Central Bank Digital Currencies Set to Surge 2,430% by 2031

Share:

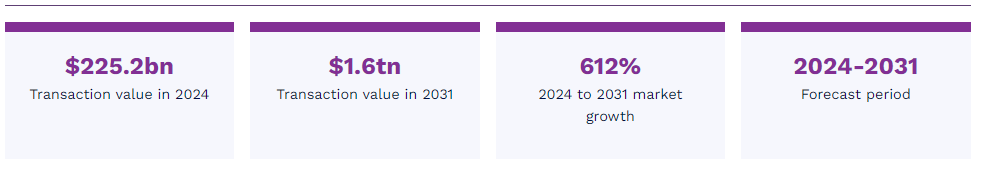

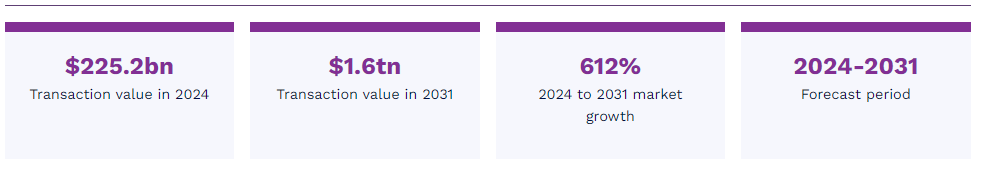

Central bank digital currencies will change how money works worldwide. A new Juniper Research study shows their use will grow by 2,430% in seven years. Their report says CBDC payments will rise from 307.1 million in 2024 to 7.8 billion by 2031.

Banks want this growth to protect their control over money from card companies and stablecoins. This growth in digital currency significantly changes how we handle payments.

Also Read: Dogecoin (DOGE) To Peak And Target $0.175, Expert Shares

Exploring the Future: CBDC Surge, Market Impact, and Financial Revolution

Record-Breaking Global Adoption

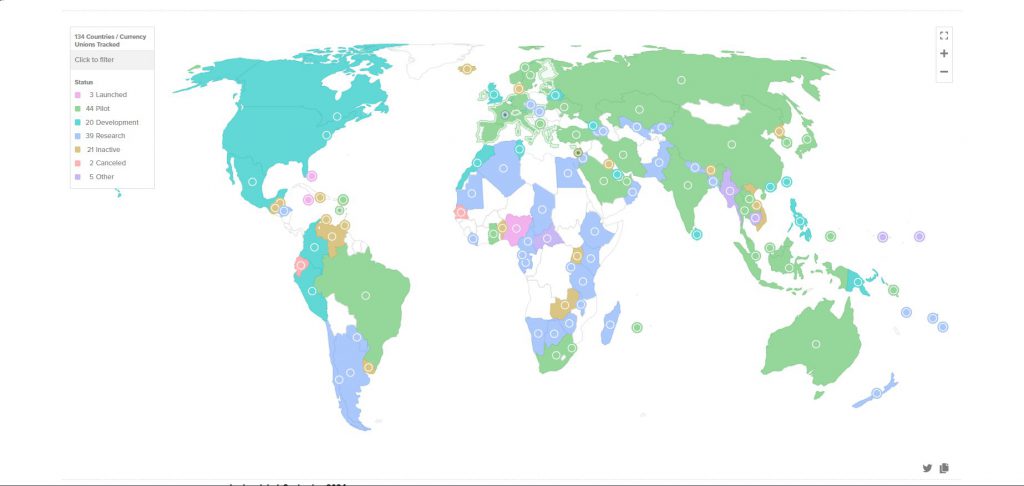

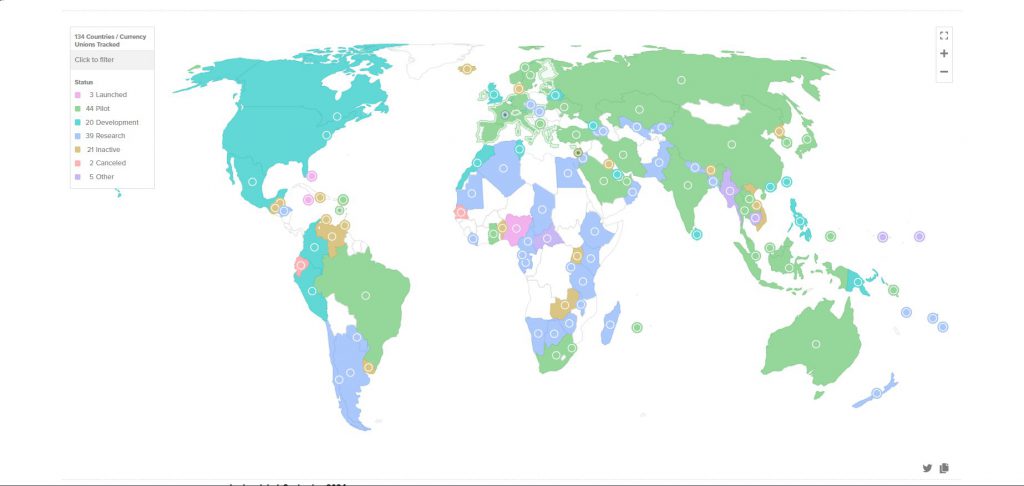

More countries now use central bank digital currencies than ever before. The number jumped from 35 in May 2020 to 134 countries today. These nations make up 98% of the world’s money.

The study shows that 66 countries are in the late stages of CBDC development. All G20 nations have joined in. Right now, 44 test programs are running. China’s digital yuan and Europe’s digital euro lead these tests.

Also Read: Bitcoin Reclaims $71,000: Will BTC Hit A New Peak This Week?

Billions in Cost Savings Drive Growth

“Through the use of CBDCs and stablecoins, cross-border payments will save $45 billion by 2031,” Juniper Research reports.

This financial future eliminates middlemen and makes sending money abroad cheaper and faster. European countries are testing these systems, and they want to improve both local and international money transfers.

Sovereignty and Integration Challenge

“This remarkable 2,430% growth will be driven by central banks seeking to safeguard monetary sovereignty in the face of card-network dominance and growing stablecoin popularity,” the research states.

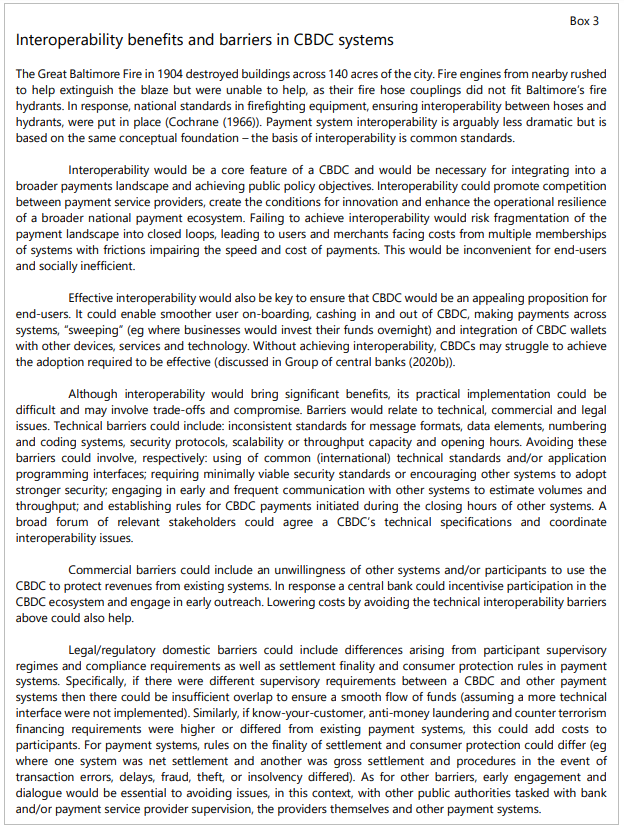

The Bank for International Settlements helps create shared rules. CBDCs might not work well together without these rules, which could limit their usefulness for global trade.

Market Revolution and Cross-Border Innovation

CBDCs will change how money moves around the world. Banks want to keep control while making payments modern. This CBDC surge needs banks to work together like never before. New systems for significant payments focus on fixing international transfer problems. They promise to make global trade cheaper and more straightforward for everyone.

Also Read: Apple (AAPL) Competes With Nvidia (NVDA) in AI Tech Showdown

Central Bank Digital Currencies Set to Surge 2,430% by 2031

Share:

Central bank digital currencies will change how money works worldwide. A new Juniper Research study shows their use will grow by 2,430% in seven years. Their report says CBDC payments will rise from 307.1 million in 2024 to 7.8 billion by 2031.

Banks want this growth to protect their control over money from card companies and stablecoins. This growth in digital currency significantly changes how we handle payments.

Also Read: Dogecoin (DOGE) To Peak And Target $0.175, Expert Shares

Exploring the Future: CBDC Surge, Market Impact, and Financial Revolution

Record-Breaking Global Adoption

More countries now use central bank digital currencies than ever before. The number jumped from 35 in May 2020 to 134 countries today. These nations make up 98% of the world’s money.

The study shows that 66 countries are in the late stages of CBDC development. All G20 nations have joined in. Right now, 44 test programs are running. China’s digital yuan and Europe’s digital euro lead these tests.

Also Read: Bitcoin Reclaims $71,000: Will BTC Hit A New Peak This Week?

Billions in Cost Savings Drive Growth

“Through the use of CBDCs and stablecoins, cross-border payments will save $45 billion by 2031,” Juniper Research reports.

This financial future eliminates middlemen and makes sending money abroad cheaper and faster. European countries are testing these systems, and they want to improve both local and international money transfers.

Sovereignty and Integration Challenge

“This remarkable 2,430% growth will be driven by central banks seeking to safeguard monetary sovereignty in the face of card-network dominance and growing stablecoin popularity,” the research states.

The Bank for International Settlements helps create shared rules. CBDCs might not work well together without these rules, which could limit their usefulness for global trade.

Market Revolution and Cross-Border Innovation

CBDCs will change how money moves around the world. Banks want to keep control while making payments modern. This CBDC surge needs banks to work together like never before. New systems for significant payments focus on fixing international transfer problems. They promise to make global trade cheaper and more straightforward for everyone.

Also Read: Apple (AAPL) Competes With Nvidia (NVDA) in AI Tech Showdown