USDT Issuer Tether Becomes Largest Independent Gold Holder

Share:

USDT issuer, Tether, is now the world’s largest independent gold holder, with almost $8.7 billion worth of the metal in its coffers. Tether’s backing has been brought into question several times, and the latest development may bring some relief to USDT holders.

Is Tether Going All In On Gold?

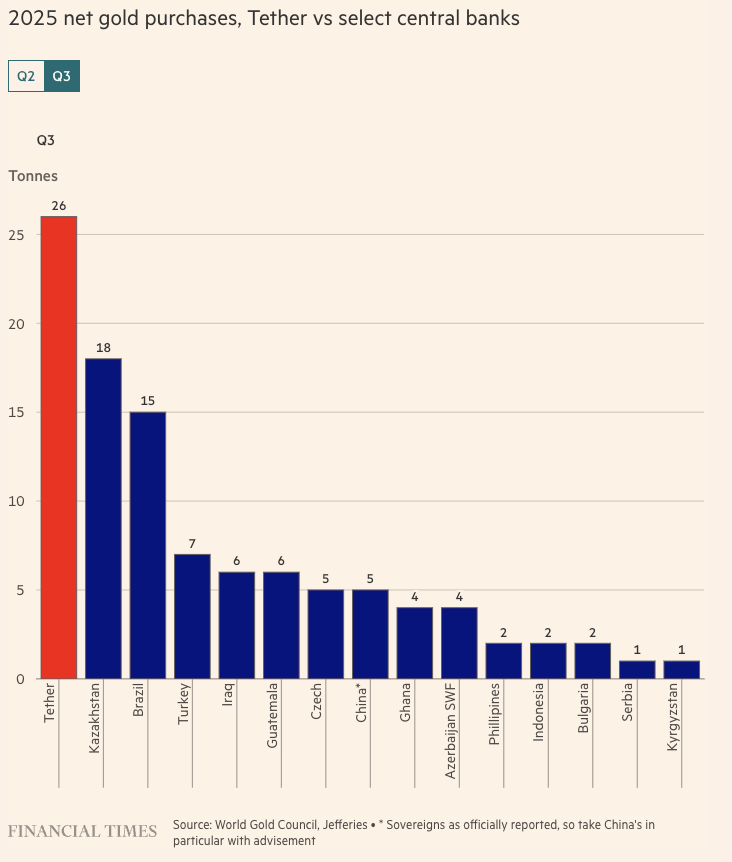

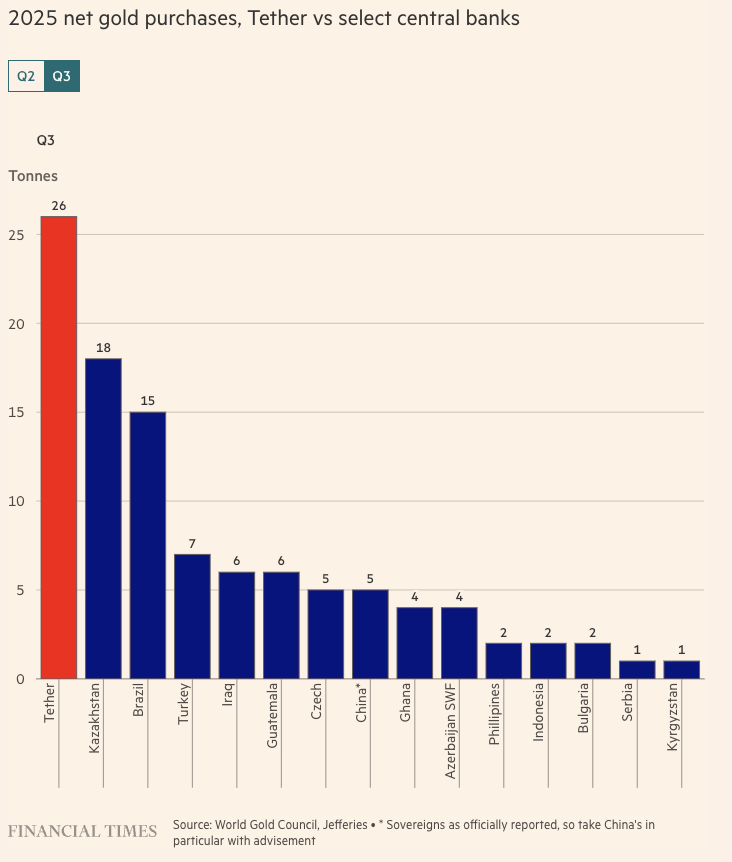

The bullish outlook for gold could be a signal that Tether views the metal as the best store of value. The company’s gold holding currently equals that of countries such as South Korea, Hungary, or Greece. According to a Financial Times report, Tether’s purchases have outshone those of Kazakhstan, Brazil, Turkey, China, etc.

According to some analysts, Tether’s recent aggressive purchases may have influenced the yellow metal’s price over the last few months. Gold has hit an all-time high of $4,379 in October 2025. The rise in gold’s price may have been due to investors taking a risk-averse strategy amid uncertain macroeconomic conditions.

Also Read: Gold Price Forecast: Analysts See Huge Upside, Targets You Need to Know

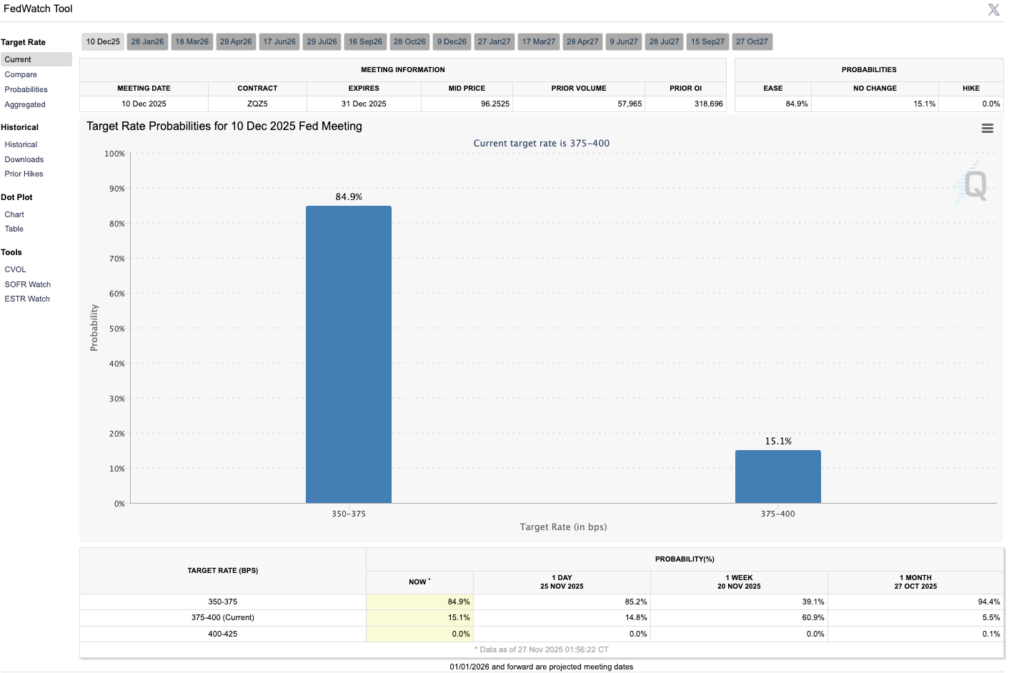

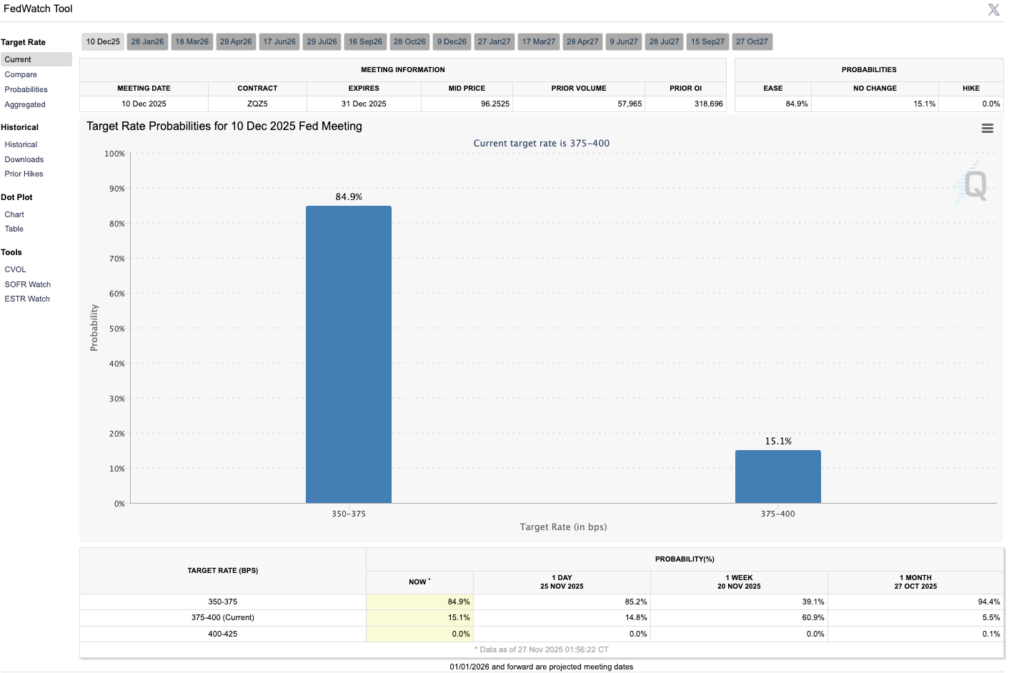

We may see a shift in investor strategy in the coming weeks as the chances of another interest rate cut in December increase. According to the CME FedWatch tool, there is an 84.9% chance of a 25 basis point interest rate cut in December 2025. Another rate cut could lead to investors moving out of safe-haven assets, such as gold, and redirect their capital into riskier assets, such as cryptocurrencies.

According to Marex analyst Edward Meir, “The focus has shifted away from the dollar and towards a decrease in interest rates in December.“

Meir believes that the rise in interest rate cut chances is helping gold’s price. He further spoke about the possibility of a new chair at the Federal Reserve. He stated, “The talk that they might nominate a Fed chairman soon and the frontrunner is Kevin Hassett from the Economic Advisory Committee of the president.“

USDT Issuer Tether Becomes Largest Independent Gold Holder

Share:

USDT issuer, Tether, is now the world’s largest independent gold holder, with almost $8.7 billion worth of the metal in its coffers. Tether’s backing has been brought into question several times, and the latest development may bring some relief to USDT holders.

Is Tether Going All In On Gold?

The bullish outlook for gold could be a signal that Tether views the metal as the best store of value. The company’s gold holding currently equals that of countries such as South Korea, Hungary, or Greece. According to a Financial Times report, Tether’s purchases have outshone those of Kazakhstan, Brazil, Turkey, China, etc.

According to some analysts, Tether’s recent aggressive purchases may have influenced the yellow metal’s price over the last few months. Gold has hit an all-time high of $4,379 in October 2025. The rise in gold’s price may have been due to investors taking a risk-averse strategy amid uncertain macroeconomic conditions.

Also Read: Gold Price Forecast: Analysts See Huge Upside, Targets You Need to Know

We may see a shift in investor strategy in the coming weeks as the chances of another interest rate cut in December increase. According to the CME FedWatch tool, there is an 84.9% chance of a 25 basis point interest rate cut in December 2025. Another rate cut could lead to investors moving out of safe-haven assets, such as gold, and redirect their capital into riskier assets, such as cryptocurrencies.

According to Marex analyst Edward Meir, “The focus has shifted away from the dollar and towards a decrease in interest rates in December.“

Meir believes that the rise in interest rate cut chances is helping gold’s price. He further spoke about the possibility of a new chair at the Federal Reserve. He stated, “The talk that they might nominate a Fed chairman soon and the frontrunner is Kevin Hassett from the Economic Advisory Committee of the president.“