Crypto Market Recap: August 2025

Bitcoin

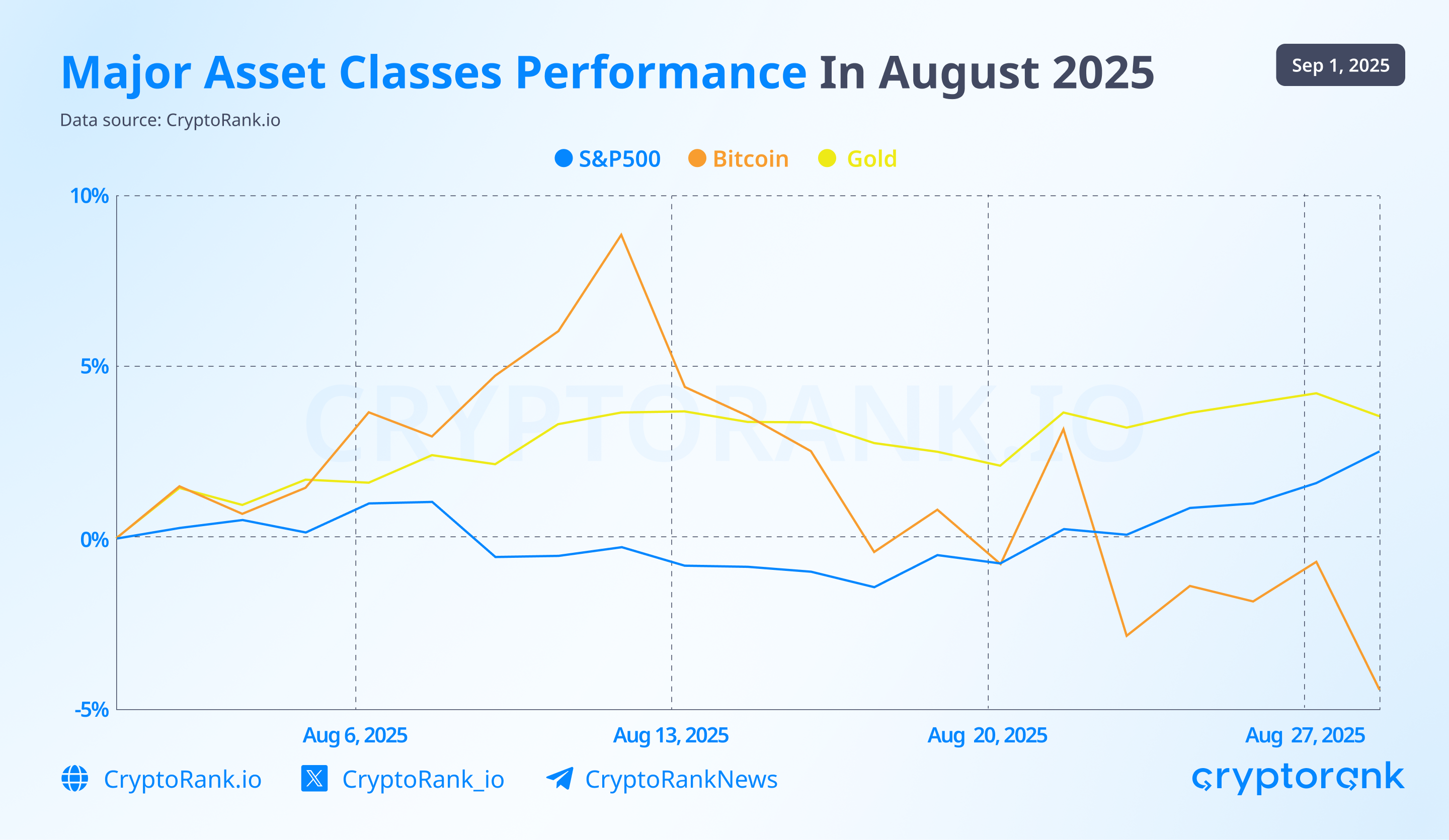

The last month of the summer has traditionally been a weak month for both Bitcoin and the stock market, along with September. This August was no exception for Bitcoin, although the S&P 500 showed positive performance, while gold emerged as the strongest gainer among the three assets.

Data source: CryptoRank API

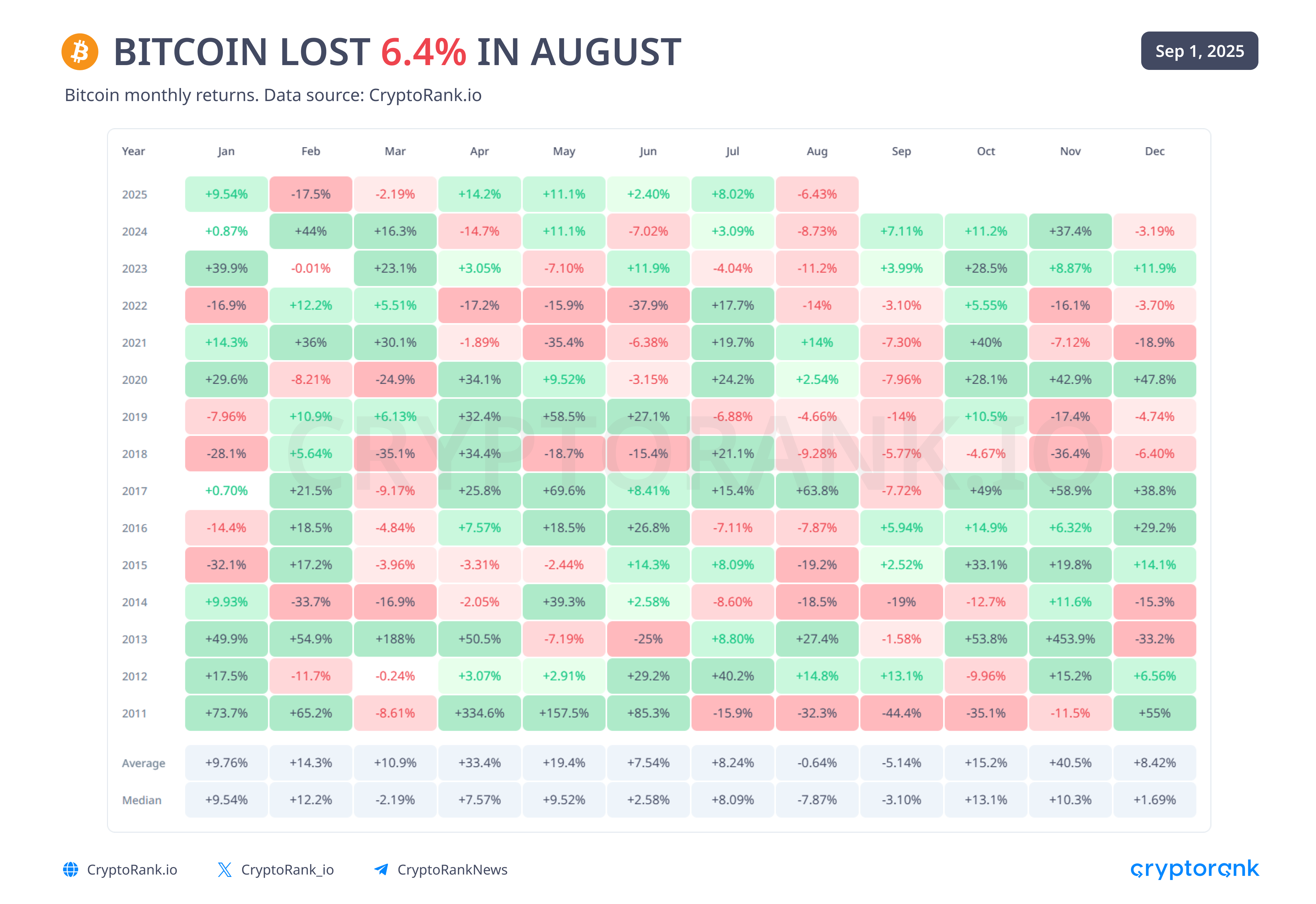

Despite a 6.4% correction in August, the macroeconomic outlook for Bitcoin remains favorable. The recent pullback can be seen as a natural cooldown following a strong rally and several consecutive all-time highs over the past four bullish months.

Data obtained by API

The correction may last for more than a month, as September has also historically been a weak period for Bitcoin. Much will depend on the pace of institutional investment, corporate involvement, and inflows into spot ETFs.

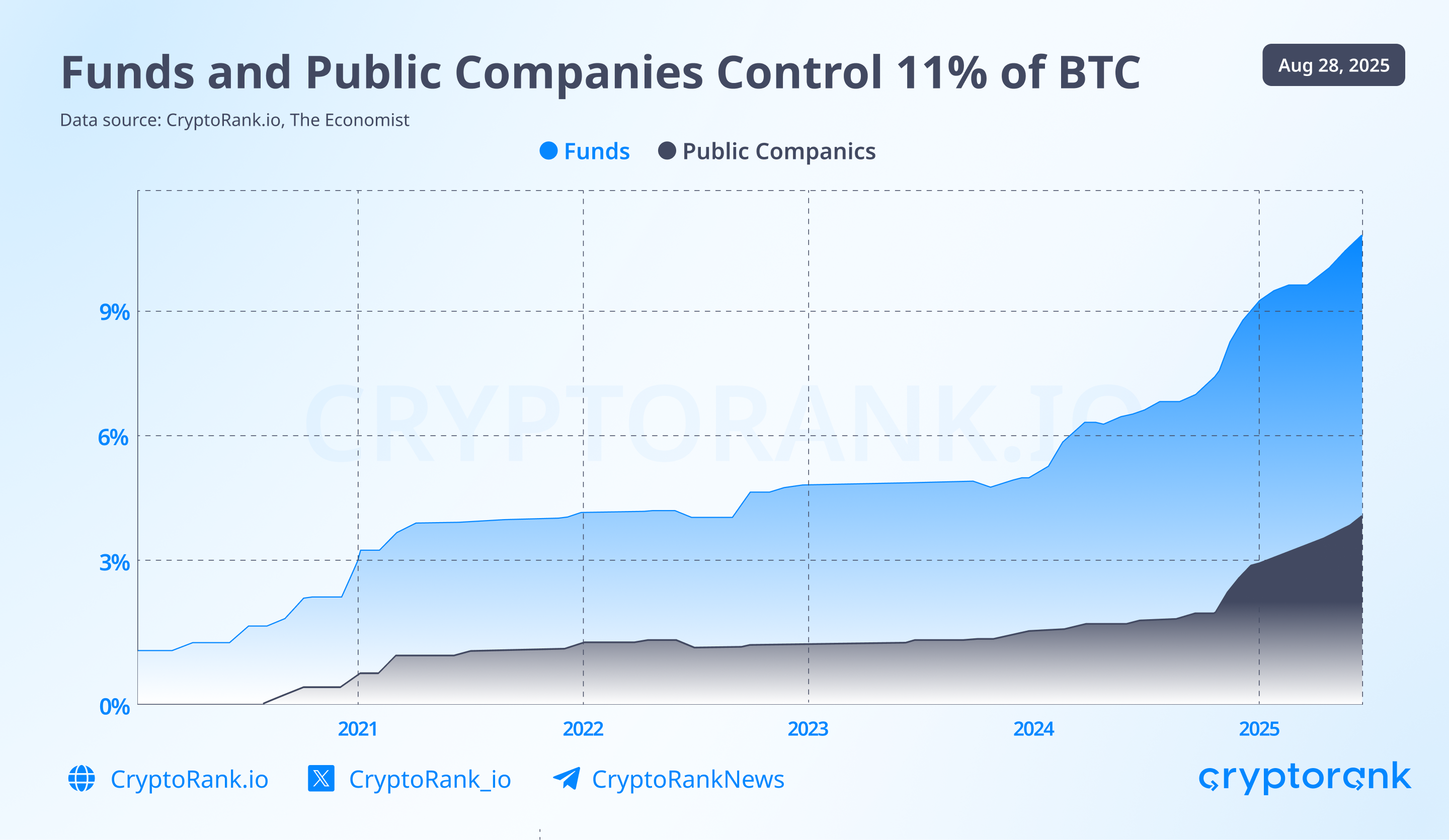

For now, the global trend of funds and companies steadily increasing their Bitcoin holdings remains strong. At the same time, the United States is exploring budget-neutral ways to expand its Bitcoin reserves. It is reasonable to expect that in the future other countries may pursue similar budget-neutral strategies or even follow El Salvador’s example by purchasing Bitcoin directly.

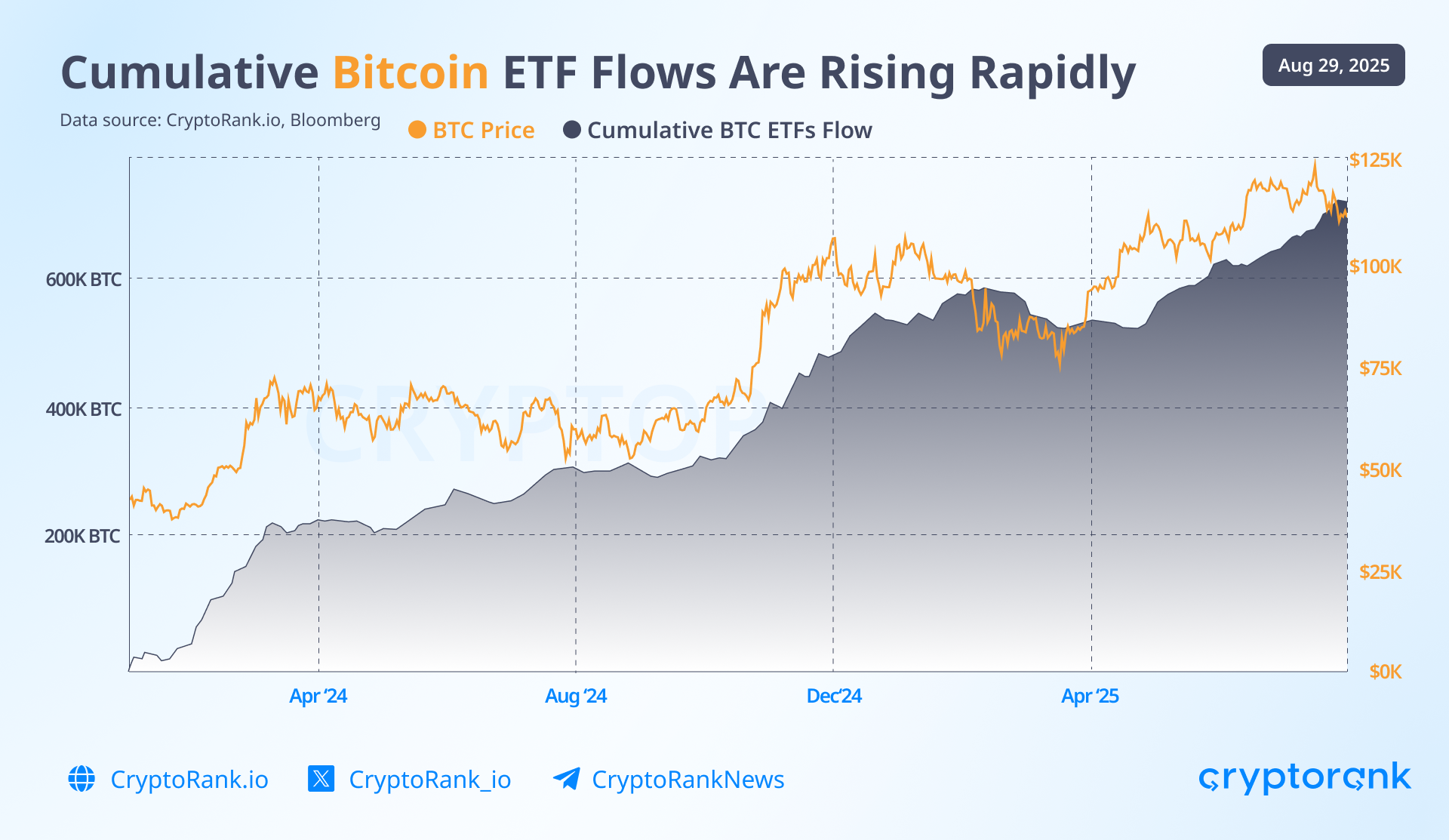

Inflows into Bitcoin ETFs also continue to grow globally, providing support for Bitcoin’s price.

Bitcoin is increasingly diversifying in terms of its holders and methods of storage, which is helping to reduce volatility. As its market capitalization grows, volatility continues to decline, signaling Bitcoin’s transition into a more mature asset.

This decline in price swings could support long-term growth, not through sharp surges, but through steadier and more sustainable increases with milder corrections. Lower volatility also enhances Bitcoin’s appeal to institutional investors and funds, which generally prefer more stable assets. This creates a positive feedback loop that can further drive growth over the long term.

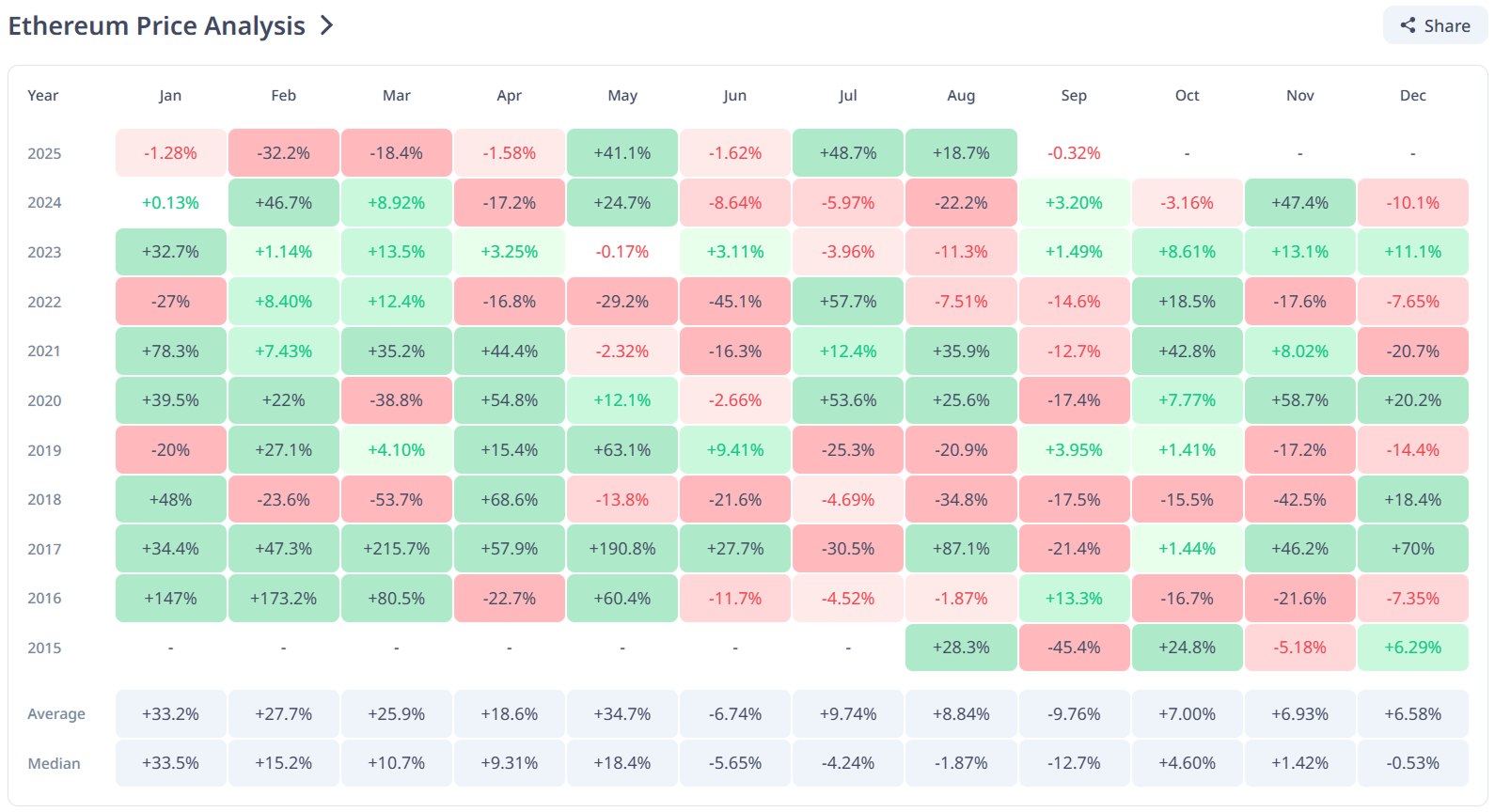

Ethereum

For Ethereum, August turned out to be a highly favorable month. Ether climbed above $4,000 and set a new all-time high on August 24, reaching $4,948, before correcting shortly afterward to around $4,400.

Data source: CryptoRank API

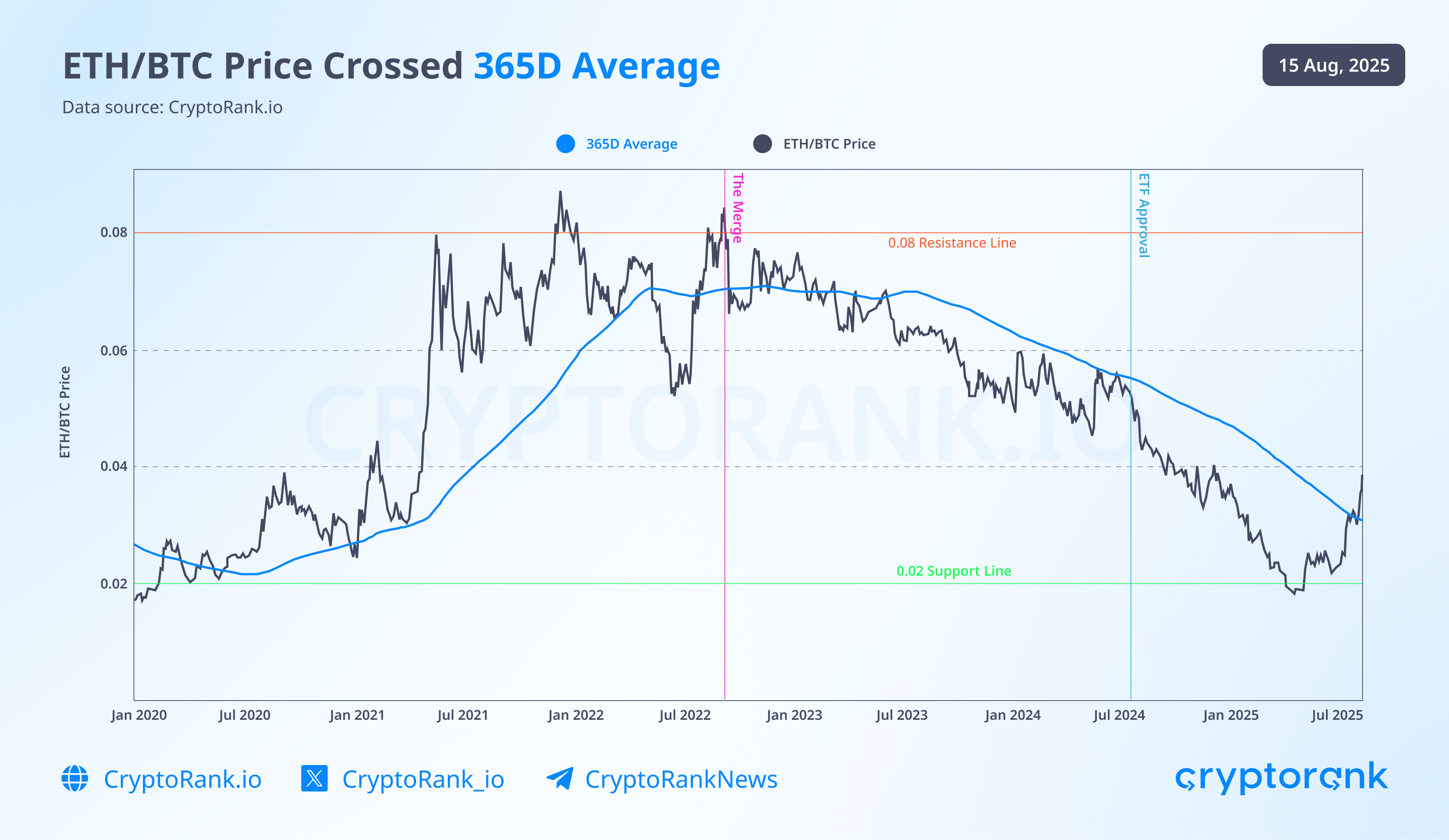

Essentially, Ethereum extended its July rally throughout August. This strong growth can be attributed to two main factors: its relative undervaluation compared to Bitcoin and the legislative package signed by Trump at the end of July, in which Ethereum is the primary beneficiary.

Ethereum managed to rebound sharply from its 0.02 BTC support level and break above the yearly moving average. Historically, Ethereum has tended to outperform in the later stages of a bull market, as capital flows further out along the risk curve and latecomers seek alternatives after missing the initial Bitcoin rally.

The ETH/BTC ratio has historically peaked around 0.08. If Bitcoin were to stabilize near $100,000, Ethereum would need to reach $8,000 to return to that historical level.

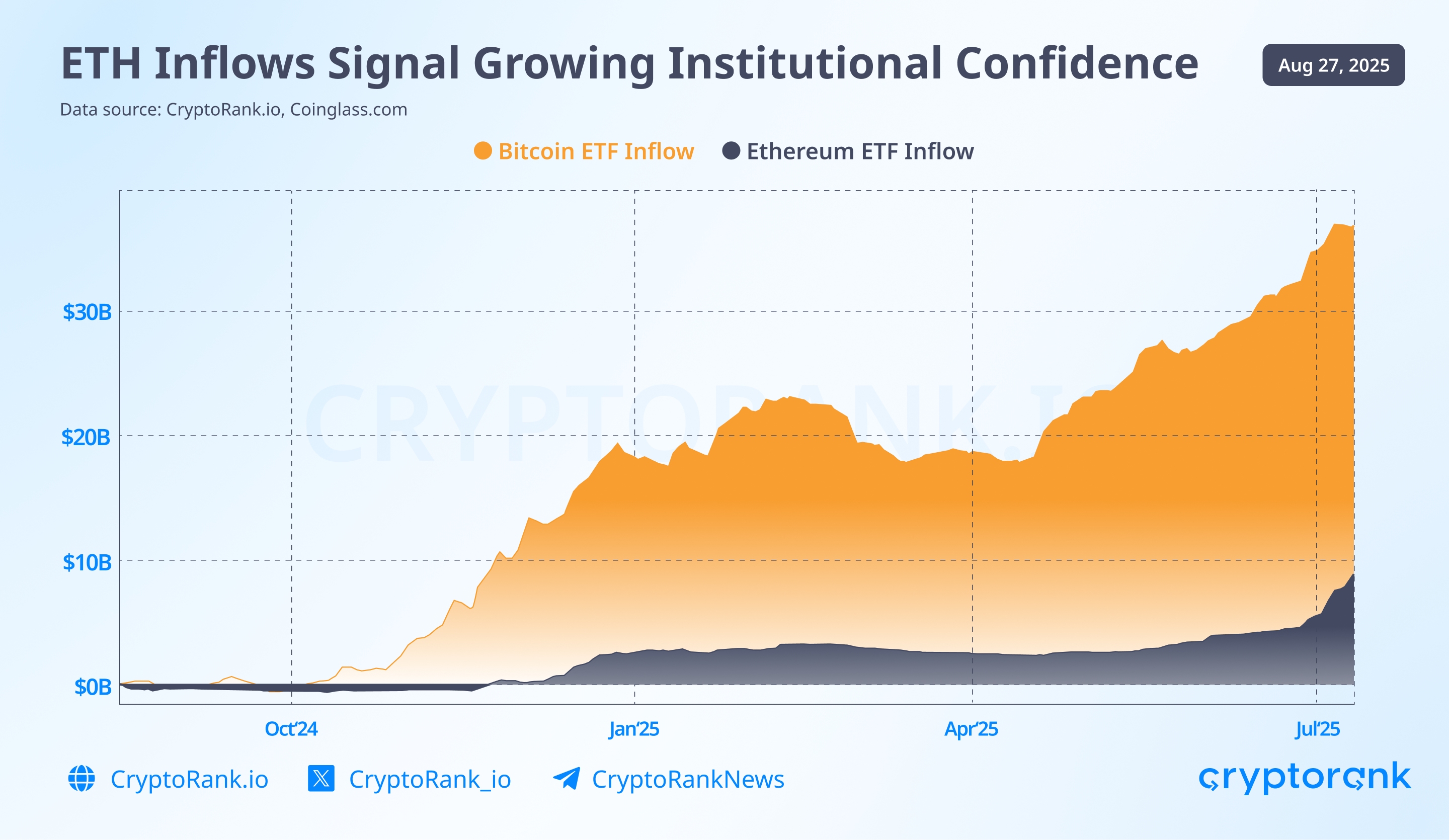

In addition, after DeFi received backing through legislative initiatives, Ethereum, as the central asset of the DeFi ecosystem, benefited from increased ETF inflows, which could support its price in a manner similar to Bitcoin.

Moreover, the shift of Ethereum from retail investors, who tend to take profits, into the hands of institutional players is likely to reduce volatility in the asset.

Altseason

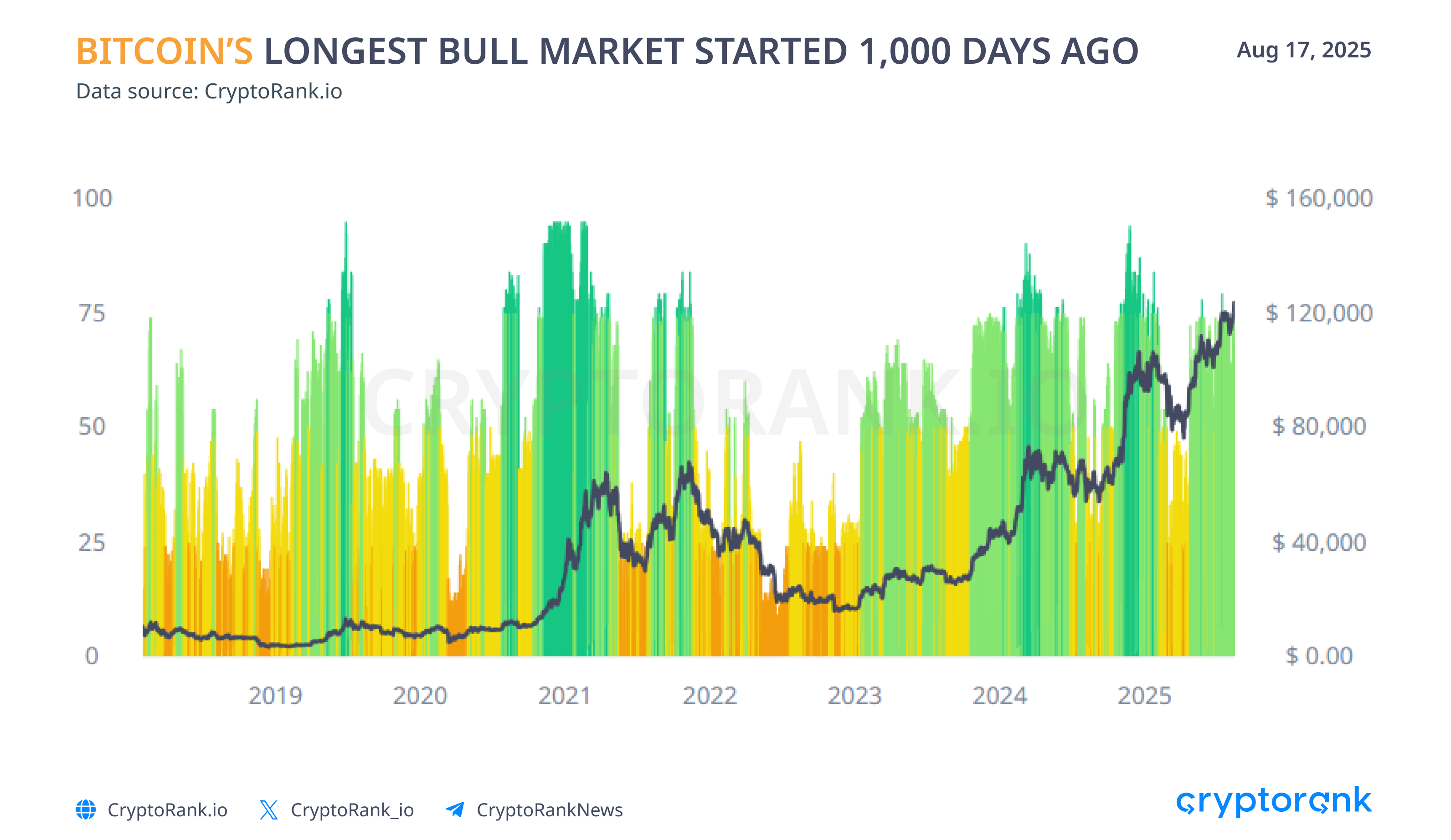

We are now entering an interesting phase in the market. Traditionally, Bitcoin and the broader cryptocurrency sector have moved in cycles tied to Bitcoin’s halving events. Typically, Bitcoin would begin to rise after a halving, followed by other cryptocurrencies. However, in 2024, the crypto market started to grow even before the halving, in anticipation of the event, and this upward trend continues to this day. As a result, this bull market has become the longest in history. Since reaching its local bottom at $15,749 on November 22, 2022, following the previous bull cycle, Bitcoin has been in a global growth phase for over 1,000 days.

Data obtained by API

While the crypto market has seen growth in individual tokens, the kind of broad and powerful percentage gains across many coins that usually define an altseason have not yet materialized.

One possible reason is the market’s maturation: projects now need to deliver real value to users in order to generate revenue and attract token holders. The market is becoming more efficient, less volatile on a global scale, and increasingly driven by real metrics.

We will explore the topic of altseason in more detail, including the top gainers of the current cycle and the reasons behind their success, in our upcoming article on the current bull run, scheduled for release in September.

In the meantime, this recap reviews the key achievements and metrics of individual projects throughout August.

L1 & L2 Performance

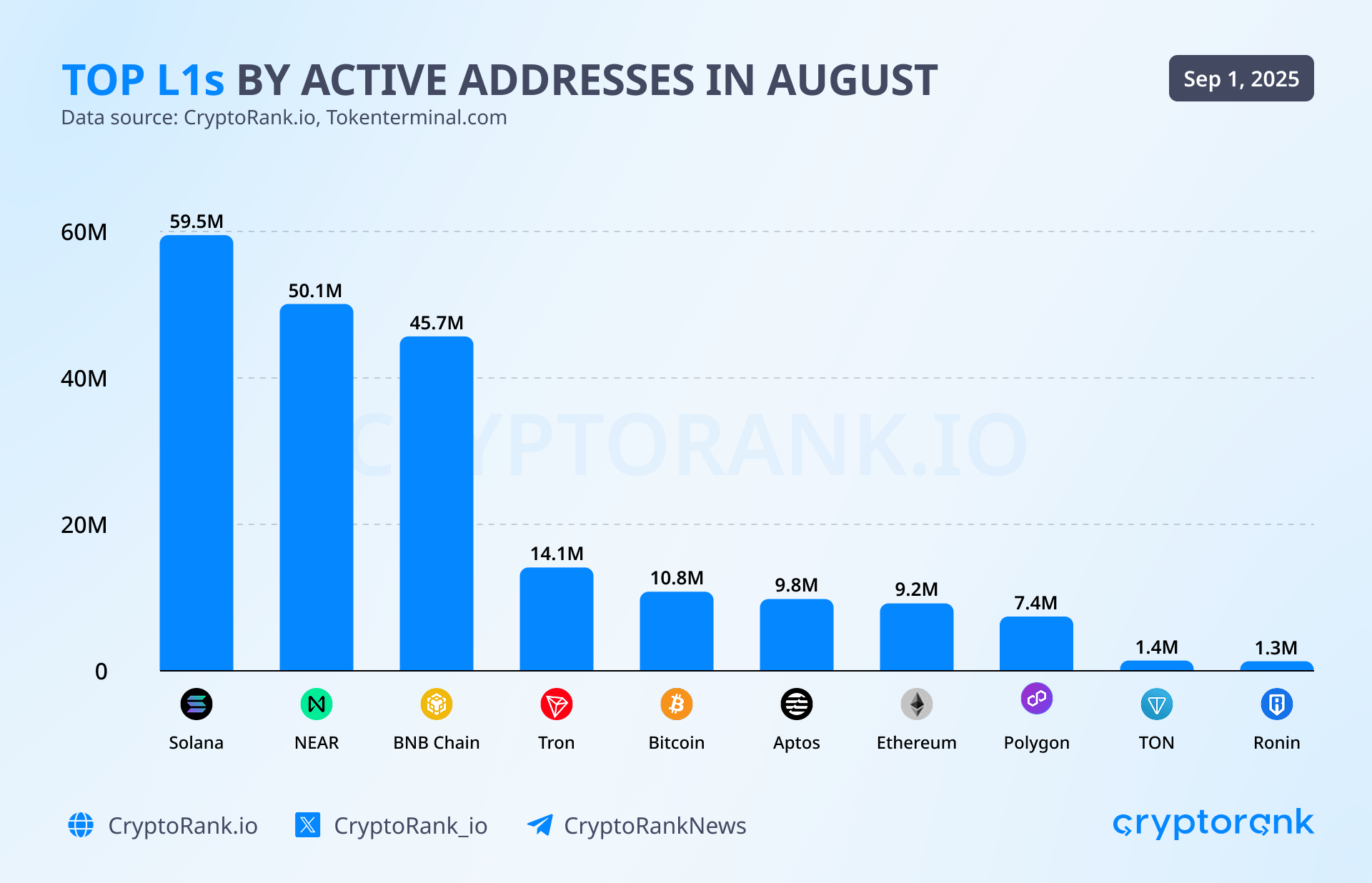

Solana leads in transaction count and active addresses

Solana’s TVL reached $30B, setting a new ATH. The network maintained its leading position by active addresses at 59.5M, surpassing Near and BNB Chain. However, despite leading among other chains, Solana’s active addresses are at their lowest since August 2024.

Solana also became the top L1 chain in August by transaction count, processing 10B transactions. In addition, it ranked #2 by DEX volume with $120B, only behind Ethereum.

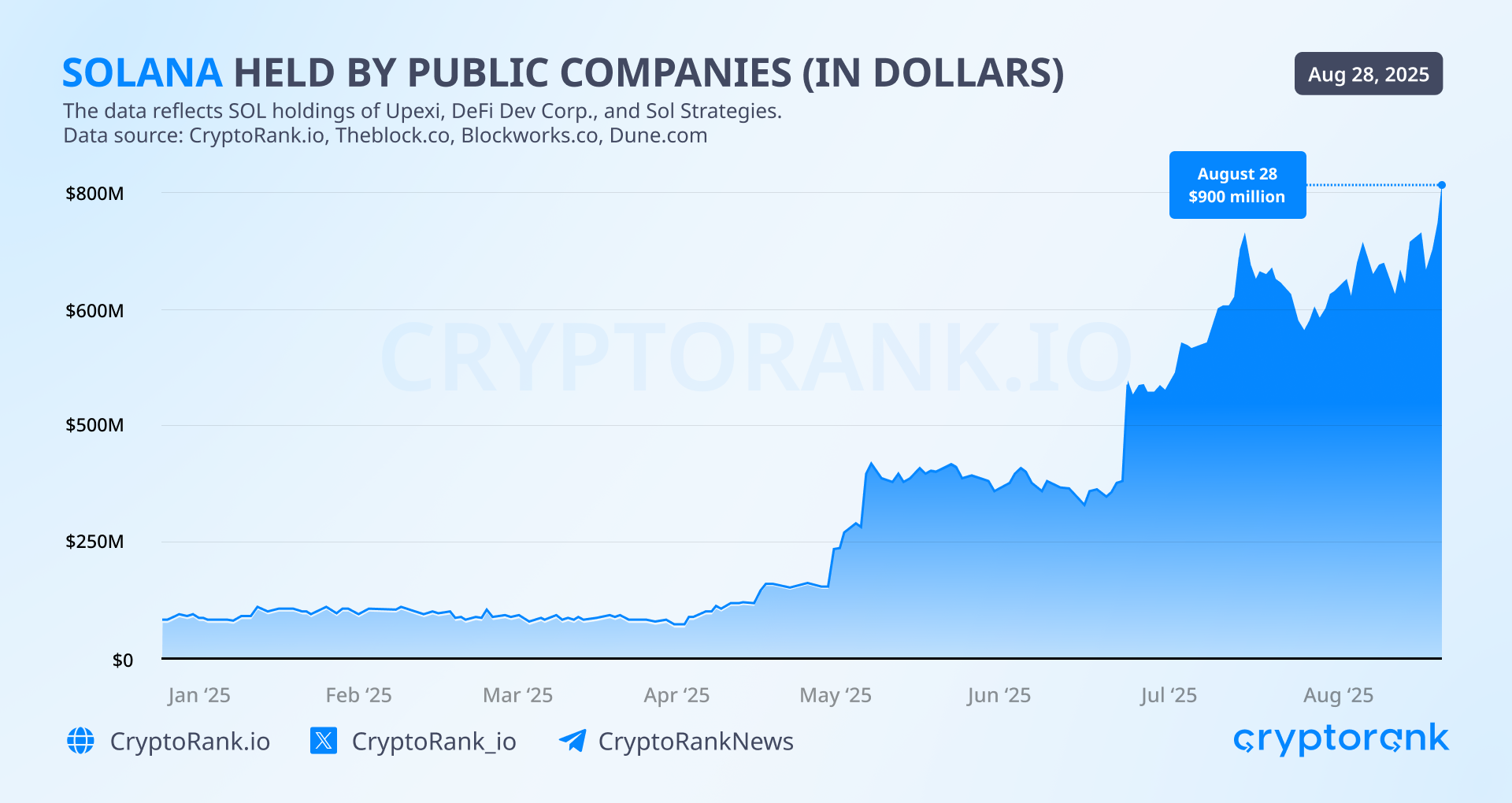

It was a strong month for SOL, as it finally touched $215. The rally was fueled largely by institutional interest and related news: Galaxy, Multicoin, and Jump are seeking to raise $1B for a Solana treasury, while Pantera is looking to raise up to $1.25B for a U.S.-listed Solana treasury company called Solana Co. Meanwhile, SOL holdings of public companies crossed $900M. The top 3 SOL among these companies are Upexi (2M SOL), DeFi Dev Corp. (1.83M SOL), and Sol Strategies (402K SOL).

Hyperliquid sets records in perps volume and fees

August was a highly productive month for the Hyperliquid ecosystem. HyperEVM’s TVL reached a new ATH, now sitting at $7.1B. Interestingly, Kinetiq has become the network’s largest liquidity hub, driven by strong user interest in liquid staking on HL and the composability of its kHYPE token with other DeFi protocols, including Pendle.

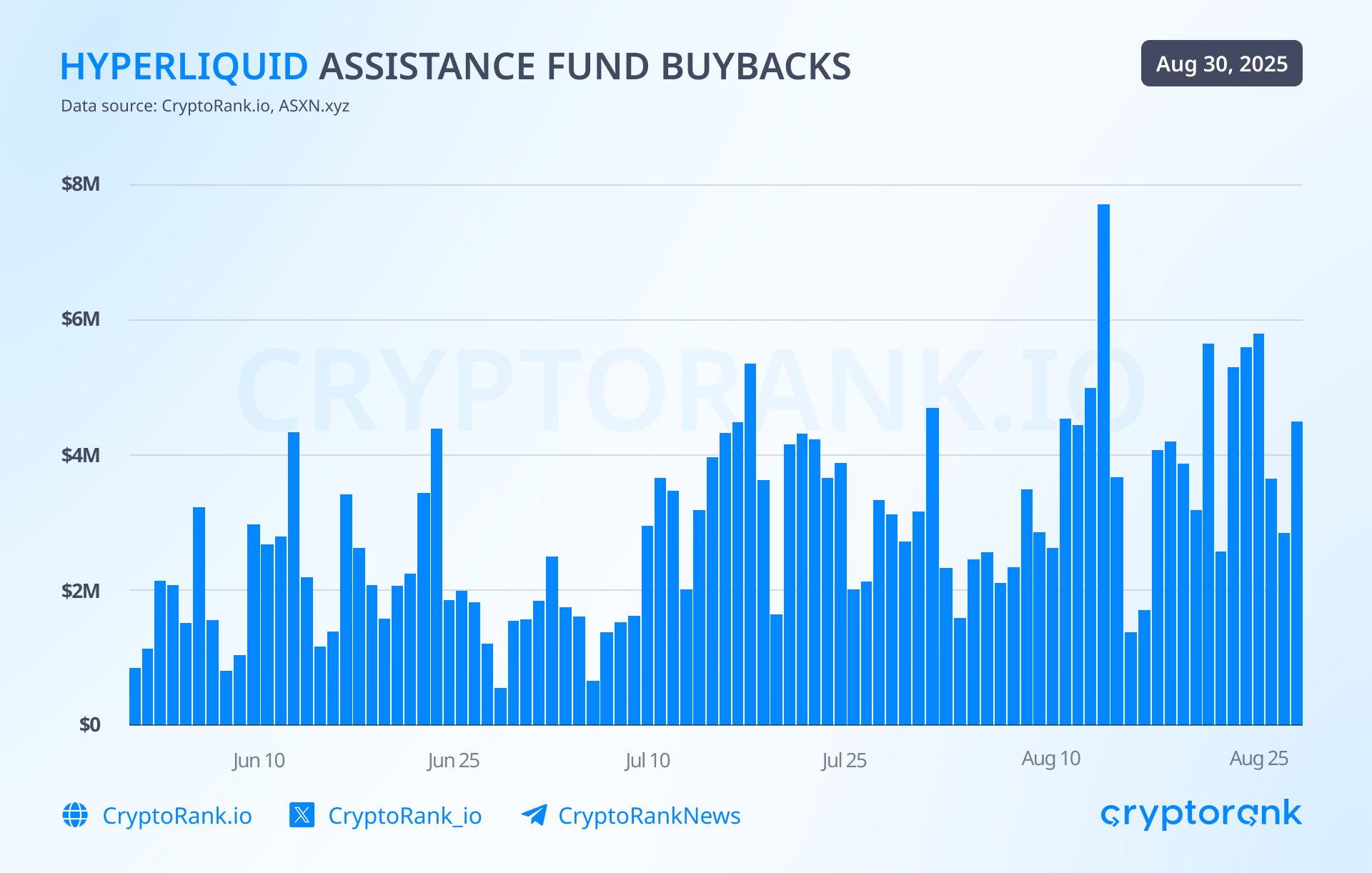

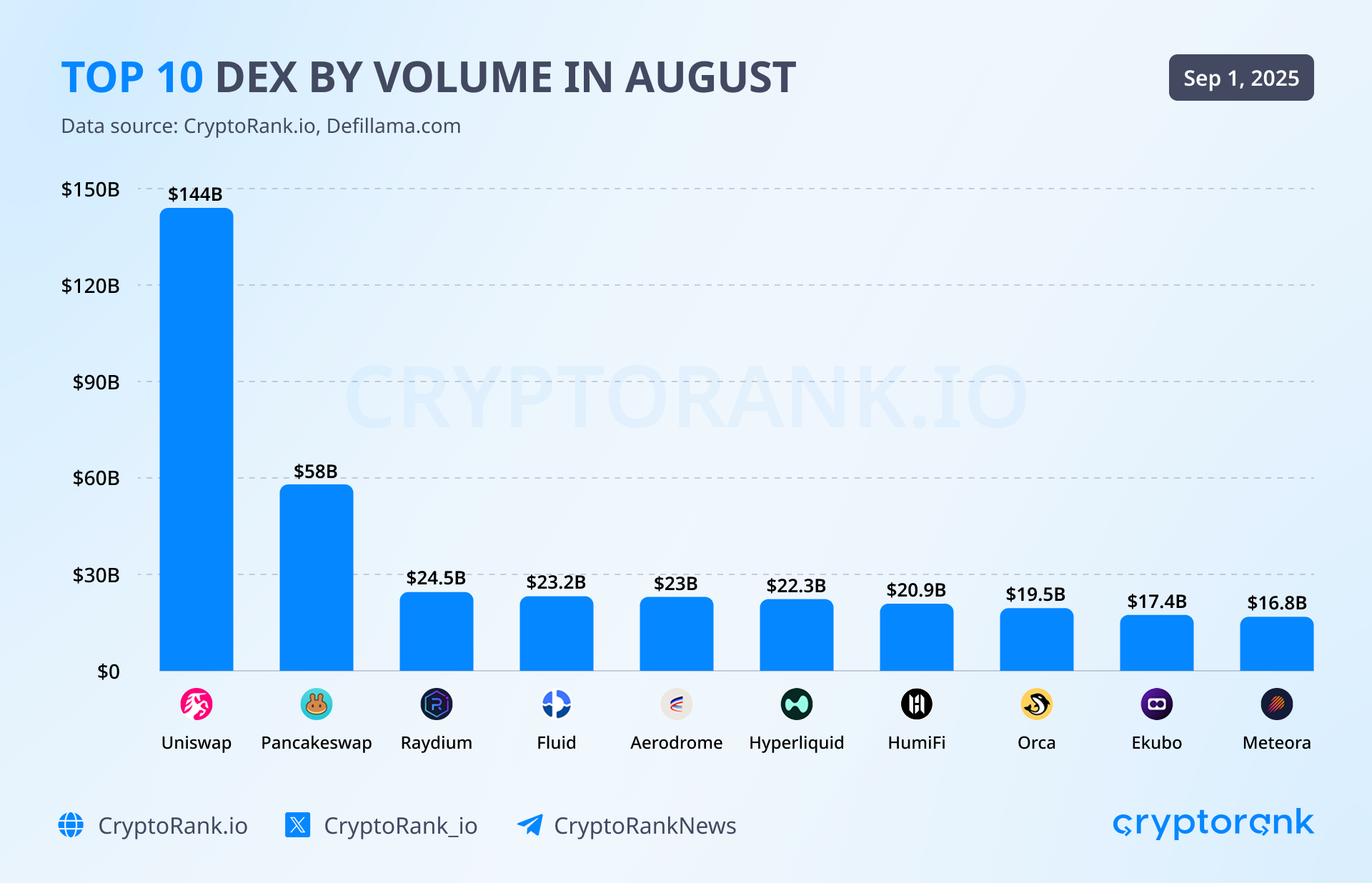

On August 14, Hyperliquid set new records with $29B in daily perps volume and $7.7M in daily fees. Monthly perps volume also hit an ATH of $405B. Hyperliquid has now become the #5 projects in crypto by fees, ranking only behind Tether, Circle, Uniswap, and Jupiter.

With the next network upgrade, Hyperliquid will reduce HLP’s fee share to 1%, directing 99% of fees to the assistance fund for HYPE buybacks. Over the last 30 days, the fund has bought back $110M worth of HYPE, driving the token to a new ATH around $51.

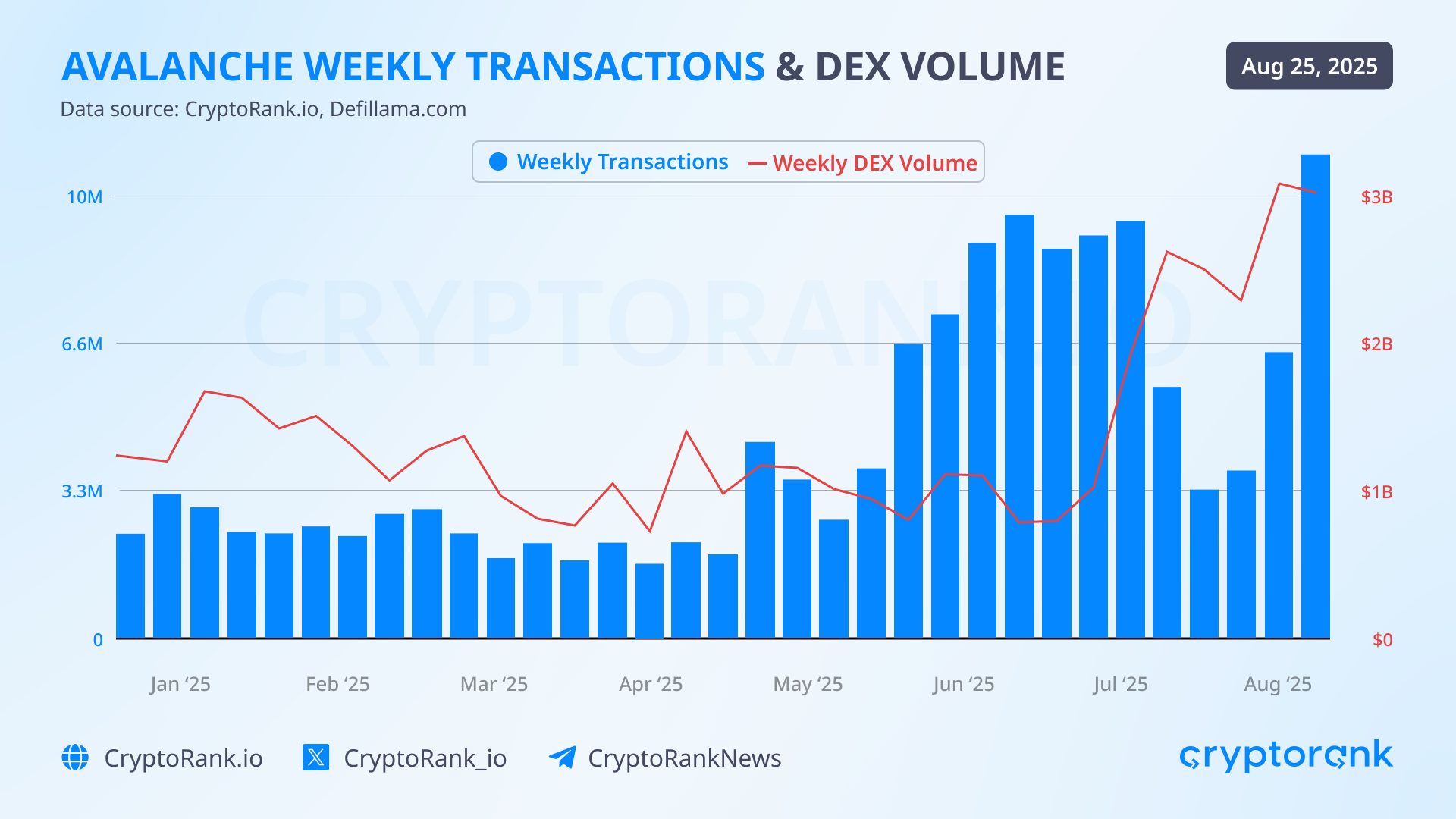

Avalanche activity soars

Avalanche weekly transactions reached 13.3M, the highest since December 2023. The network’s DEX volume hit $3B for two consecutive weeks, a milestone last seen in January 2022, while its TVL is nearing $4B for the first time in three years.

The main drivers behind this activity spike are strong institutional demand and new partnerships. First, Grayscale filed an S-1 form with the SEC to convert its Avalanche Trust into a spot ETF that would trade on Nasdaq under the AVAX ticker. Second, SkyBridge Capital and Tokeny plan to tokenize $300M in hedge funds on Avalanche. Third, Toyota’s Blockchain Lab is collaborating with Ava Labs on MON, the Mobility Orchestration Network, a blockchain system designed to make global mobility, such as car ownership and related services, more transparent and connected.

Arbitrum sees ATH in weekly transactions

In August, Arbitrum weekly transactions set 22.88M ATH, while active addresses hit 2.7M for 3 weeks in a row, the activity level last seen in January 2022. Furthermore, weekly net inflows reached a $2.95B ATH, driving the network’s TVL to $5.6B.

On the ecosystem side, Arbitrum proposed migrating Ronin (Axie Infinity’s chain) to its Orbit stack, strengthening its position in gaming. Wyoming launched its state-backed FRNT stablecoin on several networks, including Arbitrum, while Robinhood continued its rollout with 200+ tokenized U.S. stocks and ETFs on Arbitrum for EU users, drawing regulatory inquiries under MiCA. The team also rolled out a $14M audit subsidy program to boost security and introduced fair transaction sequencing to improve network stability and DAO revenue.

DeFi is booming: Aave competes with banks, Morpho and Pendle cross $10B TVL

Aave

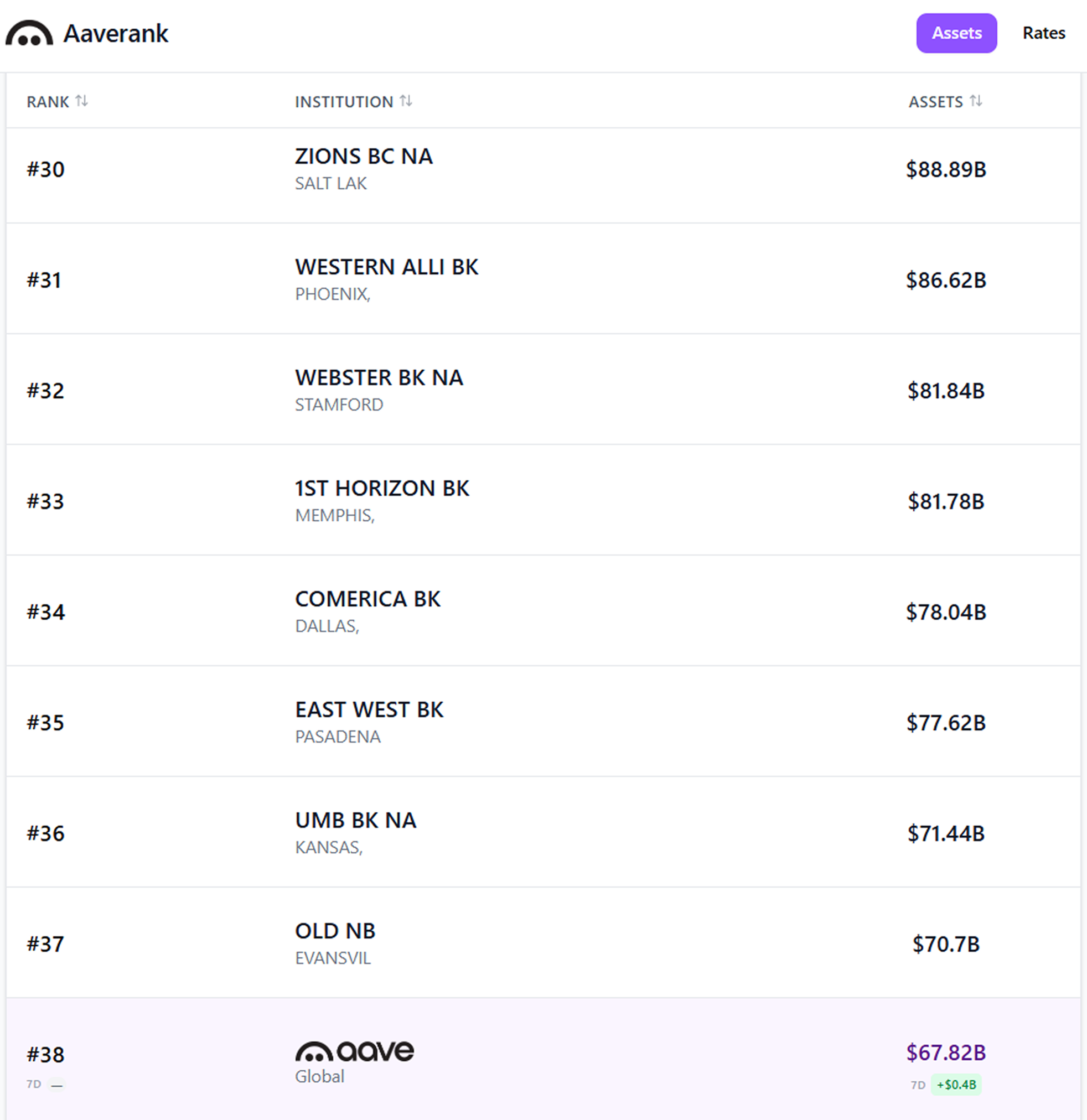

Aave hit $70B in TVL in August and currently sits at $69B, making it crypto’s leading protocol by TVL, with Lido $30B behind. It also crossed a major milestone of $3T in total deposits.

Aave’s net treasury (excluding $AAVE holdings) hit a new ATH of $132.7M, reflecting nearly 130% growth year-over-year. On the expansion front, Aave recently deployed on Aptos, making a move beyond EVM chains.

Remarkably, only 37 US banks have a higher TVL than Aave.

Pendle

Pendle’s TVL grew by $4B in August, reaching a new ATH of $10.9B. Interestingly, 68% of it is composed of Ethena’s USDe and sUSDe. The Kinetiq integration on HyperEVM added nearly $400M in TVL within just a few weeks. The protocol’s monthly fees reached $6.3M, marking its second-best month ever.

In August, the Pendle team launched a new platform called Boros. It allows users to trade tokenized on-chain yield from perpetual futures funding rates. Boros introduces a new yield primitive called Yield Units (YUs), synthetic assets that represent future yield payouts, which can be traded like any other token. This opens up new strategies for speculating on, hedging, or earning from future funding rates.

Morpho

Morpho’s monthly fees hit an ATH of $18.6M. The project’s TVL finally crossed the $10B mark and now sits at $10.9B. With this, Morpho has become a key liquidity hub across multiple networks, including Base, Katana, Unichain, and HyperEVM.

On August 21, Morpho launched a dedicated interface that rewards early loan repayments with a 10% bonus, helping reduce systemic risk. Additionally, the project partnered with Bitpanda, giving its users direct access to Morpho’s yield vaults through their DeFi wallet, expanding exposure among European users.

The MORPHO token surged to a six-month high of $2.70 before pulling back to $1.9.

Ethena

Since July 15, USDe supply has soared from $5.3B to $12.3B, making it the third-largest stablecoin with a 4.3% market share. August 7 marked Ethena’s best day ever in terms of fees earned, with $27.5M. Meanwhile, the 30-day APY for sUSDe stands at 7.5%.

The project continues to strengthen its position through integrations with other DeFi protocols. As mentioned earlier, Ethena’s USDe and sUSDe account for 68% of Pendle’s TVL. Additionally, Liquid Leverage on Aave has grown to approximately $2B across USDe and sUSDe deposits. USDe was also added for custody on Coinbase Prime, making it accessible to institutional clients.

The Ethena Foundation is currently executing a $260M ENA token buyback program to help establish ENA reserves. Since July 21, nearly $215M worth of tokens have been bought back, pushing the ENA price up by 40%.

Fluid

Fluid’s TVL has crossed $3B, with 90% of liquidity concentrated on Ethereum. August was a record month for Fluid in terms of fees and revenue: fees reached $8M, while revenue hit $1.38M, pushing annualized revenue above $16.3M. Fluid became the #4 DEX by volume in August, processing $23.2B, and ranked #2 on Ethereum, only behind Uniswap.

The protocol also expanded to Solana through a partnership with Jupiter. Jupiter Lend launched its public beta on August 27, attracting $850M in under 48 hours, making it the #2 lending market on Solana. Additionally, Fluid launched DEX Lite, an ultra-gas-optimized DEX specialized for correlated asset pairs, now doing an estimated $40M in weekly volume.

Fluid has opened a community discussion around the protocol’s long-term vision and token buyback strategies. Three different approaches are being considered, and you can read more about them on their governance forum.

Altcoin highlights: BNB breaks records, MYX explodes, YZY collapses

The altcoin season index, ASI, is now sitting at 56/100. As a reminder, ASI is a metric that tracks the dominance of the top 100 cryptocurrencies relative to Bitcoin. Its surge may signal an approaching altseason and offer insights into potential investment opportunities. Additionally, the altcoin market cap is sitting at $1.28T.

August saw many altcoin ups and downs. Below are some of the standout performers.

BNB surged to a new all-time high of $899, fueled by large institutional purchases. Nasdaq-listed CEA Industries raised $500 million through a private placement to acquire BNB as its primary treasury reserve asset. The company then purchased 388,888 BNB via BNB Network Company (Nasdaq: BNC), its treasury management arm, making it the largest BNB treasury holder.

Additionally, investment firm B Strategy announced plans to launch a BNB treasury company, aiming to raise $1 billion. BNB also became tradable on RAKBANK, one of the UAE’s largest banks. Meanwhile, REX-Osprey filed for a BNB staking ETF.

MYX grew over 1,000%, fueled by its Binance Alpha listing and anticipation around the V2 launch. MYX Finance also set a new ATH in monthly trading volume – $10.4B.

BIO has risen nearly 200%, driven by the Coinbase listing, a staking program that locked approximately 152M BIO (9.1% of the supply), and the launch of Aubrai, Bio Protocol’s first AI-powered decentralized science agent.

OKB soared over 300% amid a massive token burn and the X Layer upgrade. Also, OKX launched a $100M X Layer ecosystem fund aimed at attracting and supporting builders.

CRO doubled its price following Trump Media & Technology Group's plans to launch a joint $6.4 billion Cronos treasury in collaboration with Crypto.com.

YZY token, linked to Kanye West, hit a $3B FDV shortly after launch, but has since dropped to around $500M. As a result, 70% of traders got rekt, while one trader lost over $1M. Only 30% of traders ended up with a positive PnL, while 11 insider and sniper wallets secured around 30% of the entire profits.

Memecoins

The main August highlight in the memecoin sector was an impressive comeback of Pump.fun. Having only 11.5% market share by volume on August 1, it was able to grow it to ~90% by the end of the month.

A key reason behind the comeback was the launch of the Glass Full Foundation, an initiative aimed at supporting promising tokens and organic communities within the Pump fun ecosystem. On August 7, the project invested $1.69M across 10 tokens and has not sold any of them since.

Another factor that reinforced user confidence in Pump fun is the ongoing PUMP token buyback program. Since July, the team has bought back over $65M worth of PUMP. The buyback amount depends on daily protocol fees and typically accounts for 90-100% of daily earnings, sometimes even exceeding that. With $70.7M fees generated in August, Pump fun ranks as the #10 protocol in crypto.

Pump fun’s main competitor, LetsBonk.fun, lost its dominant position, falling from a 77% market share on August 1 to just 10% by the end of the month. Monthly fees dropped sharply from $38M in July to $7M in August. Notably, two new launchpads emerged in August – Bags and Heaven. Both briefly captured around 20% market share, but their momentum didn’t last, and they closed the month with less than $1.5M in combined daily volume.

Conclusion

August proved to be a month of mixed trends across the crypto market. Bitcoin experienced a moderate correction after a strong rally, yet the broader macro and institutional trends remain supportive for long-term growth. Ethereum continued its upward trajectory, benefiting from both legislative developments and inflows into DeFi and ETFs, highlighting its growing institutional adoption.

Layer-1 and Layer-2 networks, including Solana, Hyperliquid, Avalanche, and Arbitrum, demonstrated robust activity, transaction growth, and institutional interest, signaling healthy ecosystem expansion. DeFi protocols such as Aave, Pendle, Morpho, Ethena, and Fluid set new milestones in TVL, fees, and product innovation, further strengthening the sector.

In the altcoin market, BNB, MYX, OKB, and CRO recorded impressive gains, while certain projects like YZY faced sharp declines, illustrating the high-risk, high-reward nature of altcoins. Memecoins also saw notable shifts, with Pump.fun staging a significant comeback, showing that community-driven projects with strong buyback strategies can reclaim market share.

Overall, August reflects a maturing crypto market characterized by growing institutional participation, decreasing volatility in major assets, and an increasingly value-driven landscape. As the market moves toward potential altseason dynamics, investors and participants will continue to focus on protocols delivering real utility, strong fundamentals, and innovative growth strategies.