XRP surges 9% on Franklin Templeton & Grayscale Spot ETF Launch

Share:

- XRP surges 9% to $2.27 the second Franklin Templeton and Grayscale dropped their spot ETFs.

- Ripple’s $125M SEC settlement finally gone, Wall Street’s piling in hard.

- Big players love XRP’s 3 second cheap payments calling it the future of global settlements.

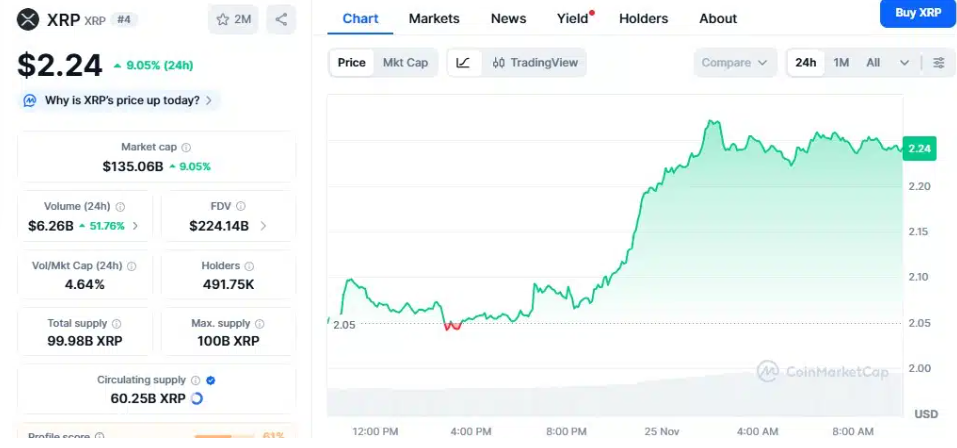

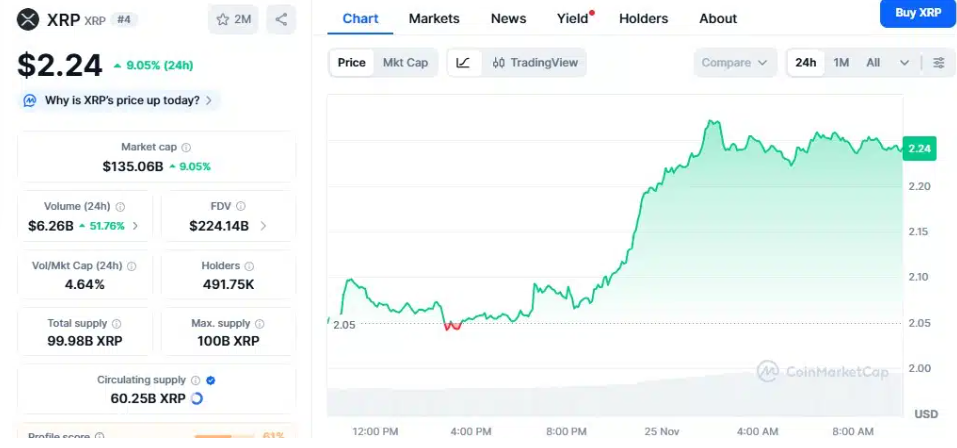

XRP shot up over 9% to $2.27 Monday after Franklin Templeton and Grayscale rolled out their spot XRP ETFs on NYSE Arca. This marks a fresh start for the token, especially after Ripple wrapped its long SEC fight with a $125 million settlement. At the time of writing, XRP sits at $2.24 with a $135.06 billion market cap, per CoinMarketCap.

Franklin’s XRPZ ETF tracks the CME CF XRP Dollar Reference Rate, with Coinbase as custodian and BNY Mellon handling admin. They call XRP key for global settlements. Grayscale’s GXRP offers a zero fee start to pull in cash. Bitwise’s version from last week already snagged $118 million inflows.

XRP’s Edge and World Trends

XRP Ledger shines with 3-5 second transactions, tiny fees, and over 3.3 billion handled so far. Reports paint it as a practical bridge for cross border payments, very different from Bitcoin’s store of value image. Interest in XRP futures is steadily rising.

Black Swan Capitalist argues that XRP fits well into payment routes across Asia, the Middle East, and Africa, and it also has links to BRICS and Japan’s SBI Holdings. BRICS supported digital settlement systems back in April 2025. The ECB’s Project Nexus is connecting regional payment networks too.

All in all, these ETFs show that the market is growing up. They combine wider acceptance, practical technology, and cleaner regulations, which could help digital payments move ahead in a big way.

XRP surges 9% on Franklin Templeton & Grayscale Spot ETF Launch

Share:

- XRP surges 9% to $2.27 the second Franklin Templeton and Grayscale dropped their spot ETFs.

- Ripple’s $125M SEC settlement finally gone, Wall Street’s piling in hard.

- Big players love XRP’s 3 second cheap payments calling it the future of global settlements.

XRP shot up over 9% to $2.27 Monday after Franklin Templeton and Grayscale rolled out their spot XRP ETFs on NYSE Arca. This marks a fresh start for the token, especially after Ripple wrapped its long SEC fight with a $125 million settlement. At the time of writing, XRP sits at $2.24 with a $135.06 billion market cap, per CoinMarketCap.

Franklin’s XRPZ ETF tracks the CME CF XRP Dollar Reference Rate, with Coinbase as custodian and BNY Mellon handling admin. They call XRP key for global settlements. Grayscale’s GXRP offers a zero fee start to pull in cash. Bitwise’s version from last week already snagged $118 million inflows.

XRP’s Edge and World Trends

XRP Ledger shines with 3-5 second transactions, tiny fees, and over 3.3 billion handled so far. Reports paint it as a practical bridge for cross border payments, very different from Bitcoin’s store of value image. Interest in XRP futures is steadily rising.

Black Swan Capitalist argues that XRP fits well into payment routes across Asia, the Middle East, and Africa, and it also has links to BRICS and Japan’s SBI Holdings. BRICS supported digital settlement systems back in April 2025. The ECB’s Project Nexus is connecting regional payment networks too.

All in all, these ETFs show that the market is growing up. They combine wider acceptance, practical technology, and cleaner regulations, which could help digital payments move ahead in a big way.