Crypto Market Recap: Q2 2025

Overall Market Performance: Bitcoin, S&P 500, and Gold

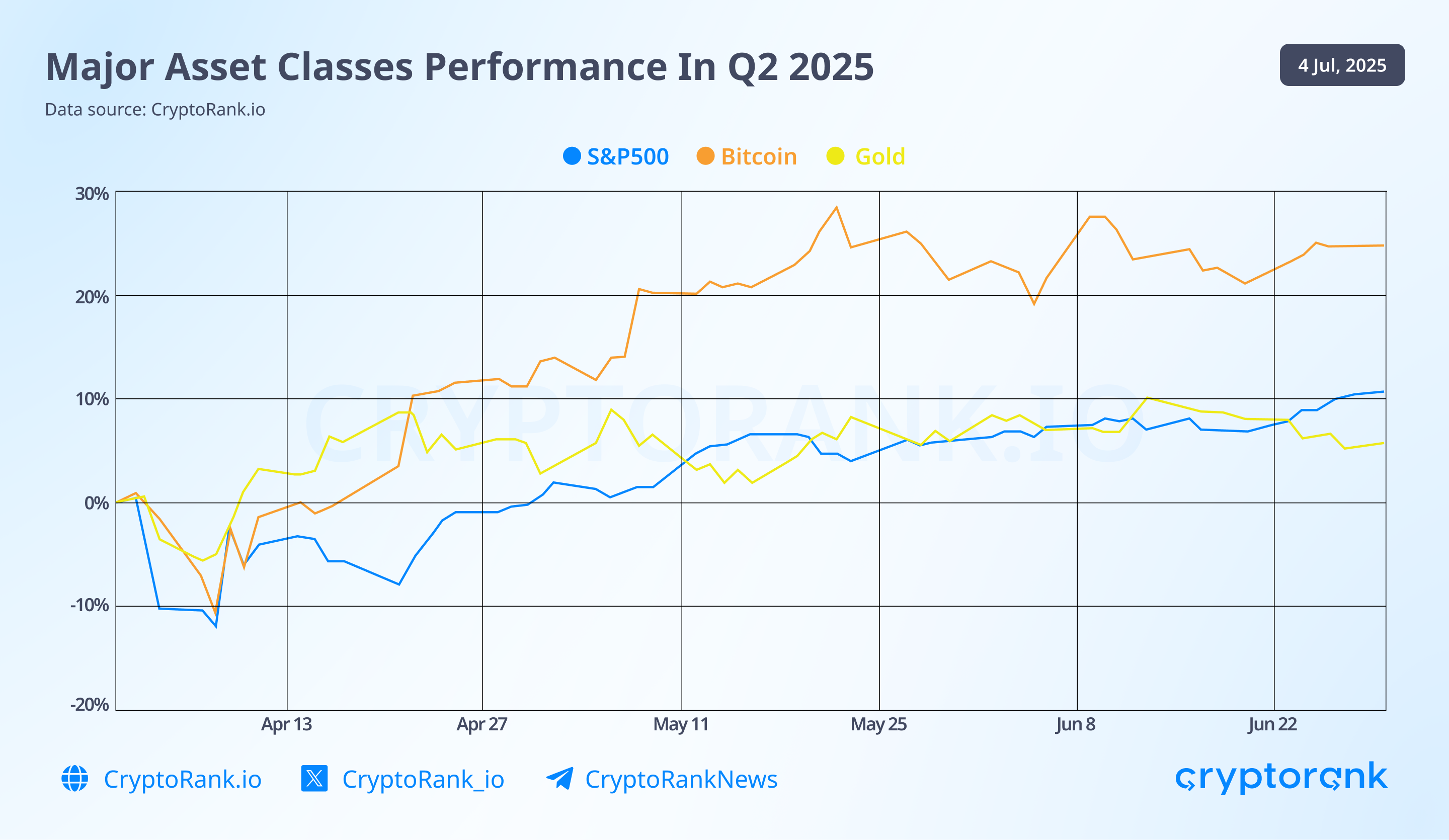

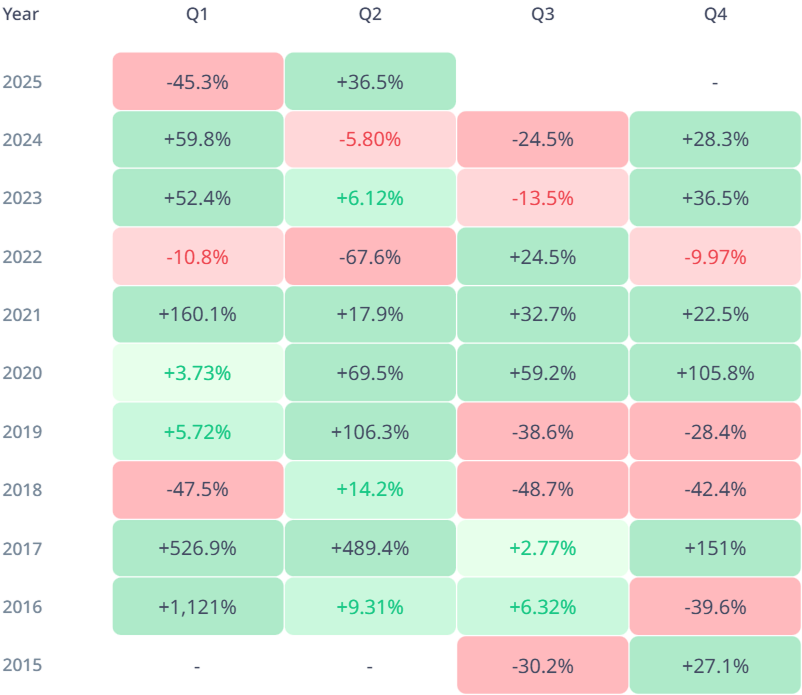

Q2 2025 was ultimately bullish across all three major asset classes — Bitcoin, the S&P 500, and gold, as each set a new all-time high during the quarter. However, the start of Q2 was marked by a sharp downturn triggered by President Trump’s surprise announcement of sweeping new tariffs.

The tariffs, in some cases reaching into the hundreds of percent, were imposed not only on traditional trade rivals and geopolitical competitors but also on strategic allies and countries with minimal trade conflicts with the U.S. The scale and speed of these measures shocked global markets, leading to a significant drop across Bitcoin, equities, and even safe-haven assets like gold.

In what appeared to be a tactical move, Trump later announced a 90-day pause on the tariffs to allow countries time to negotiate trade deals with the U.S. This move reassured markets, triggering a strong rebound. Bitcoin led the recovery, outperforming both the S&P 500 and gold as risk appetite returned.

Data obtained by API

Bitcoin

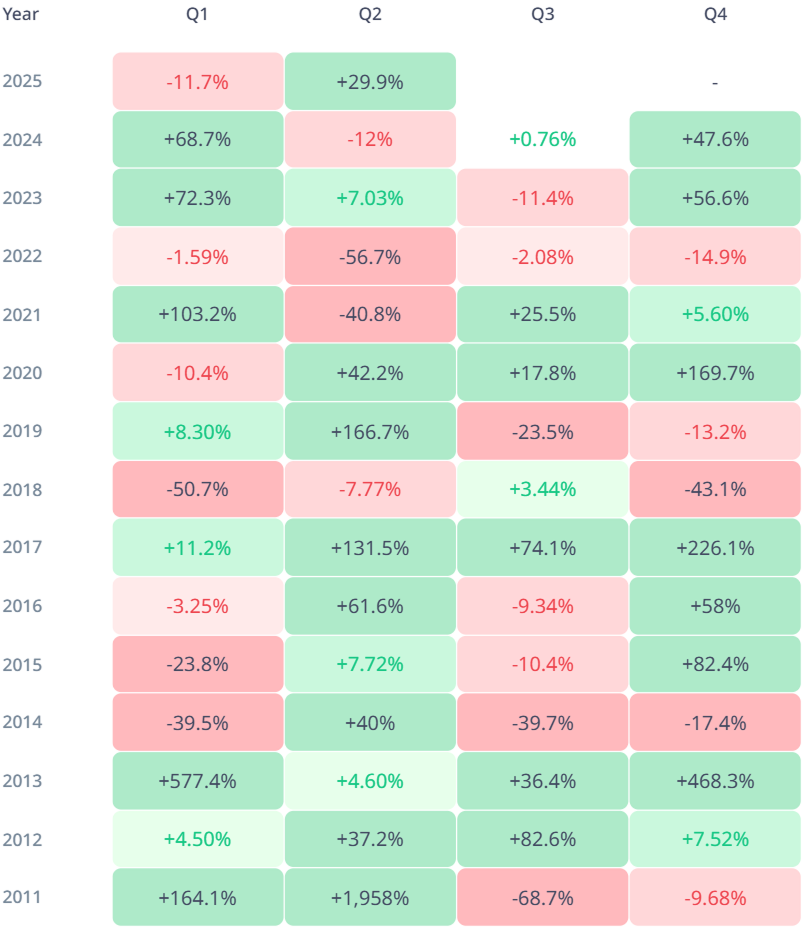

If you follow us on X or Telegram, you’ve likely seen several posts showcasing key metrics pointing to a bullish outlook for Bitcoin. In this section, we’ll summarize the most important indicators from Q2 that supported Bitcoin’s strong performance.

Data source: CryptoRank API

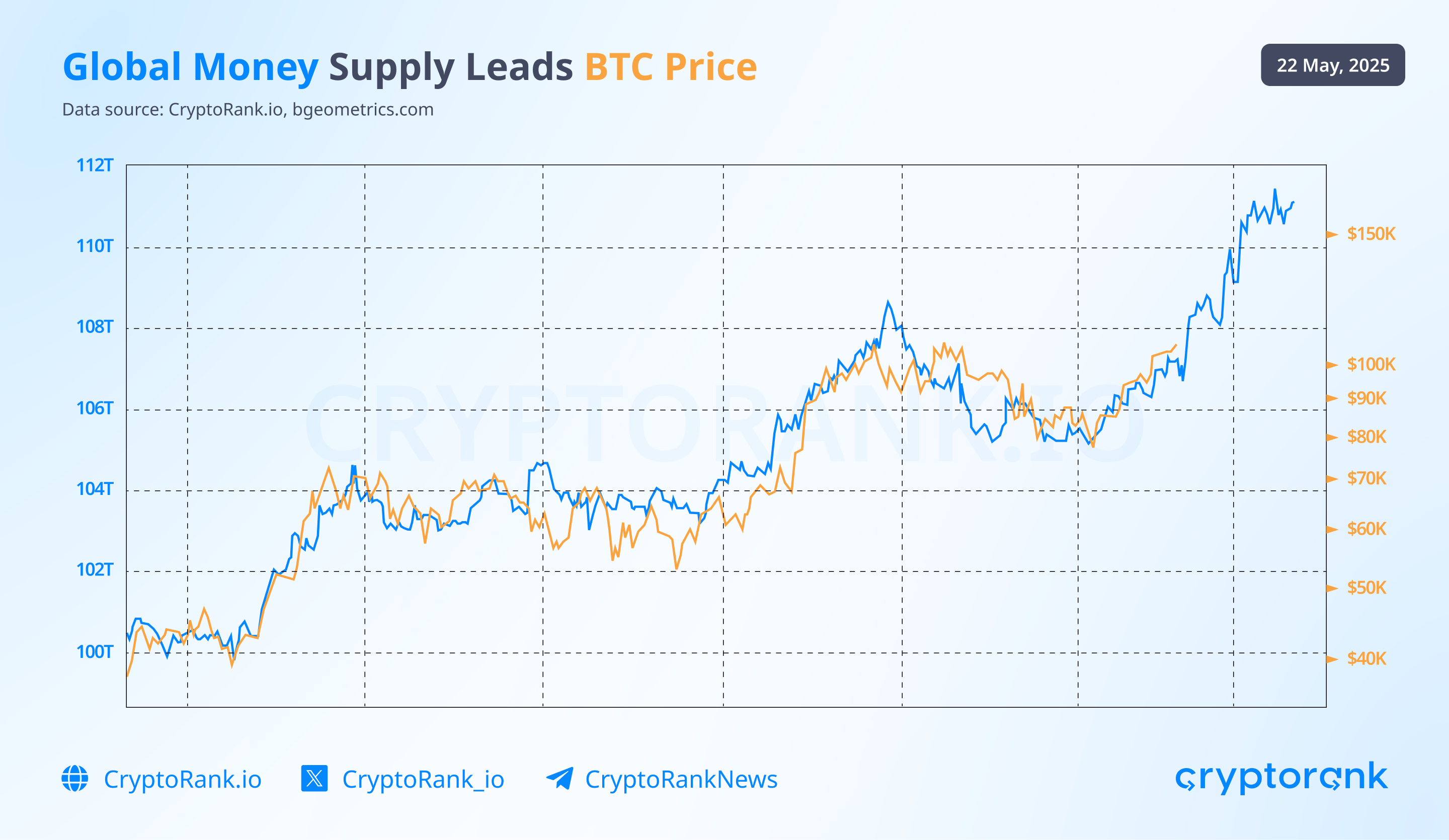

One of the standout signals was Bitcoin’s tight correlation with global M2 money supply. Based on the 10-week forward projection of global M2, this relationship continued to suggest upward momentum for Bitcoin—a trend that played out throughout the quarter.

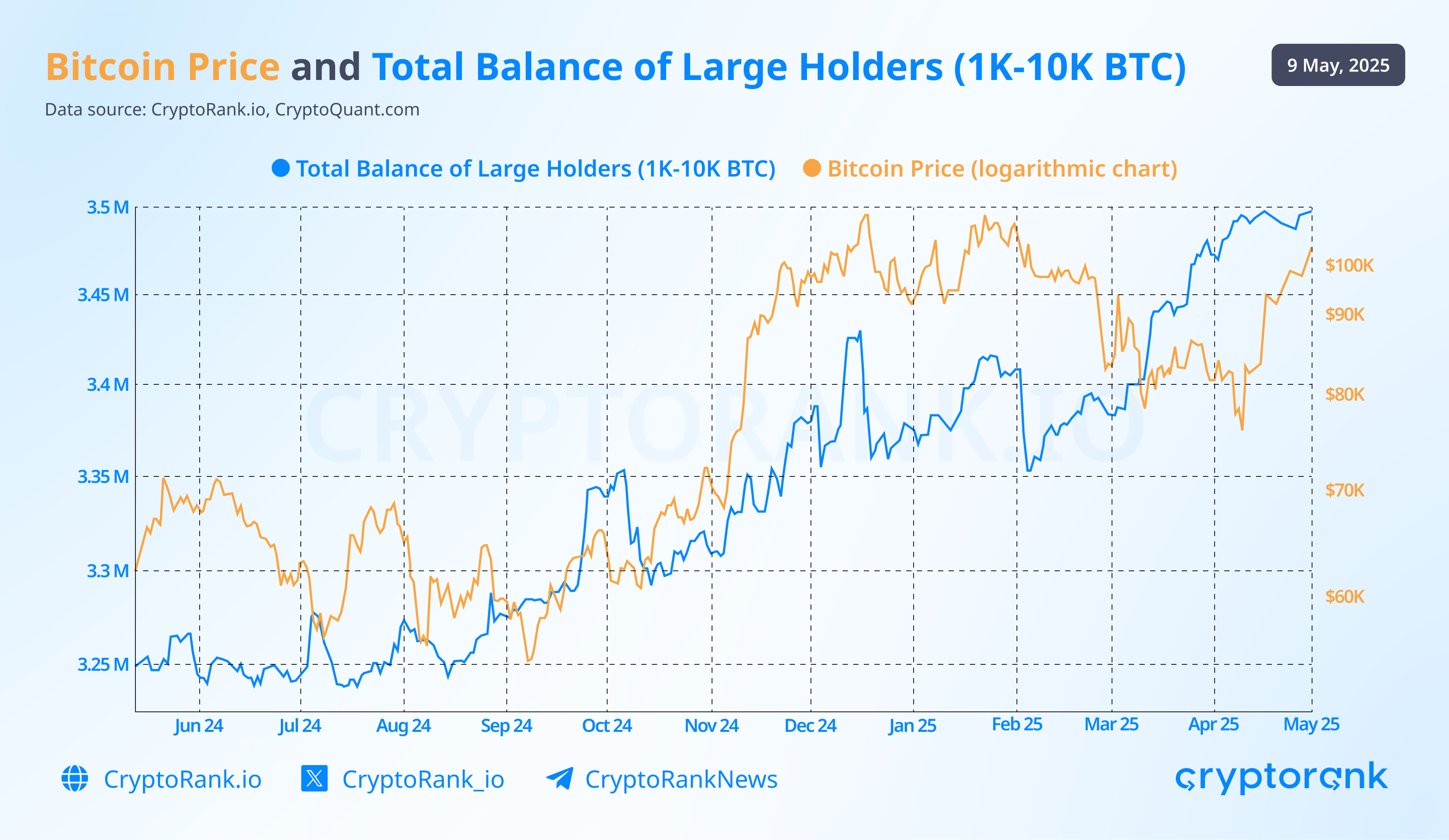

On-chain data also confirmed growing bullish sentiment. As highlighted in the infographic below, a specific group of market participants, often including institutional players like hedge funds and Bitcoin mining companies, have historically been reliable in signaling true market direction. Their activity in Q2 pointed to continued accumulation.

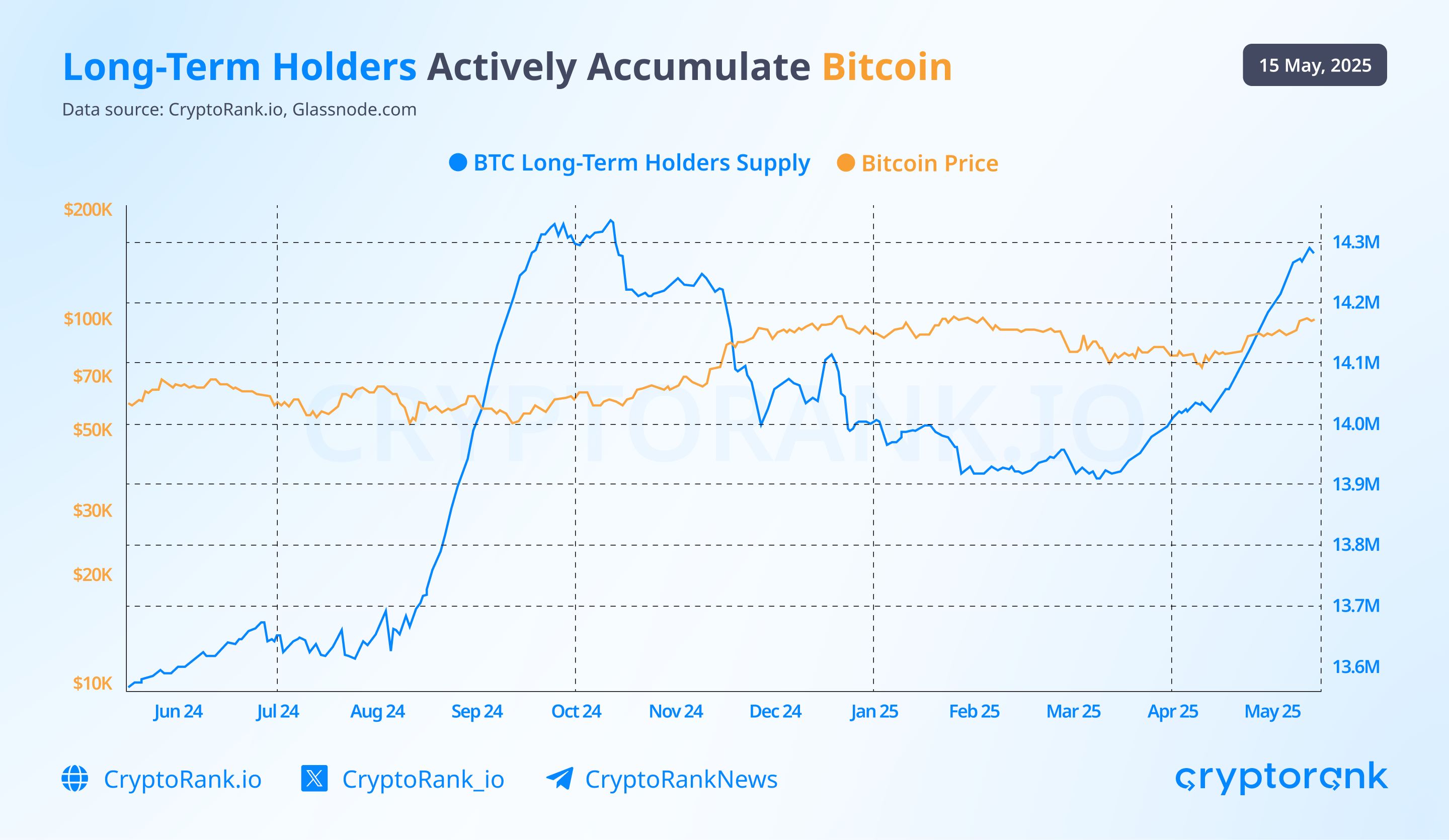

Long-term holders also kept increasing their Bitcoin positions, showing strong conviction from non-speculative investors. This behavior typically reflects confidence in Bitcoin’s long-term value.

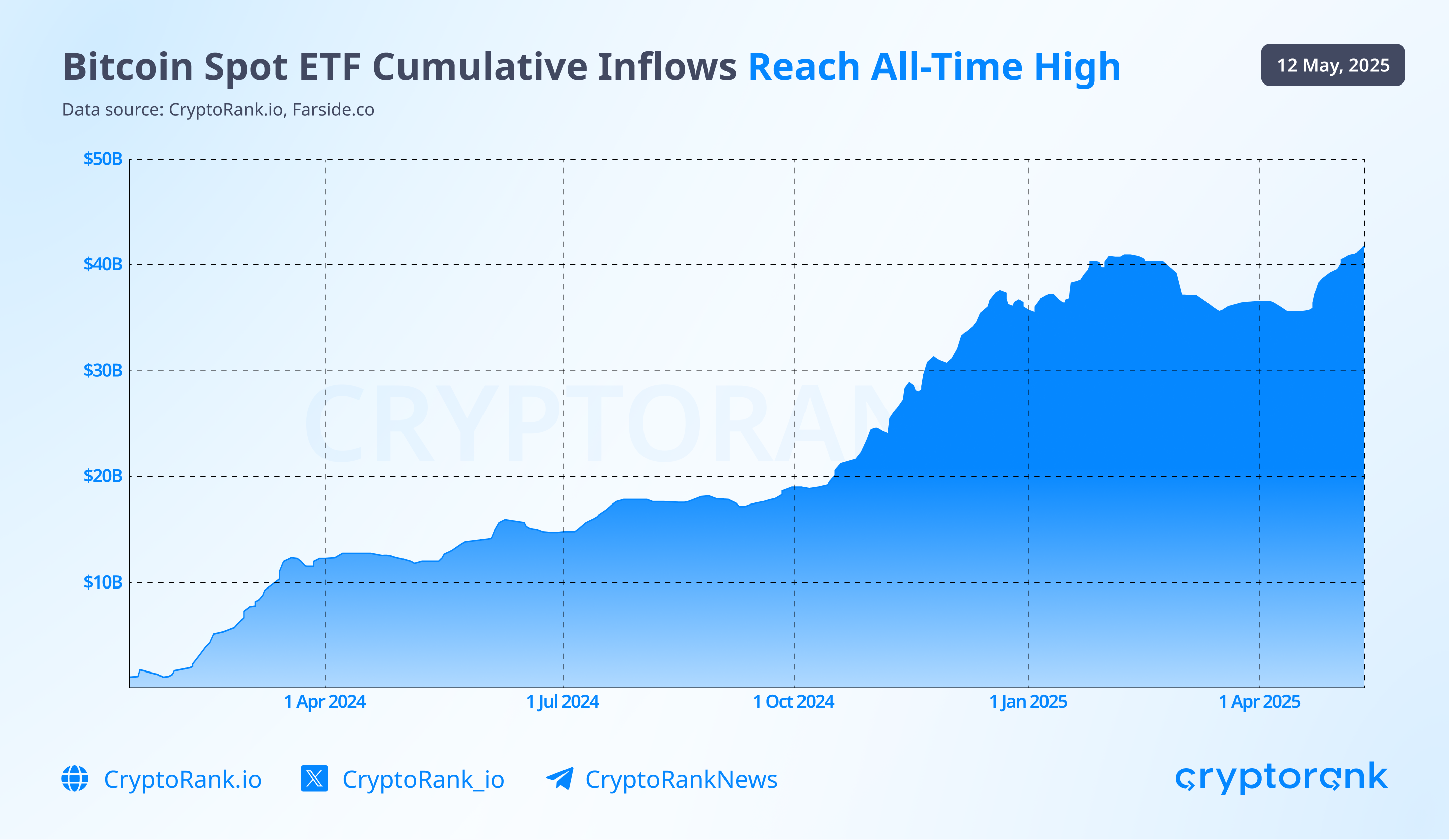

Institutional adoption played a critical role as well. BTC spot ETF issuers continued to increase their holdings.

With BlackRock becoming the second-largest holder of Bitcoin after Satoshi Nakamoto. For many institutions, ETFs remain the easiest and sometimes the only way to gain direct exposure to Bitcoin.

In fact, the number of publicly traded companies holding Bitcoin tripled in H1 2025 compared to 2024. This growth was fueled by increasingly crypto-friendly regulations in the U.S., which are accelerating corporate adoption. Rising geopolitical tensions also boosted Bitcoin’s appeal as a form of “digital gold” and a hedge against uncertainty.

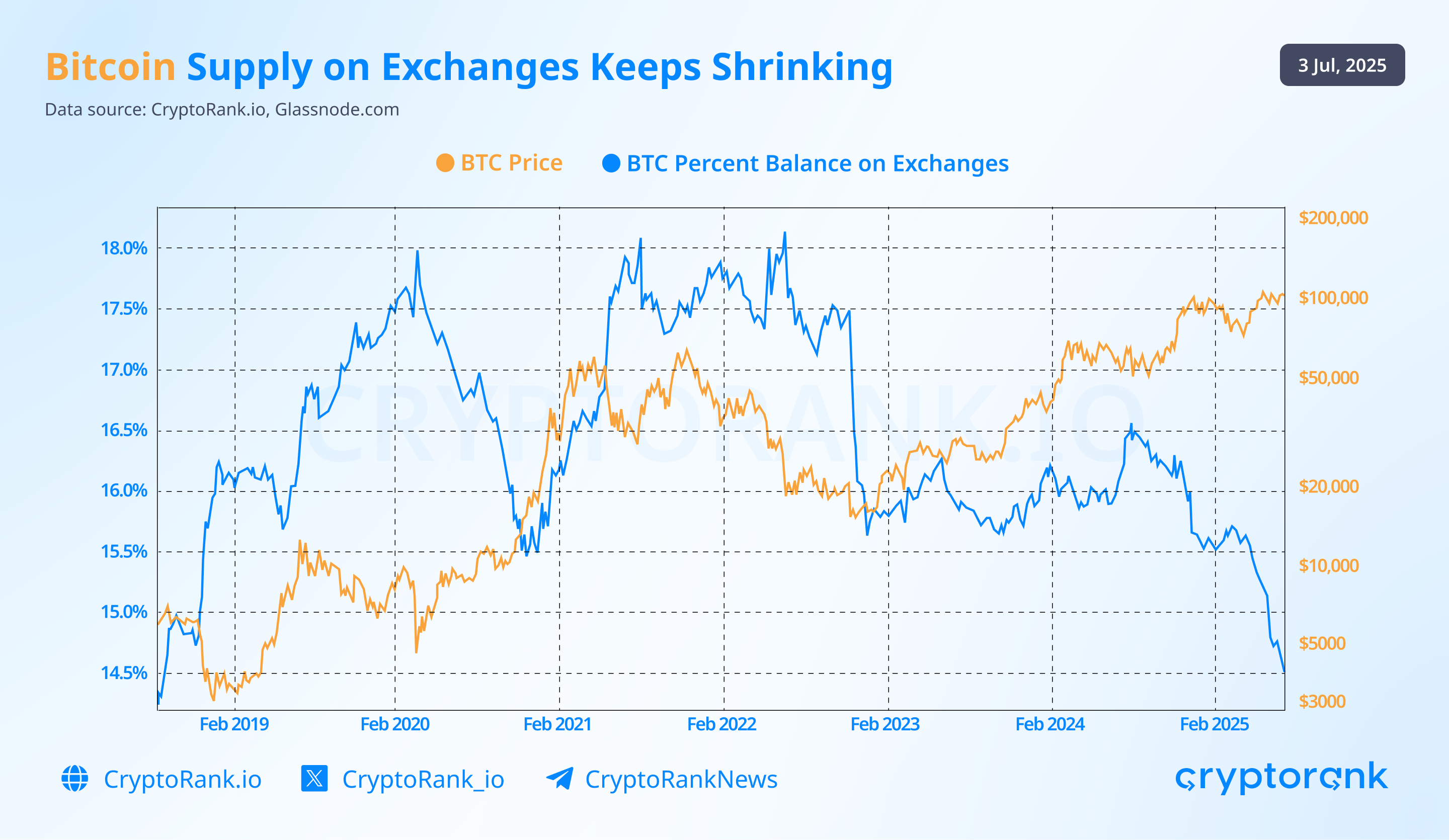

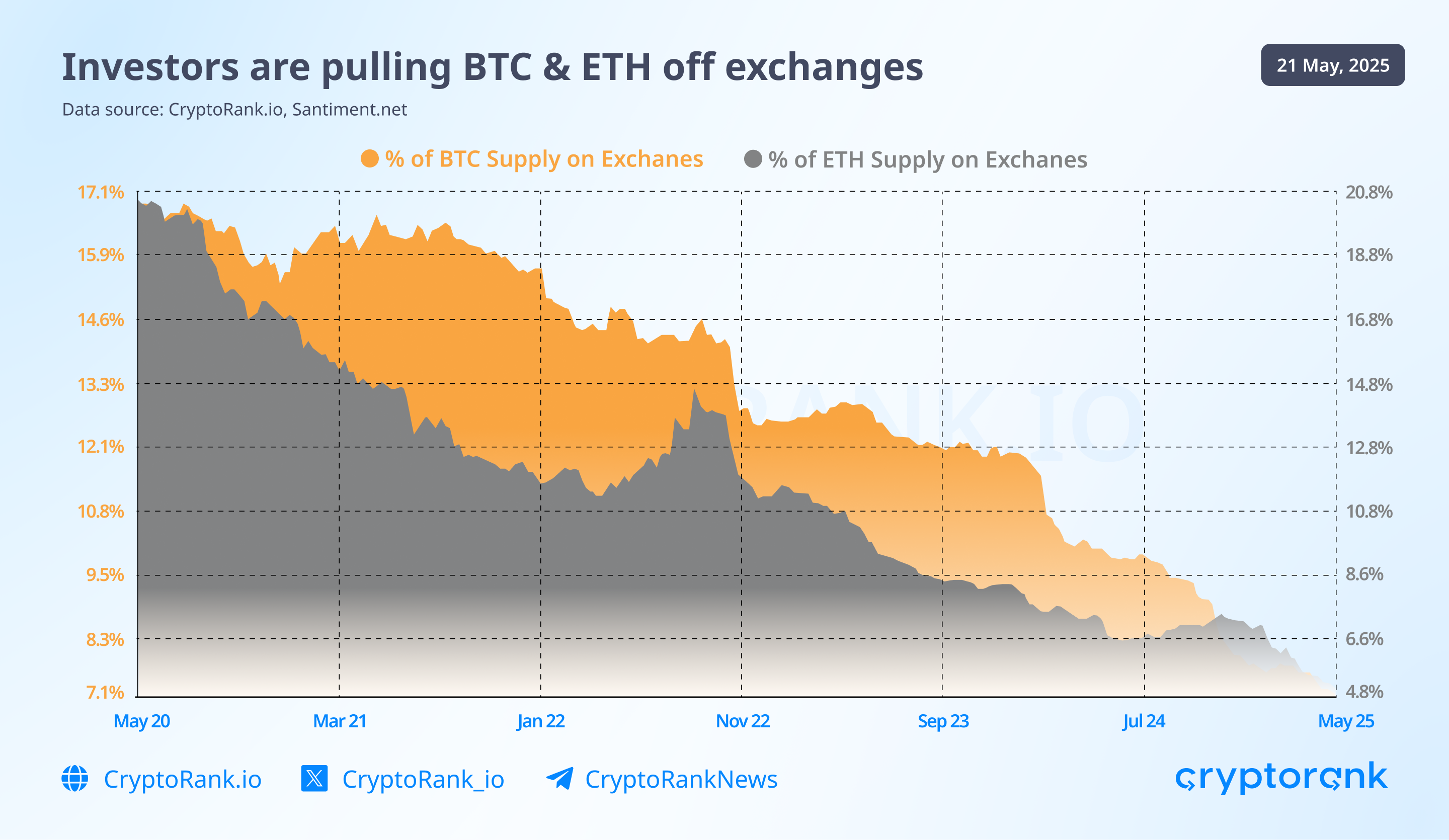

Another key indicator was the declining amount of Bitcoin held on centralized exchanges. This trend suggests a shift toward long-term holding and away from short-term speculation. It’s driven by multiple factors, including increased ETF custody, growing demand from institutions and retail investors alike, and the rise of Bitcoin DeFi—new protocols allowing BTC to be used outside of centralized platforms.

Taken together, these developments show a maturing market with growing long-term conviction. From macro trends and money supply signals to institutional flows and on-chain behavior, Q2 2025 was packed with bullish signals for Bitcoin.

To stay ahead of the curve, follow us on social media and keep reading our market recaps.

Ethereum

Q2 2025 marked the first time in a while that Ethereum outperformed Bitcoin in terms of price gains—a notable shift driven by several key developments.

Data obtained by API

1. Key Technical Rebound

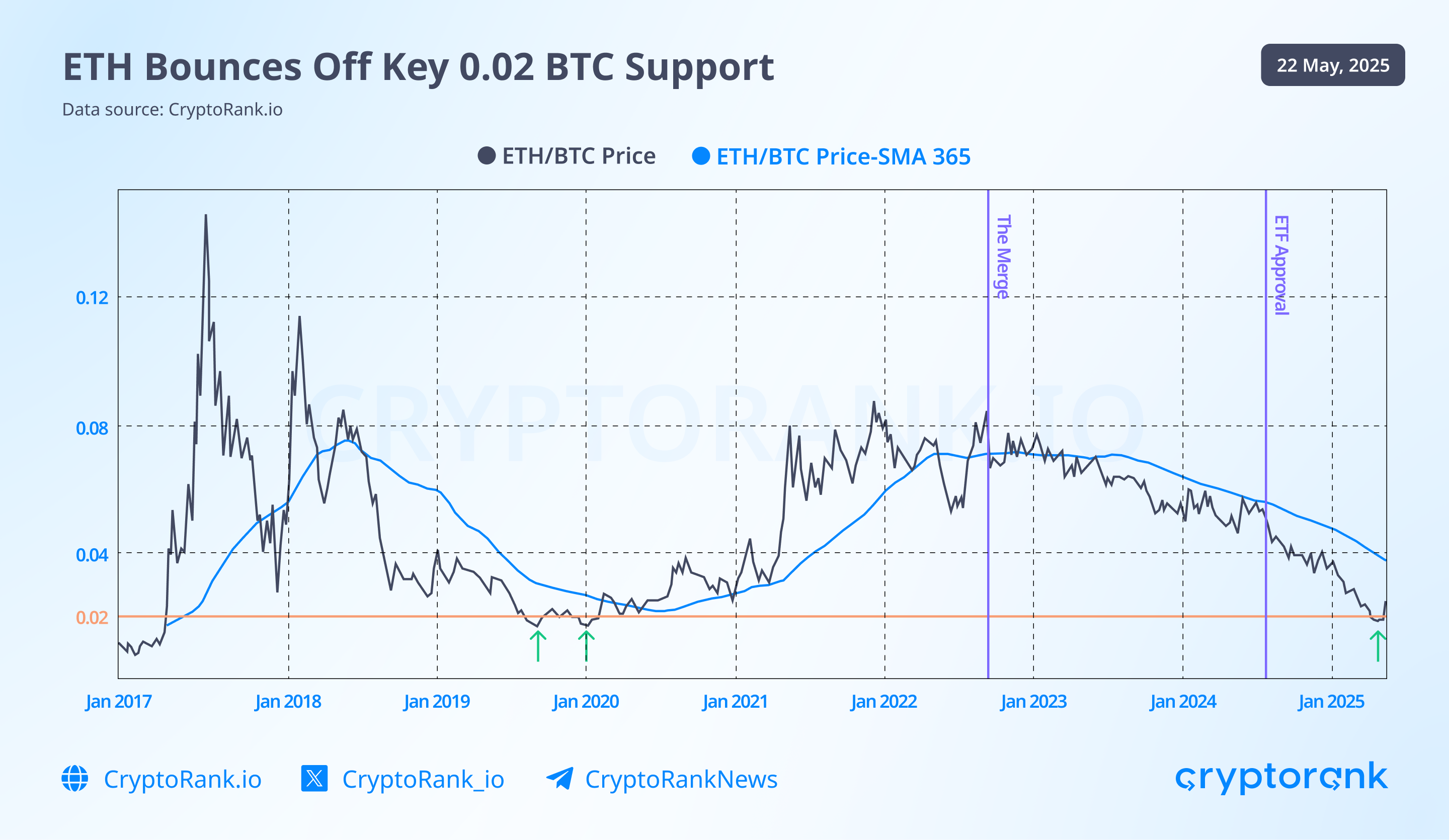

Ethereum reached a major support level at around 0.02 BTC per ETH, a historical floor that has acted as strong support multiple times in the past. The price bounced off this level, triggering renewed investor interest and bullish momentum.

Data source: CryptoRank API

2. The Pectra Upgrade

The most important technical catalyst this quarter was the Pectra upgrade, Ethereum’s most significant improvement since its transition to Proof-of-Stake. Activated on May 7, 2025, Pectra bundled 11 Ethereum Improvement Proposals (EIPs) aimed at boosting scalability, security, and user experience. We covered these changes in detail in our previous recap, and market participants clearly took note—Ethereum’s price reacted positively following the upgrade.

3. Rising Institutional Adoption

Institutional interest in Ethereum is on the rise, especially in the context of DeFi and RWA. Ethereum continues to serve as the backbone for tokenized financial infrastructure, making it increasingly attractive to professional investors.

On-chain data also pointed to sustained accumulation and confidence.

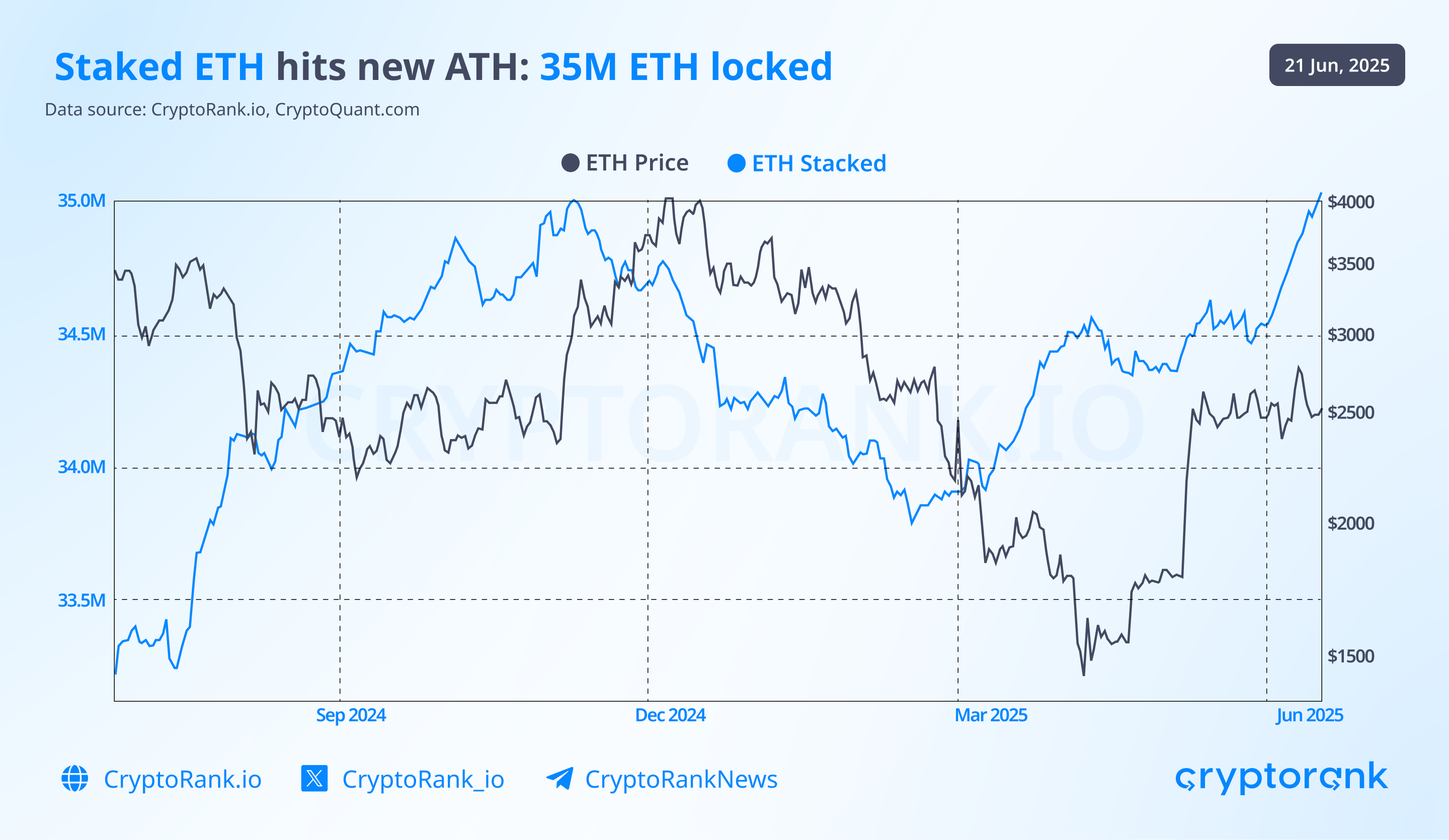

Over 30% of ETH supply is now locked in staking contracts, reducing liquid supply and showing long-term conviction among holders.

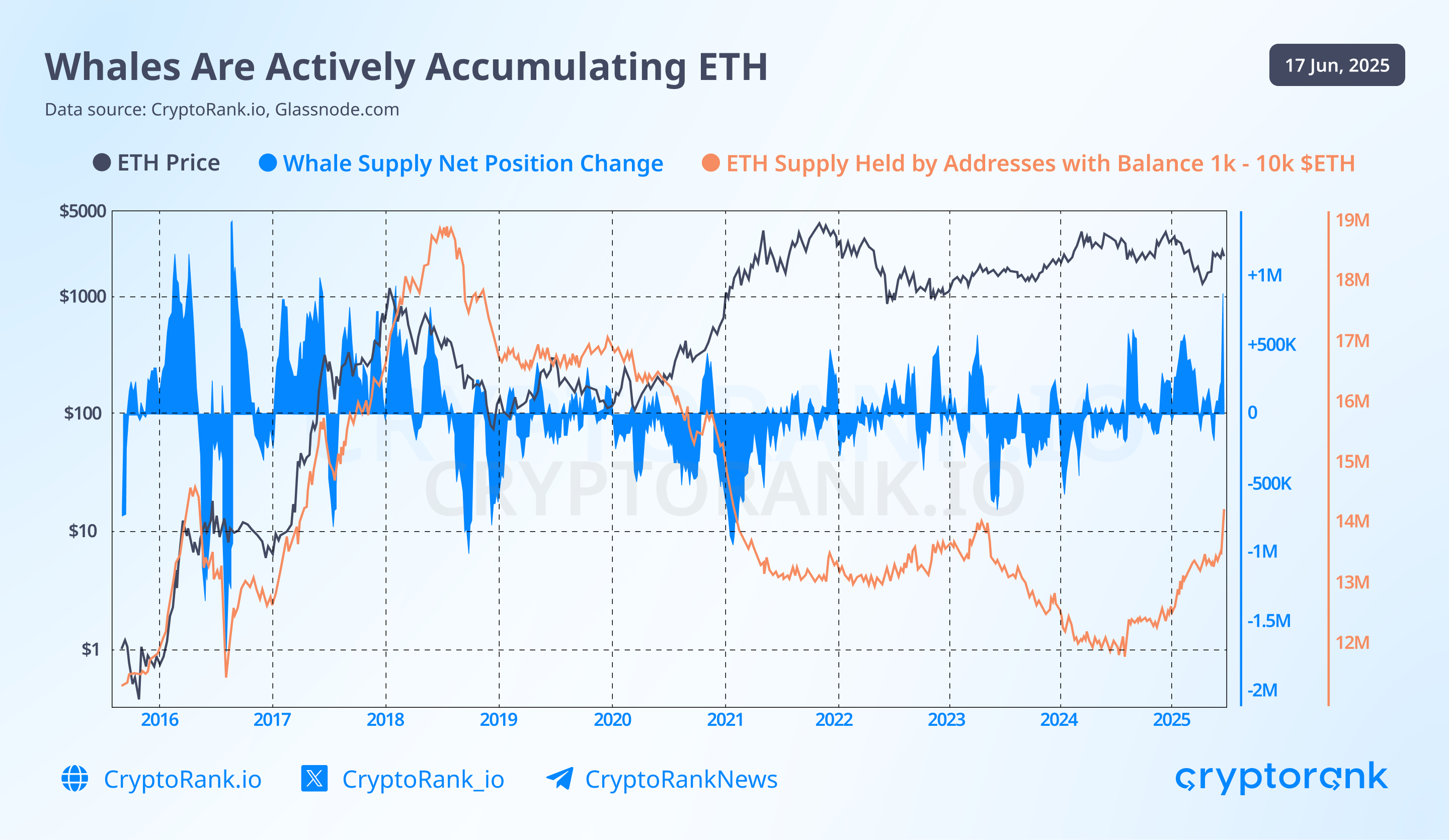

Whales have been actively accumulating ETH, a trend we’ve consistently highlighted on our social channels.

The amount of ETH on centralized exchanges continues to decline, mirroring the trend observed with Bitcoin—another sign that investors prefer holding or deploying their ETH rather than trading it.

In summary, Ethereum’s strong Q2 performance was fueled by a confluence of technical, institutional, and on-chain factors. From the Pectra upgrade to whale accumulation and the ongoing shift toward staking and DeFi, the momentum behind Ethereum continues to build.

Altcoins and crypto-native trends

DEXs: PancakeSwap’s comeback, DEX-to-CEX trade volume peak

In June, DEX-to-CEX spot trade volume hit a record 29.65%, marking nearly 150% QoQ growth. This surge was driven by broader token variety, early and faster listings, better DEX accessibility and efficiency, and growing user preference for decentralization.

Q2 2025 set a new record for DEX spot volume at $922B. PancakeSwap led the rally with a stunning jump from $59B in Q1 to $411B in Q2. Uniswap came second with $156B, down over 20% QoQ. Raydium, the previous leader, dropped over 50% to third place, mainly due to slowing memecoin activity on Solana and the launch of PumpSwap.

Interestingly, despite volume growth, DEX user activity declined 25% QoQ, from 76.7M to 57.8M in monthly average users. Raydium still led in users with 27M monthly, even after a 45% drop. Uniswap followed with 19M, and PancakeSwap with 3M.

Lending: TVL record, Active loans ATH, Aave v4

Q2 2025 was a strong quarter for DeFi lending. Total TVL across lending protocols hit $90B (including borrows and staking), with Aave maintaining its lead at $42.5B, nearly half the market. Morpho had a strong 45% QoQ TVL growth, climbing from $4.5B to $7B as it scaled on Ethereum and expanded to new chains, such as Unichain, Hyperliquid, and World Chain.

Active loans reached an all-time high of $25B in June. Aave led with $16.3B, followed by Morpho ($2.2B), Spark ($1.6B), Maple ($1.05B), and Compound ($1B).

Stanislav Kulechov recently announced a new version of the protocol, Aave v4. New features will include:

-

Unified liquidity layer: streamlines liquidity across all pools and chains, making capital more efficient and enabling seamless cross-chain loans

-

Dynamic interest rates: automated, real-time interest rate adjustments based on market conditions, powered by Chainlink oracles

-

Enhanced GHO stablecoin integration: Improved support and new features for Aave’s native stablecoin (GHO), including better liquidation mechanisms and interest-earning capabilities

-

New Modular Architecture: boosts scalability, reduces governance overhead while minimizing the impact on third-party integrators

-

Liquidity premiums

-

Smarter risk configuration

-

New liquidation engine

-

Automated treasury management and assets onboarding

Stablecoins Go Mainstream

Stablecoins played a bigger role in Q2, largely thanks to growing regulatory clarity. The U.S. Senate passed the GENIUS Act, the first federal framework for dollar-backed stablecoins, creating a regulatory ground for private companies to issue their own, with approval from the Treasury.

The GENIUS Act is now moving to the House of Representatives, which has its own version of a stablecoin bill, the STABLE Act. The big question is whether the House will push forward with its own bill, reconcile it with the Senate’s version, or simply adopt the GENIUS Act as is. Either way, a regulated stablecoin market is now closer than ever.

Another milestone for the stablecoin sector was the Circle’s IPO, the issuer of USDC. Starting with the initial valuation at around $7B, the CRCL saw a strong post-IPO surge, and its current market cap is standing at $47B. Following its successful listing, Circle announced plans to apply for a U.S. national trust bank license, aiming to further solidify its role in the regulated digital finance sector.

Regulatory progress was the key driver behind the stablecoin sector’s growth in Q2. The total market cap crossed $250B for the first time and now stands at $255B. USDT remains the dominant player, adding $14B last quarter and holding a 64.2% share ($159.1B). USDC follows with a 24.5% share, sitting at $60.6B.

Data obtained by API

Trump’s USD1 saw a sharp increase early in May, jumping from $136M to $2.1B in market cap and climbing to 7th place. The growth is caused by MGX’s two billion investment in Binance entirely in USD1 and the following Binance listing.

Ethereum remains the leading chain by stablecoin market cap, accounting for 51% ($128B). It is followed by TRON with a 32% share ($81B) and BNB Chain with 4.3% ($11B). Ethereum and TRON also lead in stablecoin volume, jointly accounting for over 50% of the market. As for Ethereum, it reached a new ATH in weekly stablecoin senders, 776K.

BNB Chain finished Q2 as the leader in stablecoin active addresses with 11.8M, a new ATH and 30% market share. It is followed by TRON and Polygon with 24% and 12.2% respectively. Q2 saw an impressive spike in stablecoin active addresses on Base, almost 300% QoQ, from 868K to 3.3M.

RWA: Tokenized finance takes off

RWA sector grew over 20% QoQ and 300$ YoY, so the total on-chain RWA value reached $24.6B (stablecoins not included). This explosive growth is driven by institutional adoption, with major players like BlackRock, JPMorgan, and Apollo moving from pilots to large-scale tokenization initiatives, particularly in private credit (now the largest RWA segment at $14.3 B) and US Treasury debt ($7.4B).

Integration with DeFi accelerated, as regulated frameworks and new protocols enabled RWAs to serve as collateral and yield-generating assets, unlocking secondary markets and yield amplification. Now, users can put RWAs to work on such platforms as Maker DAO, Morpho, Pendle, Apollo, etc.

Blackrock’s BUIDL is the largest tokenized RWA by market cap with $2.85B. It is followed by Ethena USDt ($1.46B), Ondo Finance($1.4), Paxos Gold ($0.9B), and Tether Gold ($0.8B).

Ethereum finished Q2 as the top RWA chain, demonstrating 50% QoQ growth and $7.5B RWA value. ZKsync Era $2.3B and Aptos $0.5B follow in the top 3, growing over 30% and 60% QoQ respectively.

Right at the transition from Q2 to Q3, xStocks launched tokenized versions of top U.S. stocks. Thus, tokenized shares like $AAPLX, $TSLAX, $METAX, $NVDAX, and others can now be traded on-chain on Solana and on centralized exchanges.

Data source: CryptoRank API

Major Q2 hacks: Mantra, Cetus

In April, Mantra lost over 90% of its value in under an hour erasing more than $5.5 billion in market capitalization. The collapse was triggered by a massive token movement, sparking widespread panic about insider dumping and possible market manipulation, with some community members speculating about a founder wallet hack. As panic selling ensued, stop-loss orders and leveraged liquidations cascaded, compounding the crash.

Cetus, the leading DEX on Sui, suffered a major exploit in late June when attackers manipulated its internal oracle pricing mechanism using spoof tokens. This allowed them to drain an estimated $230 million from multiple liquidity pools, affecting over 60K users. The incident triggered a 14% drop in the price of SUI. In response, Sui validators froze around $162 million of the stolen assets and approved a 90.9% governance vote to transfer them into a multisig recovery wallet.

In the weeks that followed, Cetus patched the vulnerability and secured a $30 million loan from the Sui Foundation, alongside $7 million from its own treasury, to support user reimbursement. The protocol resumed operations two weeks after the hack, with most affected pools replenished.

Memecoins: BNB Chain captures activity, Pump fun’s revenue decreases

In terms of trading volume, memecoins accounted for a significant share of DEX activity on Solana. However, total Solana DEX volume dropped sharply compared to Q1, from $232B to $423B. Raydium experienced the strongest drop, caused by the launch of PumpSwap. Though, Raydium started getting more traction again at the end of Q2 thanks to LetsBonk launchpad using Raydium SDK.

PumpSwap trading volume steadily grew throughout Q2, while other Pump fun core metrics like active users, token deployments and graduates remained largely in line with Q1. However, the platform’s revenue saw a sharp 47% decline, dropping from $256M to $137M. This dip was driven by increased competition from other platforms (LetsBonk, LaunchLabs) and a surge in memecoin activity on alternative chains, particularly BNB Chain and Base.

In Q2 2025, the memecoin sector on BNB Chain surged in both user activity and trading volume. Key reasons involve Binance Labs’ $4.4 million Meme Liquidity Program, influencer-backed launches and regional hype, particularly from Southeast Asia. Daily active addresses on BNB soared by over 140%, with memecoins like Tutorial (TUT), and Broccoli driving this growth. Also, weekly DEX volumes on BNB Chain peaked at $44B. Meanwhile, Base emerged as a vibrant memecoin hub, with top tokens such as Brett, Toshi, and Degen leading the rally..

Toward the end of Q2, Pump fun faced a serious competition for the first time ever. As of July 7, LetsBonk had taken the lead across several key metrics, including daily token deployments, graduates, trading volume, and fees. Interestingly, Pump fun announced a $PUMP token sale just a few days after LetsBonk took over the trenches. A token launch may help Pump fun grab attention back as competition between platforms becomes more serious.

InfoFi Takes Over Crypto Twitter: Kaito, Cookie3, Galxe

The InfoFi sector continued its strong rise in Q2, driven by institutional backing and growing user adoption. The main sector’s growth driver is Kaito, an AI-powered platform that aggregates various crypto data sources and offers “Yaps” rewards for high-quality social insights.

Launched in February 2025, the KAITO token experienced strong post-airdrop demand, with prices surging nearly 50% and a market cap exceeding $400M, now stabilizing at around $360M. Throughout Q2, $KAITO maintained a bullish trend, supported by exchange listings, growing adoption, and the success of its “Yaps” engagement program.

Galxe is evolving from a questing platform into a comprehensive Web3 intelligence solution. Its Starboard allows projects to track both social media dynamics and on-chain metrics in real time. Teams can better understand where traction is coming from and reward high-impact contributors with greater precision. Users can earn by posting on social media and completing on-chain actions, making participation more meaningful.

Cookie3 is another big player in this category. They launched Snaps InfoFi platform in May, attracting over 25,000 creators within 24 hours. Cookie’s Spark/Snaps model emphasizes a decentralized reward structure where creators earn for curation and engagement. This distinguishes it from Kaito’s more structured Yaps tokenomics. This Snaps launch boosted the $COOKIE market cap by 100% in the following 7 days, pushing it over $300M; however, it has since been steadily declining. Among other InfoFi players, it is worth noticing such projects as Yapyo, Ethos Network, GiveRep, Wallchain, and others.

The biggest InfoFi case in Q2 was around the $LOUD token. Within the campaign, people had to post content about $LOUD on X, earning Kaito’s Yaps. The hype was real, because the top 1000 yappers were allowed to participate in $LOUD IAO at attractive conditions: 0.2 SOL contribution on $155K FDV. In addition, everyone with 10+ so-called “smart followers” on Kaito could also participate in the token sale.

Crypto Twitter went “Loudio” mode, and for a few days, $LOUD had over 70% mindshare across all crypto projects tracked on Kaito. Contrary to expectations, the token’s post-TGE performance was not that impressive. $LOUD hit $25M market cap within an hour after launch and has been only declining since. The token’s market cap is $364K at the time of writing, with only $15K in 24-hour volume.

Conclusion

We’re witnessing a seismic shift in the crypto market, driven by a changing regulatory landscape and growing institutional adoption. As the space becomes more regulated and mature, high-quality projects with real-world use cases are beginning to take the lead. Projects that can generate revenue and build engaged user bases are gaining traction, signaling a move toward a more sustainable and utility-driven market. In many ways, the crypto ecosystem is starting to resemble the traditional startup world — where fundamentals matter and market efficiency is on the rise.