Will the Bitcoin Price Moon After Halving?

Key Takeaways:

- The Bitcoin halving event is imminent, scheduled for April 19th, and garners widespread attention.

- Historical data shows significant price surges after previous halving events, indicating potential for future growth.

- The upcoming 4th halving event shows differences from past cycles, including institutional investor involvement.

- Despite differences, familiar analytical patterns persist, such as accumulation by large holders and long-term investors.

What Is Bitcoin Halving?

The Bitcoin halving event signifies a halving of the rewards granted to miners for their efforts in validating and appending new transactions to the blockchain. This occurrence takes place roughly every four years within the Bitcoin blockchain. Engineered to regulate the issuance of new Bitcoins, it serves to curtail the supply and uphold Bitcoin's enduring scarcity and value.

In anticipation of the imminent halving, we've crafted an interactive page featuring comprehensive analyses of this pivotal process. We encourage you to explore it and conduct your own research to gain deeper insights into this significant event.

Historical Data of Past Cycles

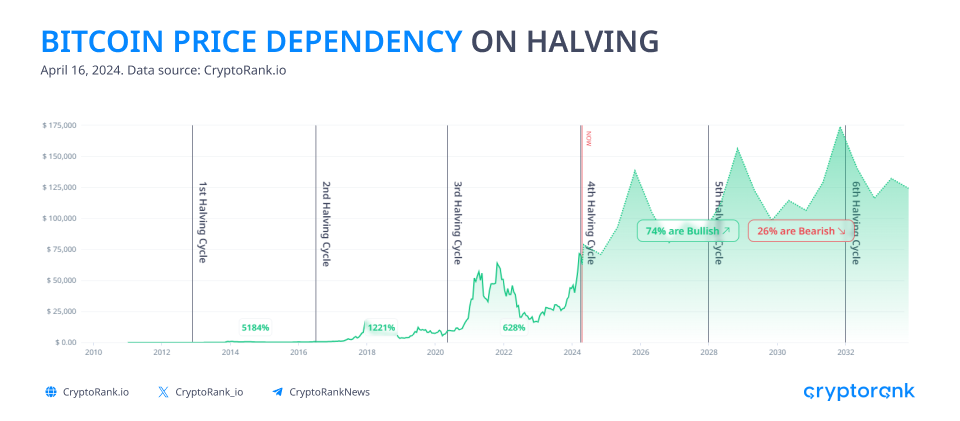

The historical data surrounding Bitcoin halving events presents a compelling narrative. These occurrences have consistently correlated with significant price surges in the value of Bitcoin.

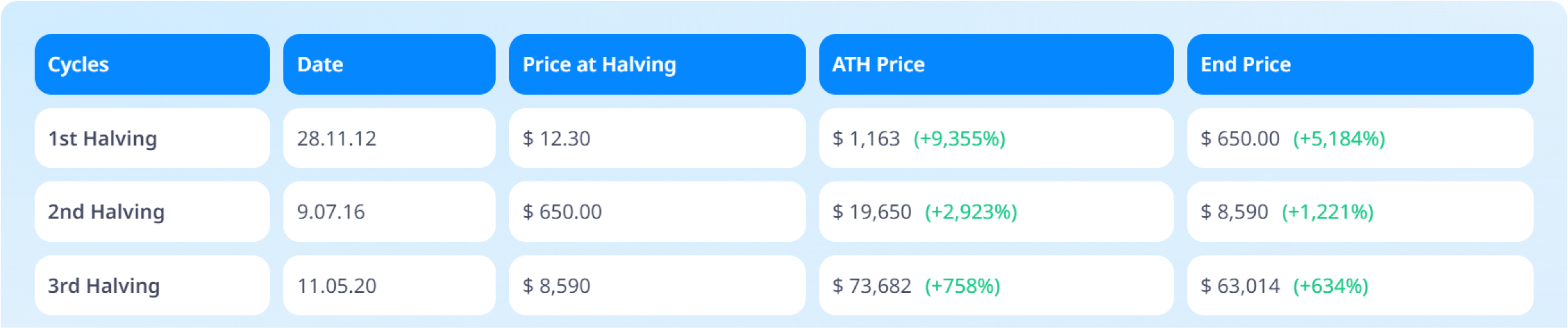

First Halving

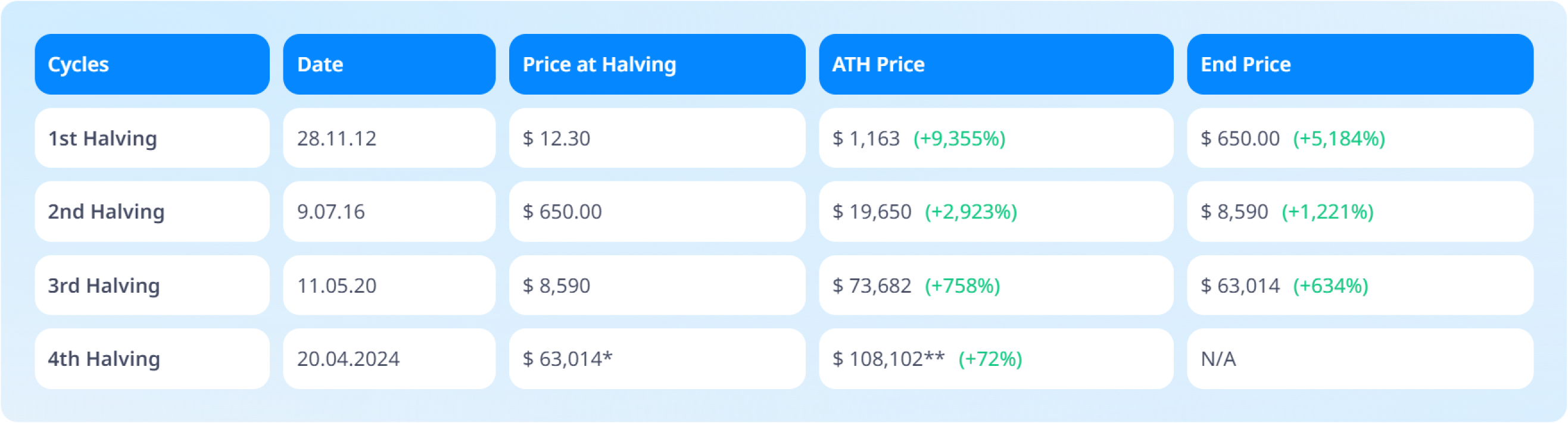

After the first halving event on November 28, 2012, Bitcoin experienced a remarkable surge in price, catapulting from around $12 to over $1,000 within a year.

Second Halving

Likewise, following the second halving on July 9, 2016, Bitcoin witnessed a staggering price surge, soaring from approximately $650 to nearly $20,000 by the end of 2017.

Third Halving

Once more, after the third halving on May 11, 2020, the price of Bitcoin skyrocketed from around $10,000 to more than $60,000 in less than a year.

The logic is straightforward: when the rate of new supply sharply declines as a result of the halving, it triggers a supply shock that stimulates an uptick in demand. This surge in demand subsequently propels the price of Bitcoin to new highs. This consistent pattern of halving-induced scarcity fueling price appreciation forms the core of the Stock-to-Flow model's predictive prowess, garnering significant attention within the cryptocurrency community.

The Fourth Halving

We are now approaching the 4th halving event, which presents several notable deviations from previous cycles:

1) The price has already surged to all-time highs (ATH) before the halving event, indicating that the market anticipates a halving-induced rally. Consequently, investors are engaging in a race to front-run each other by driving up the price.

2) A substantial influx of institutional investors, including heavyweights like BlackRock and Grayscale, has entered the market and begun accumulating significant quantities of bitcoins in preparation for the halving. This influx of institutional players may pose challenges for retail investors seeking to capitalize on the event.

Despite the aforementioned differences, numerous analytical patterns reminiscent of past cycles persist:

-

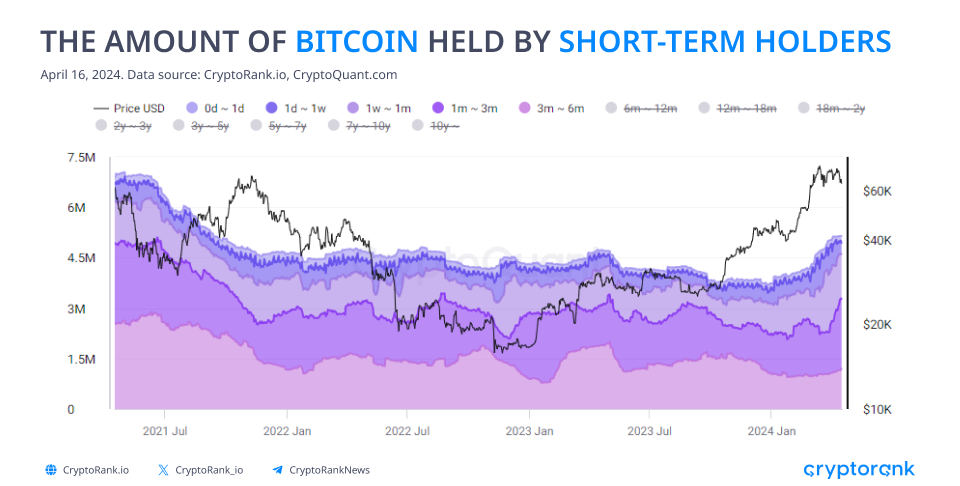

The "amount of bitcoin held by short-term holders (1 day - 6 months)" indicator serves as a gauge of interest among new buyers. Historically, at the peak of each cycle, these new buyers substantially bolster their positions.

Presently, data indicates that the positions of short-term holders have surged by approximately 35% since the start of this year. However, when compared to data from previous cycles, these levels appear to be at a minimum, suggesting ample room for growth in this value.

-

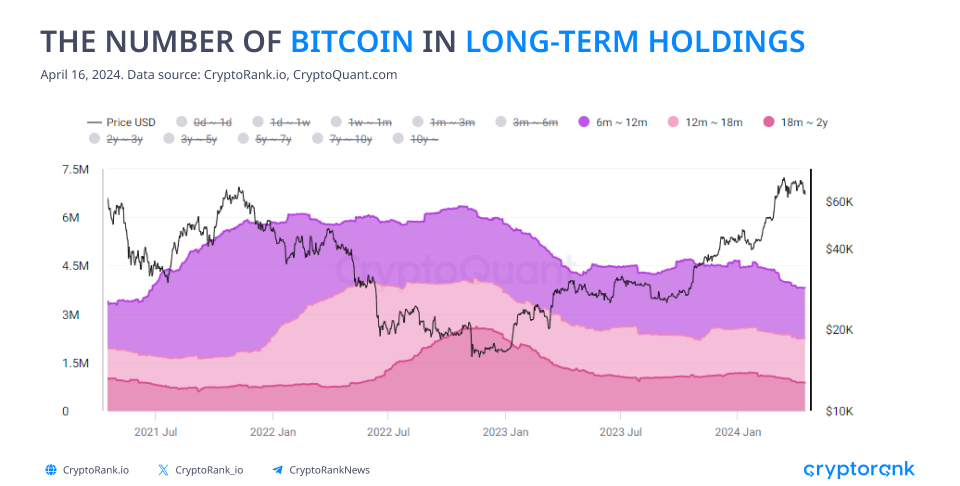

The "number of Bitcoin in Long-term Holdings (6 months - 2 years)" indicator typically exhibits an upward trend as the Bitcoin price establishes a base value, followed by a sharp ascent when the asset reaches its bottom.

Considering the current data, the growth of this indicator earlier in the year, followed by the current period of stagnation, suggests the formation of a level that could be associated with market lows.

-

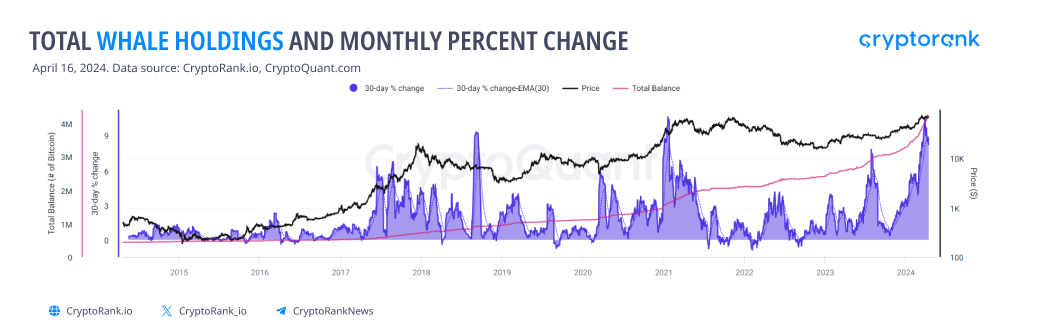

The "Total Whale Holdings and Monthly % Change" indicator reveals that large holders or whales (those who possess more than $1000 BTC) persist in accumulating the asset. Since the start of this year, their total balance has surged by approximately 30%.

This ongoing accumulation by major players may serve as an indirect indication of the potential for further growth in the market.

-

Simultaneously, the "Bitcoin Miner Reserves" indicator has plummeted to its lowest value since 2021, signaling that miners essentially have nothing to sell.

-

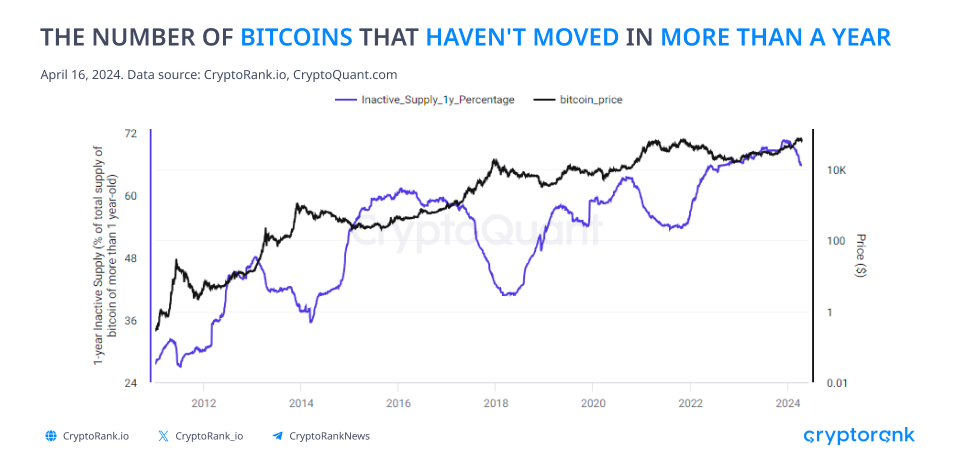

The "number of bitcoins that haven't moved in more than a year" indicator typically sees an uptick throughout much of a bull cycle, with declines only manifesting in the final stages of such a market surge. Presently, this indicator stands at 66%, having undergone a slight correction in recent months. Despite this correction, it remains elevated and is anticipated to resume its ascent following the current correction phase.

Given the plethora of data available, it's reasonable to speculate that the true Bitcoin rally may still lie ahead. However, it's essential to recognize that such assertions are merely speculative in nature, and the future trajectory of Bitcoin remains uncertain.

What Will Be Bitcoin’s ATH Price This Cycle?

The future price of bitcoin can be predicted based on bitcoin's returns after the first and second halving cycles, providing interesting insights into its price:

-

After the second halving, the ATH return decreased by approximately 3 times compared to the previous period: from 9.355% to 2.923%.

-

After the third halving (current cycle), the decline in ATH return was even more significant - about 4 times from the previous indicator: from 2.992% to 757%.

On the basis of this information, it can be assumed that after the next halving, the ATH yield will fall by approximately 5 times its previous value: from 758.0% to 72.0%.

Based on these assumptions, the possible ATH price of bitcoin in the next cycle may reach $107,657. However, if the BTC price increases in the following days, the predicted ATH price will also increase. You can follow the model on our dashboard. But do not take this as the only true value, as it can be affected by many different factors.

Conclusion

In conclusion, the upcoming Bitcoin halving event garners significant attention, historically correlated with price surges. While the Stock-to-Flow model offers insights, it's just one part of a comprehensive analysis that includes on-chain and off-chain data.

As we approach the fourth halving, we note similarities and differences from past cycles, including institutional investor involvement. Predicting Bitcoin's future price is complex, influenced by numerous factors. A balanced approach, incorporating quantitative models, qualitative insights, and market expertise, is key to navigating the cryptocurrency landscape confidently.