Liquid Staking and Restaking Outside of Ethereum: What to Farm Next?

Key Takeaways:

-

Solana's DeFi ecosystem is the most mature and utilized after Ethereum, which has enabled the demand for the development and sophistication of staking infrastructure.

-

The rest of the L1 chains are not able to offer any notable restaking architecture yet, remaining at the level of liquid staking.

-

Omnichain restaking solutions are in their early stages, but have the potential to capture the market of smaller chains.

-

Driven by the desire to unlock Bitcoin's liquidity, a myriad of BTC-staking solutions are emerging.

Basic Terminology

Staking

Staking is a process that originally involves users locking their cryptocurrency assets in a Proof-of-Stake blockchain to secure them and process transactions. In return, they earn rewards in the form of native coins.

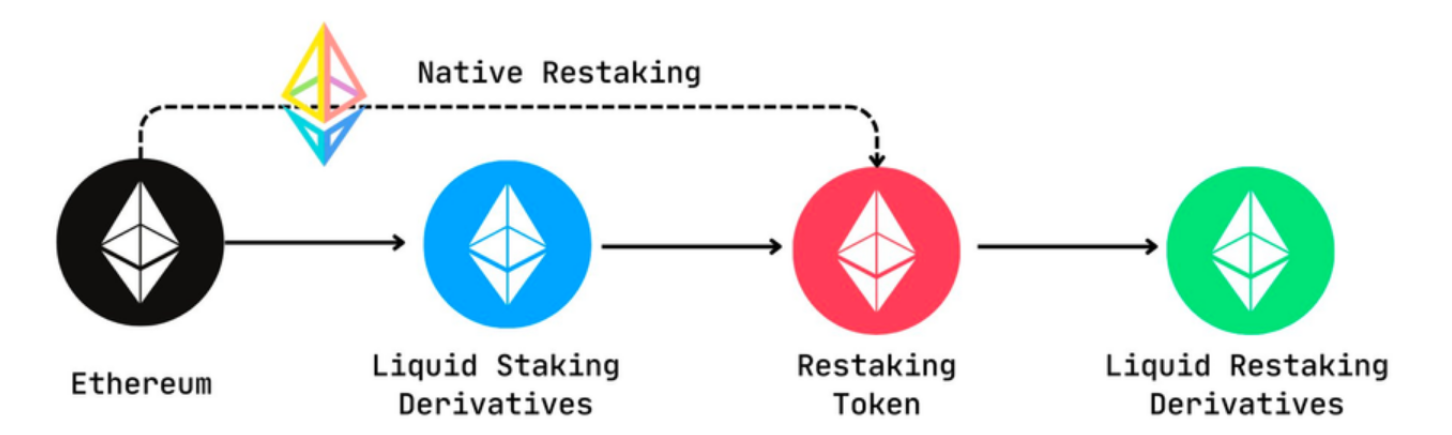

Liquid Staking

Liquid Staking is a service provided by specific platforms where users stake their assets and receive derivative tokens in return. These tokens are tied to the price of the main asset and can be used in other financial operations. The largest liquid staking provider is Lido, which offers stETH as the liquid staking derivative (LSD).

Restaking

Restaking is a process where natively staked assets can be staked recurrently (i.e., restaked) in so-called Actively Validated Services (AVS) to secure additional blockchain applications and protocols in exchange for interest. The first and largest restaking protocol is Ethereum’s EigenLayer.

Liquid Restaking

Initially, retaking involves depositing native coin (or its derivatives) into a protocol with manual operator configuration and AVS selection and offers only percentages, not a derived token. Liquid Restaking is a service similar to liquid staking but focuses on reusing restaked assets. Instead of manually restaking via underlying infrastructure, such as EigenLayer, users restake via intermediaries, such as Renzo and Ether.Fi, and receive liquid restaking tokens (LRT) instead of an interest fee.

This whole derivative restaking pyramid originally appeared and expanded on Ethereum, as long as enough stimuli existed. These are, for example, the sophistication of the DeFi ecosystem and the many barriers to original staking. However, as it often happens, copycats started appearing on other PoS networks.

What is Going on within Solana?

Liquid Staking

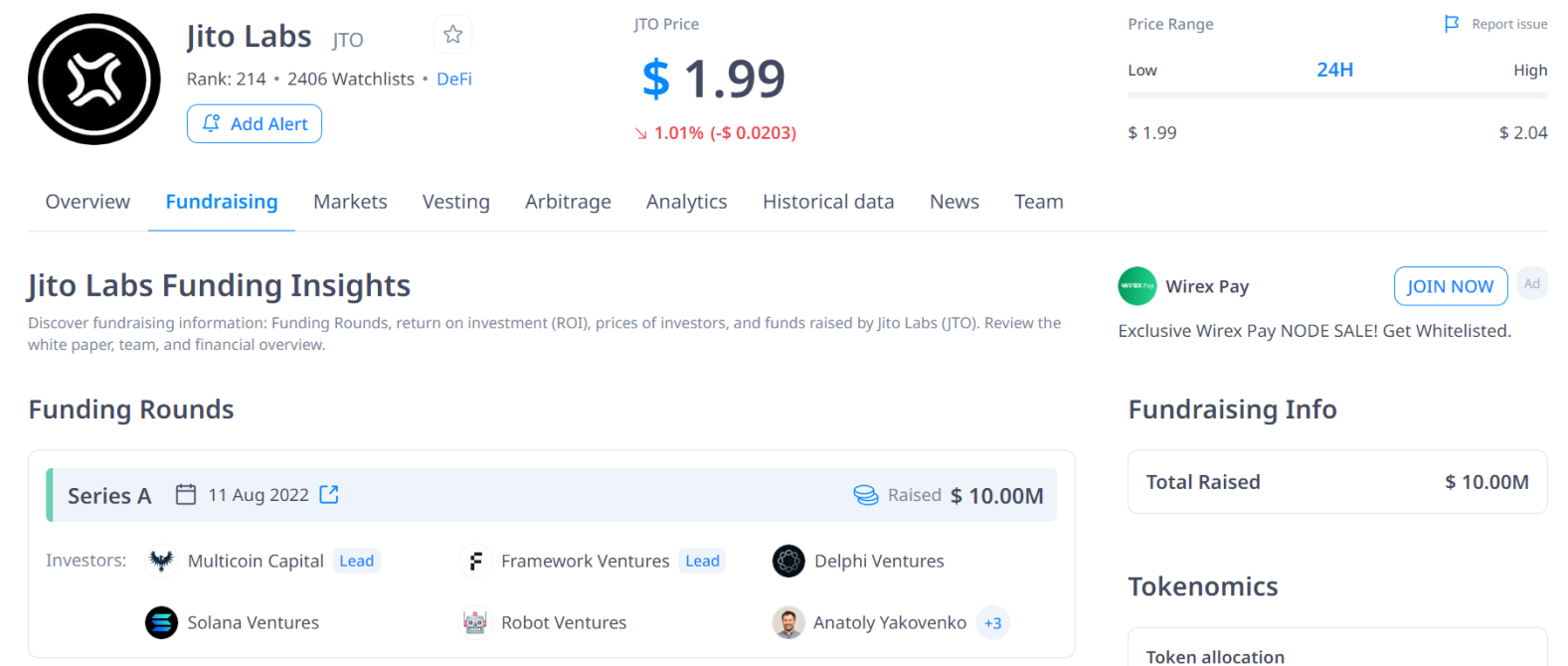

Jito

Jito, the largest liquid staking provider on Solana, offers jitoSOL as an LSD token. Jito distributed a rather generous airdrop in December 2023. The governance token $JITO is already launched and tradable.

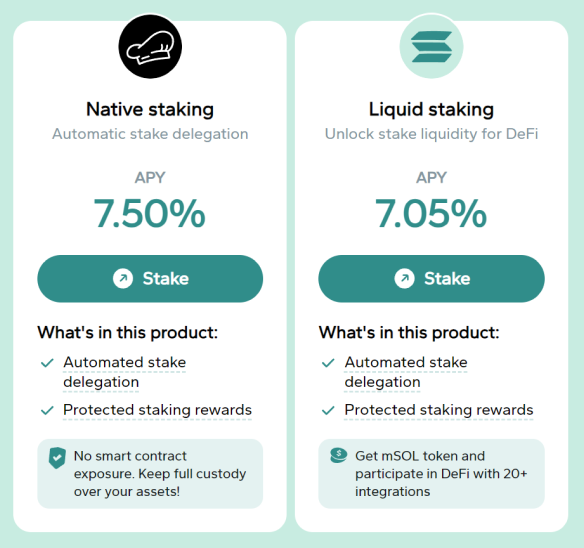

Marinade.Finance

Marinade.Finance is a non-custodial staking protocol built on Solana that offers both native staking and liquid staking with "marinated SOL" tokens (mSOL). The governance token $MNDE is already launched and tradable.

Sanctum

Sanctum is a Solana-based liquid staking provider, aiming to create a unified liquidity layer for all Solana LSD tokens. Sanctum's main product is Infinity, which is a liquidity pool that combines all whitelisted LSTs (currently over 10) and makes them tradable via the pool. Infinity token INF is the main LSD token. The airdrop farming campaign is coming to an end. The team recently launched profiles, which will be one of the criteria for receiving the $CLOUD token.

Restaking

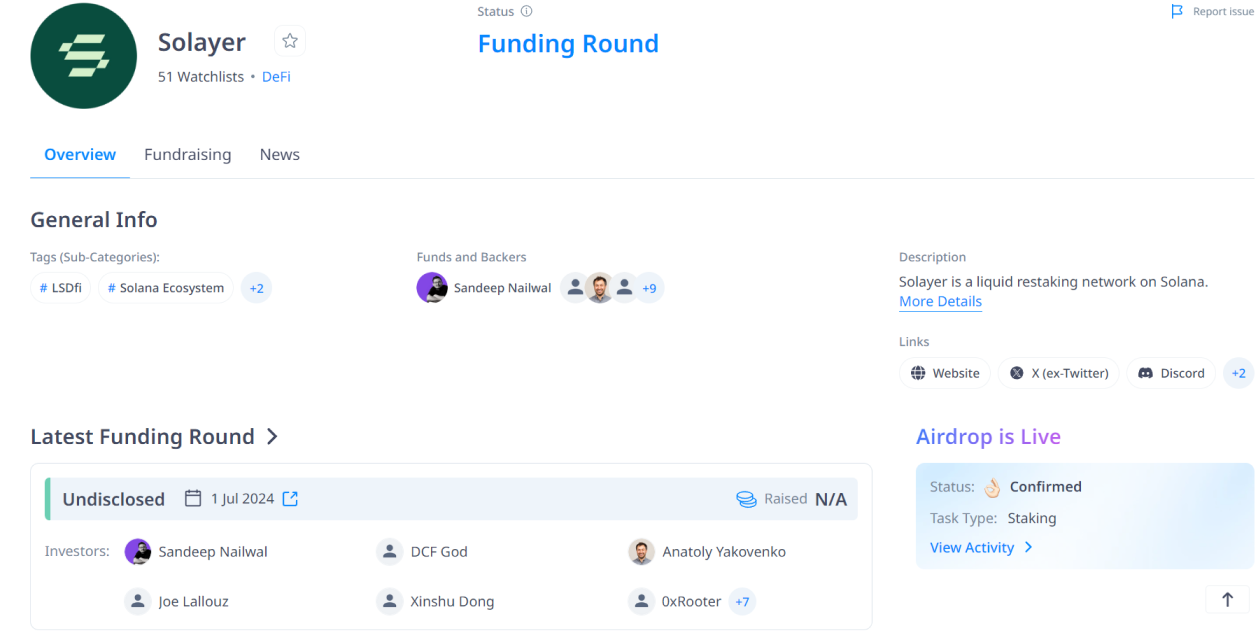

Solayer

Solayer is the main restaking protocol on Solana. At the time of writing, the third era of airdrop farming is beginning with entry by invites, TVL has exceeded $60 million. As CoinDesk reports, Solayer is looking to raise $8 million at an $80 million valuation led by Polychain.

Other Altchains to Get a Closer Look at

The problem with the other Proof-of-Stake L1 networks is that they are not yet mature enough for a full-fledged restaking infrastructure. All these layers of restaking derivatives are meaningless if the network is young and the DeFi ecosystem is underdeveloped. Most of these chains are still at the level of liquid staking adoption; there is no staking yet.

But when the restaking time comes, Ethereum compatibility will probably turn into the downside for EVM chains: all native staking protocols that will appear, if any, are likely to struggle and fall into oblivion in the longer run, while their place will be taken by either the pioneers from Ethereum or chain-agnostic protocols.

Avalanche

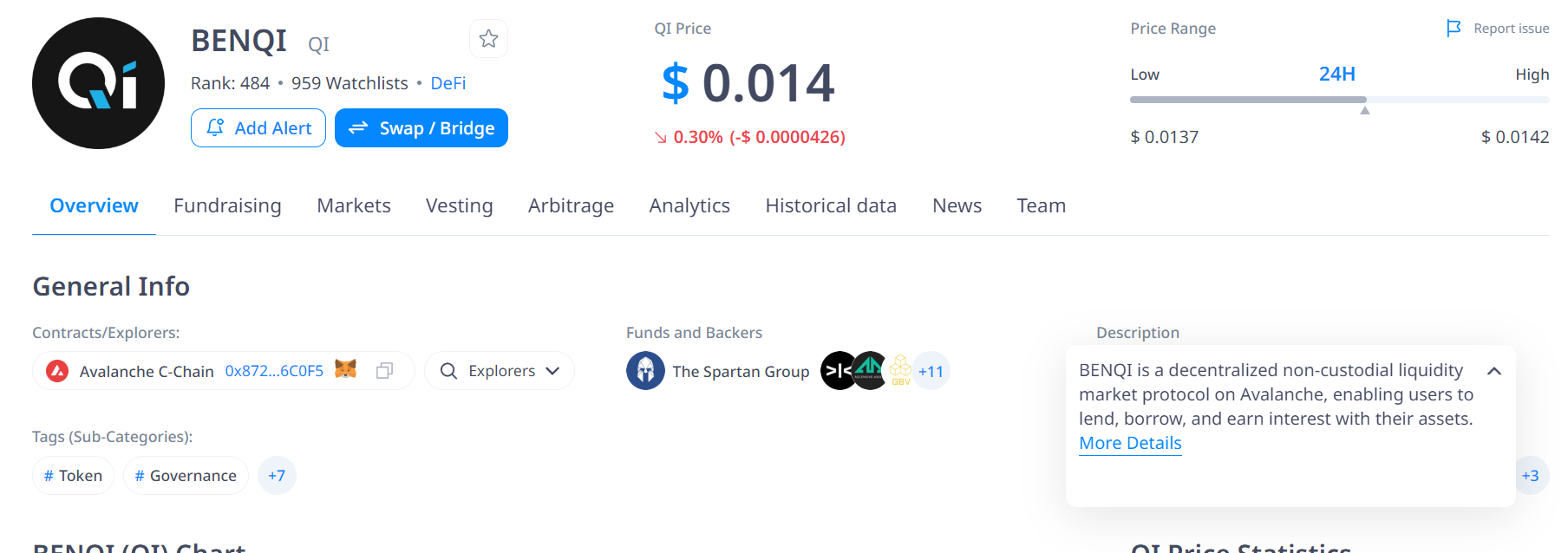

BENQI

BENQI is a decentralized, non-custodial liquidity market protocol on Avalanche, that offers lending, borrowing, and liquid staking with sAVAX token. Launched in 2021 and has firmly established leadership. The governance token $IQ is tradable.

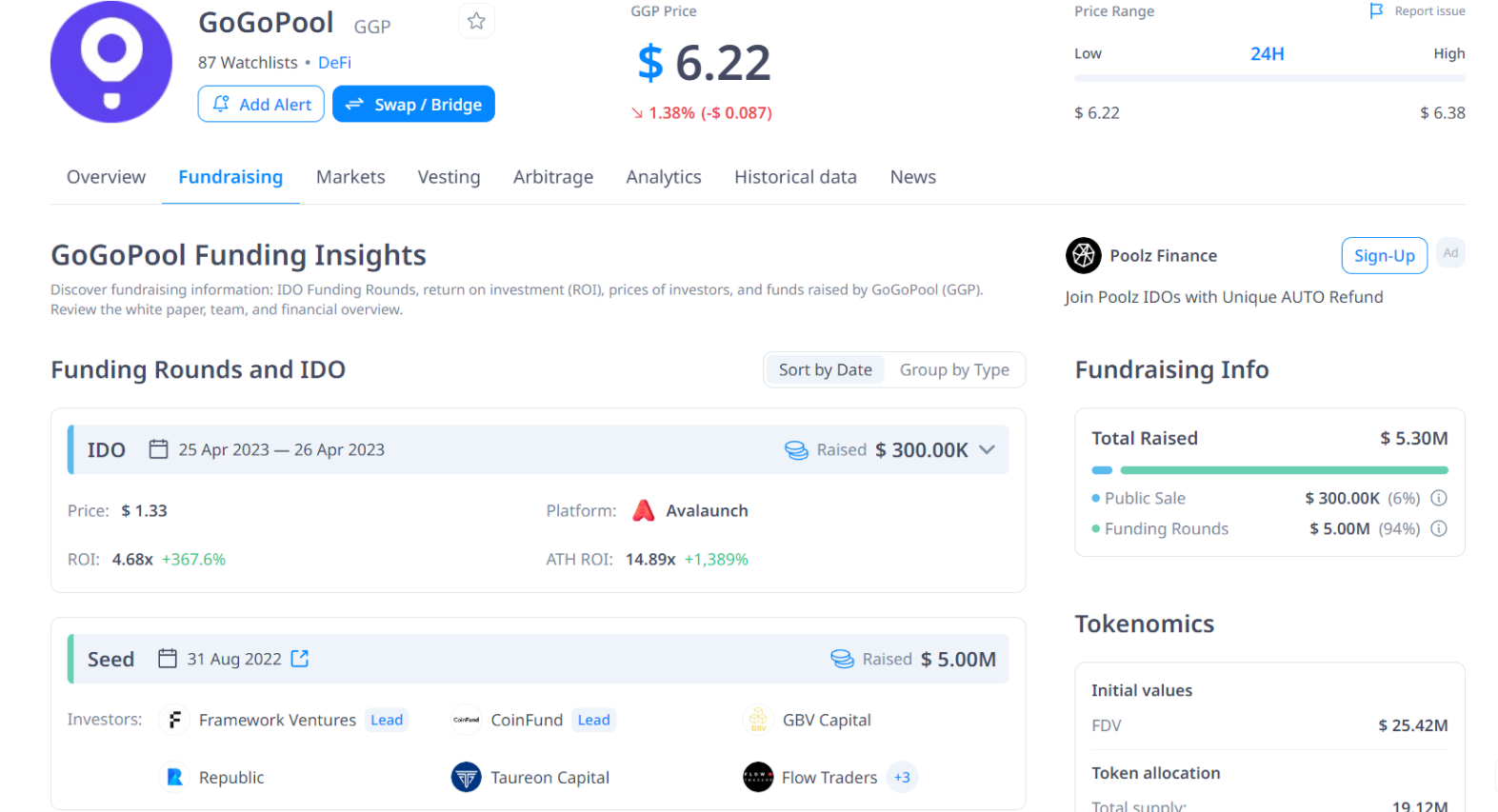

GoGoPool

GoGoPool is a permissionless and decentralized staking protocol for Avalanche, built specifically for Subnets. Offers ggAVAX as the LSD token and GGP as the governance token.

TON

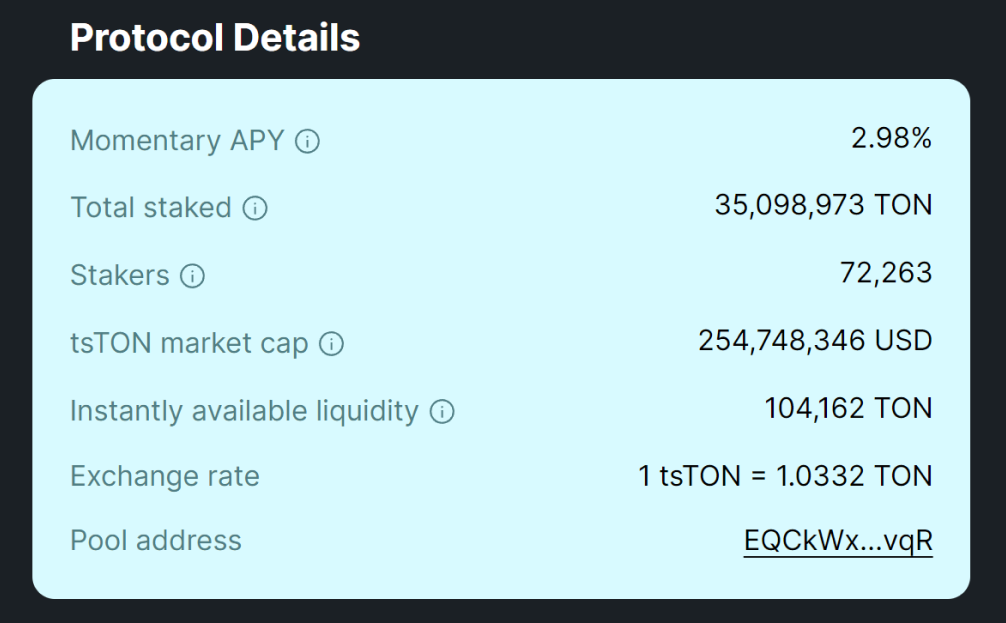

Tonstakers

Tonstakers is the largest liquid staking protocol on TON, that offers tsTON as the main LSD token. It is backed by the Ton Foundation and OKX Ventures and integrated into the Tonkeeper wallet. Currently, there are no specific incentive programs.

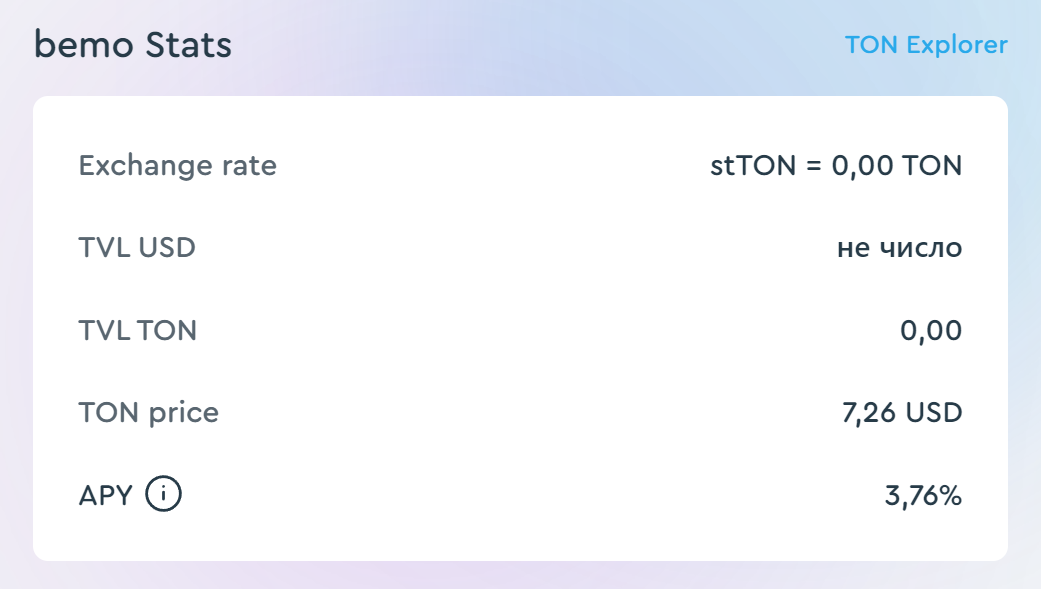

bemo

bemo is a non-custodial liquid staking protocol built on the TON blockchain that allows you to stake native TON tokens and, in return, get stTON tokens. There is the incentives program with Staking Experience Points stXP, at the end of which all the stXP holders will share a $BMO token pool of up to 20% of the total token supply.

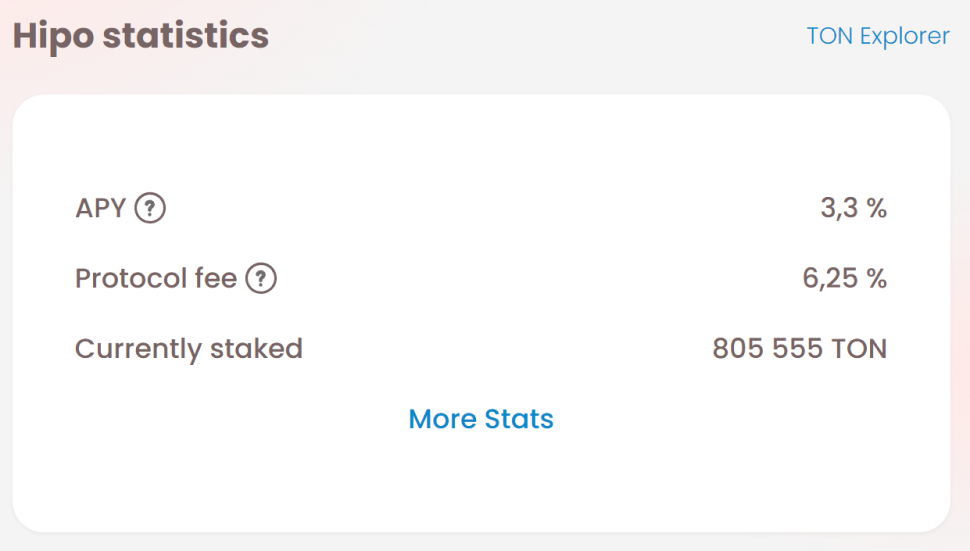

Hipo

Hipo is an open-source liquid staking protocol built on the TON blockchain, that offers hTON as the LSD token. Hipo offers 50% of the protocol fee for every successful referral.

Aptos

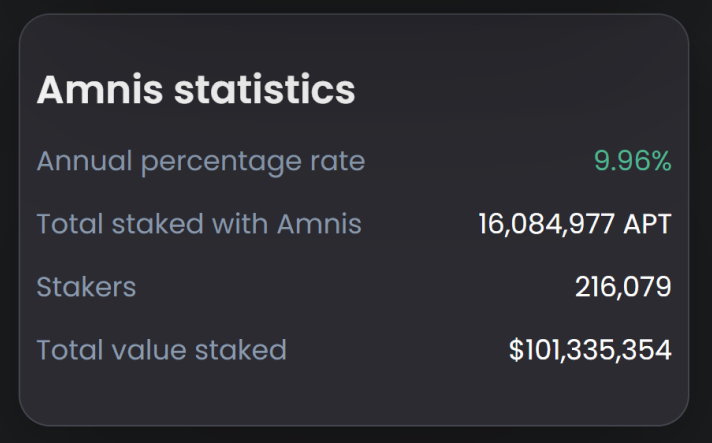

Amnis Finance

Amnis Finance is the leading liquid staking protocol on Aptos that introduces amAPT as the LSD token. As additional incentives, Amnis offers its users the opportunity to participate in various gamified raffles, such as Lucky Wheel, Lottery and the retrodrop campaign.

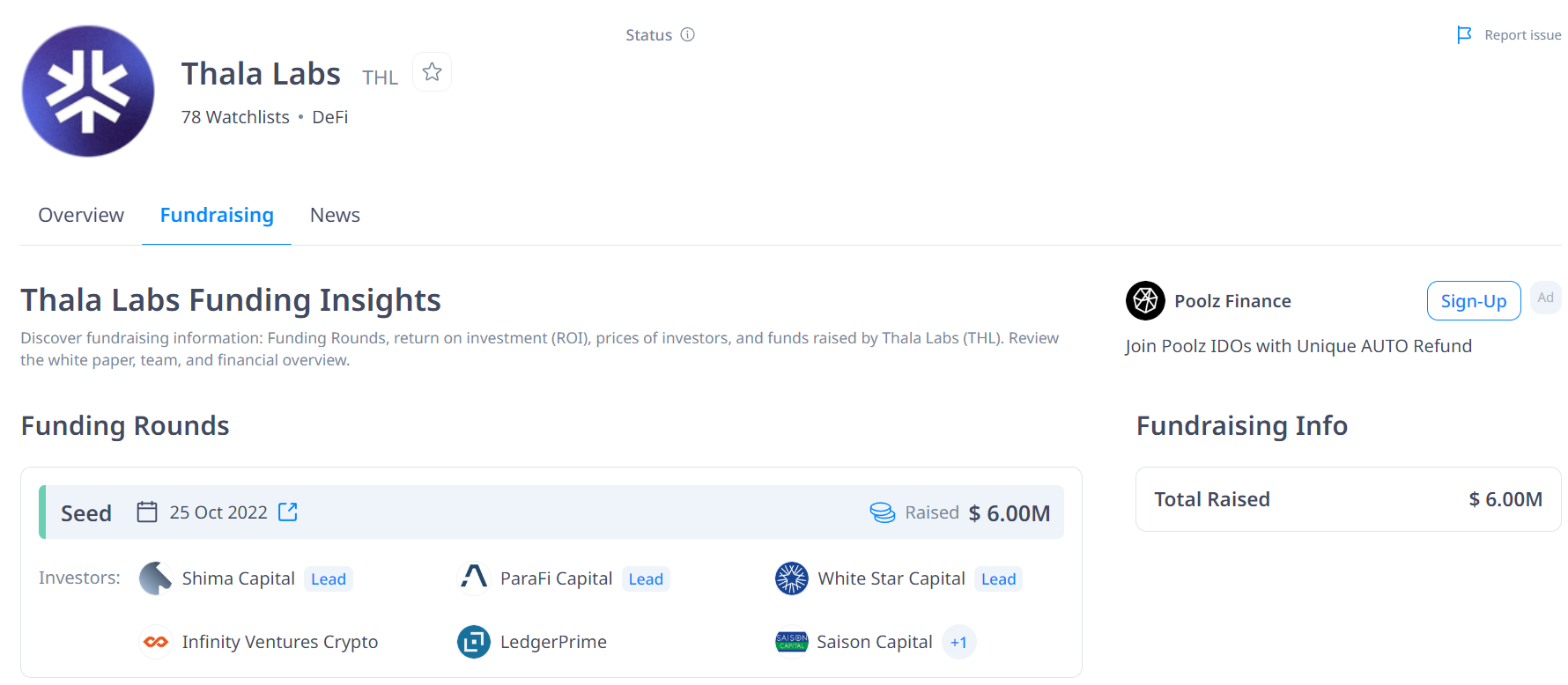

Thala

Thala is a multifunctional finance protocol that enables borrowing of an over-collateralized stablecoin, DEX, launchpad, and liquidity staking with stAPT as the LSD token. The governance token $THL is tradable.

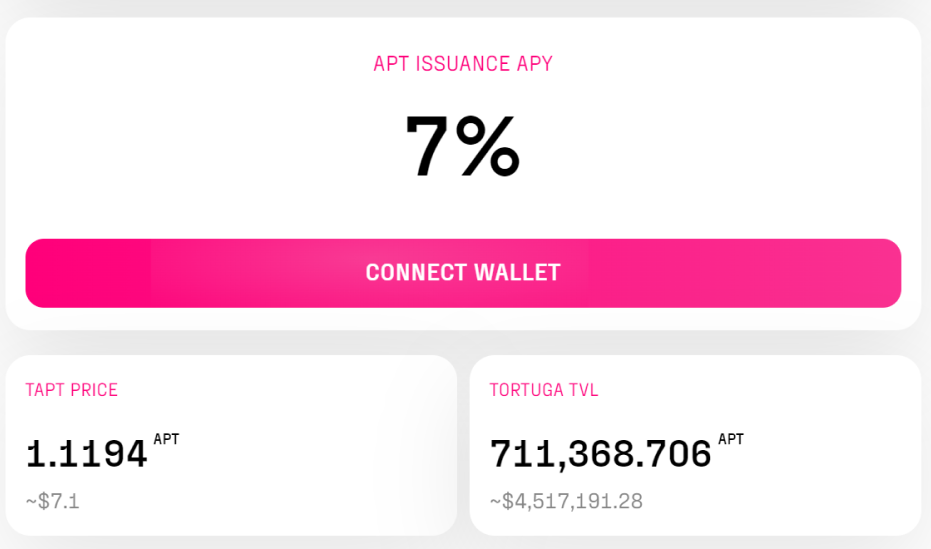

Tortuga Finance

Tortuga is a decentralized finance platform focused on liquid staking within the Aptos blockchain. It offers tAPT as the LSD token. The governance token hasn't been launched yet.

Sui

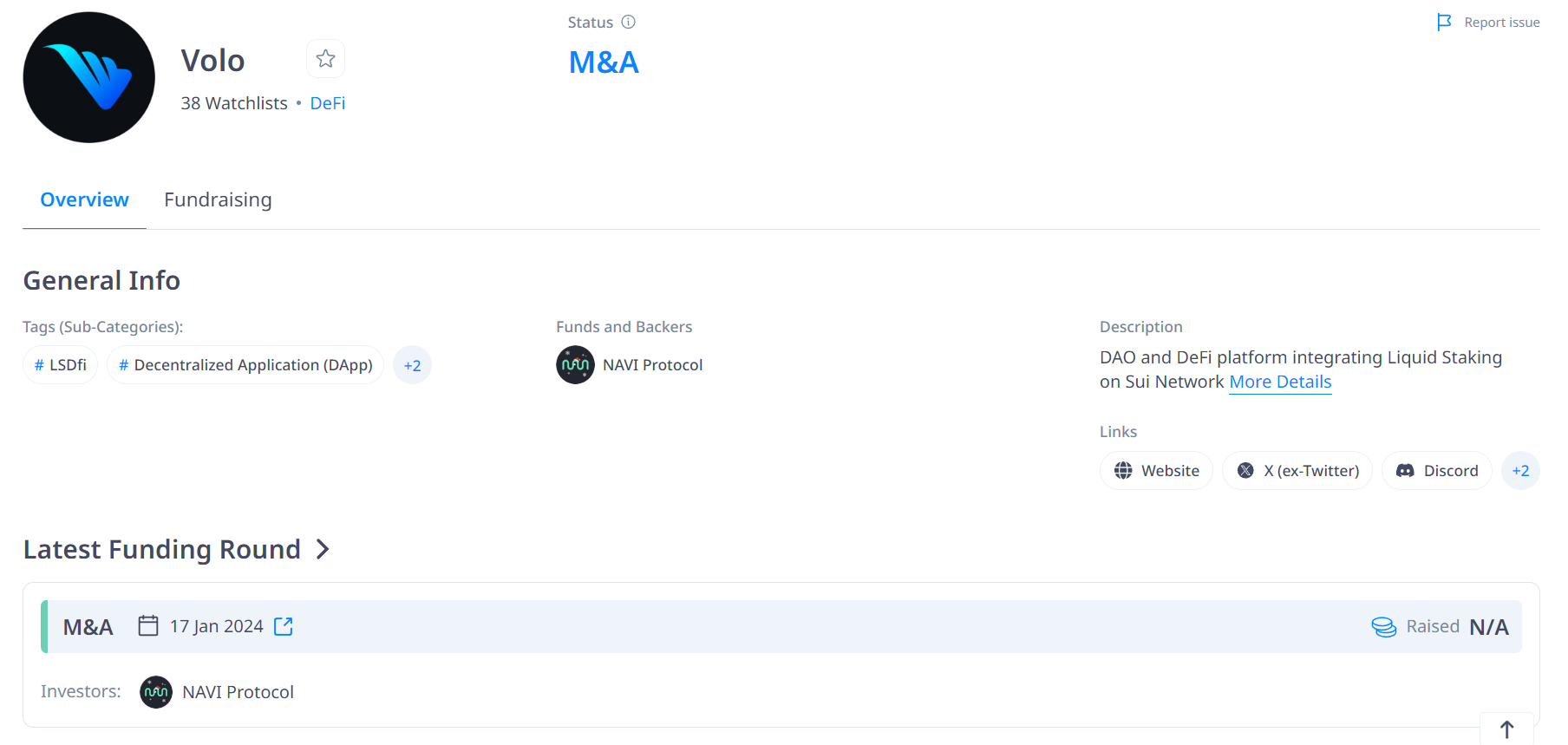

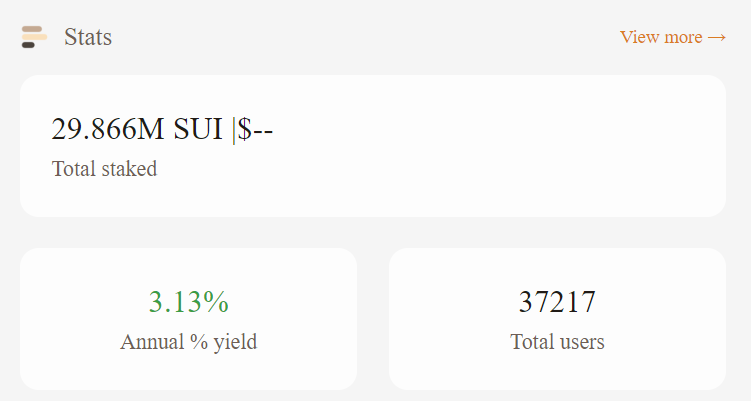

Volo

Volo is the leading liquid staking DeFi platform within Sui. Staking $SUI with Volo gives voloSUI in return as the LSD token. The governance token hasn't been launched yet.

Haedal

Haedal is a liquid staking protocol built on Sui that allows staking SUI tokens and getting haSUI in return as the LSD token. The governance token hasn't been launched yet.

Near

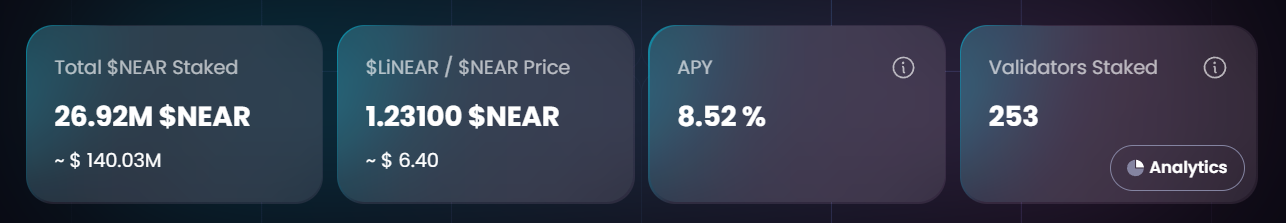

LiNEAR

LiNEAR is a non-custodial liquid staking protocol built on NEAR with LiNEAR as the LSD token. The governance token hasn't been launched yet.

HERE

HERE is a non-custodial NEAR wallet with built-in liquid staking. The same team launched telegram mini-app HOT, where you can farm by clicking.

Restaking Chains

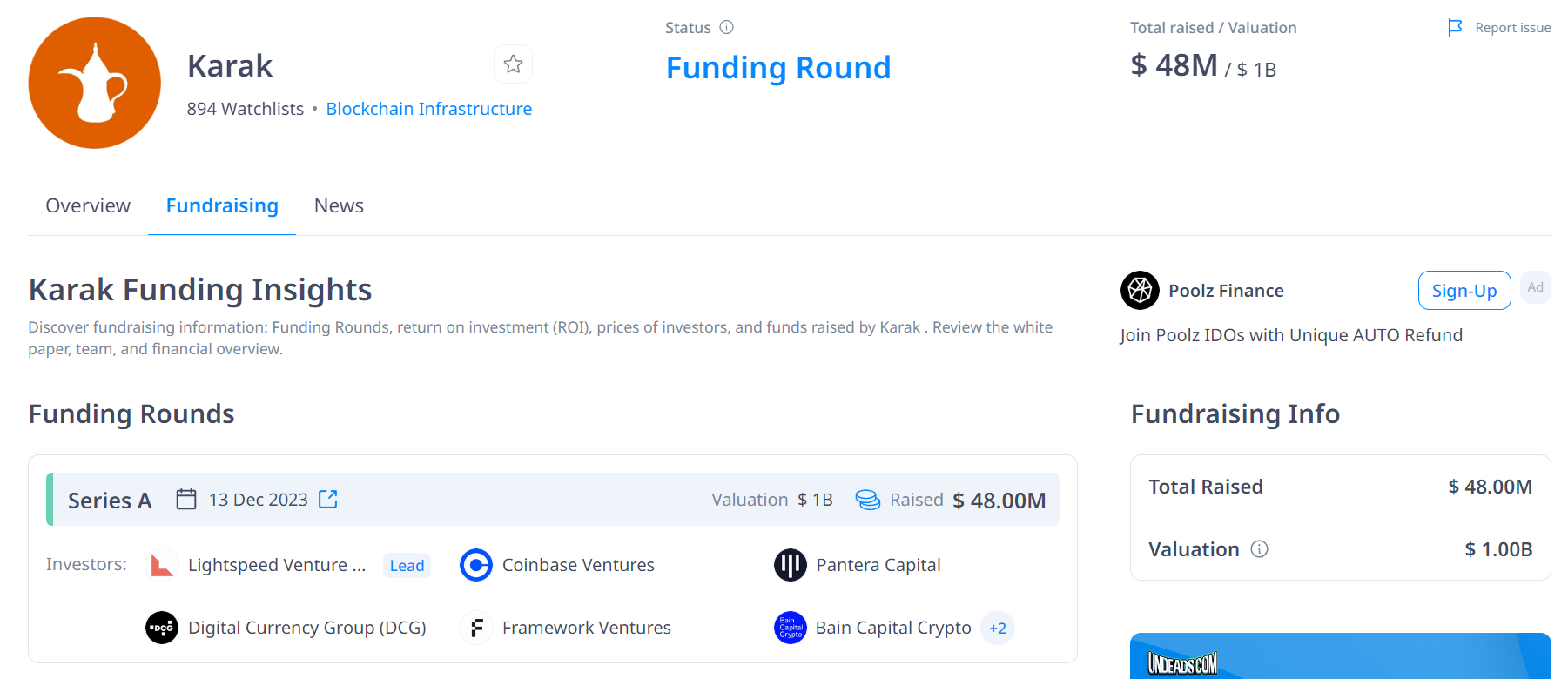

Karak

Karak aims to build a universal restaking layer. Besides ETH and its derivatives, Karak also accepts exotic types of tokens for restaking, such as USDC, USDT, sDAI, and Pendle tokens. Currently, the airdrop farming campaign is ongoing.

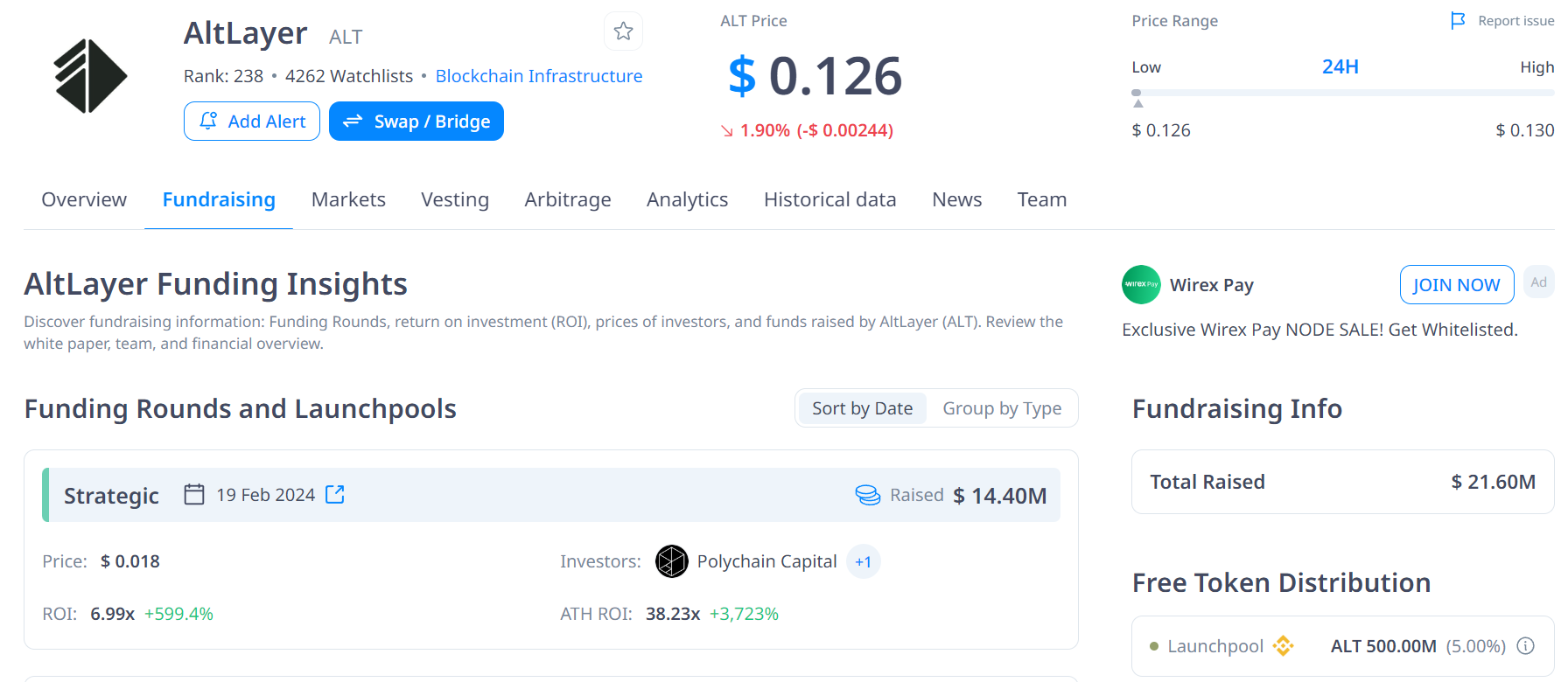

AltLayer

Altlayer is a decentralized protocol that facilitates the launch of native and restaked rollups with various stacks. The restaked rollup idea takes existing rollups and provides them with enhanced security, decentralization, interoperability, and crypto-economic fast finality. You can restake multiple assets, such as ETH, ALT, and DODO. The governance token $ALT is tradable.

Bitcoin Staking is Real Deal

Bitcoin is a Proof-of-Work blockchain, and no native staking is possible there. However, driven by the desire to unlock the liquidity of Bitcoin, various solutions are emerging that offer a variety of BTC derivatives in exchange for the lock-up of the underlying asset.

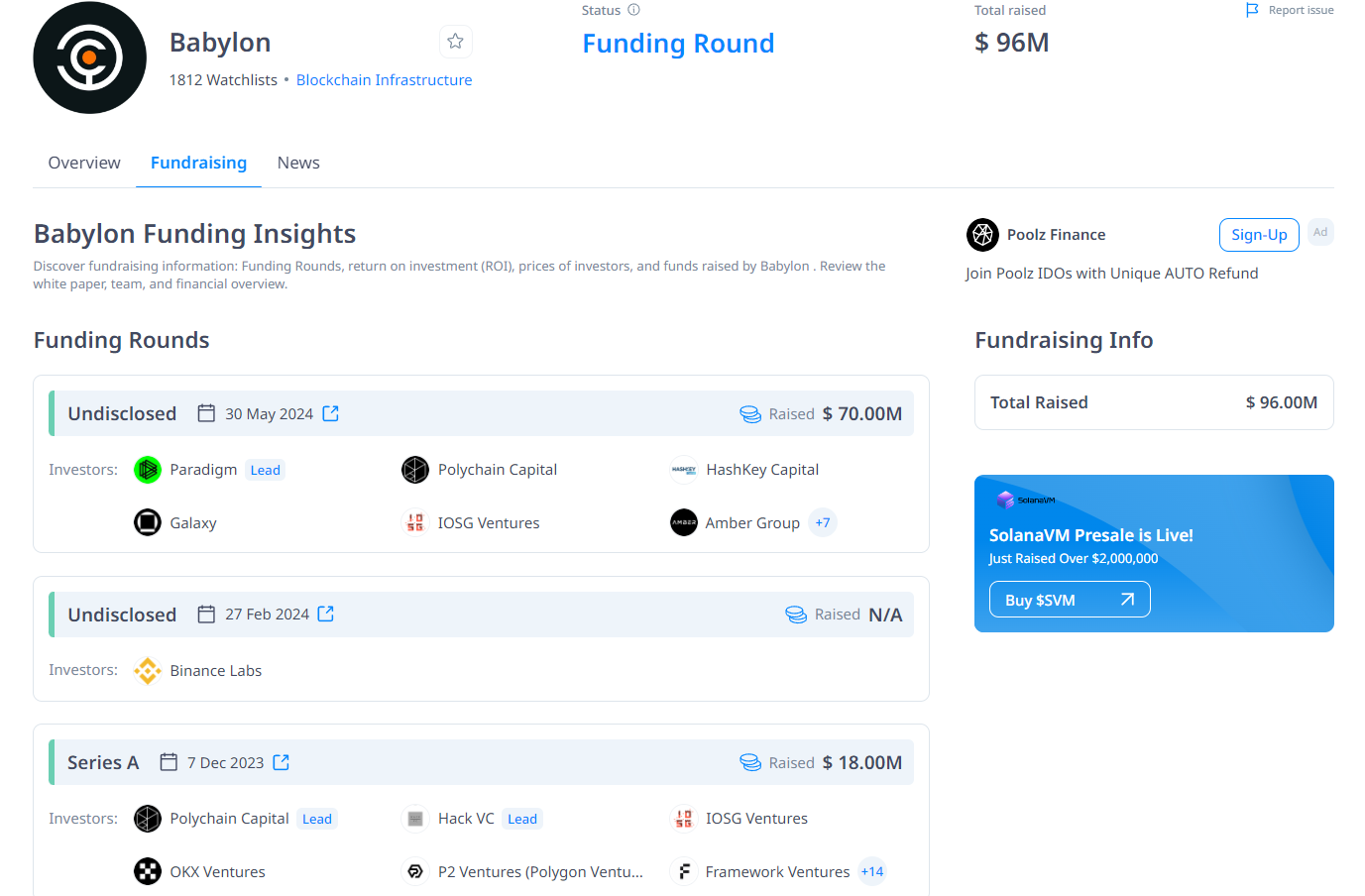

Babylon Chain

Babylon is a Cosmos chain that offers self-custodial Bitcoin staking. Babylon's Bitcoin staking protocol creates a two-sided market and acts as the control plane of the market. Bitcoin holders can lock their BTC and choose which PoS chain(s) to stake for and earn yields from. Since the protocol is modular, PoS chains and dApps can opt-in to Bitcoin-backed security of the Babylon Chain. It also enables scalable restaking for Bitcoin holders. Recently, the Babylon team closed a $70 million venture round led by Paradigm. Currently, it is in the testnet phase.

Pell Network

Pell Network aims to create a decentralized marketplace and liquidity hub for all of Bitcoin derivatives by constructing a network that aggregates native BTC Stake and LSD Restake services. They call it liquid restaking. Currently, it supports BitLayer, BounceBIt, Merlin, B² and Core. At the time of writing, there is a point program ongoing.

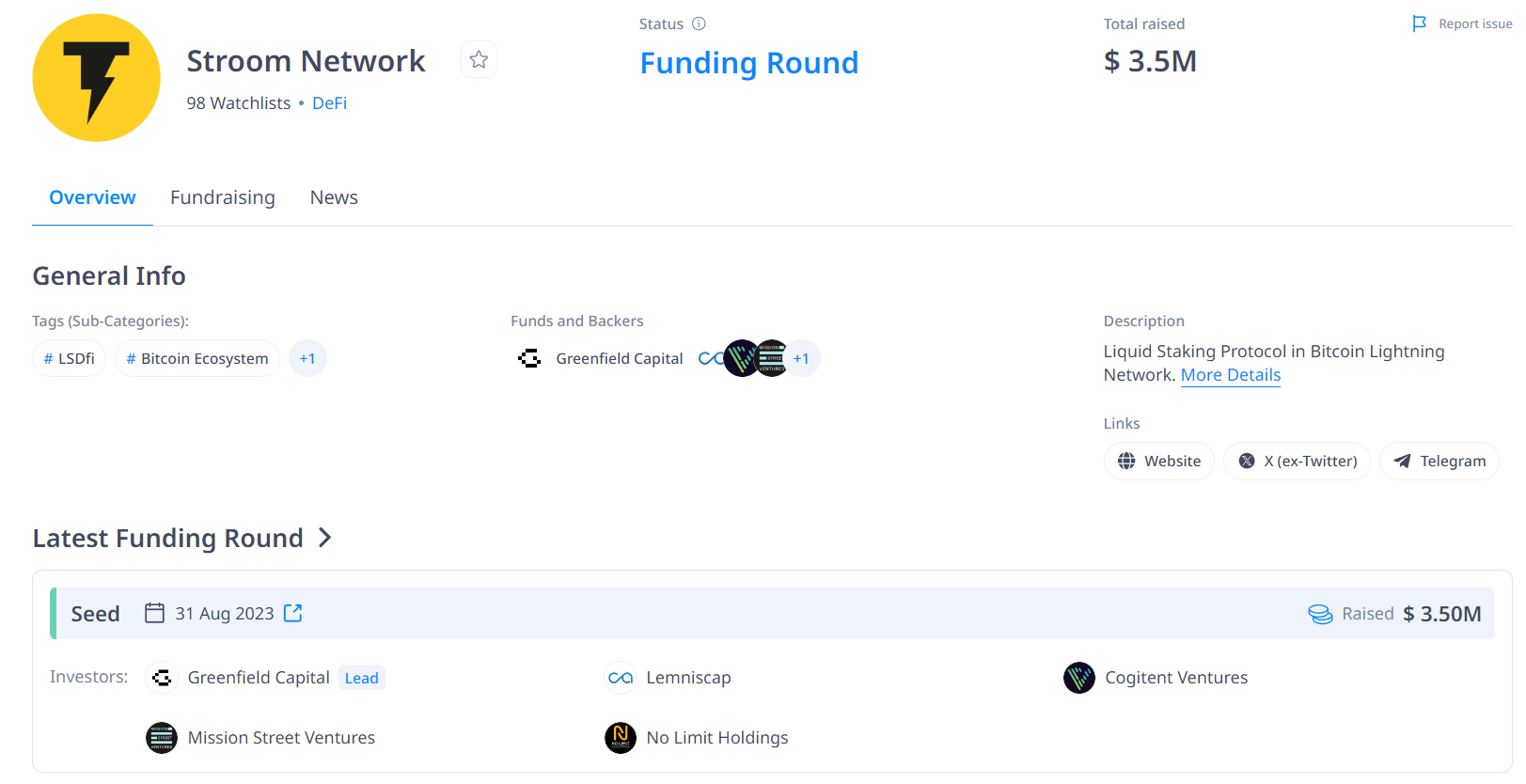

Stroom Network

Stroom is a so-called liquid staking protocol for Bitcoin's Lightning Network. By depositing bitcoin on Lightning, users can earn routing fees from payments. Stroom issues on Ethereum a wrapped Bitcoin token, lnBTC, enabling users to explore further yield. Currently, it is in the testnet phase.

Output

The innovations in liquid staking and restaking have clearly extended beyond Ethereum, with Solana making significant strides in developing a mature and sophisticated staking infrastructure. While other L1 chains are still catching up, their potential cannot be overlooked as their ecosystems continue to evolve. The early stages of omnichain restaking solutions point to a future where diverse staking opportunities across multiple smaller blockchains will be available within a single protocol. Simultaneously, driven by the desire to unlock Bitcoin's liquidity, a myriad of BTC-staking solutions are emerging.

Solana transitioned from a struggling blockchain to the second-largest DeFi ecosystem in just a few months. The same rapid development is now happening with TON. It is essential to keep a close watch on the blockchains mentioned here, as their development progresses swiftly, and market sentiment changes even faster. The restaking trend could emerge there in the near future.