Account Abstraction: Path to Mass Adoption

Key takeaways:

-

Account Abstraction introduces long-awaited by masses user-friendly experience features, such as Social Recovery, Gas Fee Abstraction, Batched Transactions, Wallets with Built-In Rules, Payroll Management.

-

Lack of those user-friendly features have led to failures in mass adoption in previous bull cycles.

-

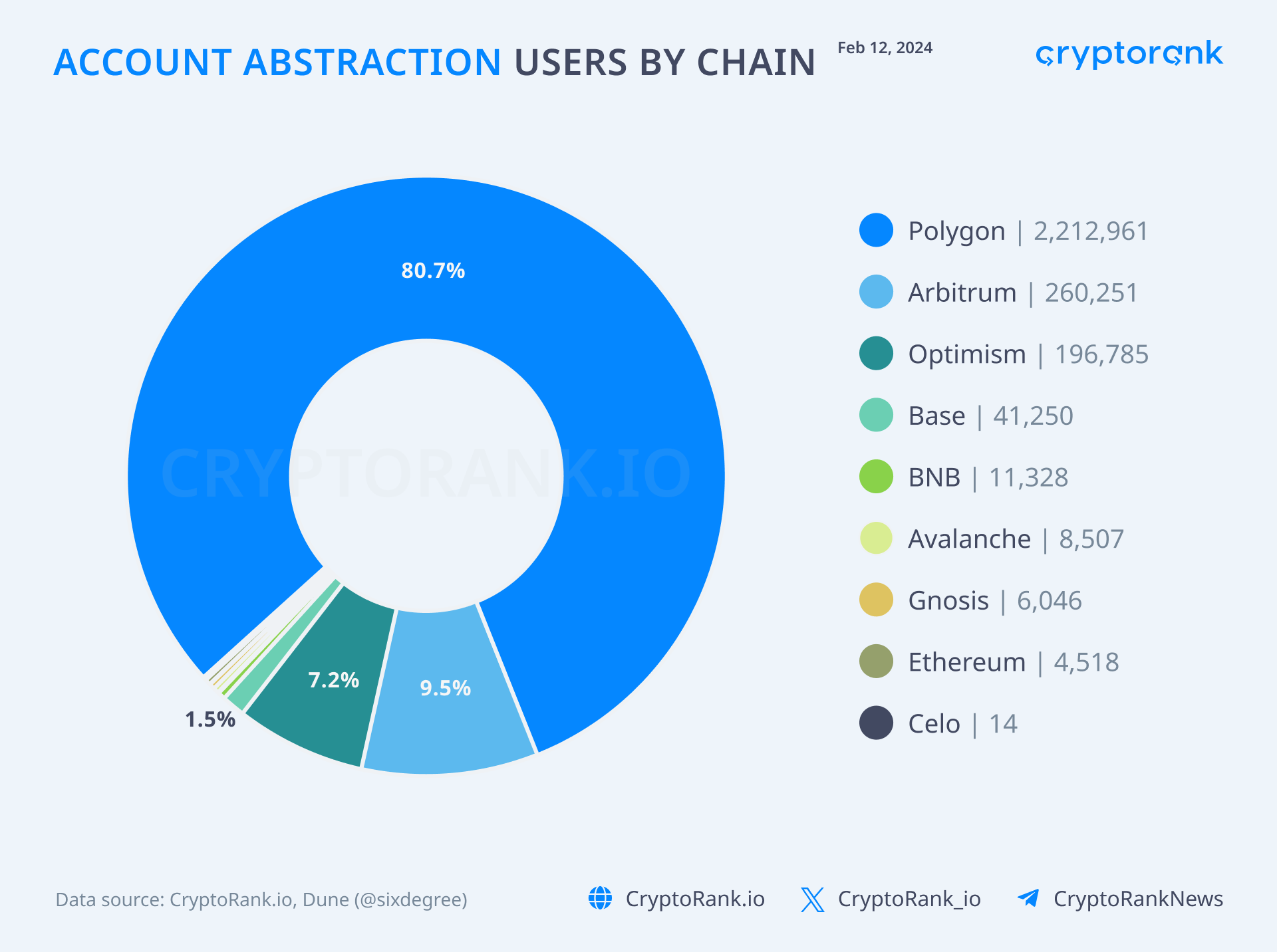

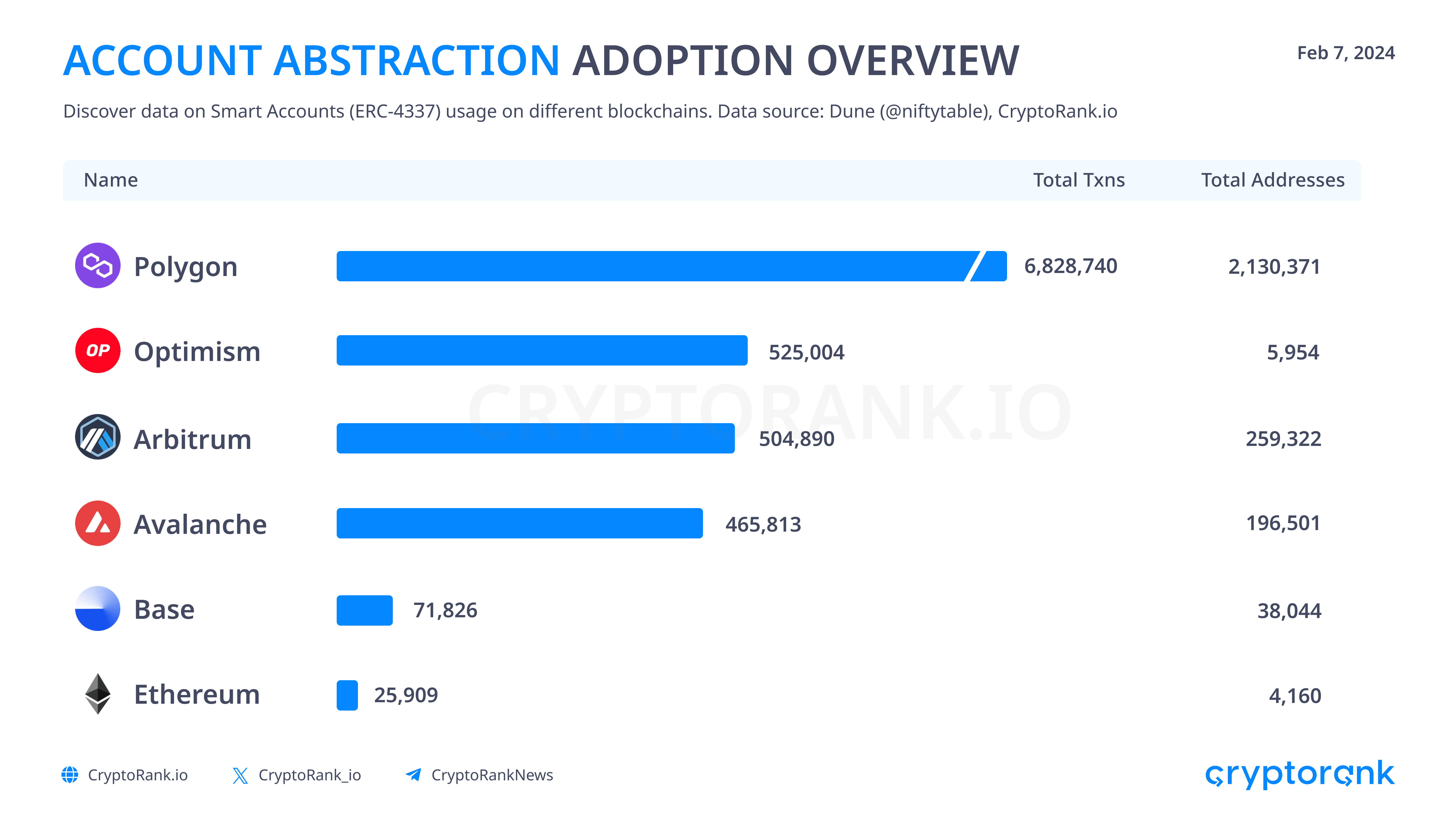

Polygon PoS remains the leader in Account Abstraction adoption, followed by Arbitrum and Optimism.

-

Investment flows to AA-based projects remained low through 2023.

-

Focus on modularity within Account Abstraction can bring “app stores” for smart wallets.

-

The mass adoption breakthrough can be expected to come from GameFi and Account Abstraction mixture.

Main Problem with Crypto

If we look at the cryptocurrency industry as it is today, we find that the vast majority of users here are just trying to buy a token to sell it higher and become rich, and they do it mostly on centralized exchanges. According to the data from the chart below, as of January 2024, DEXs account for ~7% of the trading volume compared to CEXs:

The problem here lies not in the speculative component of cryptocurrencies per se – we’ve reached the current scale of the industry so fast, specifically due to the speculative component. The problem is interconnected with the fact that the majority of users speculate on centralized platforms, not decentralized ones. More specifically, it's the main outcome of the problem. The problem itself is the lack of a user-friendly experience within crypto. That is why most of the users still prefer centralized custodians: it is more convenient.

One can wonder: Why is this a problem? Indeed, it is not a problem if one just wants to trade fancy tokens. In that case, a centralized exchange is a great option. However, if one wants more than just to exchange one token for another, but to unlock a whole world of financial instruments and opportunities built on top of blockchains, then a centralized exchange is a huge limitation. And it will remain a huge limitation until decentralized platforms become as smooth and user-friendly as centralized.

Until that happens, billions of users are stuck in this obstacle to unlocking the full potential of crypto, and we as crypto old-timers are stuck to achieve real mass adoption. So, the lack of user-friendly experience leads to failures in the mass adoption of cryptocurrencies; this is the real problem. Then, how to solve it?

Account Abstraction as Solution

Most likely, you have faced the fear of losing your seed phrase and your funds along with it at least once, like all of us. Everyone makes mistakes, but there is no excuse for that in crypto, and here lies the strongest disincentive for mass adoption. Add on top of that the necessity to sign all transactions, and you hit a wall that holds back the public.

Account Abstraction eliminates the problem of user-hostile experience by introducing the new paradigm of user accounts. There are two types of accounts in most of the blockchains: Externally-Owned Account (EOA), controlled by a private key owner; and Smart Contract Account (SMA), that is hosted on the blockchain network. In the case of Ethereum, the ERC-4337 implementation has allowed these two types of account to be combined into a single account capable of making token transactions and creating contracts at the same time. This unifying layer for the two types of accounts is the Account Abstraction. In newer blockchains, the abstraction is native.

To put it as simply as possible: instead of a user manually creating a wallet account and personally signing each transaction, now the user has a special Smart Contract Account managing all of that. Not only that, but the Smart Contract Account can offer social recovery and other features.

Account Abstraction Use Cases

Account Abstraction opens a world of possibilities in crypto space. Here are some use cases of AA, that can bring plenty of companies and non-crypto users into the space:

-

Gas Fee Abstraction. Users can pay transaction fees in tokens other than ETH (or other native token of a blockchain).

-

Batched Transactions. Users can bundle multiple actions in a single transaction, reducing fees. This is especially relevant for GameFi protocols and their users, as active play requires constant interaction.

-

Social Recovery. Users can recover accounts with the help of trusted friends or family members, eliminating the sole reliance on private keys. The fear of losing the seed phrase is becoming a thing of the past.

-

Wallets with Built-In Rules. Setting rules for transactions, like daily spending limits or whitelisting certain addresses, can be done directly in the wallet. Corporations will be transferring their employees to such wallets.

-

Payroll Management. Companies can build automated, smart contract-based payroll systems that can handle complex employee payments.

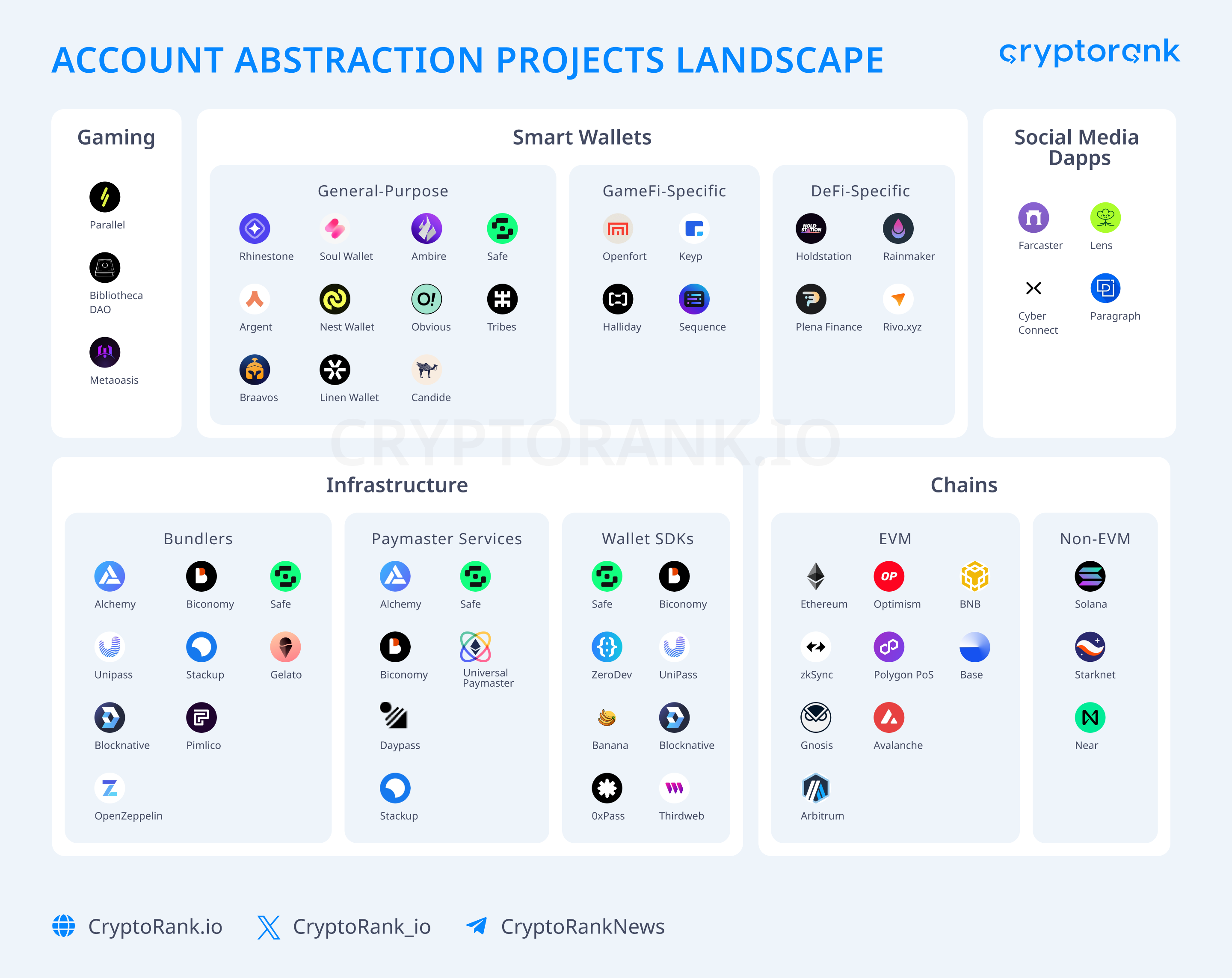

Account Abstraction Projects Landscape

Before diving into Landscape of Account Abstraction projects, it's important to understand the basic terms. Many articles have already been written about Account Abstraction technical side, so we won't spend a lot of time on it, but a basic introduction is needed:

-

User Operation (Op) – data objects containing all the information needed to execute a transaction.

-

Bundler – EOA account (classical wallet) that bundles UserOps and submit them by signing a EOA transaction (classical transaction).

-

Paymaster – smart contract that pays UserOp gas fees on the behalf of the user.

-

Wallet Factory – smart contract, owned by wallet provider company, that creates AA wallets.

-

AA wallet – smart contract wallet that can process the UserOp.

While you're exploring the infographic, we'll highlight a few core projects:

-

Alchemy. Alchemy is a Web3 development platform and research lab, providing APIs, SDKs, and other tools for Account Abstraction. Also provides Bundler and Paymaster Services.

-

Safe. Safe aka Gnosis Safe is an asset management and custody platform, as well an SDK provider.

-

Biconomy. Biconomy is a Web3 developer and transaction infrastructure platform, that offers SDKs, Bundler and Paymaster services.

-

ZeroDev. ZeroDev is a framework for the development and enhancement of smart contract wallets, both custodial and non-custodial.

Account Abstraction Oriented Blockchains

In our October Account Abstraction Adoption Overview, we stated that among various blockchains that support ERC-4337, Polygon, Arbitrum, and Optimism have the highest number of smart account addresses, surpassing other platforms significantly. That hasn’t changed much since.

As of January 22, 2024, the total number of AA wallets exceeded 1.9 million across observed EVM networks, and the number of UserOp transactions performed by them exceeded 8.5 million. At the time of writing, Polygon PoS stands out as the undisputed leader in terms of both the number of AA wallets created and the number of UserOp transactions, followed by Arbitrum and Optimism.

According to Alchemy, the top three apps driving growth in the late 2023 were:

-

Telegram bot Grindery that launched its token incentive program. In the result, Grindery token farming represented 35% of Account Abstraction-related activity in December.

-

Video streaming platform FanTV, that rewards users with tokens for watching videos (18%).

-

Web3 social app CyberConnect (13%).

The traffic was mostly driven by incentive programs, thus it can’t be considered as organic and sustainable. Remarkably, Polygon was the main beneficiary of this traffic. Either way, there is a significant decline in the number of UserOps after these programs are completed:

Although the focus of this piece is on EVM networks, it is important to note the key non-EVM players, namely Solana, Starknet and Near. These blockchains have native support for account abstraction, and this is a topic for a separate research. Starknet looks the most interesting here, emphasizing the development of on-chain games at the same time.

Fundraising in 2023 and Beyond

Let's have a closer look at a few of them:

-

Echooo. Echooo is a self-custodial smart contract wallet with a modular design, which we will cover later. The team develops AI-driven gasless infrastructure based on zkSync and supports multisig and social recovery.

-

Openfort. Openfort is a GameFi-focused wallet that is trying to build infrastructure around emerging crypto games; mainly focused on B2B cooperation with game studios. Endgame is to become the main provider of crypto accounts for players and game companies.

-

Holdstation. Holdstation is building gasless futures trading platform with up to 500x leverage. The only one of the projects mentioned has a token ($HOLD).

AA-based investment flows remained quite low through 2023, both in absolute terms and in relative terms, compared to investment in new L1 and L2 chains. This is unfortunate, given that the emergence of new VC-hyped ghost chains will not lead to mass adoption, only to the dilution of the limited on-chain user base.

The main reason for such low investment inflows, besides the lull in the bear market, is the fact that it is much easier to sell a new chain to the public than a complex concept like Account Abstraction. The key solution for mass adoption is difficult to sell to the masses – how ironic! The right path is not the easiest; but it will become easier soon.

What Account Abstraction Solutions Should We Expect?

While ERC-4337 marked a significant step for EVM blockchains by introducing programmable smart accounts, and offering new features like sponsored gas and social logins, it is only the first step into the full-scale innovative wallet functionality. Modular Account Abstraction (MAA) introduced with ERC-6900 has become the next major step. The new standard has allowed transforming smart accounts into modular structures to provide users with the ability to personalize their accounts via various plugins, rather than using multiple accounts.

Effective and high-quality modularity requires a mature ecosystem of plugins and standards that ensure compatibility and ease of integration among various components. On the horizon of a few years, we may get “app stores” for AA wallets based on emerging infrastructure of Safe, Alchemy and others. Here are some AA-based ideas for such plugins from Rhinestone developer to get inspired of what can become possible soon:

- Noob Wallet – allows users to set up an account for a friend and link the passkey via email, X (Twitter), etc.

- Timed Unlock – allows accounts or assets to be unlocked in the future when specific conditions are met.

- Spending capacity – allows users to set a max transfer or gas capacity per day/week/month.

- Payment request – sends a request for a number of tokens to a given address.

- Subscription payment – sets up a reoccurring transaction triggered by a merchant.

- Buy Now Pay Later – allows users that meet a certain criteria (transaction amount, whitelist of contracts, etc) to access delayed payments.

Another major step further is Rollup Improvement Proposal (RIP) 7650 that proposes integrating account abstraction directly into all Ethereum rollups as a native feature.

Output

The era of the seed phrases is coming to an end, and the barrier that separates the mass user from cryptocurrencies will soon be broken down. Infrastructure maturation and bull run will create a fertile ground for the emergence of user-friendly products and accelerating account abstraction, while human greed and the arrival of Web2 companies will ensure the desirable mass adoption.

The DeFi segment, despite the dominance of centralized exchanges, is already well-developed, and it's unlikely that Account Abstraction (AA) will be a game-changer here. Seed phrases won't deter someone who wants to earn, but they might stop a gamer looking to relax and have fun. Moreover, there hasn't yet been a truly mass-scale and successful Web3 game. The mass adoption breakthrough can be expected to come from GameFi and Account Abstraction mixture.

Read More

Alchemy

Alchemy Andreessen Horowitz (a16z crypto)

Andreessen Horowitz (a16z crypto) Animoca Brands

Animoca Brands CMS Holdings

CMS Holdings NGC Ventures

NGC Ventures