‘Money Will Pour In’ – CEO Predicts Bitcoin Will Explode To $180K

Share:

According to VanEck’s Mid-October 2025 ChainCheck, Bitcoin could climb much higher if several big pieces line up. The firm ties Bitcoin’s long-run gains to broad money growth and futures market flows, and it lays out a path that reaches as high as $180,000 before the current bull market ends.

VanEck Links Bitcoin To Global Money Supply

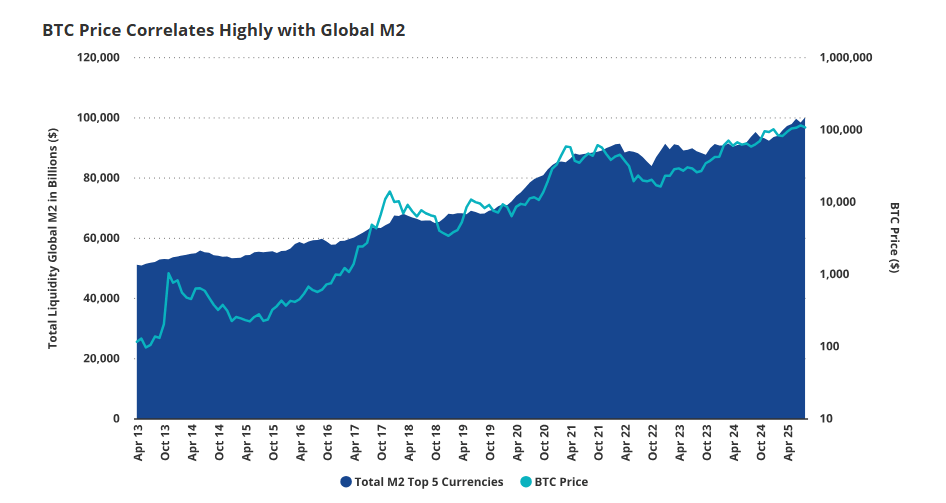

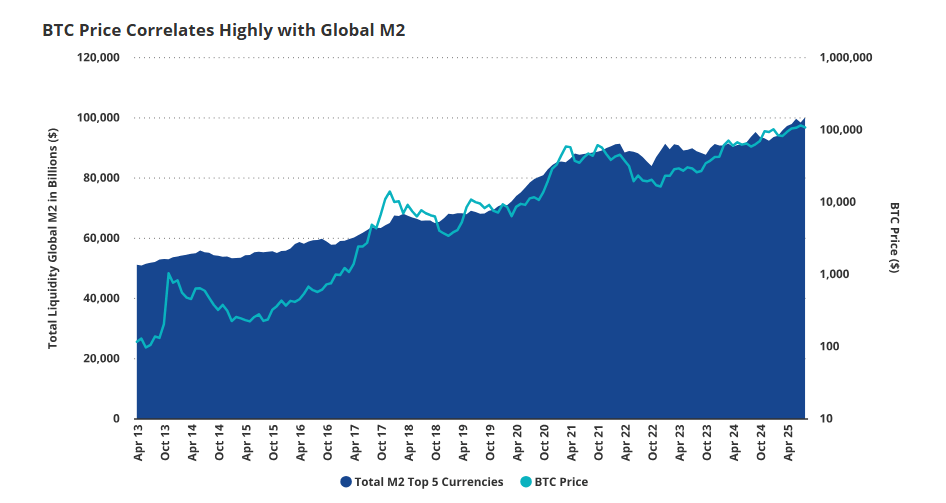

Reports have disclosed a roughly 0.5 correlation between Bitcoin and total global M2 growth since 2014. Over that span, global liquidity across the top five currencies rose from about $50 trillion to nearly $100 trillion.

Bitcoin’s price jumped roughly 700x during the same years. VanEck frames Bitcoin’s current size at about 2% of global money supply and argues that owning less than that share is, in effect, a bet against the asset class.

This is a simple, numeric way to link money printing and asset demand. It does not claim perfect prediction, but it does say the connection is meaningful.

Futures Flows And Market Fragility

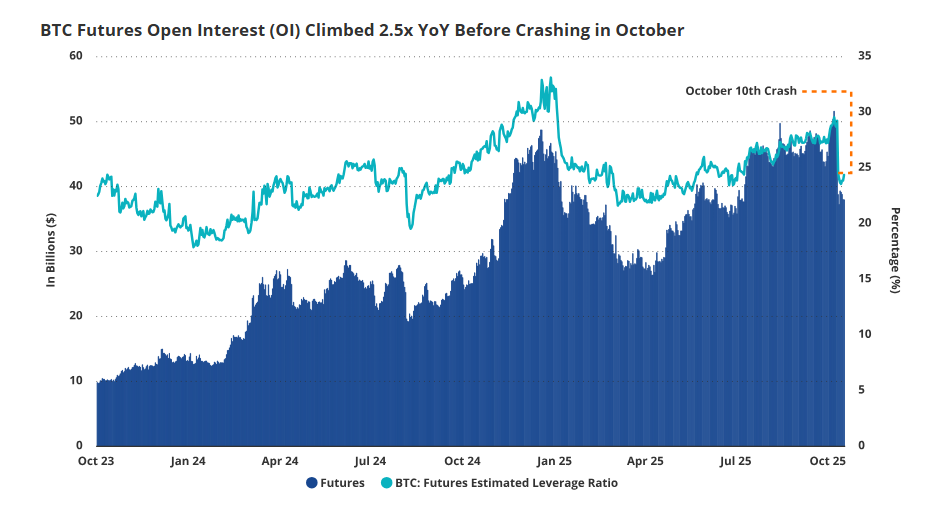

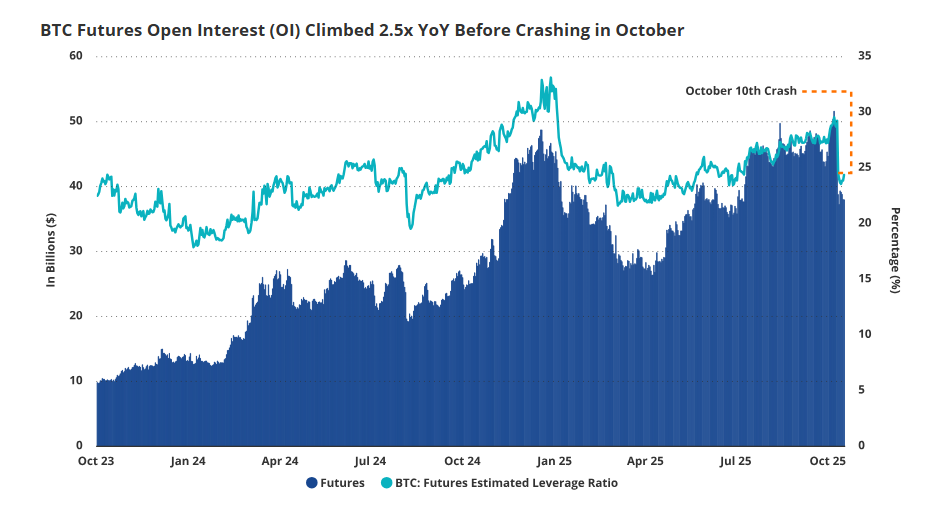

Based on reports, futures markets have been a major driver of short-term price moves. VanEck cites that about 73% of Bitcoin’s price variance since October 2020 can be traced to shifts in futures open interest, with a t-statistic of 71 supporting the relationship.

Cash collateral backing those contracts sits near $145 billion. Open interest peaked at $52B on Oct. 6 and then fell to $39 billion by Oct. 10 after an eight-hour, 20% plunge in BTC.

Borrowed positions have climbed near the 95th percentile at times, though positions above 30% have not held for more than 75 days historically. That pattern shows how crowded bets can unwind fast, and it helps explain sudden swings.

Rotation Between Safe Havens And Risk AssetsMeanwhile, analysts said that gold’s recent $2.5 trillion market cap correction should be read as a cooling off rather than a loss of faith. They said investors could shift between protection and growth exposure depending on macro prints.

Based on reports, a soft US CPI print or easing trade tensions could redirect capital into Bitcoin, supporting scenarios where BTC moves to around $130,000–$132,000 in Q1 2026. Shorter-term targets in VanEck’s work include $129,200 and $141,000, while a clear rise above $125,000 would be taken as a sign of renewed buying strength.

Key Price Levels And RisksPrice action has been trading between $108,000 and $125,000. VanEck identifies a “Whale Buy Zone” near $108,600 and says holding above $108,000 keeps the odds tilted to the upside.

Featured image from Gemini, chart from TradingView

‘Money Will Pour In’ – CEO Predicts Bitcoin Will Explode To $180K

Share:

According to VanEck’s Mid-October 2025 ChainCheck, Bitcoin could climb much higher if several big pieces line up. The firm ties Bitcoin’s long-run gains to broad money growth and futures market flows, and it lays out a path that reaches as high as $180,000 before the current bull market ends.

VanEck Links Bitcoin To Global Money Supply

Reports have disclosed a roughly 0.5 correlation between Bitcoin and total global M2 growth since 2014. Over that span, global liquidity across the top five currencies rose from about $50 trillion to nearly $100 trillion.

Bitcoin’s price jumped roughly 700x during the same years. VanEck frames Bitcoin’s current size at about 2% of global money supply and argues that owning less than that share is, in effect, a bet against the asset class.

This is a simple, numeric way to link money printing and asset demand. It does not claim perfect prediction, but it does say the connection is meaningful.

Futures Flows And Market Fragility

Based on reports, futures markets have been a major driver of short-term price moves. VanEck cites that about 73% of Bitcoin’s price variance since October 2020 can be traced to shifts in futures open interest, with a t-statistic of 71 supporting the relationship.

Cash collateral backing those contracts sits near $145 billion. Open interest peaked at $52B on Oct. 6 and then fell to $39 billion by Oct. 10 after an eight-hour, 20% plunge in BTC.

Borrowed positions have climbed near the 95th percentile at times, though positions above 30% have not held for more than 75 days historically. That pattern shows how crowded bets can unwind fast, and it helps explain sudden swings.

Rotation Between Safe Havens And Risk AssetsMeanwhile, analysts said that gold’s recent $2.5 trillion market cap correction should be read as a cooling off rather than a loss of faith. They said investors could shift between protection and growth exposure depending on macro prints.

Based on reports, a soft US CPI print or easing trade tensions could redirect capital into Bitcoin, supporting scenarios where BTC moves to around $130,000–$132,000 in Q1 2026. Shorter-term targets in VanEck’s work include $129,200 and $141,000, while a clear rise above $125,000 would be taken as a sign of renewed buying strength.

Key Price Levels And RisksPrice action has been trading between $108,000 and $125,000. VanEck identifies a “Whale Buy Zone” near $108,600 and says holding above $108,000 keeps the odds tilted to the upside.

Featured image from Gemini, chart from TradingView