The Rise of Permissioned DeFi: How Institutions Are Shaping the Next Phase of Crypto

The Emerging Crypto Regulation Opens the Path to Permissioned DeFi

For most of its history, DeFi has been synonymous with permissionless access: anyone with a wallet could borrow, lend, or provide liquidity. This openness drove the sector’s rapid growth from under $1 billion in TVL in early 2020 to over $150 billion in 2025. Permissionless protocols such as Uniswap, Aave, and Curve became the backbone of DeFi, capturing tens of billions in liquidity by enabling composable financial activity without gatekeepers.

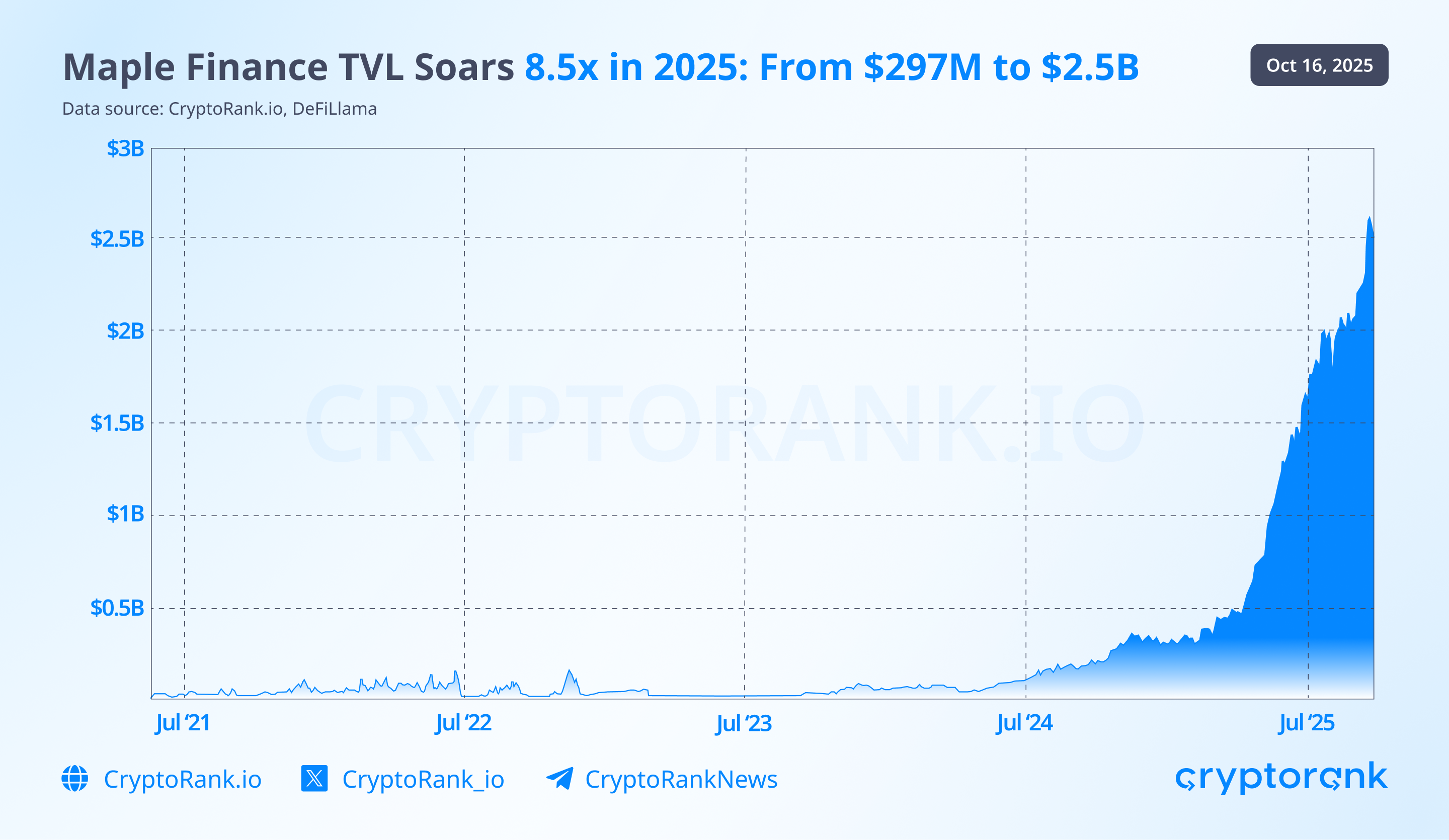

Yet, as the market matures and the promise of institutional adoption becomes tangible, a new narrative is emerging. Permissioned DeFi, pools and vaults restricted to whitelisted, KYC-verified participants, is gaining traction. This can be illustrated by the booming TVL growth of Maple Finance, a lending protocol that functions as an institutional capital marketplace.

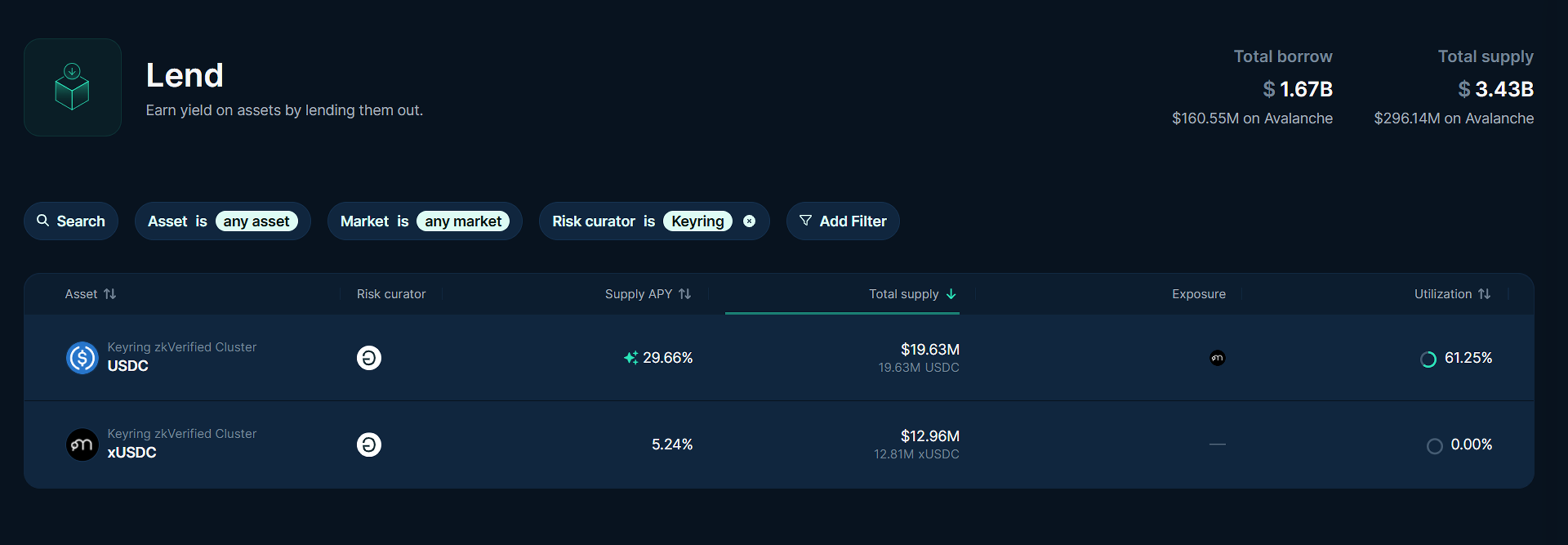

Unlike the permissionless world, where anonymity and unrestricted access prevail, permissioned DeFi introduces compliance and identity verification as core components of the protocol. Solutions like Keyring enable protocols to verify institutional participants on-chain, bridging the gap between DeFi innovation and regulatory requirements. The goal is not to abandon decentralization but to build bridges that allow regulated capital to flow safely into DeFi. As of now, Keyring Connect already secures $105M in TVL and continues to grow.

The catalyst for the rise of permissioned has been regulatory clarity, particularly under the Trump administration in 2025. In July, President Trump signed the GENIUS Act, the first federal law providing comprehensive oversight for stablecoins. By requiring full reserve backing, transparency of reserves, and federal licensing for issuers, the act transformed stablecoins into instruments that institutions could use with confidence. Where banks, funds, and insurance firms previously feared legal exposure in DeFi, the GENIUS Act now provides a framework that enables participation in permissioned pools.

Additional regulations in 2025, such as the Digital Asset Market Clarity Act and updated SEC custody guidance, further reduced uncertainty, clarifying rules for counterparty verification, KYC, and reporting obligations. These legal guardrails made it feasible for large institutions to access DeFi in a compliant way, unlocking new capital flows that were previously barred from blockchain markets.

The impact is already visible in the market. Following the GENIUS Act, permissioned vaults and pools have started actively growing, targeting institutions with pre-verified access. These platforms often offer yields comparable to or exceeding traditional finance products: delta-neutral stablecoin strategies are generating 8–15% base yields, far above U.S. Treasury yields of 2–4%. And in some cases, it might generate even more lucrative APYs due to incentivized programs running for limited periods. Below are just two examples of permissioned pools on Euler curated by Keyring.

Reduced regulatory uncertainty and higher returns attract more institutions and liquidity into permissioned DeFi. The impact is already visible in the market. By mid-2025, institutional capital exposure in DeFi reached $41 billion, with over 900 institutions now whitelisted across various permissioned platforms.

Why Institutions Prefer Permissioned DeFi Pools

In the crypto and DeFi world, institutional participation is heavily shaped by regulatory pressures, pushing most large players toward permissioned pools rather than the open, public ones that attract retail users. At the heart of this shift is the need for compliance with anti-money laundering (AML) rules, know-your-customer (KYC) requirements, and securities regulations. Institutions, unlike individual traders, face intense scrutiny from regulators such as the SEC in the United States, the FCA in the UK, and equivalent bodies worldwide. These regulators are clear: if a platform allows anonymous trading without controls to prevent illicit activity, any institution using it could be held liable.

Permissioned pools, by design, enforce identity verification, eligibility checks, and often limits on asset types or transaction sizes. This directly addresses concerns around AML/KYC compliance, making these pools a safer legal harbor for banks, hedge funds, and asset managers. Securities law adds another layer of pressure. Certain tokens, particularly those that resemble equity or debt instruments, may be classified as securities in many jurisdictions. Trading them in public, unregulated pools could constitute an unlicensed offering. By contrast, permissioned pools often restrict access to accredited investors or institutions, aligning the trading environment with securities exemptions.

Custody and fund management regulations also play a significant role. Institutional investors are bound by fiduciary duties and operational risk rules. Using a public, permissionless pool could expose them to counterparty risks that violate internal governance or regulatory standards. Permissioned environments often integrate with KYC solutions, insurance, and audit trails, mitigating these risks and allowing institutions to meet both internal and external compliance mandates.

Tax reporting is another subtle but crucial factor. For institutions, every transaction may need to be recorded and reported. Public pools rarely provide the transparency or automated reporting needed for compliance, whereas permissioned pools typically generate detailed transaction histories compatible with regulatory reporting frameworks.

In short, the migration of institutions to permissioned pools is not a matter of preference but of necessity. Regulatory frameworks around AML, KYC, securities law, fiduciary duties, and tax compliance collectively make permissionless public pools too risky for professional players. Permissioned pools offer a controlled, auditable environment where institutions can engage in crypto markets without jeopardizing their legal standing. This regulatory-driven shift is shaping the very architecture of institutional DeFi, emphasizing compliance and control over the borderless openness that defines retail-focused crypto.

Hedge Fund Inflows as a Catalyst for Crypto Liquidity

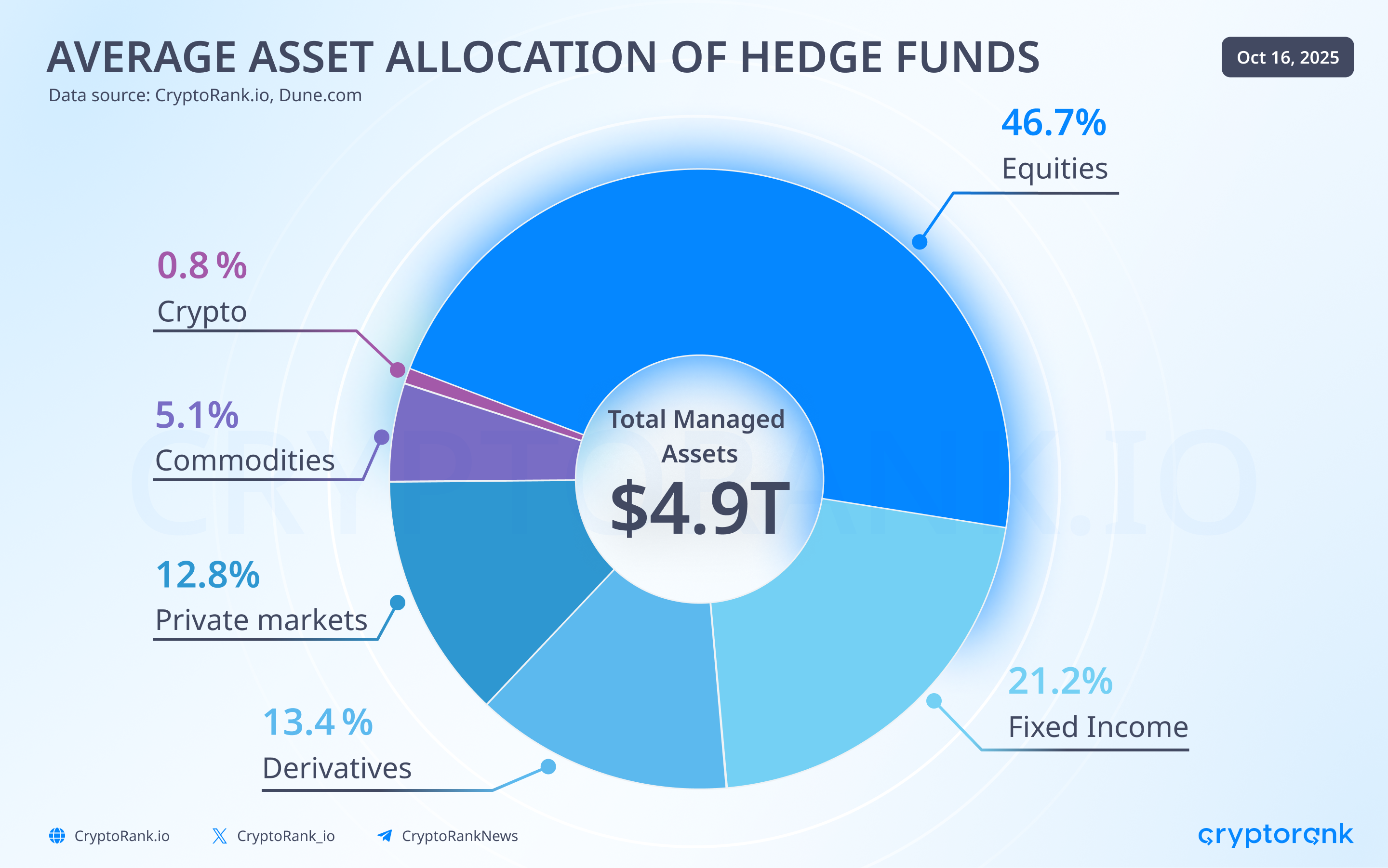

The growing participation of hedge funds in DeFi and crypto markets is a major driver of liquidity expansion. Globally, hedge funds manage over $5 trillion in assets, and even a small allocation to digital assets can inject billions into the ecosystem. By deploying capital across tokenized treasuries, permissioned pools, and staking services, these funds not only increase trading volumes but also deepen order books, reduce slippage, and enable larger market-making strategies.

In practice, hedge fund inflows can amplify market efficiency. For instance, when multiple funds participate in KYC-compliant staking or liquidity provisioning, stablecoin pools swell, and on-chain protocols can sustain higher yield products without destabilizing prices. This institutional capital acts as a stabilizing force, bridging the liquidity gap that retail-only markets often face, and making DeFi more attractive to additional institutional participants.

By mid-2025, the combined influence of crypto-native funds, traditional asset managers, and hedge funds has already contributed to over $41 billion in institutional exposure in DeFi. This trend signals that as regulatory clarity and permissioned structures expand, the next wave of liquidity may come from these professionally managed pools, creating a more robust and scalable market for all participants.

Who will benefit institutional adoption and permissioned pool expansion

The rise of permissioned DeFi is not just a shift in market structure, it’s a realignment of which projects capture value as institutions enter. Several categories and players are positioned to benefit most:

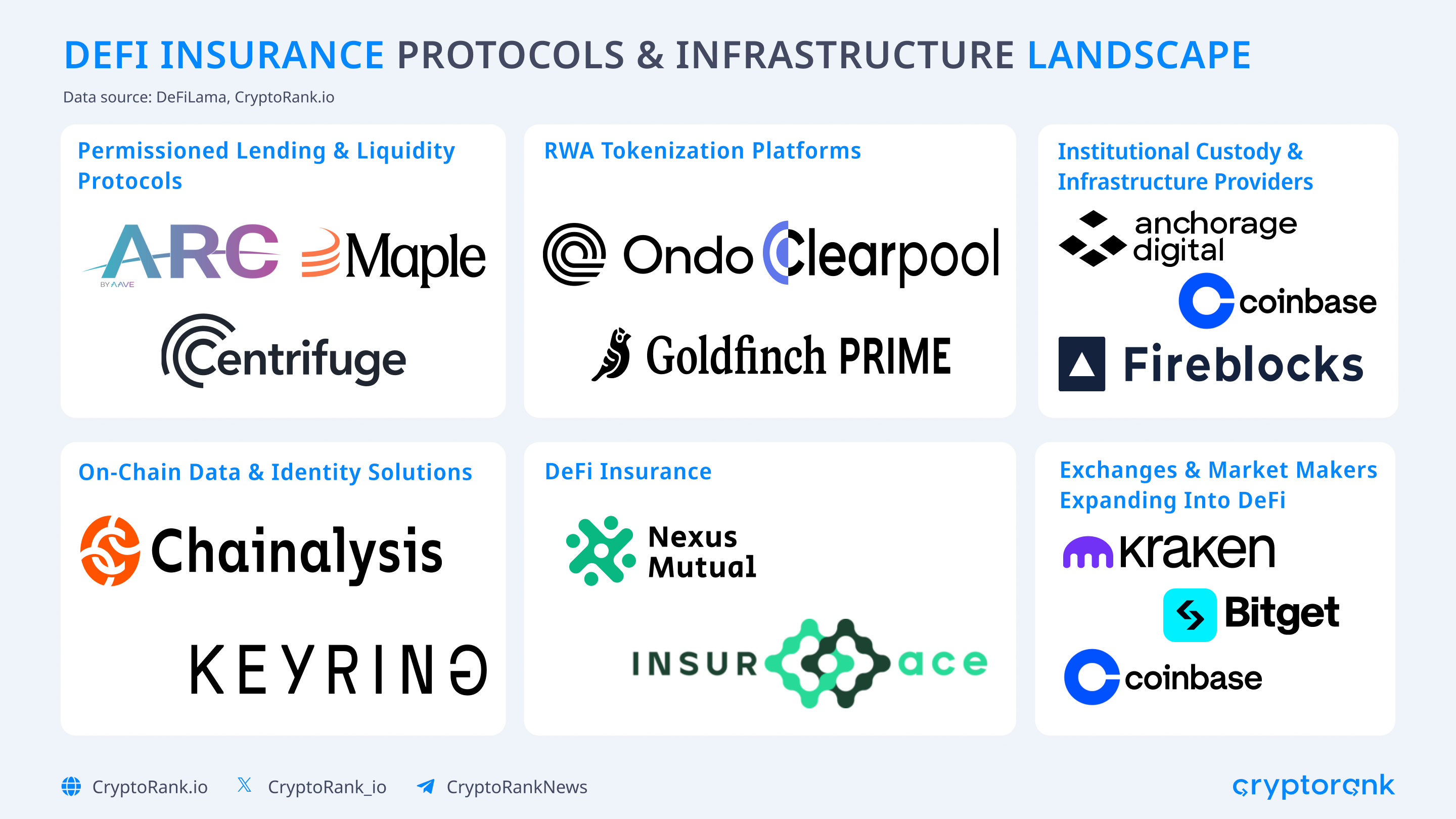

1. Permissioned Lending & Liquidity Protocols

-

Aave Arc – a permissioned version of Aave, launched with Fireblocks, allows only whitelisted institutions to borrow and lend.

-

Maple Finance and Centrifuge – already focus on undercollateralized and real-world asset lending to institutions, with built-in KYC requirements.

2. RWA Tokenization Platforms

-

Ondo Finance, Clearpool, Goldfinch – specialize in bringing Treasuries, bonds, and private credit on-chain.

3. Institutional Custody & Infrastructure Providers

-

Fireblocks, Anchorage, Coinbase Institutional – provide the custody, compliance, and KYC infrastructure that permissioned DeFi pools rely on.

4. On-Chain Data & Identity Solutions

-

Chainalysis, Keyring Network – identity and compliance oracles that enable KYC/AML verification directly at the protocol level.

5. DeFi Insurance

-

Nexus Mutual, InsurAce – DeFi insurance protocols benefit from the rise of permissioned DeFi because institutional participation increases demand for coverage, as professional players require protection against smart contract failures, counterparty risks, and compliance-related liabilities.

6. Exchanges

-

Centralized exchanges like Coinbase, Kraken, and Bitget are increasingly integrating with DeFi protocols. Their compliance-first approach positions them well to become liquidity bridges between traditional finance, CeFi, and permissioned DeFi.

The projects mentioned above are direct beneficiaries of institutional adoption and the expansion of permissioned DeFi. More broadly, the entire crypto ecosystem stands to gain from the growth of this niche, which does not compete with permissionless DeFi but instead operates in symbiosis, contributing to the overall flourishing of the crypto industry.

Is Institutional Adoption Compatible with the DeFi Ethos?

The rise of permissioned DeFi inevitably raises a question at the heart of crypto philosophy: can institutional adoption coexist with the decentralized, permissionless ethos that defined the early days of DeFi?

At first glance, these two worlds appear at odds. Traditional institutions operate under strict regulatory frameworks, requiring KYC, AML compliance, and fiduciary oversight. Permissioned pools and whitelisted vaults provide this structure, often leveraging advanced solutions like zk-proof technology and identity oracles such as Keyring. By using zk-proofs, protocols can verify participants and enforce compliance without exposing sensitive personal information, a critical solution that reconciles regulatory requirements with DeFi’s privacy and decentralization principles.

Institutional participation does not need to undermine the principles of DeFi. Permissioned and permissionless protocols can exist in symbiosis. By providing a compliant gateway for institutional capital, permissioned platforms increase liquidity, deepen markets, and enable more sophisticated strategies that ultimately benefit the broader ecosystem. Meanwhile, permissionless protocols continue to foster innovation, experimentation, and open access for retail participants.

In this sense, institutional adoption and the DeFi ethos are compatible. Privacy-preserving compliance solutions, powered by zk-proof technology, allow the crypto industry to evolve without sacrificing its core values creating a more robust, liquid, and sustainable ecosystem for all participants.

Сonclusion

Legislative clarity has accelerated institutional adoption, fueling the growth of protocols tailored to professional needs, such as Maple Finance, Keyring Network, and Fireblocks. Permissioned DeFi is only beginning its ascent as institutions cautiously enter the crypto sphere, yet its impact is already reshaping the market. Ultimately, the entire ecosystem stands to benefit from deeper liquidity and the coexistence of both permissionless and permissioned models.