Bitcoin Reserves: MicroStrategy Outshines Berkshire, Predicts $500K Surge

Share:

Bitcoin reserves have made MicroStrategy a standout performer in the market. Its stock now beats Warren Buffett’s Berkshire Hathaway by the largest margin since the dot-com bubble. This remarkable success in cryptocurrency investment trends directly challenges Berkshire’s conservative crypto outlook, with the company’s performance driving predictions of Bitcoin reaching $500,000.

Also Read: Top 3 Cryptocurrencies for Healthy Gains In December 2024

MicroStrategy vs. Berkshire: A Bold $500K Bitcoin Vision Explained

Record-Breaking Performance Gap

MicroStrategy stock rose 2,295.74% after starting its Bitcoin strategy in August 2020. Berkshire Hathaway gained just 36.02%. The gap between MSTR and BRK.B sits at 0.72, near dot-com era levels. Berkshire’s top holdings show smaller gains. Bank of America rose 76.15%. American Express gained 171%. Apple increased 86%. All these traditional investments fell significantly short of MSTR’s remarkable growth.

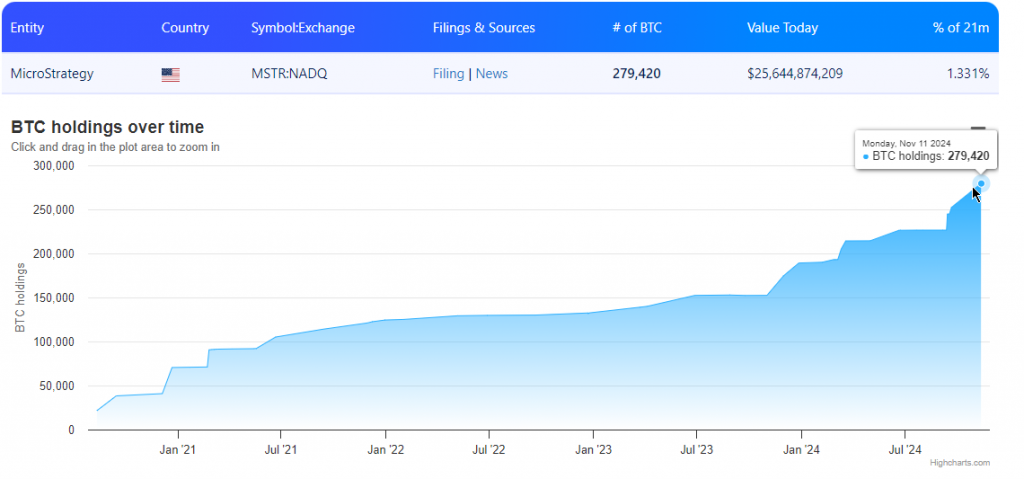

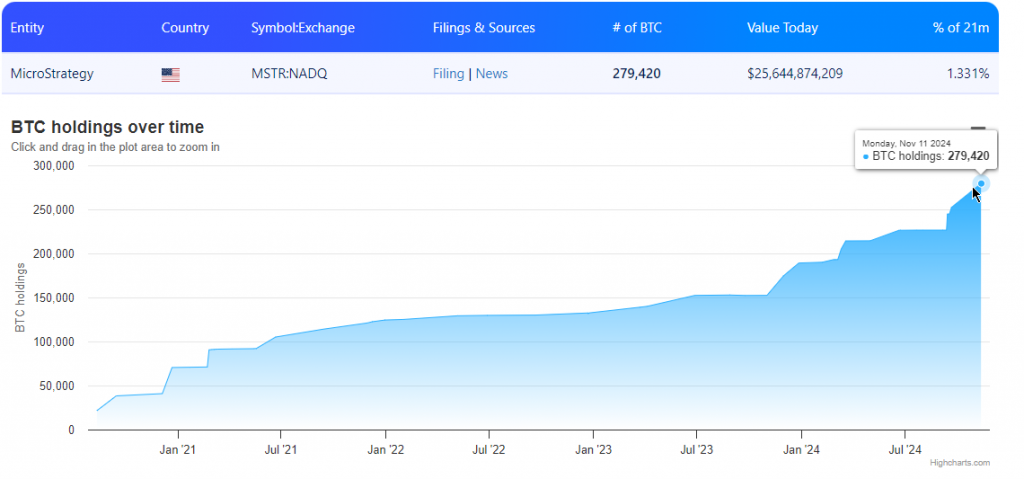

Strategic Bitcoin Reserves Accumulation

MicroStrategy now holds 279,420 BTC, which equals $25.3 billion at today’s price of $90,540 per Bitcoin. They bought 27,200 more bitcoins in November 2024 for $2.03 billion, keeping their average purchase price at $42,692 per BTC. The company now owns over 1% of all Bitcoin in circulation, making it the largest corporate holder.

Also Read: Ripple: After Reaching $1, XRP Predicted to Hit $2: Here’s How

Market Impact and Corporate Adoption

Berkshire Hathaway remains skeptical. Warren Buffett called Bitcoin “rat poison squared.” Yet MicroStrategy’s impressive results continue to attract other companies. Solidion Technology will put 60% of its extra cash into Bitcoin. Metaplanet in Tokyo started a similar strategic plan in May.

Also Read: After XRP, Cardano’s ADA Predicted to Breach $1

Bitcoin Reserves Future Growth Potential

MicroStrategy beat Berkshire and Bitcoin, which grew 673.83% in this period. CEO Michael Saylor sees more gains ahead. He expects substantially higher values as institutional adoption accelerates and more companies add Bitcoin to their reserves.

Bitcoin Reserves: MicroStrategy Outshines Berkshire, Predicts $500K Surge

Share:

Bitcoin reserves have made MicroStrategy a standout performer in the market. Its stock now beats Warren Buffett’s Berkshire Hathaway by the largest margin since the dot-com bubble. This remarkable success in cryptocurrency investment trends directly challenges Berkshire’s conservative crypto outlook, with the company’s performance driving predictions of Bitcoin reaching $500,000.

Also Read: Top 3 Cryptocurrencies for Healthy Gains In December 2024

MicroStrategy vs. Berkshire: A Bold $500K Bitcoin Vision Explained

Record-Breaking Performance Gap

MicroStrategy stock rose 2,295.74% after starting its Bitcoin strategy in August 2020. Berkshire Hathaway gained just 36.02%. The gap between MSTR and BRK.B sits at 0.72, near dot-com era levels. Berkshire’s top holdings show smaller gains. Bank of America rose 76.15%. American Express gained 171%. Apple increased 86%. All these traditional investments fell significantly short of MSTR’s remarkable growth.

Strategic Bitcoin Reserves Accumulation

MicroStrategy now holds 279,420 BTC, which equals $25.3 billion at today’s price of $90,540 per Bitcoin. They bought 27,200 more bitcoins in November 2024 for $2.03 billion, keeping their average purchase price at $42,692 per BTC. The company now owns over 1% of all Bitcoin in circulation, making it the largest corporate holder.

Also Read: Ripple: After Reaching $1, XRP Predicted to Hit $2: Here’s How

Market Impact and Corporate Adoption

Berkshire Hathaway remains skeptical. Warren Buffett called Bitcoin “rat poison squared.” Yet MicroStrategy’s impressive results continue to attract other companies. Solidion Technology will put 60% of its extra cash into Bitcoin. Metaplanet in Tokyo started a similar strategic plan in May.

Also Read: After XRP, Cardano’s ADA Predicted to Breach $1

Bitcoin Reserves Future Growth Potential

MicroStrategy beat Berkshire and Bitcoin, which grew 673.83% in this period. CEO Michael Saylor sees more gains ahead. He expects substantially higher values as institutional adoption accelerates and more companies add Bitcoin to their reserves.