Deny or Approve: Why Ethereum ETF Is Different from Bitcoin One?

Key Takeaways:

-

The key event for spot Bitcoin ETFs approval was Grayscale's victory over the SEC in court, where SEC officials failed to make a compelling argument for banning spot funds when futures funds are available.

-

Even though Ethereum futures ETFs are already trading and the argument for spot is valid, there are no signs of the commission preparing for approval, as was the case with Bitcoin.

-

The problem with the Ethereum ETF is that there is still no regulatory clarity on Ethereum’s status, whether it is a commodity or a security.

-

Another issue lies in Ethereum’s staking mechanism itself, specifically concerning questions on how and where to stake, or who is owed the profits from staking.

-

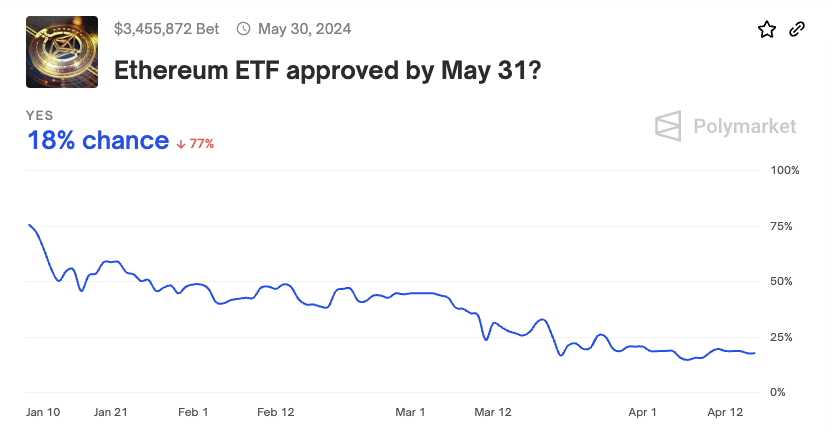

According to ETF analysts and Polymarket probability rates (only ~25% for approval), Ethereum’s ETF denial in May is almost priced in.

-

In the long run, Ethereum ETF approval is inevitable, as the world's largest investment funds with teams of professional lawyers and analysts have bet on it.

Since the beginning of the year, spot exchange-traded funds (ETFs) for Bitcoin have collectively received more than $25 billion of fresh capital inflows. The approval triggered a new bullish cycle, and the Bitcoin price has risen nearly 60% since the beginning of the year, reaching a new all-time high above $73K.

The ETH price in anticipation of the decision to approve Ethereum ETFs initially showed similarities to BTC dynamics; applications for the Ethereum ETF have already been sent by almost all issuers of Bitcoin ETFs. But in March, ETH started losing value rapidly in the BTC pair due to the market re-evaluation of the approval. On May 23, the first application deadline for VanEck's spot Ethereum ETF expires, and the U.S. Securities and Exchange Commission (SEC) has to make a decision. Let's try to figure out what that decision will be.

Why Were Bitcoin ETFs Approved?

In 2021, the SEC approved the launch of several Bitcoin futures ETFs. There were no major obstacles to getting it approved because futures ETF trading has no direct market impact. There is no purchase of physical assets in the futures trading process, unlike spot ETFs, where the asset is purchased to back the mutual funds.

Since the cryptocurrency market is highly manipulative and spot ETF purchases directly affect the price, the SEC was reluctant to approve Bitcoin ETFs. The key event for spot Bitcoin ETFs approval was Grayscale's victory over the SEC in court. The court overturned the SEC's denial of Grayscale's application to convert its existing trust fund into the actual exchange-traded fund. The judge found the denial unreasonable because SEC officials failed to make a compelling argument for banning spot funds when futures funds are available.

What Is the Issue with the SEC?

According to crypto lawyer Jake Czerwinski, who has been working on the Ethereum ETF for about five years, everything boils down to an intractable bias on the SEC's part. The SEC's reluctance to approve an Ethereum ETF is attributed to its scepticism of cryptocurrency, viewing opposition as politically beneficial and aligning with anti-crypto sentiments in politics. Despite the Grayscale case highlighting issues with the SEC's arguments on market correlation, the SEC may still use this as a denial basis. It also appears ready to face legal challenges to maintain a tough stance on crypto.

SEC's Behavior Differs from the Bitcoin Case

The SEC's antipathy toward cryptocurrencies is well-known, but it has failed to prevent the approval of the Bitcoin ETF. Why might this time be different? Even though Ethereum futures ETFs are already trading, and the argument for spot is valid, there are no signs of the commission preparing for approval, as was the case with Bitcoin. From October 2023 all the way through January 2024, we could observe the SEC constantly refining the details and working out the specific mechanism of action for Bitcoin ETFs. This is not yet the case for Ethereum-based exchange-traded funds. Perhaps the SEC and issuers are learning from experience and have shortened the process. But, in reality, the focus seems to be on establishing a stronger argument for denial based on market correlation issues rather than advancing the approval process. If we don't see progress in April, the likelihood of approval in May drops to zero. Which stronger argument could there be?

Actual Problems with Ethereum ETF

The situation is somewhat different from that of Bitcoin due to the technical nature of Ethereum. Some Ethereum ETF applicants are considering staking ETH for additional fund income. And this is a completely unprecedented case with no clear legal regulation. It's not only the fact that Gary Gensler has stated that digital assets using staking protocols could be recognized as unregistered securities under U.S. law. BlackRock CEO Larry Fink stated that this would not prevent the launch of ETFs.

Another problem is that there is still no regulatory clarity on Ethereum’s status, how and where to stake, or who is owed the profits from staking. The situation is complicated by the emergence of a huge number of restacking protocols that allow the same asset to be staked multiple times. As a result, a whole pyramid of synthetic assets with double- and triple-digit returns is created on top of Ethereum. This is too risky and underregulated for TradFi.

In addition, a multi-level trolling incident occurred in March. Users identified the address of a cryptocurrency wallet on the Ethereum network owned by BlackRock. In addition to NFT and meme tokens, 1 ETH was sent to this wallet via the Tornado Cash mixer. It was further reported that North Korean hackers from the Lazarus group were behind. After the US authorities imposed sanctions against Tornado Cash in 2022, many protocols began to add all wallets that interacted with it to a blacklist. This incident has yet to receive comment from officials, but it has highlighted the obvious problem of having a public ETF-related Ethereum address.

Denial in May Is Almost Priced In

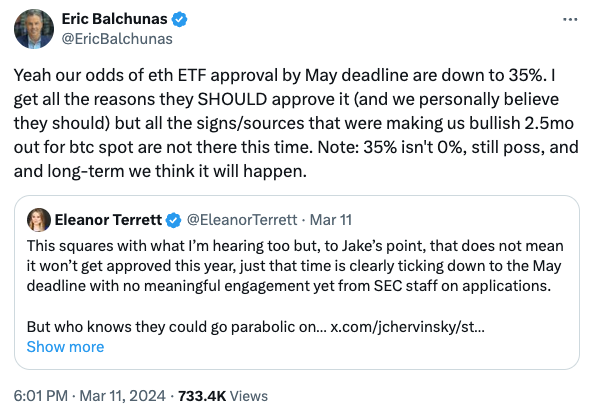

On March 11, Eric Balchunas, Senior ETF Analyst for Bloomberg, estimated the chances of the Ethereum ETF being approved by the May deadline at 35%. However, he believes it will happen in the long term. Since then, the probability has further decreased, as no sign of the SEC preparing for approval has ever been seen, be it clarifying questions or anything else.

In early April, Bitwise CIO (Chief Information Officer) Matt Hougan called for a delay in approving applications for spot Ethereum ETFs until December 2024. He argued that the growth performance of spot Bitcoin ETFs has exceeded analyst and industry expectations, and such hype around Bitcoin will prevent investment firms from focusing proper attention on launching Ethereum-based products. And the launch won't result in large inflows, as it will be faded by Bitcoin. However, Bitwise filed for a spot Ethereum’s ETF a few days earlier.

In early April, Bitwise CIO (Chief Information Officer) Matt Hougan called for a delay in approving applications for spot Ethereum ETFs until December 2024. He argued that the growth performance of spot Bitcoin ETFs has exceeded analyst and industry expectations, and such hype around Bitcoin will prevent investment firms from focusing proper attention on launching Ethereum-based products. And the launch won't result in large inflows, as it will be faded by Bitcoin. However, Bitwise filed for a spot Ethereum’s ETF a few days earlier.

According to Polymarket, the largest prediction market, at the time of writing, the probability of the Ethereum ETF being approved by May 31 is hovering around 18%. At the time of reading this article, the probability is likely to drop further unless something unexpected happens. So, we can state that Ethereum’s ETF denial in May is almost priced in. Imagine the price pump if it suddenly gets the approval.

Output

The question of Ethereum's regulatory status in the US remains open. The SEC considers Bitcoin a commodity, has named more than a dozen other popular coins as securities, but has yet to define Ethereum's status. There is a recording of Gensler's 2018 speech in which he says he does not consider ETH a security, but he is now evasive. Until Ethereum's status is determined, it is unlikely that an Ethereum ETF will be approved.

In the long run, Ethereum ETF approval is inevitable, as the world's largest investment funds with teams of professional lawyers and analysts have bet on it. The issue of approval is a matter of time. And most likely, when the time gets closer, it will be noticeable by the SEC's behavior, as in the case of Bitcoin. It just wasn’t noticeable at the time of writing. What will be the impact on the industry, price action, and DeFi? That's a question for a separate article.

Read More