Crypto Fundraising Recap Q2 2024

Key Takeaways:

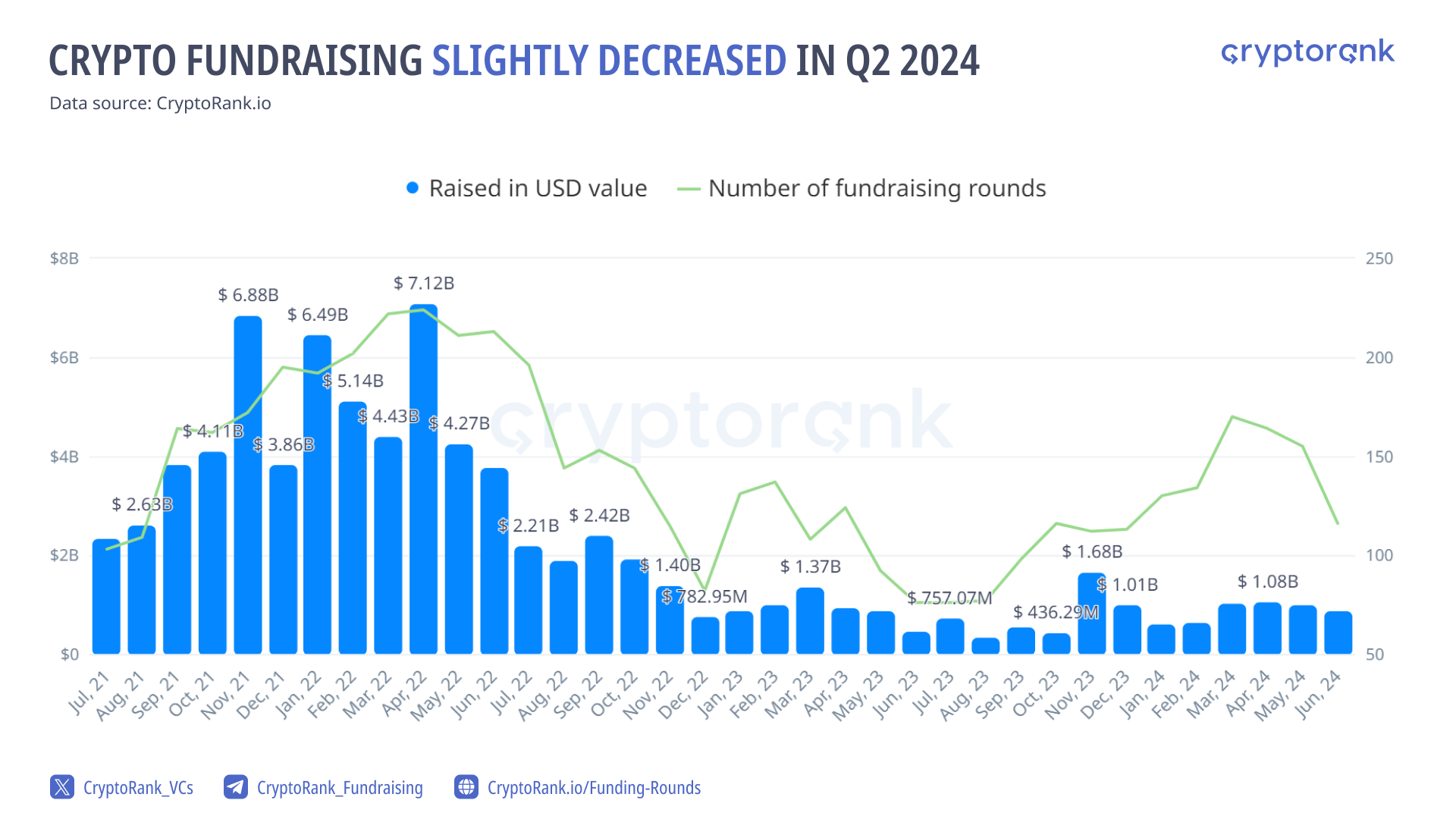

- In Q2 2024, a total of $2.98 billion was raised across 435 funding rounds;

-

In Q2, the fundraising amount increased by 27% compared to Q1;

-

From a long-term perspective, crypto fundraising remains at low levels, which indicates a certain pessimism and a lack of new ideas;

-

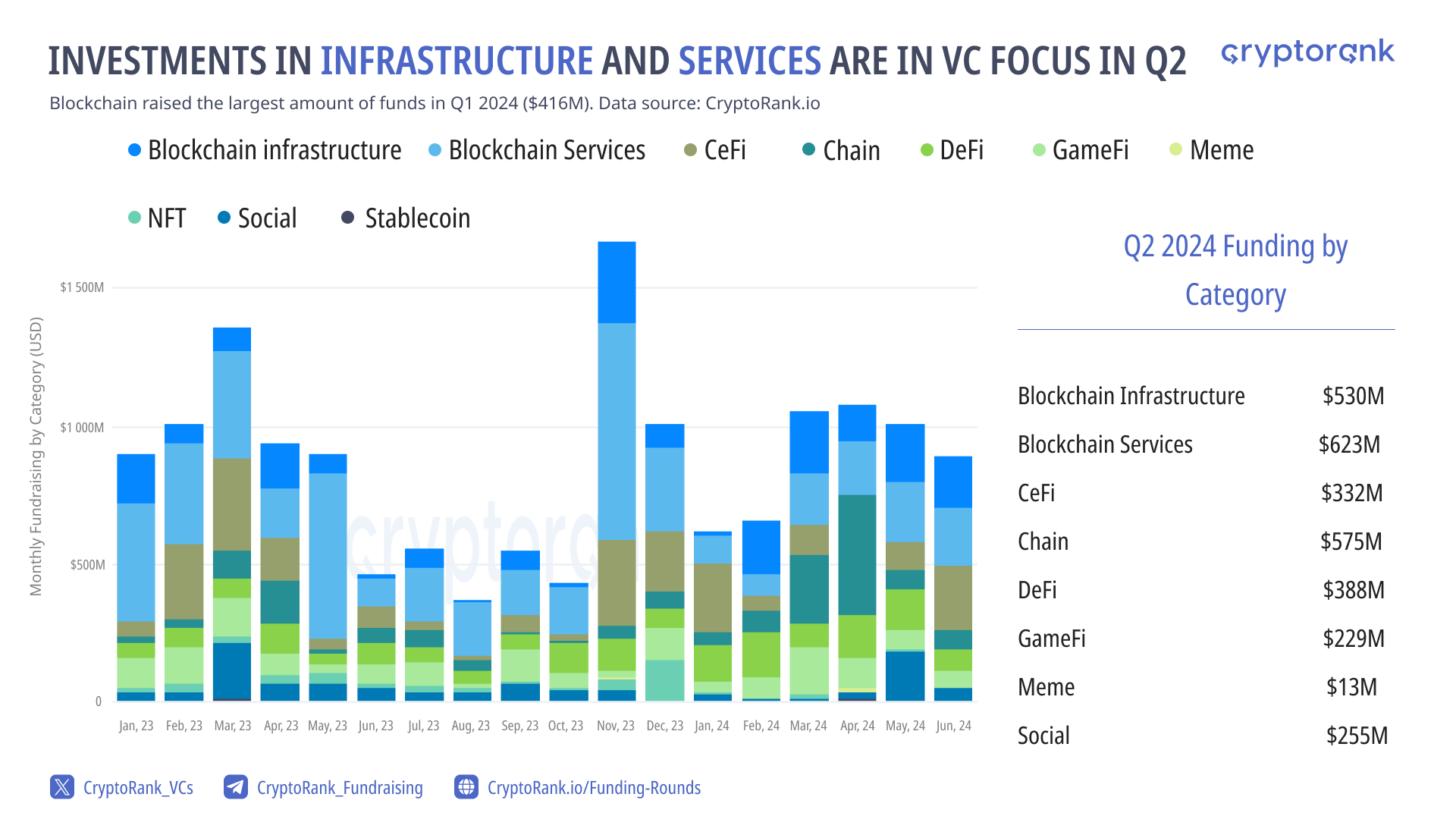

Infrastructure projects are in the focus of venture capital firms;

Crypto Fundraising Fails to Signal a Bull Market

From a long-term perspective, crypto fundraising has remained relatively unchanged since the beginning of 2023, when Bitcoin was trading around $20,000. This stability reflects the overall pessimism in the crypto sector and indicates a general decline in fundraising activity. With the impending bear market, there is a high probability that fundraising will shrink further.

Crypto Market is Focused on Infrastructure Projects

In the short term, however, fundraising in Q2 exceeded that of Q1 by 27%, reaching $2.98 billion compared to $2.35 billion. Investments in infrastructure projects have increased, suggesting that the market is currently focusing on developing solutions to address internal challenges.

Among the top 10 notable funding rounds in Q2 2024, several were for infrastructure projects, including:

Babylon is a Bitcoin native staking infrastructure that allows users to stake their Bitcoin and earn rewards.

Avail is a Web3 infrastructure layer designed to allow modular execution layers to scale and interoperate in a trust-minimized way.

Movement Labs is a network of modular move based blockchains.

Conduit is a crypto-native infrastructure platform designed to support and accelerate builders in the crypto space.

As usual, among the notable funding rounds, there were several promising blockchain projects:

Monad is a Layer1 EVM-compatible blockchain with parallel execution.

Berachain is an EVM-compatible layer 1 blockchain, built using the Cosmos SDK, and secured by the novel Proof-of-Liquidity Consensus Protocol.

XION is the only layer-1 blockchain specifically built for consumer adoption with chain abstraction technology.

This inward-oriented focus of crypto projects can lay the foundation for future developments, potentially expanding decentralized apps beyond the crypto market. Farcaster is an example of this effort, utilizing account abstraction to function similarly to traditional social media platforms. However, currently, Farcaster is primarily used by crypto enthusiasts.

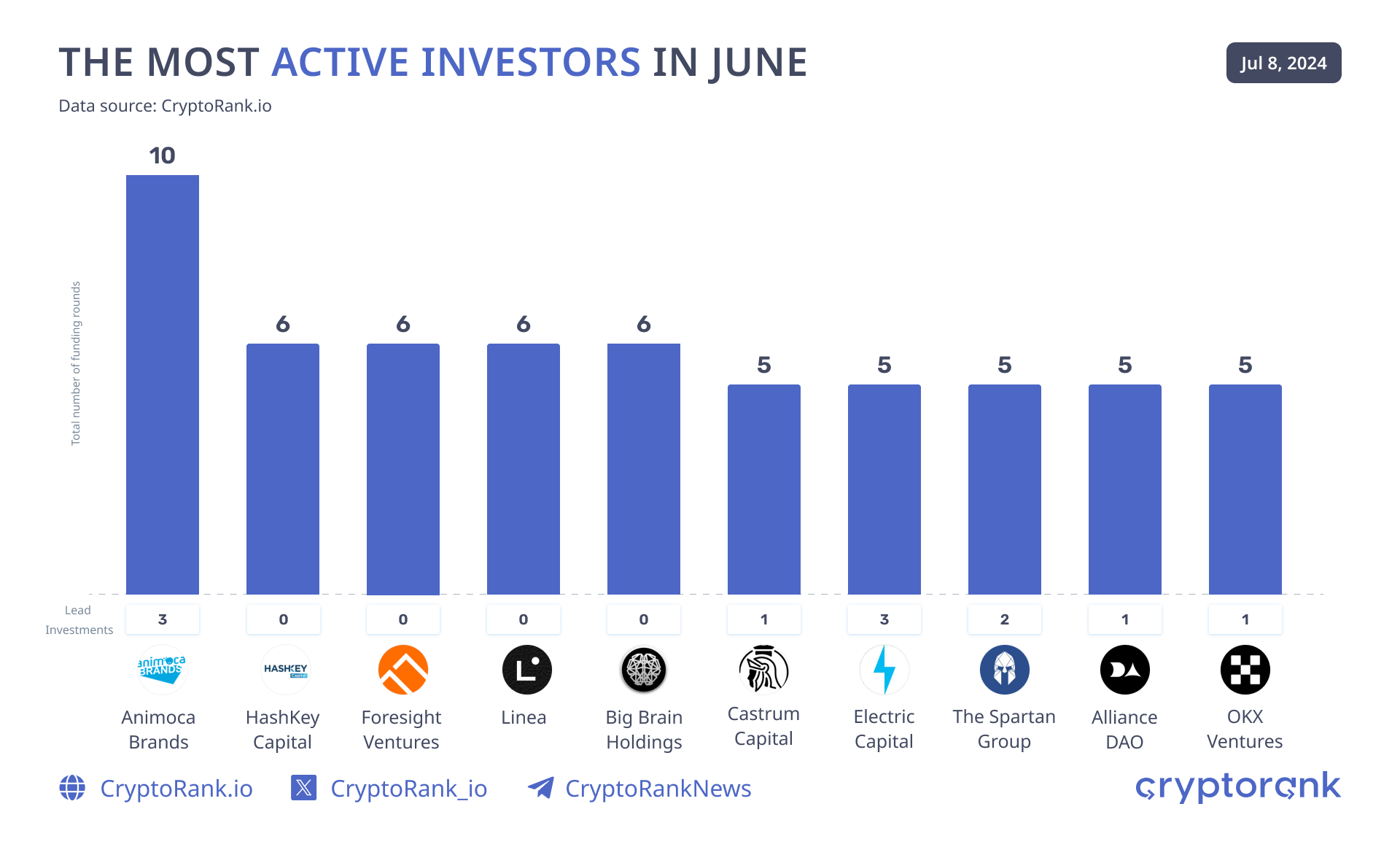

Animoca Brands Stands Out as The Most Active Investor in Q2 2024

Among the most active crypto investors is Animoca Brands, which frequently invests in the GameFi sector. OKX Ventures has also emerged as a very active investor this year.

Spartan and HashKey Capital stand out as the most active Tier 1 investors this quarter.

In June, Animoca Brands led the market with 10 investments, followed by HashKey Capital, Foresight Ventures, Big Brain Holdings, Linea and Castrum Capital. Overall, venture capital funds reduced their investment activity compared to the beginning of the second quarter.

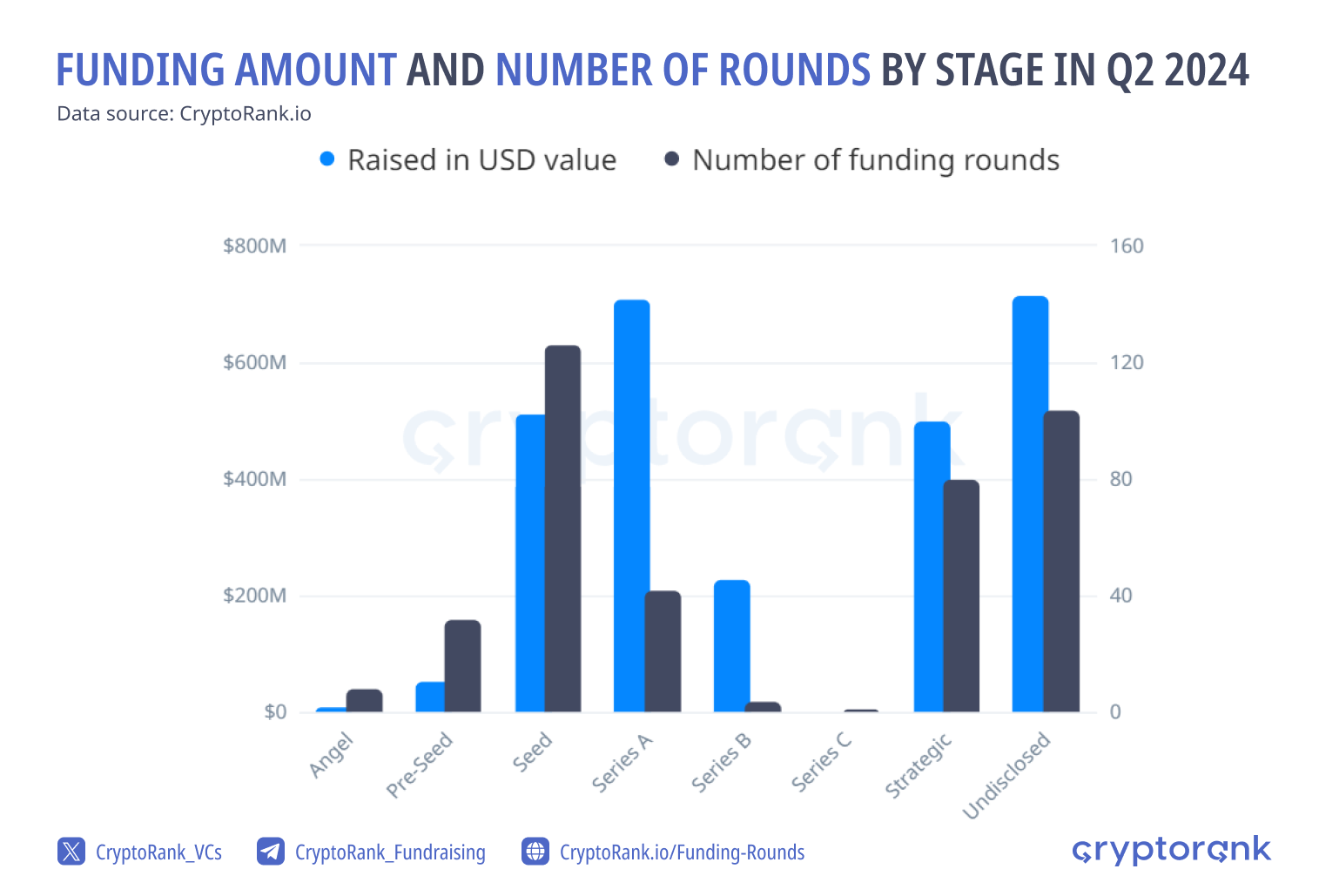

Seed rounds remain the most popular funding stage by the number of deals, followed by Series A. However, in terms of total funding amount, Series A leads, followed by Seed rounds.

Blockchains, Mining Companies, and Infrastructure Projects Lead the Largest Funding Rounds

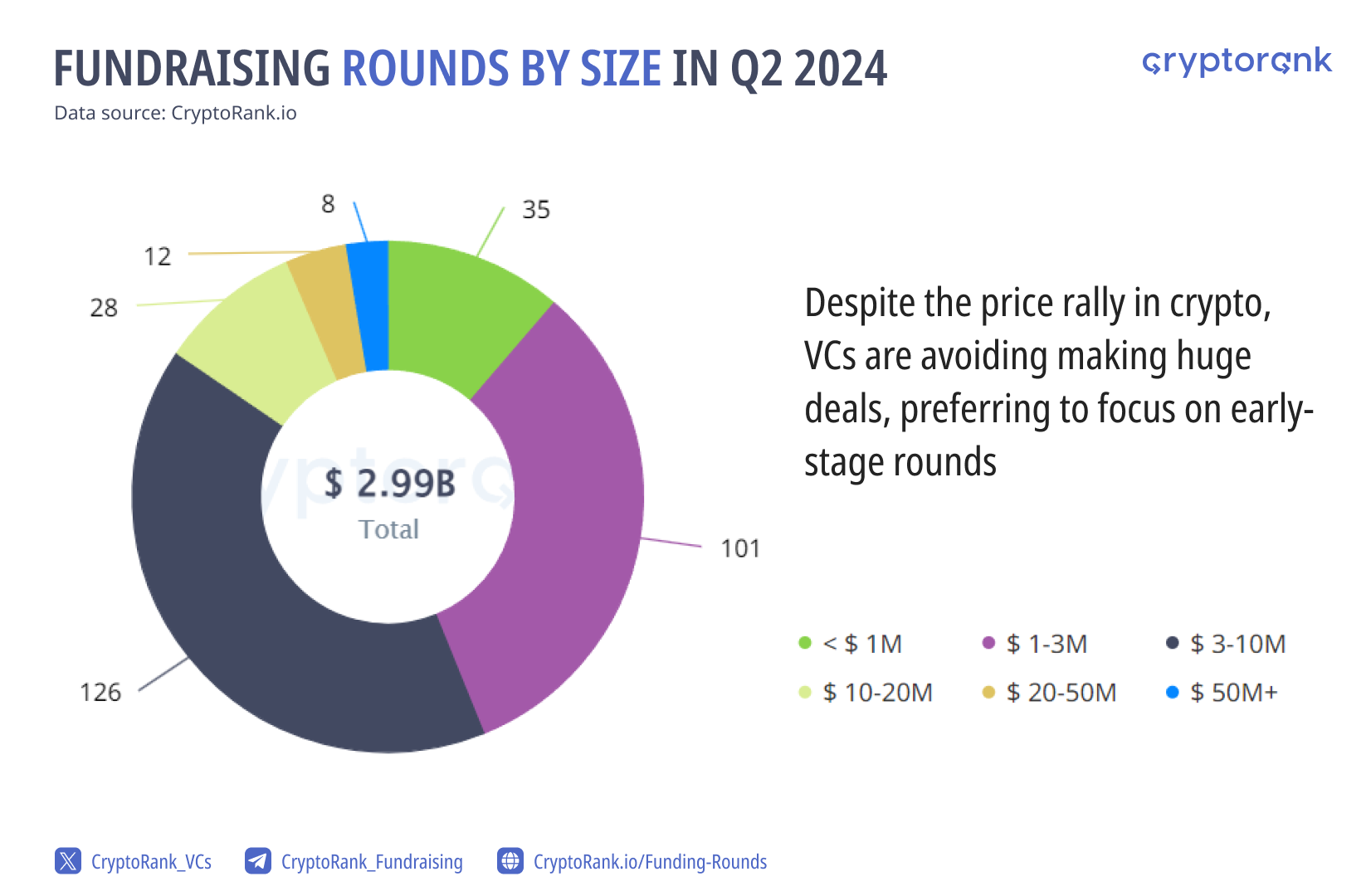

Most investment rounds fall in the $1-10 million range, with only eight projects receiving funding exceeding $50 million.

Monad is a Layer1 EVM-compatible blockchain with parallel execution.

Bitstamp is a European cryptocurrency exchange founded in 2011.

Hut 8 Mining is an energy infrastructure operator and Bitcoin miner with self-mining, hosting, managed services, and data center operations.

Bitdeer is a provider of digital asset mining services, offering reliable miner-sharing services.

Farcaster is a protocol for building sufficiently decentralized social networks.

Berachain is an EVM-compatible layer 1 blockchain, built using the Cosmos SDK, and secured by the novel Proof-of-Liquidity Consensus Protocol.

Auradine is a pioneer in web infrastructure solutions including blockchain, privacy and AI.

Babylon is a Bitcoin native staking infrastructure that allows users to stake their Bitcoin and earn rewards.

Among the eight largest fundraising projects, there are two blockchains, two mining companies, and two blockchain infrastructure products. The only consumer-oriented projects are the social media platform Farcaster and the exchange Bitstamp. This indicates that venture capital is primarily focused on infrastructure investments.

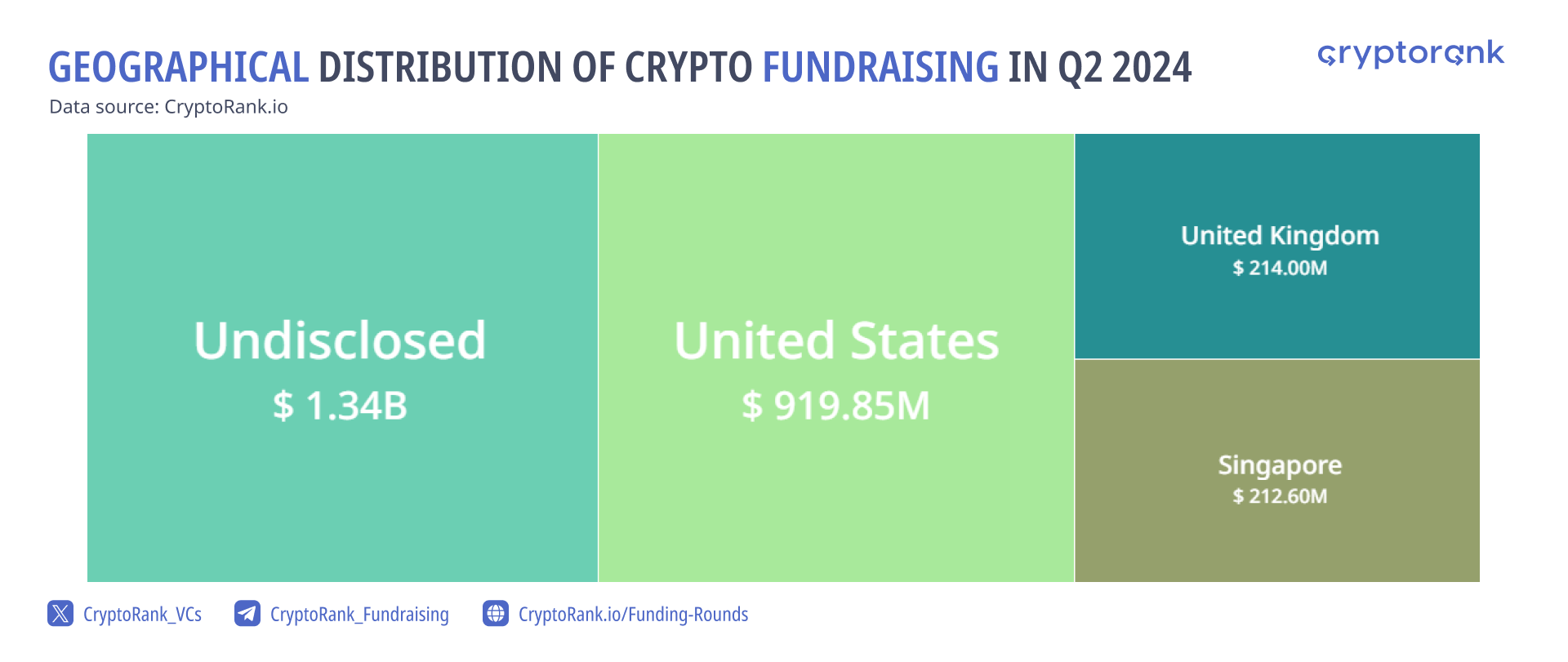

The United States continues to be the leading jurisdiction for crypto fundraising, followed by the United Kingdom and Singapore.

Conclusion

Since early 2023, fundraising has shown long-term stability at low levels, reflecting market pessimism. In Q2, crypto fundraising saw a slight increase compared to Q1 but exhibited a downward trend within the quarter. The largest funding rounds were primarily driven by blockchain and infrastructure projects, indicating an inward focus within the crypto market. While the future trend appears pessimistic, the crypto market remains capable of delivering significant surprises.

Animoca Brands

Animoca Brands Castrum Capital

Castrum Capital HashKey Capital

HashKey Capital OKX Ventures

OKX Ventures The Spartan Group

The Spartan Group