Why Is Crypto Down Today? – January 29, 2026

Share:

The crypto market is down today. After a single day of increases, it fell 1.7% over the past 24 hours to the current $3.06 trillion. Also, 90 of the top 100 coins fell in this period. The total crypto trading volume stands at $124 billion.

Crypto Winners & Losers

On Thursday morning (UTC), 9 of the top 10 coins per market capitalisation have seen their prices decrease.

Bitcoin (BTC) fell by 1.7%, the same amount it had gone up yesterday, currently trading at $87,820. This is the smallest green percentage in the category.

Ethereum (ETH) is down 2.5%, changing hands at $2,942.

The highest drop in this category is Dogecoin (DOGE)’s 4.5% to $0.1214.

It’s followed by Solana (SOL)’s 3.4% fall to the price of $122.

Binance Coin (BNB) saw the smallest drop, 1%, now trading at $896.

At the same time, the only increase among the top 10 is 0.8% by Tron (TRX), now trading at $0.2945.

Furthermore, of the top 100 coins per market cap, 90 have posted price decreases today.

Pump-fun (PUMP) fell the most, with the only double-digit drop of 10% to $0.003001.

River (RIVER) is next, having dropped 7.3% to the price of $50.56.

On the green side, Worldcoin (WLD) appreciated the most in this category. It’s up 5.4% to $0.4898.

PAX Gold (PAXG) is next, rising 4.7% to $5,540.

The day’s decrease follows a hawkish-leaning US Federal Reserve, lack of fresh capital, and geopolitical stress.

Reinforcing Consolidation

Gracy Chen, CEO at Bitget, commented on the US Federal Reserve’s decision to hold interest rates steady at 3.50%–3.75% during its first policy meeting of 2026. This was as expected and consistent with market pricing, Chen says.

Moreover, rate cuts are unlikely until later in the year, provided there’s no clear weakness in economic data.

A rate-hold preserves existing liquidity and supports risk assets without tightening financial conditions further – so it could be constructive for the crypto market in the near term. Maintaining stability while monitoring incoming data supports Bitcoin’s and Ethereum’s resilience and “broader crypto adoption under a macro regime that has yet to signal aggressive tightening.”

Currently, BTC and ETH have traded “relatively flat, holding key psychological levels as traders reassess risk appetite and positioning rather than immediately reacting to a policy shift.”

Per Chen, “Bitcoin is likely to keep consolidating in the $88,000–$91,000 range, with attempts to break out toward the $95,000 psychological level.”

But both of these coins could benefit from the steady US policy, she argues. This environment could “help sustain risk appetite” and reinforce BTC’s and ETH’s “roles as hedges against medium-term monetary pressures and dollar debasement narratives – particularly if future data points suggest easing later in 2026.

Jimmy Xue, co-founder and COO of Axis, commented that a signal that Quantitative Tightening (QT) will persist at current levels, despite political pressure, could act as a ceiling for risk assets.

The ‘debasement trade’ would remain the primary driver. And “any perceived loss of Fed independence amid ongoing DOJ scrutiny may ironically provide the floor that crypto needs, even if interest rates remain higher for longer,” Xue says.

Providing Necessary Market Reset

Fabian Dori, CIO at Sygnum Bank, says that markets are set up for a holding pattern, not a policy pivot. This was confirmed by the FOMC meeting.

The meeting outcome was “always more likely to reinforce consolidation than trigger a directional break. The next thing to watch is whether the growing political overhang around Fed independence starts to show up more explicitly in Fed communication, and in how markets price policy risk.”

Meanwhile, Nic Roberts-Huntley, CEO and co-founder of Blueprint Finance, argued that “the underlying market structure for digital assets is arguably healthier than it was during the leverage-fueled peaks above $125,000.”

Importantly, this period of consolidation allows for a necessary reset, he says.

Per Nic Roberts-Huntley, “shifting the focus from speculative froth back to long-term fundamentals and the potential for a renewed rally once macro clarity improves. Looking ahead, the interplay between fiscal policy and the central bank’s eventual pivot will remain the primary driver for risk-asset sentiment through 2026.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC was changing hands at $87,820. The day began at $90,315, but the coin has gradually dropped below the $90,000 level and to the intraday low of $87,653.

Over the past week, BTC fell 2.4%. It traded between $86,319 and $90,475 during this period.

Failing to stay above $86,000 would take BTC back to $85,300 and then to the $83,000-$84,000 zone.

At the same time, Ethereum was trading at $2,942. Earlier in the day, the coin stood at the intraday high of $3,036. It then decreased below the $3,000 zone and to a low of $2,934.

ETH is down 2.2% over the last seven days. It moved in the $2,801-$3,034 range.

The coin couldn’t hold the $3,000 level. Additional drops would take ETH to $2,890, $2,790, and $2,650.

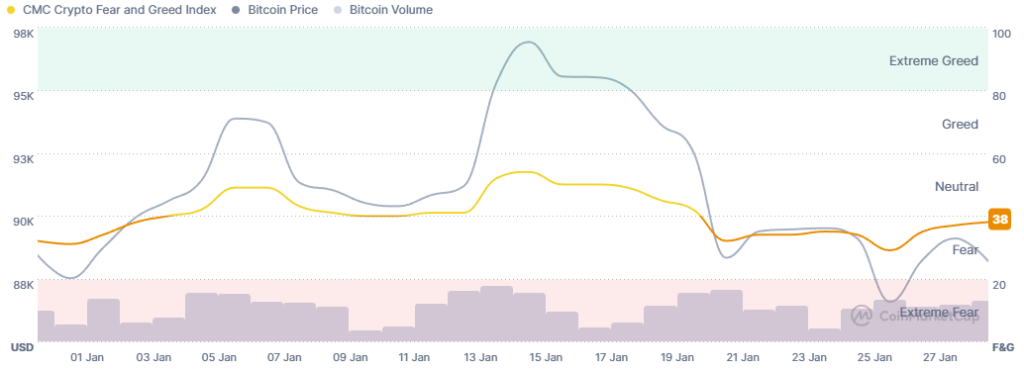

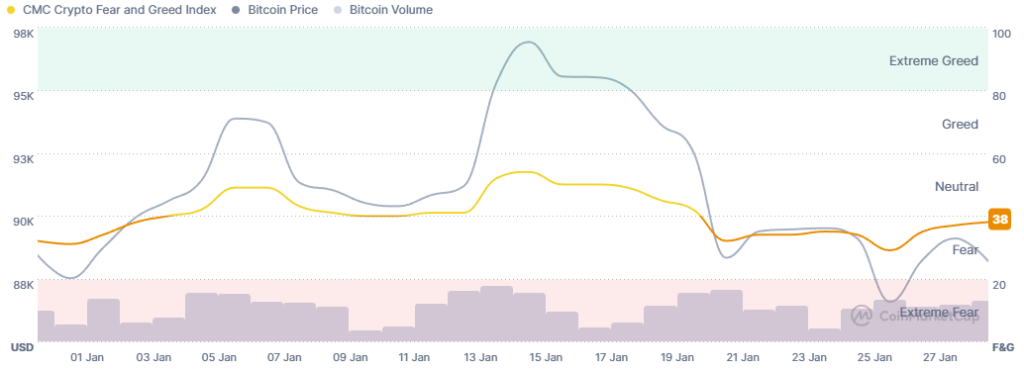

Meanwhile, the crypto market sentiment posted a small increase since this time a day ago. It’s again standing on the verge between fear and neutral zones, but still standing in the former.

The crypto fear and greed index currently stands at 38, compared to 34 recorded yesterday.

This level indicates a minor rise in optimism among the market participants, which followed the equally minor rise in the crypto market cap. It will not see a significant move upwards without a notable market rally.

ETFs Post Mixed Results

The US BTC spot exchange-traded funds (ETFs) closed the Wednesday session with negative flows. They recorded $19.64 million in outflows on 28 January. The total net inflow decreased to $56.33 billion.

Looking at the twelve ETFs, we find one green and three red ones. Fidelity posted inflows of $19.45 million.

BlackRock let go of $14.18 million, followed by Bitwise’s $12.61 million and Ark & 21Shares’ $12.3 million in outflows.

On the other hand, the US ETH ETFs posted minor inflows during the Wednesday session, with $28.1 million. The total net inflow increased to $12.38 billion.

Of the nine ETH ETFs, two saw inflows, and none saw outflows. BlackRock recorded $27.34 million in positive flows, followed by Fidelity’s $752,030.

Meanwhile, in the first four months, digital asset banking group Sygnum raised 750 BTC for the Starboard Sygnum BTC Alpha Fund from professional and institutional investors.

“The strategy captures pricing dislocations across major crypto markets by leveraging arbitrage opportunities between spot and derivatives instruments,” the company says, while maintaining “a market-neutral exposure that seeks to limit reliance on Bitcoin’s day-to-day price movements.”

Quick FAQ

- Did crypto move with stocks today?

The crypto market cut the latest brief green streak, decreasing over the past 24 hours. Meanwhile, the US stock market closed the previous session relatively unchanged. By the closing time on Wednesday, 28 January, the S&P 500 was down 0.0082%, the Nasdaq-100 increased by 0.32%, and the Dow Jones Industrial Average rose by 0.025%. This came after the US Federal Reserve kept interest rates steady.

- Is this drop sustainable?

A drop is typical and was expected, and minor decreases tend to be healthy for the market. The crypto market is still trading in a consolidation range, and it will likely continue doing so in the short term.

The post Why Is Crypto Down Today? – January 29, 2026 appeared first on Cryptonews.

Why Is Crypto Down Today? – January 29, 2026

Share:

The crypto market is down today. After a single day of increases, it fell 1.7% over the past 24 hours to the current $3.06 trillion. Also, 90 of the top 100 coins fell in this period. The total crypto trading volume stands at $124 billion.

Crypto Winners & Losers

On Thursday morning (UTC), 9 of the top 10 coins per market capitalisation have seen their prices decrease.

Bitcoin (BTC) fell by 1.7%, the same amount it had gone up yesterday, currently trading at $87,820. This is the smallest green percentage in the category.

Ethereum (ETH) is down 2.5%, changing hands at $2,942.

The highest drop in this category is Dogecoin (DOGE)’s 4.5% to $0.1214.

It’s followed by Solana (SOL)’s 3.4% fall to the price of $122.

Binance Coin (BNB) saw the smallest drop, 1%, now trading at $896.

At the same time, the only increase among the top 10 is 0.8% by Tron (TRX), now trading at $0.2945.

Furthermore, of the top 100 coins per market cap, 90 have posted price decreases today.

Pump-fun (PUMP) fell the most, with the only double-digit drop of 10% to $0.003001.

River (RIVER) is next, having dropped 7.3% to the price of $50.56.

On the green side, Worldcoin (WLD) appreciated the most in this category. It’s up 5.4% to $0.4898.

PAX Gold (PAXG) is next, rising 4.7% to $5,540.

The day’s decrease follows a hawkish-leaning US Federal Reserve, lack of fresh capital, and geopolitical stress.

Reinforcing Consolidation

Gracy Chen, CEO at Bitget, commented on the US Federal Reserve’s decision to hold interest rates steady at 3.50%–3.75% during its first policy meeting of 2026. This was as expected and consistent with market pricing, Chen says.

Moreover, rate cuts are unlikely until later in the year, provided there’s no clear weakness in economic data.

A rate-hold preserves existing liquidity and supports risk assets without tightening financial conditions further – so it could be constructive for the crypto market in the near term. Maintaining stability while monitoring incoming data supports Bitcoin’s and Ethereum’s resilience and “broader crypto adoption under a macro regime that has yet to signal aggressive tightening.”

Currently, BTC and ETH have traded “relatively flat, holding key psychological levels as traders reassess risk appetite and positioning rather than immediately reacting to a policy shift.”

Per Chen, “Bitcoin is likely to keep consolidating in the $88,000–$91,000 range, with attempts to break out toward the $95,000 psychological level.”

But both of these coins could benefit from the steady US policy, she argues. This environment could “help sustain risk appetite” and reinforce BTC’s and ETH’s “roles as hedges against medium-term monetary pressures and dollar debasement narratives – particularly if future data points suggest easing later in 2026.

Jimmy Xue, co-founder and COO of Axis, commented that a signal that Quantitative Tightening (QT) will persist at current levels, despite political pressure, could act as a ceiling for risk assets.

The ‘debasement trade’ would remain the primary driver. And “any perceived loss of Fed independence amid ongoing DOJ scrutiny may ironically provide the floor that crypto needs, even if interest rates remain higher for longer,” Xue says.

Providing Necessary Market Reset

Fabian Dori, CIO at Sygnum Bank, says that markets are set up for a holding pattern, not a policy pivot. This was confirmed by the FOMC meeting.

The meeting outcome was “always more likely to reinforce consolidation than trigger a directional break. The next thing to watch is whether the growing political overhang around Fed independence starts to show up more explicitly in Fed communication, and in how markets price policy risk.”

Meanwhile, Nic Roberts-Huntley, CEO and co-founder of Blueprint Finance, argued that “the underlying market structure for digital assets is arguably healthier than it was during the leverage-fueled peaks above $125,000.”

Importantly, this period of consolidation allows for a necessary reset, he says.

Per Nic Roberts-Huntley, “shifting the focus from speculative froth back to long-term fundamentals and the potential for a renewed rally once macro clarity improves. Looking ahead, the interplay between fiscal policy and the central bank’s eventual pivot will remain the primary driver for risk-asset sentiment through 2026.”

Levels & Events to Watch Next

At the time of writing on Thursday morning, BTC was changing hands at $87,820. The day began at $90,315, but the coin has gradually dropped below the $90,000 level and to the intraday low of $87,653.

Over the past week, BTC fell 2.4%. It traded between $86,319 and $90,475 during this period.

Failing to stay above $86,000 would take BTC back to $85,300 and then to the $83,000-$84,000 zone.

At the same time, Ethereum was trading at $2,942. Earlier in the day, the coin stood at the intraday high of $3,036. It then decreased below the $3,000 zone and to a low of $2,934.

ETH is down 2.2% over the last seven days. It moved in the $2,801-$3,034 range.

The coin couldn’t hold the $3,000 level. Additional drops would take ETH to $2,890, $2,790, and $2,650.

Meanwhile, the crypto market sentiment posted a small increase since this time a day ago. It’s again standing on the verge between fear and neutral zones, but still standing in the former.

The crypto fear and greed index currently stands at 38, compared to 34 recorded yesterday.

This level indicates a minor rise in optimism among the market participants, which followed the equally minor rise in the crypto market cap. It will not see a significant move upwards without a notable market rally.

ETFs Post Mixed Results

The US BTC spot exchange-traded funds (ETFs) closed the Wednesday session with negative flows. They recorded $19.64 million in outflows on 28 January. The total net inflow decreased to $56.33 billion.

Looking at the twelve ETFs, we find one green and three red ones. Fidelity posted inflows of $19.45 million.

BlackRock let go of $14.18 million, followed by Bitwise’s $12.61 million and Ark & 21Shares’ $12.3 million in outflows.

On the other hand, the US ETH ETFs posted minor inflows during the Wednesday session, with $28.1 million. The total net inflow increased to $12.38 billion.

Of the nine ETH ETFs, two saw inflows, and none saw outflows. BlackRock recorded $27.34 million in positive flows, followed by Fidelity’s $752,030.

Meanwhile, in the first four months, digital asset banking group Sygnum raised 750 BTC for the Starboard Sygnum BTC Alpha Fund from professional and institutional investors.

“The strategy captures pricing dislocations across major crypto markets by leveraging arbitrage opportunities between spot and derivatives instruments,” the company says, while maintaining “a market-neutral exposure that seeks to limit reliance on Bitcoin’s day-to-day price movements.”

Quick FAQ

- Did crypto move with stocks today?

The crypto market cut the latest brief green streak, decreasing over the past 24 hours. Meanwhile, the US stock market closed the previous session relatively unchanged. By the closing time on Wednesday, 28 January, the S&P 500 was down 0.0082%, the Nasdaq-100 increased by 0.32%, and the Dow Jones Industrial Average rose by 0.025%. This came after the US Federal Reserve kept interest rates steady.

- Is this drop sustainable?

A drop is typical and was expected, and minor decreases tend to be healthy for the market. The crypto market is still trading in a consolidation range, and it will likely continue doing so in the short term.

The post Why Is Crypto Down Today? – January 29, 2026 appeared first on Cryptonews.

Bitcoin has slipped below $89,000 as a hawkish-leaning Federal Reserve and Middle East tensions sap risk appetite.

Bitcoin has slipped below $89,000 as a hawkish-leaning Federal Reserve and Middle East tensions sap risk appetite. News: Sygnum and Starboard Digital raise over 750 BTC for BTC Alpha Fund

News: Sygnum and Starboard Digital raise over 750 BTC for BTC Alpha Fund First regulated bank globally to offer market-neutral…

First regulated bank globally to offer market-neutral…

![[LIVE] Crypto News Today: Latest Updates for Jan. 29, 2026 – Crypto Market Extends Correction as Most Sectors Slip](https://cimg.co/wp-content/uploads/2026/01/29051214/1769663533-crypto-news-today-jan-29.jpg)