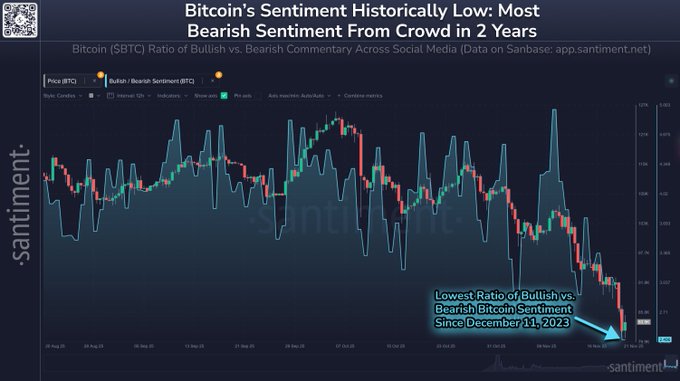

📊 Bitcoin’s sentiment across social media has officially dipped to its lowest point since December 11, 2023. According to bullish vs. bearish comments on X, Reddit, Telegram, and others, retail is capitulating and panic selling at a significant level we haven’t seen in 2 years.

Bitcoin price clings to $86K as market recovers above $3T; Canton bucks trend

Share:

Bitcoin staged a brief recovery rally earlier in the day before settling just above $86,000, as markets remained cautious in the aftermath of last week’s sharp selloff.

The total crypto market cap dipped slightly by under 1% over the past 24 hours, but managed to climb back above the $3 trillion threshold after briefly slipping below it over the weekend.

Sentiment showed mild signs of improvement, with the crypto fear and greed index ticking up six points to 19. Despite the gain, it remained firmly in the “extreme fear” zone, suggesting traders are still wary of another downturn.

Altcoins continued to lag, weighed down by Bitcoin’s lack of momentum and a broader sense of unease that has kept the market mostly subdued.

Why is Bitcoin price stuck?

Bitcoin traded between a narrow band of $85,577 and $87,995 as volatile conditions gave way to a more restrained session.

While prices briefly rallied toward $88,000 in early Monday trades, lingering uncertainty and profit-taking capped the upside and forced a pullback.

One of the reasons Bitcoin remains stuck in a tight range is the fading momentum from the weekend’s relief rally.

After plunging by double digits in recent weeks, Bitcoin and several altcoins became technically oversold, prompting a wave of dip buying.

This bounce was further supported by a modest uptick in open interest and a sharp cooldown in liquidations, both signs that speculative pressure had temporarily eased.

Open interest rose by 2% in the past 24 hours to $128 billion, a modest but positive sign of returning activity. Liquidations dropped to $207 million, down 2% from the day before.

At the same time, sentiment indicators showed early signs of repair. The Crypto Fear and Greed Index, which had slumped to its joint lowest reading of the year last week, nearly doubled to 19 on Monday.

While that still reflects deep fear across the market, the bounce suggests some traders are beginning to test the waters again.

Historically, when open interest begins to climb and liquidations ease, it creates a more supportive environment for price recovery, especially when accompanied by even the slightest shift in sentiment.

However, that optimism has been tempered by the broader macro setup. While expectations of a Federal Reserve rate cut have risen, with Polymarket odds now hovering around 70%, the path forward remains uncertain.

A flood of delayed economic data—including PPI, PCE, Q3 GDP, and jobless claims—will hit markets over the shortened Thanksgiving week, potentially reshaping sentiment once again. Traders appear hesitant to make bold moves ahead of these releases.

Any upside surprises or sticky inflation could challenge the current dovish expectations and lead to volatility across risk assets.

Adding to the caution, U.S. equities have already priced in much of the dovish tilt. The Dow, S&P 500, and Nasdaq all ended last week in the green and continued climbing on Monday, offering a favorable backdrop.

But for Bitcoin, which often moves in tandem with risk assets, the follow-through has been weaker than expected, perhaps a sign that crypto participants remain more risk-sensitive after last week’s liquidations crossed $2 billion.

Bitcoin gave back a chunk of its intraday gains as the session progressed, reflecting caution ahead of a dense macroeconomic calendar.

Meanwhile, altcoins have yet to decisively rebound. Despite ETF news surrounding XRP and Dogecoin, most tokens are still under pressure, and any broader rotation into alts remains elusive.

Stablecoin inflows to exchanges have slightly improved, with Nansen showing a rise from $85 billion to $86 billion in exchange balances, hinting at some dry powder on the sidelines.

But until conviction returns, particularly in Bitcoin, price action is likely to stay range-bound.

Will Bitcoin price go up?

Market watchers are currently split over where Bitcoin is heading next, with sentiment around the bellwether asset still fragile.

According to on-chain data firm Santiment, Bitcoin’s social sentiment has fallen to its lowest level since mid-December 2023.

“Bitcoin’s sentiment across social media has officially dipped to its lowest point since December 11, 2023,” Santiment wrote in a Friday post.

Part of that caution may stem from structural shifts in Bitcoin’s holder base. New research from CryptoQuant indicates that coins are increasingly moving out of the hands of long-term holders (LTHs) and into those of short-term holders (STHs), who tend to react more quickly to market moves.

“Long-Term Holders are heavily distributing and selling, while Short-Term Holders are buying and accumulating,” contributor CryptoOnChain noted in a recent QuickTake blog.

The report showed that over a 30-day period, some 63,000 BTC have shifted from entities holding for over 155 days to those with shorter-term conviction.

This change may help stabilize prices for now, but it also adds volatility risk, as STHs are typically more sensitive to market swings.

From a technical standpoint, analysts are pointing to signs that the path ahead may not be smooth.

A death cross appeared on the BTC/USD daily chart on November 15, when the 50-day simple moving average slipped below the 200-day moving average, a signal often interpreted as bearish.

While some view it as a potential bottoming marker, others like market analyst Benjamin Cowen believe the next few days are critical.

“Note that prior death crosses marked local lows in the market,” Cowen said.

“Of course, when the cycle is over, the death cross rally fails. The time for Bitcoin to bounce if the cycle is not over would be starting within the next week.”

He warned that a failure to bounce could push prices back toward the 200-day moving average near $110,130, which would act as resistance and likely confirm a macro lower high.

This technical setup also aligns with commentary from trader and analyst Rekt Capital, who noted that Bitcoin’s 50-week exponential moving average is now colliding with a broader macro downtrend line.

“It just so happens that the 50-week EMA (purple) tends to be approximately confluent with the Macro Downtrend (black),” he explained.

BTC/USD – 1 Month price chart. Source: Rekt Capital on X.

Rejection at both the trendline and the 50-week EMA, without flipping the level into support, would suggest that the market is leaning further into weakness, the analyst warned.

Some short-term upside may still be in play, with Bitcoin having just closed out a lingering CME gap, these fills often remove short-term pressure and can attract opportunistic bids.

$BTC CME gap has been fully filled.

Despite the short-term setup, there’s concern that the move may be short-lived, with some market participants expecting it to fade into a classic dead cat bounce.

Hear me out. Range until month-end while forming a bottom. Then a pump to $95K – $105K, enough to spark euphoria, bullish headlines everywhere, everyone thinking the worst is over. People get trapped again. Market sends it to new lows. $BTC

For a rally to gain traction in the coming trading sessions, Bitcoin price needs to push firmly above the $87,500 to $88,000 range, where a dense cluster of liquidation levels is currently stacked.

According to the 24-hour liquidation heatmap from CoinGlass, this zone has become a pocket of concentrated short interest, meaning any decisive move through this level could trigger a wave of short liquidations, potentially fueling upside momentum.

Bitcoin 24-hour liquidation heatmap. Source: Coinglass.

If the price manages to break through that band with conviction, it may open the door toward higher resistance levels closer to $89,500 and beyond, where additional liquidation bands begin to thin out.

That could offer Bitcoin some breathing room for a broader relief move, especially if macro data and sentiment continue to stabilise.

On the contrary, a drop below $85,000 would place Bitcoin in a vulnerable spot, as liquidation clusters reappear just beneath current levels.

At press time, Bitcoin was priced at a little over $86,400, with a loss of less than 1% over the past 24 hours.

Top altcoin gainers for the day

The altcoin market cap initially rose from $1.38 trillion to an intraday high of $1.4 trillion before falling to $1.28 trillion, ending the day down by 7.2%.

This came as market sentiment regarding an altcoin season has nearly been smashed, with most of the major altcoins suffering losses at the time of writing.

The Altcoin Season Index, a closely followed gauge of how altcoins are performing relative to Bitcoin, showed a reading of 23 and has dropped by nearly 10 points over the past 10 days.

This brings the index closer to what is commonly referred to as a “Bitcoin Season”, dimming hopes that a broader altcoin rally is on the horizon.

Ethereum (ETH), the leading altcoin by market cap, traded between $2,750 and $2,900 over the 24-hour session before stabilizing near $2,850 with nearly 1% gains on the day.

XRP (XRP) stood at $2.09, up 1.4%, while BNB (BNB), Solana (SOL), and Cardano (ADA) posted modest losses similar to Ethereum.

Canton led altcoin gains as investors appeared to rotate out of Zcash into other emerging privacy coins.

The other two top gainers, SPX6900 (SPX) and XDC network (SDC), saw limited single-digit gains between 2-5%. (See below.)

Source: CoinMarketCap

The post Bitcoin price clings to $86K as market recovers above $3T; Canton bucks trend appeared first on Invezz

Bitcoin price clings to $86K as market recovers above $3T; Canton bucks trend

Share:

Bitcoin staged a brief recovery rally earlier in the day before settling just above $86,000, as markets remained cautious in the aftermath of last week’s sharp selloff.

The total crypto market cap dipped slightly by under 1% over the past 24 hours, but managed to climb back above the $3 trillion threshold after briefly slipping below it over the weekend.

Sentiment showed mild signs of improvement, with the crypto fear and greed index ticking up six points to 19. Despite the gain, it remained firmly in the “extreme fear” zone, suggesting traders are still wary of another downturn.

Altcoins continued to lag, weighed down by Bitcoin’s lack of momentum and a broader sense of unease that has kept the market mostly subdued.

Why is Bitcoin price stuck?

Bitcoin traded between a narrow band of $85,577 and $87,995 as volatile conditions gave way to a more restrained session.

While prices briefly rallied toward $88,000 in early Monday trades, lingering uncertainty and profit-taking capped the upside and forced a pullback.

One of the reasons Bitcoin remains stuck in a tight range is the fading momentum from the weekend’s relief rally.

After plunging by double digits in recent weeks, Bitcoin and several altcoins became technically oversold, prompting a wave of dip buying.

This bounce was further supported by a modest uptick in open interest and a sharp cooldown in liquidations, both signs that speculative pressure had temporarily eased.

Open interest rose by 2% in the past 24 hours to $128 billion, a modest but positive sign of returning activity. Liquidations dropped to $207 million, down 2% from the day before.

At the same time, sentiment indicators showed early signs of repair. The Crypto Fear and Greed Index, which had slumped to its joint lowest reading of the year last week, nearly doubled to 19 on Monday.

While that still reflects deep fear across the market, the bounce suggests some traders are beginning to test the waters again.

Historically, when open interest begins to climb and liquidations ease, it creates a more supportive environment for price recovery, especially when accompanied by even the slightest shift in sentiment.

However, that optimism has been tempered by the broader macro setup. While expectations of a Federal Reserve rate cut have risen, with Polymarket odds now hovering around 70%, the path forward remains uncertain.

A flood of delayed economic data—including PPI, PCE, Q3 GDP, and jobless claims—will hit markets over the shortened Thanksgiving week, potentially reshaping sentiment once again. Traders appear hesitant to make bold moves ahead of these releases.

Any upside surprises or sticky inflation could challenge the current dovish expectations and lead to volatility across risk assets.

Adding to the caution, U.S. equities have already priced in much of the dovish tilt. The Dow, S&P 500, and Nasdaq all ended last week in the green and continued climbing on Monday, offering a favorable backdrop.

But for Bitcoin, which often moves in tandem with risk assets, the follow-through has been weaker than expected, perhaps a sign that crypto participants remain more risk-sensitive after last week’s liquidations crossed $2 billion.

Bitcoin gave back a chunk of its intraday gains as the session progressed, reflecting caution ahead of a dense macroeconomic calendar.

Meanwhile, altcoins have yet to decisively rebound. Despite ETF news surrounding XRP and Dogecoin, most tokens are still under pressure, and any broader rotation into alts remains elusive.

Stablecoin inflows to exchanges have slightly improved, with Nansen showing a rise from $85 billion to $86 billion in exchange balances, hinting at some dry powder on the sidelines.

But until conviction returns, particularly in Bitcoin, price action is likely to stay range-bound.

Will Bitcoin price go up?

Market watchers are currently split over where Bitcoin is heading next, with sentiment around the bellwether asset still fragile.

According to on-chain data firm Santiment, Bitcoin’s social sentiment has fallen to its lowest level since mid-December 2023.

“Bitcoin’s sentiment across social media has officially dipped to its lowest point since December 11, 2023,” Santiment wrote in a Friday post.

📊 Bitcoin’s sentiment across social media has officially dipped to its lowest point since December 11, 2023. According to bullish vs. bearish comments on X, Reddit, Telegram, and others, retail is capitulating and panic selling at a significant level we haven’t seen in 2 years.

Part of that caution may stem from structural shifts in Bitcoin’s holder base. New research from CryptoQuant indicates that coins are increasingly moving out of the hands of long-term holders (LTHs) and into those of short-term holders (STHs), who tend to react more quickly to market moves.

“Long-Term Holders are heavily distributing and selling, while Short-Term Holders are buying and accumulating,” contributor CryptoOnChain noted in a recent QuickTake blog.

The report showed that over a 30-day period, some 63,000 BTC have shifted from entities holding for over 155 days to those with shorter-term conviction.

This change may help stabilize prices for now, but it also adds volatility risk, as STHs are typically more sensitive to market swings.

From a technical standpoint, analysts are pointing to signs that the path ahead may not be smooth.

A death cross appeared on the BTC/USD daily chart on November 15, when the 50-day simple moving average slipped below the 200-day moving average, a signal often interpreted as bearish.

While some view it as a potential bottoming marker, others like market analyst Benjamin Cowen believe the next few days are critical.

“Note that prior death crosses marked local lows in the market,” Cowen said.

“Of course, when the cycle is over, the death cross rally fails. The time for Bitcoin to bounce if the cycle is not over would be starting within the next week.”

He warned that a failure to bounce could push prices back toward the 200-day moving average near $110,130, which would act as resistance and likely confirm a macro lower high.

This technical setup also aligns with commentary from trader and analyst Rekt Capital, who noted that Bitcoin’s 50-week exponential moving average is now colliding with a broader macro downtrend line.

“It just so happens that the 50-week EMA (purple) tends to be approximately confluent with the Macro Downtrend (black),” he explained.

BTC/USD – 1 Month price chart. Source: Rekt Capital on X.

Rejection at both the trendline and the 50-week EMA, without flipping the level into support, would suggest that the market is leaning further into weakness, the analyst warned.

Some short-term upside may still be in play, with Bitcoin having just closed out a lingering CME gap, these fills often remove short-term pressure and can attract opportunistic bids.

$BTC CME gap has been fully filled.

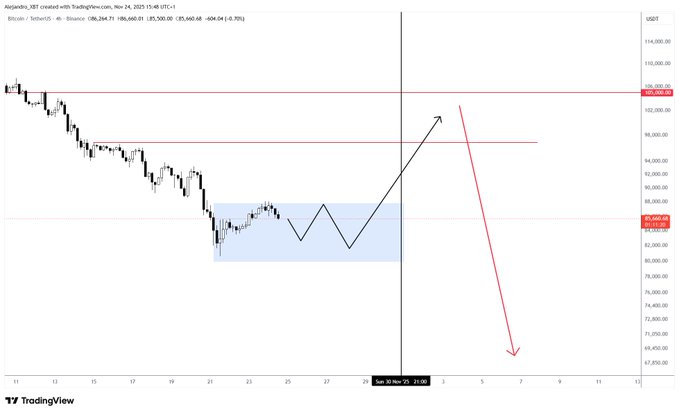

Despite the short-term setup, there’s concern that the move may be short-lived, with some market participants expecting it to fade into a classic dead cat bounce.

Hear me out. Range until month-end while forming a bottom. Then a pump to $95K – $105K, enough to spark euphoria, bullish headlines everywhere, everyone thinking the worst is over. People get trapped again. Market sends it to new lows. $BTC

For a rally to gain traction in the coming trading sessions, Bitcoin price needs to push firmly above the $87,500 to $88,000 range, where a dense cluster of liquidation levels is currently stacked.

According to the 24-hour liquidation heatmap from CoinGlass, this zone has become a pocket of concentrated short interest, meaning any decisive move through this level could trigger a wave of short liquidations, potentially fueling upside momentum.

Bitcoin 24-hour liquidation heatmap. Source: Coinglass.

If the price manages to break through that band with conviction, it may open the door toward higher resistance levels closer to $89,500 and beyond, where additional liquidation bands begin to thin out.

That could offer Bitcoin some breathing room for a broader relief move, especially if macro data and sentiment continue to stabilise.

On the contrary, a drop below $85,000 would place Bitcoin in a vulnerable spot, as liquidation clusters reappear just beneath current levels.

At press time, Bitcoin was priced at a little over $86,400, with a loss of less than 1% over the past 24 hours.

Top altcoin gainers for the day

The altcoin market cap initially rose from $1.38 trillion to an intraday high of $1.4 trillion before falling to $1.28 trillion, ending the day down by 7.2%.

This came as market sentiment regarding an altcoin season has nearly been smashed, with most of the major altcoins suffering losses at the time of writing.

The Altcoin Season Index, a closely followed gauge of how altcoins are performing relative to Bitcoin, showed a reading of 23 and has dropped by nearly 10 points over the past 10 days.

This brings the index closer to what is commonly referred to as a “Bitcoin Season”, dimming hopes that a broader altcoin rally is on the horizon.

Ethereum (ETH), the leading altcoin by market cap, traded between $2,750 and $2,900 over the 24-hour session before stabilizing near $2,850 with nearly 1% gains on the day.

XRP (XRP) stood at $2.09, up 1.4%, while BNB (BNB), Solana (SOL), and Cardano (ADA) posted modest losses similar to Ethereum.

Canton led altcoin gains as investors appeared to rotate out of Zcash into other emerging privacy coins.

The other two top gainers, SPX6900 (SPX) and XDC network (SDC), saw limited single-digit gains between 2-5%. (See below.)

Source: CoinMarketCap

The post Bitcoin price clings to $86K as market recovers above $3T; Canton bucks trend appeared first on Invezz