that this narrative has migrated to Solana, making it available to many users due to low fees.

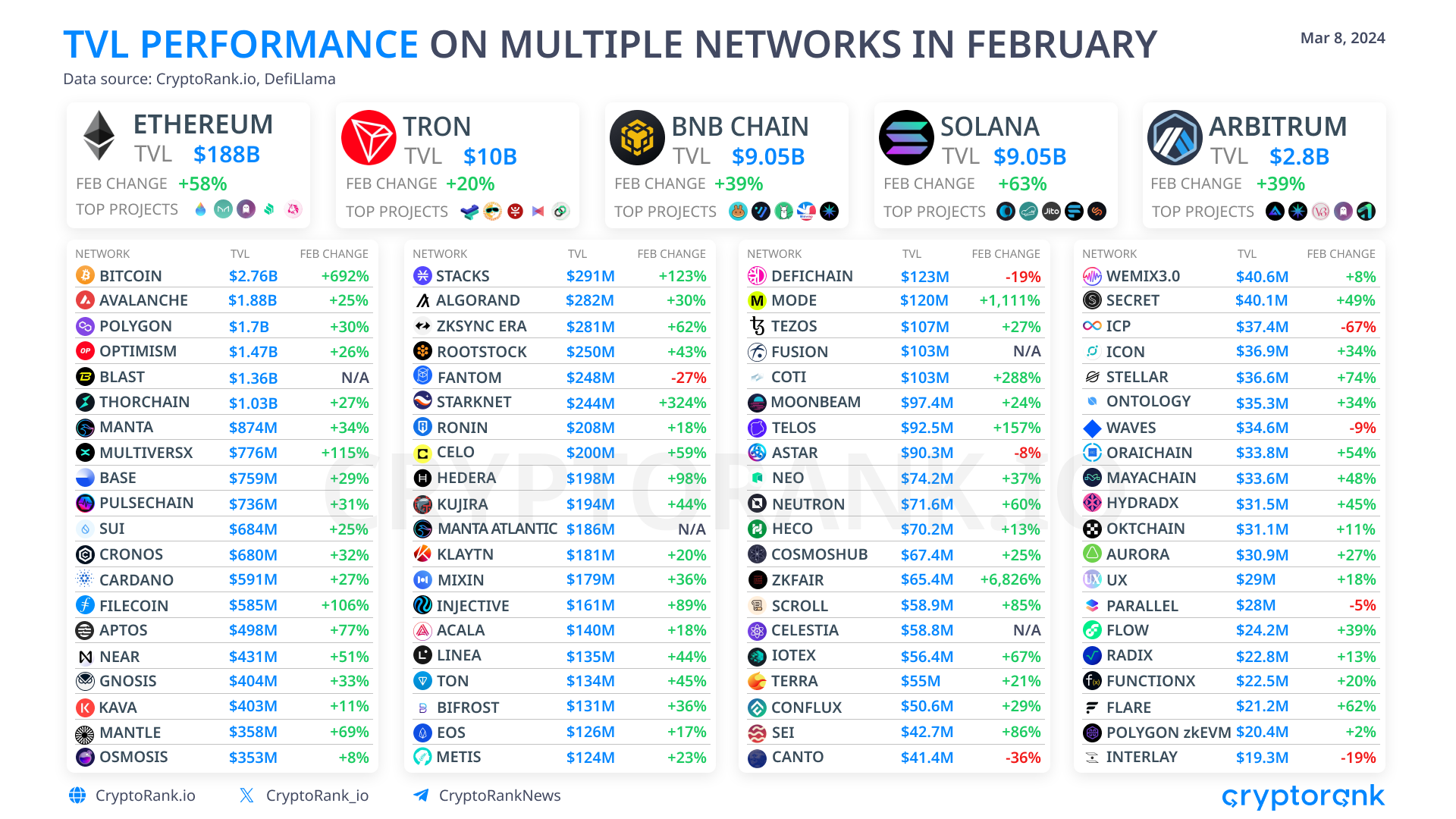

Enormous Gains for DeFi TVL

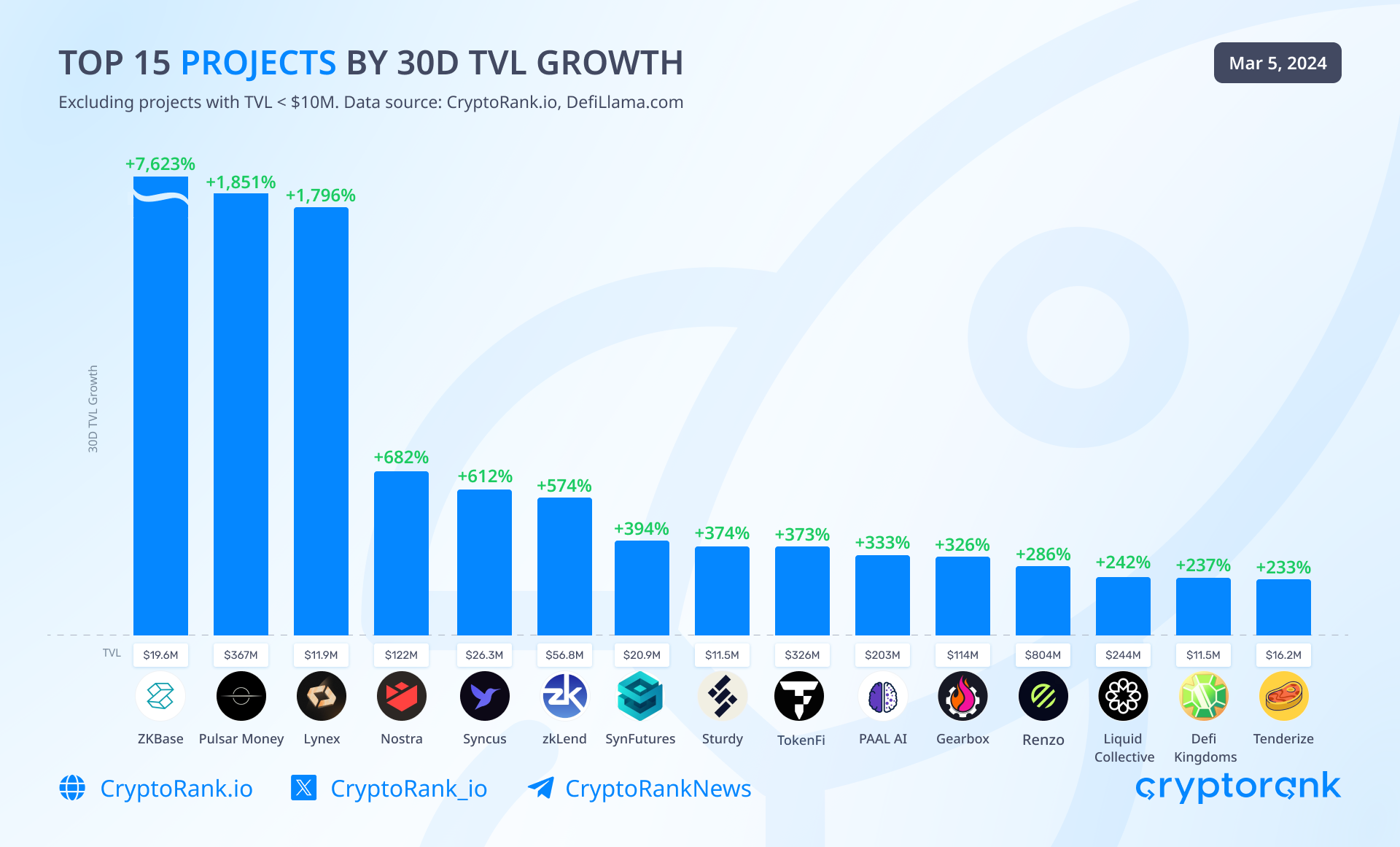

In sync with the remarkable price rally, Total Value Locked (TVL) within the blockchain ecosystem has witnessed a significant surge. Bitcoin emerges as the primary gainer among the top 10 blockchains by TVL size, closely trailed by Solana and Ethereum. Notably, Blast, a relatively new entrant, swiftly ascends the ranks, securing a position among the top 10 blockchains by TVL size shortly after its mainnet launch.

Among the projects, ZKBase, Pulsar Money and Lynex are the growth leaders by total value locked in February.

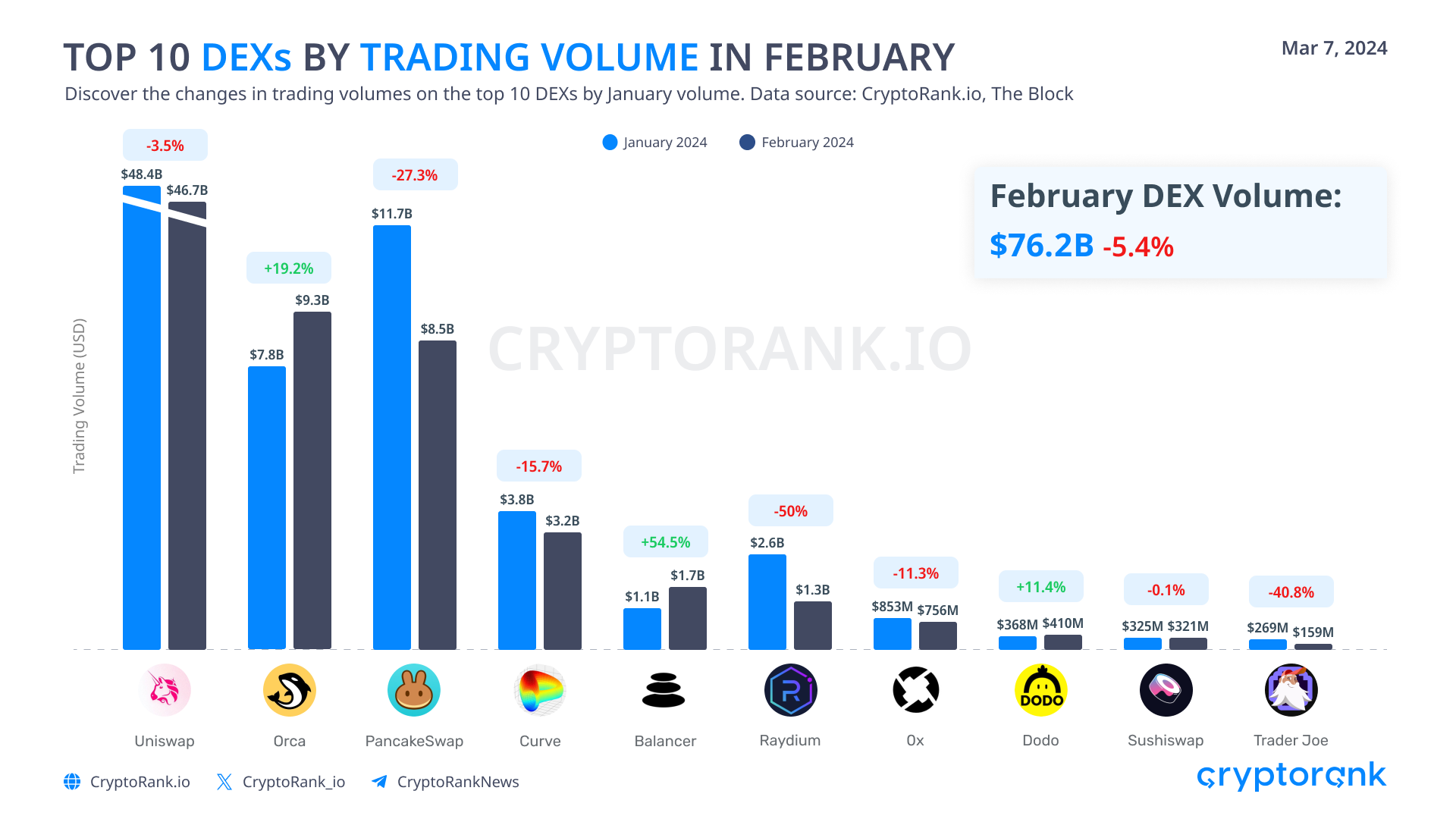

Despite the overall growth, DEX volume decreased in February by -5.4% compared to January. The former exchanges on the three largest blockchains, Uniswap, PancakeSwap, and Orca, holding the leading positions.

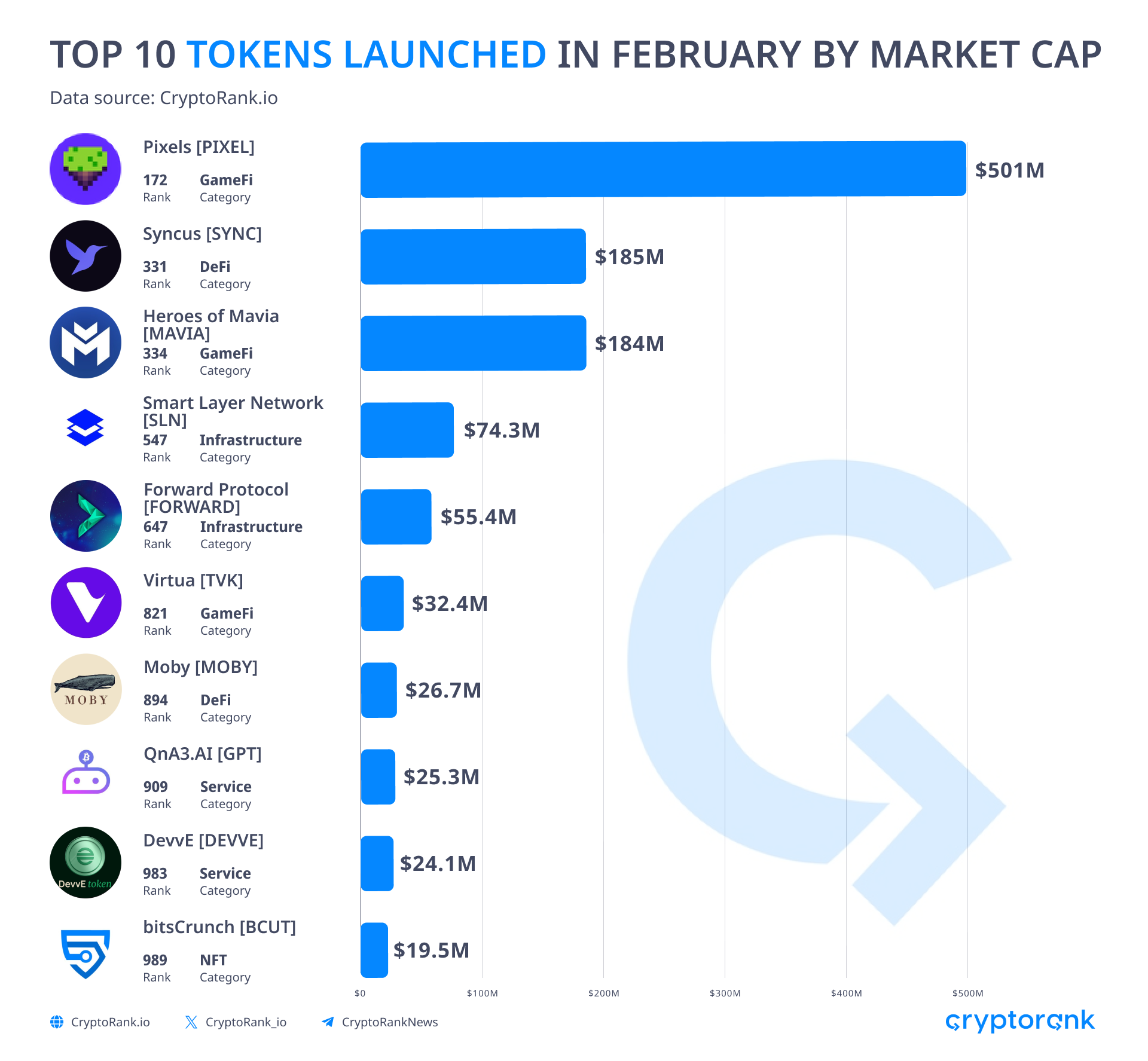

New Projects Enter the Market

While February may not have been marked by high-profile token launches, it did witness the long-awaited arrival of several anticipated airdrops, notably from projects such as Optimism and Starknet. However, the month also set the stage for the imminent release of tokens and airdrops from a plethora of well-established projects in the coming months. As anticipation builds within the crypto community, these forthcoming launches are poised to captivate attention and potentially reshape the landscape of the decentralized ecosystem.

February Fundraising Activity

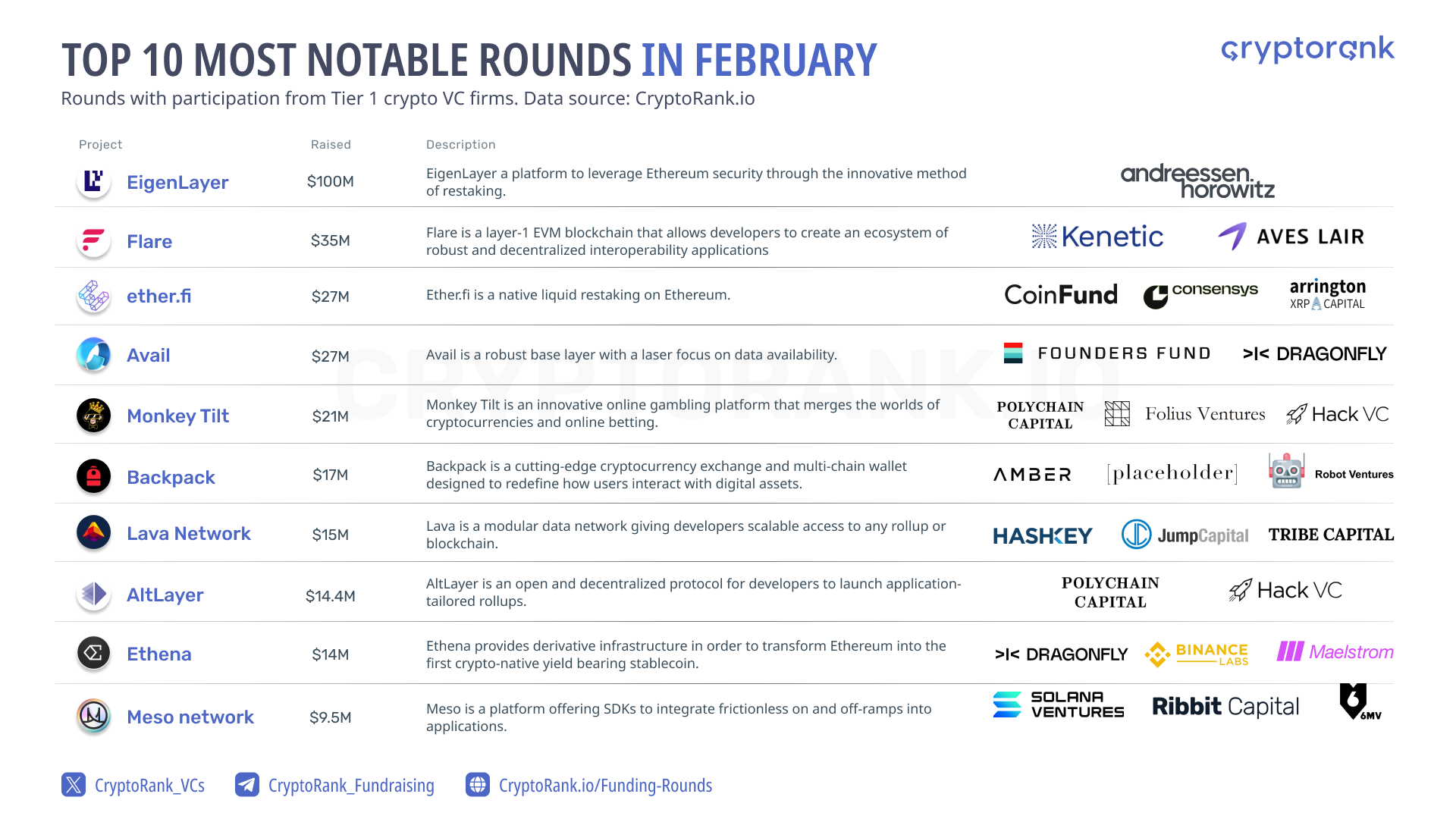

February saw a plethora of promising funding rounds, with EigenLayer leading the pack by securing an impressive $100 million exclusively from Andreessen Horowitz. Additionally, EtherFi, a liquid restaking protocol on Ethereum, raised $27 million. The focus of venture capitalists in February was notably on liquid restaking protocols, highlighting their growing importance and potential within the crypto ecosystem.

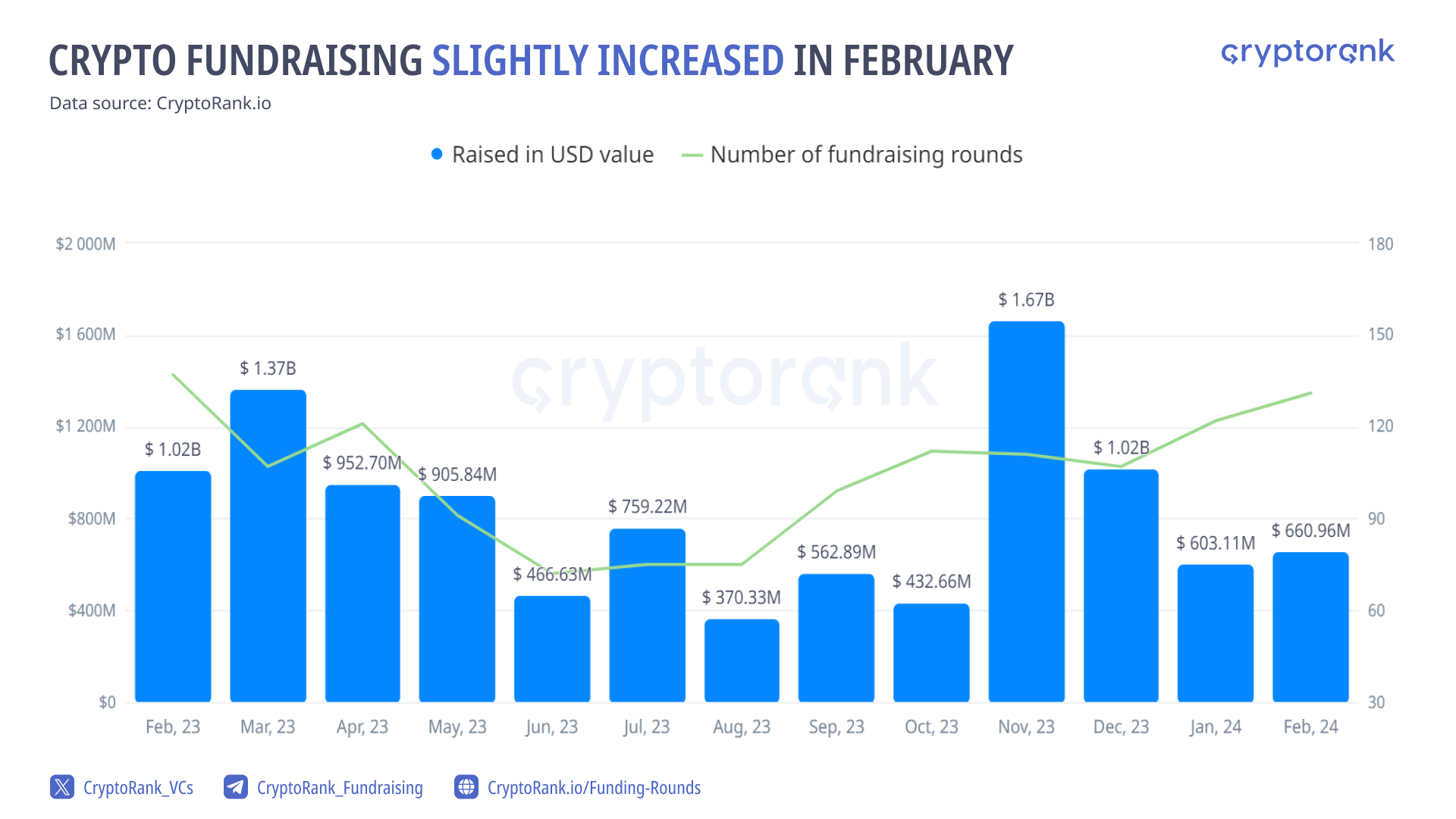

In February, fundraising activity exhibited a slight uptick compared to January, continuing its steady growth trajectory month by month since the nadir observed in August 2023. Concurrently, the number of funding rounds has been on the rise, reflecting sustained momentum within the crypto space. Notably, a significant portion of these projects are poised to enter the market through new token launches, Initial DEX Offerings (IDOs), and airdrops in the future.

In tandem with the increase in funds raised and the number of funding rounds, the number of Initial DEX Offerings (IDOs) also saw a notable uptick in February.

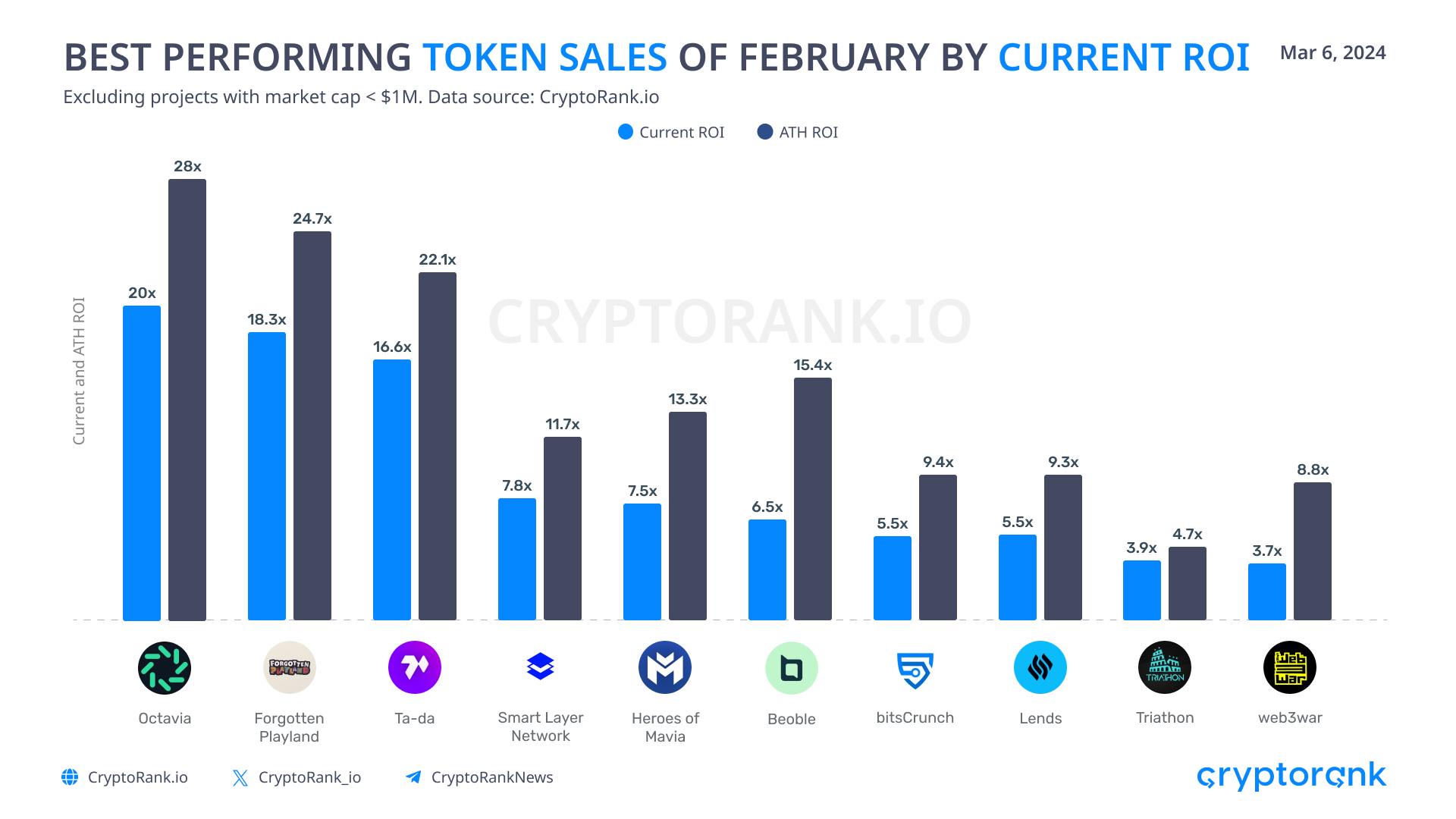

The month witnessed notable success in token sales, with Octavia, Forgotten Playeland, and Ta-da emerging as standout performers. Additionally, the return on investment (ROI) for new token sales continues to rise, rendering launchpads increasingly attractive investment avenues.

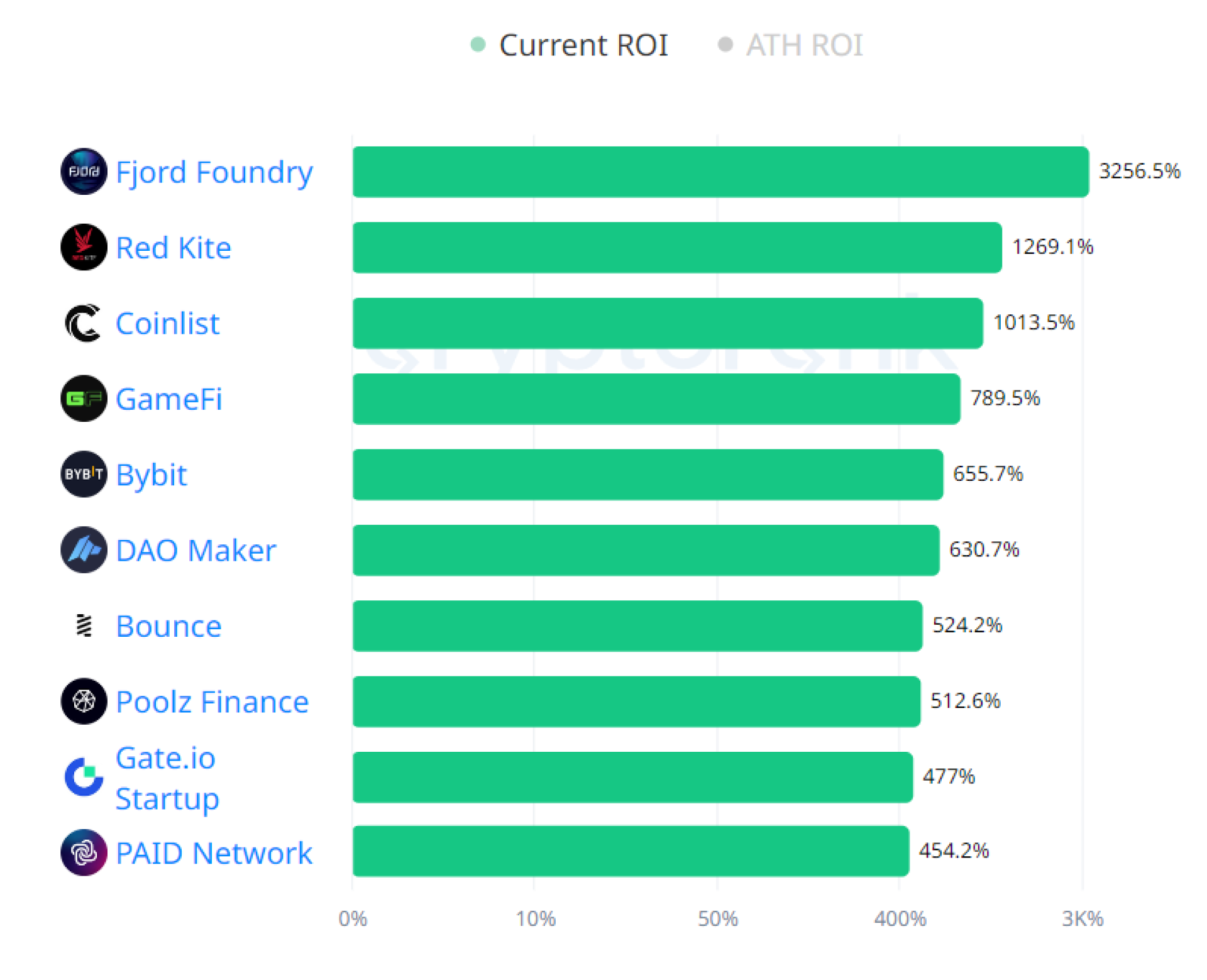

Launchpads Becoming Attractive Again

The ROI of launchpads in February appeared highly promising, with IDO platforms beginning to outpace centralized exchange (CEX) launchpads in terms of profitability. This trend suggests the possibility of an upcoming IDO season in the near future, as investors increasingly gravitate towards decentralized fundraising platforms for potentially higher returns and lower capital entrance barrier.

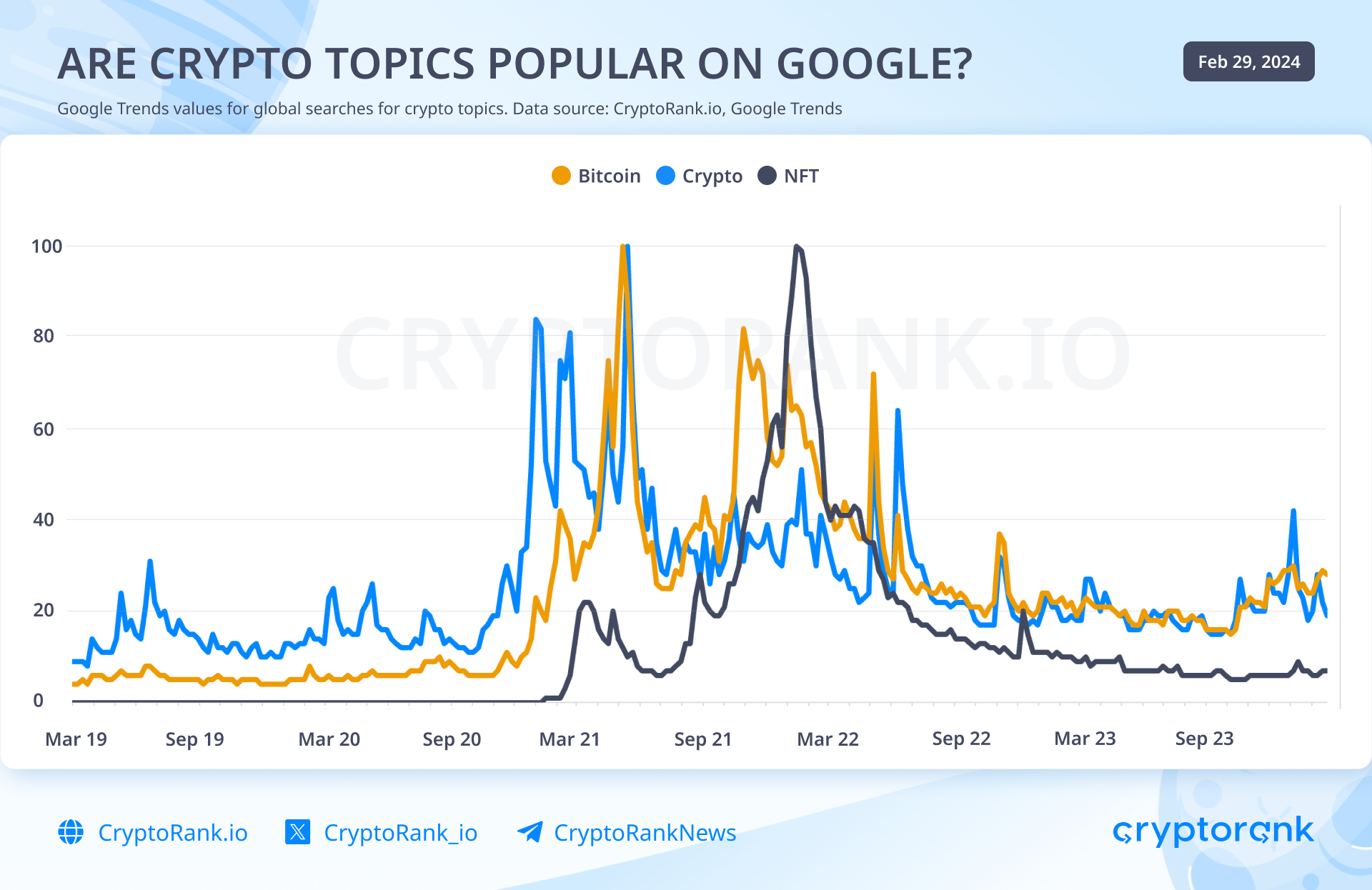

Retail Investors and Crypto

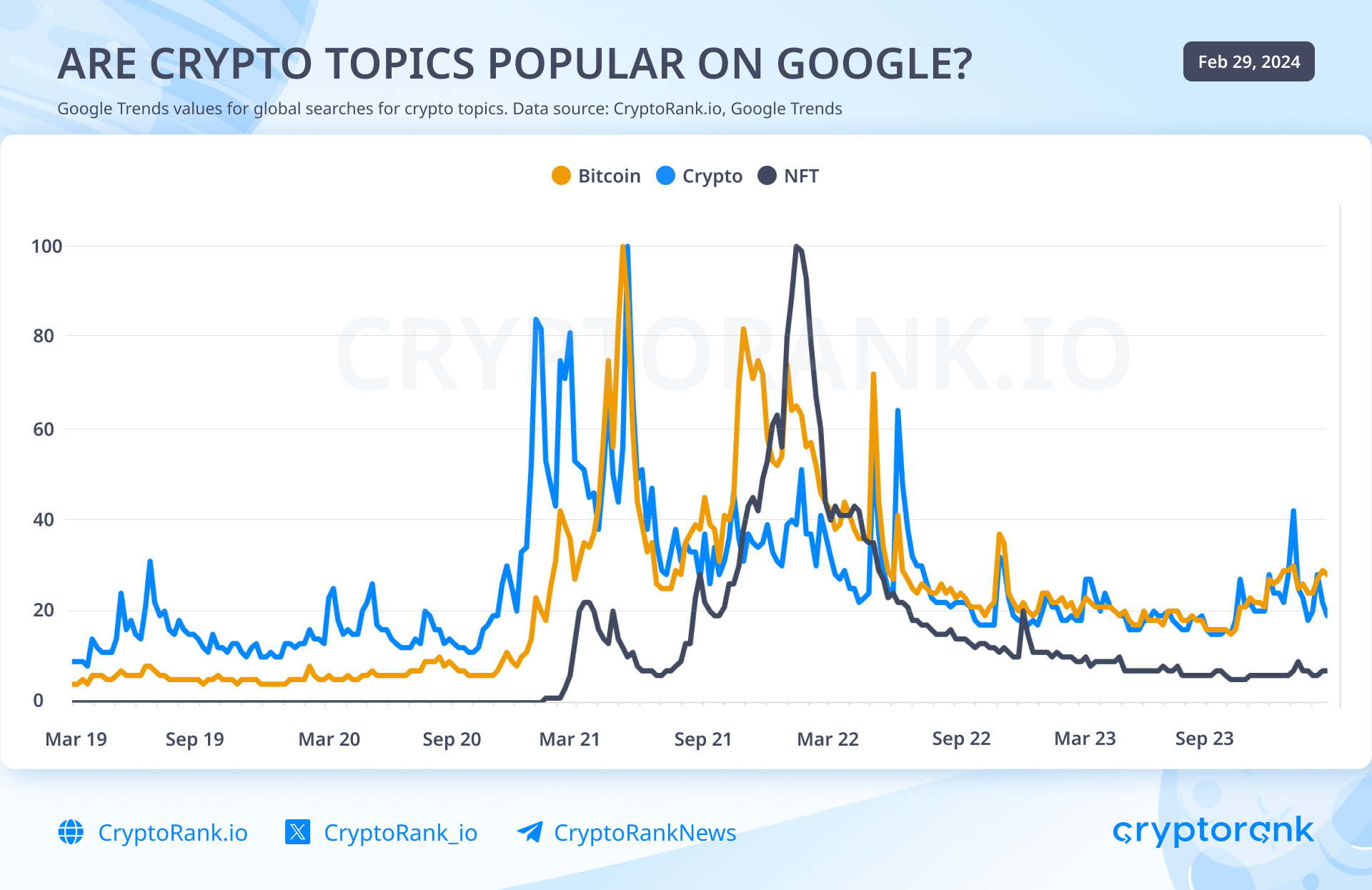

Despite the remarkable growth of the crypto market in recent weeks, mainstream interest in crypto remains relatively subdued. Google Trends values for search queries related to "Bitcoin" and "Crypto" hover just slightly above 20. Meanwhile, searches for "NFT" are approaching all-time lows (ATL), suggesting that users and investors entrenched in Web2 technologies are not yet considering NFTs as a significant focal point.

It's notable that the peak of interest in Bitcoin and crypto occurred around May 2021, aligning with the market's all-time high (ATH) capitalization set in November 2021, with Google Trends values reaching around 80. In contrast, queries for "NFT" peaked in early 2022, nearly 10 months after the initial peak in searches for "Bitcoin." This discrepancy highlights the evolving nature of interest and adoption within the cryptocurrency space, with NFTs gaining significant attention at a later stage compared to more established cryptocurrencies like Bitcoin.

Mining Stocks Outperformed Bitcoin

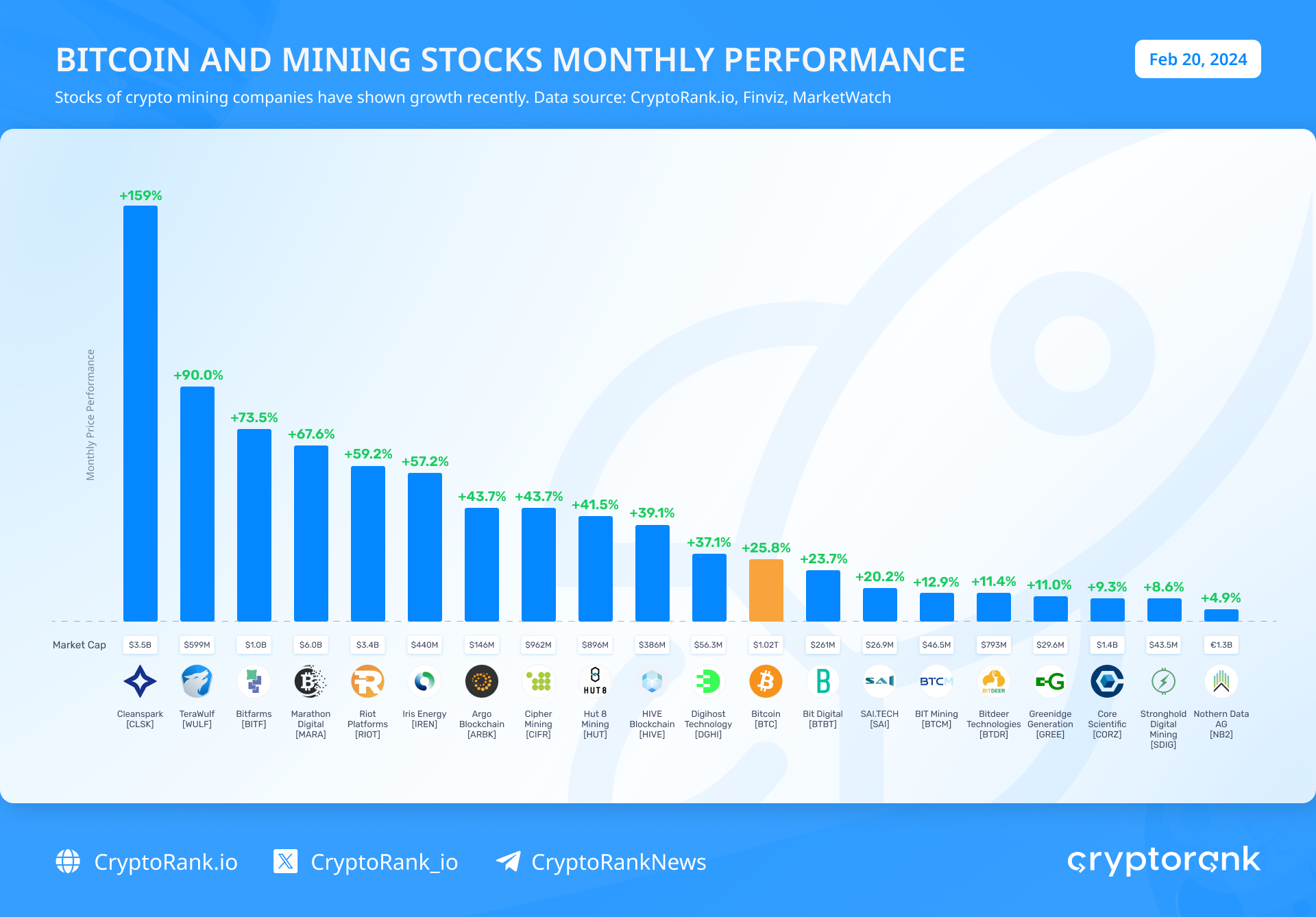

In February, over half of the mining stocks surpassed the performance of BTC, indicating that the ongoing cryptocurrency rally is partially bolstered by growth in the stock market.

ETFs Drives Bitcoin Price Up

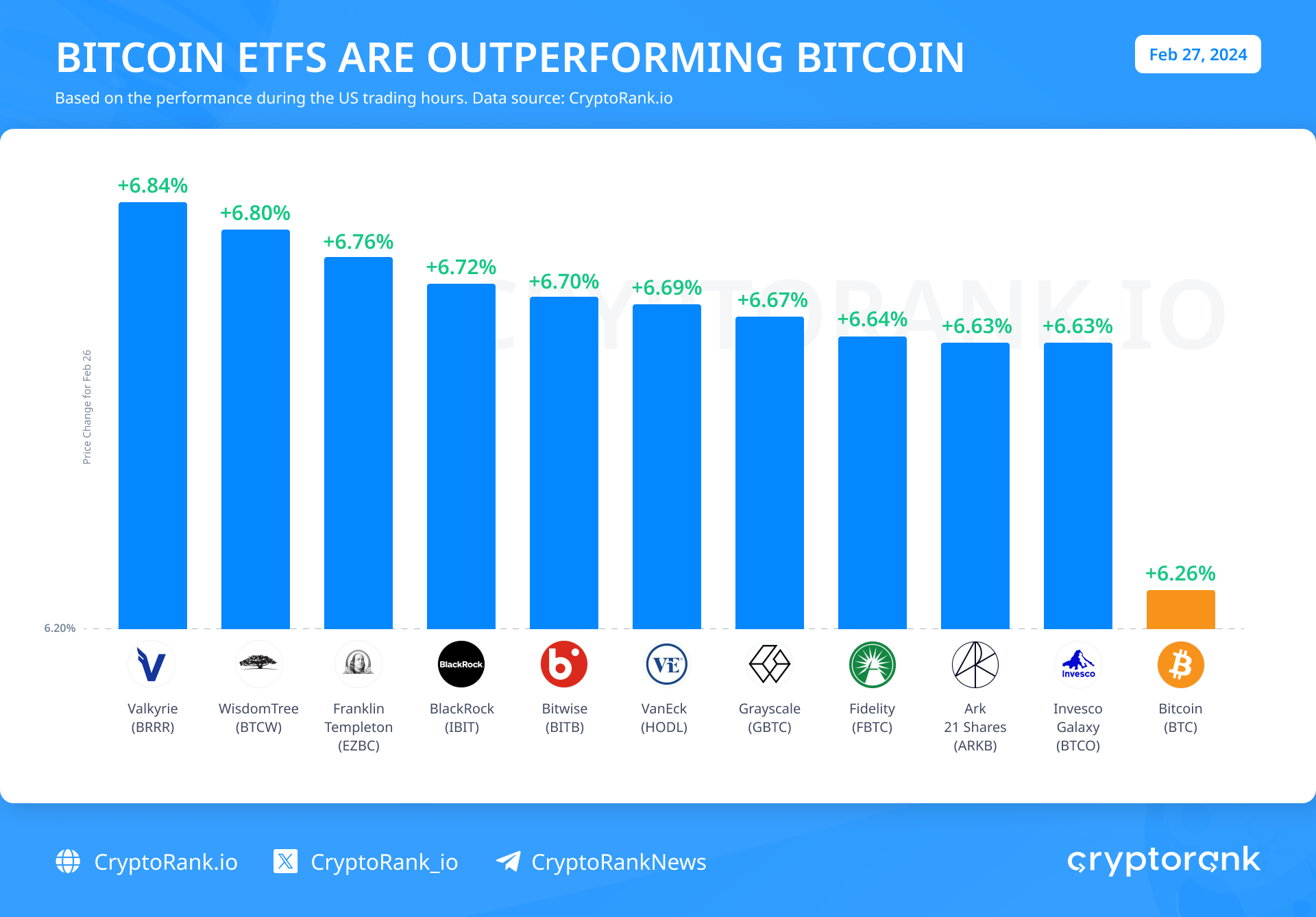

Another crucial indicator shedding light on the nature of the current growth is the comparison between ETF and Bitcoin performance. On February 27th, amidst one of Bitcoin's best-performing days, ETFs outpaced Bitcoin, suggesting that the inflow of funds from the traditional market serves as a significant pillar supporting the current rally.

New Competition Round Among Blockchains

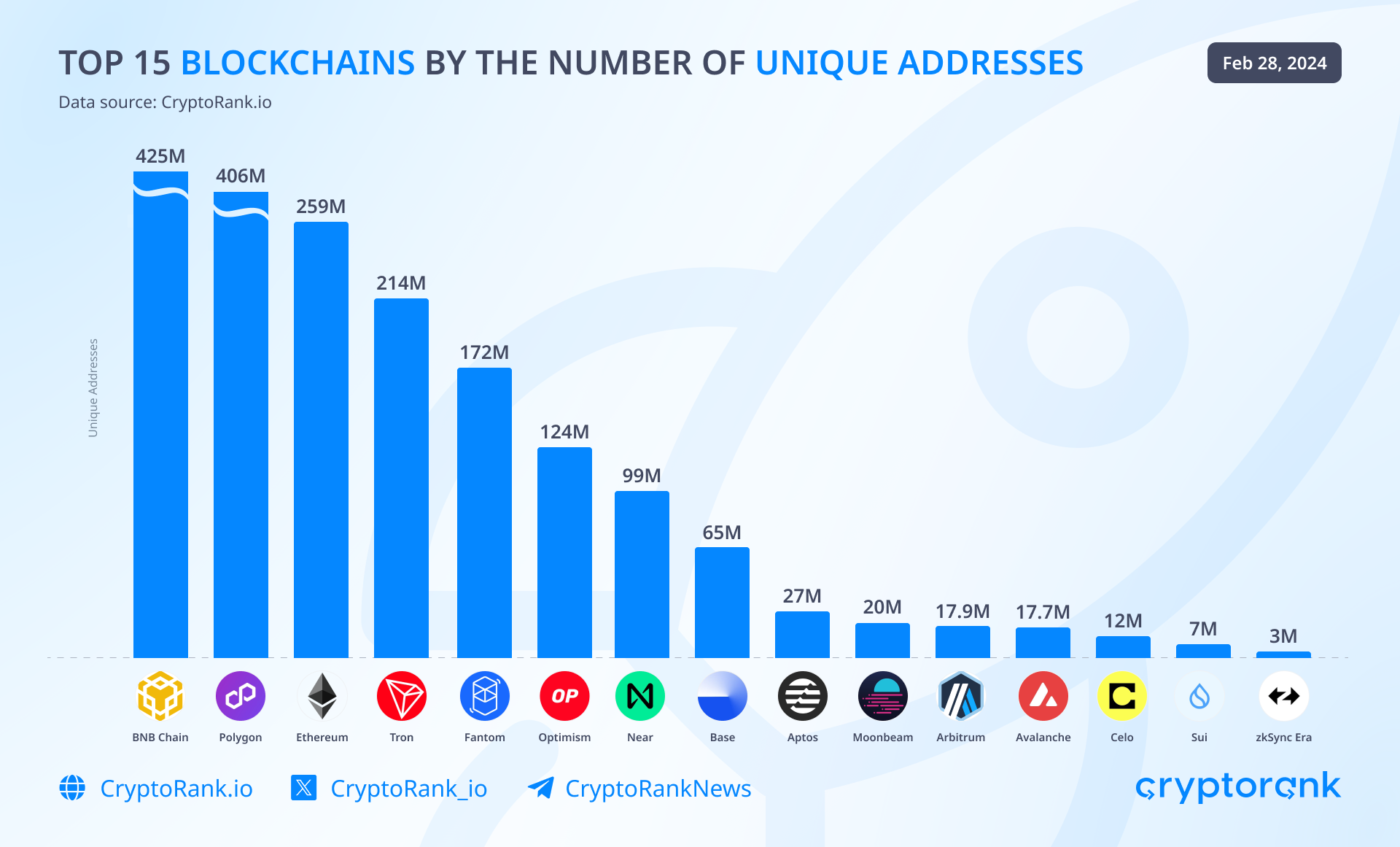

As the market continues to expand, blockchain platforms are intensifying their competition for DApps, users, and Total Value Locked (TVL). Based on the number of unique addresses, BNB Chain maintains its leading position, closely followed by Polygon. Ethereum retains its third place ranking in terms of unique addresses. Notably, among recently established blockchains, Base stands out as the fastest-growing blockchain by the number of unique addresses.

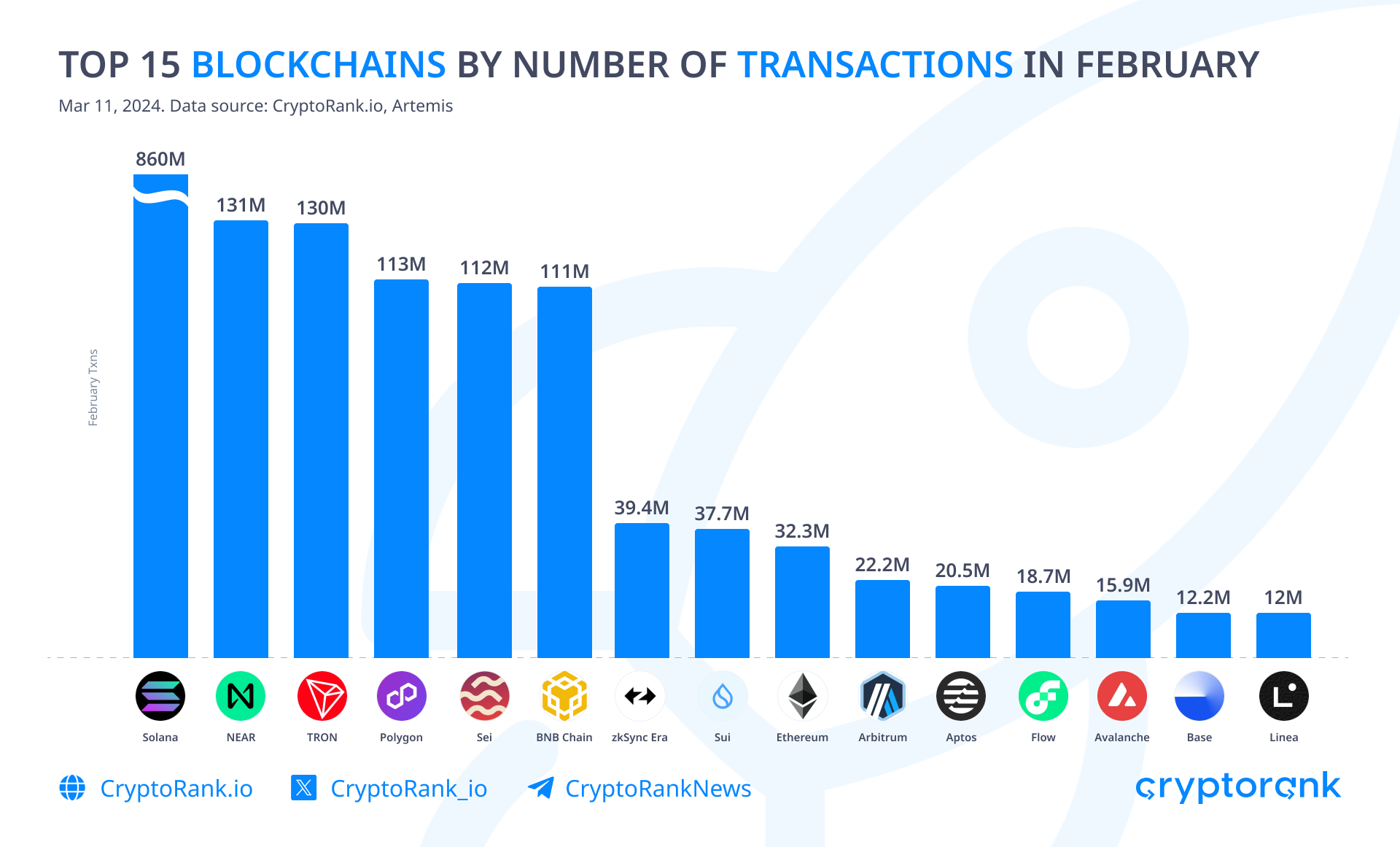

Another metric closely related to the previous one is the number of transactions, where Solana maintains an indisputable leadership position with its fast and cost-effective transactions. Near follows closely, offering similarly affordable and rapid transactions. Tron, on the other hand, emerges as the primary chain for stablecoin transactions, showcasing its significance in facilitating such transactions within the ecosystem.

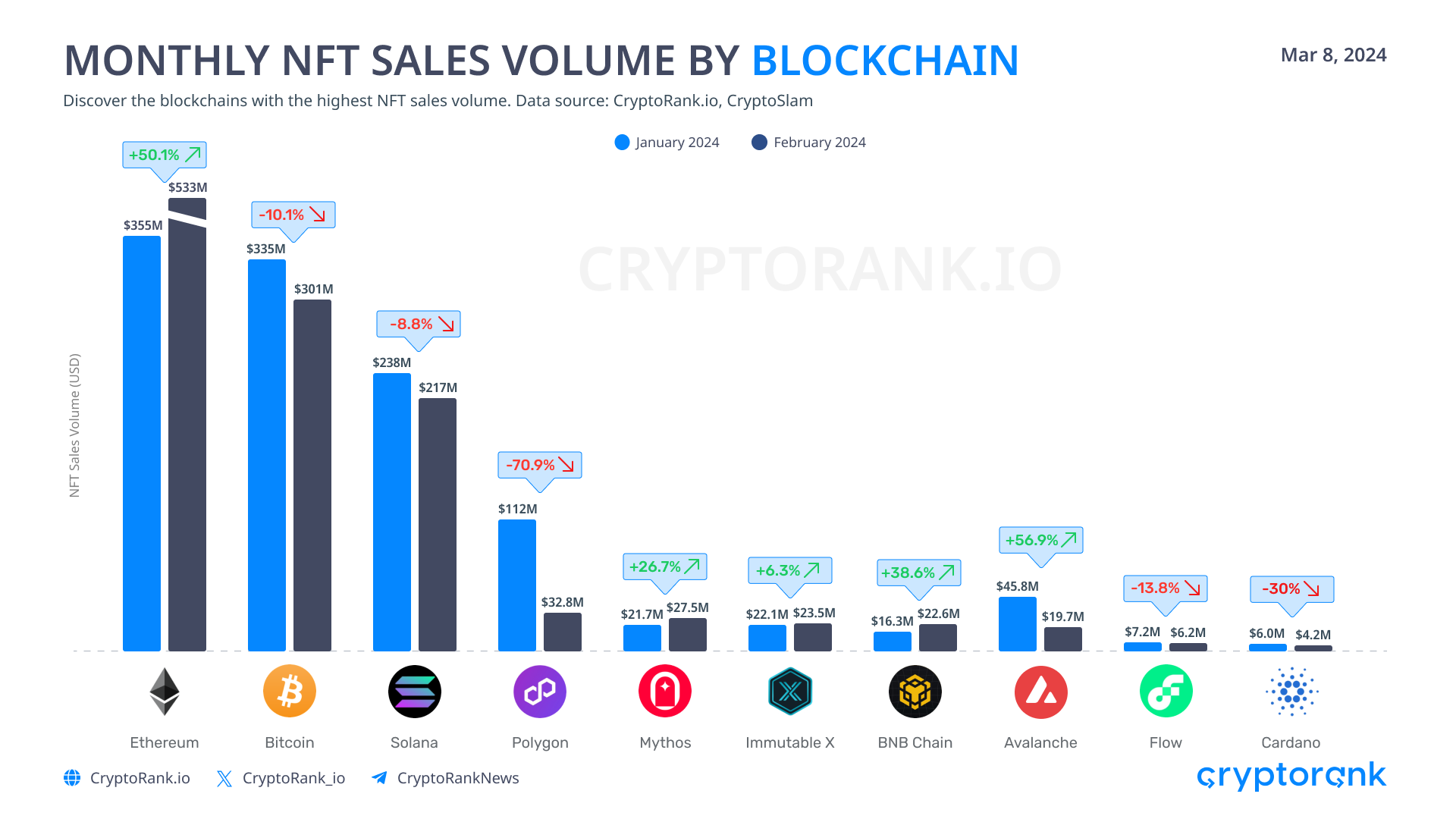

After its ascent as the second most popular chain for NFT trading, Ethereum solidifies its position alongside Bitcoin and Solana as the leading chains in terms of NFT trading volume. Ethereum and Bitcoin attract users with their established reliability, while Solana distinguishes itself with low transaction costs and a vibrant ecosystem positioning.

The Bottom Line

February mirrored the positive market sentiment following ETF approvals from the previous month, emerging as one of the best months for crypto, especially Bitcoin. Market optimism is on the rise, and the first half of 2024 looks promising for the crypto market overall. Numerous projects are still awaiting entry into the market, and the influx of money from retail investors into the crypto market continues to increase.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto)