Crypto Market Recap: May 2025

Macro Overview

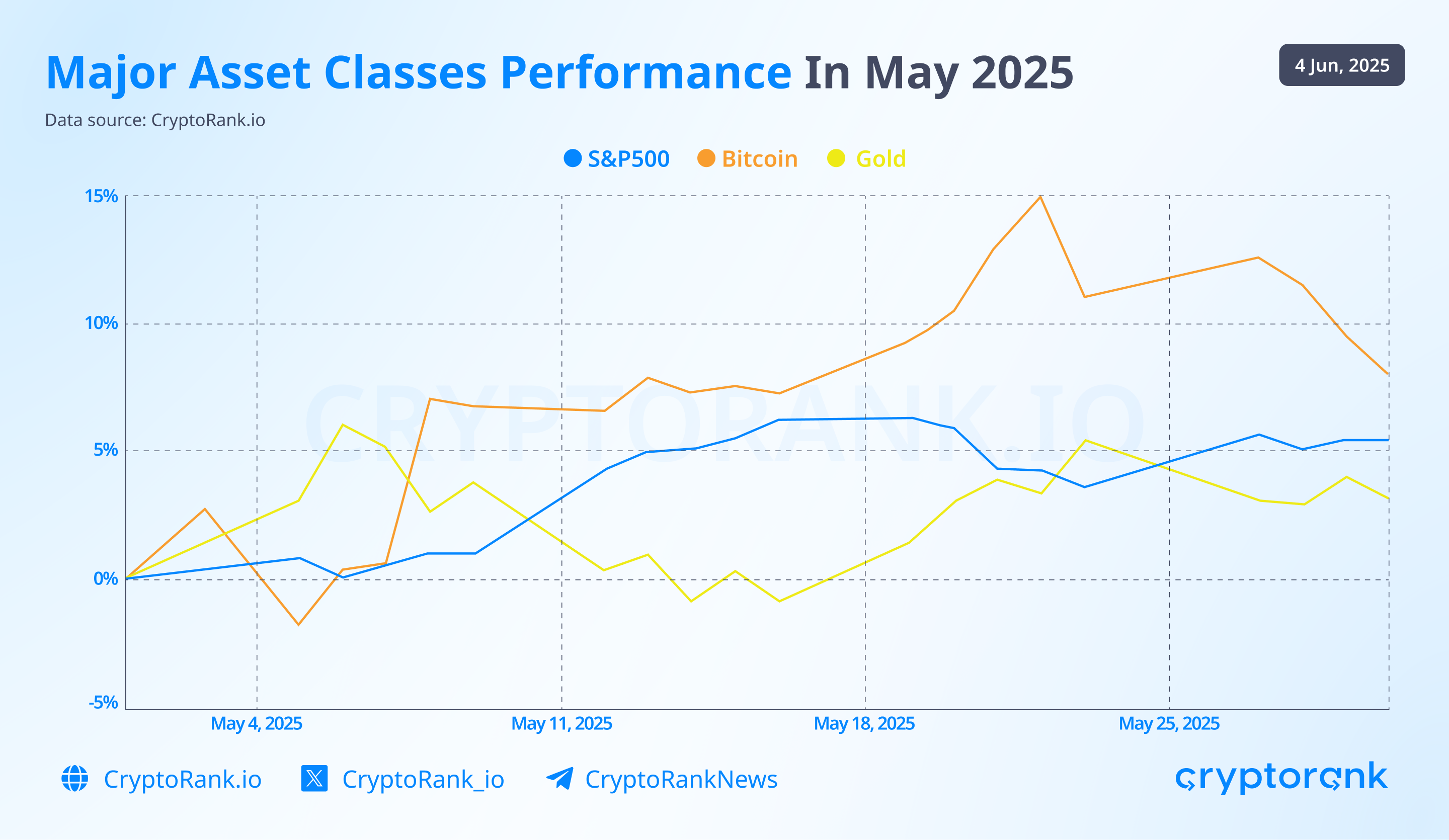

Market participants' outlook on the macro environment has notably improved compared to April. This shift was driven by the U.S. stepping back from its previously aggressive tariff agenda in favor of a more moderate approach, largely due to growing concerns over a potential recession and a weakening stock market. The move reassured investors that the U.S. administration is mindful of the importance of the S&P 500 and is reluctant to allow a significant decline in the index. As a result, the S&P 500 continued its upward trend from April, recovering losses from the first quarter.

However, the U.S. government remains committed to tightening its trade policy. It has extended tariffs on Chinese imports and introduced new 50% tariffs on European goods. This strategy is partially driven by the Trump administration’s intent to implement tax cuts, which will reduce government revenue and require compensation through other means—namely, increased tariffs. Therefore, it's unlikely that the administration will fully retreat from its protectionist stance.

Despite the improved short-term sentiment, broader market uncertainty persists. Trade tensions, the rising U.S. national debt, and ongoing geopolitical conflicts all contribute to a fragile global environment. This persistent uncertainty helps explain the concurrent rise in gold prices, as investors seek safe-haven assets.

Bitcoin remains correlated with the S&P 500 but continues to outperform it. This is largely due to growing institutional demand and a broader shift in perception: Bitcoin is increasingly being viewed not merely as a speculative asset but as a legitimate store of value in the face of macroeconomic volatility.

Bitcoin

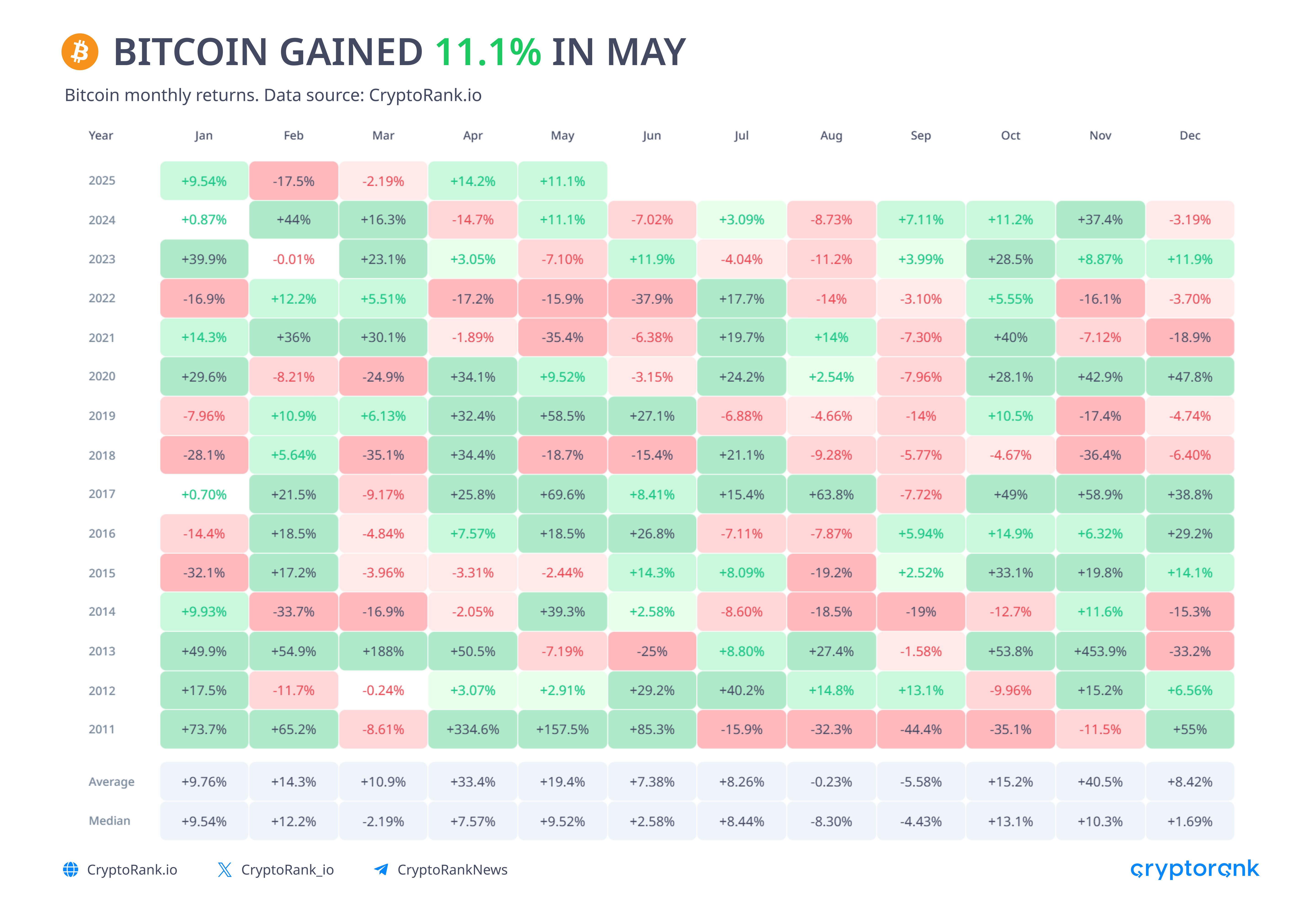

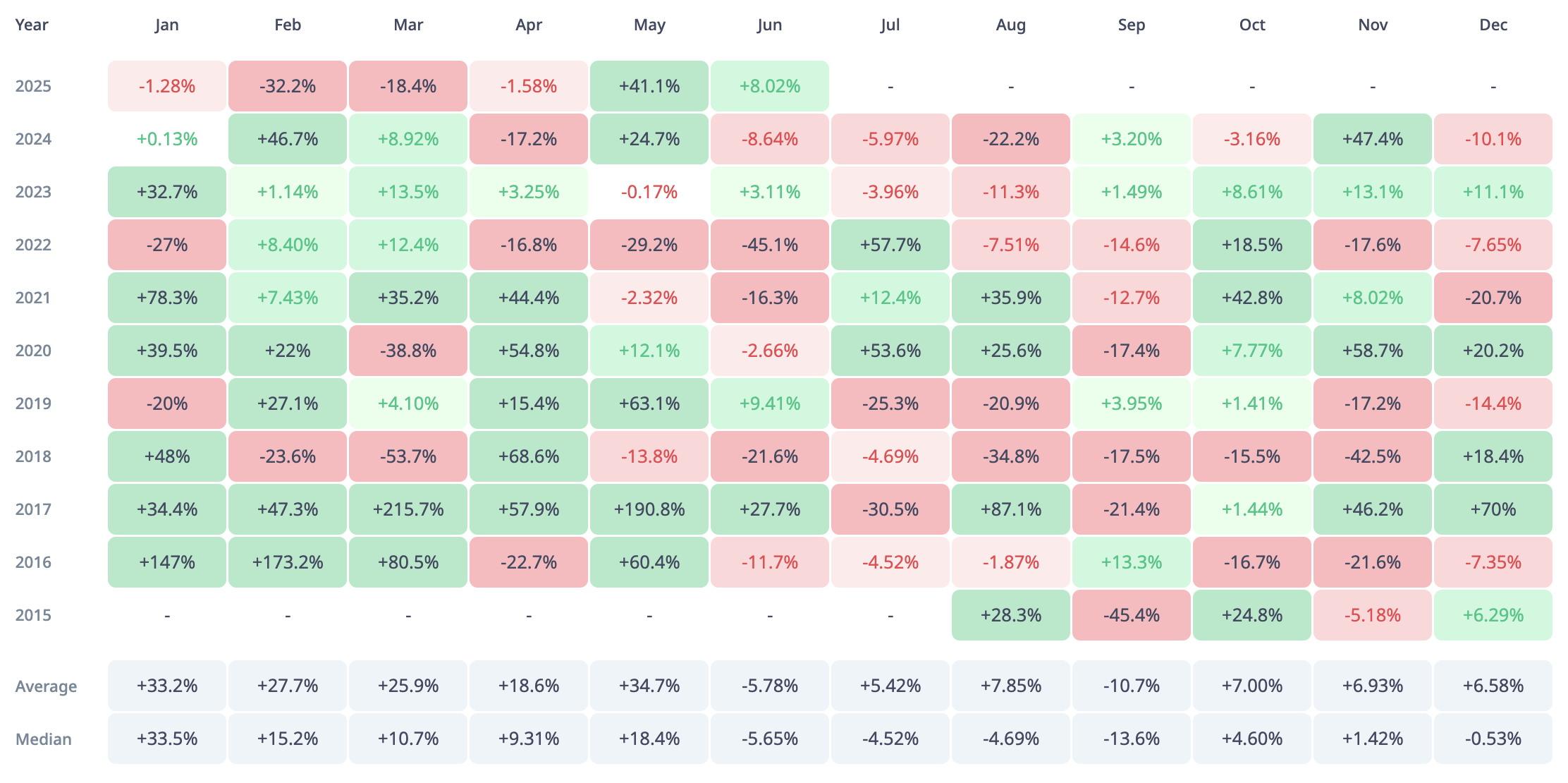

In May, Bitcoin rose by 11.1%, setting a new all-time high of $111,784 and surpassing its previous peak near $108,000. However, after breaking through this level, Bitcoin reversed and began a gradual decline. This price behavior suggests two key points:

-

The current bull trend lacks strong momentum.

-

Bitcoin is becoming a less volatile asset.

The first point is evidenced by Bitcoin’s failure to continue rallying after breaking its ATH — unlike in November, following the U.S. presidential election, when a strong pro-crypto narrative drove Bitcoin over 40% higher after breaching previous highs.

On the other hand, with Bitcoin’s market capitalization now exceeding $2 trillion, its volatility is naturally decreasing. As a result, Bitcoin’s price movements are starting to resemble those of traditional assets like the S&P 500 or gold, rather than the wild swings often seen in the crypto market. This reduced volatility means that sharp price surges will become increasingly rare, but so will steep declines. Indeed, Bitcoin has held up well since reaching its ATH, and the broader outlook remains favorable.

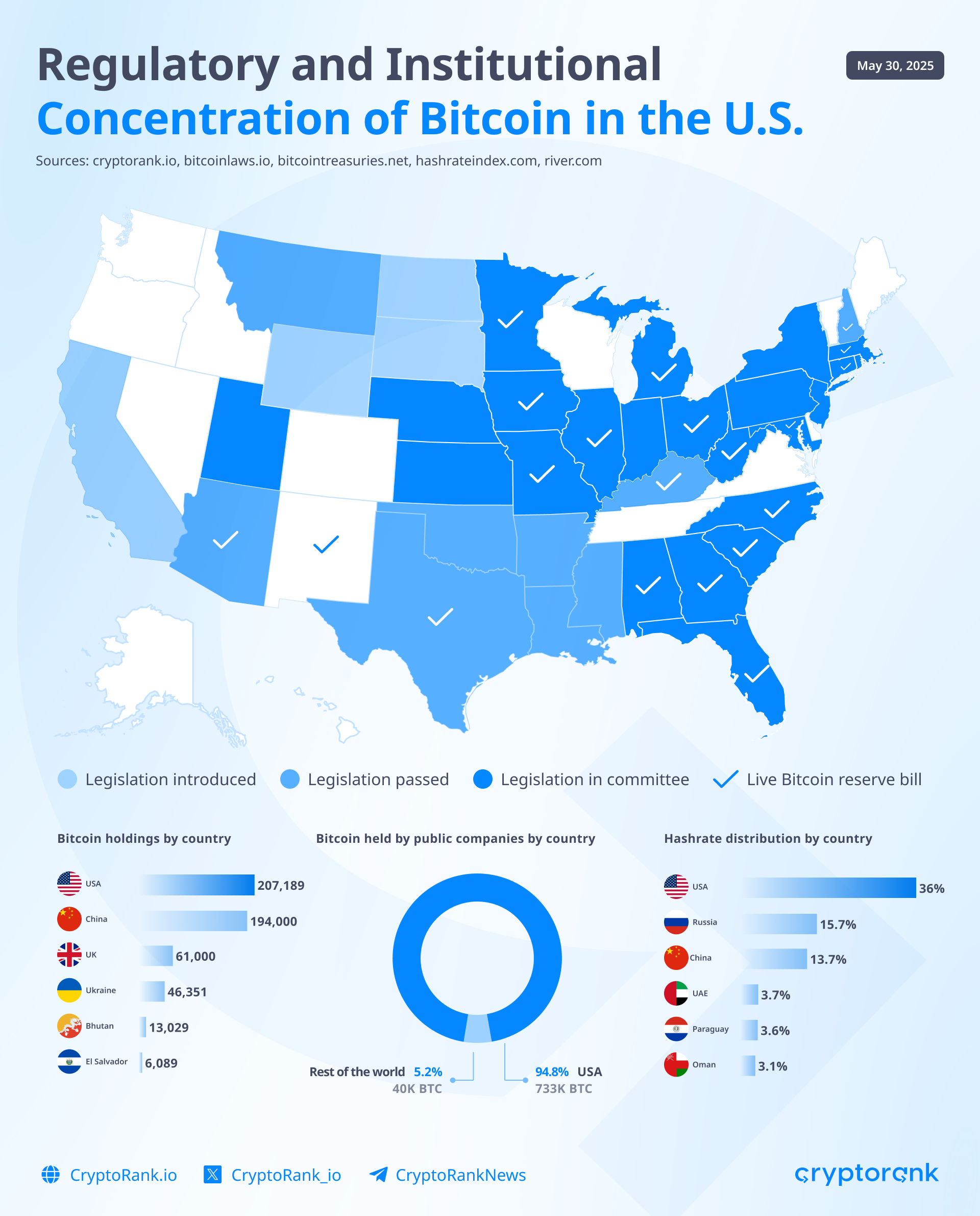

In the U.S., several states have proposed initiatives to create Bitcoin reserves. These developments are helping to shift the Overton window, making the idea of sovereign wealth funds or pension funds buying Bitcoin far more plausible than it seemed just a few years ago.

Among the largest holders of Bitcoin, institutional players, including national governments and major asset managers like BlackRock and Fidelity, are steadily increasing their share. In just over a year, BlackRock has gone from holding virtually no Bitcoin to becoming the second-largest holder, surpassed only by the legendary Satoshi Nakamoto (whose coins are considered lost).

This rapid rise in BlackRock’s holdings — along with other ETF providers — underscores the growing popularity of Bitcoin ETFs. For many institutional investors, ETFs are the most convenient, and often the only, way to gain exposure to Bitcoin. As institutional interest continues to grow, more BTC is being concentrated in the hands of large, regulated financial institutions.

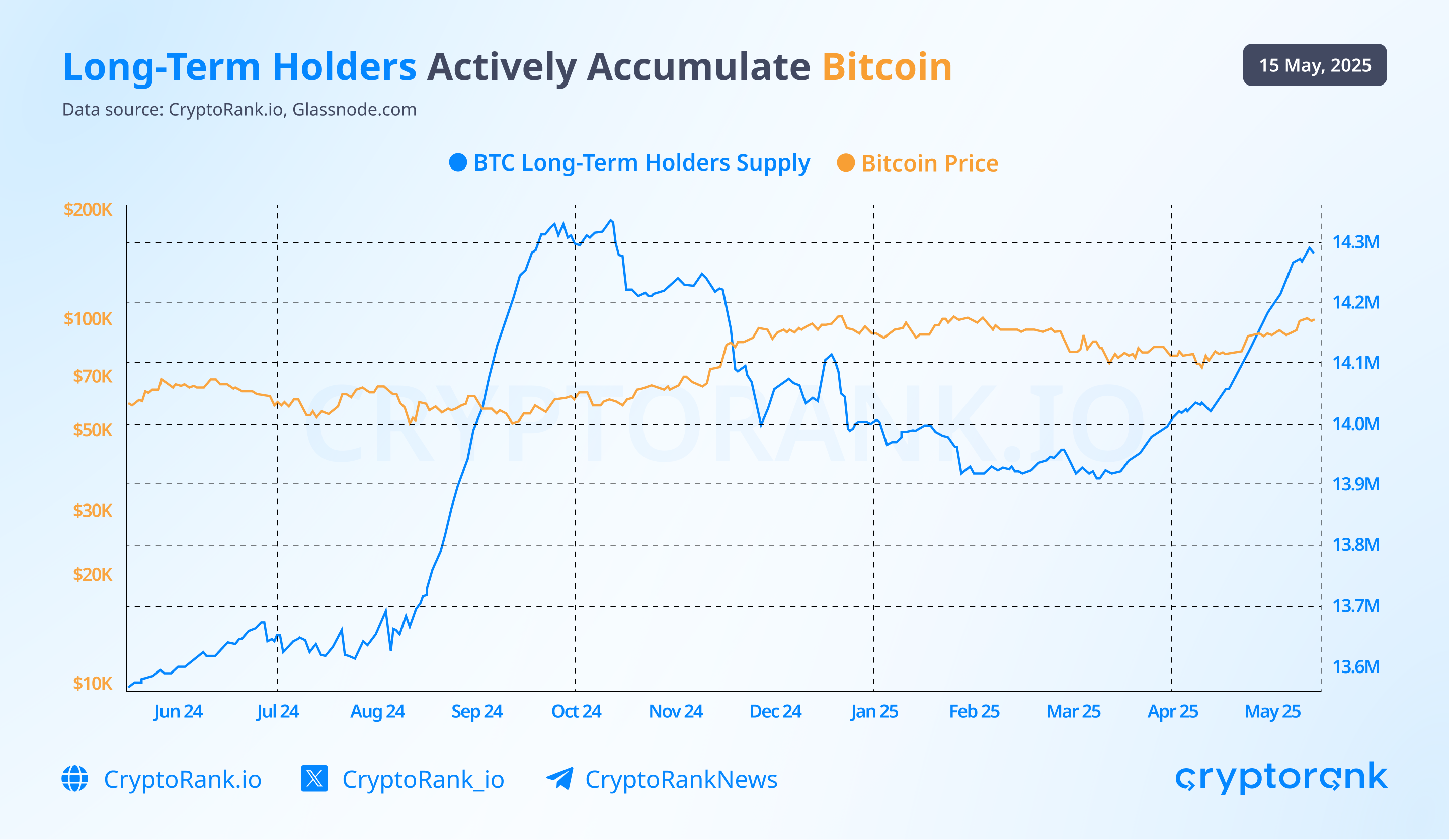

The Long-Term Holders (LTH) indicator shows that these investors have been actively accumulating Bitcoin since the end of March. The last major accumulation by this cohort occurred between August and October 2024 — a period of local lows just before the post-election rally following Donald Trump’s victory.

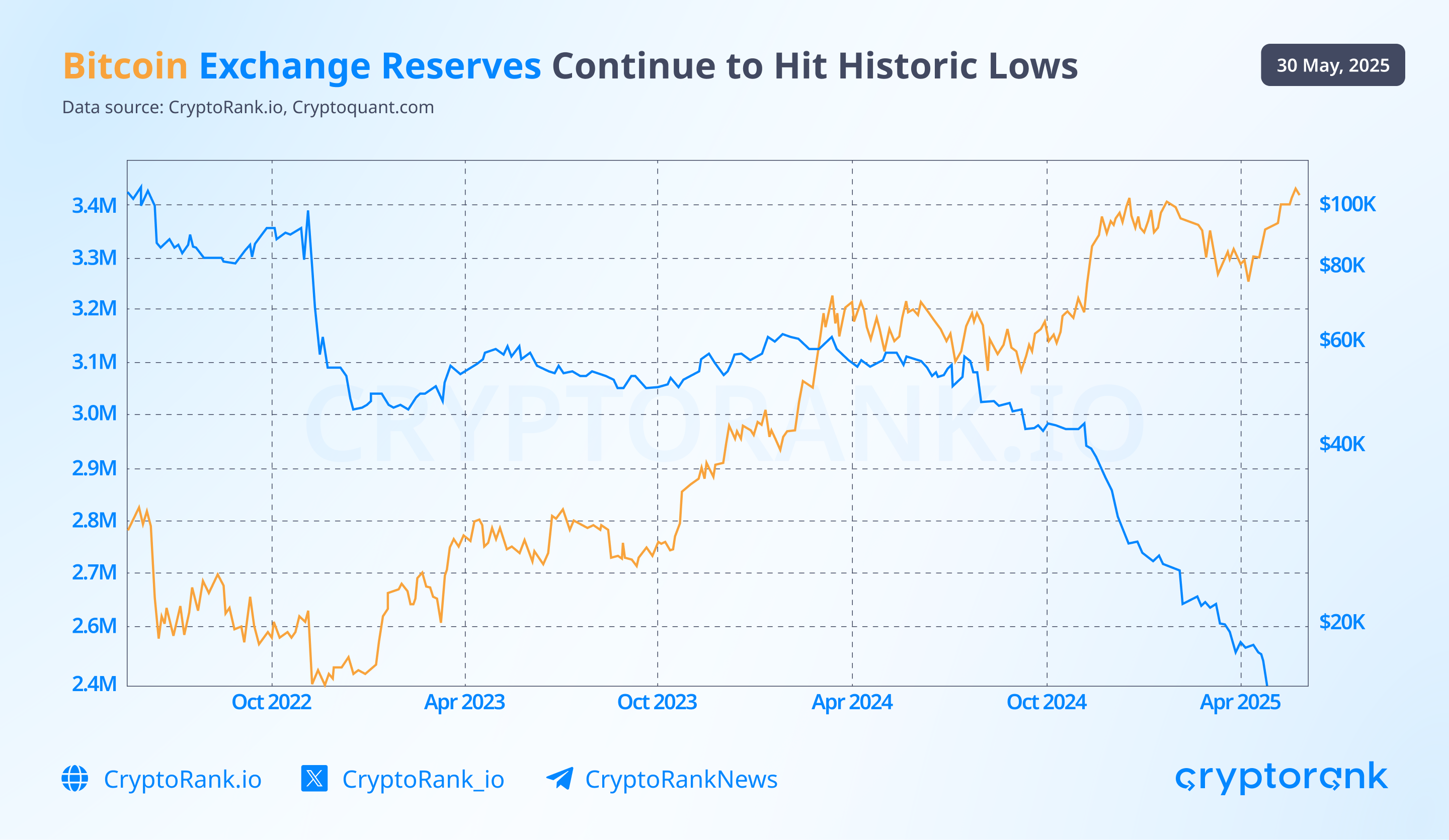

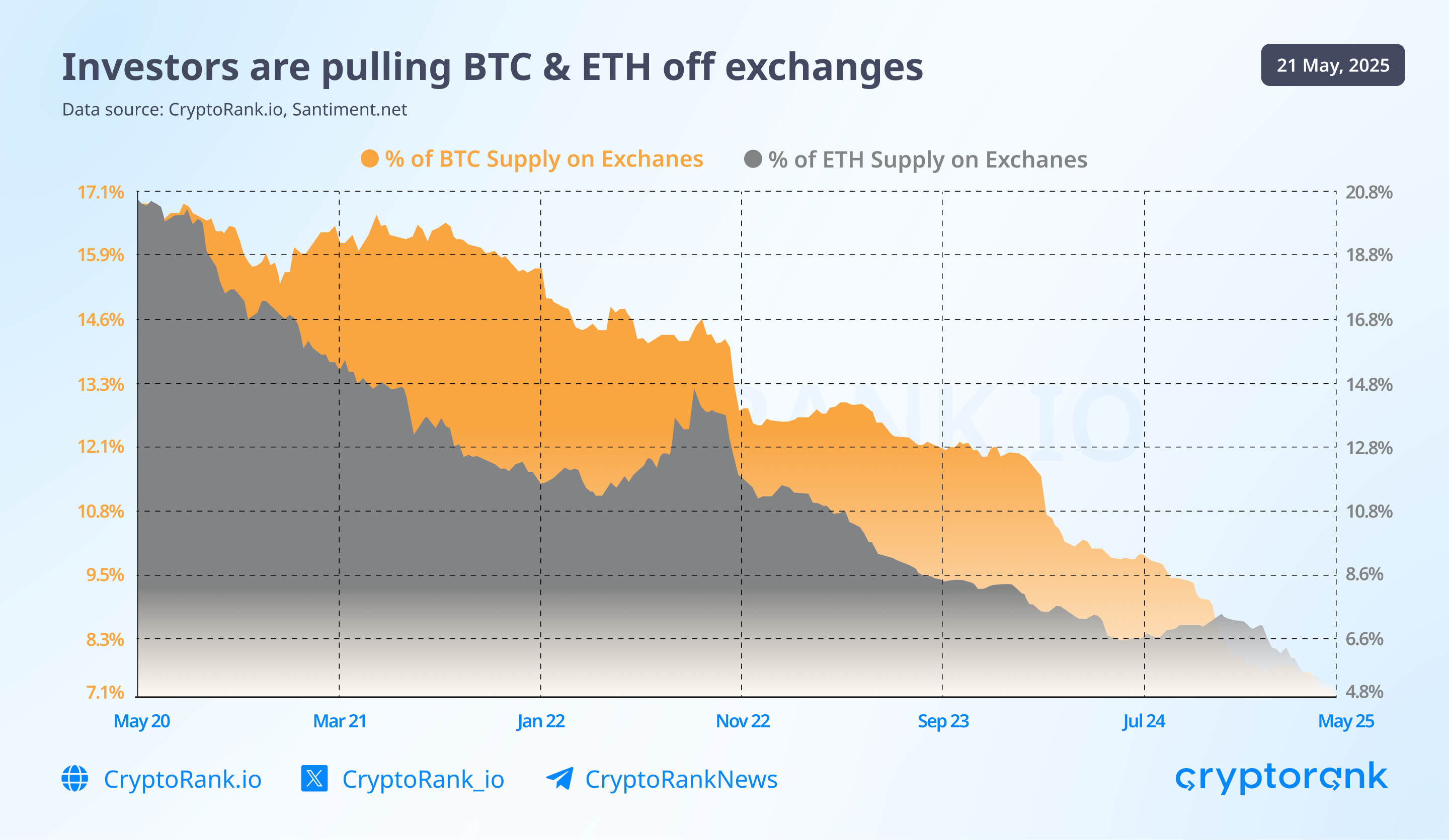

At the same time, Bitcoin continues to be withdrawn from centralized exchanges, another sign of growing interest from long-term holders. Historically, such outflows indicate accumulation, as investors move coins to cold storage rather than keeping them on trading platforms. This trend may also point to increased activity from whales and possibly even institutional or state-level buyers who prefer non-custodial storage to minimize centralized risk.

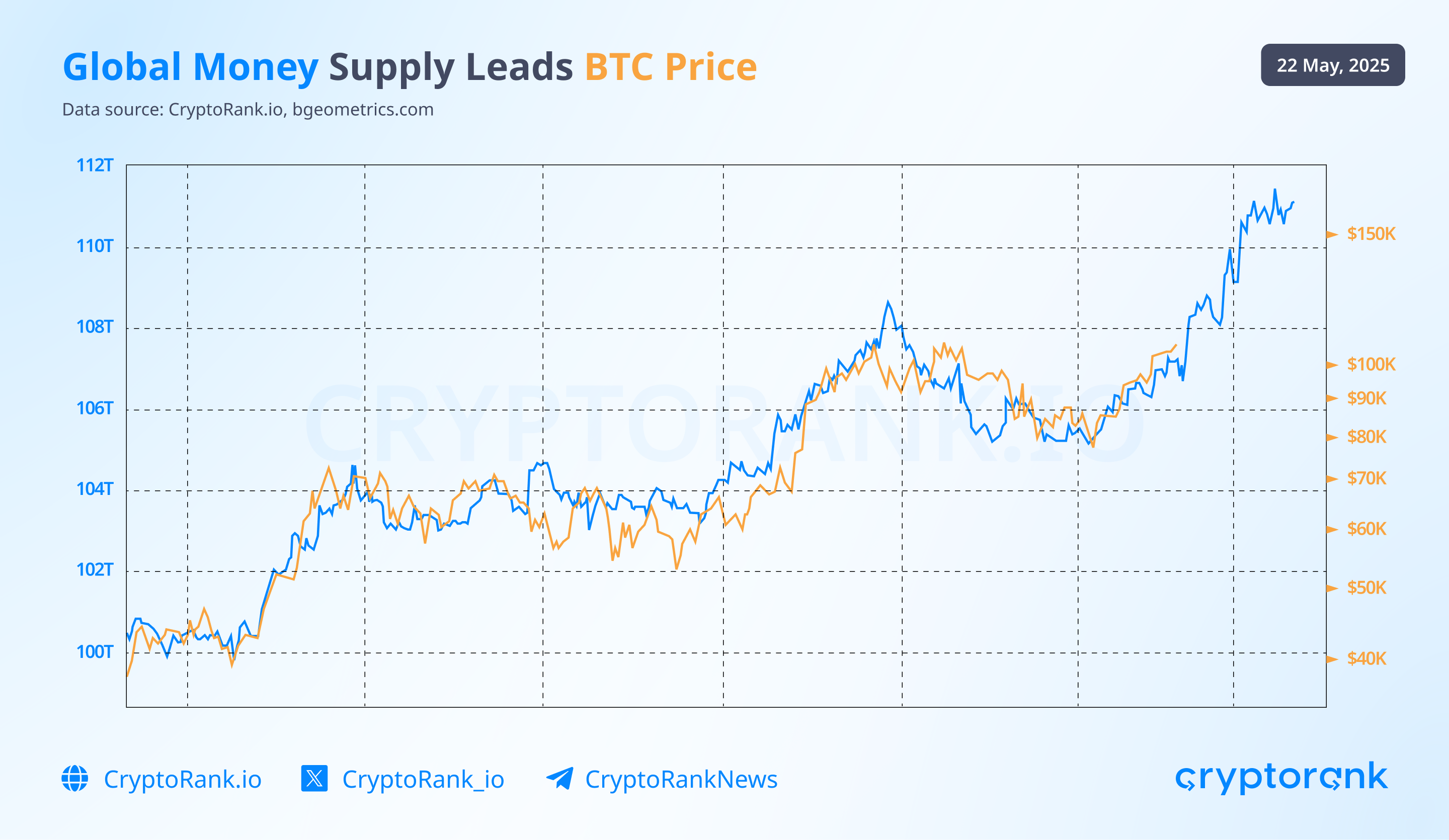

Now the fifth-largest asset by market capitalization globally, Bitcoin is showing a growing correlation with global M2 money supply. Historically, M2 has led BTC movements by about 10 weeks, and current projections suggest continued strength, adding another layer of support to the bullish long-term outlook.

Ethereum

May was a notably profitable month for Ethereum, showing impressive gains. However, this growth represents only a partial recovery from the asset's previous price declines. Unlike Bitcoin, which is trading near its all-time highs, ETH is still priced at nearly half of its former peak levels.

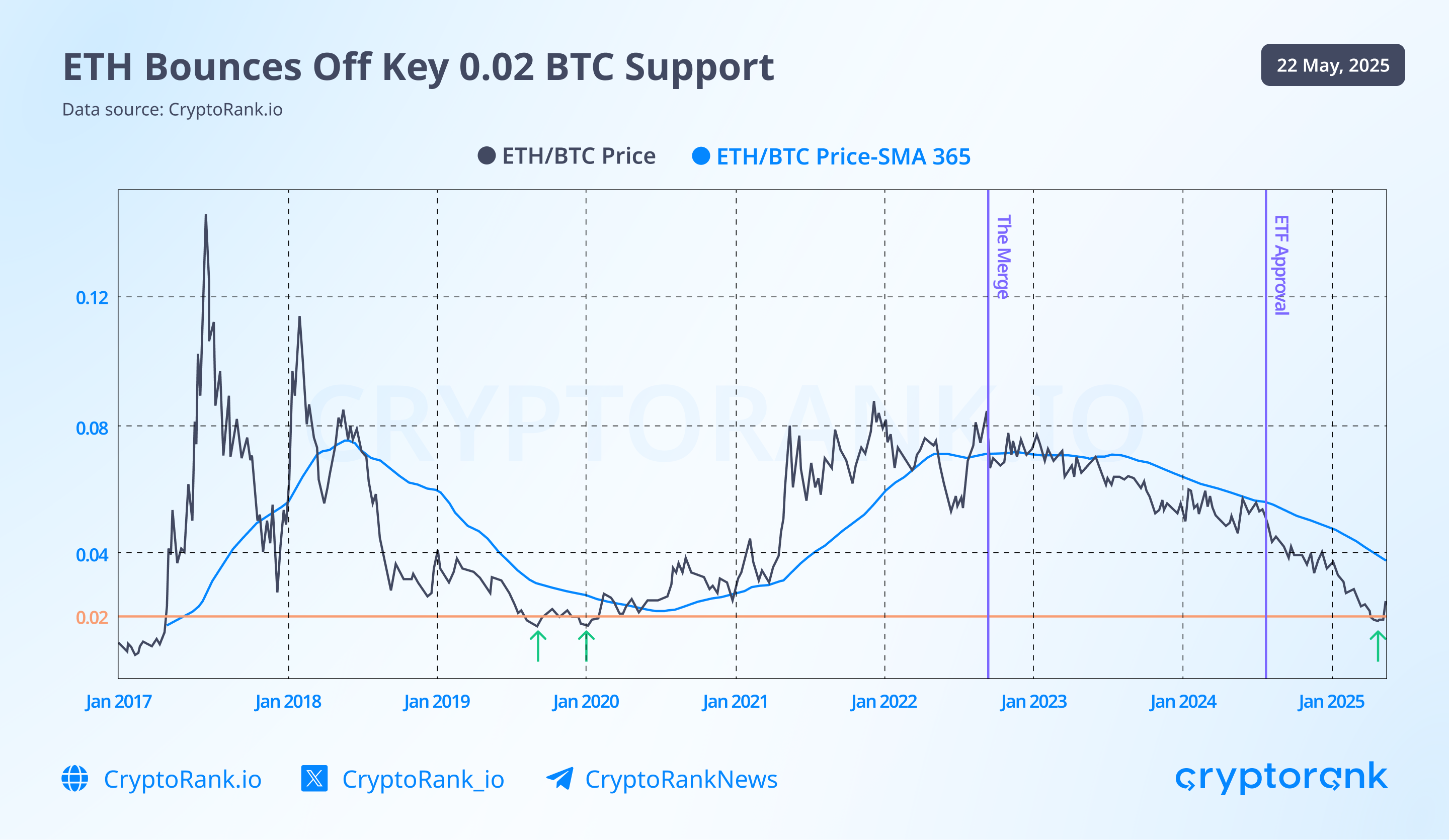

When priced in Bitcoin, the situation looks even less favorable for Ethereum. ETH is currently trading at a five-year low relative to BTC. However, a strong support zone appears to be forming around the 0.02 BTC level — a range that has consistently held up in the past, including during the recent price dip.

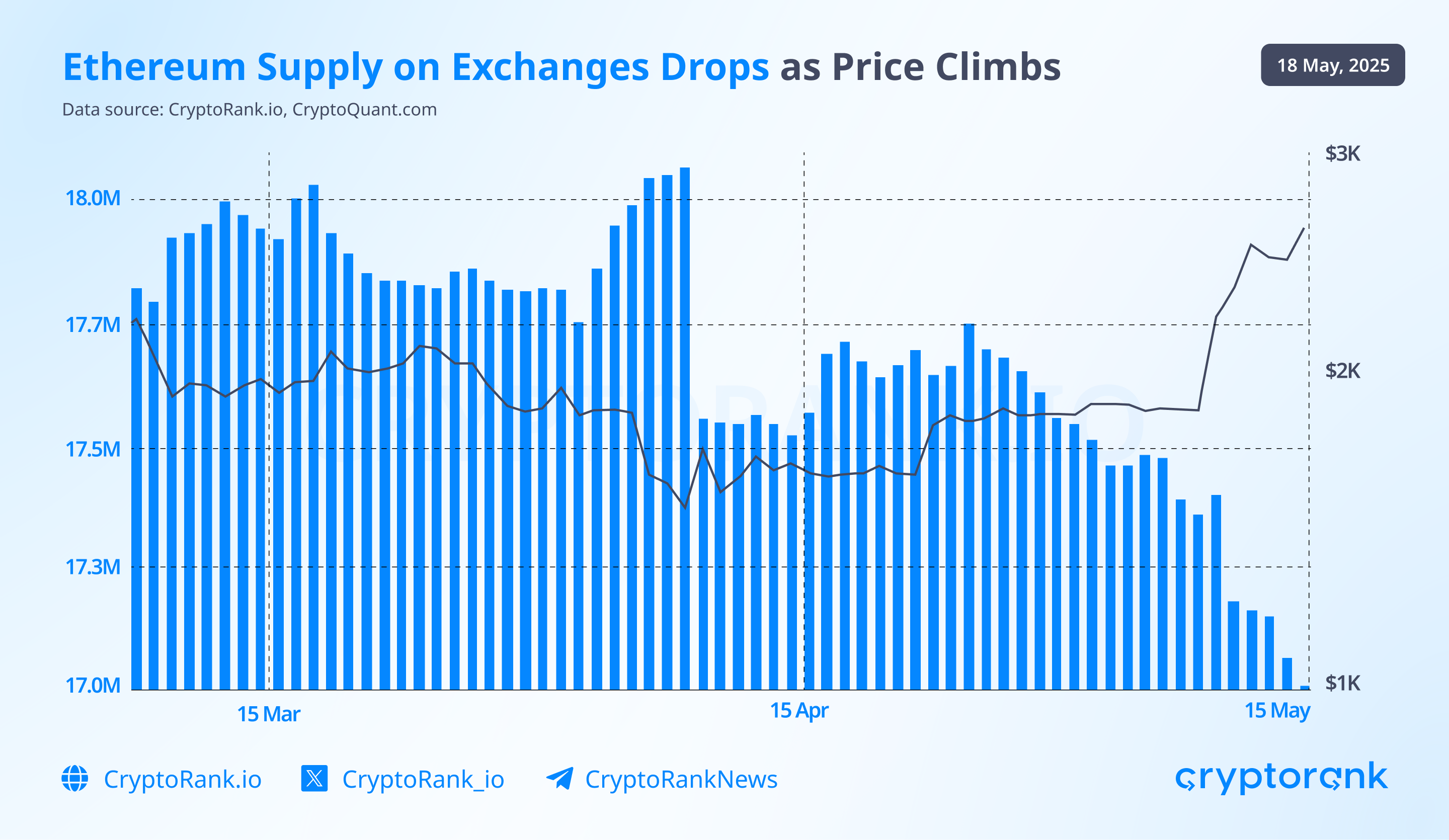

In recent weeks, Ethereum's price has started to rise, accompanied by a decline in ETH reserves on centralized exchanges. Over the past month, more than 1 million ETH have been withdrawn from these platforms — roughly 5.5% of the total ETH previously held there. This trend suggests growing investor preference for holding Ethereum rather than trading it.

Ethereum reserves on centralized exchanges continue to decline, similar to Bitcoin. However, Ethereum’s presence on exchanges is even lower — just 4.8% of its total supply, compared to 7.1% for Bitcoin. This difference reflects Ethereum’s broader utility in the DeFi ecosystem, where it is used more extensively than Bitcoin.

Ethereum Pectra Upgrade

In May, Ethereum underwent the Pectra upgrade — the most significant technical update since the network transitioned to the Proof-of-Stake consensus mechanism. Activated on May 7, 2025, Pectra introduced 11 Ethereum Improvement Proposals (EIPs) in one go. Following successful testing on Ethereum’s testnets (Holesky, Sepolia, and Hoodi), the upgrade is now live on the mainnet.

Although developers describe Pectra as a preparatory stage for upcoming major upgrades, it already brings substantial improvements: smarter wallets, more efficient validators, and faster, cheaper Layer 2 networks.

EIP-7702: Account Abstraction and Smart Wallets

One of the headline features of the Pectra upgrade is the implementation of account abstraction. This allows regular wallets (like MetaMask) to behave like smart contracts. In practice, this gives users far more flexibility: for instance, applications can now accept gas fees in tokens other than ETH — such as USDT. Previously, you needed ETH in your wallet to execute a USDT transfer. Now, you can pay fees directly with your USDT balance.

Additionally, multiple actions can be bundled into a single transaction — such as approval, token swap, and transfer. This streamlines the DeFi experience by saving time, reducing fees, and simplifying interactions.

It also unlocks features familiar to Web2 users: Face ID authentication instead of passwords, social recovery mechanisms, and more intuitive wallet experiences. The ultimate goal is to bring Web3 usability closer to mainstream expectations.

EIP-7251: Efficient Staking for Large Validators

Previously, a single Ethereum validator could stake up to 32 ETH. Anything beyond that required splitting the stake into multiple validators, each with its own keys and infrastructure. With EIP-7251, the cap has increased to 2048 ETH per validator.

Why does this matter? Imagine a platform staking 3,200 ETH — under the old limit, it would need to run 100 separate validators. Now, it only needs two. This reduces operational complexity, lowers infrastructure costs, and eases network load.

While this may seem irrelevant to retail users, it significantly boosts efficiency for large players — exchanges, staking services, and DeFi platforms. With better capital management and fewer technical hurdles, they can offer improved services and onboard users faster.

EIP-7691: Lower Fees for Layer 2 Networks

This update directly benefits users of rollups like Arbitrum and Optimism, which function as Layer 2 networks on top of Ethereum. EIP-7691 increases the number of "blobs" — temporary data containers used to post L2 transactions to the Ethereum mainnet — from 6 to 9 per block.

In practice, this means more space for rollup transactions and better data compression, resulting in lower and more stable fees for L2 users, especially during peak periods.

As rollups increasingly become the primary interface for Ethereum users, this change enables faster scaling for projects and lower transaction costs — all while maintaining the speed and security users expect.

EIP-7002: Smart Contract-Controlled Withdrawals

This proposal enhances the flexibility and security of validator operations. Previously, withdrawing staked ETH required access to consensus-layer keys that had to stay online — posing security risks if compromised.

With EIP-7002, validator exits and fund withdrawals can now be initiated from the execution layer — the part of Ethereum that handles regular transactions and smart contracts. This means that withdrawals can be managed via secure smart contract logic, such as time delays or multi-signature approvals.

While retail users won’t see a direct change, this significantly improves infrastructure safety — particularly for decentralized staking services managing validators on behalf of users.

EIP-6110: Faster Validator Activation

Previously, new validators had to wait up to 12 hours after depositing funds before activation. EIP-6110 moves this process to the execution layer, reducing activation time to just 13 minutes.

For large staking pools, this enables more precise liquidity management and near-instant validator deployment — critical during market surges or increased staking demand. It also enables seamless features like auto-deposits and real-time fund distribution.

Retail users may not notice this immediately, but it lays the foundation for user-friendly staking services that offer instant activation and streamlined deposits.

Behind-the-Scenes Improvements

Pectra also includes several technical enhancements that don’t directly affect the user interface but make the Ethereum network faster and more resilient:

-

EIP-2935 allows smart contracts to access recent block hashes without relying on external sources — a key feature for oracles and cross-chain integrations.

-

EIP-7623 increases the cost of storing data in traditional formats, encouraging the use of more efficient blobs, thus reducing network congestion and transaction fees.

-

EIP-2537 accelerates cryptographic operations (notably BLS signatures used in staking), reducing processing loads and infrastructure costs.

-

EIP-7685, EIP-7549, and EIP-7840 improve Ethereum’s architecture, enhance layer interoperability, and make gas cost calculations more predictable and stable.

The Pectra upgrade marks a pivotal moment for Ethereum, combining enhanced scalability, security, and user experience. While some changes cater to developers and institutional players, the cumulative effect is a faster, cheaper, and more intuitive Ethereum for everyone.

Altcoins

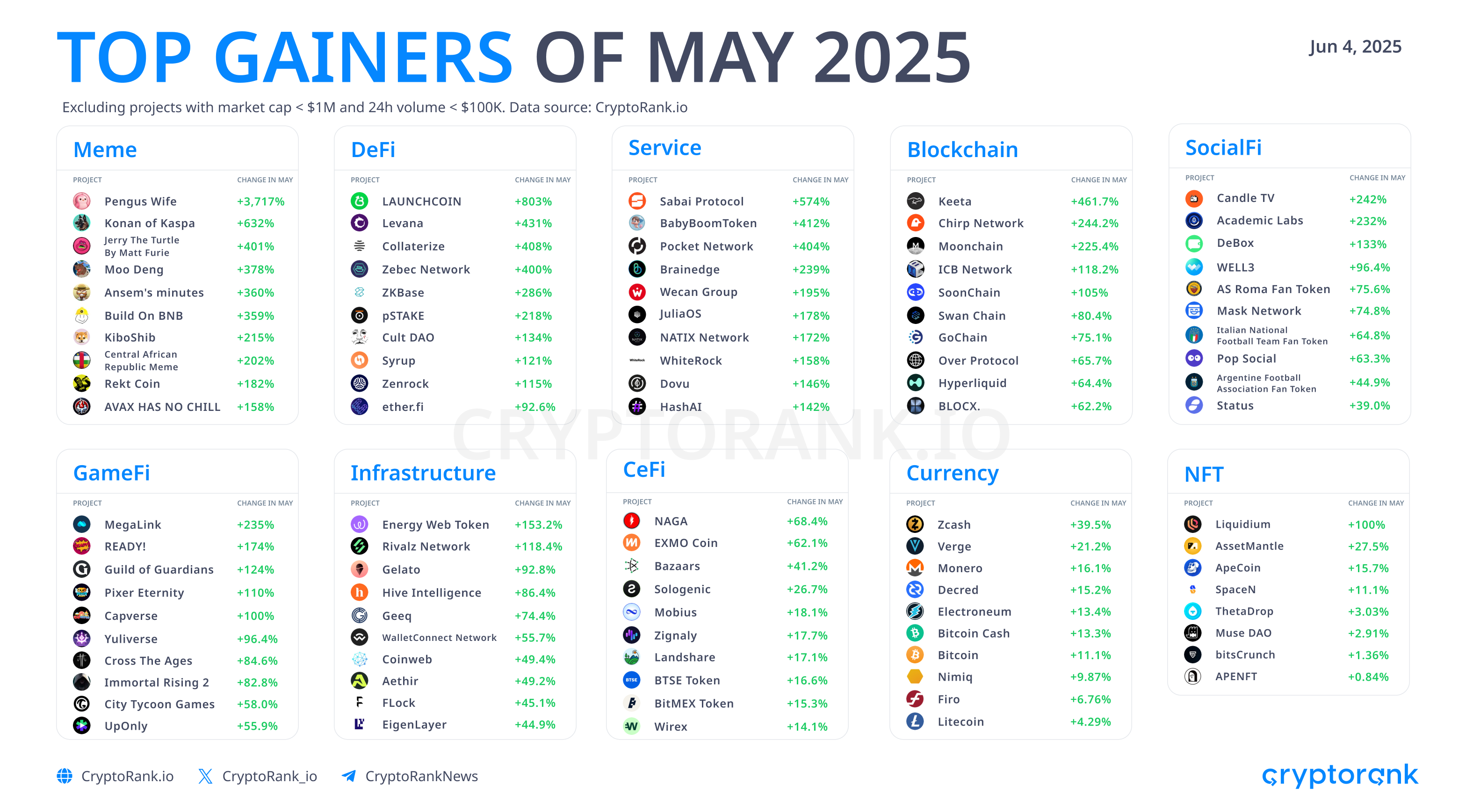

Many altcoins also showed positive price performance.

Pumpfun

Since its launch in 2024, Pumpfun has generated over $700 million in revenue, maintaining its position as the dominant platform for launching memecoins. However, in May, competitors like LetsBonk, Believeme App, and LaunchLab began gaining traction. Notably, LaunchLab — built by the Raydium team - entered the scene shortly after Pumpfun launched its own DEX, Pumpswap, in March. This move cut off one of Raydium’s key revenue streams. In May alone, Pumpswap recorded a staggering $14.2 billion in trading volume. Pumpfun also introduced creator revenue sharing, a mechanism that redistributes 50% of platform revenue to token creators.

There are growing rumors that Pumpfun may soon launch its own token. Reportedly, the team aims to raise $1 billion at a potential $4 billion valuation, with the token expected to be offered to both public and private investors. If true, this could mark a major shift in the protocol’s evolution, with the $PUMP token potentially being used for governance, community rewards, and creator payouts. However, the exact utility and structure of the token remain unclear at this stage.

Hyperliquid

May was a highly successful month for the Hyperliquid ecosystem. The platform reached new all-time highs with $10.1B in open interest and $18.91B in 24-hour trading volume, ranking 5th in the industry, behind only Binance, Bitget, Bybit, and OKX. Long-awaited assets, SOL and FARTCOIN, were finally listed on Hyperliquid in May, contributing to these record-breaking numbers.

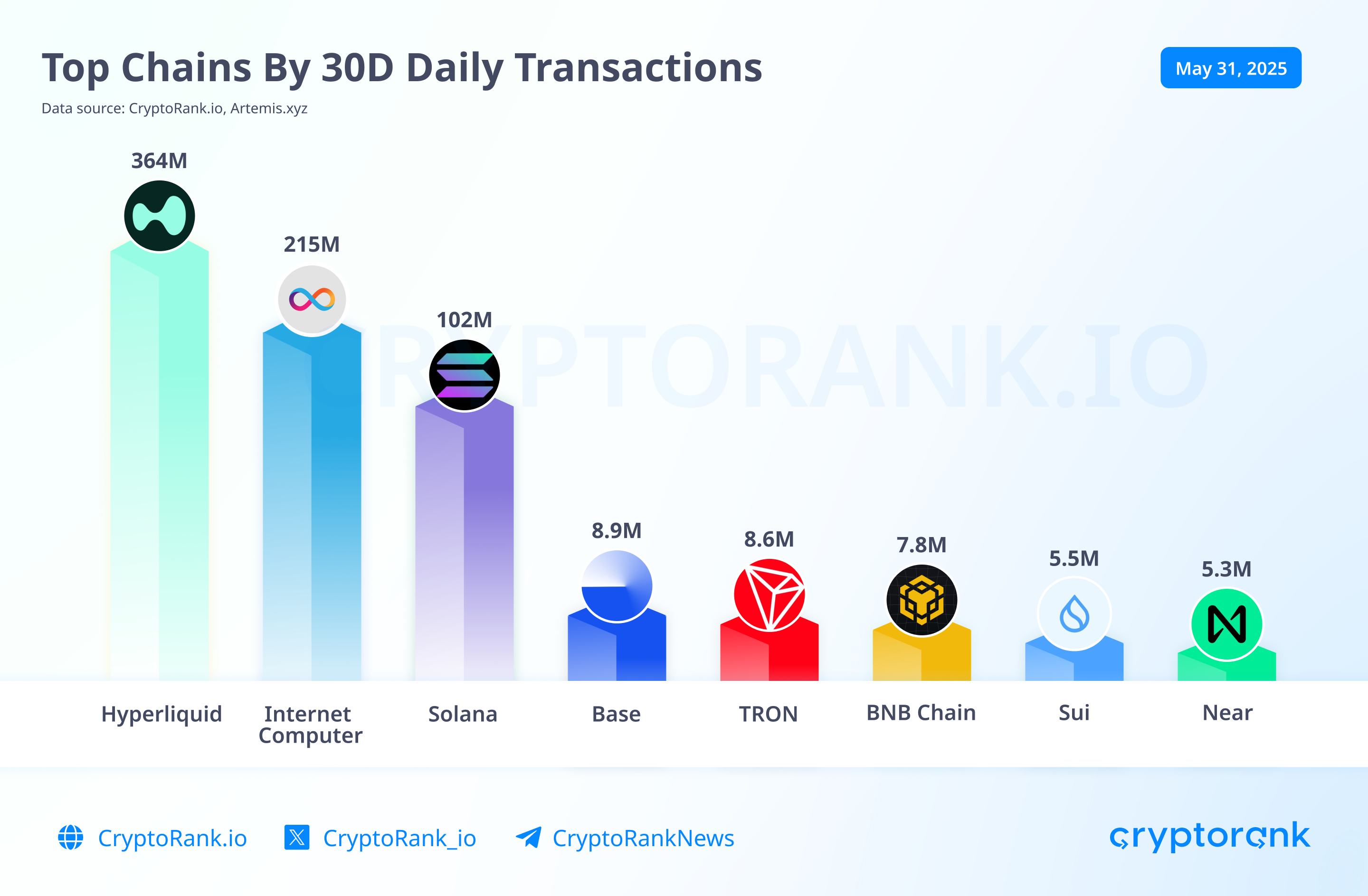

Hyperliquid also surpassed a major milestone of $1B in TVL. Originally launched as a perps-focused network, it is now evolving into a broader, more diversified ecosystem, with an increasing number of lending and yield farming dApps deploying on the platform. In May, Hyperliquid became the #1 blockchain by transaction count, processing an impressive 364 million transactions, surpassing both Internet Computer and Solana. It also led the industry in gross profit, generating $72.3M during the month.

The platform’s token, HYPE, performed strongly in May, gaining over 50%. This growth was driven by a combination of increased trading activity, strategic buybacks by the Hyperliquid team, real token utility, and a strong community. Additionally, Hyperliquid introduced a new fee structure and staking tiers for HYPE, further enhancing its value proposition.

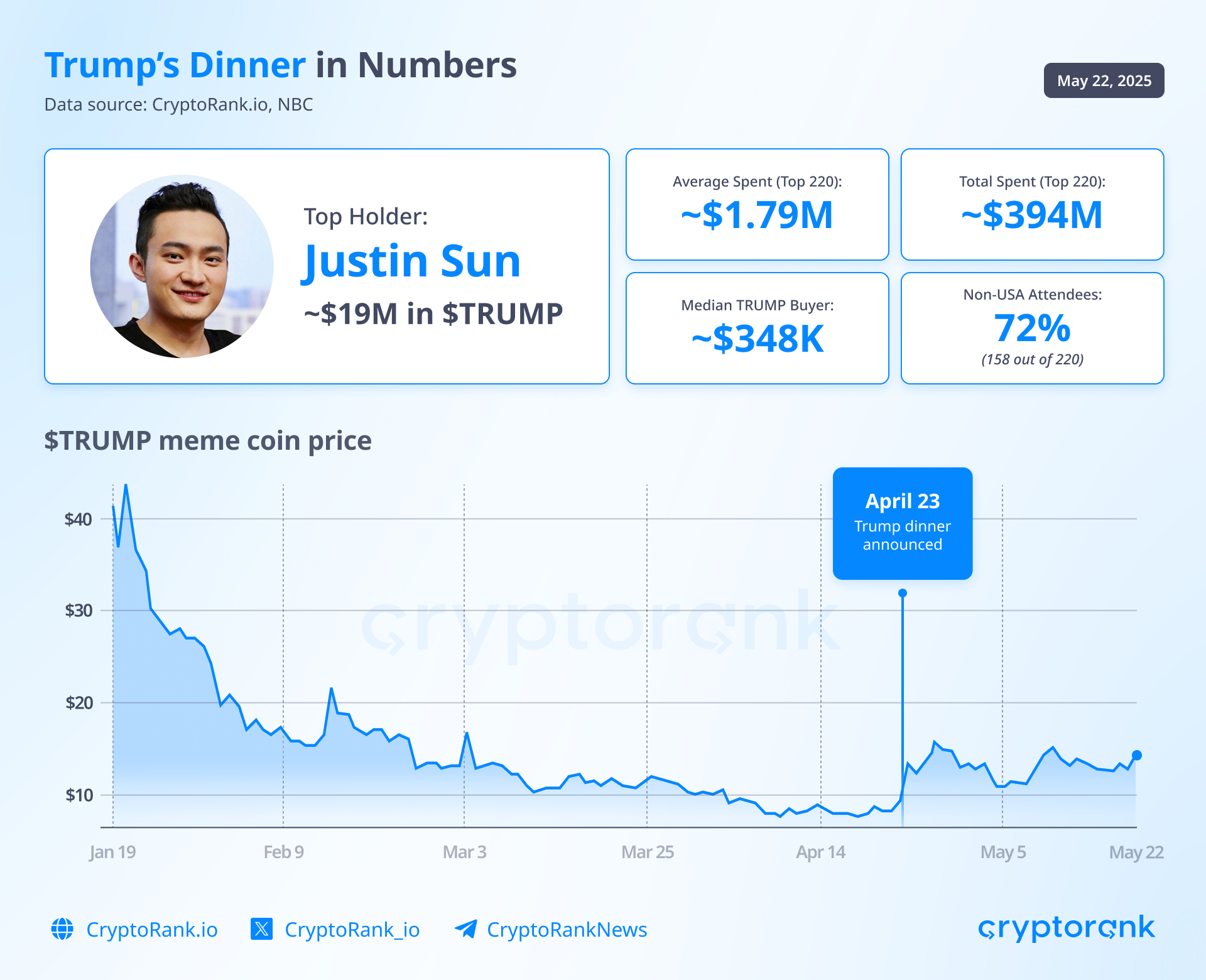

Trump dinner

Donald Trump organized a private dinner for wealthy holders of the TRUMP token. It took place at Trump National Golf Club, with the president himself arriving by Marine One. There were 220 people invited, and the top 25 people, who alone spent over $111 million, received VIP status. The most notable crypto attendee was Justin Sun, the founder of Tron.

According to reports, Trump spent less than an hour with guests and stated that the U.S. is “dominating” in Bitcoin and crypto. The TRUMP token had been growing before the event, peaking around $15.8. However, soon after the dinner, there was a sharp sell-off.

The Bottom Line

In May 2025, Bitcoin rose by 11.1% to a new all-time high of $111,784, largely due to increased institutional accumulation from major players like BlackRock and U.S. states. Ethereum underwent an important Pectra upgrade, but the ETH token remains below its previous highs. May 2025 demonstrated that institutional adoption is increasing, technical upgrades are strengthening networks, and the sector is becoming more intertwined with traditional finance and politics.

In DeFi, Hyperliquid achieved several records, illustrating that on-chain trading terminals can effectively compete with centralized exchanges, a concept that previously seemed unlikely. Overall, while volatility and uncertainty persist, the foundations for long-term growth are present.

Read More