Grayscale to Launch First U.S. Spot Chainlink ETF This Week

Share:

Grayscale is set to introduce the United States’ first spot exchange-traded fund (ETF) for Chainlink (LINK), potentially as early as this week.

The new fund will convert Grayscale’s existing Chainlink private trust into a fully listed ETF. Consequently, U.S. investors will gain direct exposure to LINK through a regulated market vehicle. Nate Geraci, co-founder of ETF Institute, called attention to this impending development in a tweet today.

ETF Launch Timeline and Market Context

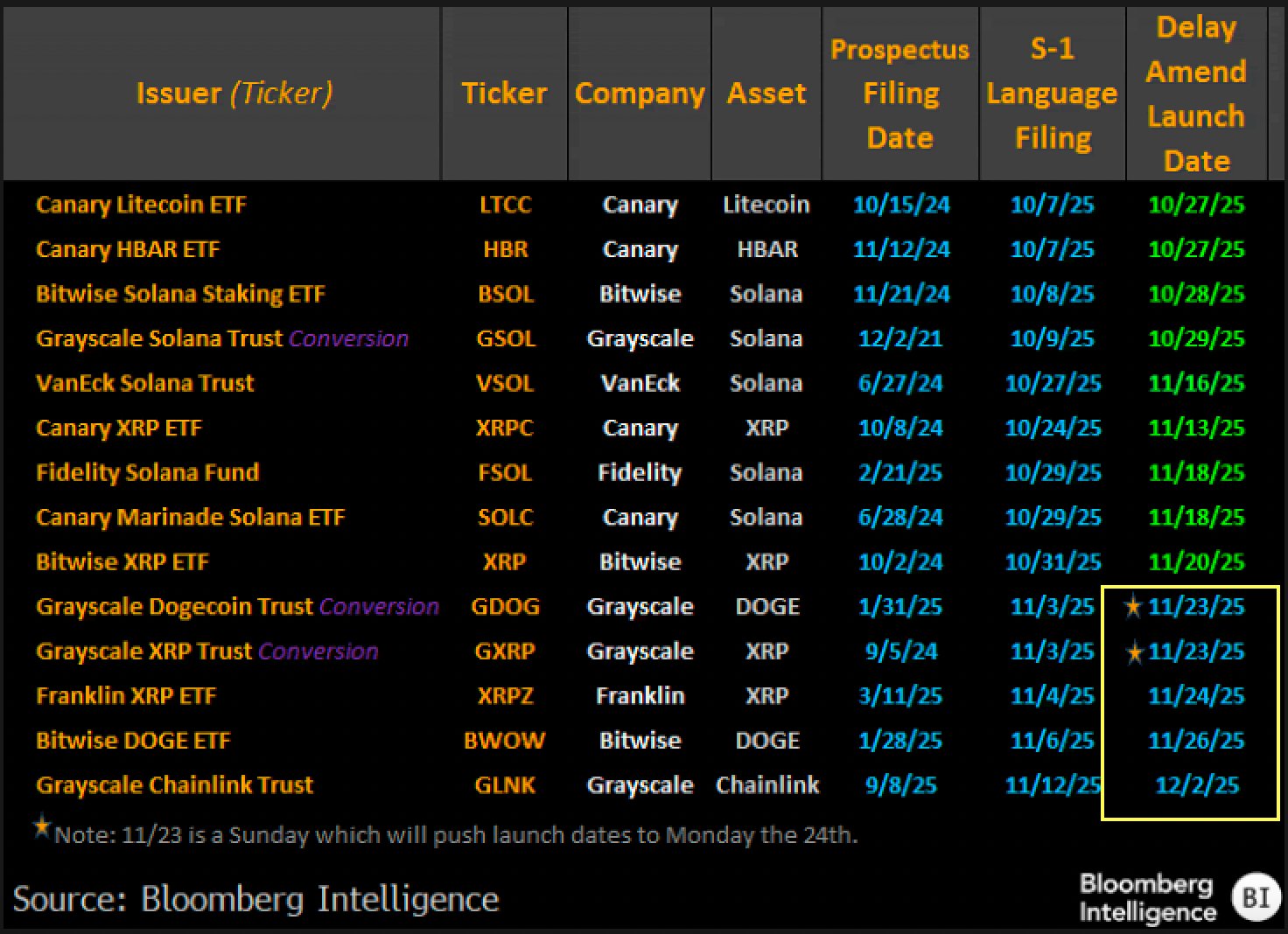

The expected launch aligns with Bloomberg Intelligence’s December 2 projection, according to senior analyst Eric Balchunas. Specifically, he cited internal listings data showing the product is positioned for near-term approval.

Balchunas anticipates that more than 100 new crypto-linked ETFs will be introduced to the U.S. market within the next six months. Of these, at least five spot crypto ETFs could commence trading in the coming days.

This surge in activity follows a year of regulatory adjustments in Washington, which have eased resistance to crypto investment products. Consequently, the shifts have created an environment conducive to mainstream adoption of digital-asset funds.

Structure of Grayscale’s Chainlink ETF

Grayscale’s Chainlink ETF will be formed by converting its original LINK trust, which began operations in late 2020, into a publicly traded market instrument. Additionally, the fund will track the spot price of LINK and incorporate staking-related returns where permitted under current regulations.

The move positions Grayscale in direct competition with Bitwise, another asset manager planning its own Chainlink ETF. Analysts expect the competition to attract both retail and institutional investors seeking exposure to the oracle-focused token.

Grayscale has previously highlighted Chainlink’s distinctive role as a bridge between blockchain networks and real-world financial systems. In this capacity, it delivers essential data feeds, pricing information, and settlement triggers for both cryptocurrency and traditional financial platforms.

Altcoin ETFs Gain Traction

The Chainlink ETF arrives amid growing interest in altcoin-focused ETFs. For instance, in recent weeks, funds tied to Solana, XRP, and Dogecoin have debuted, while additional XRP and Dogecoin ETFs are launching this week.

Early performance highlights strong investor demand. The Canary Capital XRP ETF (XRPC) recorded $245 million in net inflows on its inaugural day. Notably, this impressive debut marked the largest opening-day total for any ETF in 2025.

Similarly, the Bitwise Solana Staking ETF (BSOL) amassed over $660 million in assets within three weeks and did not experience a single day of outflows.

Adding to the momentum, Grayscale’s XRP and Dogecoin ETFs also commenced trading last Monday. Bitwise has also launched a Dogecoin ETF, reflecting growing investor appetite for regulated exposure to altcoins.

Grayscale to Launch First U.S. Spot Chainlink ETF This Week

Share:

Grayscale is set to introduce the United States’ first spot exchange-traded fund (ETF) for Chainlink (LINK), potentially as early as this week.

The new fund will convert Grayscale’s existing Chainlink private trust into a fully listed ETF. Consequently, U.S. investors will gain direct exposure to LINK through a regulated market vehicle. Nate Geraci, co-founder of ETF Institute, called attention to this impending development in a tweet today.

ETF Launch Timeline and Market Context

The expected launch aligns with Bloomberg Intelligence’s December 2 projection, according to senior analyst Eric Balchunas. Specifically, he cited internal listings data showing the product is positioned for near-term approval.

Balchunas anticipates that more than 100 new crypto-linked ETFs will be introduced to the U.S. market within the next six months. Of these, at least five spot crypto ETFs could commence trading in the coming days.

This surge in activity follows a year of regulatory adjustments in Washington, which have eased resistance to crypto investment products. Consequently, the shifts have created an environment conducive to mainstream adoption of digital-asset funds.

Structure of Grayscale’s Chainlink ETF

Grayscale’s Chainlink ETF will be formed by converting its original LINK trust, which began operations in late 2020, into a publicly traded market instrument. Additionally, the fund will track the spot price of LINK and incorporate staking-related returns where permitted under current regulations.

The move positions Grayscale in direct competition with Bitwise, another asset manager planning its own Chainlink ETF. Analysts expect the competition to attract both retail and institutional investors seeking exposure to the oracle-focused token.

Grayscale has previously highlighted Chainlink’s distinctive role as a bridge between blockchain networks and real-world financial systems. In this capacity, it delivers essential data feeds, pricing information, and settlement triggers for both cryptocurrency and traditional financial platforms.

Altcoin ETFs Gain Traction

The Chainlink ETF arrives amid growing interest in altcoin-focused ETFs. For instance, in recent weeks, funds tied to Solana, XRP, and Dogecoin have debuted, while additional XRP and Dogecoin ETFs are launching this week.

Early performance highlights strong investor demand. The Canary Capital XRP ETF (XRPC) recorded $245 million in net inflows on its inaugural day. Notably, this impressive debut marked the largest opening-day total for any ETF in 2025.

Similarly, the Bitwise Solana Staking ETF (BSOL) amassed over $660 million in assets within three weeks and did not experience a single day of outflows.

Adding to the momentum, Grayscale’s XRP and Dogecoin ETFs also commenced trading last Monday. Bitwise has also launched a Dogecoin ETF, reflecting growing investor appetite for regulated exposure to altcoins.