August Crypto Exchanges Report: Trading Volumes, Key Milestones, and Future Outlook

Introduction

The past two months have highlighted how leading centralized exchanges are racing to evolve into full ecosystems, extending far beyond spot and derivatives trading. Platforms are rolling out on-chain products, layer-2 networks, and integrated wallets to secure long-term relevance. Binance has expanded its tokenization partnerships, while OKX advanced its X Layer blockchain and multi-chain wallet. Amid this, Gate has emerged as one of the strongest rising stars, with a notable increase in spot volumes in August, securing the exchange the second global position behind Binance.

Market Positioning: Gate Consolidates Its Top-Tier Status

The summer months brought steady trading activity across major centralized exchanges, with Binance maintaining its dominance, OKX and Bitget strengthening their positions, and Bybit advancing through regulatory milestones. Within this landscape, Gate has consolidated its place in the top tier, holding the second spot globally in spot trading and recording one of the fastest growth rates in the futures market.

Spot Market

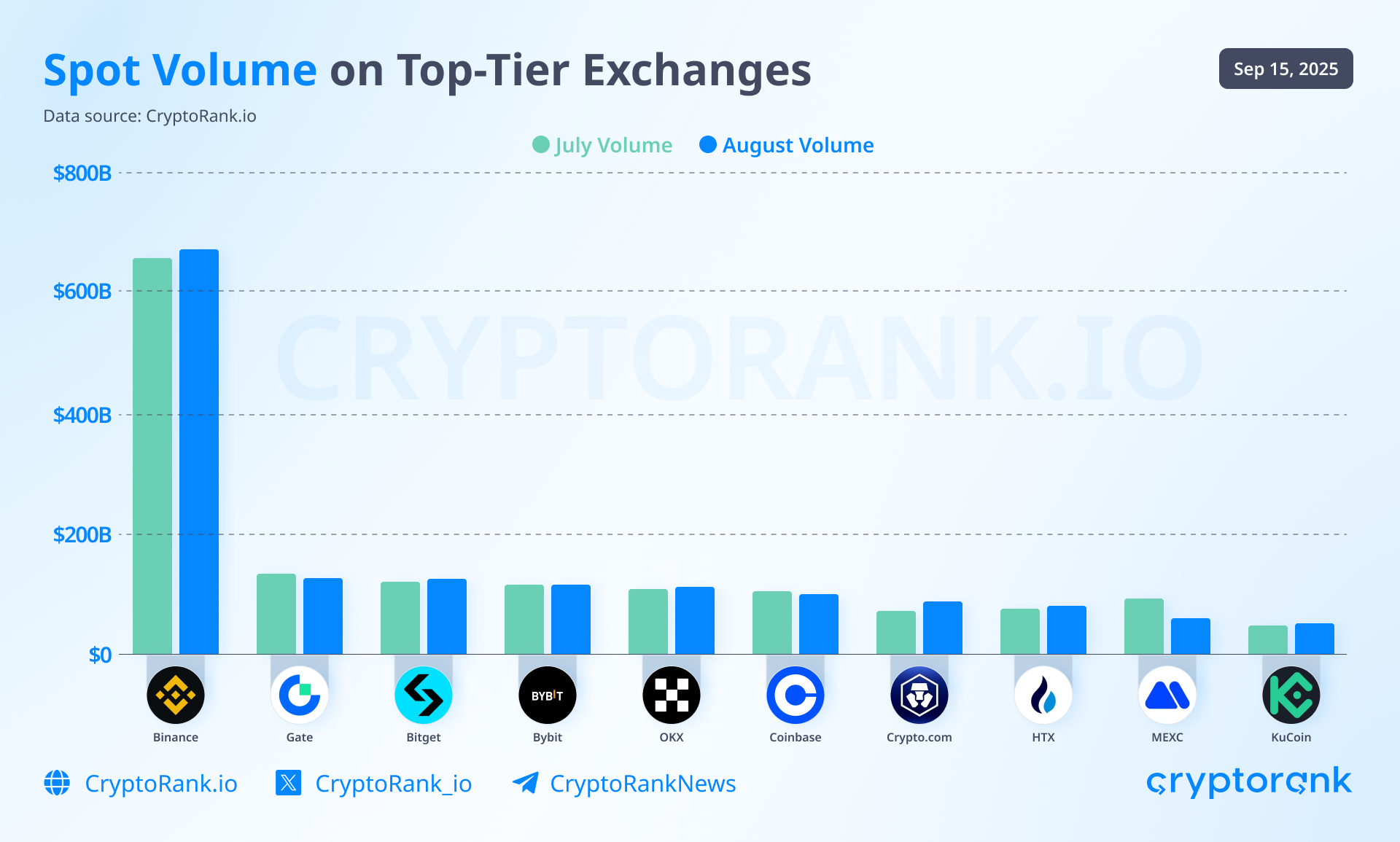

In spot trading, Binance remains the clear leader with volumes above $600B monthly, but Gate secured the second position globally in both July and August, according to data from CryptoRank. Spot volumes on Gate reached $135B in July and $131B in August, reflecting a slight MoM decline of about 3%, though still firmly ahead of close rivals Bitget and Bybit with $124B and $119B in August, respectively.

Other competitors posted mixed trends: OKX grew its volumes from $106B in July to $115B in August (+8%), while Coinbase slipped from $103B to $99.4B (-4%). Crypto.com registered a strong surge, jumping from $70.3B to $90.9B (+29%).

Despite these shifts, Gate’s ability to hold second place by a comfortable margin underscores the exchange’s depth of liquidity and user engagement.

Futures Market

On the derivatives side, Binance remains dominant with volumes over $3.25T in August, followed by OKX with $1.26T.

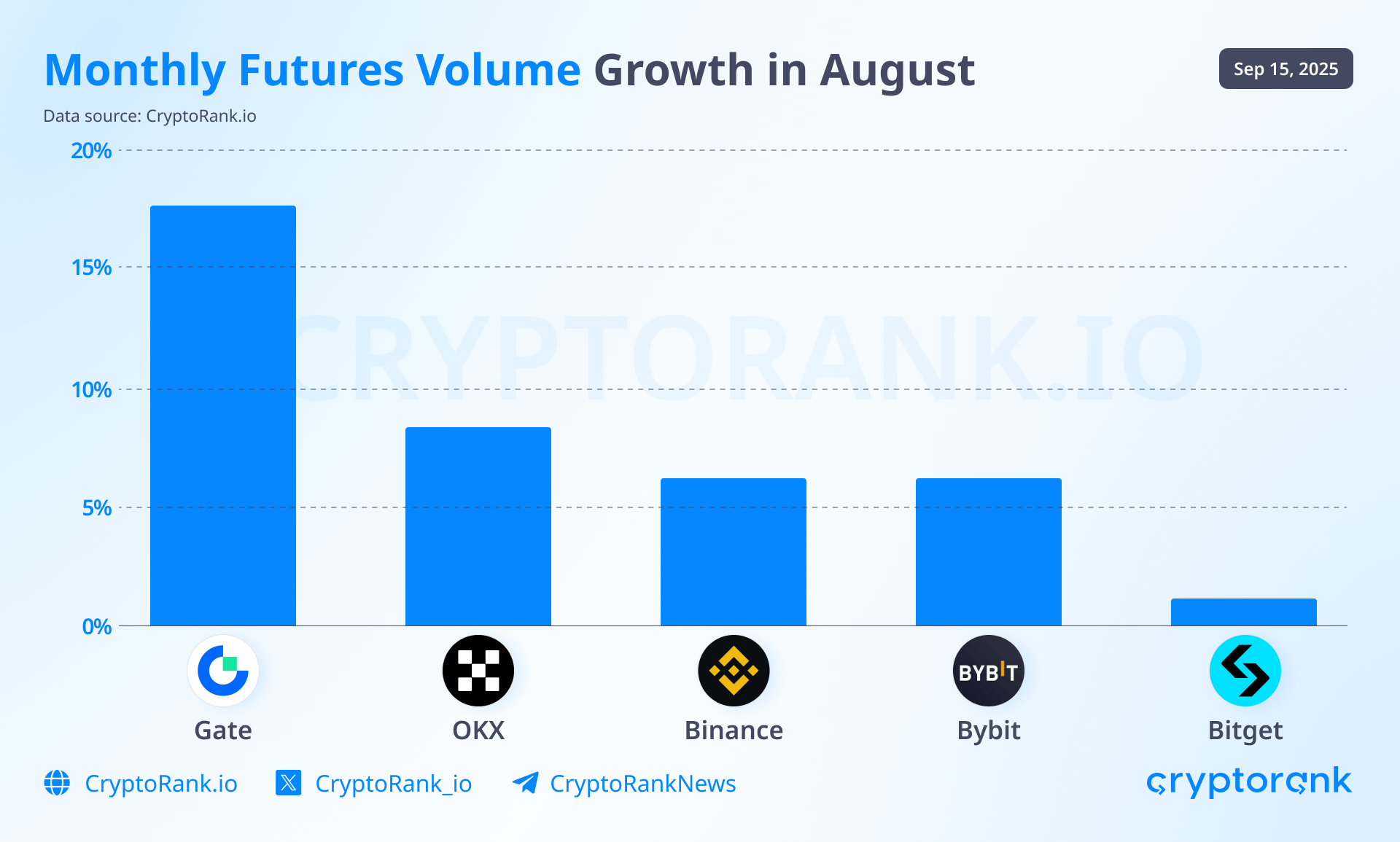

Meanwhile, Gate is rapidly strengthening its presence in futures trading, showing meaningful growth and securing a solid position among the top players. Gate’s futures volumes climbed from $784B in July to $923B in August, marking an impressive 18% MoM increase, which positioned Gate as the strongest growth rate among the major derivatives exchanges.

The sustained expansion of Gate’s futures trading highlights its growing relevance in a segment historically concentrated around a handful of dominant players.

New Leader in IEOs

While previously leading IEO venues such as Binance and Bybit have slowed down on token sales, emerging players are taking their place as leading CEX platforms for token offerings. Over the past two months (July and August), Gate’s Launchpad was the only one among the top exchanges to hold token sales, including the $5M IKA and $10M PUMP sales, both oversubscribed. In a quieter IEO market, projects have been able to raise larger sums and benefit from concentrated demand.

In contrast, Binance hasn’t held an IEO since mid-2023, and the same is true for OKX. Meanwhile, the last IEO on Bitget took place in mid-2024, and Bybit, once highly active platform, has held just one token sale in 2025. This shift in the IEO landscape creates an opening for platforms like Gate to demonstrate strong performance and overtake leading positions.

Launchpools as a Driver of Engagement

While many leading exchanges have scaled back the frequency of their Launchpool and Launchpad campaigns, Gate has continued to strengthen its position in this space. Bitget was the only other major platform to remain active, running three campaigns in July and two in August, underscoring how limited the competition has become. Meanwhile, Gate reached a major milestone in August with its 300th Launchpool campaign. Over time, these campaigns have delivered more than $95 million in airdrop rewards, making Launchpools one of Gate’s most effective tools for both user acquisition and project visibility.

Rather than sporadic promotions, Gate runs Launchpools at a steady cadence, offering users regular opportunities to stake assets and access new tokens. This consistency has turned Launchpools into a core growth engine, reinforcing Gate’s position as a platform where token launches are not just listings, but community events. Gate Launchpool has already delivered $96.8M in cumulative airdrops and $2.64M in estimated rewards, mobilized $38.6B in funding, and engaged over six million participants.

Read more about Gate Launchpool in our latest article.

New Token Listings Activity

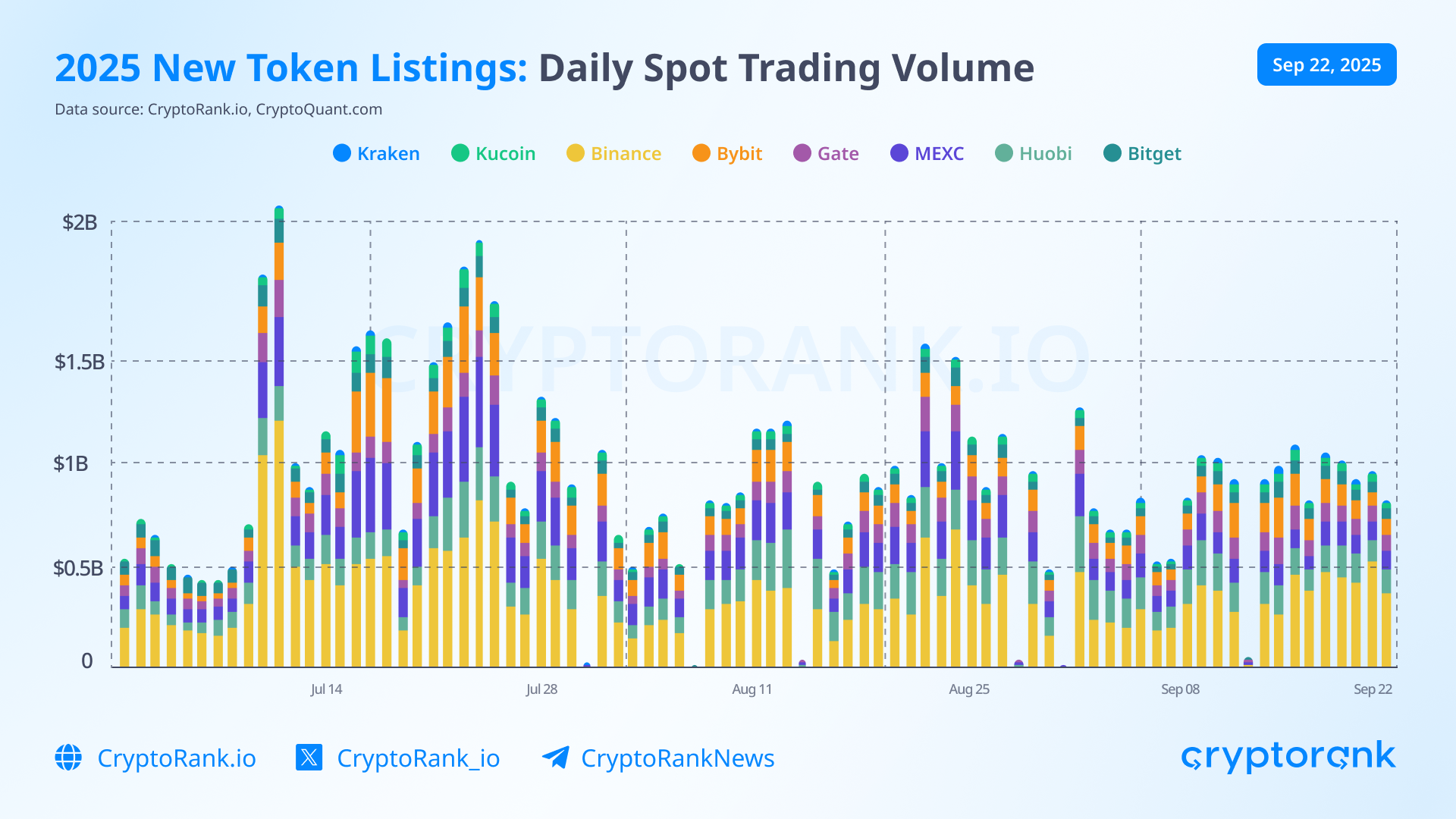

Trading in newly listed tokens remained active through July and August, with Binance retaining the largest share of daily spot volumes. The segment, however, has been highly dynamic, with several mid-tier exchanges expanding their footprint.

In early July, Gate accounted for about 8% of daily new-token spot trading volume, positioning it firmly in the middle tier among major players, just behind Bybit and ahead of KuCoin. By the end of August, Gate’s share had expanded and stabilized around 10%, even as total market activity was more fragmented. This trajectory underscores Gate’s growing relevance as a listing venue, particularly at a time when exchanges compete aggressively for attention around new token launches. Meanwhile, Binance and HTX continued to dominate, each holding more than 25% of this market by the end of the period.

New Partnerships and Important Updates Among Top CEXs

The competitive landscape among centralized exchanges has remained highly active through the summer. A common trend has been clear: leading platforms are not only pushing product innovation but also securing new licenses and compliance approvals, positioning themselves for long-term relevance in a market shaped increasingly by regulation.

Binance has concentrated on strengthening its institutional presence. The exchange partnered with BBVA in Spain to give customers the option of off-exchange custody, addressing investor concerns around security and compliance. At the same time, Binance announced a collaboration with Franklin Templeton to co-develop tokenized investment products, underscoring its ambition to bridge digital assets with traditional financial markets.

Bybit has been equally active on the regulatory front. It secured full MiCAR authorization in the EU, enabling operations across all 29 EEA countries, and filed for a MiFID II license in Austria to broaden its regulated derivatives offering. The exchange also restored full access for users in India after registering with the Financial Intelligence Unit and aligning with AML requirements. Alongside these regulatory steps, Bybit expanded support for USDT0, a standardized stablecoin format, to new blockchains, strengthening its infrastructure for cross-chain liquidity.

Gate has also pursued a dual track of innovation and institutional readiness. Gate introduced GUSD, a tokenized US Treasury product backed by real-world assets (RWAs), such as US Treasury bonds. It brings the duration and yield characteristics of traditional fixed-income securities on-chain, enabling users to access the benefits of conventional debt instruments within a blockchain framework. GUSD minted on-chain surpassed 171 million with high demand.

Institutional infrastructure was another area of progress. By integrating with BitGo’s Go Network Off-Exchange Settlement (OES), Gate now enables professional clients to trade directly against its liquidity while keeping assets in regulated, insured custody. This model, already familiar in traditional finance, enhances capital efficiency, mitigates counterparty risk, and aligns Gate more closely with institutional standards.

OKX has focused on payments and geographic expansion. It became a member of the Global Dollar Network, integrating USDG stablecoin for its global users, and added Circle’s Cross-Chain Transfer Protocol (CCTP) to streamline USDC transfers across chains. OKX also partnered with PayPal to enable crypto purchases in the European Economic Area and launched both its centralized exchange and multi-chain wallet in the U.S., marking a significant entry into one of the most competitive regulated markets.

Bitget, meanwhile, has leaned on retail adoption and trading tools. The exchange’s wallet service launched a zero-fee crypto card in partnership with Mastercard and Immersive, giving users in the UK and EU a straightforward fiat bridge. It also rolled out GetAgent, an AI-powered trading assistant that quickly attracted more than 20,000 users.

Transparency Overview

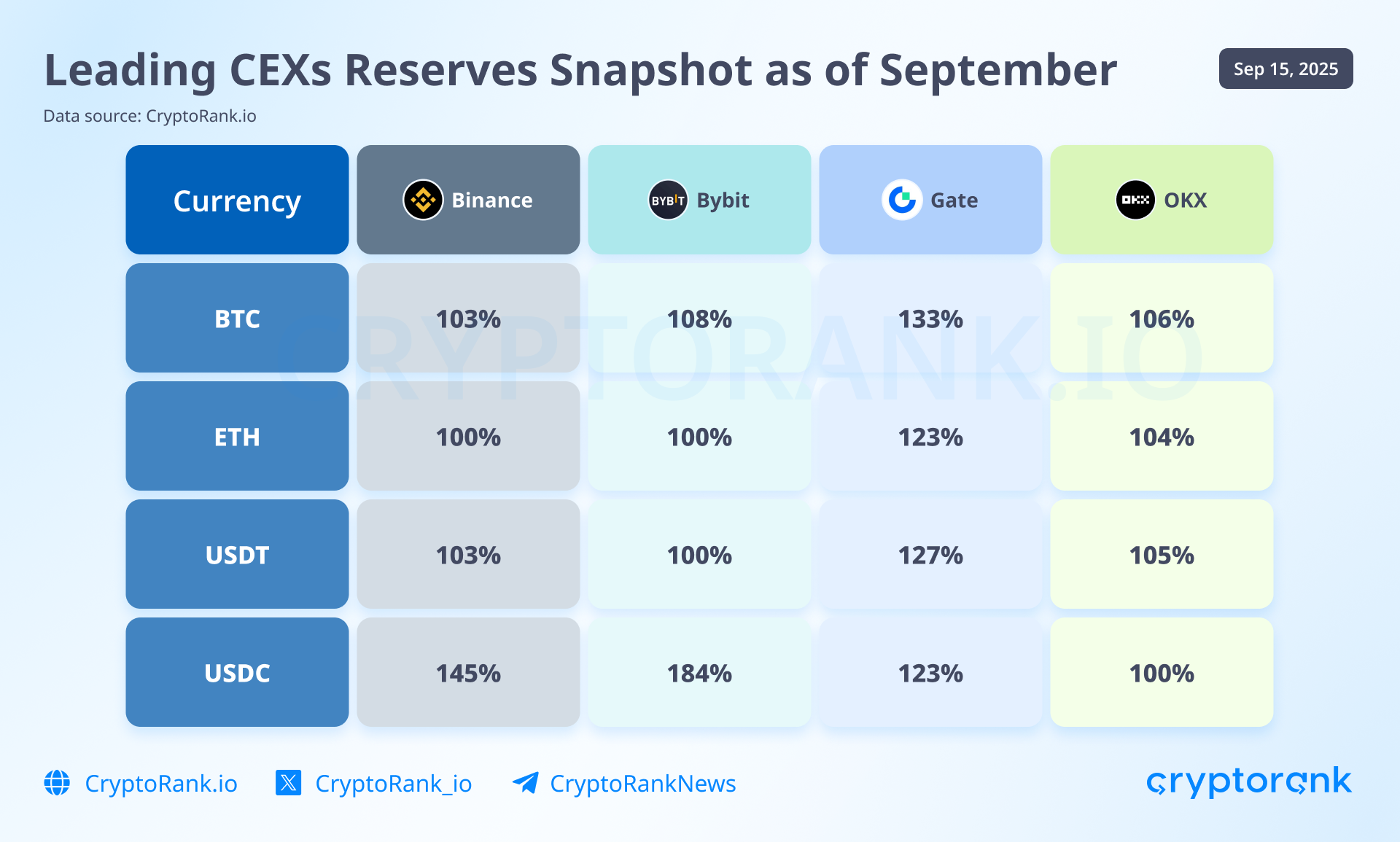

In the recent 34th Proof of Reserves snapshot, Binance reported notable shifts in major assets. Bitcoin holdings rose by 2.85% to 608,017 BTC, while USDT reserves increased by 1.4 B (+4.69%) to 31.25 B. Ethereum balances declined by 4.7% to 4.34 million ETH, reflecting user movements, though overall reserves across key assets remained fully covered.

Bybit's latest PoR audit by Hacken confirmed full 1:1 coverage across all in-scope assets, with Bitcoin, Ethereum, USDT, and USDC all maintaining collateral ratios above 100%. Liabilities for more than 65 million accounts were fully backed, while ownership of audited wallets was validated through on-chain proofs.

Gate’s August Transparency Report showed total assets of $12 billion with a 124% total reserve ratio, placing Gate among the more conservatively managed major exchanges. Importantly, reserve ratios for core assets such as BTC, ETH, and USDT remained comfortably above 120%, which is on average higher than most exchanges.

OKX verified $33.7 billion in assets across 22 cryptocurrencies in its latest report. All major assets were confirmed above the full coverage threshold, including BTC at 106%. Bitget also updated its reserves in August with a total coverage ratio of 188%.

You can check more data on CEX transparency on CryptoRank.

Future Outlook

Looking ahead, the trajectory of leading centralized exchanges will be shaped less by pure trading volumes and more by their ability to secure regulatory approvals and integrate with traditional finance. The top players are actively positioning themselves as bridges between Web3 and institutional markets.

Gate’s steady expansion of products and infrastructure fits within this wider trend. Its efforts to scale Launchpools, grow tokenized products, and build institutional rails alongside partners such as BitGo reflect the broader push to combine user-facing innovation with institutional-grade trust. Together, these developments suggest that the exchange sector is moving toward a model where CEXs function not only as trading venues, but as gateways connecting digital assets with traditional financial systems.