Azuro: More Than Just Another Prediction Market Application

Key Takeaways:

-

Prediction markets exist for trading shares of future outcomes, but these remain niche due to liquidity issues.

-

Azuro functions as a settlement and liquidity layer for on-chain predictions.

-

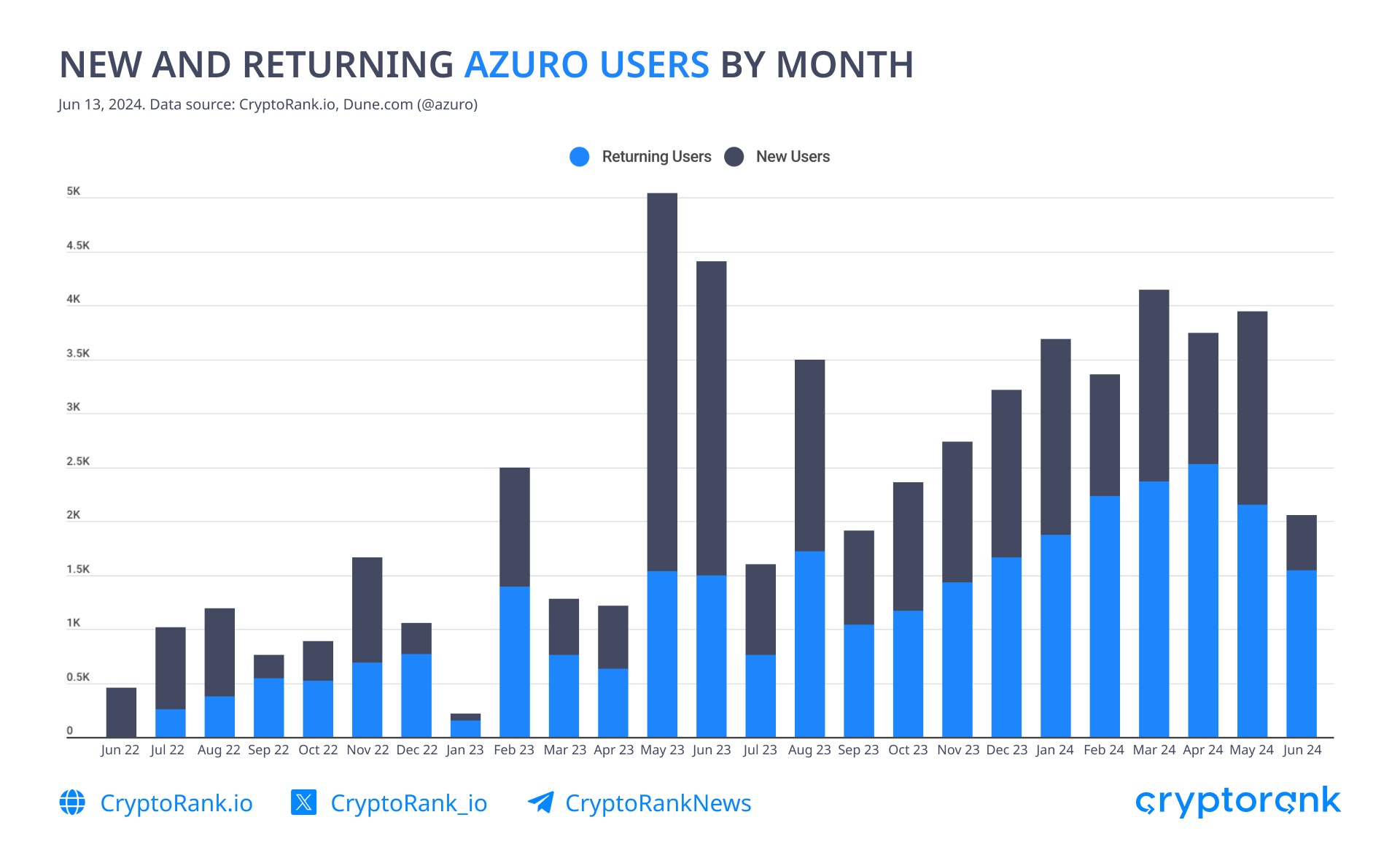

Azuro's metrics demonstrate user interest, especially in terms of reusability. Such a performance was achieved by a combination of the unique use case, the farming campaign, and the lack of prediction market solutions in general.

-

Azuro has 28 independent apps that use the protocol, with 28,000+ users on top of it, who have generated $350+ million in volumes in 300,000+ transactions per month.

-

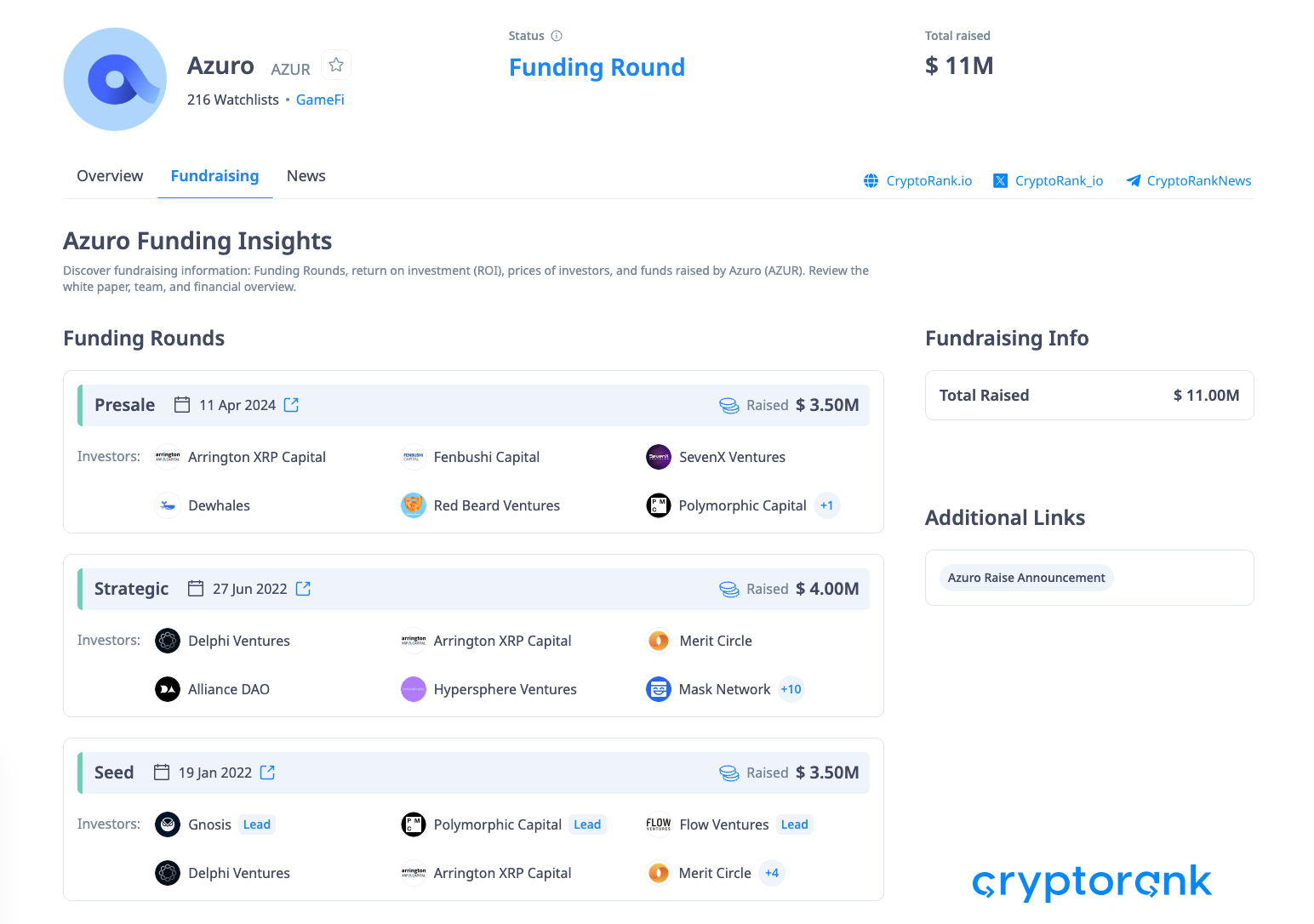

Azuro closed three venture rounds totaling $11 million, with Gnosis, the prediction markets OG, leading the seed round.

-

Azuro’s competitive landscape is underexposed, since there are no direct competitors.

-

There are multiple ways to get exposure, such as staking and liquidity providing.

Prediction Markets and Their Problems

Prediction markets are markets where users can trade shares of various future outcomes. For example, you can trade tokenized shares of candidates like "Joe Biden" or "Donald Trump" on the 2024 presidential election market. The price of these shares reflects the likelihood of each candidate winning. In the context of predicting the future, prediction markets have been shown to produce results equivalent to or better than alternatives like expert opinion or the aggregation of estimates from multiple individuals.

However, prediction markets remain niche due to the main issue of liquidity. Liquidity provision is risky because of impermanent losses, where liquidity providers may lose money if market prices move in a single direction too fast. To mitigate this risk, successful prediction markets limit themselves to events with predetermined outcome dates and minimal partial insights, such as sports competitions or elections. While this approach attracts liquidity, it significantly narrows the scope of applicable questions.

Azuro’s Solution

Azuro is a protocol that functions as a settlement and liquidity layer for on-chain predictions. It employs a novel Liquidity Pool design called the Liquidity Tree, which is intended to create and maintain market liquidity, oracle solution, and SDK for apps developers. Its features can be utilized by anyone without permission, allowing for the creation of various applications, embedded integrations, or derivative products.

Instead of building another prediction market from scratch, Azuro aims to address the issue of liquidity and broaden the applicability of existing prediction markets. So, Azuro is trying to solve the existing problems instead of creating new ones.

Market Fit and Recent Performance

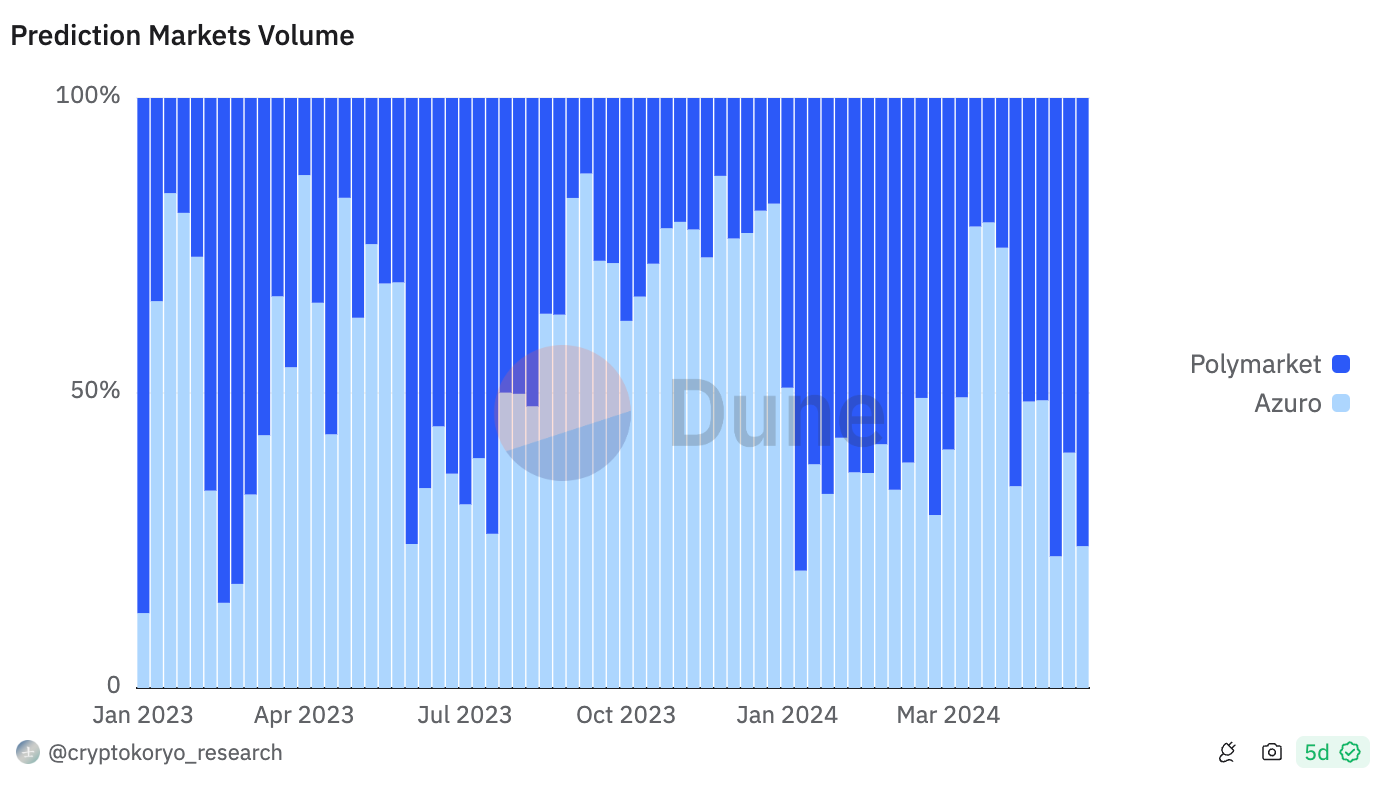

Polymarket has been the leading application for several years, focusing on social and political markets with an order book design.

However, Azuro’s focus on sports markets via pooled liquidity and separating the protocol from the applications is showing great promise.

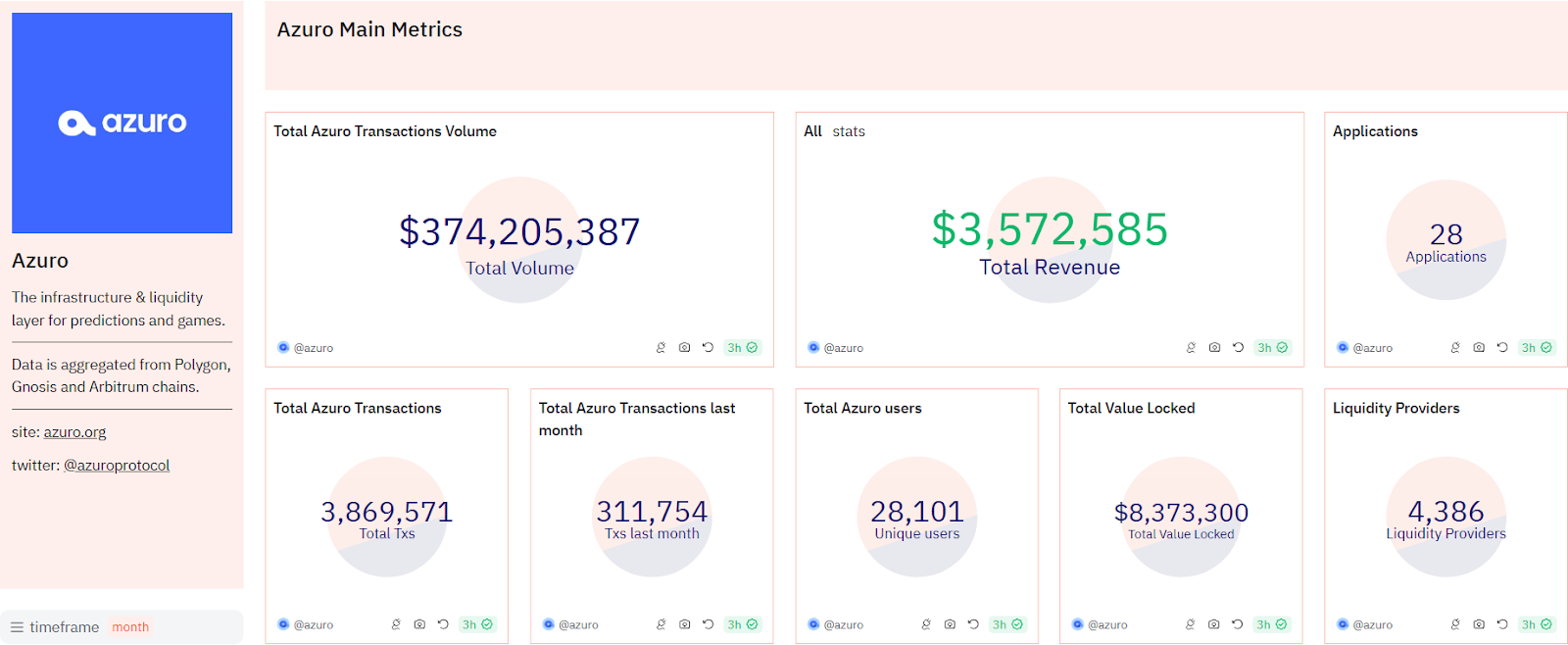

In this screenshot from Dune, you can observe Azuro's key metrics. These are impressive; Azuro has 28 independent applications that use the protocol, with 28,000+ users on top of it, who have generated $350+ million in volumes in 300,000+ transactions per month. More than 4,500 liquidity providers have ~20% APY over 12+ months in Azuro USDT pool on Polygon with $8M+ pool size.

In this screenshot from Dune, you can observe Azuro's key metrics. These are impressive; Azuro has 28 independent applications that use the protocol, with 28,000+ users on top of it, who have generated $350+ million in volumes in 300,000+ transactions per month. More than 4,500 liquidity providers have ~20% APY over 12+ months in Azuro USDT pool on Polygon with $8M+ pool size.

So far, the best metric matches returning users; gambling knows how to retain.

Despite the ups and downs in some metrics, Azuro has proven to lead the way both in activity and revenue for most of their integrated chains. According to Gnosis Chain’s Dune data, Azuro currently accounts for over 11% of their total daily transactions. As seen on DeFiLlama, we can observe that the protocol is among revenue leaders on Polygon. Also, Azuro offers so far the highest USDT-based yields on that network.

Despite the ups and downs in some metrics, Azuro has proven to lead the way both in activity and revenue for most of their integrated chains. According to Gnosis Chain’s Dune data, Azuro currently accounts for over 11% of their total daily transactions. As seen on DeFiLlama, we can observe that the protocol is among revenue leaders on Polygon. Also, Azuro offers so far the highest USDT-based yields on that network.

At the time of writing, there are 28 applications deployed on Azuro, according to Dune data. Among these, 5 apps have generated their own revenue exceeding $100,000 to date, with the largest app earning over $2 million. The most popular one is bookmaker.xyz, which currently runs a points campaign for airdrop marketing. More complex and niche products take longer to implement, so conclusions are premature.

Fundraising

Azuro closed three venture rounds totaling $11 million. The most notable thing here is that Gnosis co-led the seed round.

Few are aware of the crucial role Gnosis played in shaping the modern prediction market landscape. Starting in 2015 as an Ethereum-based prediction market platform, Gnosis pivoted to building various infrastructure products, such as Gnosis Chain, Safe, and Gnosis Pay. The Gnosis team developed the mechanisms and framework for two prediction marketplaces: Omen and Polymarket. Polymarket focused on political and social events, while Omen targeted sports. Eventually, the first captured the majority of the market, while the second did not gain similar popularity and has currently paused its services. However, Gnosis still plays an important role in building the prediction markets ecosystem, either by assisting or investing.

Few are aware of the crucial role Gnosis played in shaping the modern prediction market landscape. Starting in 2015 as an Ethereum-based prediction market platform, Gnosis pivoted to building various infrastructure products, such as Gnosis Chain, Safe, and Gnosis Pay. The Gnosis team developed the mechanisms and framework for two prediction marketplaces: Omen and Polymarket. Polymarket focused on political and social events, while Omen targeted sports. Eventually, the first captured the majority of the market, while the second did not gain similar popularity and has currently paused its services. However, Gnosis still plays an important role in building the prediction markets ecosystem, either by assisting or investing.

Competitive Analysis

Since Azuro is not a prediction market application per se but rather a prediction layer whose main purpose is providing liquidity to various prediction market apps, it has no direct competitors yet. At the time of writing, we have not been able to identify another valuable project building a prediction layer (although there are some claiming to do so). Therefore, Azuro is currently occupying a unique position, pretending to become a single source of liquidity for prediction markets. Nevertheless, it is worth noting some players in the related niche.

The most notable peer of Azuro is Polymarket. Polymarket is the leading prediction market app where users can trade on various events. Despite being focused on political and social topics, Polymarket also offers sports bets. Polymarket has been the most popular and trusted app among blockchain-based prediction markets for many years. Some would say it's Polygon's crucial, if not sole, use case that still keeps it relevant. Polymarket recently closed a $45 million Series B round at a nearly $1 billion valuation, led by the Founders Fund and joined by Vitalik Buterin.

An Azuro vs. Polymarket on-chain dashboard can be found here.

How to Get Exposure?

The $AZUR token is expected to be released via airdrop in June with over 90% probability according to Polymarket, and some platforms, such as Aevo, have already launched the pre-market. You may consider participating in liquidity farming to get the $AZUR token airdrop.

The initial allocation for airdrop is still unknown, but the team promises to deliver more than 37% of the issue to the community. And multi-year vesting for the team and investors signals that the team is thinking strategically.

Also, since Azuro is a prediction layer, a lot of prediction market apps are expected to launch on top of it. According to Azuro’s documentation, there are 4 types of contributors, each with a corresponding reward: liquidity providers, data providers, affiliates, and Azuro DAO. Ordinary users can qualify for DAO rewards and LP rewards:

-

After the TGE, $AZUR tokens can be locked at the Azuro App to get staking rewards and possibly future airdrops from ecosystem apps and partners, just as $ATOM and $TIA stakers receive allocations from protocols running on top of them. However, due to the number of people involved in staking for airdrop purposes nowadays, staking is becoming less and less worth it. Furthermore, the future of Azuro won't ever depend on the stakers in any way, since they are not the ones who maintain the consensus of the network.

-

On the contrary, Azuro's vitality depends directly on the liquidity providers, so their rewards are likely to be way more suitable. After the token farming campaign is over, a significant percentage of liquidity providers will move on to farm another protocol, thus decreasing competition.

Output

Azuro addresses the liquidity problems in prediction markets by creating a framework and liquidity hub for launching various applications. The prediction market niche remains underdeveloped, and Azuro’s infrastructure shows potential for filling this gap. Despite the initial overinflation of metrics due to airdrop campaigns, the project’s continued development and deployment of applications highlight its efforts to address existing market needs. As the market evolves, Azuro's approach to providing liquidity will be crucial in enhancing the functionality and adoption of prediction markets.

Arrington Capital

Arrington Capital Delphi Ventures

Delphi Ventures Fenbushi Capital

Fenbushi Capital Merit Circle

Merit Circle Polymorphic Capital

Polymorphic Capital