Binance Sees Massive Whale Inflows, But Demand Looks Thin – Details

Share:

Large crypto holders transferred approximately $2.4 billion in Bitcoin and Ether to Binance, with deposit sizes increasing significantly. However, stablecoin flows were flat, indicating no new buying power. Market analysts suggest this behavior may signal preparation for selling, leading to potential downward pressure on prices amidst geopolitical tensions.

Large crypto holders moved about $2.4 billion in Bitcoin and Ether to Binance in the past week, a flow split almost evenly between the two tokens. According to CryptoOnchain, the size of individual deposits has jumped — average transfers onto the exchange rose from around eight to 10 Bitcoin to highs near 22 to 26 Bitcoin.

At the same time, withdrawals have shrunk, with the Exchange Outflow Mean reported between 5.5 and 8.3 Bitcoin. That change in behavior signals a shift away from taking coins into long-term storage and toward holding tradable balances on-platform.

Rising Deposit Sizes And Flat Stablecoin Flows

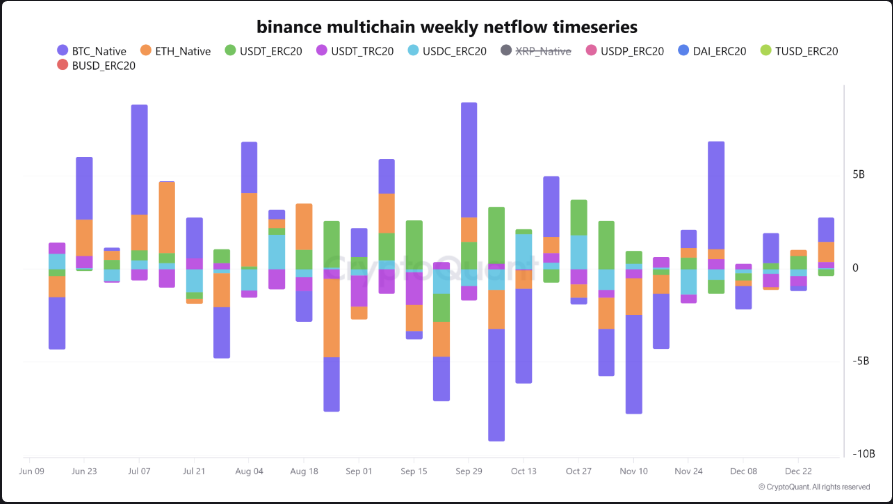

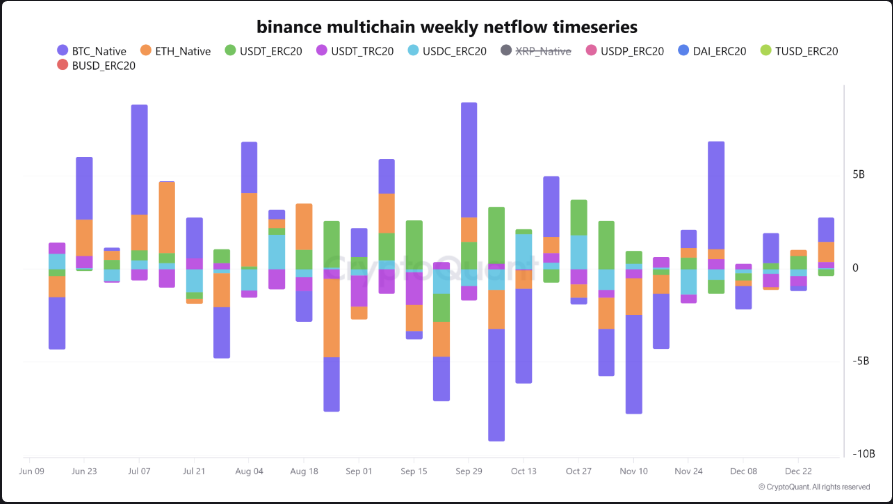

Based on reports, the move onto Binance did not arrive with fresh buying power. Stablecoin net flows were essentially flat, showing an inflow of $42 million for the week, a figure that analysts say mostly reflected token transfers between Ethereum and Tron rather than new capital entering crypto.

CryptoOnchain said that such large transfers to exchanges can mean preparation for selling or the use of assets as collateral in derivatives markets. In plain terms: more supply is ready to hit the market, while obvious signs of new demand are missing.

Market Action Tested By Geopolitics

Bitcoin traded around $92,620 after earlier hitting a 24-hour peak of $93,180, and it was reported to have climbed to a three-week high of $93,340 in early Asian trading. The price moves came as political tension rose following the US military’s action on Venezuela that resulted in the capture of its president, Nicolas Maduro.

Meanwhile, gold climbed above $4,400 an ounce, and silver jumped as much as 4.8%. According to FalconX, the recent Bitcoin uptick was driven in part by crypto-focused firms and by limited selling from miners and big holders.

Analysts are watching the mismatch. Large deposits and a fall in the average size of withdrawals suggest that major holders are less willing to lock up Bitcoin in cold storage. Reports say accumulation has stalled since October. That combination creates a scenario where price rallies are more likely to be met by selling from holders who have quietly moved assets onto exchanges.

Outlook: Cautious, Not CatastrophicBased on these signals, the risk of downward pressure has risen but a major crash is not guaranteed. Price strength right now appears tied to headlines and cross-market moves as much as to fresh crypto demand.

Traders and investors will be watching whether stablecoin inflows pick up or whether whales actually press sell. US President Donald Trump’s previously cited pro-crypto stance was not enough to reverse the accumulation lull by year-end, and until buyers return in force, gains may be limited and short lived.

Featured image from Gemini, chart from TradingView

Binance Sees Massive Whale Inflows, But Demand Looks Thin – Details

Share:

Large crypto holders transferred approximately $2.4 billion in Bitcoin and Ether to Binance, with deposit sizes increasing significantly. However, stablecoin flows were flat, indicating no new buying power. Market analysts suggest this behavior may signal preparation for selling, leading to potential downward pressure on prices amidst geopolitical tensions.

Large crypto holders moved about $2.4 billion in Bitcoin and Ether to Binance in the past week, a flow split almost evenly between the two tokens. According to CryptoOnchain, the size of individual deposits has jumped — average transfers onto the exchange rose from around eight to 10 Bitcoin to highs near 22 to 26 Bitcoin.

At the same time, withdrawals have shrunk, with the Exchange Outflow Mean reported between 5.5 and 8.3 Bitcoin. That change in behavior signals a shift away from taking coins into long-term storage and toward holding tradable balances on-platform.

Rising Deposit Sizes And Flat Stablecoin Flows

Based on reports, the move onto Binance did not arrive with fresh buying power. Stablecoin net flows were essentially flat, showing an inflow of $42 million for the week, a figure that analysts say mostly reflected token transfers between Ethereum and Tron rather than new capital entering crypto.

CryptoOnchain said that such large transfers to exchanges can mean preparation for selling or the use of assets as collateral in derivatives markets. In plain terms: more supply is ready to hit the market, while obvious signs of new demand are missing.

Market Action Tested By Geopolitics

Bitcoin traded around $92,620 after earlier hitting a 24-hour peak of $93,180, and it was reported to have climbed to a three-week high of $93,340 in early Asian trading. The price moves came as political tension rose following the US military’s action on Venezuela that resulted in the capture of its president, Nicolas Maduro.

Meanwhile, gold climbed above $4,400 an ounce, and silver jumped as much as 4.8%. According to FalconX, the recent Bitcoin uptick was driven in part by crypto-focused firms and by limited selling from miners and big holders.

Analysts are watching the mismatch. Large deposits and a fall in the average size of withdrawals suggest that major holders are less willing to lock up Bitcoin in cold storage. Reports say accumulation has stalled since October. That combination creates a scenario where price rallies are more likely to be met by selling from holders who have quietly moved assets onto exchanges.

Outlook: Cautious, Not CatastrophicBased on these signals, the risk of downward pressure has risen but a major crash is not guaranteed. Price strength right now appears tied to headlines and cross-market moves as much as to fresh crypto demand.

Traders and investors will be watching whether stablecoin inflows pick up or whether whales actually press sell. US President Donald Trump’s previously cited pro-crypto stance was not enough to reverse the accumulation lull by year-end, and until buyers return in force, gains may be limited and short lived.

Featured image from Gemini, chart from TradingView