Crypto Market Crashes as ‘Liberation Day’ Tariffs Spark Global Sell-Off – Black Monday 2.0?

Share:

- The total crypto market cap dropped by over 8.6%, falling to $2.44 trillion.

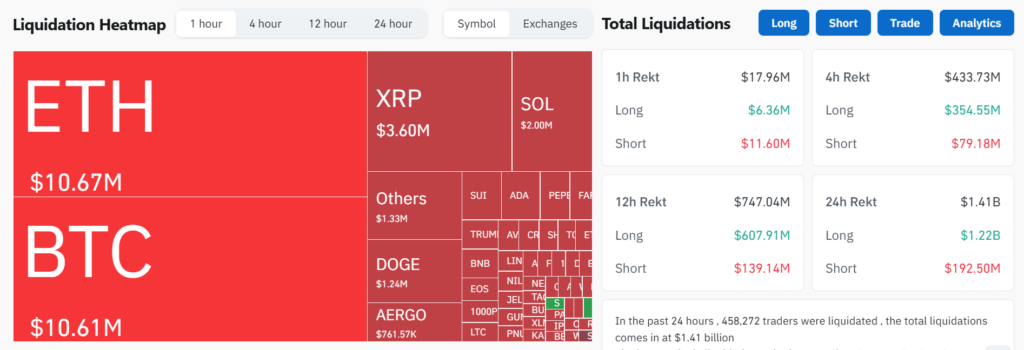

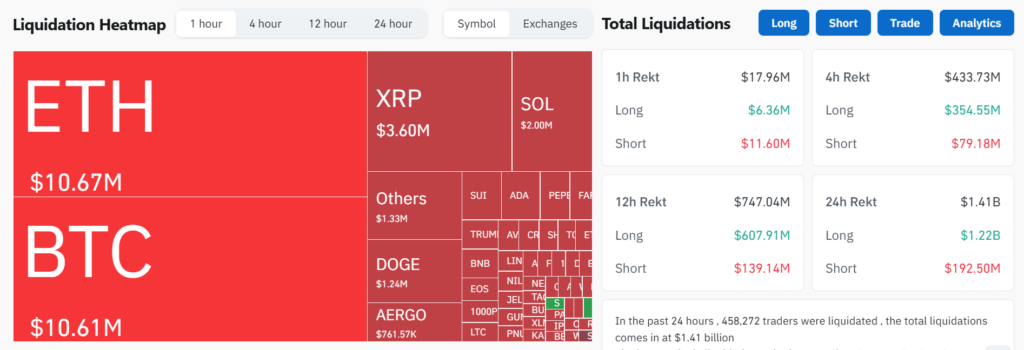

- Over $1.41 billion worth of crypto positions were liquidated in just 24 hours.

- Trump’s sudden ‘Liberation Day’ tariffs triggered a massive sell-off, crashing global stock markets.

The global financial world is in panic mode and crypto is right at the center of it. After what’s now being called a new “Black Monday,” both traditional stock markets and crypto markets are seeing red.

It all started with U.S. President Donald Trump’s sudden declaration of April 6 as “Liberation Day,” alongside new tariffs that triggered a major market sell-off worldwide. Stock markets in the U.S., China, Japan and Europe tumbled for the second straight day. But crypto investors didn’t escape the storm either.

Market in Freefall: Major Cryptos Crash in Single-Day Panic Sell-Off

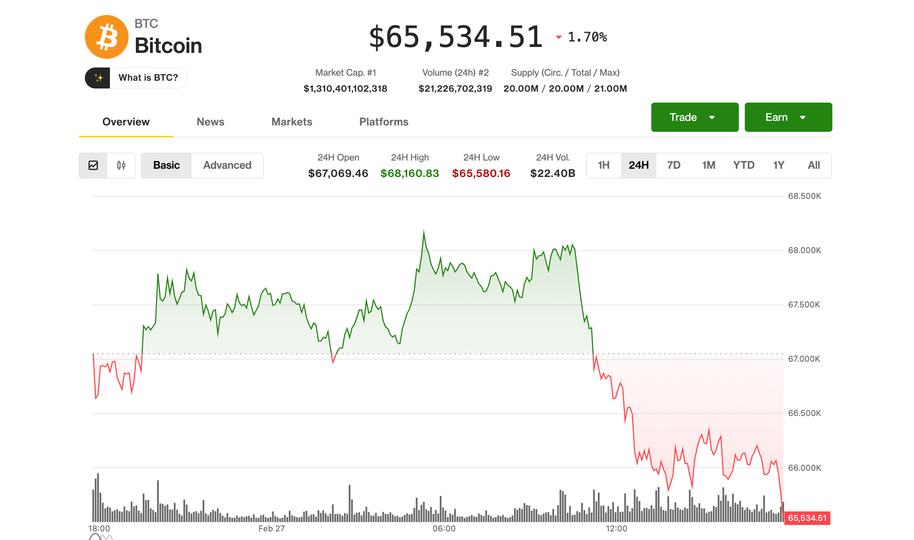

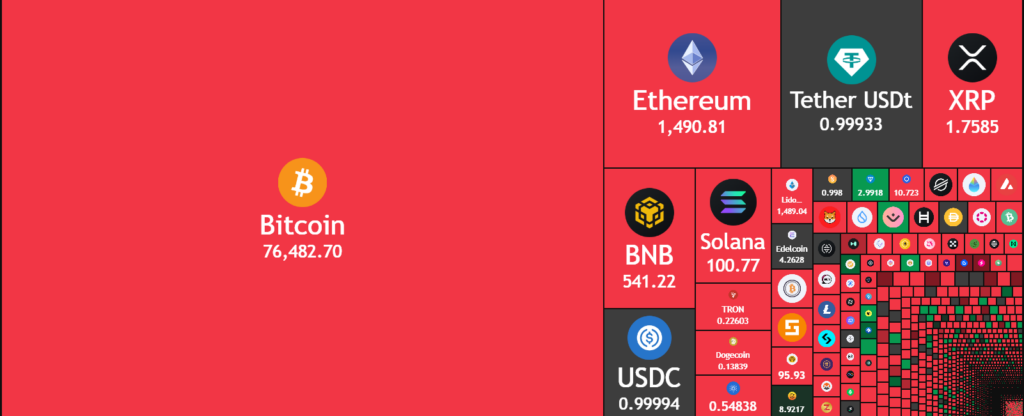

The overall crypto market cap fell by over 8.64%, dropping to $2.44 trillion. The largest cryptocurrency, Bitcoin (BTC), slipped around 10.44%, falling from $83,108 to an intraday low of $74,436. Meanwhile, Ethereum (ETH) took an even harder hit, plunging more than 21% to a low of $1,415, though it is currently priced at $1,496.

Other altcoins like XRP and Solana (SOL) also suffered sharp losses, dropping by 22% and 19% respectively. XRP has fallen below $2 for the first time since early December, while SOL has dropped below $100—a level not seen since January 2024. Furthermore, major tokens like Binance Coin (BNB), Cardano (ADA), and Tron (TRX) are experiencing even deeper pains.

Memecoins weren’t spared either, with leading tokens Dogecoin and Shiba Inu recording single day losses of 20% and 15% respectively. DOGE lost momentum and dropped below $0.15 while SHIB hit a new yearly low.

What’s scarier? Over $1.41 billion in crypto positions were liquidated in just 24 hours—a 750% spike and the worst wipeout since March 2020. This wave of forced selling shows just how fragile investor confidence is right now.

The Fear & Greed Index dropped to 17, signaling “extreme fear.” While panic spread, only a few tokens like KAVA managed to stay afloat with 1.22% rise. Others like BERA (25.56%), LTC (23%), and MOVE (24.5% to ATL) saw some of the biggest drops and topped the losers list.

Global Stock Markets Crumble Under Tariff Pressure

The stock market hasn’t been spared amid the escalating global trade war. Tariffs ranging from 10% to 50% on imported goods have led to significant declines in global stock markets with Wall Street losing $9 trillion in value. The Australian Securities Exchange (ASX) also suffered a $160 billion loss.

Asian markets have also felt the brunt of these developments. Japan’s Nikkei 225 plunged by 7.8% while South Korea’s Kospi dropped 5.6%, prompting a temporary halt in trading. In China, the Hang Seng index fell 11.7%, and the SSE Composite decreased by 7.7% following the announcement of retaliatory tariffs.

Despite market reactions, President Trump remains steadfast describing the tariffs as “a very beautiful thing.” He acknowledged potential short-term market volatility but emphasized the necessity of these measures to correct longstanding trade imbalances, stating, “Sometimes you have to take medicine to fix something.

However, Prime Minister Keir Starmer warned of severe ramifications from a full-blown trade war and indicated potential interventions to protect affected industries. Similarly, financial experts are also expressing concern. Jim Cramer of CNBC warns that without a policy reversal, the market could face a crash reminiscent of Black Monday in 1987.

Read More

Crypto Market Crashes as ‘Liberation Day’ Tariffs Spark Global Sell-Off – Black Monday 2.0?

Share:

- The total crypto market cap dropped by over 8.6%, falling to $2.44 trillion.

- Over $1.41 billion worth of crypto positions were liquidated in just 24 hours.

- Trump’s sudden ‘Liberation Day’ tariffs triggered a massive sell-off, crashing global stock markets.

The global financial world is in panic mode and crypto is right at the center of it. After what’s now being called a new “Black Monday,” both traditional stock markets and crypto markets are seeing red.

It all started with U.S. President Donald Trump’s sudden declaration of April 6 as “Liberation Day,” alongside new tariffs that triggered a major market sell-off worldwide. Stock markets in the U.S., China, Japan and Europe tumbled for the second straight day. But crypto investors didn’t escape the storm either.

Market in Freefall: Major Cryptos Crash in Single-Day Panic Sell-Off

The overall crypto market cap fell by over 8.64%, dropping to $2.44 trillion. The largest cryptocurrency, Bitcoin (BTC), slipped around 10.44%, falling from $83,108 to an intraday low of $74,436. Meanwhile, Ethereum (ETH) took an even harder hit, plunging more than 21% to a low of $1,415, though it is currently priced at $1,496.

Other altcoins like XRP and Solana (SOL) also suffered sharp losses, dropping by 22% and 19% respectively. XRP has fallen below $2 for the first time since early December, while SOL has dropped below $100—a level not seen since January 2024. Furthermore, major tokens like Binance Coin (BNB), Cardano (ADA), and Tron (TRX) are experiencing even deeper pains.

Memecoins weren’t spared either, with leading tokens Dogecoin and Shiba Inu recording single day losses of 20% and 15% respectively. DOGE lost momentum and dropped below $0.15 while SHIB hit a new yearly low.

What’s scarier? Over $1.41 billion in crypto positions were liquidated in just 24 hours—a 750% spike and the worst wipeout since March 2020. This wave of forced selling shows just how fragile investor confidence is right now.

The Fear & Greed Index dropped to 17, signaling “extreme fear.” While panic spread, only a few tokens like KAVA managed to stay afloat with 1.22% rise. Others like BERA (25.56%), LTC (23%), and MOVE (24.5% to ATL) saw some of the biggest drops and topped the losers list.

Global Stock Markets Crumble Under Tariff Pressure

The stock market hasn’t been spared amid the escalating global trade war. Tariffs ranging from 10% to 50% on imported goods have led to significant declines in global stock markets with Wall Street losing $9 trillion in value. The Australian Securities Exchange (ASX) also suffered a $160 billion loss.

Asian markets have also felt the brunt of these developments. Japan’s Nikkei 225 plunged by 7.8% while South Korea’s Kospi dropped 5.6%, prompting a temporary halt in trading. In China, the Hang Seng index fell 11.7%, and the SSE Composite decreased by 7.7% following the announcement of retaliatory tariffs.

Despite market reactions, President Trump remains steadfast describing the tariffs as “a very beautiful thing.” He acknowledged potential short-term market volatility but emphasized the necessity of these measures to correct longstanding trade imbalances, stating, “Sometimes you have to take medicine to fix something.

However, Prime Minister Keir Starmer warned of severe ramifications from a full-blown trade war and indicated potential interventions to protect affected industries. Similarly, financial experts are also expressing concern. Jim Cramer of CNBC warns that without a policy reversal, the market could face a crash reminiscent of Black Monday in 1987.

Read More