Bloomberg Intel Shows Five Spot Altcoin ETFs Set to List Soon as Bitcoin Loses Capital

Share:

Intelligence data from Bloomberg shows that five spot altcoin ETFs are scheduled to list in the next six days as major altcoins like ETH, SOL, and XRP experience positive capital flows.

Following the recent launch of the Fidelity Solana Fund and the Canary Marinade Solana ETF, five more altcoin ETFs are slated to debut in early December, which include the Grayscale Dogecoin ETF, the Grayscale XRP Trust, the Franklin XRP ETF, the Bitwise DOGE ETF, and the Grayscale Chainlink Trust.

Bloomberg Senior ETF analyst Eric Balchunas said that, beyond the five spot ETFs, he expects a steady supply, likely over 100, in the next six months.

Expert ETF analyst James Seyffart added that he’s tracking over 150 ETFs yet to be launched and expects many altcoin spot and leverage products to flood the market soon.

“Starting with Solana, there’s going to be a massive flow of altcoin ETFs coming into the market, and we’ve already seen about four approved XRP ETFs that are already doing numbers in the first month of launch,” Seyffart said.

Bitcoin Bleeds $151M as Major Altcoin ETFs Capture $318M

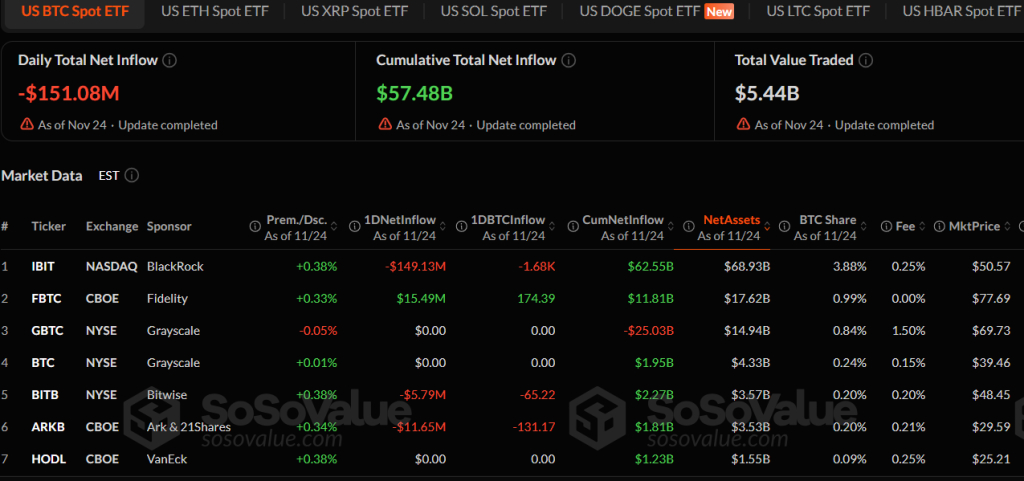

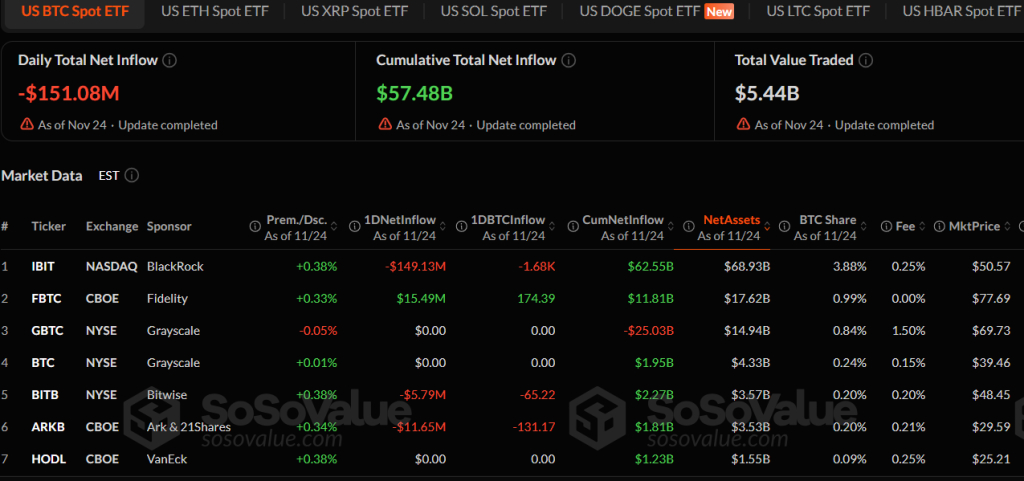

Data from SosoValue shows that while altcoin ETFs are gaining momentum, U.S. BTC spot ETFs are now experiencing negative flows.

In the last 24 hours, Bitcoin spot ETFs recorded -$151.08M in daily net inflow, while ETH, XRP, and SOL spot ETFs posted +$96.6M, +$164.04M, and +$57.99M respectively.

VanEck head of digital asset research Matthew Sigel noted that Bitcoin’s selloff was overwhelmingly a U.S.-session phenomenon, driven by tightening liquidity and widening credit spreads as AI-capex fears collided with a fragile funding market.

However, Bitwise CIO Matt Hougan believes Bitcoin’s capital flight is creating opportunities for altcoins to capture their network value effects better.

“Tokens are getting much better at capturing value. I’ll cover three examples: UNI, ETH, and XRP,” Hougan said.

He pointed to ETH’s coming Fusaka upgrade in December, which increases token value capture.

“Specifically, the coming Fusaka upgrade (est. December) significantly increases token value capture. Surprisingly, almost no one is talking about this.”

He also observed investors’ appetite for other altcoins like XRP. According to him, there’s a growing focus on value capture in XRP as well.

“The community is starting to consider ideas like staking, which would change the economics for token holders,” he added.

Analyst Predicts ETH $3,200, XRP $3, and SOL $150 in Year-end Rally

Ray Youssef, Founder and CEO of crypto superapp NoOnes, told Cryptonews that ETFs create a steady inflow channel that can serve as a liquidity buffer and help absorb recent selling pressure.

“We are already seeing early signs of this with Solana ETFs bucking the outflow trend seen in Bitcoin ETFs, which saw them bleed billions of dollars,” he said.

Youssef added that the U.S. XRP ETFs have also posted six consecutive days of inflows exceeding $420 million, including over $250 million on the first trading day, which is the strongest ETF debut day performance witnessed this year.

“The start of the altcoin ETF season means that, for the first time, retail and institutional investors can gain brokerage-integrated exposure to a diversified set of high-beta altcoins at scale,” he added.

While cautioning against expecting an immediate trend reversal due to the fragile macro environment, Youssef believes ETF momentum is strengthening selective altcoin exposure.

This could drive the altcoin market toward new price discovery once Bitcoin stabilizes.

He predicted that “Altcoin ETF season momentum could trigger an end-of-year rally, with Ether returning above $3,200, XRP reaching $3, and Solana reclaiming $150, provided ETF demand is sustainable and macro volatility continues to ease.”

The post Bloomberg Intel Shows Five Spot Altcoin ETFs Set to List Soon as Bitcoin Loses Capital appeared first on Cryptonews.

Bloomberg Intel Shows Five Spot Altcoin ETFs Set to List Soon as Bitcoin Loses Capital

Share:

Intelligence data from Bloomberg shows that five spot altcoin ETFs are scheduled to list in the next six days as major altcoins like ETH, SOL, and XRP experience positive capital flows.

Following the recent launch of the Fidelity Solana Fund and the Canary Marinade Solana ETF, five more altcoin ETFs are slated to debut in early December, which include the Grayscale Dogecoin ETF, the Grayscale XRP Trust, the Franklin XRP ETF, the Bitwise DOGE ETF, and the Grayscale Chainlink Trust.

Bloomberg Senior ETF analyst Eric Balchunas said that, beyond the five spot ETFs, he expects a steady supply, likely over 100, in the next six months.

Expert ETF analyst James Seyffart added that he’s tracking over 150 ETFs yet to be launched and expects many altcoin spot and leverage products to flood the market soon.

“Starting with Solana, there’s going to be a massive flow of altcoin ETFs coming into the market, and we’ve already seen about four approved XRP ETFs that are already doing numbers in the first month of launch,” Seyffart said.

Bitcoin Bleeds $151M as Major Altcoin ETFs Capture $318M

Data from SosoValue shows that while altcoin ETFs are gaining momentum, U.S. BTC spot ETFs are now experiencing negative flows.

In the last 24 hours, Bitcoin spot ETFs recorded -$151.08M in daily net inflow, while ETH, XRP, and SOL spot ETFs posted +$96.6M, +$164.04M, and +$57.99M respectively.

VanEck head of digital asset research Matthew Sigel noted that Bitcoin’s selloff was overwhelmingly a U.S.-session phenomenon, driven by tightening liquidity and widening credit spreads as AI-capex fears collided with a fragile funding market.

However, Bitwise CIO Matt Hougan believes Bitcoin’s capital flight is creating opportunities for altcoins to capture their network value effects better.

“Tokens are getting much better at capturing value. I’ll cover three examples: UNI, ETH, and XRP,” Hougan said.

He pointed to ETH’s coming Fusaka upgrade in December, which increases token value capture.

“Specifically, the coming Fusaka upgrade (est. December) significantly increases token value capture. Surprisingly, almost no one is talking about this.”

He also observed investors’ appetite for other altcoins like XRP. According to him, there’s a growing focus on value capture in XRP as well.

“The community is starting to consider ideas like staking, which would change the economics for token holders,” he added.

Analyst Predicts ETH $3,200, XRP $3, and SOL $150 in Year-end Rally

Ray Youssef, Founder and CEO of crypto superapp NoOnes, told Cryptonews that ETFs create a steady inflow channel that can serve as a liquidity buffer and help absorb recent selling pressure.

“We are already seeing early signs of this with Solana ETFs bucking the outflow trend seen in Bitcoin ETFs, which saw them bleed billions of dollars,” he said.

Youssef added that the U.S. XRP ETFs have also posted six consecutive days of inflows exceeding $420 million, including over $250 million on the first trading day, which is the strongest ETF debut day performance witnessed this year.

“The start of the altcoin ETF season means that, for the first time, retail and institutional investors can gain brokerage-integrated exposure to a diversified set of high-beta altcoins at scale,” he added.

While cautioning against expecting an immediate trend reversal due to the fragile macro environment, Youssef believes ETF momentum is strengthening selective altcoin exposure.

This could drive the altcoin market toward new price discovery once Bitcoin stabilizes.

He predicted that “Altcoin ETF season momentum could trigger an end-of-year rally, with Ether returning above $3,200, XRP reaching $3, and Solana reclaiming $150, provided ETF demand is sustainable and macro volatility continues to ease.”

The post Bloomberg Intel Shows Five Spot Altcoin ETFs Set to List Soon as Bitcoin Loses Capital appeared first on Cryptonews.

Crypto funds saw record outflows led by Bitcoin and Ethereum, while Solana and XRP drew inflows amid selective investor rotation.

Crypto funds saw record outflows led by Bitcoin and Ethereum, while Solana and XRP drew inflows amid selective investor rotation.