Curve DAO CRVPrice $ 0.369

Rank: 95

CRV Price

General Info

Contracts/Explorers:

Ethereum

Funds and Backers

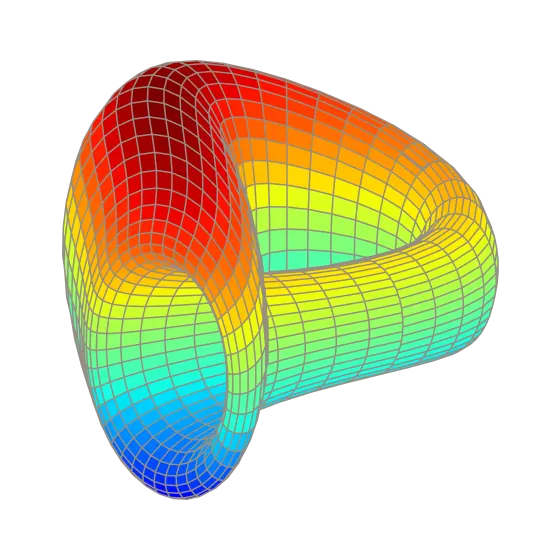

Curve DAO (CRV) Chart

CRV to USD Converter

CRV

CRVCRV Price Statistics

What is Curve DAO (CRV)?

What is Curve DAO?

Curve Finance, launched in 2020, is one of the most important building blocks in decentralized finance (DeFi). It started as a decentralized exchange (DEX) optimized for stablecoin trading with low slippage and deep liquidity. Over time, it has grown into a complete DeFi ecosystem with trading, lending, stablecoins, governance, and multichain infrastructure.

At the center of the ecosystem is the Curve DAO, governed by the CRV token. The DAO ensures that decision-making and incentive distribution remain in the hands of the community. By locking CRV into veCRV (vote-escrowed CRV), users gain the right to participate in governance, boost rewards, and collect a share of protocol fees. This alignment between liquidity providers and token holders has been a key driver of Curve’s growth.

Key Features of Curve Finance and Curve DAO:

DEX with deep liquidity — Curve powers some of the largest and most efficient stablecoin markets, ensuring low-cost and low-slippage swaps.

Llamalend and LLAMMA — Curve extends into lending via Llamalend, using LLAMMA (Lending-Liquidating AMM Algorithm). This system provides liquidation protection by gradually converting collateral instead of liquidating it all at once, reducing systemic risk.

crvUSD Stablecoin — Curve introduced crvUSD, a fully decentralized, overcollateralized stablecoin. Thanks to LLAMMA, crvUSD offers borrowers more flexibility and resilience against market volatility while maintaining a stable $1 peg.

Governance and incentives — CRV token holders guide the protocol through proposals and gauge weight voting, deciding where liquidity incentives go. Liquidity providers can also boost rewards by holding veCRV.

Ecosystem integration — Curve is deeply integrated into DeFi protocols such as Yearn, Convex, and Frax, and is now pioneering on-chain FX markets with its new FXSwaps product.

CRV Token Utility:

Incentivizing liquidity providers with CRV rewards.

Boosting rewards up to 2.5x via veCRV.

Participating in governance, including directing CRV emissions.

Earning a share of fees from swaps and loans.

Future Outlook:

Curve DAO is more than a DEX — it is a fully-fledged ecosystem, combining liquidity, lending, governance, and innovation to remain one of the most influential protocols in DeFi. crvUSD also positions Curve as a potential hub for institutional adoption, offering a decentralized, censorship-resistant stablecoin.

Curve DAO Price Today

Curve DAO's current price is $ 0.369, it has dropped -1.26% over the past 24 hours.

Curve DAO's All Time High (ATH) of $ 40.91 was reached on 14 Aug 2020, and is currently -99.1% down.

The current circulating supply of Curve DAO is 1.47 Billion tokens, and the maximum supply of Curve DAO is 3.03 Billions.

Curve DAO’s 24 hour trading volume is $ 33.94 Million.

Curve DAO's current share of the entire cryptocurrency market is 0.02%, with a market capitalization of $ 541.46 Million.

You can find more details about Curve DAO on its official website and on the block explorer.

Trending Coins and Tokens

- 450

Lagrange Labs

LA$ 0.295

1.68% - 744

Swarm Network

TRUTH$ 0.0111

0.11%

CertiK

N/A

Tashi Network

N/A

Coinbax

N/A

Paxi Network

PAXI$ 0.0245

8.23%- 24

Canton Network

CC$ 0.137

9.59%