Polkadot Holds Key Demand Level – DOT Could Hit $11 In Coming Weeks

Share:

Polkadot (DOT) has entered a consolidation phase, trading below the $6 mark after a strong 30% rally since last Friday. This period of sideways movement has brought some volatility, but market conditions suggest DOT might be gearing up for its next major move. Investors watch the asset closely as it maintains a bullish structure despite temporary resistance near the $6 level.

Top crypto analyst Ali Martinez has shared a technical analysis highlighting Polkadot’s resilience. According to Martinez, DOT is holding the firm above a critical demand zone, a sign that the asset could prepare for a significant breakout. His insights point to growing interest and optimism around Polkadot, fueled by its potential for another bullish leg.

As one of the leading blockchain ecosystems with robust interoperability solutions, Polkadot continues to capture attention in a market increasingly favoring quality projects. The next few days will determine whether DOT can capitalize on its recent momentum to push past key resistance levels. All eyes remain on Polkadot’s price action as it tests investor confidence and market strength. If the anticipated surge materializes, DOT could soon reclaim higher ground, further solidifying its position in the crypto space.

Polkadot Preparing For A Breakout

Polkadot appears to be on the verge of a breakout as it maintains bullish momentum despite a recent pullback from the $6 resistance level. After a nearly 10% retrace, DOT has found stability above the critical $5.7 demand zone, signaling buyers are still firmly in control. This resilience has sparked optimism among investors and analysts, who view the current price action as a setup for a significant rally.

Top crypto analyst Ali Martinez recently shared his insights on X, pointing to Polkadot’s weekly price chart as evidence of its potential. According to Martinez, DOT has shown remarkable strength by holding above the $3.6 support level, which has served as a foundation for its recent recovery. He suggests that if the current momentum continues, DOT could climb to $11 in the coming weeks, representing a substantial gain from current levels.

Martinez also emphasized that reaching and consolidating above the $11 mark could set the stage for an even bigger rally. He predicts that such a move would open the door for a surge to $22, aligning with broader bullish expectations for the altcoin market.

With Polkadot’s fundamentals and technical setup aligning, all eyes are on its ability to overcome key resistance levels. If these predictions materialize, DOT could reestablish itself as a leading player in the crypto market.

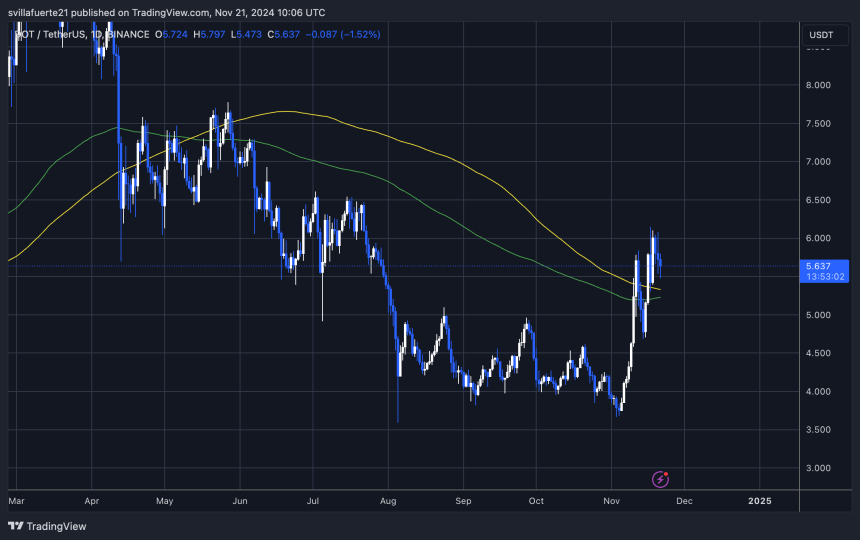

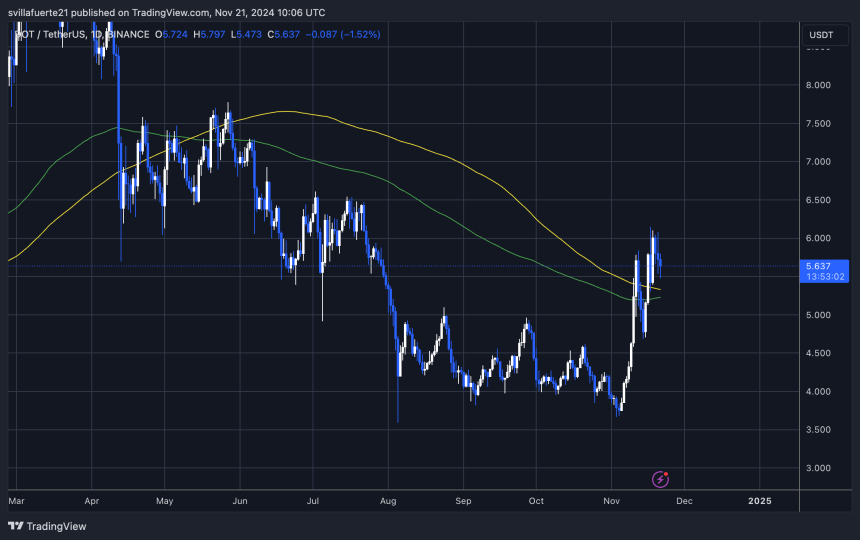

DOT Price Action: Technical Details

Polkadot is trading at $5.6, maintaining its position above the critical 200-day Moving Average (MA) at $5.3. Breaking above this key indicator is a strong bullish signal, suggesting that DOT shows long-term strength as buyers gain control. The price is also holding firmly above the $5.6 demand level, which served as crucial support during June and July but was lost until its recent recovery.

This regained demand level at $5.6 has reignited optimism among investors, as sustaining this zone could provide the foundation for further bullish momentum. If DOT manages to hold steady above this level in the coming days, a move toward new supply zones is likely, with the next target at approximately $6.5.

The combination of breaking the 200-day MA and reclaiming a significant demand level demonstrates that DOT has the potential to maintain its current upward trajectory. However, sustained buying pressure will be necessary to overcome resistance and push toward higher targets. For now, all eyes remain on DOT’s ability to consolidate above $5.6, which will be a key indicator of whether it can continue climbing in the coming weeks.

Featured image from Dall-E, chart from TradingView

Polkadot Holds Key Demand Level – DOT Could Hit $11 In Coming Weeks

Share:

Polkadot (DOT) has entered a consolidation phase, trading below the $6 mark after a strong 30% rally since last Friday. This period of sideways movement has brought some volatility, but market conditions suggest DOT might be gearing up for its next major move. Investors watch the asset closely as it maintains a bullish structure despite temporary resistance near the $6 level.

Top crypto analyst Ali Martinez has shared a technical analysis highlighting Polkadot’s resilience. According to Martinez, DOT is holding the firm above a critical demand zone, a sign that the asset could prepare for a significant breakout. His insights point to growing interest and optimism around Polkadot, fueled by its potential for another bullish leg.

As one of the leading blockchain ecosystems with robust interoperability solutions, Polkadot continues to capture attention in a market increasingly favoring quality projects. The next few days will determine whether DOT can capitalize on its recent momentum to push past key resistance levels. All eyes remain on Polkadot’s price action as it tests investor confidence and market strength. If the anticipated surge materializes, DOT could soon reclaim higher ground, further solidifying its position in the crypto space.

Polkadot Preparing For A Breakout

Polkadot appears to be on the verge of a breakout as it maintains bullish momentum despite a recent pullback from the $6 resistance level. After a nearly 10% retrace, DOT has found stability above the critical $5.7 demand zone, signaling buyers are still firmly in control. This resilience has sparked optimism among investors and analysts, who view the current price action as a setup for a significant rally.

Top crypto analyst Ali Martinez recently shared his insights on X, pointing to Polkadot’s weekly price chart as evidence of its potential. According to Martinez, DOT has shown remarkable strength by holding above the $3.6 support level, which has served as a foundation for its recent recovery. He suggests that if the current momentum continues, DOT could climb to $11 in the coming weeks, representing a substantial gain from current levels.

Martinez also emphasized that reaching and consolidating above the $11 mark could set the stage for an even bigger rally. He predicts that such a move would open the door for a surge to $22, aligning with broader bullish expectations for the altcoin market.

With Polkadot’s fundamentals and technical setup aligning, all eyes are on its ability to overcome key resistance levels. If these predictions materialize, DOT could reestablish itself as a leading player in the crypto market.

DOT Price Action: Technical Details

Polkadot is trading at $5.6, maintaining its position above the critical 200-day Moving Average (MA) at $5.3. Breaking above this key indicator is a strong bullish signal, suggesting that DOT shows long-term strength as buyers gain control. The price is also holding firmly above the $5.6 demand level, which served as crucial support during June and July but was lost until its recent recovery.

This regained demand level at $5.6 has reignited optimism among investors, as sustaining this zone could provide the foundation for further bullish momentum. If DOT manages to hold steady above this level in the coming days, a move toward new supply zones is likely, with the next target at approximately $6.5.

The combination of breaking the 200-day MA and reclaiming a significant demand level demonstrates that DOT has the potential to maintain its current upward trajectory. However, sustained buying pressure will be necessary to overcome resistance and push toward higher targets. For now, all eyes remain on DOT’s ability to consolidate above $5.6, which will be a key indicator of whether it can continue climbing in the coming weeks.

Featured image from Dall-E, chart from TradingView