Best Crypto to Buy Now November 27 – XLM, SAND, TIA

Share:

Bitcoin’s four-day pullback has created ripples in the cryptocurrency market after achieving an all-time high of $99,609 on November 22

After surging to historic highs throughout November, Bitcoin faced profit-taking by long-term holders, triggering a sharp downturn.

This profit-taking wave resulted in $250 million in liquidations of leveraged bullish positions, a significant but non-panic-inducing event.

Historical trends suggest Bitcoin’s correction may not signal the onset of a bear market.

A similar scenario played out earlier this year in March, where profit-taking by whales preceded a two-month correction before Bitcoin resumed its upward trajectory.

Analysts predict that Bitcoin’s price could bottom around $82,500, representing a standard 17% retracement from its recent high.

Amidst this correction, select altcoins, including Stellar (XLM), The Sandbox (SAND), and Celestia (TIA), are standing out as the best crypto to buy in the current market environment.

Stellar (XLM): Blockchain for Financial Transactions

Stellar, known for facilitating fast and cost-effective cross-border payments, has recorded a good performance during the current altcoin rally.

Utilizing the Stellar Consensus Protocol, the blockchain validates transactions without mining, ensuring efficiency and scalability.

Over the past 30 days, Stellar has seen a 433% rise, peaking at $0.64 on November 24.

However, the token has experienced some turbulence, with a 30% decline over four days before rebounding 16.97% in the last 24 hours to trade at $0.4997.

Data from derivatives markets highlights a decrease in Stellar’s Open Interest (OI) from an all-time high of $339 million to $209 million.

This suggests a cooling off in speculative activity, which could impact short-term price movements.

Technically, the token’s overbought Relative Strength Index (RSI) indicates a potential for consolidation. Key resistance lies between $0.45 and $0.48, a critical zone for determining Stellar’s next move.

Despite near-term volatility, Stellar’s transformative potential in financial transactions makes it one of the best crypto to buy for long-term investors.

The Sandbox (SAND): Leading the Metaverse Revolution

The Sandbox, a metaverse platform enabling users to create and monetize virtual experiences, has gained significant traction as interest in blockchain-based gaming and virtual worlds grows

Powered by its SAND utility token, the platform has become a key player in the metaverse ecosystem.

SAND has seen a 143.12% surge in the past month, although it recently experienced a 4.27% correction in the last 24 hours.

Its trading volume has also declined, with the market cap dropping to $1.46 billion.

Despite this, investor confidence remains strong, as evidenced by a record-high 877 exchange withdrawals on November 26, a bullish indicator of long-term holding sentiment.

Despite this, investor confidence remains strong, as evidenced by a record-high 877 exchange withdrawals on November 26, a bullish indicator of long-term holding sentiment.

For prospective buyers, SAND’s consolidation presents an opportunity to enter at favorable levels.

However, caution is warranted as selling pressure could push the token toward its support level of $0.56.

Celestia (TIA): Redefining Blockchain Scalability

Celestia, a modular blockchain designed to address scalability and interoperability challenges, is another standout performer.

Its unique architecture separates consensus from execution, allowing developers to deploy customized blockchains with minimal overhead.

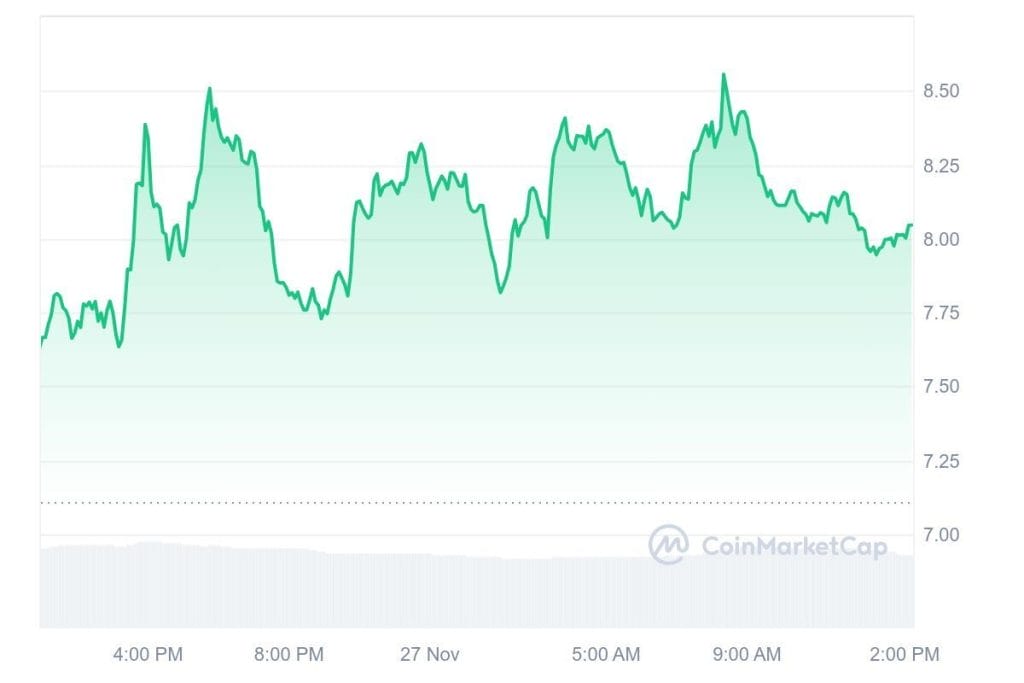

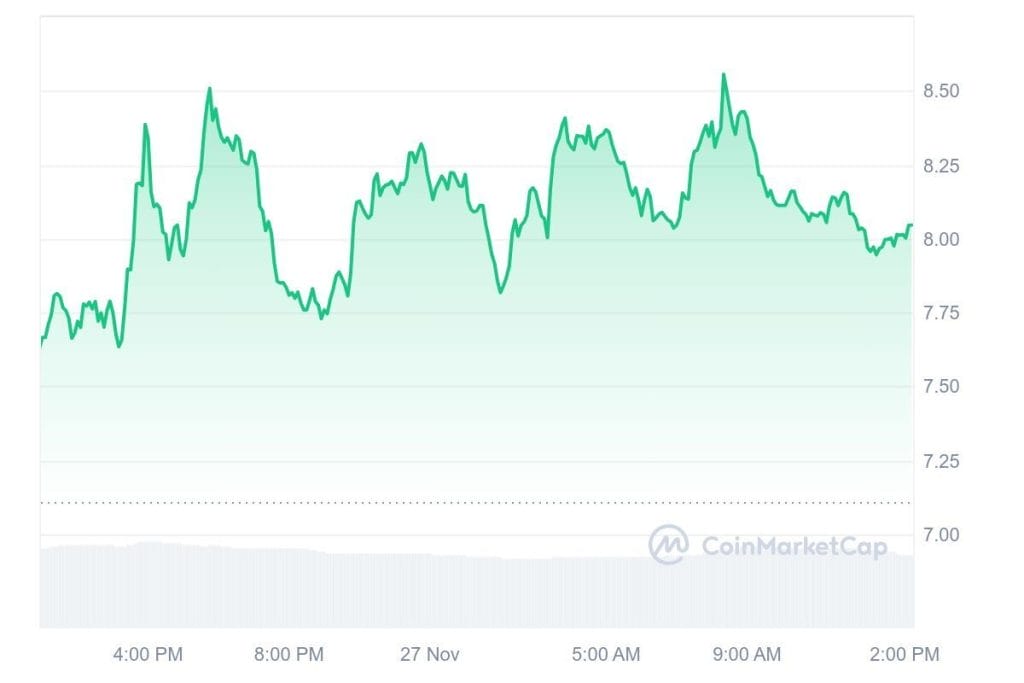

Celestia has seen a strong breakout, surging past its descending trendline to trade at $8.05, a 4.45% gain in the last 24 hours.

The token’s move above $7.27, a key Fibonacci retracement level, confirms its bullish momentum.

While its RSI indicates overbought conditions, suggesting a potential cooldown, the next significant resistance at $9.20 could be a target for bullish investors.

With the TIA token’s price still 161.7% below its all-time high of $20.91, it offers significant upside potential.

Its innovative approach to blockchain technology positions it as one of the best crypto to buy for investors seeking exposure to cutting-edge solutions in the crypto space.

Better Alternatives to Consider

As the crypto market navigates Bitcoin’s correction, recent reports of regulatory clarity under President-elect Donald Trump’s administration have bolstered investor sentiment.

Plans to expand the Commodity Futures Trading Commission’s (CFTC) oversight to include digital assets could provide much-needed transparency and confidence in the market.

This development is particularly relevant for altcoins like Stellar, Sandbox, and Celestia, which could benefit from increased institutional participation.

Alongside promising presale opportunities, these tokens represent strategic investments for those looking to capitalize on the ongoing altseason and Bitcoin’s market leadership.

The post Best Crypto to Buy Now November 27 – XLM, SAND, TIA appeared first on Cryptonews.

Best Crypto to Buy Now November 27 – XLM, SAND, TIA

Share:

Bitcoin’s four-day pullback has created ripples in the cryptocurrency market after achieving an all-time high of $99,609 on November 22

After surging to historic highs throughout November, Bitcoin faced profit-taking by long-term holders, triggering a sharp downturn.

This profit-taking wave resulted in $250 million in liquidations of leveraged bullish positions, a significant but non-panic-inducing event.

Historical trends suggest Bitcoin’s correction may not signal the onset of a bear market.

A similar scenario played out earlier this year in March, where profit-taking by whales preceded a two-month correction before Bitcoin resumed its upward trajectory.

Analysts predict that Bitcoin’s price could bottom around $82,500, representing a standard 17% retracement from its recent high.

Amidst this correction, select altcoins, including Stellar (XLM), The Sandbox (SAND), and Celestia (TIA), are standing out as the best crypto to buy in the current market environment.

Stellar (XLM): Blockchain for Financial Transactions

Stellar, known for facilitating fast and cost-effective cross-border payments, has recorded a good performance during the current altcoin rally.

Utilizing the Stellar Consensus Protocol, the blockchain validates transactions without mining, ensuring efficiency and scalability.

Over the past 30 days, Stellar has seen a 433% rise, peaking at $0.64 on November 24.

However, the token has experienced some turbulence, with a 30% decline over four days before rebounding 16.97% in the last 24 hours to trade at $0.4997.

Data from derivatives markets highlights a decrease in Stellar’s Open Interest (OI) from an all-time high of $339 million to $209 million.

This suggests a cooling off in speculative activity, which could impact short-term price movements.

Technically, the token’s overbought Relative Strength Index (RSI) indicates a potential for consolidation. Key resistance lies between $0.45 and $0.48, a critical zone for determining Stellar’s next move.

Despite near-term volatility, Stellar’s transformative potential in financial transactions makes it one of the best crypto to buy for long-term investors.

The Sandbox (SAND): Leading the Metaverse Revolution

The Sandbox, a metaverse platform enabling users to create and monetize virtual experiences, has gained significant traction as interest in blockchain-based gaming and virtual worlds grows

Powered by its SAND utility token, the platform has become a key player in the metaverse ecosystem.

SAND has seen a 143.12% surge in the past month, although it recently experienced a 4.27% correction in the last 24 hours.

Its trading volume has also declined, with the market cap dropping to $1.46 billion.

Despite this, investor confidence remains strong, as evidenced by a record-high 877 exchange withdrawals on November 26, a bullish indicator of long-term holding sentiment.

Despite this, investor confidence remains strong, as evidenced by a record-high 877 exchange withdrawals on November 26, a bullish indicator of long-term holding sentiment.

For prospective buyers, SAND’s consolidation presents an opportunity to enter at favorable levels.

However, caution is warranted as selling pressure could push the token toward its support level of $0.56.

Celestia (TIA): Redefining Blockchain Scalability

Celestia, a modular blockchain designed to address scalability and interoperability challenges, is another standout performer.

Its unique architecture separates consensus from execution, allowing developers to deploy customized blockchains with minimal overhead.

Celestia has seen a strong breakout, surging past its descending trendline to trade at $8.05, a 4.45% gain in the last 24 hours.

The token’s move above $7.27, a key Fibonacci retracement level, confirms its bullish momentum.

While its RSI indicates overbought conditions, suggesting a potential cooldown, the next significant resistance at $9.20 could be a target for bullish investors.

With the TIA token’s price still 161.7% below its all-time high of $20.91, it offers significant upside potential.

Its innovative approach to blockchain technology positions it as one of the best crypto to buy for investors seeking exposure to cutting-edge solutions in the crypto space.

Better Alternatives to Consider

As the crypto market navigates Bitcoin’s correction, recent reports of regulatory clarity under President-elect Donald Trump’s administration have bolstered investor sentiment.

Plans to expand the Commodity Futures Trading Commission’s (CFTC) oversight to include digital assets could provide much-needed transparency and confidence in the market.

This development is particularly relevant for altcoins like Stellar, Sandbox, and Celestia, which could benefit from increased institutional participation.

Alongside promising presale opportunities, these tokens represent strategic investments for those looking to capitalize on the ongoing altseason and Bitcoin’s market leadership.

The post Best Crypto to Buy Now November 27 – XLM, SAND, TIA appeared first on Cryptonews.

Big Move Alert:

Big Move Alert:

The

The

![[LIVE] Crypto News Today: Latest Updates for Nov. 13, 2025 – RWA and NFT Tokens Lead Market Gains as Bitcoin Slips Below $103K](https://cimg.co/p/assets/empty-cryptonews.jpg)