Crypto Market Recap: August 2024

Key Takeaways:

- August was the worst month for crypto performance in 2024.

- Disappointment over poor performance, small airdrops, and the lack of new narratives fueled memecoin trading.

- Memecoins were the top performers in August.

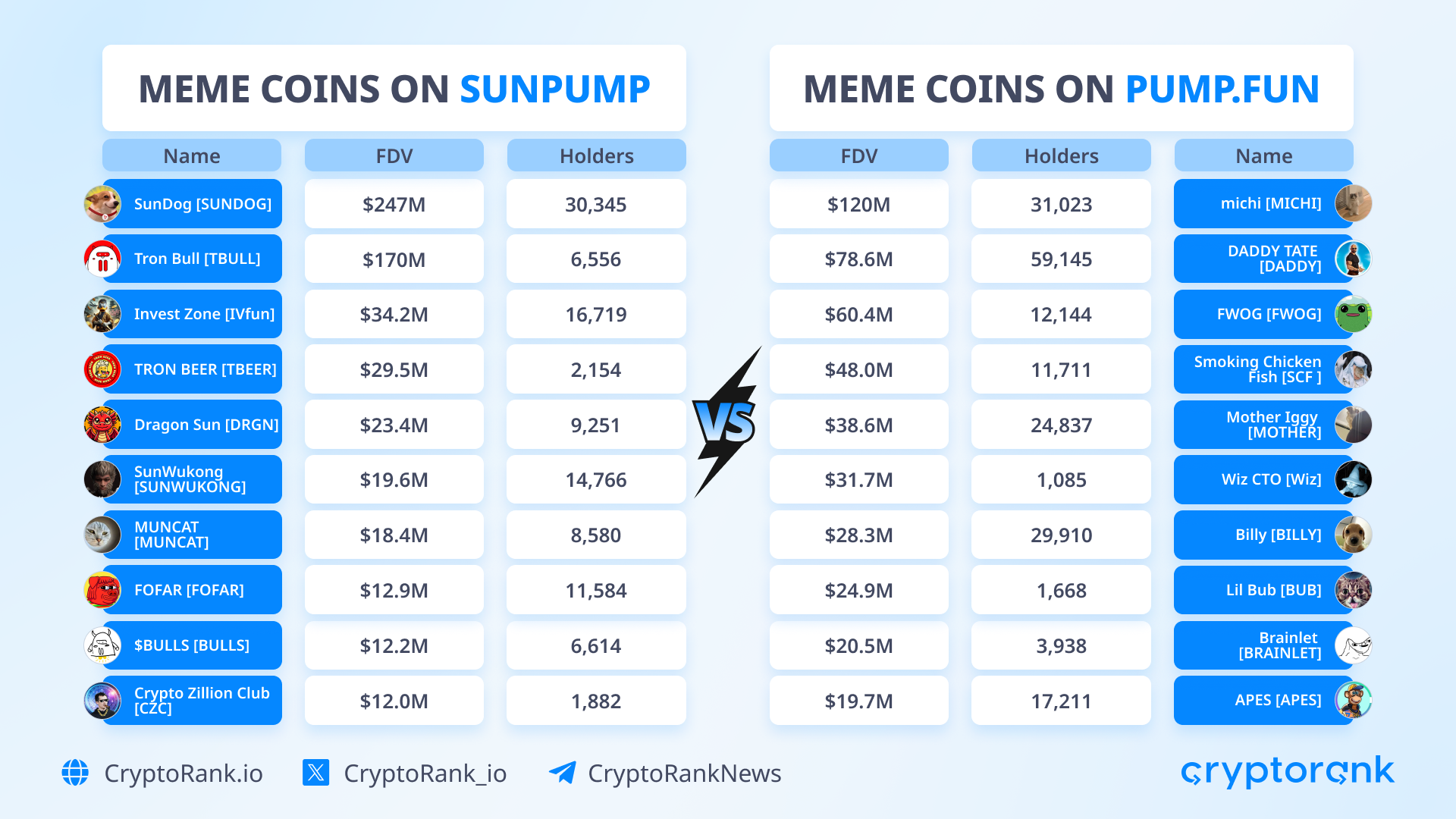

- Solana and TRON led the memecoin trading scene, with Solana’s pump.fun and TRON’s SunPump platforms driving activity.

Is It The End of the Bull Market?

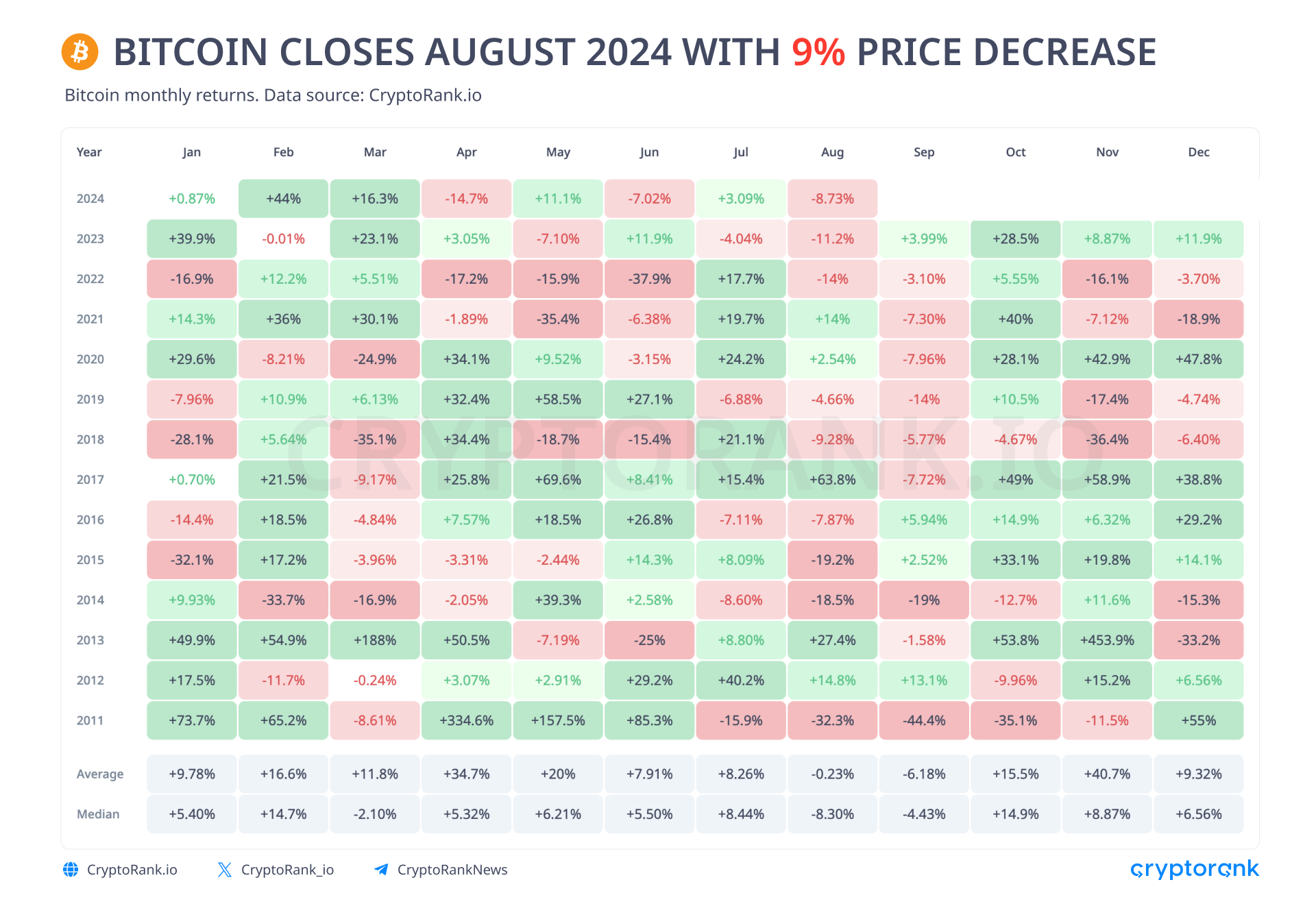

For Bitcoin, August has been the second-worst month of the year following the correction from its all-time high in April. Historically, August—and particularly September—are challenging months for the crypto sector, and this year is no exception, with Bitcoin losing 8.73% in August.

Altcoins, with their higher beta coefficients, have followed Bitcoin's decline but experienced even steeper price drops. Among those tokens, which managed to grow memecoins are prevail. Investors are now questioning whether this is a market correction or the end of the bull market. From the perspective of bull-market duration, it could be either. However, there is still potential for positive developments, such as de-escalating political tensions, the start of FED rate cuts, and crypto-friendly policies from the U.S. government. Nevertheless, the market is clearly lacking the breakout success stories and fresh narratives needed to attract new audiences and liquidity.

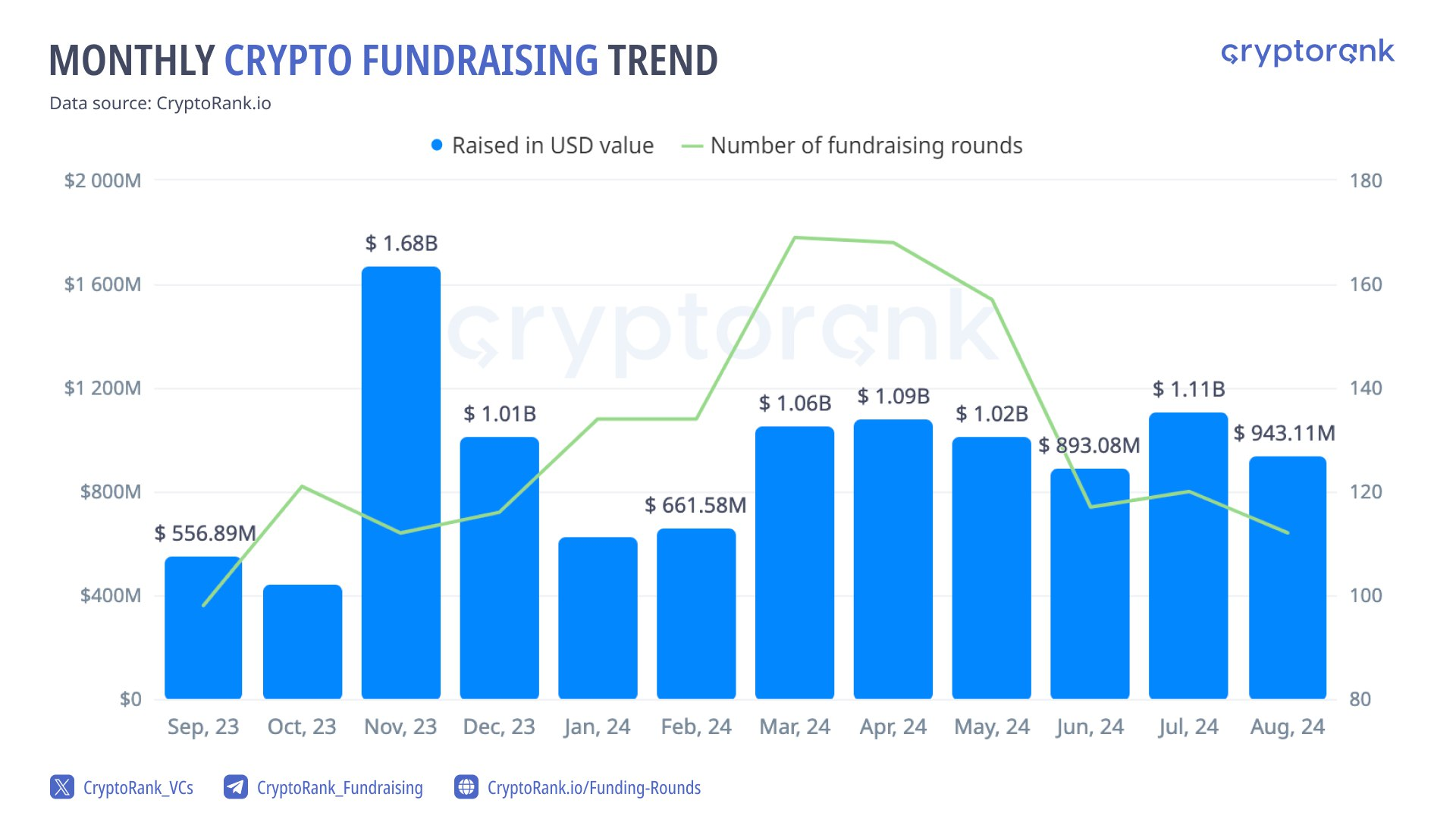

Number of Funding Rounds Reached All Time Low in 2024

Despite the decline in crypto project prices, venture capital activity in August remained steady compared to previous months. However, the number of funding rounds hit an all-time low for 2024.

Top 10 Notable Rounds

In August, VC investments in crypto showed no clear preference for any specific segment.

Among the top 10 notable funding rounds, Story Protocol stands out, securing $80 million in a Series B round led by Andreessen Horowitz (a16z), with participation from Polychain Capital and others. This protocol is particularly interesting as it enters the massive intellectual property market, where blockchain technology has the potential to revolutionize processes by increasing transparency, speed, security, and improving pricing.

Sahara AI merges decentralization with artificial intelligence, creating personalized Knowledge Agents that ensure security, equity, and accessibility for all. The combination of AI and blockchain could enhance AI’s efficiency through the trustless nature of blockchain, making it a project worth watching.

Chaos Labs is a platform focused on advanced risk management solutions for decentralized finance (DeFi) protocols. It provides tools for simulating, testing, and analyzing various scenarios' impact on DeFi ecosystems, helping projects optimize both their security and efficiency.

For the crypto space to thrive, it needs a diverse range of startups and business models. Venture capital should become more selective, prioritizing innovative ideas over financing similar chains and protocols with only minor differences.

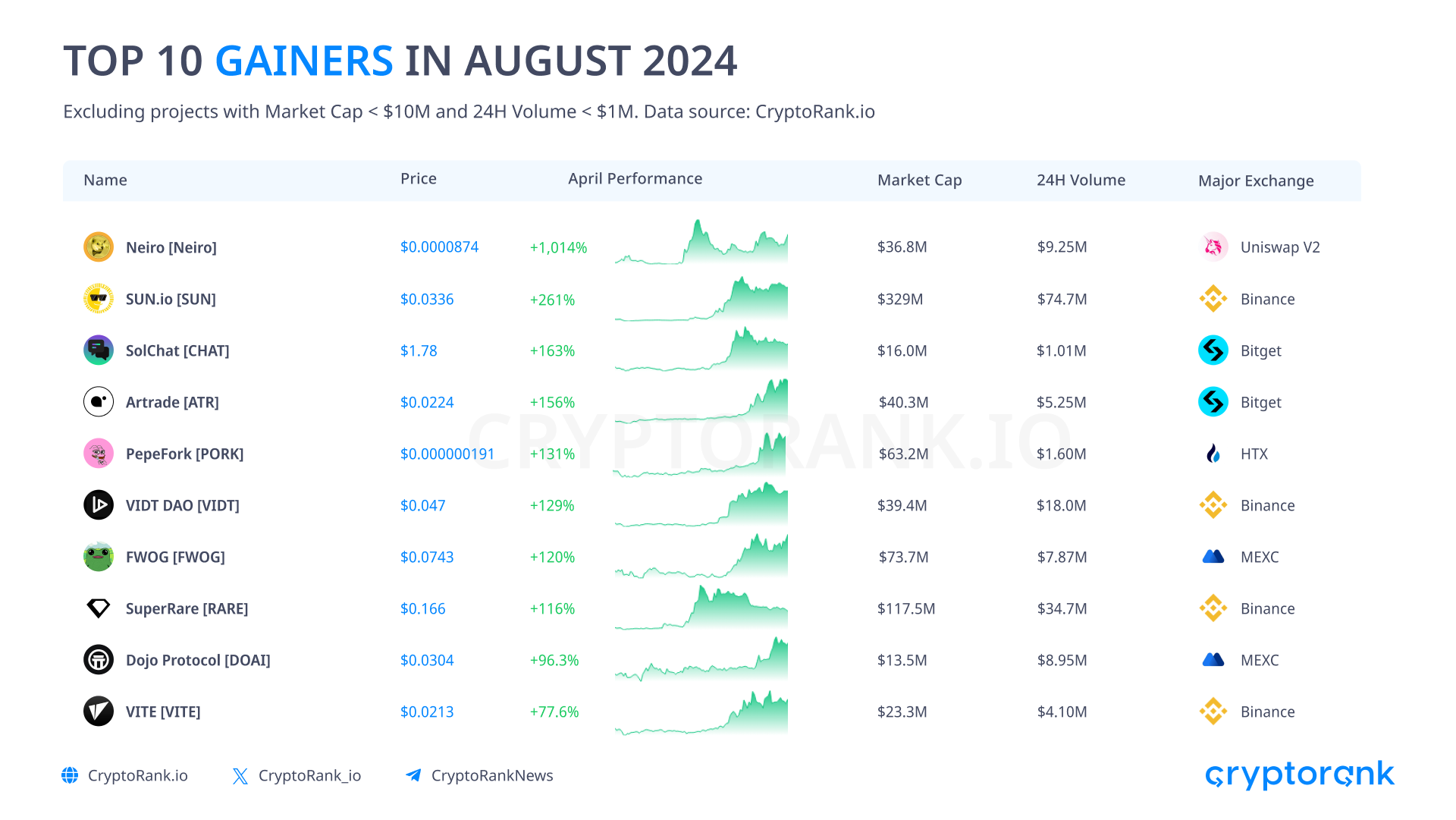

Memes Are All We Have

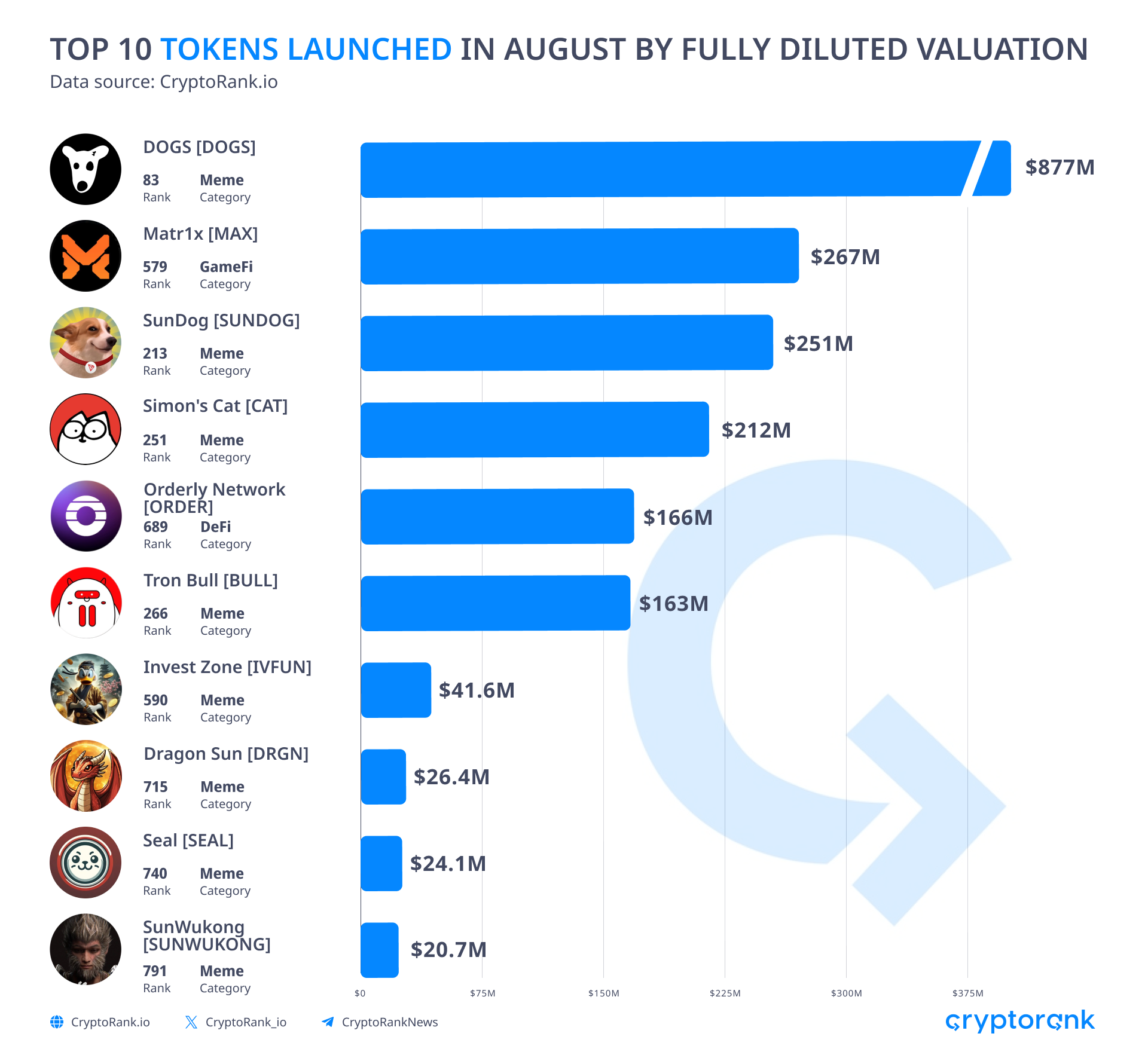

Currently, memes dominate the crypto space, with 8 out of the 10 highest market cap tokens launched in August being meme coins. Notably, a newly launched memecoin called "Dogs" has a higher market cap than several long-anticipated, fundamentally useful projects. Additionally, 5 of the top 10 tokens by market cap were launched on SunPump.

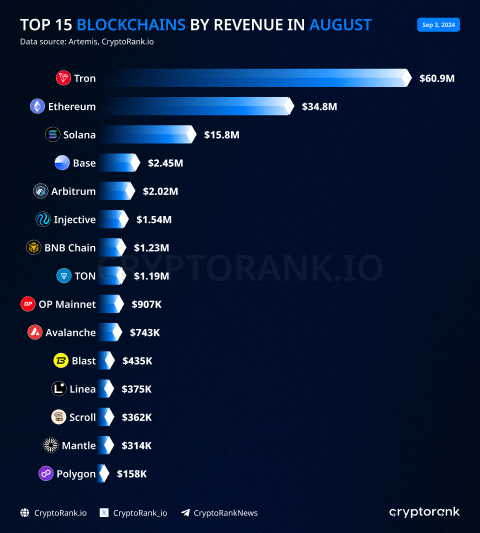

TRON Dominates by Revenue

The success of SunPump boosted TRON's revenue, making it the top blockchain by revenue in August. This surge in popularity has given the traditionally less popular TRON ecosystem an opportunity to attract a significant number of new users.

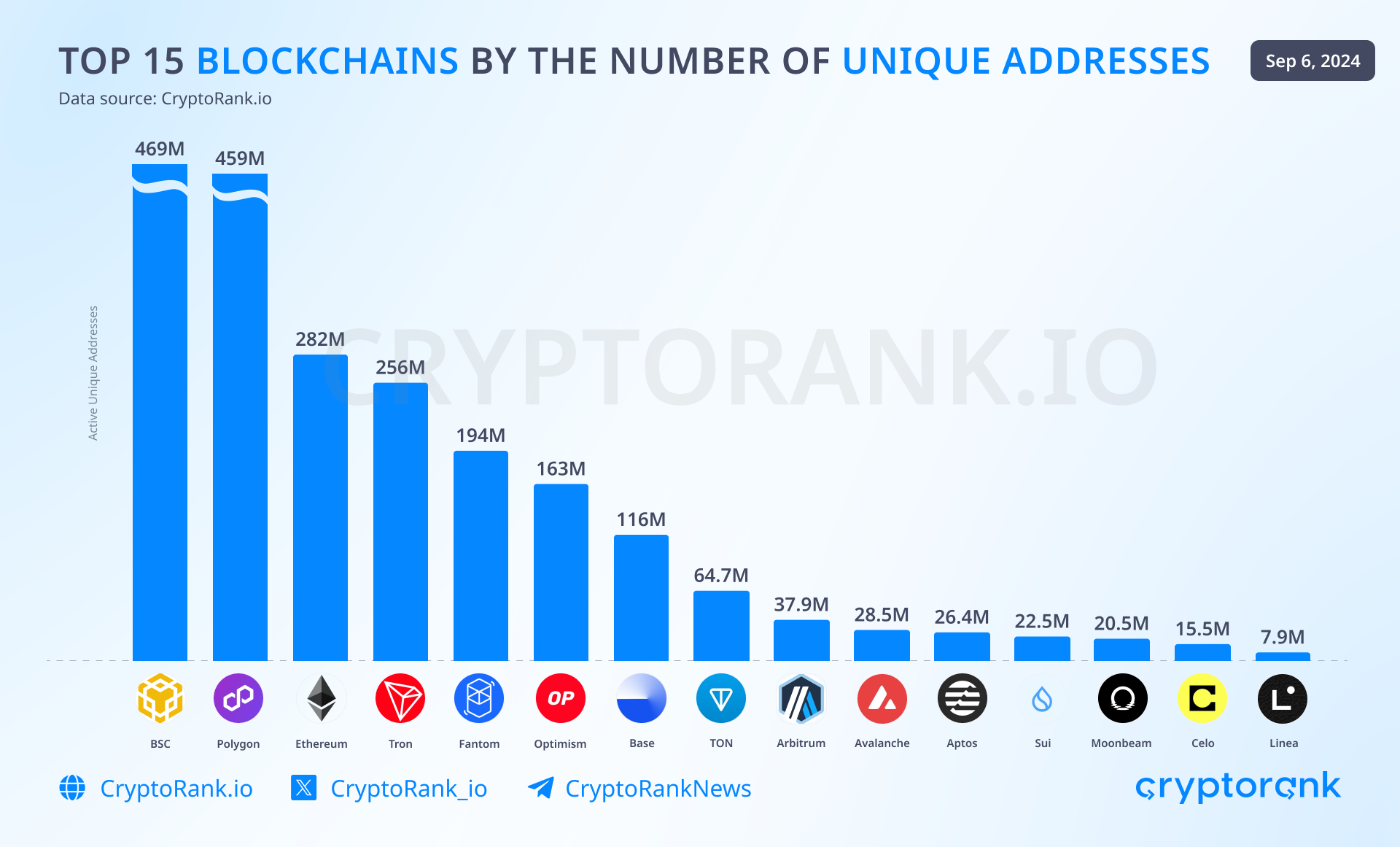

Top Blockchains by the Number of Unique Addresses and Transactions

All blockchains gradually continue to grow by the number of unique addresses Base and TON demonstrate the fastest growth caused by the popularity of both blockchains.

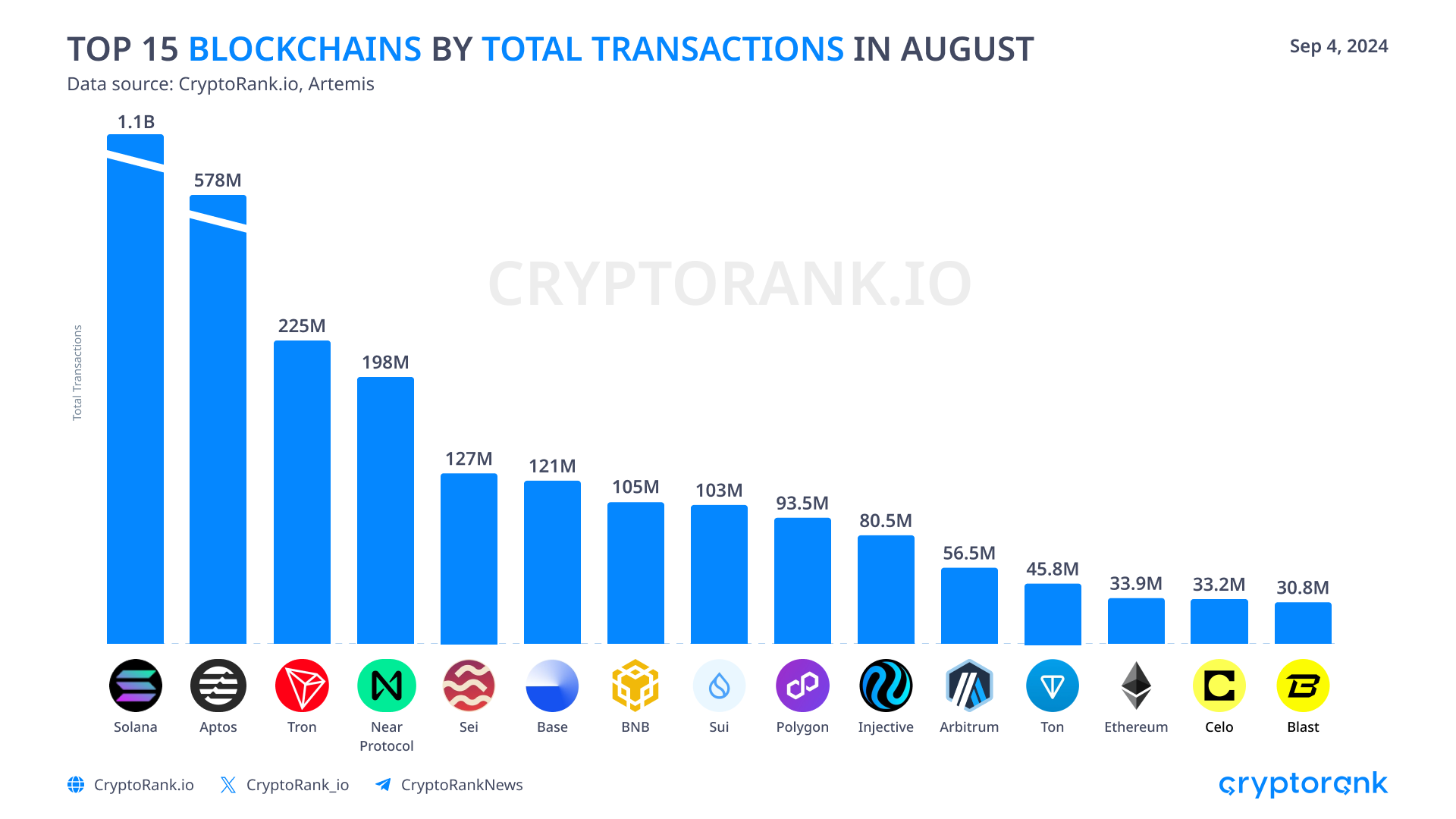

In August, Solana maintained its position as the leader in total transactions, followed by Aptos, which saw a spike in activity, and TRON, which gained popularity with the launch of SunPump.

Blockchains Competition by the Trading Volume

The chart highlights three tiers of trading volume where blockchains compete. In the top tier, with approximately $50 billion in trading volume, Ethereum and Solana contend for dominance. Solana briefly surpassed Ethereum in July but relinquished the lead in August, allowing Ethereum to regain its position. The second tier, with around $20 billion in volume, features a close competition between Arbitrum, BNB, and Base. The third tier, with volumes below $4 billion, includes various smaller blockchains vying for the remaining market share.

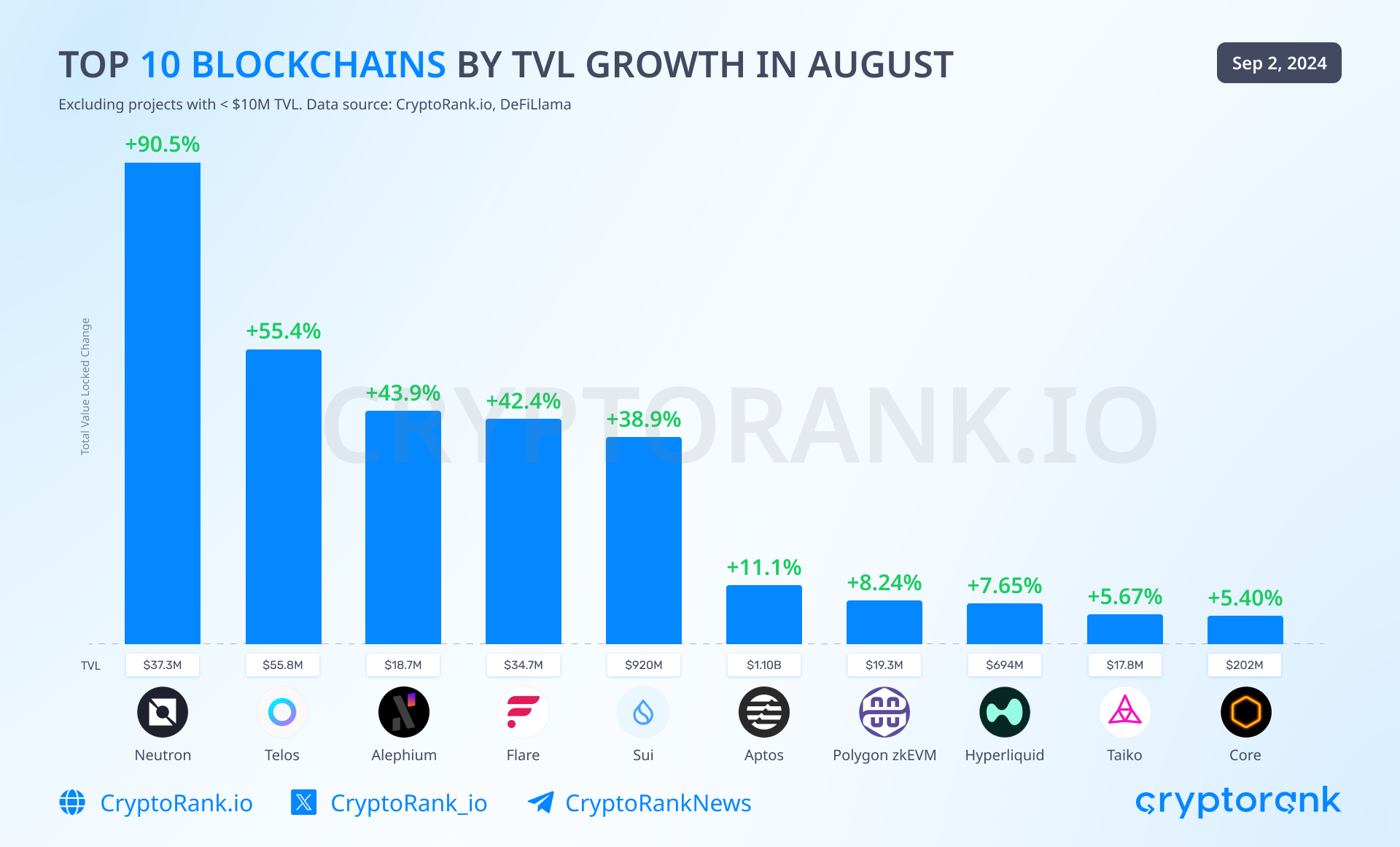

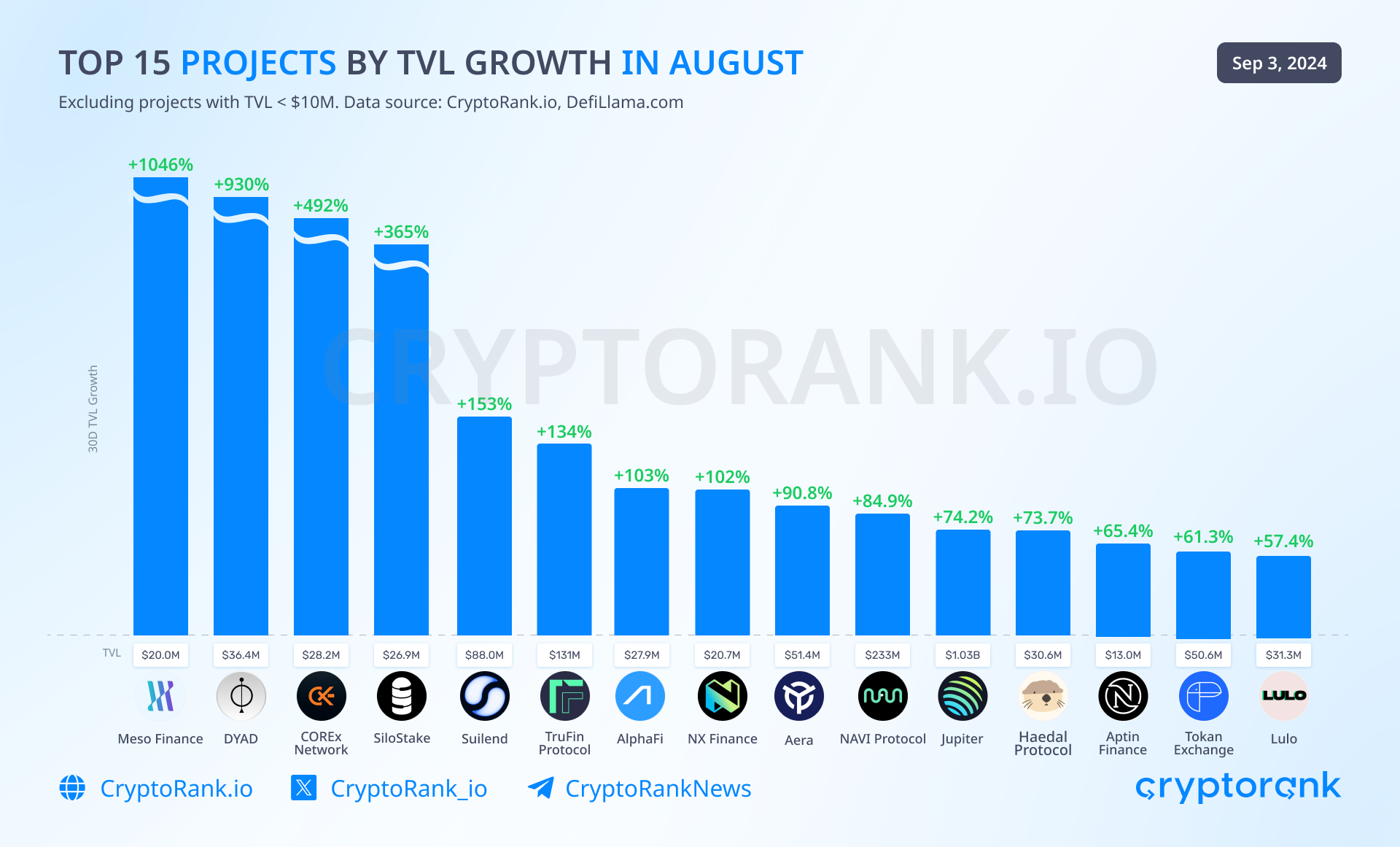

Top Leaders by TVL Growth

Among blockchains, Neutron led in Total Value Locked (TVL) growth, followed by Telos, Alephium, and Flare. Among big blockchains only Sui and Aptos managed to show positive performance.

Among projects, Meso Finance led in Total Value Locked (TVL) growth, followed by DYAD, COREx Network, and SiloStake.

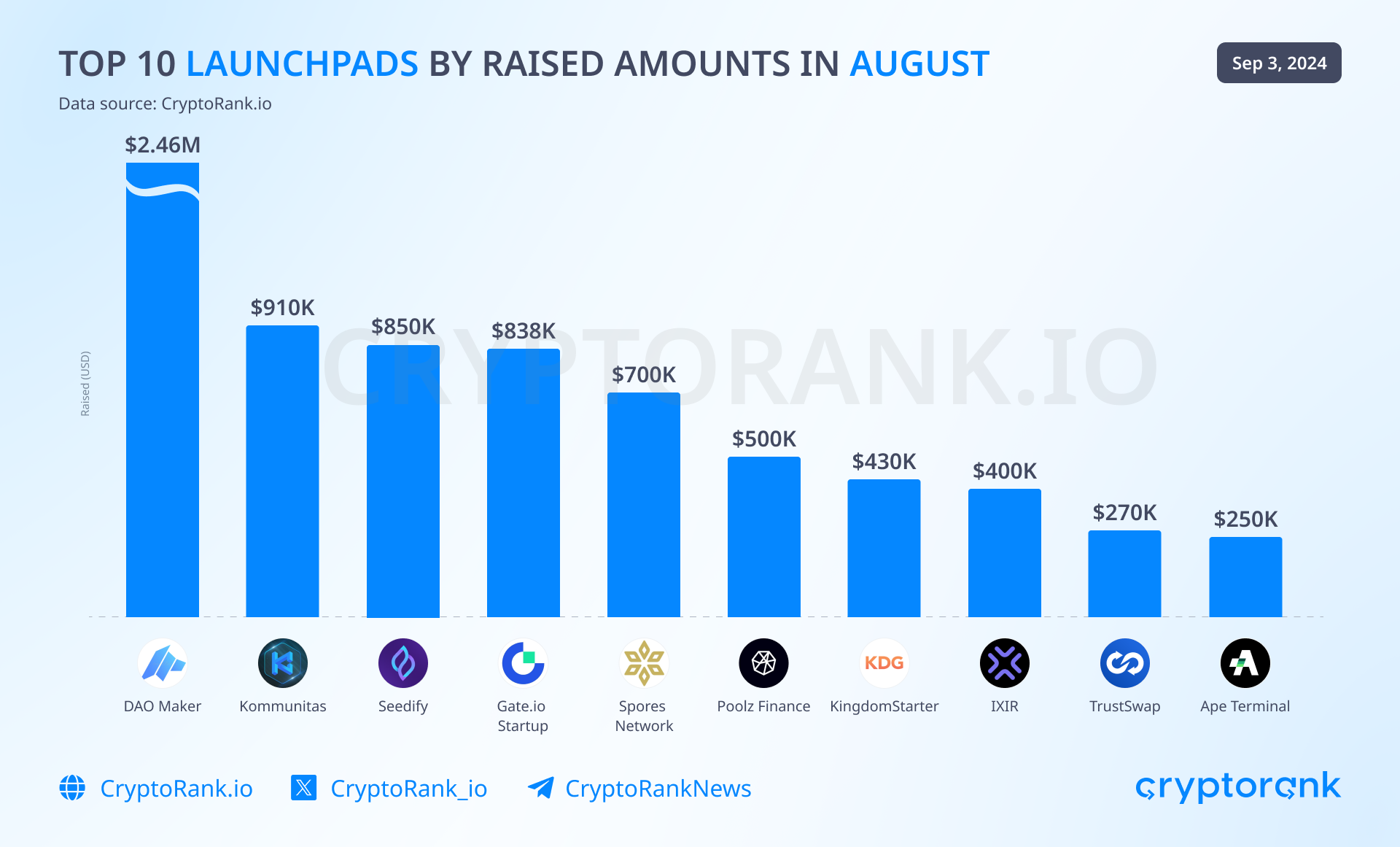

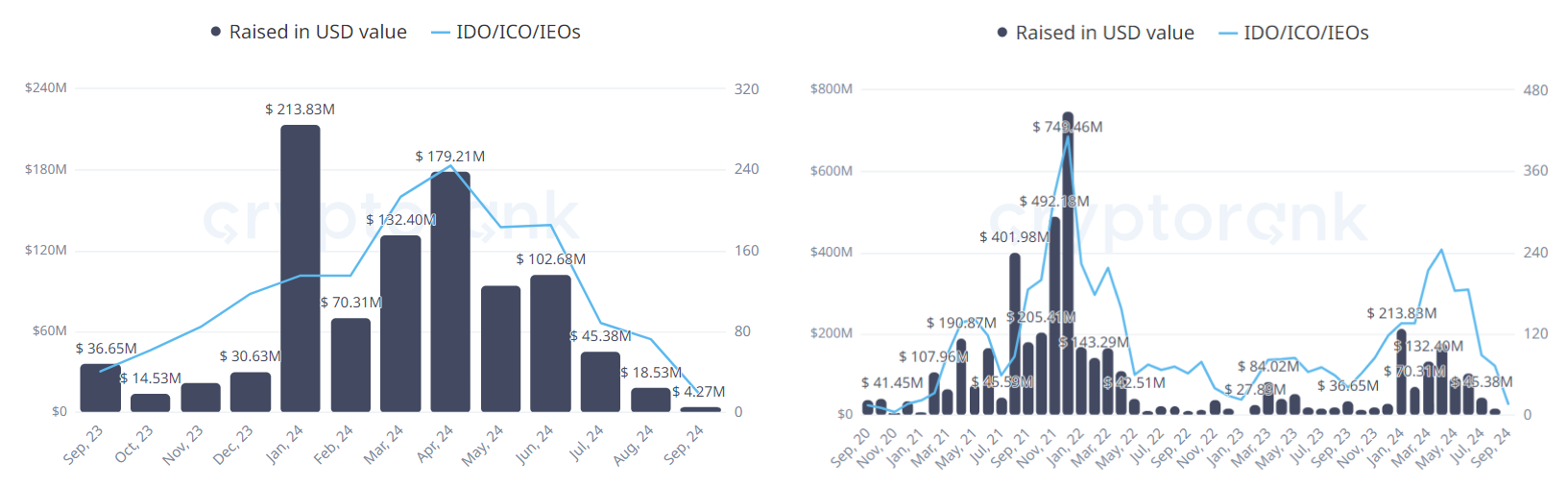

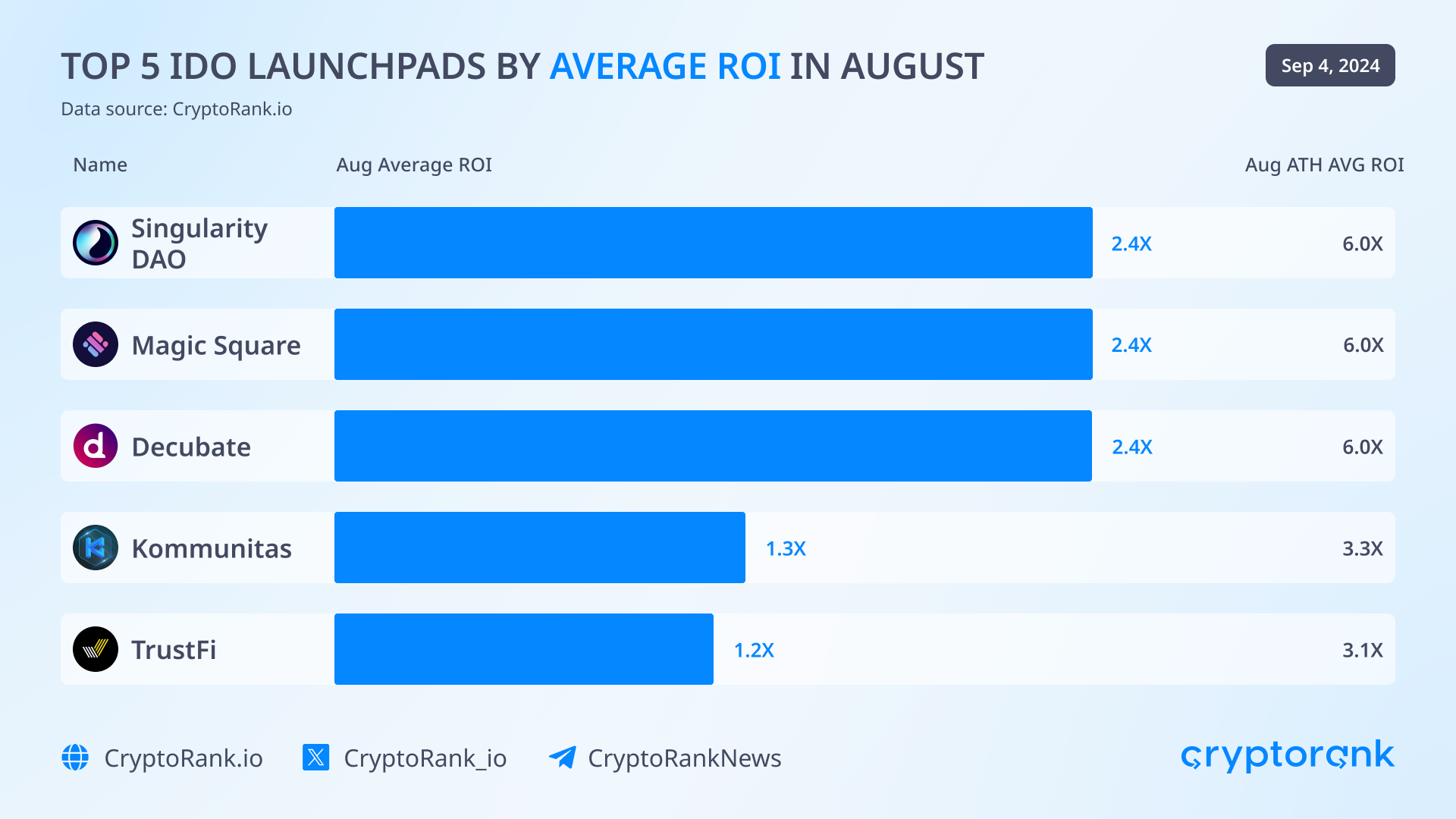

IDO Market Fades Away

The IDO market is currently experiencing low activity, resulting in a minimal amount of funds raised in August.

It appears that launchpads and IDOs are gradually fading out. The left image shows that IDO activity has hit its lowest point since October 2023. In the broader view on the right, it’s clear that despite the current bull market, IDOs are attracting less capital and fewer projects. This suggests the issue goes beyond typical market cycles and reflects deeper challenges.

A smaller number of launchpads are showing positive market performance. The once-popular IDO model now requires reshaping to regain its former success. While the IDO concept remains appealing—offering investors easy access to project tokens and a simpler alternative to drop hunting—venture capital funds have absorbed most high-quality projects, leaving IDO platforms with lower-tier opportunities.

Battle for Memes

In August, the crypto community's attention was focused on the battle between Pump.fun and SunPump, representing the Solana and Tron blockchains, respectively. Memecoins became the hottest topic of the month, largely due to the lack of other compelling narratives in the crypto space, where users saw the potential to earn substantial profits.

Conclusion

Transformations often come with disappointments, and August may represent the initial step in the market's shift to a new phase with fresh narratives. While meme coins are currently capturing attention, they are unlikely to be a sustainable long-term focus. Therefore, something else is likely to emerge as the next big trend. Potential catalysts could include new policy initiatives related to cryptocurrency, which might drive future growth. Meanwhile, uncertainty remains high, compounded by frustration and the decline of old narratives like airdrops and IDOs.

Read More