DePin, One of The Top Narratives for 2024

DePINs fall into two categories: PRN (physical resource network) and DRN (digital resource network):

-

PRNs incentivize users to employ equipment to provide goods and services in the real world, such as 5G, VPN, and others.

-

DRNs encourage those who use equipment to create real physical infrastructure networks for digital resources.

Major crypto funds like Coinbase Ventures, Pantera Capital, and Spartan Group are making a big bet on this narrative in their forecasts for 2024. This view is also held by one of the world’s biggest funds, VanEck.

The market is already packed with projects that are traded on exchanges or those getting ready to issue tokens.

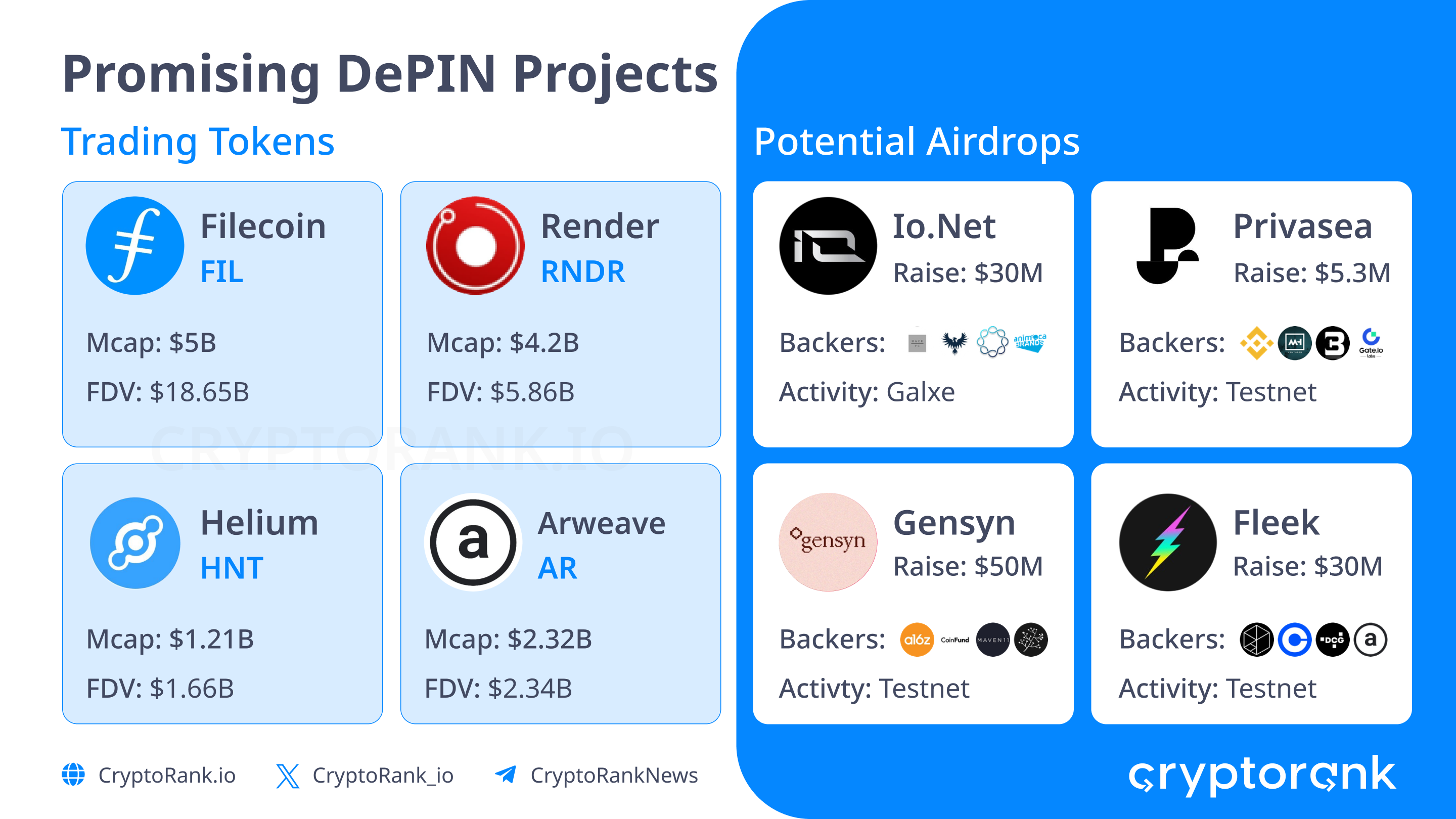

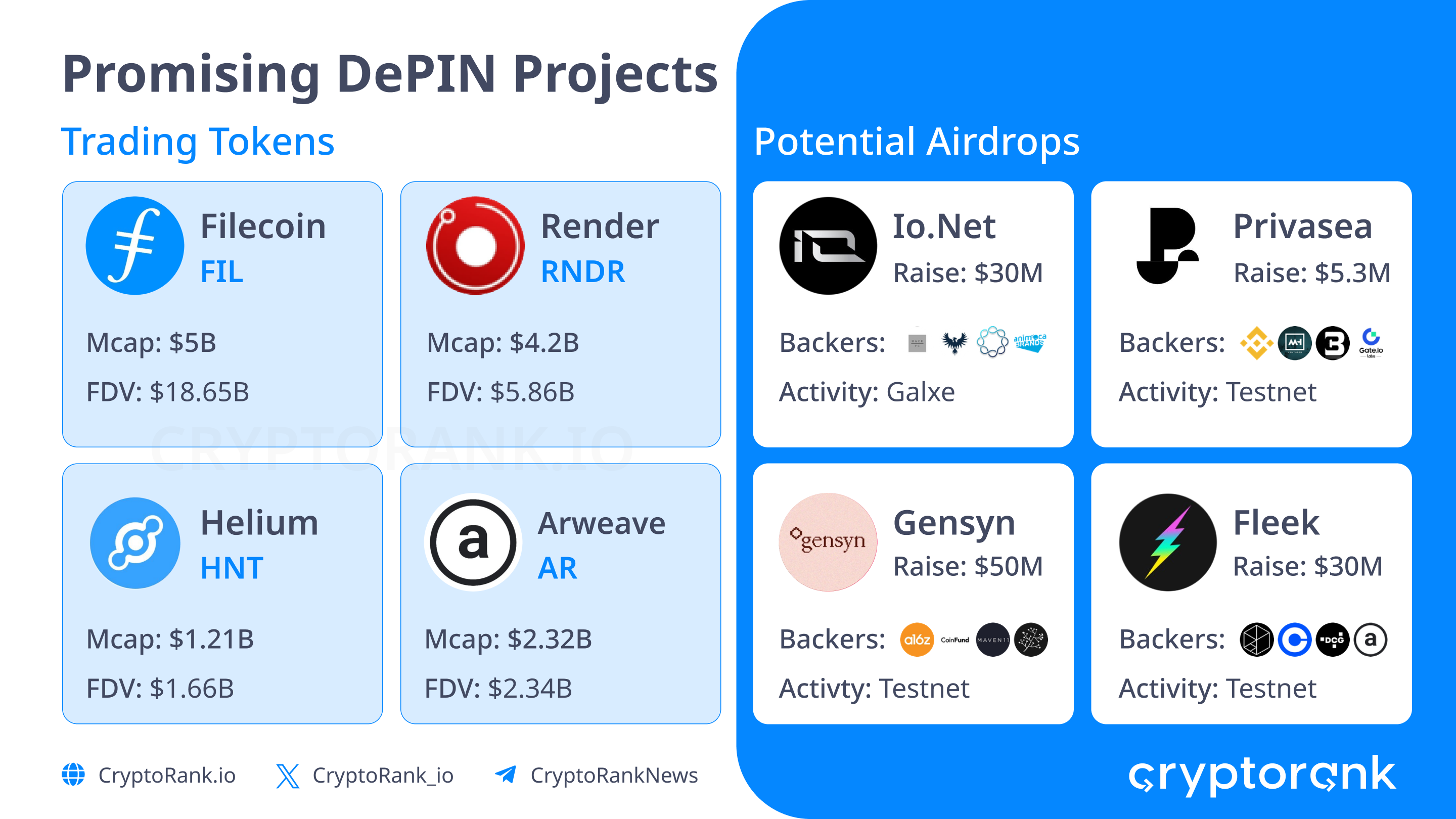

Trading Tokens

There are several dozen tokens of DePIN projects available in the market. We’ve analyzed the most interesting ones.

Filecoin

Filecoin (FIL) is a direct competitor to giants like AWS, Google Cloud Services, and Microsoft Azure. It’s a decentralized data storage network.

TVL: the figure tripled over the last few months to $2.51M, nearing new all-time highs.

Market Cap: $5.46B.

FDV: $20.42B.

Circulating Supply: 26.7%.

Token Price: $10.41, down by 95% from its highs and only by 3x from its lows.

Filecoin is likely the safest bet on the DePIN narrative, though its not-so-good tokenomics, with early users receiving large rewards, might serve as a bearish factor.

Render Network

Render Network (RNDR) is a leading provider of decentralized rendering solutions based on GPUs.

Market Cap: $4.3B.

FDV: $6B.

Circulating Supply: 71.7%.

Token Price: $11.28, the token is already trading close to its all-time highs.

Render Network could play out well not only on the DePIN narrative but also on the AI one, since it also utilizes graphics processors. Plus, RNDR is partnering with Apple. It’ll be presenting at the upcoming NVIDIA conference, which could serve as another price catalyst.

Helium

Helium (HNT) is a truly decentralized blockchain network that connects IoT devices. It relies on the community and their nodes. By deploying hotspots and managing the nodes, users receive token rewards for participating in the network’s operations.

Market Cap: $1.35B.

FDV: $1.85B.

Circulating Supply: 72.8%.

Token Price: $8.28, down by 84% from its highs and up by 7.874% from its lows.

Arweave

Arweave (AR) is a data storage platform based on the Proof-of-Access protocol that creates persistent and scalable storage. It offers low-cost data storage, high throughput, and censorship resistance.

Market Cap: $2.4B.

FDV: $2.42B.

Circulating Supply: 99.2%.

Token Price: $36.7, down by 60% from its highs, and up by 12.153% from its lows.

Arweave is used by many projects, including Lens. Moreover, it recently launched the Arweave AO testnet, with the AO Hyper Parallel Computer playing a key role. It aims at scaling the blockchain for social networks and AI apps. Participation in the testnet is possible. A good factor is that almost all tokens are already in circulation.

More interesting trading DePIN tokens are available on CryptoRank.

Potential Airdrops

Given that the narrative is still only in its infancy, there are lots of new projects without tokens yet.

io.net

io.net is a decentralized computing network that enables developing machine learning apps on the Solana blockchain.

Investments: $30M from Hack VC, Multicoin Capital, Delphi Digital, Animoca Brands, and others.

What to do: participate in the Galxe campaign and be active on Discord.

Privasea

Privasea is a decentralized AI network that uses Fully Homomorphic Encryption Machine Learning (FHEML).

Investments: $5M from Binance Labs, MH Ventures, and others.

What to do: participate in the testnet.

Gensyn

Gensyn is a marketplace that allows small data centers and individual devices to provide computing power for machine learning.

Investments: $43M from a16z, CoinFund, and Maven 11 Capital.

What to do: provide or receive computing power at the early stage of the project by filling out a form on the website.

Fleek

Fleek is a platform that builds websites and applications on IPFS. Fleek strives to create an interface and protocol layer to make the basic level of Web3 services available to users.

Investments: $25M from Polychain Capital, Coinbase Ventures, DCG, and others.

What to do: participate in the testnet.

More interesting trading DePIN tokens are available on CryptoRank.

Conclusion

The DePIN narrative is at the intersection of blockchain and the real world, and leading financial funds believe in its success. Besides, many projects interact with AI, a pivotal technology of recent years. It’ll undoubtedly play a very important role in blockchain development, so it’s worth exploring more about the projects of this narrative.

Disclaimer: This post was independently created by the author(s) for general informational purposes and does not necessarily reflect the views of ChainRank Analytics OÜ. The author(s) may hold cryptocurrencies mentioned in this report. This post is not investment advice. Conduct your own research and consult an independent financial, tax, or legal advisor before making any investment decisions. The information here does not constitute an offer or solicitation to buy or sell any financial instrument or participate in any trading strategy. Past performance is no guarantee of future results. Without the prior written consent of CryptoRank, no part of this report may be copied, photocopied, reproduced or redistributed in any form or by any means.

Coinbase Ventures

Coinbase Ventures Pantera Capital

Pantera Capital Polychain Capital

Polychain Capital VanEck

VanEck YZi Labs (Prev. Binance Labs)

YZi Labs (Prev. Binance Labs)