Everyone Wants to Build a Bitcoin Rollup

Key takeaways:

-

Bitcoin rollups became possible after the Taproot upgrade and BitVM introduction.

-

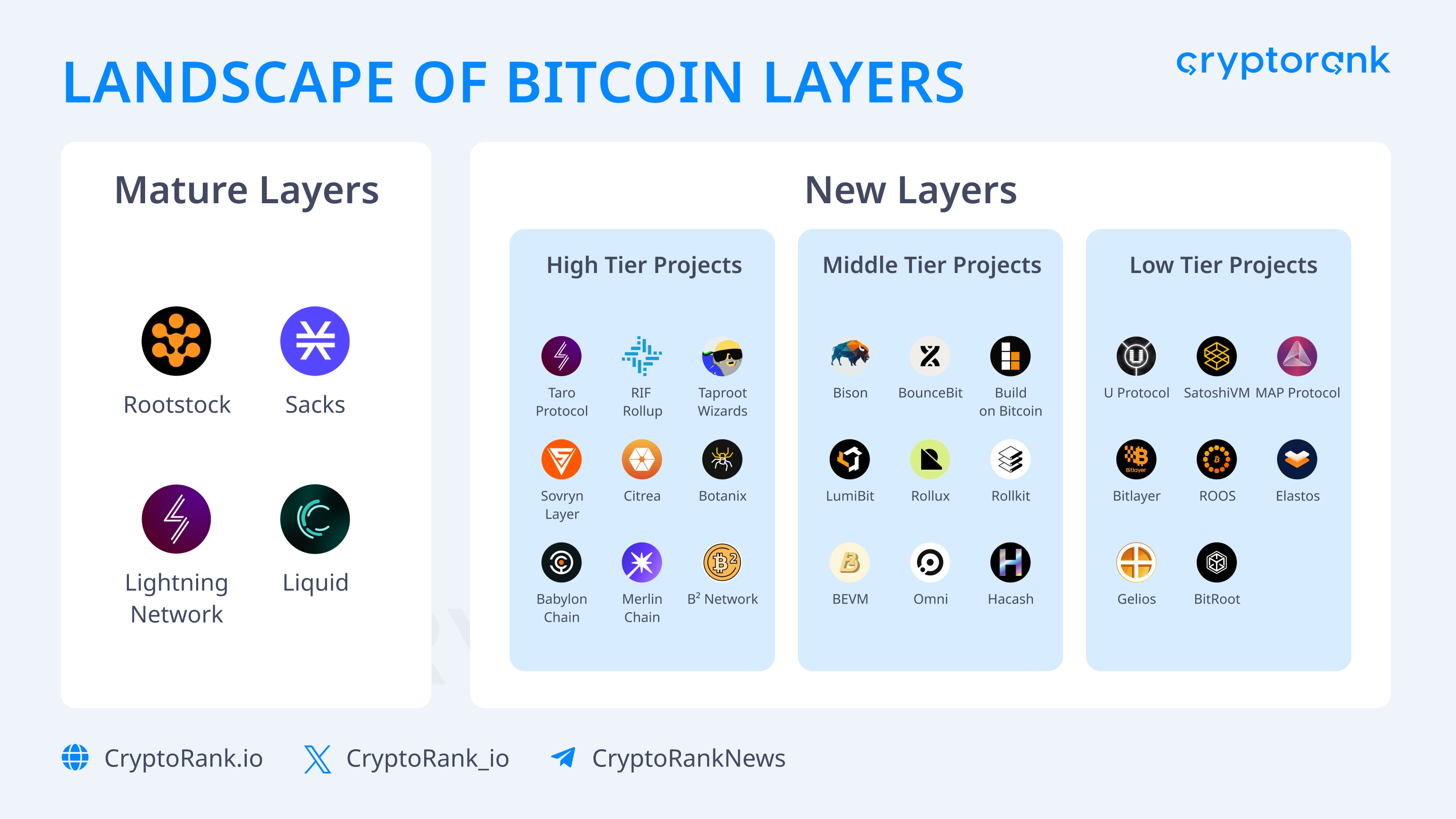

Currently, the largest and most used Bitcoin scaling solutions are Lightning Network, Rootstock sidechain and Stacks.

-

BitVM allows creation of a so-called sovereign rollup, a type of rollup that works without relying on smart contracts and the settlement layer of a mother chain for verification.

-

Zk-rollups like zkSync or Starknet are not quite possible on Bitcoin, so one should be wary of projects popping out from nowhere claiming to be building Bitcoin zk-rollups.

-

Unlocking Bitcoin's liquidity has long been a dream that now becomes the reality.

-

Bitcoin rollups will reshape the crypto landscape and arguably make many chains irrelevant.

Bitcoin Scaling Basics

First, let's get the definitions straight. According to the scalability trilemma, a blockchain cannot be scalable, secure, and decentralized at the same time; only a combination of two out of the three is possible at the same time. The two most secure, decentralized, and utilized at the same time blockchains are Bitcoin and Ethereum. To solve the trilemma and achieve scalability on those two, developers began building additional Layer 2 (L2) networks connected to the mainchain. Thus, Layer 2 is a collective term to describe a specific set of blockchain scaling solutions.

There are three main types of Layer 2s: sidechain, state channel, and rollup. Each type has its advantages and disadvantages, but overall, the rollup turns out to be the best solution. And unlike state channels and sidechains, rollups fully inherit the security of the mainchain. We are now witnessing the heyday of rollups on Ethereum: transactions there are getting cheaper and ecosystems are getting richer. Even the largest sidechain, Polygon, has pivoted towards building its own rollup ecosystem.

Bitcoin's problem here is that its original architecture did not allow for rollup creation. This was the case before the Taproot update was implemented, which made Bitcoin rollups technically possible, and before the BitVM concept was introduced, which offered a theoretical framework for how exactly it could be done. But before we dig into the BitVM era we've entered, it's important to highlight the solutions that came before.

Pre-BitVM Era

There are many more than the three solutions below that claim to scale Bitcoin: bridges, DeFi platforms, custodians, etc. However we decided not to take them into account because of their limited functionality or user base.

Rootstock

Rootstock, often referred to as RSK, is an EVM-compliant sidechain that was launched in 2018. RSK uses a synthetic merge-mined and two-way-pegged version of BTC called Smart Bitcoin (RBTC) as a gas coin. Merged-mining consensus protocol allows miners to mine RBTC in parallel with BTC and rewards them with additional transaction fees. Two-way-peg mechanism enables the automatic transfer of BTC between mainchain and sidechain via locking BTC in the mainchain.

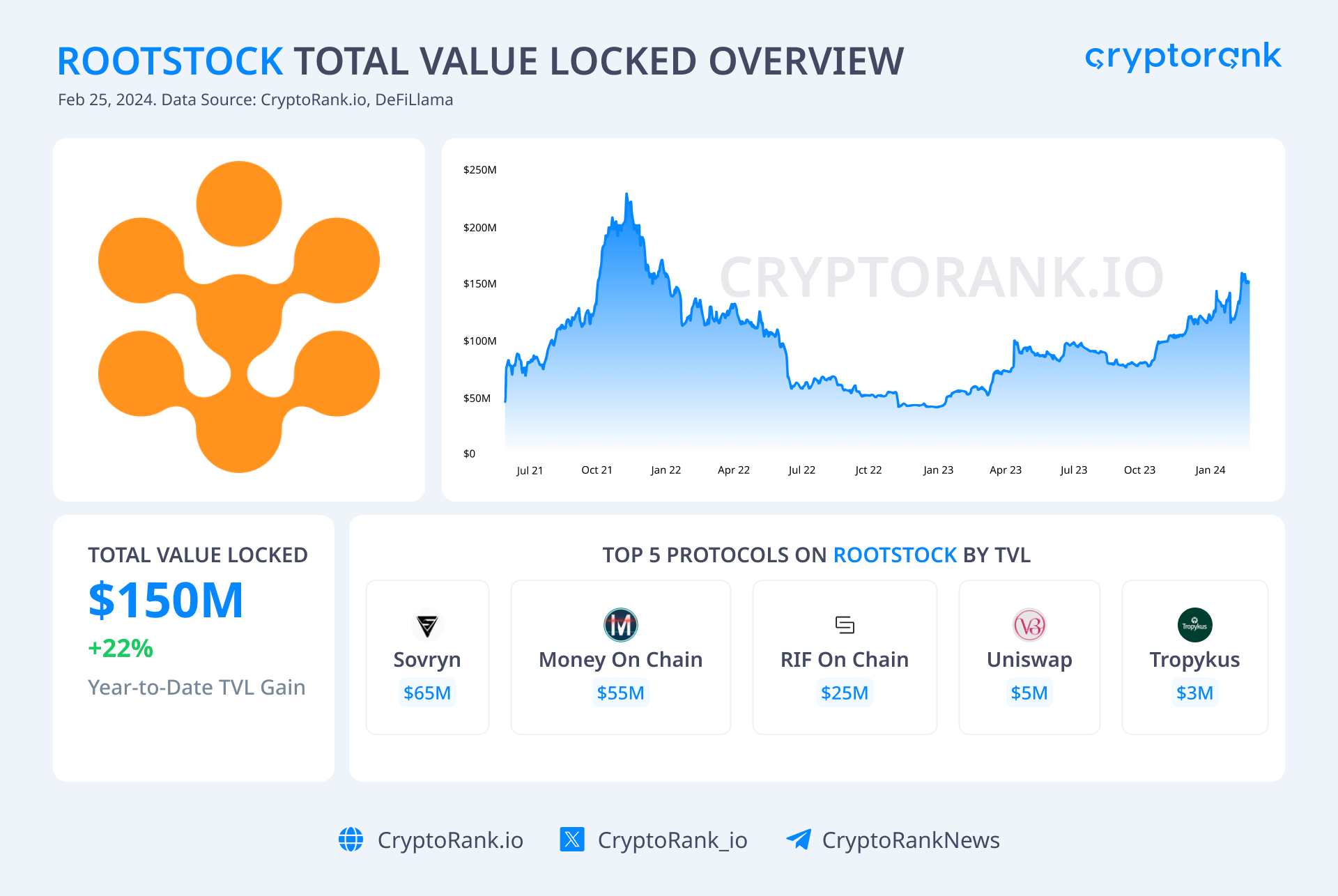

Currently, about 47% of Bitcoin miners engage in merged-mining. However, high merged-mining adoption doesn't guarantee success. At the time of writitng, Total Value Locked (TVL) of RSK sits at around $150 million, modest compared to the top Ethereum Layer 2s. Yet, RSK's TVL showed resilience during the bear market, indicating better sustainability than many other chains. There's an explanation: for a long time, RSK remained the only smart contract platform for Bitcoin DeFi.

Key projects on Rootstock are:

-

Rootstock Infrastructure Framework (RIF). RIF offers a suite of protocols for dApp development, RNS Name Service, RIF wallet, RIF Lumino Network for Layer 3 state channels, RIF Marketplace for decentralized services, RIF governance token, etc.

-

Sovryn. Sovryn is a DeFi platform that offers trading, lending, and borrowing services, with SOV as its governance token and DLLR as a stablecoin.

-

Money on Chain. Money on Chain introduces smart contracts for stablecoin creation, using MoC tokens for governance and RBTC as collateral for the DOC (Dollar on Chain), a USD-pegged ERC-20 stablecoin.

-

BabelFish. BabelFish is a cross-chain stablecoin protocol merging liquidity from various chains and issuers into aggregated stablecoin XUSD.

Lightning Network

Lightning Network is a peer-to-peer protocol for creating payment channels between two parties launched in 2019 by Lightning Labs. To open a channel, parties lock in some BTC, which is then used for transactions between them. These transactions are conducted off-chain, bypassing miner confirmations and allowing unlimited transfers as long as the channel remains open. Channels can be closed by mutual agreement or upon one party's request, with a final on-chain transaction on the Bitcoin chain recording the closing balances.

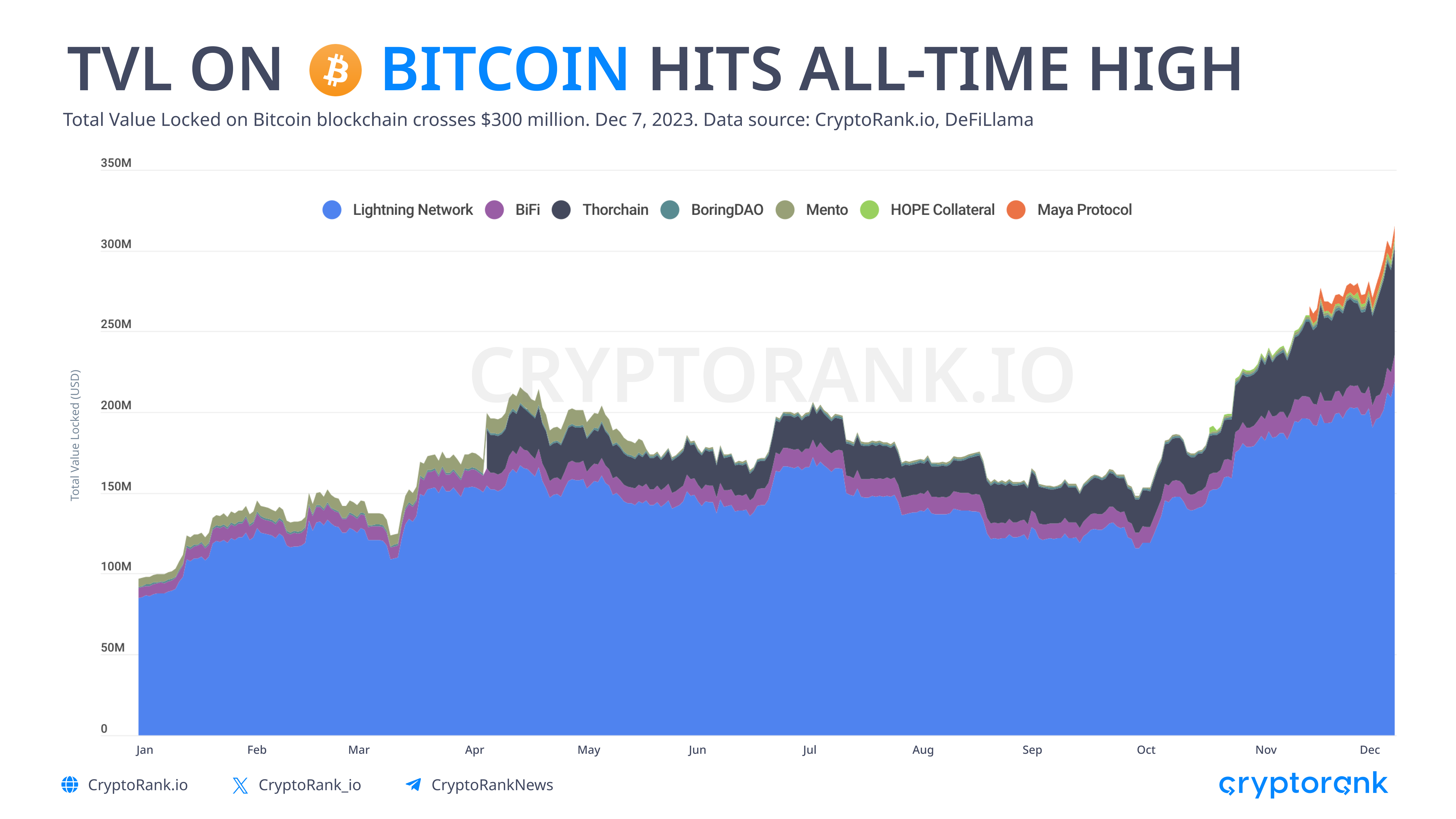

Lightning is widely adopted across business, retail, and Bitcoin maximalists, remaining the most successful Bitcoin Layer 2 so far. The key adoption indicators are:

-

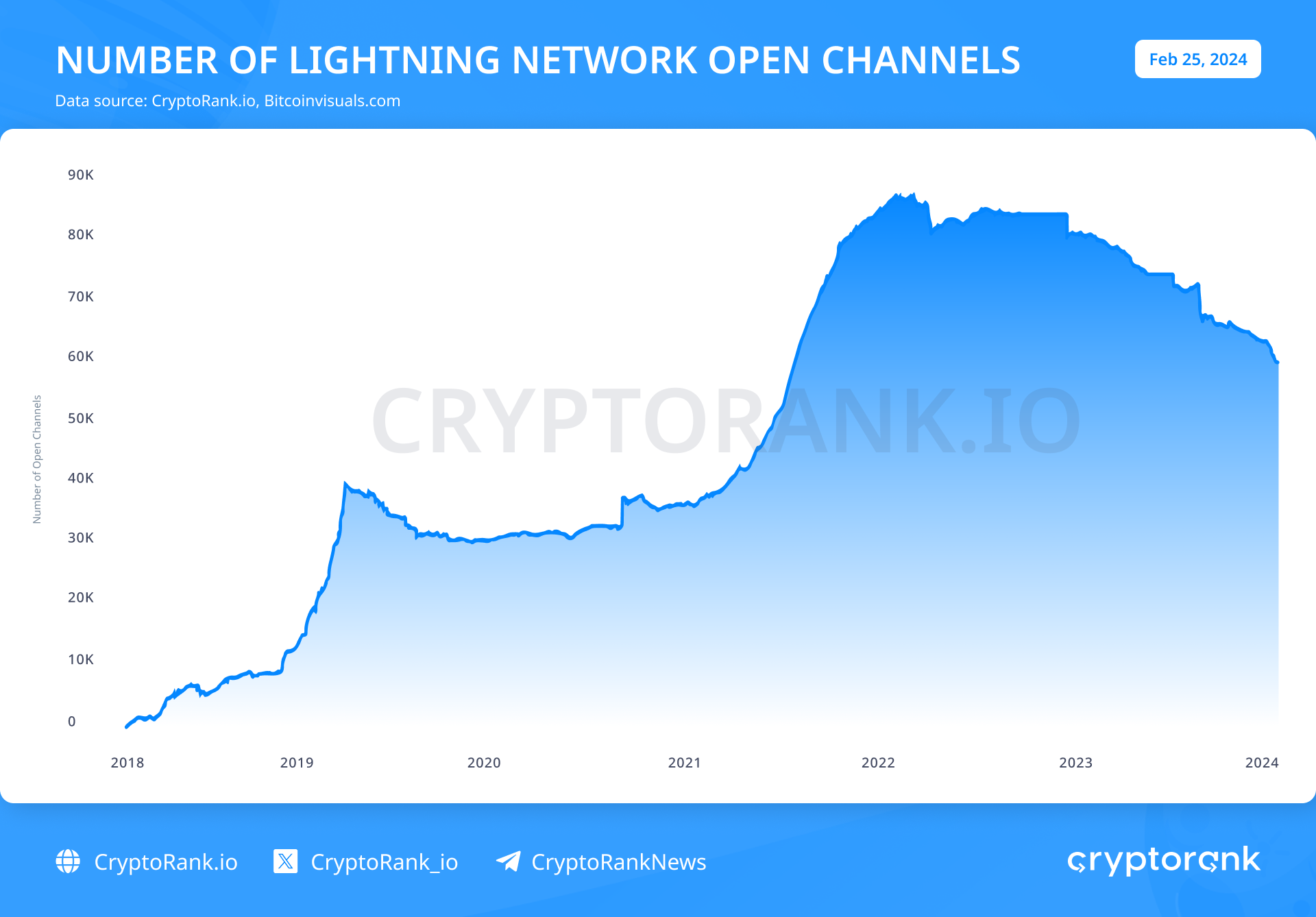

Number of open channels. At the time of writing, there are more than 62,000 open channels:

-

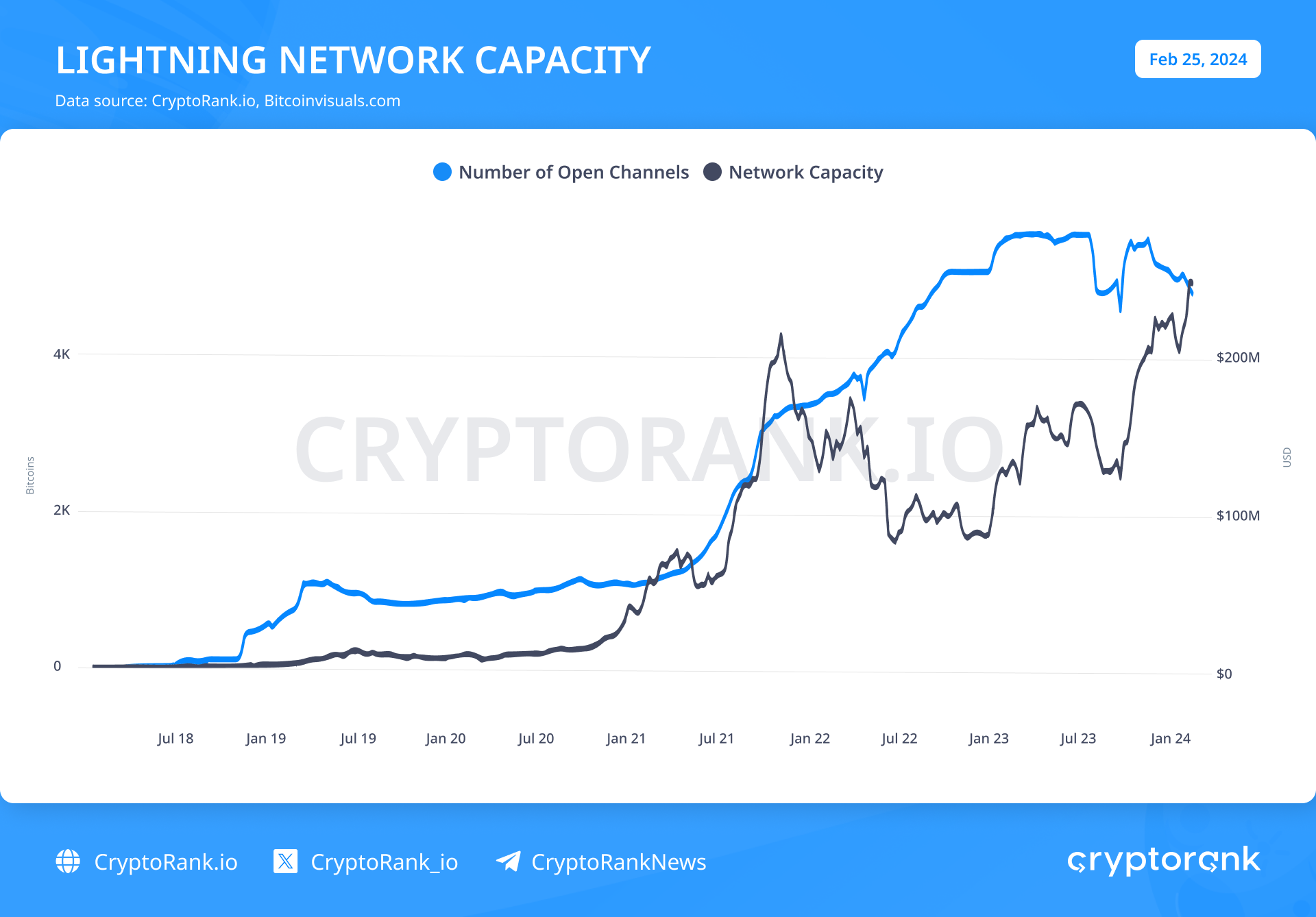

Network Capacity, which indicates the number of locked BTC on the Lightning Network. As of February 2024, the network capacity is more than $230 million worth of BTC:

The infographics show that the growth in key indicators wasn't explosive even during the bull run, at the same time the crypto winter didn't cause declines, unlike other networks, suggesting organic and sustainable growth. The main barrier to further expansion is still the same, the limited range of use cases. With the emergence of new solutions, recently we have witnessed a decline in Lightning usage.

Stacks

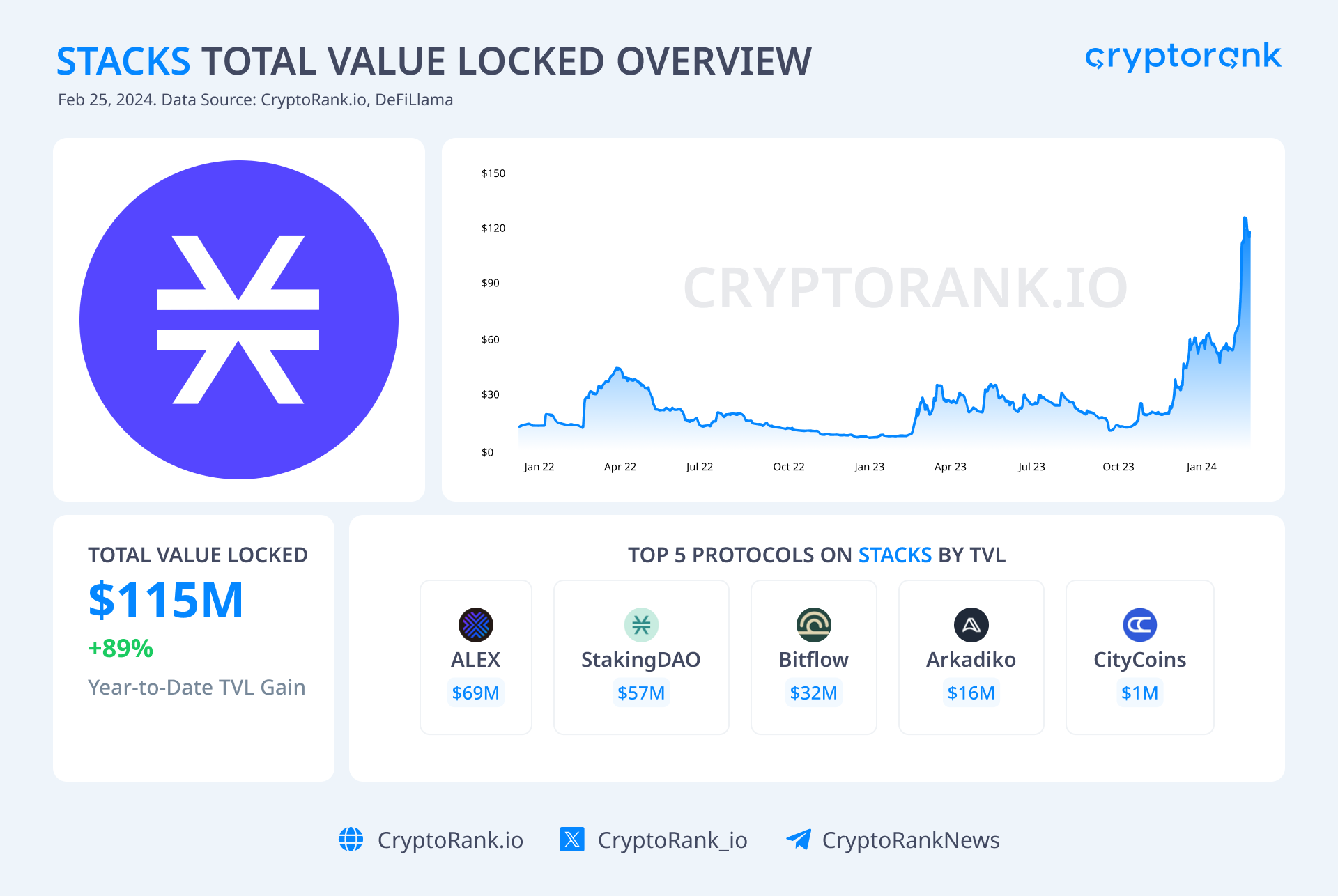

In its current state, Stacks is neither a sidechain nor a state channel, nor a rollup. Rather, it is an abstraction layer or a software stack on top of the Bitcoin chain. Stacks is connected to Bitcoin through the Proof-of-Transfer (PoX) consensus mechanism, which operates alongside Bitcoin's Proof-of-Work, processing transactions on the Bitcoin chain and anchoring Stacks block metadata to Bitcoin blocks. This dual security mechanism involves both BTC miners and STX holders, where STX holders contribute to consensus and earn BTC through a process called “stacking”. Thus, Stacks adds functionality to Bitcoin, but there are no transaction confirmations on the Bitcoin chain.

Since Bitcoin Layer 2 solutions aim to unlock BTC's value for DeFi liquidity, creation of some sort of synthetic versions of BTC is necessary. Currently, wBTC on Ethereum is a major liquidity source with a $7.6 billion market cap as of February 2024, while representing a small portion of Bitcoin's value and waving trust concerns. In the planned Nakamoto upgrade, Stacks will introduce sBTC, offering a more trustless version of synthetic BTC without extra trust layers, thanks to Stacks' continuous synchronization with the Bitcoin network. In anticipation of this, Stacks has experienced an inflow of liquidity and attention over the past few months.

Stacks key protocols include:

-

ALEX Lab. ALEX is the major DeFi hub within Stacks, featuring a DEX with an order book for BRC-20 token trading, a launchpad, and a BSC bridge.

-

Arkadiko. Arkadiko offers USDA, a stablecoin overcollateralized with STX, ALEX, and sBTC in the future.

-

Hiro. Hiro offers tools for app development on Bitcoin, including deployment and scaling solutions, along with the most recognized Stacks Leather (former Hiro) wallet.

How Did Bitcoin Rollups Become Possible?

The chain of events started with the Taproot update in November 2021, which has provided the technical opportunity for rollups. The emergence of Inscriptions and Ordinals has drawn widespread attention to the Bitcoin ecosystem, making it clear that Bitcoin is no longer just a high-quality crypto asset, but rather something more. Finally, the emergence of BitVM Introduced the possibility of rollups in Bitcoin and offered a theoretical framework for creating them.

On October 9th, developer Robin Linus from ZeroSync introduced a concept called BitVM, which allows any arbitrary computation on the Bitcoin blockchain to be conducted without changing the consensus. In BitVM, all the computation logic is taken off-chain, while on the Bitcoin mainnet, the only thing left to do is challenge an unfair result. Basically, BitVM turns Bitcoin into a Turing-complete system, like the Ethereum Virtual Machine.

BitVM changes a lot; it allows the creation of so-called sovereign rollups. A sovereign rollup is a type of rollup that works without relying on smart contracts and the settlement layer of a mother chain for verification. Instead, the verification process occurs within the rollup itself, allowing sovereign rollups to be implemented on blockchains without smart contracts, like Bitcoin. BitVM in that sense is a framework that introduces peer-to-peer connection with the Bitcoin main chain and penalties for false proof. But so far the only function implemented is zero-checking for proof itself without penalties for being false.

In terms of interconnection with the Bitcoin mainchain, rollups are more similar to the Lightning Network than to the Ethereum rollups. Zk-rollups like zkSync or Starknet are not quite possible on Bitcoin, so one should be wary of projects popping out from nowhere claiming to be building Bitcoin zk-rollups. There are projects whose teams just want to make money on a hype topic, using the unawareness of the ordinary user. Anyway, the paradigm of what is possible on Bitcoin has shifted significantly.

BitVM Era

Despite the fact that many of the projects presented below use solutions not directly related to BitVM and appeared earlier, we believe it is correct to put them in the same row.

High Tier Projects:

-

Taro by Lightning Labs. Taro is a Layer 3 protocol that allows creating various assets on the Bitcoin network, including stablecoins, and unlocking them on the Lightning Network. Currently, in Testnet.

-

RIF rollup by Rootstock Infrastructure Framework . RIF is claiming to build a payment-oriented rollup, but there were no updates lately. The RIF team basically own RSK sidechain, so one can expect something like trying to build an ecosystem similar to what Polygon is doing, but on Bitcoin. RIF is a governance token for all RIF products.

-

Unknown rollup by Taproot Wizards. Taproot Wizards is the group behind Bitcoin inscriptions that in order to scale BitVM wants to revive one of the original opcodes called OP_CAT, which was disabled by Satoshi Nakamoto in 2010 due to vulnerability concerns. OP_CAT can improve creation and management of tokens, as well as data verification. Since Bitcoin has grown and matured, OP_CAT no longer poses a vulnerability threat.

According to publicly available information, Taproot Wizards are working on a rollup project. No details regarding this rollup are available yet. The Taproot Wizards team has recently launched an Ordinals collection of 3,333 cat images called Quantum Cats. This collection will potentially be linked to the rollup.

-

Sovryn Layer. Sovryn Layer is a sovereign rollup project by Sovryn team. Sovryn aims to create a platform for sovereign rollups with a single DeFi hub within Sovryn. Currently, there is only original Sovryn DeFi platform on RSK with SOV token and DLLR stablecoin.

-

Citrea by Chainway. The Citrea team has been building its sovereign rollup for more than a year. Citrea’s approach includes the integration of BitVM, which would influence how smart contracts are deployed on Bitcoin. Currently, in Pre-testnet without token.

-

Botanix. Botanix is an EVM-compatible Bitcoin layer 2, secured by Spiderchain, a distributed network of multisigs that secure all the actual BTC on Botanix. Currently, in Testnet without a token.

-

Babylon Chain. Babylon is a modular blockchain on Cosmos that secures rollups by staking BTC on the Bitcoin blockchain. No bridges and associated risks. Recently closed round for $18 million from Polychain, Hack VC etc. Currently, it has finished the first phase of the Testnet, no token.

-

Merlin Chain. Merlin chain is the EVM-compatible Bitcoin Layer 2, built upon native assets, protocols, and products on Bitcoin and powered by BitmapTech, Particle and Polygon. The project has a long list of investors and a lot of Twitter influencers. Currently, in Mainnet without token.

-

B² Network (Bsquared). B² Network is an EVM-compatible zk-rollup project backed by Hashkey Capital, OKX Ventures, and others. Currently, in Testnet without token, but with the point system.

Middle Tier Projects

-

Bison. Bison aims to build a Bitcoin zk-rollup based on zk-stark technology and Ordinals. Currently, in Testnet without a token.

-

BounceBit. BounceBit is a Bitcoin Layer 2 project that offers BTC stacking. Currently, in Testnet with AUCTION token and points program.

-

BOB (Build on Bitcoin). BOB is an EVM-compatible rollup project by Interlay team. Currently, in Testnet without a token.

-

LumiBit. LumiBit is an EVM-compatible zk-rollup project, based on Scroll tech; offers full EVM equivalence and BTC-native account abstraction. Currently, in Testnet without a token.

-

Rollux. Rollux is an EVM-compatible rollup project by Syscoin, built with OP stack. Claims to be the first and most secure rollup on Bitcoin and official L2 of Syscoin. Currently, in Testnet without a token.

-

Rollkit. Rollkit is the modular framework for sovereign rollups powered by Celestia. Currently, in Testnet without a token.

-

Bevm. Bevm is an EVM-compatible Bitcoin Layer 2 that claims to build its own stack. Currently, in Mainnet with BEVM token.

-

Omni Layer. Omni Layer is a software provider and asset platform on Bitcoin that offers wallet services and its own blockchain explorer. Currently, in Testnet with OMNI token.

-

Hacash. Hacash offers a multi-layer scaling solution for Bitcoin based on one-way transfer, scaling Bitcoin's store of value, payments, applications, and economic models. Currently, in Testnet without a token

Low Tier Projects

-

U Protocol. U Protocol is an EVM-compatible Layer 3 backed by Arbitrum AnyTrust and Celestia. Currently, in Mainnet with YOU governance token and uBTC gas token.

-

SatoshiVM. SatoshiVM describes itself as Bitcoin zk-rollup. The project has recently hyped on X (Twitter) with a shady token sale. Currently, in Testnet with SAVM token.

-

Map Protocol. MAP Protocol Describes itself as a Bitcoin Layer 2 for peer-to-peer cross-chain interoperability. Currently, in Mainnet with MAP token.

-

Bitlayer. Bitlayer describes itself as the first Bitcoin security-equivalent Layer2 based on BitVM. Currently, in Pre testnet without token.

-

ROOS. ROOS describes itself as the first Layer 2 solution for Bitcoin utilizing zero-knowledge rollup technology. Currently, in Testnet without token.

-

Elastos. Elastos is a merged-mining based Bitcoin Layer 2. Currently, in Mainnet with ELA token.

-

Gelios. Gelios is building a Dapp layer for the Bitcoin ecosystem. Currently, in Testnet, without a token, there is a points program.

-

BitRoot. BitRoot claims to be the first Bitcoin-programmable asset issuance protocol. Currently, in Testnet, there is open registration for token IDO.

Bitcoin Endgame

The pre-BitVM era showcased limited but significant attempts to scale Bitcoin, such as the Rootstock sidechain, Lightning Network, and Stacks, each contributing uniquely to Bitcoin and its capabilities. However, these solutions, while pioneering, hinted at the untapped potential awaiting exploitation through more advanced technologies.

The Taproot upgrade with the following the introduction of BitVM herald a quantum leap, enabling the creation of zero-proof knowledge-based sovereign rollups, thereby broadening the scope of what's achievable on Bitcoin's network. Unlocking Bitcoin's liquidity has long been a dream of developers, Bitcoin maximalists, and everyone involved in cryptocurrencies; now it is becoming the reality. This is the Bitcoin Endgame, that will make a lot of L1 chains irrelevant.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.