Bitcoin Price Prediction: Michael Saylor Escapes Multi-Billion Tax Bomb – Will This Trigger a New Wave of Corporate Buying?

Share:

Bitcoin traded at $118,610 on Thursday with daily volumes near $67 billion, holding firm after one of the most consequential tax clarifications for U.S. corporate holders of digital assets. Strategy, the world’s largest public holder of Bitcoin with a $75 billion trove, announced it no longer expects to face a multi-billion tax liability tied to unrealized crypto gains after new guidance from the IRS and Treasury.

The 71-page update says companies don’t have to include unrealized Bitcoin gains or losses in the 15% Corporate Alternative Minimum Tax (CAMT) calculation.

This saves Strategy from billions in potential payments and eases fears that long-term Bitcoin treasuries would be penalized for appreciation.

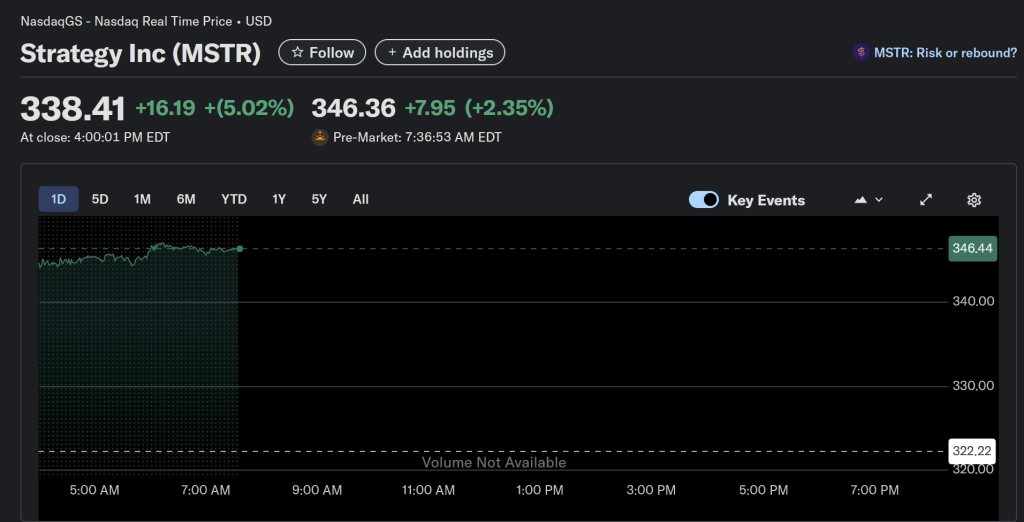

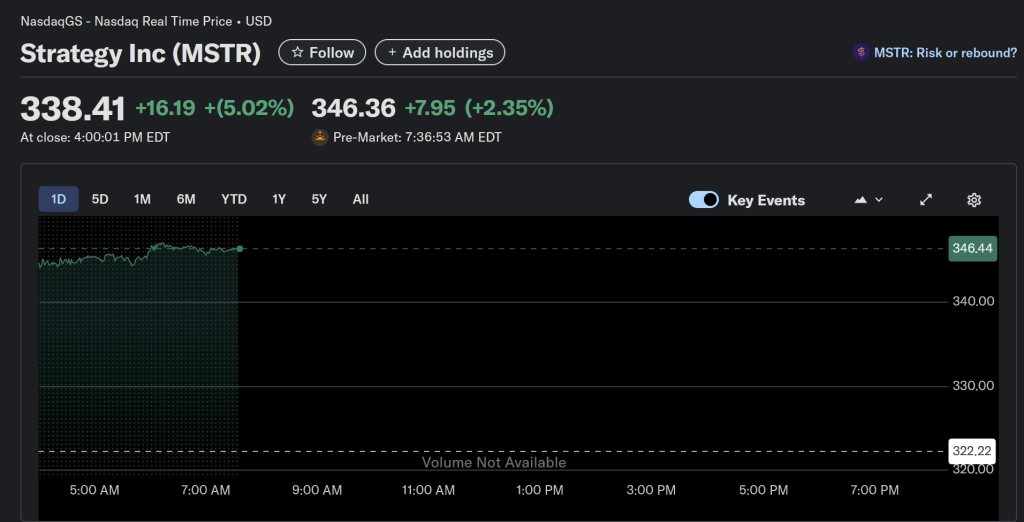

Shares of Strategy climbed 5% to $338 on Wednesday, extending a six-month advance of more than 10%. Analysts say the decision removes a “significant overhang” that could have weighed on corporate adoption.

For Strategy, which has never sold a Bitcoin since it began buying in 2020, the relief comes as it sits on roughly $28 billion in unrealized profit.

Bitcoin Price Prediction: Technical Outlook

From a technical standpoint, Bitcoin broke out above the descending trendline that capped September’s rallies, closing above $118,600 and testing $119,477. A bullish engulfing candle on the 4 hour chart with strong volume did the trick. The 50-SMA ($112,455) is above the 100-SMA ($113,555) confirming the uptrend.

The RSI at 79 is overbought, so we’re likely to see some consolidation or a pullback to $116,950-$117,500 before the next leg up.

If support holds, the next targets are $122,335 and $124,525 with potential extensions to $128,000 in the coming weeks. For traders, the most balanced setup involves waiting for a dip toward the $117K zone before targeting a renewed push higher.

With macro tailwinds, institutional buying, and now regulatory clarity favoring holders, Bitcoin’s latest rally positions it not just for near-term gains but for a broader corporate adoption cycle. That combination could fuel the next wave of demand as firms reassess the role of BTC in treasury management.

Presale Maxi Doge ($MAXI) Blends Meme Power With Gym-Bro Energy

Maxi Doge ($MAXI) is a meme-fueled token designed for degens who thrive on 1000x leverage and relentless hustle. More than just a meme coin, $MAXI represents a community-driven culture that fuses trading intensity with gym-bro energy, caffeine, and competitive camaraderie.

By holding $MAXI, investors unlock staking rewards, trading contests, and access to gamified partner events. The smart contract has been audited by SolidProof and Coinsult, giving added confidence in the project’s foundations.

Momentum is strong. The presale has already raised over $2.6 million, with tokens priced at just $0.00026. This figure will rise as the presale progresses, making early entry more attractive.

$MAXI holders gain access to:

- Staking rewards with dynamic APYs

- Trading contests with leaderboard prizes

- Community-driven partner events and future integrations

You can buy $MAXI on the official Maxi Doge website using ETH, BNB, USDT, USDC, or a bank card.

Visit the Official Maxi Doge Website Here

The post Bitcoin Price Prediction: Michael Saylor Escapes Multi-Billion Tax Bomb – Will This Trigger a New Wave of Corporate Buying? appeared first on Cryptonews.

Bitcoin Price Prediction: Michael Saylor Escapes Multi-Billion Tax Bomb – Will This Trigger a New Wave of Corporate Buying?

Share:

Bitcoin traded at $118,610 on Thursday with daily volumes near $67 billion, holding firm after one of the most consequential tax clarifications for U.S. corporate holders of digital assets. Strategy, the world’s largest public holder of Bitcoin with a $75 billion trove, announced it no longer expects to face a multi-billion tax liability tied to unrealized crypto gains after new guidance from the IRS and Treasury.

The 71-page update says companies don’t have to include unrealized Bitcoin gains or losses in the 15% Corporate Alternative Minimum Tax (CAMT) calculation.

This saves Strategy from billions in potential payments and eases fears that long-term Bitcoin treasuries would be penalized for appreciation.

Shares of Strategy climbed 5% to $338 on Wednesday, extending a six-month advance of more than 10%. Analysts say the decision removes a “significant overhang” that could have weighed on corporate adoption.

For Strategy, which has never sold a Bitcoin since it began buying in 2020, the relief comes as it sits on roughly $28 billion in unrealized profit.

Bitcoin Price Prediction: Technical Outlook

From a technical standpoint, Bitcoin broke out above the descending trendline that capped September’s rallies, closing above $118,600 and testing $119,477. A bullish engulfing candle on the 4 hour chart with strong volume did the trick. The 50-SMA ($112,455) is above the 100-SMA ($113,555) confirming the uptrend.

The RSI at 79 is overbought, so we’re likely to see some consolidation or a pullback to $116,950-$117,500 before the next leg up.

If support holds, the next targets are $122,335 and $124,525 with potential extensions to $128,000 in the coming weeks. For traders, the most balanced setup involves waiting for a dip toward the $117K zone before targeting a renewed push higher.

With macro tailwinds, institutional buying, and now regulatory clarity favoring holders, Bitcoin’s latest rally positions it not just for near-term gains but for a broader corporate adoption cycle. That combination could fuel the next wave of demand as firms reassess the role of BTC in treasury management.

Presale Maxi Doge ($MAXI) Blends Meme Power With Gym-Bro Energy

Maxi Doge ($MAXI) is a meme-fueled token designed for degens who thrive on 1000x leverage and relentless hustle. More than just a meme coin, $MAXI represents a community-driven culture that fuses trading intensity with gym-bro energy, caffeine, and competitive camaraderie.

By holding $MAXI, investors unlock staking rewards, trading contests, and access to gamified partner events. The smart contract has been audited by SolidProof and Coinsult, giving added confidence in the project’s foundations.

Momentum is strong. The presale has already raised over $2.6 million, with tokens priced at just $0.00026. This figure will rise as the presale progresses, making early entry more attractive.

$MAXI holders gain access to:

- Staking rewards with dynamic APYs

- Trading contests with leaderboard prizes

- Community-driven partner events and future integrations

You can buy $MAXI on the official Maxi Doge website using ETH, BNB, USDT, USDC, or a bank card.

Visit the Official Maxi Doge Website Here

The post Bitcoin Price Prediction: Michael Saylor Escapes Multi-Billion Tax Bomb – Will This Trigger a New Wave of Corporate Buying? appeared first on Cryptonews.