Sell in May and Go Away: How to Outperform Market in 2024

The last month of spring is traditionally associated with the upcoming vacation season, which usually leads to a liquidity drain and reduced activity across all financial markets, including DeFi.

But this year, the situation is shaping up differently due to several related factors, the main one being the approaching Bitcoin halving.

Arguments Against Exiting the Market

Let’s make a pivot and start with the arguments against selling assets:

-

Since the last halving, the DeFi market has matured, and crypto-assets are no longer associated solely with “money surrogate,” finding widespread use in many areas of life. While it’s still inaccurate to compare decentralized finances with traditional ones, the current cycle is expected to be the most significant so far, possibly leading to a real mass adoption.

-

The increased interest from Web2 users, along with numerous on-chain indicators we’ve discussed in this article, suggests that the real growth hasn’t started yet, and we’re still in the accumulation phase.

-

A few days ago, BTC funding turned negative for the first time since October 2023, which usually signals the beginning of a bull market.

Arguments in Favor of Exiting the Market

As for the arguments in favor of selling assets, we can include the following:

-

The inflation rate is still high, and the Fed is in no hurry to lower the base rate. Unlike the previous “COVID cycle,” there’s no dollar liquidity flood that could serve as a significant growth catalyst.

-

The narrative that “Bitcoin’s halving equals Bitcoin’s growth” has deeply rooted itself among the masses, including Web2 users far from the crypto world. In such situations, the market can often show a pattern opposite to the crowd’s expectations, which the community terms a “black swan.”

Current Situation

The previous cycles have gone through several correction stages, and the ongoing fourth cycle is no exception. At the moment, the correction has been going on for 11 days, and only recently BTC started showing “signs of life”:

Most analysts agree that the uptrend isn’t over until BTC consolidates below $58,000 for at least one weekly candle.

There’s a high probability that Bitcoin is forming, or has already formed, a local bottom for the mid-term corridor. However, this scenario doesn’t rule out a possible rapid flash crash that could occur during or after the halving.

Flash crash during the previous halving (May 2020)

It’s obvious that predicting such an event in advance is practically impossible, but one can and should be prepared for it.

Possible Action Plan

Given all the uncertainty, perhaps the most rational action plan for the coming weeks would be to:

-

Refrain from new margin positions and either close all current ones or hedge them on DEXs with a point farming system, bringing delta to neutral.

-

Prepare in advance some stablecoins to add to interesting assets according to your strategy, as well as set levels and place limit orders for possible “sell-offs.” But don’t be too extreme and try to “buy the bottom,” it’s unlikely to work, but improving the entry point is possible.

-

Increase the efficiency of using the existing capital by providing liquidity in protocols with point systems. Thus, obtaining a constant cash flow stream that can be used in case of a worsening situation.

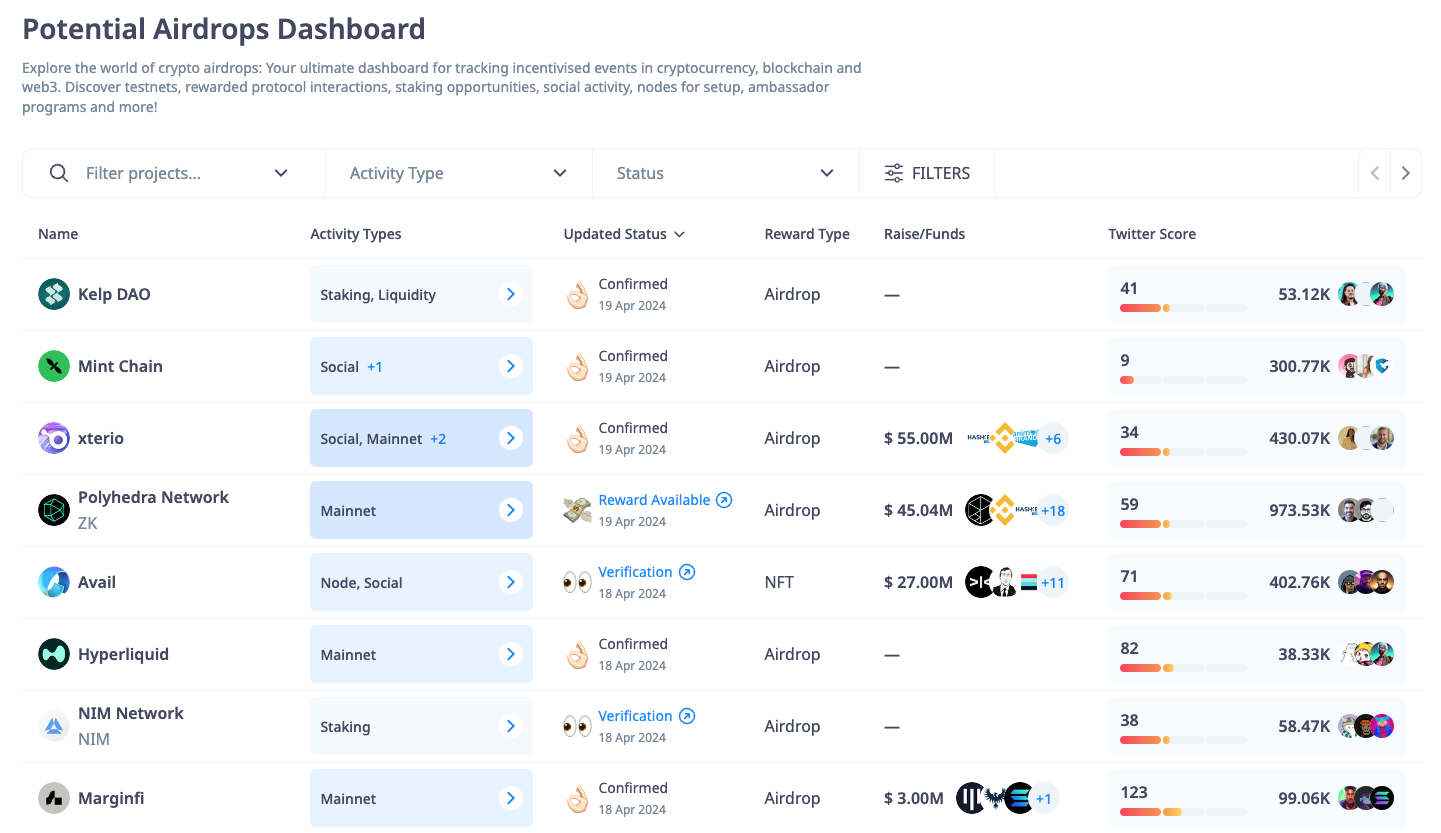

It’s worth recalling that we’ve recently introduced a new section called “Drop Hunting,” dedicated specifically to airdrops, where you can find detailed guides for various projects.

Perhaps such precautionary measures may seem a bit excessive and even pessimistic, but it’s necessary to be prepared for any market situations.

Undoubtedly, the real rally in the market awaits us ahead. Nonetheless, any growth is impossible without periodic local corrections.

Read More