Ethereum ETF ‘Diamond Hands’ Face Their Harshest Test At $2,000

Share:

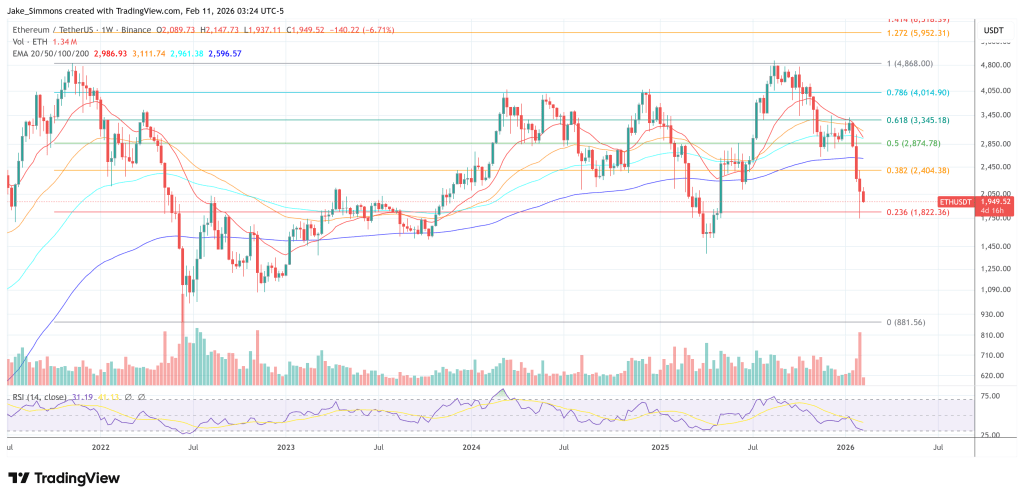

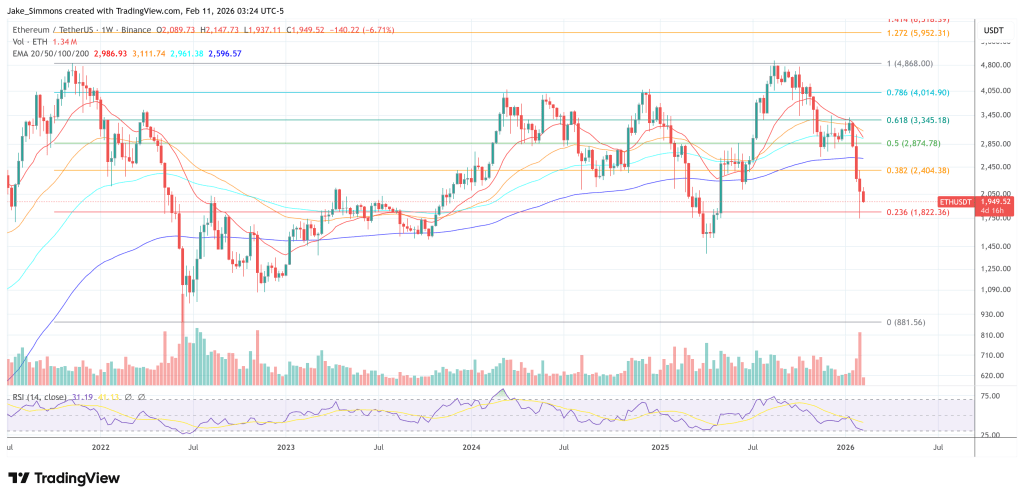

Ethereum ETF holders currently face significant losses, with an average purchase price around $3,500 against the current price of $2,000. Despite outflows totaling $350 million last month, Goldman Sachs disclosed over $1 billion in spot ether ETF positions, indicating growing institutional interest in Ethereum. This contrasts with the sharp outflows from the ETH ETF complex, highlighting notable volatility and continued market challenges.

Ethereum ETF investors are sitting on a far uglier entry point than their bitcoin counterparts, according to Bloomberg Intelligence analyst James Seyffart, with spot ETH funds now absorbing a drawdown that has left many buyers deep underwater.

“Ethereum ETF holders are sitting in a worse position than their Bitcoin ETF brethren,” Seyffart wrote on X late Tuesday. “The current ETH price of $2,000 is way below their average cost basis of ETF holders at about ~$3,500. It’s a painful proposition. But it’s one that Eth ETF holders have experienced already.”

Seyffart added that the most recent ETH ETF trough pushed the drawdown “beyond 60%,” roughly matching the percentage decline ETH saw at its April 2025 low, framing the move as severe but not unprecedented for ether’s investor base.

Even so, he argued the investor response has been more stoic than the price action implies. “Still, the vast majority of buyers have stayed put,” he wrote, pointing to net inflows across the ETH ETF complex falling from roughly $15 billion to below $12 billion — a materially larger deterioration than bitcoin ETFs “on a relative basis,” but, in his words, “still fairly decent diamond hands in grand scheme (for now).”

Fresh flow data suggests the bleeding has slowed, but not flipped decisively. SoSoValue data shows US spot ether ETFs took in about $13.82 million in net inflows on Feb. 10. That followed a week of net redemptions totaling roughly $166 million, extending a multi-week outflow streak.

On a monthly basis, SoSoValue figures peg last month’s net flow at about $350 million in outflows. Cumulatively, total net assets are at $11.76 billion as of Feb.10.

Goldman Sachs Is Bullish On Ethereum

Against that backdrop, Goldman Sachs’ latest 13F disclosure added a different kind of signal: traditional finance’s exposure is increasingly visible, and not confined to bitcoin. On Tuesday, Goldman disclosed about $2.36 billion in crypto-related positions, including roughly $1.06 billion tied to spot bitcoin ETFs and about $1.0 billion to spot ether ETFs, alongside smaller exposures of about $153 million in XRP and $108 million in Solana — a roughly 0.33% allocation in the context of its broader holdings.

The reactions on X leaned into the optics. Binance founder Changpeng “CZ” Zhao framed the filing as a positioning gap between crypto natives and banks: “Crypto is probably the only place you had an earlier start than the banks. But if you sold your crypto last quarter, while the banks are buying, then…”

MoonRock Capital founder Simon Dedic focused on the ETH sizing itself: “Very interesting to see them holding almost as much ETH as Bitcoin. For a conservative investment bank that typically sticks to standard portfolio structures like market cap weighting, this speaks volumes on how they’re significantly more bullish on Ethereum than Bitcoin, which would normally be 4–6x larger in such portfolios. This is the institutional supercycle, and ETH is clearly the institutional darling.”

At press time, ETH traded at $1,949.

Read More

Ethereum ETF ‘Diamond Hands’ Face Their Harshest Test At $2,000

Share:

Ethereum ETF holders currently face significant losses, with an average purchase price around $3,500 against the current price of $2,000. Despite outflows totaling $350 million last month, Goldman Sachs disclosed over $1 billion in spot ether ETF positions, indicating growing institutional interest in Ethereum. This contrasts with the sharp outflows from the ETH ETF complex, highlighting notable volatility and continued market challenges.

Ethereum ETF investors are sitting on a far uglier entry point than their bitcoin counterparts, according to Bloomberg Intelligence analyst James Seyffart, with spot ETH funds now absorbing a drawdown that has left many buyers deep underwater.

“Ethereum ETF holders are sitting in a worse position than their Bitcoin ETF brethren,” Seyffart wrote on X late Tuesday. “The current ETH price of $2,000 is way below their average cost basis of ETF holders at about ~$3,500. It’s a painful proposition. But it’s one that Eth ETF holders have experienced already.”

Seyffart added that the most recent ETH ETF trough pushed the drawdown “beyond 60%,” roughly matching the percentage decline ETH saw at its April 2025 low, framing the move as severe but not unprecedented for ether’s investor base.

Even so, he argued the investor response has been more stoic than the price action implies. “Still, the vast majority of buyers have stayed put,” he wrote, pointing to net inflows across the ETH ETF complex falling from roughly $15 billion to below $12 billion — a materially larger deterioration than bitcoin ETFs “on a relative basis,” but, in his words, “still fairly decent diamond hands in grand scheme (for now).”

Fresh flow data suggests the bleeding has slowed, but not flipped decisively. SoSoValue data shows US spot ether ETFs took in about $13.82 million in net inflows on Feb. 10. That followed a week of net redemptions totaling roughly $166 million, extending a multi-week outflow streak.

On a monthly basis, SoSoValue figures peg last month’s net flow at about $350 million in outflows. Cumulatively, total net assets are at $11.76 billion as of Feb.10.

Goldman Sachs Is Bullish On Ethereum

Against that backdrop, Goldman Sachs’ latest 13F disclosure added a different kind of signal: traditional finance’s exposure is increasingly visible, and not confined to bitcoin. On Tuesday, Goldman disclosed about $2.36 billion in crypto-related positions, including roughly $1.06 billion tied to spot bitcoin ETFs and about $1.0 billion to spot ether ETFs, alongside smaller exposures of about $153 million in XRP and $108 million in Solana — a roughly 0.33% allocation in the context of its broader holdings.

The reactions on X leaned into the optics. Binance founder Changpeng “CZ” Zhao framed the filing as a positioning gap between crypto natives and banks: “Crypto is probably the only place you had an earlier start than the banks. But if you sold your crypto last quarter, while the banks are buying, then…”

MoonRock Capital founder Simon Dedic focused on the ETH sizing itself: “Very interesting to see them holding almost as much ETH as Bitcoin. For a conservative investment bank that typically sticks to standard portfolio structures like market cap weighting, this speaks volumes on how they’re significantly more bullish on Ethereum than Bitcoin, which would normally be 4–6x larger in such portfolios. This is the institutional supercycle, and ETH is clearly the institutional darling.”

At press time, ETH traded at $1,949.

Read More