Why BNB Matters: Key Drivers Behind The Rally and BNB Chain’s Growth

Share:

The recent surge in BNB’s price has drawn broad attention across the crypto community. Although the native token of the BNB Chain is down more than 2.5% in the last 24 hours, the cryptocurrency reached a new all-time high above $1,300 earlier this week.

The latest rally has pushed BNB past Ripple’s XRP and Tether’s USDT stablecoin. At the time of writing, BNB stands as the fourth-largest cryptocurrency, with a market cap of $170 billion according to CoinMarketCap.

BNB Chain recently experienced a “meme coin frenzy.” According to GeckoTerminal, the total trading volume on BNB Chain reached approximately $20.5 billion on October 8, compared to $12.7 billion on Solana, a difference of roughly $7.8 billion.

Earlier this week, a trader turned $3,000 into $2 million in days by sniping a meme coin on BNB Chain. Yet, BNB Chain’s meme coin rally came to a sudden halt when Binance founder Changpeng “CZ” Zhao clarified that his social media posts should not be taken as trading indicators or endorsements.

What’s Driving BNB’s Surge?

Meme coins and hype aside, industry experts believe that BNB’s recent surge is being driven by Binance’s scale and user reach. The popular cryptocurrency exchange saw $14.8 billion in inflows last quarter, which directly correlates to BNB Chain activity surging.

Zac Cheah, co-founder of Pundi AI—a data ecosystem infrastructure built on BNB Chain—told Cryptonews that BNB’s utility has always been tied to real activity on BNB Chain. Cheah believes this connection has only grown stronger as the ecosystem matures.

“Every time gas fees are lowered, or new applications in DeFi, GameFi, or AI gain traction, it drives more on-chain usage and reinforces BNB’s position as the native fuel of the ecosystem,” Cheah said.

Therefore, Cheah believes that BNB’s price surge reflects the strength of the underlying network. “BNB Chain has recently shown consistent user activity, high transaction volume, and expanding developer participation,” he said.

Marwan Kawadri, DeFi lead and head of EMEA at BNB Chain, told Cryptonews that the ecosystem has indeed started to see more real-world use cases.

“We’re seeing more real use, from tokenized real-world assets to payments and DeFi, all supported by ultra-low fees and high-speed execution. The market is recognizing that this isn’t hype; it’s utility and adoption driving activity,” Kawadri said.

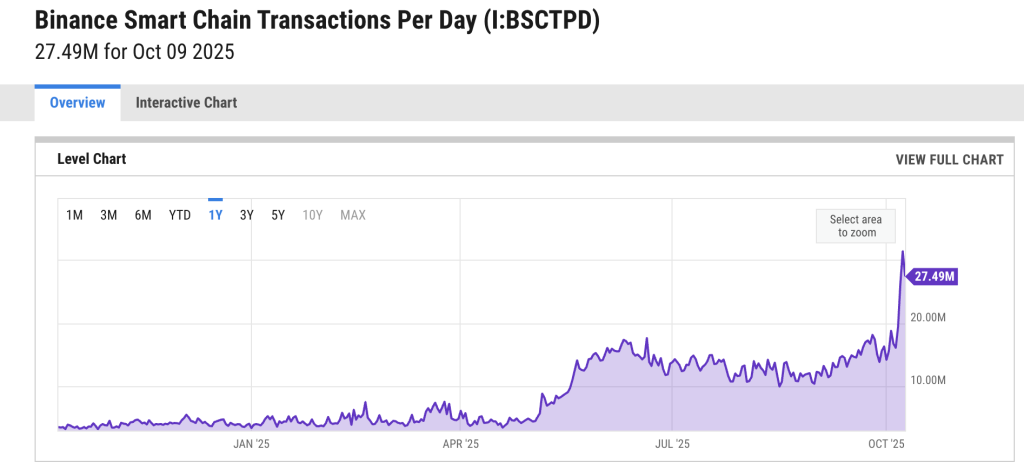

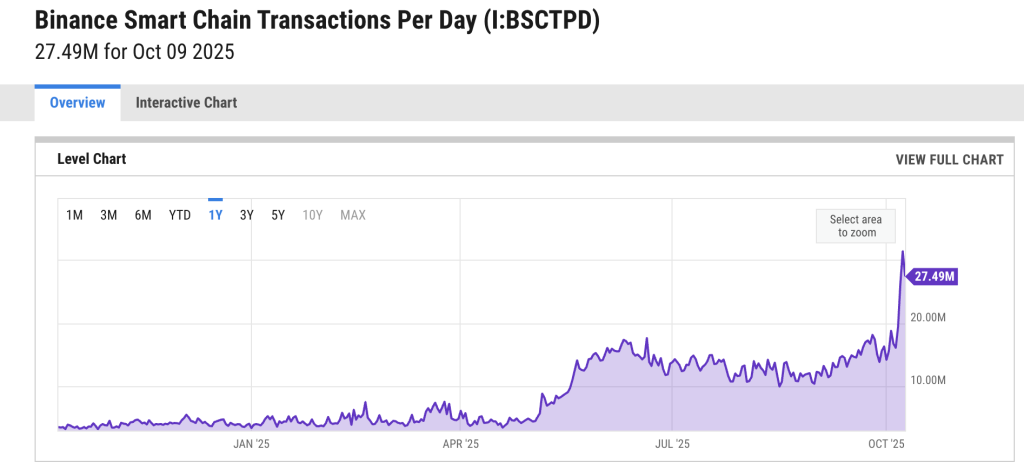

According to YCharts, transaction volume on Binance Smart Chain reached $27.49 million on October 9. The month prior, transaction volume was $13 million, representing a more than double increase.

BNB Chain’s Technical Glow Up

The higher transaction volume on the BNB Chain is attributed to recent network advancements. Kawadri shared that the BNB Chain tech stack has matured, offering faster finality, higher capacity, and consistently low gas costs.

“We’re building one of the most scalable environments for on-chain trading. That combination is resonating with both active traders and institutions,” he remarked.

For instance, BNB Chain’s Maxwell upgrade in June this year dramatically reduced block times from 1.5 seconds to 0.75 seconds, demonstrating the network’s most aggressive speed optimization yet. This upgrade positioned BNB Smart Chain as the fastest major Layer-1 (L1) blockchain, making BNB Chain more attractive for dApps, traders, and builders.

With this in mind, Cheah shared that BNB Chain represents a balance between performance, accessibility, and ecosystem maturity. “For developers, it offers something very practical: a fast, low-cost environment where products can scale without friction.”

He added that the new 0.05 Gwei standard gas fee has made the BNB Chain one of the most cost-efficient L1s in the market, which is key for AI and data-intensive applications like ours.

Kawadri also added that BNB Chain has further upgrades in store this year, including a 10x increase in the block gas limit, faster transaction finality down to 450ms on mainnet, and ultra-low fees.

A Thriving Builder Ecosystem

BNB Chain’s builder ecosystem is also thriving. On October 8, an announcement stated that BNB Chain’s $1 billion Builder Fund, backed by YZi Labs, intends to accelerate current and future builders on the network. The announcement further notes that the BNB Chain ecosystem currently consists of more than 460 million users.

“The BNB Most Valuable Builder program and the new $1B Builder Fund are clear signals that BNB Chain is serious about long-term innovation. It is not just funding hype cycles; it is a funding utility, from AI to DeFi to RWAs. That attracts developers who want to build for the next decade, not just the next bull run,” Cheah said.

Institutional Inflows and Treasury Allocations

In addition to technical maturity and a thriving builder ecosystem, BNB’s price surge has likely been influenced by several corporations and organizations that have disclosed sizable BNB holdings.

For instance, CEA Industries (BNC) reportedly added BNB to its treasury. On October 7, the publicly traded consumer products firm announced that it now holds 480,000 BNB tokens with an average acquisition cost of $860 per token. This represents a total investment of approximately $412.8 million.

Additionally, B Strategy—a digital asset investment firm founded by former Bitmain executives—recently announced plans to launch a $1 billion crypto treasury focused on investing in BNB.

Challenges To Consider

While the BNB Chain is gaining traction, a number of challenges remain for the L1.

Mati Greenspan, founder and CEO of Quantum Economics, told Cryptonews that perception remains a major hurdle for the BNB Chain ecosystem.

“Many see it as too centralized and too tied to Binance. The technology is strong, but it needs real-world applications before the masses jump in,” Greenspan said.

Given this, Greenspan believes that in the short term, the crypto sector can expect more noise and meme mania related to the chain. He added that if the BNB Chain continues to deliver on scalability and privacy, it could eventually evolve into a serious bedrock infrastructure.

The post Why BNB Matters: Key Drivers Behind The Rally and BNB Chain’s Growth appeared first on Cryptonews.

Read More

Why BNB Matters: Key Drivers Behind The Rally and BNB Chain’s Growth

Share:

The recent surge in BNB’s price has drawn broad attention across the crypto community. Although the native token of the BNB Chain is down more than 2.5% in the last 24 hours, the cryptocurrency reached a new all-time high above $1,300 earlier this week.

The latest rally has pushed BNB past Ripple’s XRP and Tether’s USDT stablecoin. At the time of writing, BNB stands as the fourth-largest cryptocurrency, with a market cap of $170 billion according to CoinMarketCap.

BNB Chain recently experienced a “meme coin frenzy.” According to GeckoTerminal, the total trading volume on BNB Chain reached approximately $20.5 billion on October 8, compared to $12.7 billion on Solana, a difference of roughly $7.8 billion.

Earlier this week, a trader turned $3,000 into $2 million in days by sniping a meme coin on BNB Chain. Yet, BNB Chain’s meme coin rally came to a sudden halt when Binance founder Changpeng “CZ” Zhao clarified that his social media posts should not be taken as trading indicators or endorsements.

What’s Driving BNB’s Surge?

Meme coins and hype aside, industry experts believe that BNB’s recent surge is being driven by Binance’s scale and user reach. The popular cryptocurrency exchange saw $14.8 billion in inflows last quarter, which directly correlates to BNB Chain activity surging.

Zac Cheah, co-founder of Pundi AI—a data ecosystem infrastructure built on BNB Chain—told Cryptonews that BNB’s utility has always been tied to real activity on BNB Chain. Cheah believes this connection has only grown stronger as the ecosystem matures.

“Every time gas fees are lowered, or new applications in DeFi, GameFi, or AI gain traction, it drives more on-chain usage and reinforces BNB’s position as the native fuel of the ecosystem,” Cheah said.

Therefore, Cheah believes that BNB’s price surge reflects the strength of the underlying network. “BNB Chain has recently shown consistent user activity, high transaction volume, and expanding developer participation,” he said.

Marwan Kawadri, DeFi lead and head of EMEA at BNB Chain, told Cryptonews that the ecosystem has indeed started to see more real-world use cases.

“We’re seeing more real use, from tokenized real-world assets to payments and DeFi, all supported by ultra-low fees and high-speed execution. The market is recognizing that this isn’t hype; it’s utility and adoption driving activity,” Kawadri said.

According to YCharts, transaction volume on Binance Smart Chain reached $27.49 million on October 9. The month prior, transaction volume was $13 million, representing a more than double increase.

BNB Chain’s Technical Glow Up

The higher transaction volume on the BNB Chain is attributed to recent network advancements. Kawadri shared that the BNB Chain tech stack has matured, offering faster finality, higher capacity, and consistently low gas costs.

“We’re building one of the most scalable environments for on-chain trading. That combination is resonating with both active traders and institutions,” he remarked.

For instance, BNB Chain’s Maxwell upgrade in June this year dramatically reduced block times from 1.5 seconds to 0.75 seconds, demonstrating the network’s most aggressive speed optimization yet. This upgrade positioned BNB Smart Chain as the fastest major Layer-1 (L1) blockchain, making BNB Chain more attractive for dApps, traders, and builders.

With this in mind, Cheah shared that BNB Chain represents a balance between performance, accessibility, and ecosystem maturity. “For developers, it offers something very practical: a fast, low-cost environment where products can scale without friction.”

He added that the new 0.05 Gwei standard gas fee has made the BNB Chain one of the most cost-efficient L1s in the market, which is key for AI and data-intensive applications like ours.

Kawadri also added that BNB Chain has further upgrades in store this year, including a 10x increase in the block gas limit, faster transaction finality down to 450ms on mainnet, and ultra-low fees.

A Thriving Builder Ecosystem

BNB Chain’s builder ecosystem is also thriving. On October 8, an announcement stated that BNB Chain’s $1 billion Builder Fund, backed by YZi Labs, intends to accelerate current and future builders on the network. The announcement further notes that the BNB Chain ecosystem currently consists of more than 460 million users.

“The BNB Most Valuable Builder program and the new $1B Builder Fund are clear signals that BNB Chain is serious about long-term innovation. It is not just funding hype cycles; it is a funding utility, from AI to DeFi to RWAs. That attracts developers who want to build for the next decade, not just the next bull run,” Cheah said.

Institutional Inflows and Treasury Allocations

In addition to technical maturity and a thriving builder ecosystem, BNB’s price surge has likely been influenced by several corporations and organizations that have disclosed sizable BNB holdings.

For instance, CEA Industries (BNC) reportedly added BNB to its treasury. On October 7, the publicly traded consumer products firm announced that it now holds 480,000 BNB tokens with an average acquisition cost of $860 per token. This represents a total investment of approximately $412.8 million.

Additionally, B Strategy—a digital asset investment firm founded by former Bitmain executives—recently announced plans to launch a $1 billion crypto treasury focused on investing in BNB.

Challenges To Consider

While the BNB Chain is gaining traction, a number of challenges remain for the L1.

Mati Greenspan, founder and CEO of Quantum Economics, told Cryptonews that perception remains a major hurdle for the BNB Chain ecosystem.

“Many see it as too centralized and too tied to Binance. The technology is strong, but it needs real-world applications before the masses jump in,” Greenspan said.

Given this, Greenspan believes that in the short term, the crypto sector can expect more noise and meme mania related to the chain. He added that if the BNB Chain continues to deliver on scalability and privacy, it could eventually evolve into a serious bedrock infrastructure.

The post Why BNB Matters: Key Drivers Behind The Rally and BNB Chain’s Growth appeared first on Cryptonews.

Read More

Week in BNB Chain: Meme Season Hits, BNB Flips XRP

Week in BNB Chain: Meme Season Hits, BNB Flips XRP

BNB (@cz_binance)

BNB (@cz_binance)