Goldman Sachs Broadens Portfolio With Strategic XRP, Solana ETF Stakes

Share:

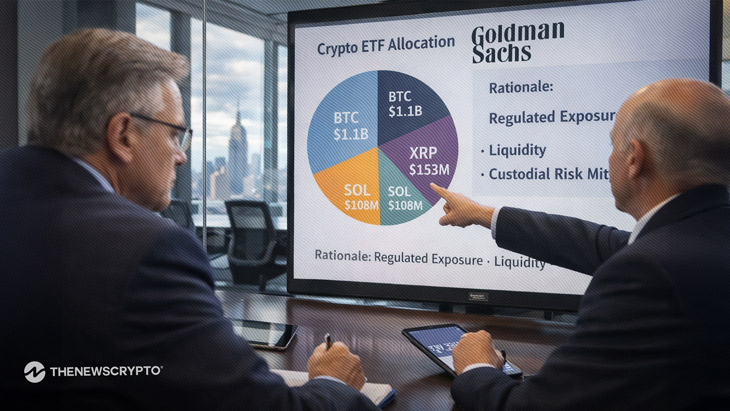

- Goldman Sachs reported over $2.36 billion worth of cryptocurrency ETF holdings from its Q4 2025 13F filing

- The bank announced the addition of new positions consisting of XRP and Solana ETFs.

Goldman Sachs had $2.36 billion of cryptocurrency ETFs in its Q4 2025 13F regulatory filing. The disclosure revealed that $1.1 billion was allocated to Bitcoin exchange-traded funds. At the end of the quarter, the bank held $1.0 billion of Ethereum ETF positions. For the first time, Goldman Sachs reported $153 million XRP ETF exposure. The investment bank also reported having $108 million of Solana ETF positions. This is after it filed a substantial increase in regulated cryptocurrency investments. The digital asset with the biggest position at Goldman Sachs remains Bitcoin. Ethereum was a close second in its diversified crypto holdings. All told, the bank’s crypto ETF exposure equated to roughly 0.33 % of its total investment portfolio.

JUST IN: Goldman Sachs discloses $2.36B in crypto exposure.

— Satoshi Club (@esatoshiclub) February 10, 2026

$1.1B in Bitcoin

$1.0B in Ethereum

$153M in XRP

$108M in Solana

That’s a 0.33% allocation.

Institutional interest has risen in digital asset ETFs in line with the growth of Wall Street’s adoption of digital assets. Major investment companies have consistently increased their exposure to Bitcoin and Ethereum ETFs. The addition by Goldman Sachs to their portfolio complies with the ongoing regulatory environment within the cryptocurrency ETF sector. Goldman Sachs’ involvement in cryptocurrency ETFs mirrors overall patterns observed in the wider financial institution sector. By pursuing the option to use ETFs, Goldman Sachs effectively reduces institutional custody risks associated with holding cryptocurrencies. Goldman Sachs’ involvement with the XRP ETF involved diversified issuers. The Solana coin exposure came from existing financial providers.

Portfolio Strategy and Market Implications

Goldman Sachs’s continued ETF accumulation is a result of its increasingly confident, yet still conservative, view of digital assets. The inclusion of altcoins indicates increasing institutional interest beyond just Bitcoin and Ethereum. The inclusion of XRP and Solana indicates a desire to work with a multitude of different blockchain systems. This is because the value of their virtual assets increased by around 15% compared to the last quarter. This indicates that their assets were invested further in crypto ETFs at such a challenging time. Moreover, their Bitcoin and Ethereum ETF assets were part of their core crypto assets. We should also note their investment in XRP and Solana holdings, as this investment, despite being small, is noteworthy too. Most importantly, it was ESG investments that influenced their decision-making process.

Industry analysts see these patterns as part of a greater institutional adoption of crypto investment products. Other major banks and asset management companies have disclosed greater crypto ETF holdings. Institutional investment in crypto products can have further implications for market liquidity as well as asset pricing. For example, Bitcoin and Ethereum continue to be the dominant holdings in a regulated crypto portfolio.

Highlighted Crypto News:

Bankman-Fried Petitions Federal Court for Retrial in FTX Collapse Case

Read More

Goldman Sachs Broadens Portfolio With Strategic XRP, Solana ETF Stakes

Share:

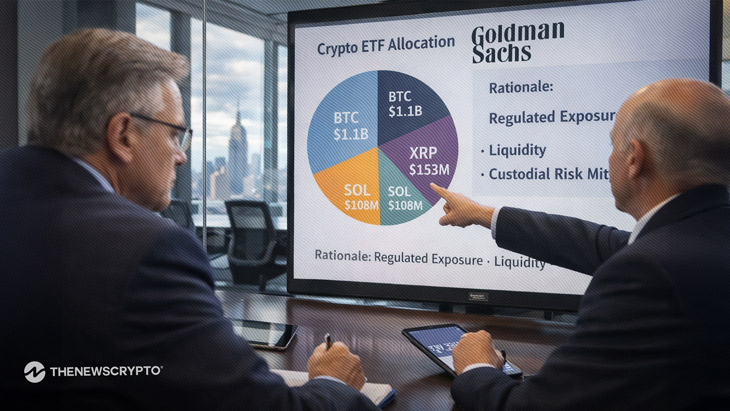

- Goldman Sachs reported over $2.36 billion worth of cryptocurrency ETF holdings from its Q4 2025 13F filing

- The bank announced the addition of new positions consisting of XRP and Solana ETFs.

Goldman Sachs had $2.36 billion of cryptocurrency ETFs in its Q4 2025 13F regulatory filing. The disclosure revealed that $1.1 billion was allocated to Bitcoin exchange-traded funds. At the end of the quarter, the bank held $1.0 billion of Ethereum ETF positions. For the first time, Goldman Sachs reported $153 million XRP ETF exposure. The investment bank also reported having $108 million of Solana ETF positions. This is after it filed a substantial increase in regulated cryptocurrency investments. The digital asset with the biggest position at Goldman Sachs remains Bitcoin. Ethereum was a close second in its diversified crypto holdings. All told, the bank’s crypto ETF exposure equated to roughly 0.33 % of its total investment portfolio.

JUST IN: Goldman Sachs discloses $2.36B in crypto exposure.

— Satoshi Club (@esatoshiclub) February 10, 2026

$1.1B in Bitcoin

$1.0B in Ethereum

$153M in XRP

$108M in Solana

That’s a 0.33% allocation.

Institutional interest has risen in digital asset ETFs in line with the growth of Wall Street’s adoption of digital assets. Major investment companies have consistently increased their exposure to Bitcoin and Ethereum ETFs. The addition by Goldman Sachs to their portfolio complies with the ongoing regulatory environment within the cryptocurrency ETF sector. Goldman Sachs’ involvement in cryptocurrency ETFs mirrors overall patterns observed in the wider financial institution sector. By pursuing the option to use ETFs, Goldman Sachs effectively reduces institutional custody risks associated with holding cryptocurrencies. Goldman Sachs’ involvement with the XRP ETF involved diversified issuers. The Solana coin exposure came from existing financial providers.

Portfolio Strategy and Market Implications

Goldman Sachs’s continued ETF accumulation is a result of its increasingly confident, yet still conservative, view of digital assets. The inclusion of altcoins indicates increasing institutional interest beyond just Bitcoin and Ethereum. The inclusion of XRP and Solana indicates a desire to work with a multitude of different blockchain systems. This is because the value of their virtual assets increased by around 15% compared to the last quarter. This indicates that their assets were invested further in crypto ETFs at such a challenging time. Moreover, their Bitcoin and Ethereum ETF assets were part of their core crypto assets. We should also note their investment in XRP and Solana holdings, as this investment, despite being small, is noteworthy too. Most importantly, it was ESG investments that influenced their decision-making process.

Industry analysts see these patterns as part of a greater institutional adoption of crypto investment products. Other major banks and asset management companies have disclosed greater crypto ETF holdings. Institutional investment in crypto products can have further implications for market liquidity as well as asset pricing. For example, Bitcoin and Ethereum continue to be the dominant holdings in a regulated crypto portfolio.

Highlighted Crypto News:

Bankman-Fried Petitions Federal Court for Retrial in FTX Collapse Case

Read More