Can Ethereum Hold Above $2,700 and Break Toward $3,000?

Share:

- Ethereum futures open interest hits $35.69B as ETF inflows reach $402M.

- Whale wallets add 1M ETH in May, pushing price near $2,820 resistance.

Ethereum (ETH) is trading at $2,729 following a 3.80% gain in the last 24 hours. The coin moved between $2,611 and $2,785, indicating strong intraday activity. Market capitalization now stands at $328.12 billion. Ethereum’s daily trading volume surged to $26.91 billion, marking a 22.56% increase.

Since the start of the week, ETH has defied the broader market downturn and continues to trend upward. While Bitcoin lost 3.73% from its May 22 high, Ethereum advanced close to 4%. February recorded this particular price level which mirrors the increasing strength of Ethereum independently.

As Ethereum moves past recent resistance levels, positive momentum is gaining strength. The rally reflects renewed interest in assets that underperformed during earlier phases.

Ethereum Sees Record Futures Interest and ETF Inflows

Trading in derivatives has spiked at the same time as Ethereum has extended its rally. According to CoinGlass, Open Interest for ETH Futures hit $35.69 billion in the month of May. This is now the greatest increase ever seen, demonstrating higher borrowing and hopes that prices will rise.

Ethereum’s rise in spot price continues to fall behind its rapid increase in Open Interest. Still, the rising bullish mood may be followed by more noticeable price swings.

Institutional flows have further reinforced Ethereum’s performance. U.S. spot Ethereum ETFs reported $402 million in inflows in the past month. These inflows suggest growing attention from large funds and regulated platforms. The demand points to Ethereum’s expanding role beyond retail speculation.

ETH is attractive to many because it supports and fuels decentralized applications. The platform uses smart contracts, enables token creation, and helps blockchain scale. It makes Ethereum stand out with regulators as the latest blockchain advances emerge.

Whales Accumulate 1M ETH as $2,820 Emerges as Next Target

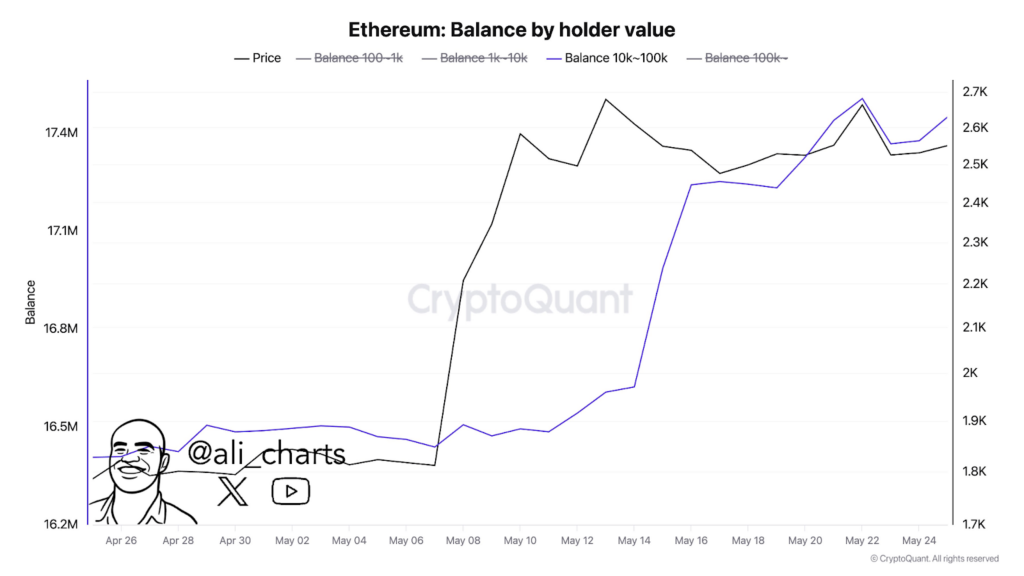

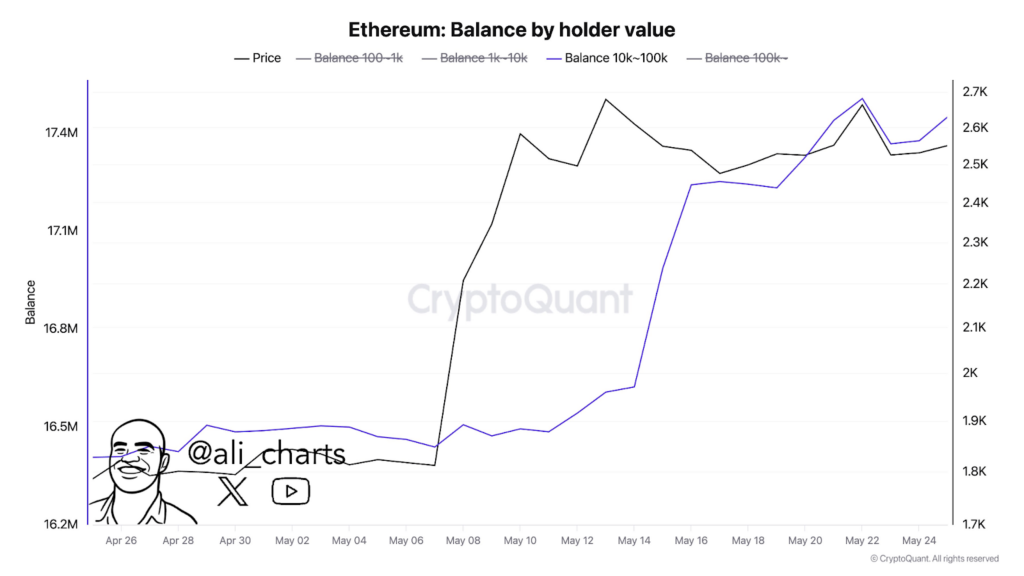

Large whales’ purchases of Ethereum have been confirmed by information on CryptoQuant. Wallets with amounts between 10,000 and 100,000 ETH raised their balance from 16.4 million to 17.4 million according to analyst Ali. Starting from May 8, the gaming company quietly collected these tokens amid Ethereum’s regular 51% monthly price increase.

But, technical indicators now suggest that the momentum has stopped. Currently, the Relative Strength Index (RSI) reads 45, which is neutral. The bearish crossover in MACD is visible, as the MACD and signal lines are now below zero.

Key support lies at $2,700. If this level fails, ETH could drop to $2,675. On the upside, resistance is seen at $2,775. A breakout above this zone may push Ethereum toward the $2,820–$3,000 area. Without a bullish MACD shift or RSI above 60, ETH may remain range-bound in the short term.

Highlighted Crypto News Today:

Russia’s Central Bank Approves Crypto-Linked Financial Products for Qualified Investors

Can Ethereum Hold Above $2,700 and Break Toward $3,000?

Share:

- Ethereum futures open interest hits $35.69B as ETF inflows reach $402M.

- Whale wallets add 1M ETH in May, pushing price near $2,820 resistance.

Ethereum (ETH) is trading at $2,729 following a 3.80% gain in the last 24 hours. The coin moved between $2,611 and $2,785, indicating strong intraday activity. Market capitalization now stands at $328.12 billion. Ethereum’s daily trading volume surged to $26.91 billion, marking a 22.56% increase.

Since the start of the week, ETH has defied the broader market downturn and continues to trend upward. While Bitcoin lost 3.73% from its May 22 high, Ethereum advanced close to 4%. February recorded this particular price level which mirrors the increasing strength of Ethereum independently.

As Ethereum moves past recent resistance levels, positive momentum is gaining strength. The rally reflects renewed interest in assets that underperformed during earlier phases.

Ethereum Sees Record Futures Interest and ETF Inflows

Trading in derivatives has spiked at the same time as Ethereum has extended its rally. According to CoinGlass, Open Interest for ETH Futures hit $35.69 billion in the month of May. This is now the greatest increase ever seen, demonstrating higher borrowing and hopes that prices will rise.

Ethereum’s rise in spot price continues to fall behind its rapid increase in Open Interest. Still, the rising bullish mood may be followed by more noticeable price swings.

Institutional flows have further reinforced Ethereum’s performance. U.S. spot Ethereum ETFs reported $402 million in inflows in the past month. These inflows suggest growing attention from large funds and regulated platforms. The demand points to Ethereum’s expanding role beyond retail speculation.

ETH is attractive to many because it supports and fuels decentralized applications. The platform uses smart contracts, enables token creation, and helps blockchain scale. It makes Ethereum stand out with regulators as the latest blockchain advances emerge.

Whales Accumulate 1M ETH as $2,820 Emerges as Next Target

Large whales’ purchases of Ethereum have been confirmed by information on CryptoQuant. Wallets with amounts between 10,000 and 100,000 ETH raised their balance from 16.4 million to 17.4 million according to analyst Ali. Starting from May 8, the gaming company quietly collected these tokens amid Ethereum’s regular 51% monthly price increase.

But, technical indicators now suggest that the momentum has stopped. Currently, the Relative Strength Index (RSI) reads 45, which is neutral. The bearish crossover in MACD is visible, as the MACD and signal lines are now below zero.

Key support lies at $2,700. If this level fails, ETH could drop to $2,675. On the upside, resistance is seen at $2,775. A breakout above this zone may push Ethereum toward the $2,820–$3,000 area. Without a bullish MACD shift or RSI above 60, ETH may remain range-bound in the short term.

Highlighted Crypto News Today:

Russia’s Central Bank Approves Crypto-Linked Financial Products for Qualified Investors