Crypto Market Recap: May 2024

Key Takeaways:

-

Spot Ethereum ETH got green light from SEC

-

ZkSync, LayerZero and EigenLayer announced long awaited airdrops

-

Both leading american party republican and democrat include crypto in its agenda with republicans seems to be more crypto friendly

-

Market is fulfilled with positive expectations concerning a launch of spot ETH ETF trading and expected airdrop distribution from top tier projects

Market Performance

Overall, May was not overwhelmingly bullish, with the market experiencing relatively moderate growth and several major projects trading in the red. However, the market exceeded expectations, shifting sentiment from neutral to positive.

The primary growth catalyst was undoubtedly the approval of the spot Ethereum ETF. This approval is expected to attract more investment and attention to the crypto sector, albeit indirectly. Among the top gainers with significant market capitalization were Ethereum and its competitor Solana. There are rumors that Solana might be the next candidate for a spot ETF, although this is not anticipated to happen soon. Nonetheless, hope continues to drive the market.

However, despite the positive sentiment, the spot trading volume on CEXs (one of the key indicators of activity) is 2 times lower than in March 2024, when the market experienced growth following the approval of BTC ETFs.

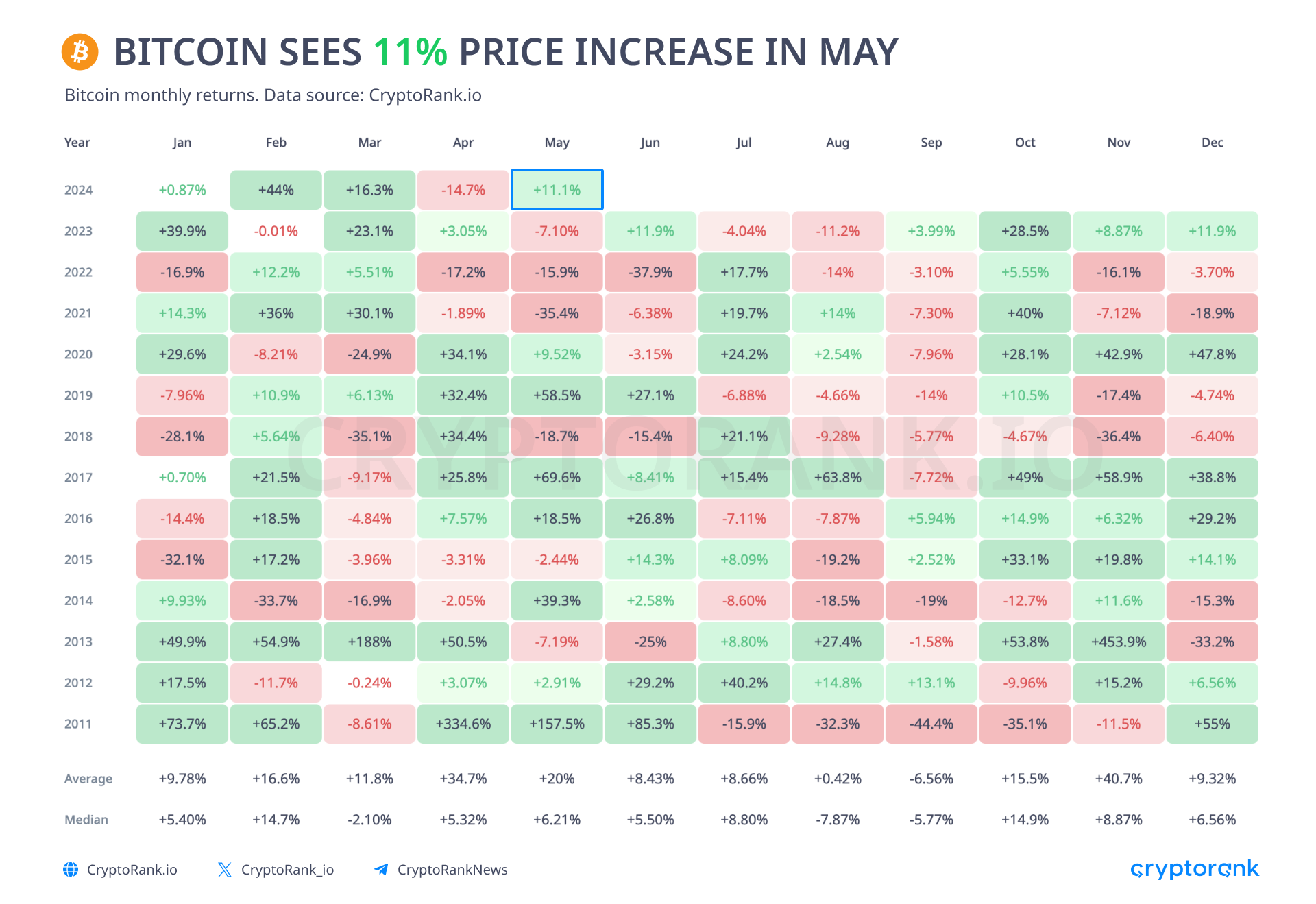

Bitcoin Price Grew 8 Out of 9 Last Months

Bitcoin price drew support line around $60,000 - $63,000, which will serve as an important mark during corrections or downtrend. With its growing market cap and approval of the ETF, Bitcoin should be less volatile, which may contribute to its further adoption. However, it will be revealed later when a huge stress test comes. For now after breaking $70,000 the next target is $80,000 which can be reached any time soon.

Memes Appeared to Be Biggest Gainers

Good or not memes to be the most gaining crypto category, which partly split crypto community opinion on whether it’s normal or negative for crypto industry. Some people consider that memes contribute to the popularity of crypto and enhance communities, while others suppose that meme tokens took financial resources and attention from serious projects and also discredit the crypto industry as a whole.

New Projects on the Market

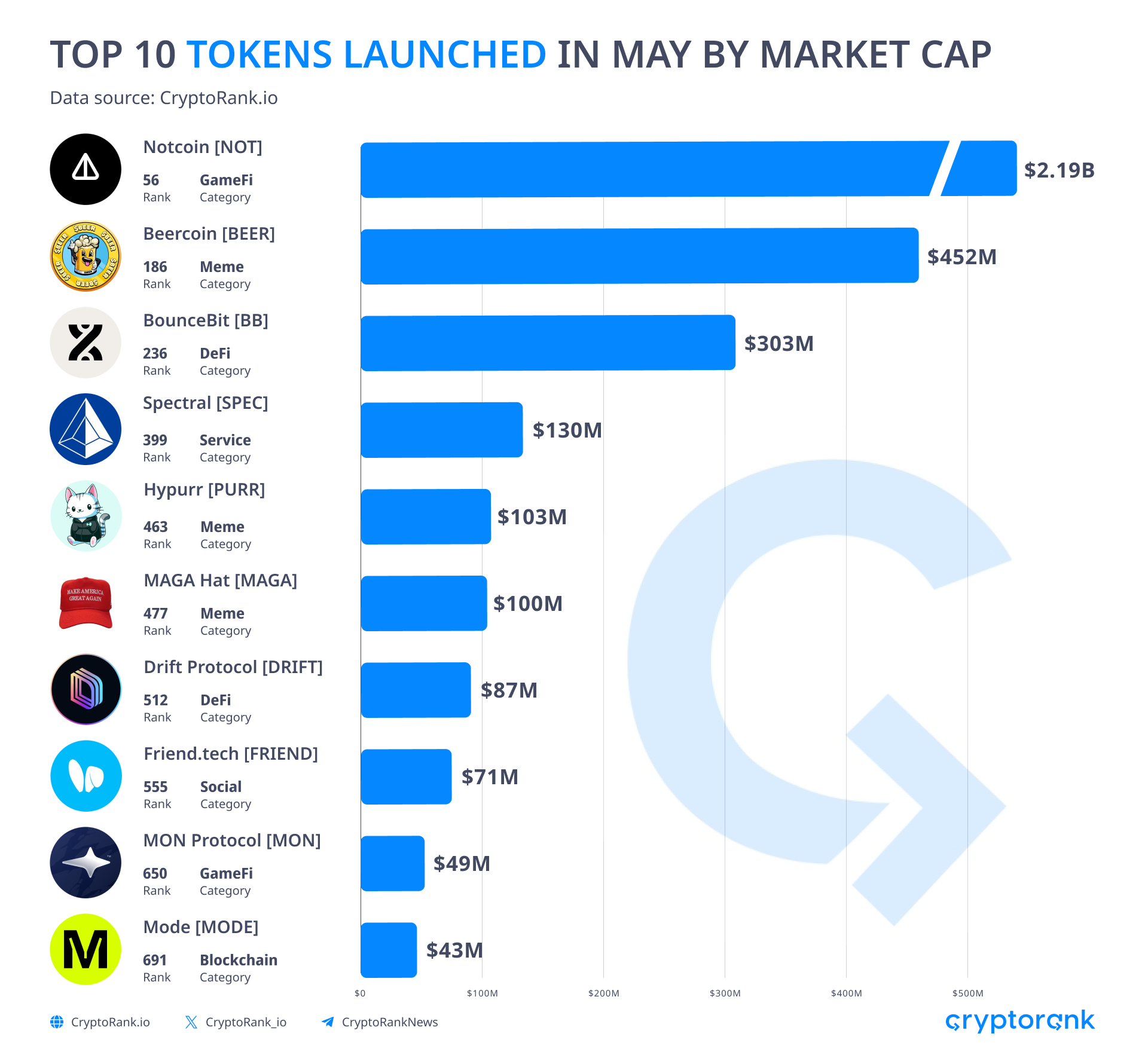

This year, the crypto market is flooded with memecoins. Every day hundreds of new memecoins are launched, and every week one of them achieves a very high market capitalization. In May, 3 memecoins reached a market cap of over $100 million.

May also saw several highly anticipated airdrops: Notcoin, BounceBit, Drift, MON, friend.tech, and Mode. NOT was a real surprise for the market, gaining a capitalization of almost $3 billion on ATH.

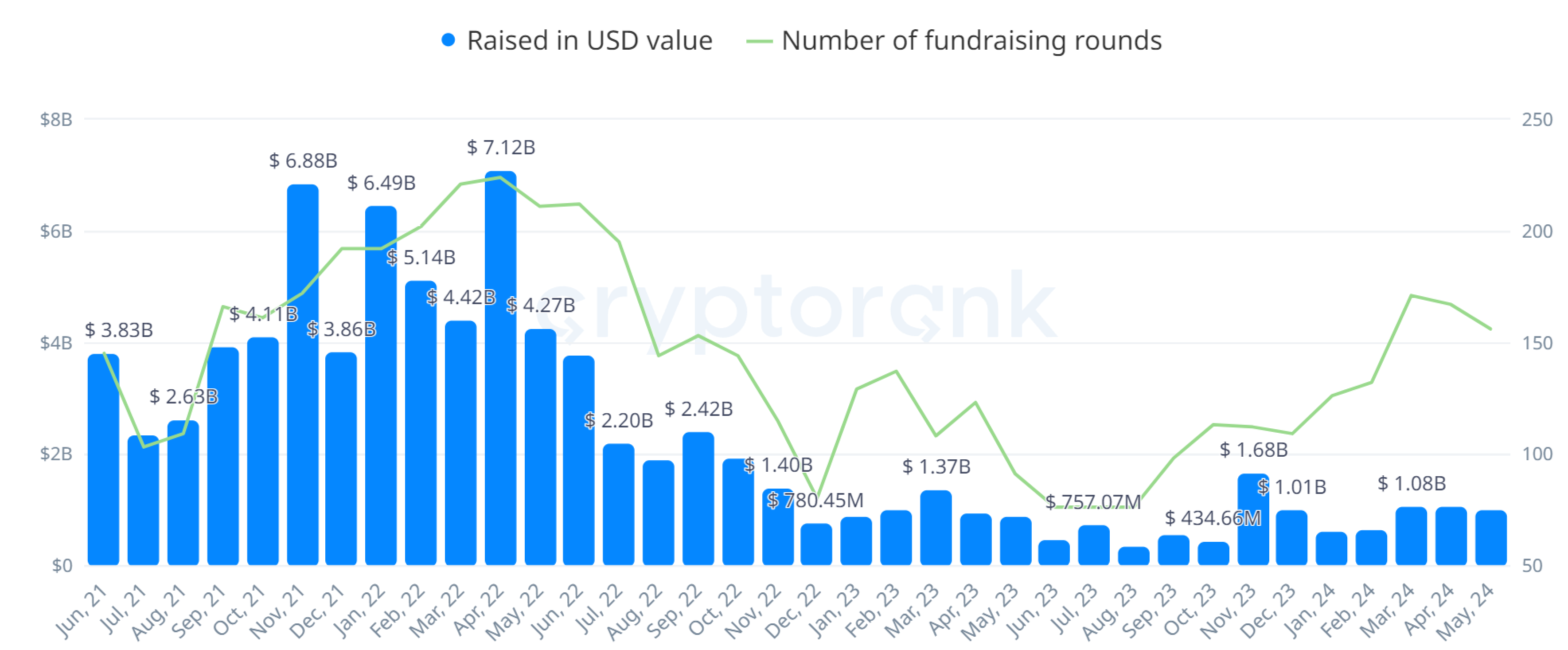

Token Sales and Fundraising Overview

While the fundraising in crypto remains at the same level for the third month straight, token sales market continues posting gains.

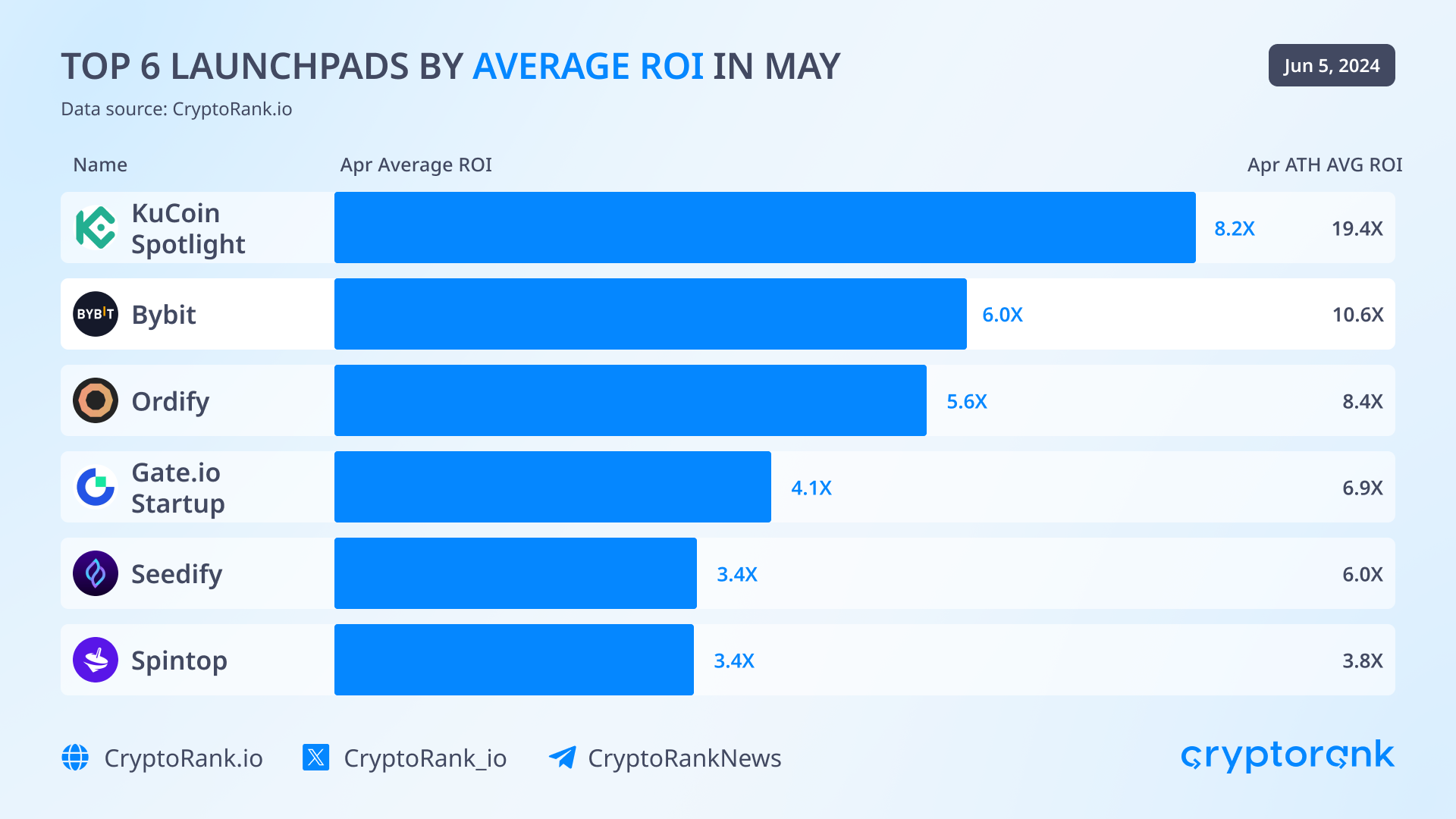

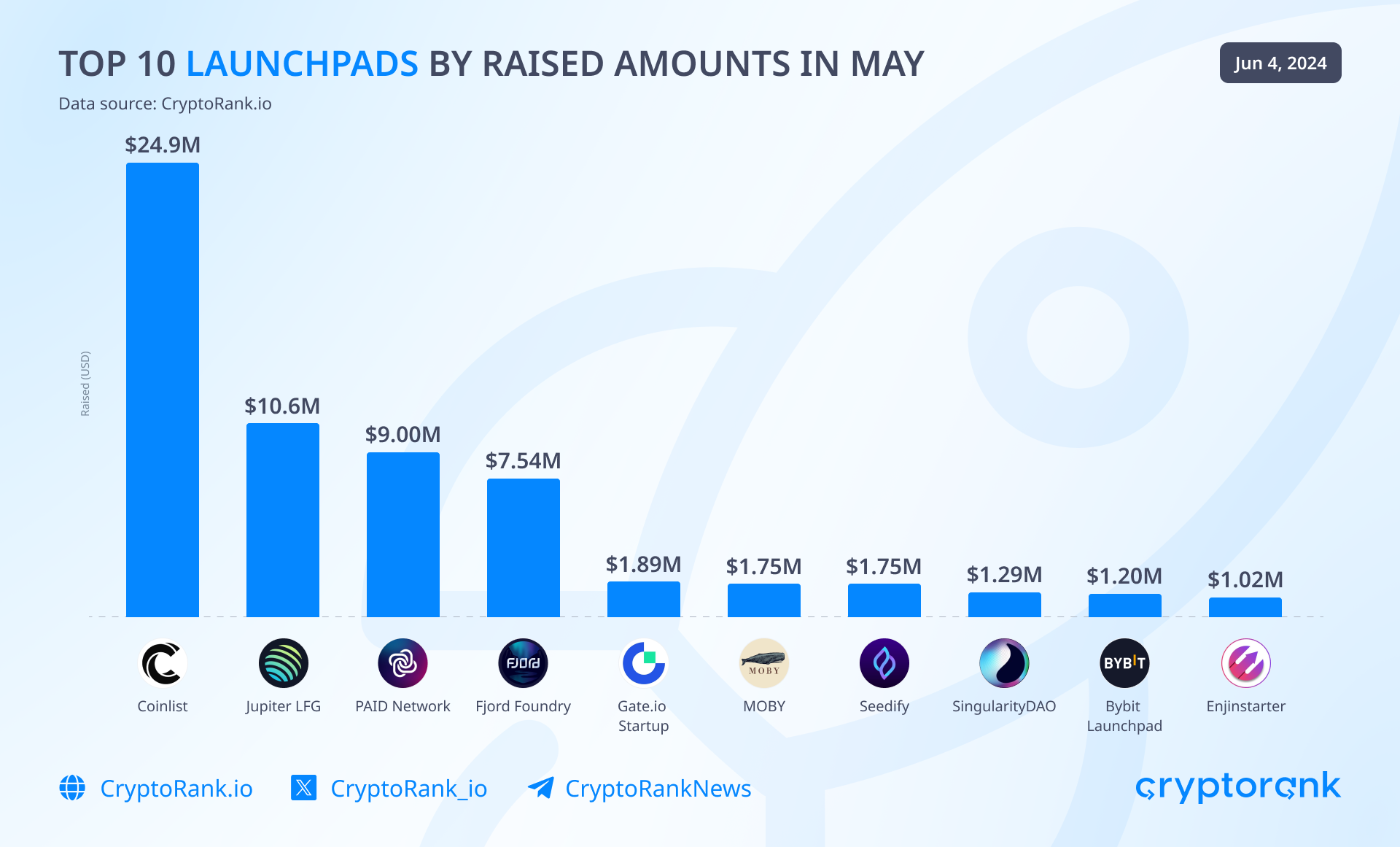

Notably, launchpads of centralized exchanges outperformed decentralized one’s by ROI of token sales in May. KuCoin Spotlight takes the first place, followed by Bybit Launchpad.

Coinlist led by the raised amount with almost $25 million raised in 3 token sales: TAP Protocol, Natix Network, and peaq. It is followed by Jupiter LFG, PAID Network, and Fjord Foundry.

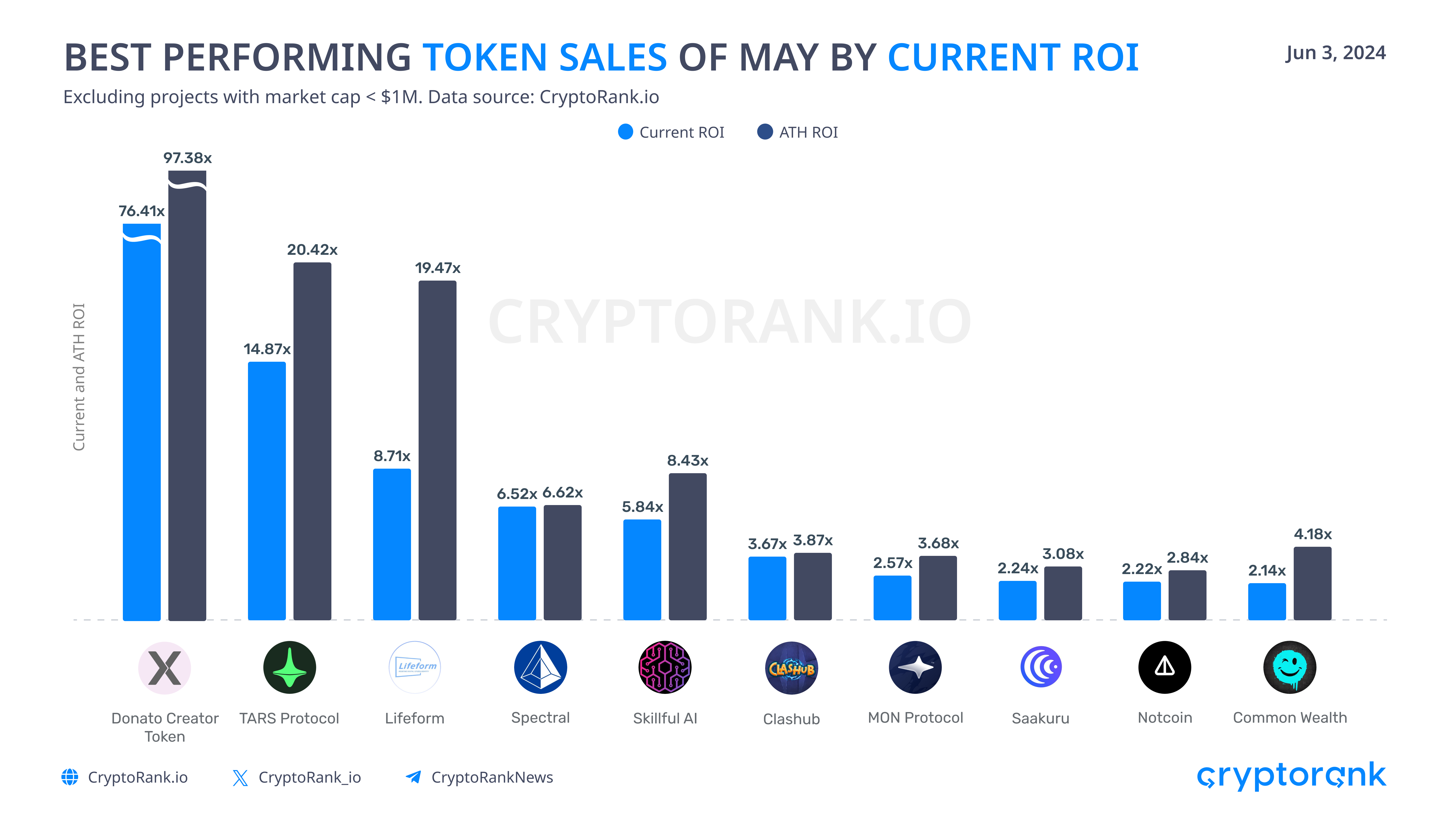

Donato Creator Token leads with nearly 76x returns in May, followed by TARS Protocol and Lifeform.

It is worth noting that the market sentiment remains positive for IDO & ICO, however, investors today are much more careful while picking the projects for token sales.

On-Chain Overview

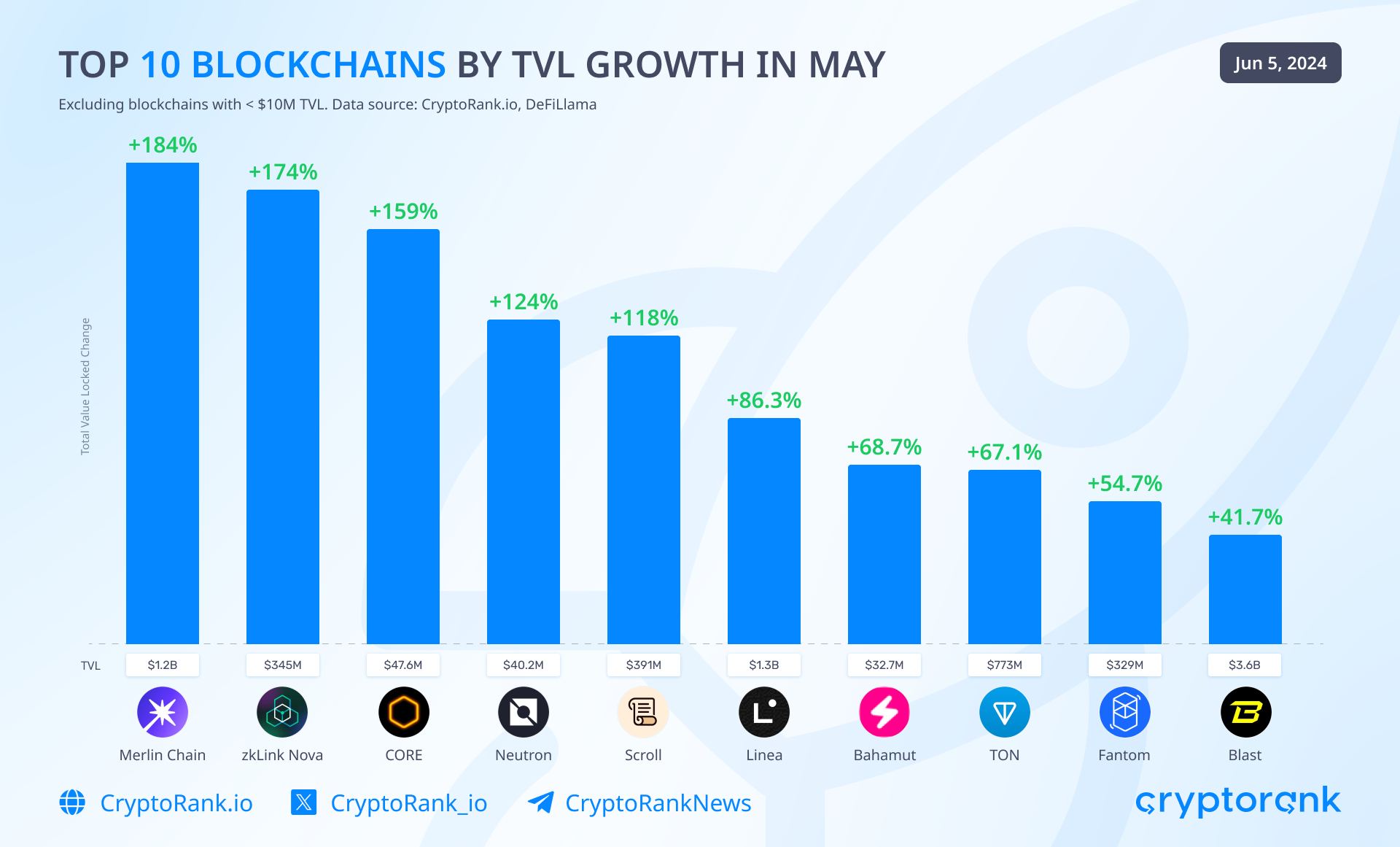

Following the price rally, DeFi also raised its TVL, but an overall increase of 25% doesn't seem too optimistic. The main increase occurred due to the growth of tier-1 blockchains: Blast and Linea. Surprisingly, Merlin Chain, the layer 2 network for Bitcoin, also took the first place in the ranking.

Among the projects, BitGenie, Puff Penthouse and TLX Finance are the growth leaders by total value locked in May.

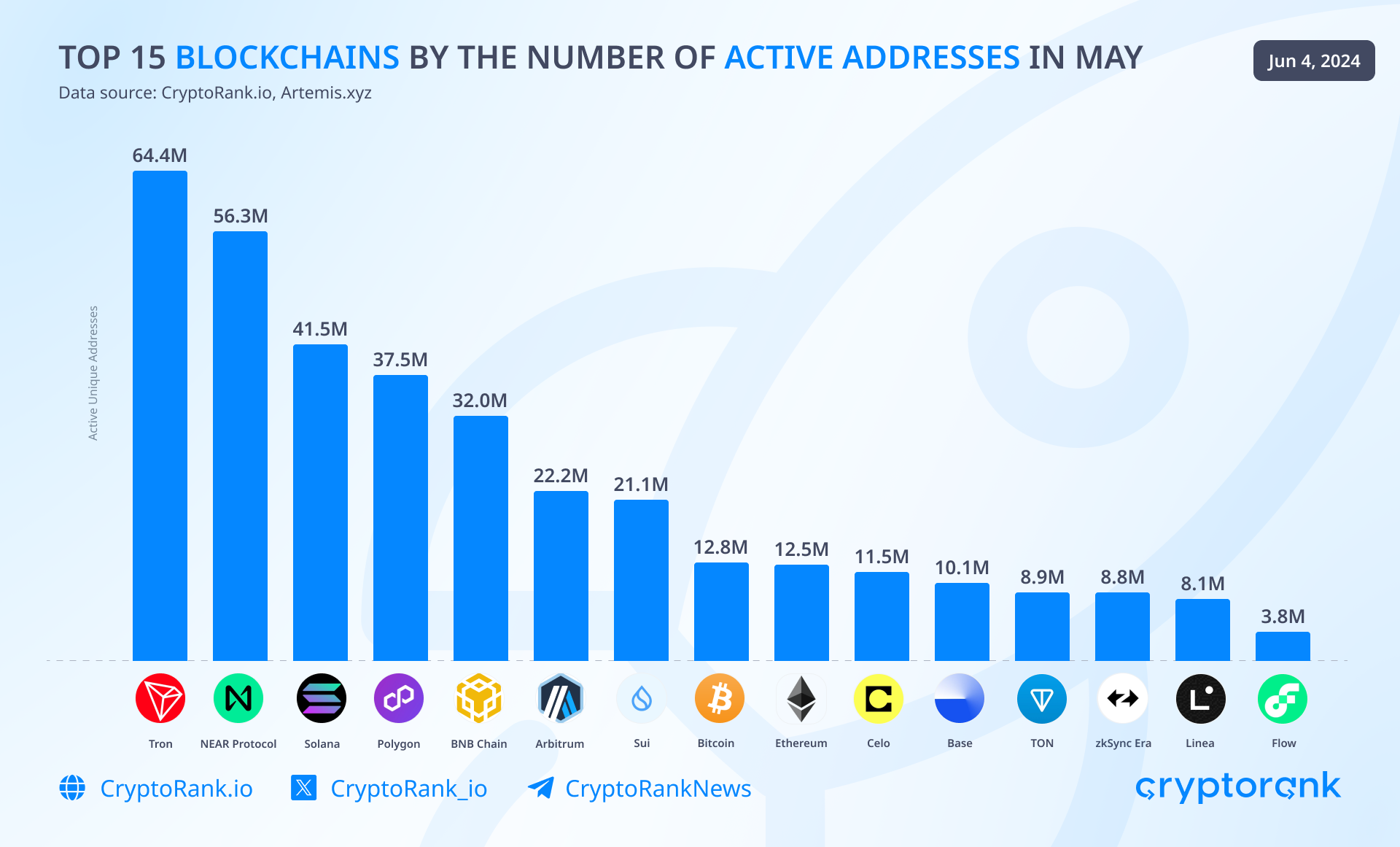

Once again, Tron became the leader by the number of monthly active addresses, followed by Near and Solana. Ton has entered the top-15 for the first time with almost 9 million active wallets.

The Bottom Line

In May, the cryptocurrency market defied the traditional "sell in May and go away" adage, transitioning from consolidation to an uptrend. The standout event was the SEC's approval of the spot Ethereum ETF, which significantly boosted market sentiment and attracted investor attention. Despite moderate overall growth and some projects trading in the red, the market exceeded expectations. Other notable developments included major airdrop announcements, increased political interest in crypto, and a surge in new memecoins.