The Rise and Fall of Play To Earn Games

GameFi dApps quickly rose in popularity across blockchains and even surpassed many DeFi apps (including DEXes) by number of users. Such soaring popularity can be attributed to the relatively new Play to Earn mechanism, with users being intrigued by the concept of earning money by playing games without requiring skill or top-level hardware.

Key Themes:

- What happened to GameFi during the market downturn?

- Why do most Play to Earn games die?

- Metaverse lacks users

- Will Move to Earn become a fitness revolution?

- Gaming guild problems

- What’s next for GameFi?

Play To Earn: A Real Alternative to a Work?

There are thousands of blockchain games currently on the market, but only a few of them have managed to produce successful products. Most games tend to fail even before launch, and those that do manage to produce a product often have a short lifespan, suffering from falling profitability levels.

Axie Infinity is a demonstrative example of a Play To Earn game quickly gaining popularity and, almost as rapidly, losing it. Sky Mavis, the company behind Axie Infinity, started development back in 2018, but the project only became popular in 2020, when a lot of users, mainly from emerging markets, saw an opportunity to easily earn money. The game exemplifies the entire performance of the crypto gaming industry.

Axie Infinity became one of the fastest growing decentralized applications. A huge increase in users was evident in 2021, coinciding with the rapid growth of the market. Along with the increase in users, the values of its token and its NFTs also substantially grew.

In a similar way to its rapid growth, the popularity of the game also suffered a sharp decline. A major problem that lead to the large scale decline was a $625 million hack of the Ronin Network (an EVM blockchain built especially for Axie Infinity) which occurred in March 2022. Another reason for the fall in popularity is that SLP (its in-game cryptocurrency) is an inflationary token, which rapidly decreased in value after the rapid influx of new players in 2021. Consequently, profits decreased and many players eventually got frustrated and left the game.

Many other P2E games have the same problem: they cannot maintain the price of their tokens as waves of new players join. The next stage for Axie Infinity is its transition from a Play to Earn model to “Axie Infinity: Origins”, which does not involve cryptocurrency.

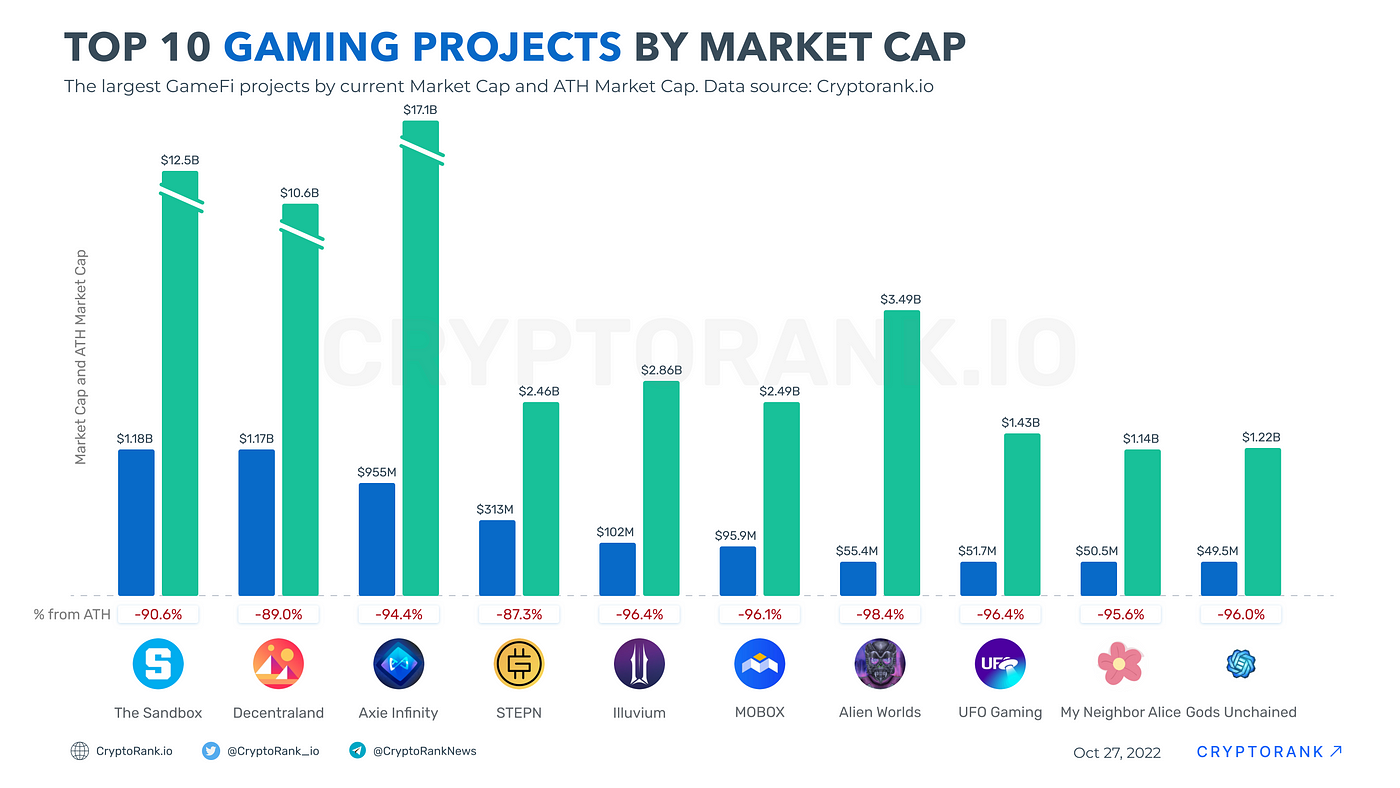

Speaking of other GameFi projects, the major projects of this category have shown mediocre performance too with the picture being all too familiar. Projects are often trading much lower than their historical maximums. To the disappointment of investors, many projects are also trading lower than their ICO prices.

How is the Metaverse Doing?

Metaverses are often mistakenly associated with Play to Earn (many of them do not have the associated mechanisms for earning), but they are undoubtedly part of GameFi. Although metaverses have less problems than Play to Earn games, they are still doing not as well as they could. Although, there has been a lot of news this year that various companies have been beginning to integrate into metaverse (JP Morgan, Disney, and others). One of the main benefits of metaverses is that they can offer the user a diverse and interesting experience in everyday affairs.

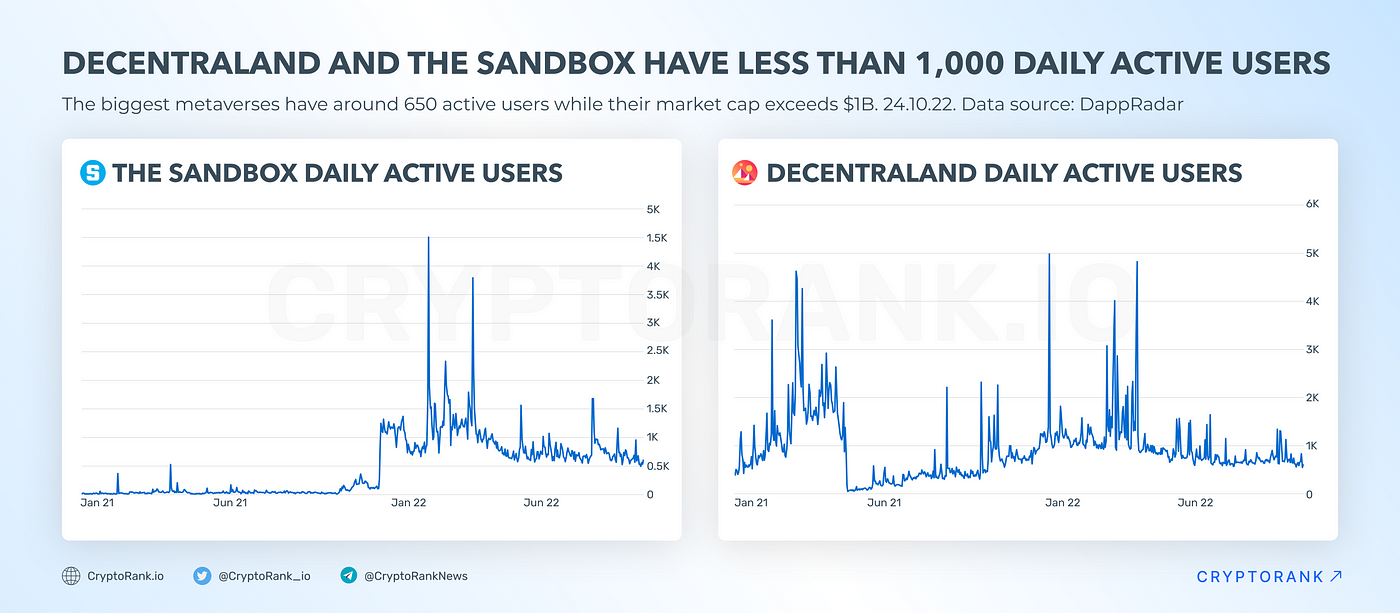

However, at the moment, metaverses have tended to become overrated projects. The largest of them, Decentraland and The Sandbox, are valued above $1.1 billion and were valued at over $10 billion at their peak. However, the number of their users is quite low in comparison to DeFi or Play to Earnprojects.

The number of daily active users (unique wallets interacting with smart contracts of platforms) of The Sandbox and Decentraland currently fluctuate around 650, and only during the peak period of popularity exceeded 1,000–2,000. It is much more difficult to estimate real users, but in comparison with popular Play To Earn projects, for example, Axie Infinity, these numbers are very weak.

Indeed, we are only at an early stage of the implementation of metaverses. Many promising projects are just planning their launch and still working on developing their products.

GameFi Trend of 2022

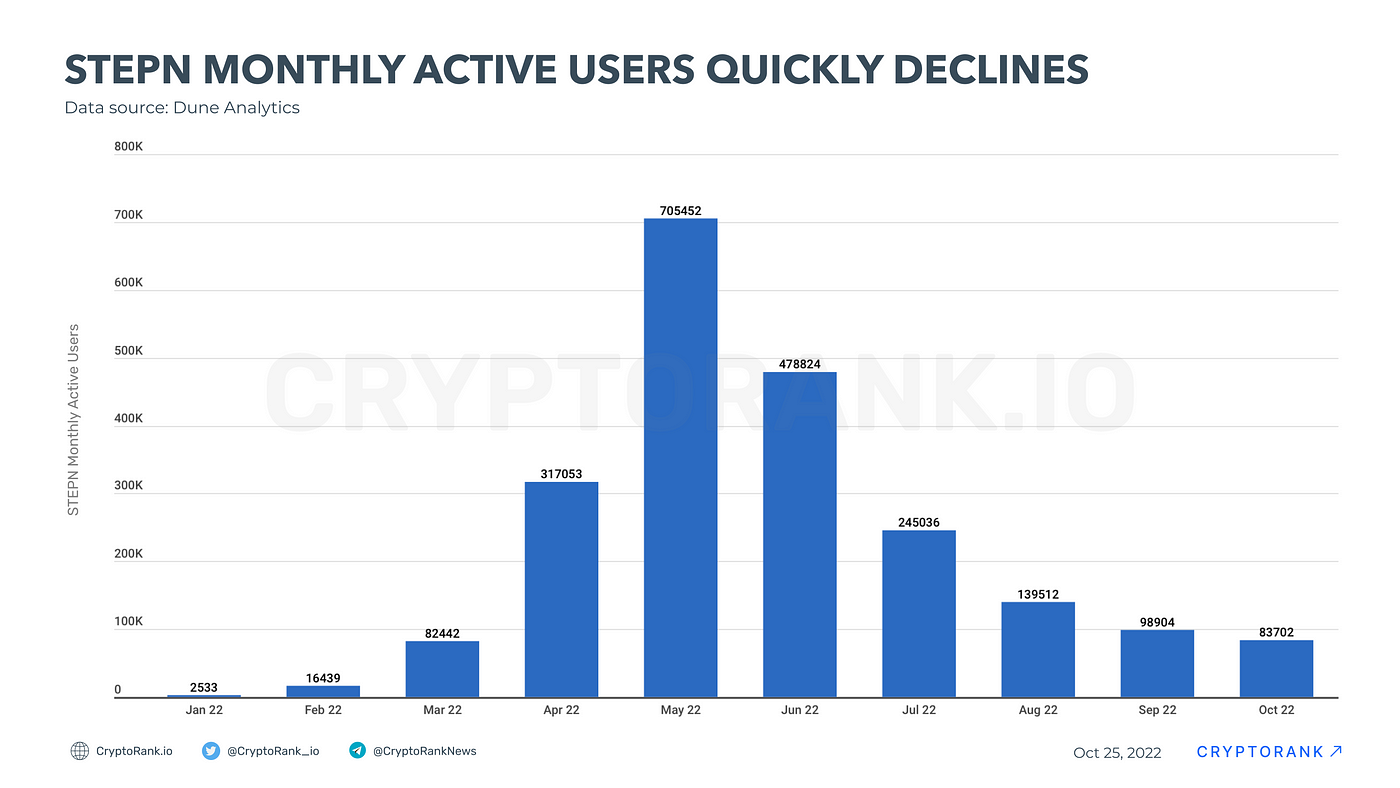

Without a doubt Move to Earn is the biggest GameFi trend of 2022, which began with the launch of Stepn. This game embodies all the basic functions of M2E, and has brought remarkably good returns to its early players. The game emerged during a phase of market downturn, but was still able to show very good growth in its early stages. At the same time, it is worth noting that a sharp increase in popularity could be thanks to the Stepn’s simple mechanics which make it easier for users to quickly grasp and start earning money. Players just have to move and exercise in order to earn in-game cryptocurrency Green Satoshi Token. The game has had a large impact on the adoption of GameFi, and M2E in particular. Indeed, there are now many games with almost identical mechanisms, however, only a few have turned out to be worthy competitors.

Nevertheless, Stepn has faced a similar fate to that of Axie. To start using and earning on Stepn, NFT sneakers are needed, on which making a profit depends. Of course, before its surge in popularity, the price of these sneakers was growing strongly, as did the project’s main token. However, after a short while the in-game cryptocurrency (GST) began to quickly fall in value due to the large influx of new users, and consequently the NFT sneakers also fell in price.

The Stepn model somewhat resembled a Ponzi scheme, as the players who came before the end of the trend invested a decent amount of money in the purchase of NFT, but it became very difficult to earn this back and make a profit due to the strong drop in GST. This is becominga trend related to hyperinflation of in-game tokens, which can often be found in similar projects.

It goes without saying that concepts such as Move to Earn have the potential to start fitness revolutions. Indeed, M2E was arguably close, just one single app managed to reach more than 1.5 million accounts. However, it has become clear that for most users, Stepn was more about money, rather than fitness. Hopefully, we will see new iterations of “X to Earn” projects, including fitness ones in the future.

Key Problems of GameFi

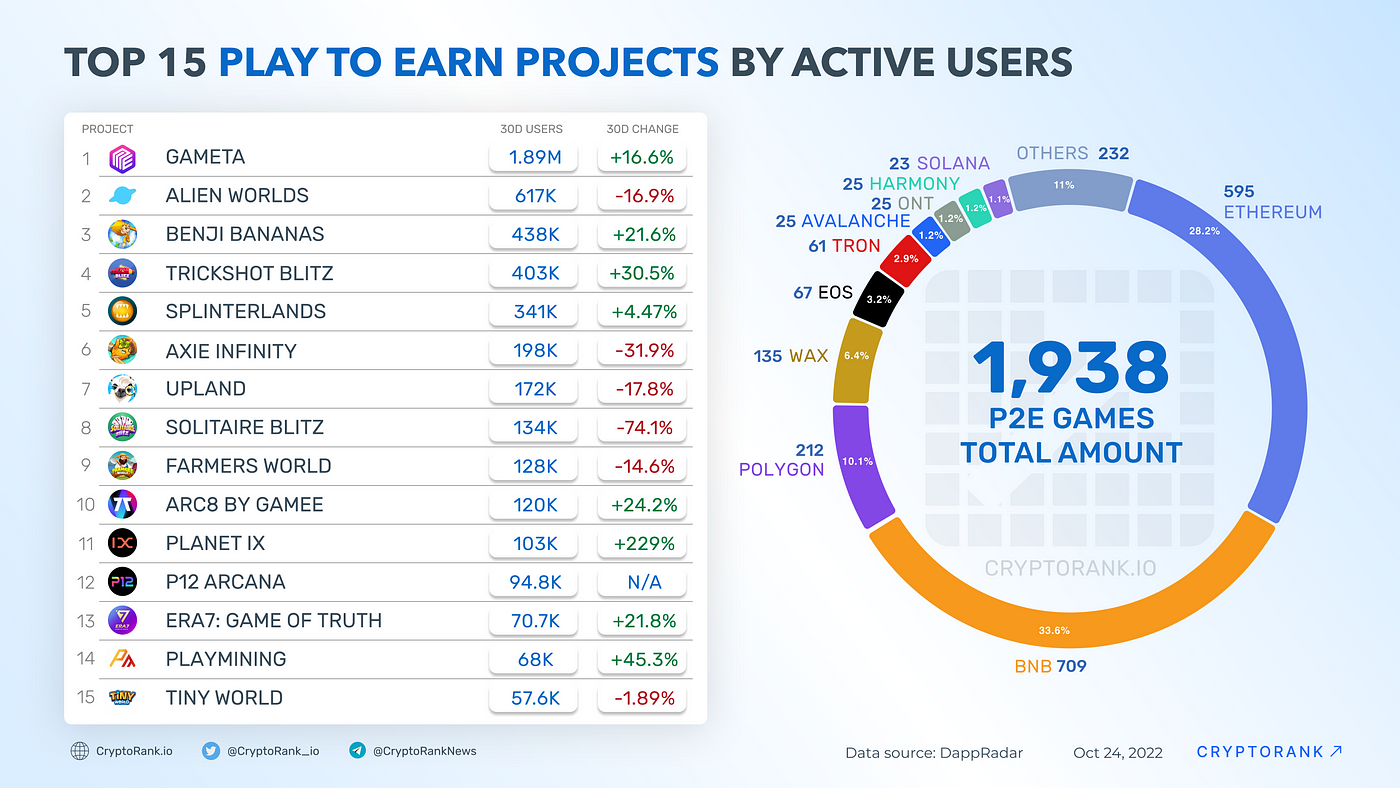

Changes in GameFi trends occur regularly, with new gameplay mechanisms replacing older games offering higher returns. One of the most significant indicators of the success of new gaming projects is number of users (accounts interacting with smart contracts of the game). New projects replace the old ones, and this happens every month.

It is worth noting that the projects that lead according to number of users are not necessarily those with the largest market capitzalizations, as is the case for Axie Infinity. Several of them are oriented more towards different types of user rewards, such as stablecoins, rather than their own tokens. However, many people remain unconvinced that blockchain gaming is not just a Ponzi scheme.

The fall of Play to Earn games occurred for many reasons. One of the main problems is the lack of its reasonable need for blockchain. Many projects could exist without needing to be based on a decentralized network, and, essentially, they are almost no different from traditional games. However, blockchain could still simplify some of the problems of games, for example, payments.

Another problem is the resemblance of many games with Ponzi schemes, when the income of early players is provided by an influx of new ones. Most users consider blockchain games solely as an opportunity to earn money, rather than enjoying the gameplay. As soon as the game ceases to be profitable, players start dropping it en masse, causing a further drop. Other problems are less significant since they depend on the projects themselves rather than on the P2E concept.

Gaming Guild Problems

Gaming guilds are very closely linked to the Play to Earn trend. Guildssimplify the process of earning money for gamers, and provide for themselves an opportunity to earn passive income via crowdfunding. Essentially, they invest in P2E games at an early stage and later monetize their assets such as NFTs and tokens. Gaming guilds emerged after the spike in the interest of Play to Earn games primarily in poorer countries of Southern Asia, where people realized P2E games could provide a realistic alternative to a work. The idea behind gaming guilds was to increase the accessibility of Play to Earn gaming and grow earnings for the tokenholders. Axie Infinity has remained the most important game within most gaming guild’s collections, however, a lot of them are beginning to diversify their portfolios and invest in other games, given the current turbulent situation.

Evidently, the market downturn has hit the whole industry, and this includes gaming guilds. Yield Guild, one of the largest gaming guilds within the space, has noted that fall in token prices (and as a consequence, potential game earnings) has resulted in a lower amount of scholarships. The majority of which are facing sharp declines in earnings as a result of a huge inflation of in-game tokens. This comes together with the decrease in value of guilds’ own native tokens, many of which are currently at historic lows.

Another issue is the worsening performance of treasuries. Especially since the value of NFTs has been significantly dropping along with native tokens and coins. For example, GuildFi has noted that there was an increase in the balance of tokens and NFT on the back of Q2, but highlights that this growth occurred as a result of additional investments, with the value of previously acquired assets decreasing significantly. Most guilds strive for maximum transparency, which can be accounted for with their use of blockchain. But only a few of them publish clear reports. For example, with data from Merit Circle (currently the largest guild by market capitalization) it is easy to follow its trends and patterns. We can see that the gaming guild’s asset portfolio has declined in value since the beginning of the year, even when taking into account assets that are not on the market (which are not being traded yet) and new investments.

Despite the current problems facing the industry, leading gaming guildshave not stopped investing in projects. First and foremost, top gaming guilds seek to invest in early stage projects. We can also see that several guilds are also moving towards turning into platforms to help and support game development. In this manner, they are becoming fully fledged parts of the GameFi ecosystem and helping to accelerate its developement.

What can we expect from the blockchain gaming sector in future?

Market downturns are always perceived negatively, however, they can also have positive notes. One of them includes helping to clear the market from unsuccessful projects, which often form the majority. For example, we can already see that most projects’ tokens have collapsed in price, and only the strongest gaming projects that have value have continued to remain above their initial offering prices, albeit many of them remain far from their ATH.

The projects which have been able to remain afloat during the volatile market are now actively developing recovery plans. Many projects are releasing products on other blockchains, and also creating other services under the same brand hoping to capitalize on their branding and build on the trust of their users.

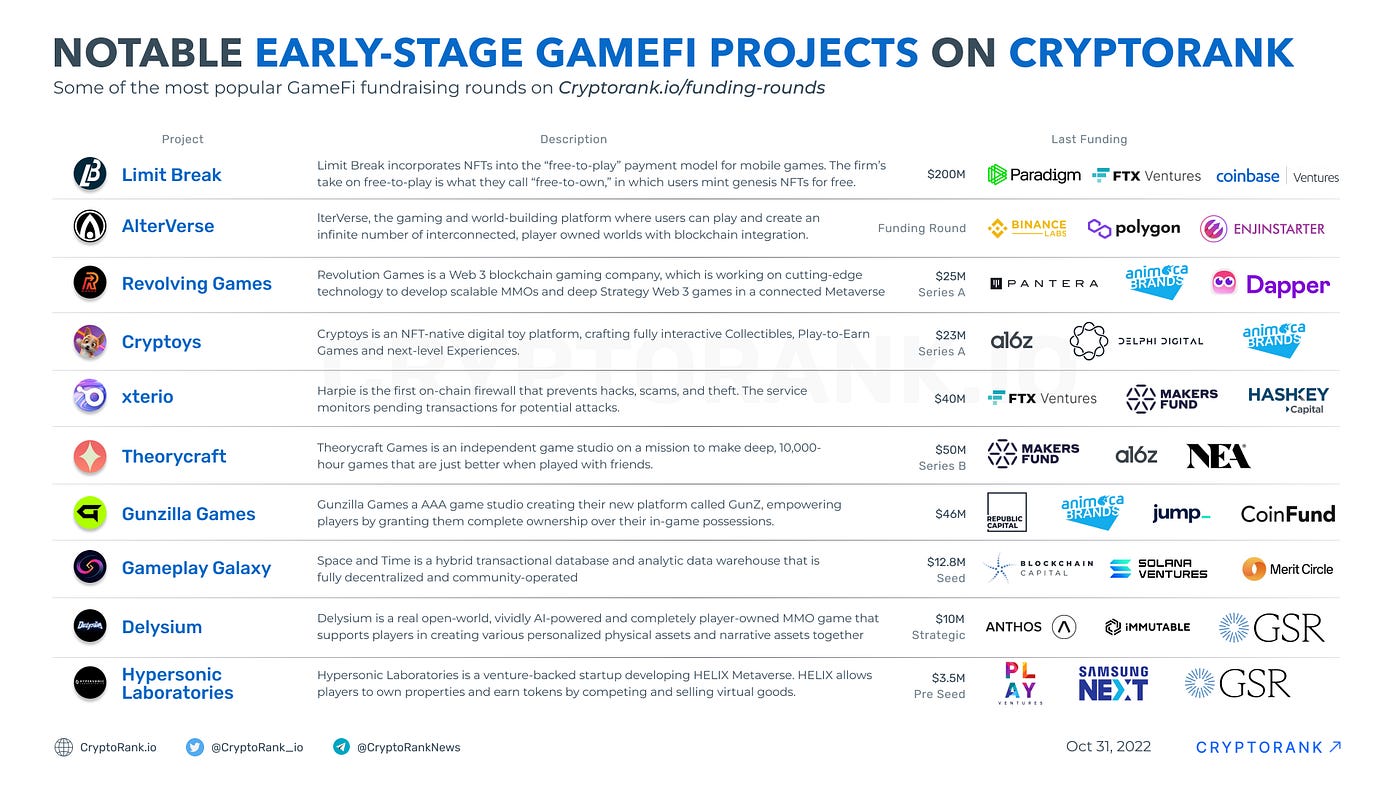

Additionally, it is also worth paying attention to projects currently at their early stages. Even during falling markets, funds still look for promising projects for investment. Indeed, it can be extremely beneficial to keep track of VC fund activities to when studying the market and trying to find early stage projects to invest in.

An important stage in the development of blockchain games will be that game studios developing AAA projects will integrate cryptocurrencies and elements of the P2E into them. This can be a very big incentive for GameFi, and currently we are already seeing the first steps in this direction.

In summary, it is possible to conclude that Play to Earn has experienced a fall as influential as its rise. The same has happened, and will likely happen with many other crypto trends, but in this case, it happened at a very inopportune moment; right in the midst of an already declining market. In terms of future developments, it is likely that the gaming sector will see many new and improved mechanisms, for example, the Play to Earn concept amongst other growing trends. There successes of which will depend on market activity and.

Read More

Animoca Brands

Animoca Brands Merit Circle

Merit Circle Paradigm

Paradigm Yield Guild Games (YGG)

Yield Guild Games (YGG) YZi Labs (Prev. Binance Labs)

YZi Labs (Prev. Binance Labs)