Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Share:

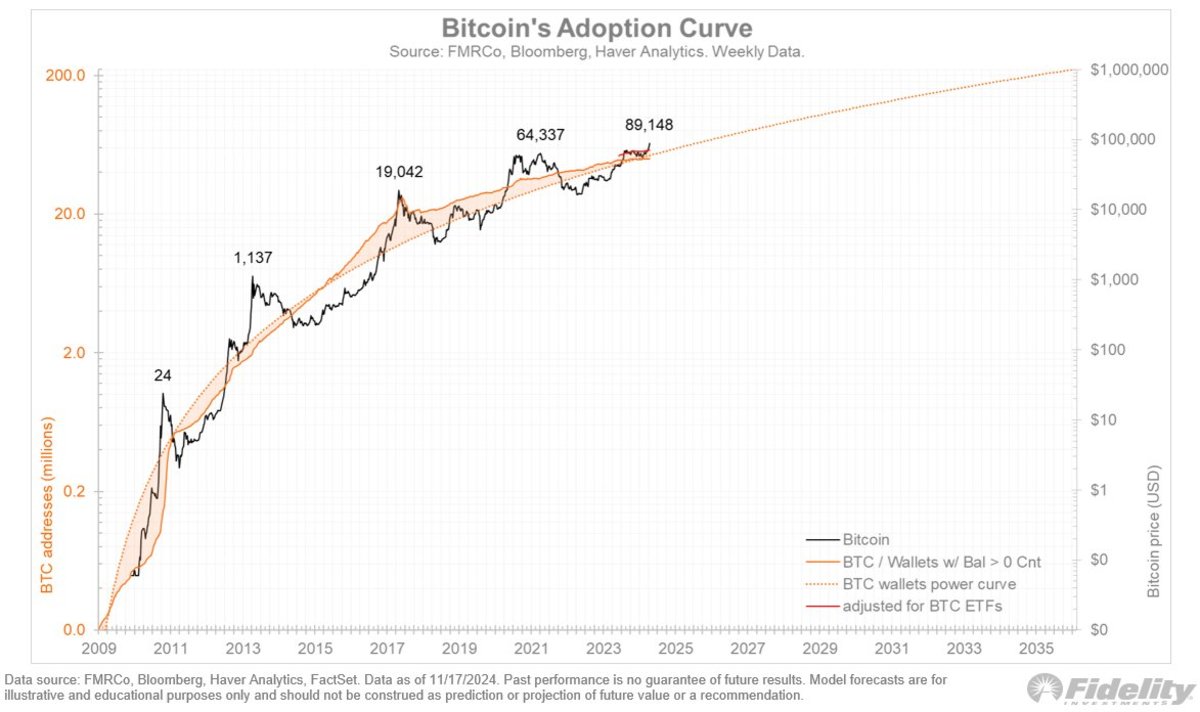

Fidelity Investments’ Director of Global Macro, Jurrien Timmer, continues to provide insightful frameworks for understanding Bitcoin’s valuation and growth. In a recent update, Timmer shared his take on Bitcoin’s adoption and value trajectories, illustrated by detailed charts that reflect both historical trends and hypothetical scenarios.

Timmer’s models aim to simplify Bitcoin’s complex growth dynamics, bridging the gap between network adoption and valuation. “While the supply is known, the demand is not,” he stated, emphasizing the critical role of adoption curves and macroeconomic variables such as real rates and monetary policy.

Adoption Curves: Slowing But Consistent Growth

Despite a slowdown in Bitcoin’s network growth, as measured by the number of wallets with a non-zero balance, Timmer noted that the trend still aligns with the steep power curve shown in his updated adoption chart. While the internet adoption curve has a gentler slope, Bitcoin’s adoption trajectory remains steeper, signifying its rapid but maturing growth.

Importantly, Timmer highlighted a key limitation in the measurement of wallet growth: the understated wallet/address count due to Bitcoin ETFs, which consolidate holdings into just a few wallets. “It’s very likely that the wallet/address count is understated,” he said, pointing out that ETFs obscure the broader distribution of Bitcoin adoption.

Monetary Policy Meets Adoption Dynamics

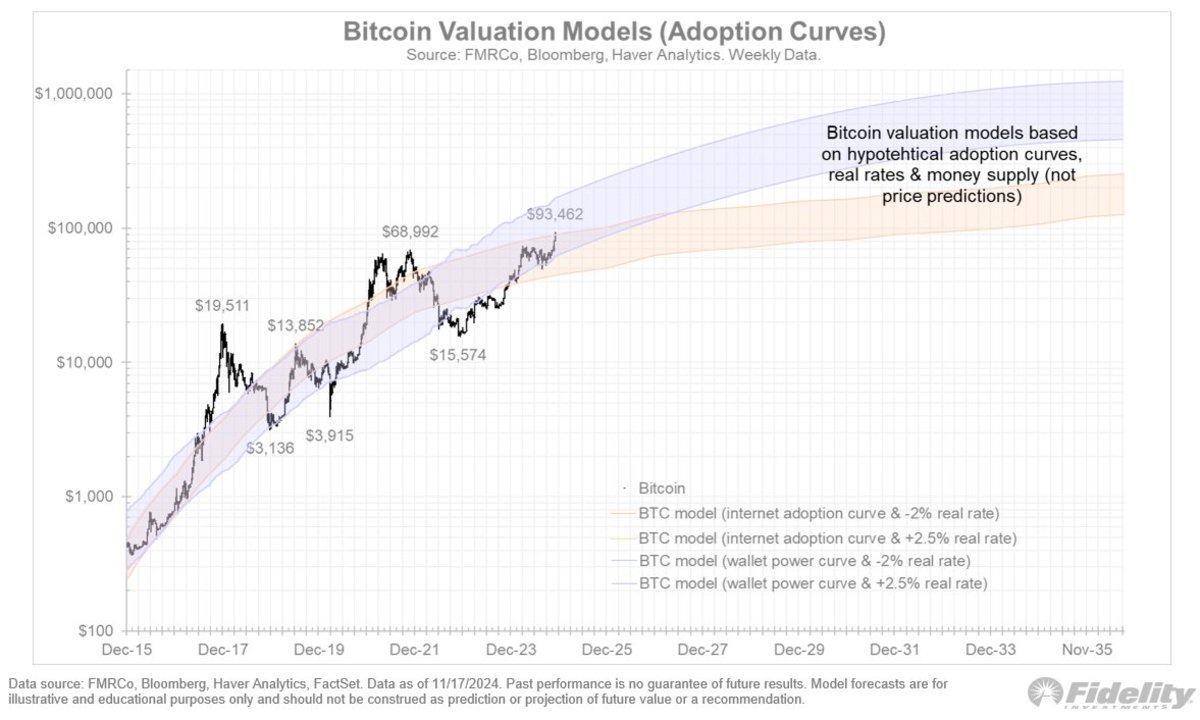

Building on his previous models, Timmer added a new layer to his valuation framework by incorporating money supply growth alongside real interest rates. The updated charts compare two hypothetical paths for Bitcoin’s valuation: one driven by adoption curves and real rates, and another that includes monetary inflation as a factor.

“Again, these are not predictions,” Timmer clarified, “but merely attempts at visualizing the use case on the basis of adoption, real rates, and monetary inflation.” This layered approach underscores how external macroeconomic forces, like monetary policy, could influence Bitcoin’s adoption and valuation.

Why This Matters

Timmer’s updated models reinforce Bitcoin’s position as a maturing financial asset. By combining historical S-curves, Metcalfe’s Law, and macroeconomic factors, he offers a comprehensive view of Bitcoin’s unique blend of network utility and monetary features. His work highlights the importance of adoption in driving Bitcoin’s value, while also demonstrating how real-world monetary conditions could shape its future.

For Bitcoin proponents and skeptics alike, Timmer’s insights serve as a valuable framework for understanding the asset’s dual nature as both a network and a form of money. The inclusion of monetary inflation in his models further underscores Bitcoin’s potential as a hedge against fiat currency debasement.

The Road Ahead

As Bitcoin continues to evolve, Timmer’s models provide a critical lens for tracking its development. Whether it’s the flattening of the adoption curve or the interplay between monetary policy and valuation, his analysis underscores the asset’s growing complexity—and its enduring relevance in the financial world.

For investors, analysts, and enthusiasts, these insights are a reminder of Bitcoin’s transformative potential, even as its growth curve matures.

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Share:

Fidelity Investments’ Director of Global Macro, Jurrien Timmer, continues to provide insightful frameworks for understanding Bitcoin’s valuation and growth. In a recent update, Timmer shared his take on Bitcoin’s adoption and value trajectories, illustrated by detailed charts that reflect both historical trends and hypothetical scenarios.

Timmer’s models aim to simplify Bitcoin’s complex growth dynamics, bridging the gap between network adoption and valuation. “While the supply is known, the demand is not,” he stated, emphasizing the critical role of adoption curves and macroeconomic variables such as real rates and monetary policy.

Adoption Curves: Slowing But Consistent Growth

Despite a slowdown in Bitcoin’s network growth, as measured by the number of wallets with a non-zero balance, Timmer noted that the trend still aligns with the steep power curve shown in his updated adoption chart. While the internet adoption curve has a gentler slope, Bitcoin’s adoption trajectory remains steeper, signifying its rapid but maturing growth.

Importantly, Timmer highlighted a key limitation in the measurement of wallet growth: the understated wallet/address count due to Bitcoin ETFs, which consolidate holdings into just a few wallets. “It’s very likely that the wallet/address count is understated,” he said, pointing out that ETFs obscure the broader distribution of Bitcoin adoption.

Monetary Policy Meets Adoption Dynamics

Building on his previous models, Timmer added a new layer to his valuation framework by incorporating money supply growth alongside real interest rates. The updated charts compare two hypothetical paths for Bitcoin’s valuation: one driven by adoption curves and real rates, and another that includes monetary inflation as a factor.

“Again, these are not predictions,” Timmer clarified, “but merely attempts at visualizing the use case on the basis of adoption, real rates, and monetary inflation.” This layered approach underscores how external macroeconomic forces, like monetary policy, could influence Bitcoin’s adoption and valuation.

Why This Matters

Timmer’s updated models reinforce Bitcoin’s position as a maturing financial asset. By combining historical S-curves, Metcalfe’s Law, and macroeconomic factors, he offers a comprehensive view of Bitcoin’s unique blend of network utility and monetary features. His work highlights the importance of adoption in driving Bitcoin’s value, while also demonstrating how real-world monetary conditions could shape its future.

For Bitcoin proponents and skeptics alike, Timmer’s insights serve as a valuable framework for understanding the asset’s dual nature as both a network and a form of money. The inclusion of monetary inflation in his models further underscores Bitcoin’s potential as a hedge against fiat currency debasement.

The Road Ahead

As Bitcoin continues to evolve, Timmer’s models provide a critical lens for tracking its development. Whether it’s the flattening of the adoption curve or the interplay between monetary policy and valuation, his analysis underscores the asset’s growing complexity—and its enduring relevance in the financial world.

For investors, analysts, and enthusiasts, these insights are a reminder of Bitcoin’s transformative potential, even as its growth curve matures.